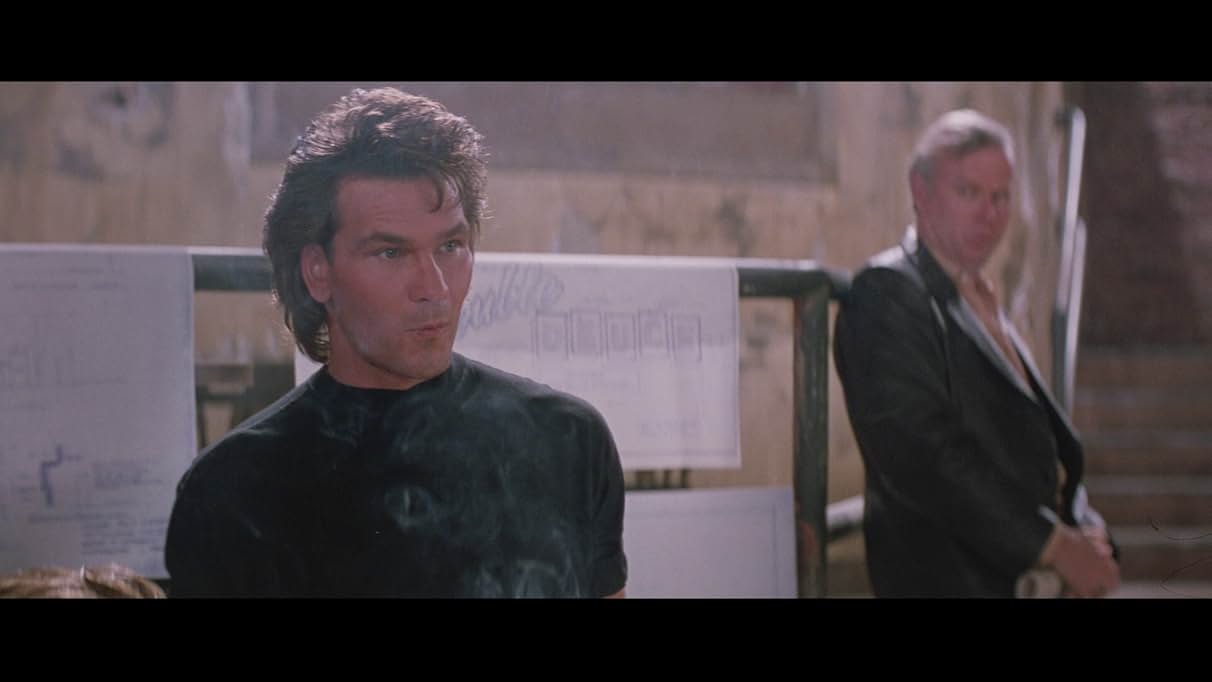

Josh, next to Malcolm at Post 9, says PANW is one of the best stocks in the market

We didn't know if we were being put on — or if it was just a crazy coincidence.

Late in Thursday's (6/12) Halftime Report, Josh Brown actually talked up PANW as one of the best stocks in the market — while Malcolm Ethridge sat to Josh's left.

(If you don't know why that's significant, see below.)

We didn't hear anything from Josh about the billing percentage from the federal government.

Whether the CEO will issue a statement on Friday, we guess we'll find out.

How in the world does ‘AI’ come up with all this information??

Brad Gerstner, star guest of Thursday's (6/12) Halftime Report, actually was heard to say, "The AI supercycle is larger than the internet itself."

And we wonder exactly what AI Brad is using. Because in terms of the printed word, it seems like AI is just ... scraping words that someone else actually wrote.

We typed in some familiar terms (tip: people on the Halftime Report) to ChatGPT, and it took a fair amount of time for the "AI" to post for us the Barrons.com, Wikipedia and office website descriptions of a couple folks on the Halftime Report. (At least it didn't take credit for writing those profiles from scratch.)

Brad said we might even only be in "maybe the first batter in the first inning" of the AI wave. (Which articles will AI be scraping from in the 8th and 9th innings?)

Brad said Henry Blodget "got ridiculed and laughed off of Wall Street" for his AMZN $400 call in 2000, but "Amazon is up 87 times today from where it was when he made that call."

‘Is the strategy Navarro?’

Brad Gerstner was the star guest of Thursday's (6/12) Halftime Report, taking part early in a discussion about the markets, and later in a discussion about his White House event with Donald Trump.

Brad claimed that it "looks like we have a deal with China." (Heard that one before.) Brad said, "So I feel very comfortable, um, where we're going to land the plane on tariffs."

Malcolm Ethridge said Brad made a great case for long-term holds, but that March and April weren't that long ago and a lot of people thought about getting out of the market and it's not a bad idea to be "derisking some" and "do yourself some justice."

Kevin Simpson said "the risk is still to the upside." He's expecting "more of a range-bound market."

Judge told Brad that the Wall Street Journal editorial team says Donald Trump has no trade "strategy." Brad stressed that there's a difference between a "strategy" and "tactics" (bringing memories of the McCain-Obama debate of 2008) and that the show is often about tactics.

Brad said Donald Trump's tactics are apparent from the book, but "the strategy is what scared the market earlier in the year," as the markets had to wonder, "Is the strategy Navarro?" And Brad said that if the market believed now that Navarro was the strategy, it would be down 20%.

(OK, we don't agree with Brad on everything, but if he — like others on the show recently — keeps noting the Navarro element of the White House, we might just elect Brad to office.)

Instead, Brad said the markets decided the strategy is "the Bessent consensus" (snicker). Brad said it looks to him like "the president's got trillions of dollars of incremental investments in the United States" and that we're "re-onshoring some critical industries" (though he didn't actually name them).

Brad said the poster that the president held up in April at the White House showing all the tariffs on countries "terrified the markets."

Josh Brown said the "revelation" to the markets was that the only negative was the trade war. Josh drew an analogy to kids playing street hockey and having to pause and move the nets when a car comes through.

Josh said, "Quite frankly, the- the Liberation Day to, the- the TACO didn't last that long." Josh said "These ARR businesses are absolutely smokin'."

Brad added, "We're still below the 5-year average on software multiples."

Brad said, contrary to what Malcolm Ethridge was saying, that investors should be "leaning in" to the markets as opposed to hedging.

Malcolm said his "one concern" with the market was that Q1 earnings may have been a "pull forward" on tariff fears.

Josh said some companies are pricing in the impact of a trade war, but the biggest companies haven't been hit hard.

Josh said the "push and pull" about rates and labor market will probably continue this year.

What’s ‘surreal’ about it?

Judge actually asked Brad Gerstner on Thursday's (6/12) Halftime Report if it was "surreal" (sic) (snicker) to be at the White House on Monday. (That was so the president could tout the "Trump Accounts" that used to be known as "Invest America.")

Brad said it was an "incredible moment for America." CNBC's screen graphic still called it "Gerstner's Invest America."

Judge wondered if the plan, however close to the goal line, will still get across the finish line in Congress. Brad insisted it has "broad support" and predicted it would "remain in the reconciliation bill."

Meanwhile, Malcolm Ethridge said he finally bought AAPL because it reached "peak pessimism."

Josh Brown bought JOBY and ACHR and called them "super speculative." Kevin Simpson said he got stopped out of TPL.

On Fast Money, ADBE came up; Tim Seymour said "at some point," it will catch a bid. Dan Nathan called it a "no-touch." Steve Grasso said it bounced technically in April and the technicals "look great," but it's still in a declining trend for 2025, so he'd wait for it to gain another $10 to the upside before buying. (This writer has no position in ADBE.) (It was Steve's birthday, as well as his twins'.)

The M&A cycle is just around the corner ...

Early on Wednesday's (6/11) Halftime Report, Grandpa Steve Weiss stated, "Earnings aren't gonna be good."

Weiss shrugged at the China tariff news; "There's nothing new coming out of it" and CEOs have "no clarity." But Weiss is "pretty fully invested."

Joe Terranova didn't opine on whether earnings will be good but said if they're not, that'll be a problem.

Joe said the China news was "priced in already." Joe noted the VIX is at 16. Joe said there's a "broadening out" going on.

Weiss wondered if we might see NVDA "trade down again." Joe said semi activity seems like it's "beginning to moderate somewhat."

Shannon Saccocia said there's going to continue to be a "wait-and-see approach" to AAPL. Joe said TSLA and AAPL are "struggling" and that the "totality" of the Mag 7 doesn't have the same dominance as in 2023/2024.

Joe yet again explained how the JOET "strategy" has to be "rules-based" unless he changes the "SEC prospectus," which would be a "big process." (It doesn't stop him from buying whatever he wants for his personal account.)

Shannon said the markets are "anticipating" tariffs moving lower. Jason Snipe said "part of" the catalyst ahead would be the Fed.

Shannon said energy's starting to look more attractive. Jason said financials are a "nice opportunity" and said something we've been hearing for years from various people on this program, the M&A cycle is "due" to come back. Moments later, Joe said he sees no reason to be selling GS. Jason brought up the "M&A cycle" again.

Weiss said he bought CAT and XLI for the reason of, "What if I'm wrong."

Weiss may have been wearing Adidas Stan Smith sneakers.

Dom Chu was enlisted for ETF Edge, but the mike wasn't working, so Dom was doing a Shields & Yarnell routine before guest host Frank Holland cut away to commercial. (Judge was surely traveling back from California.)

Todd Lewis previewed the U.S. Open (the golf tournament, not the September tennis gala) from Oakmont. (Obviously, it's being televised this weekend on NBC.) (SpinCo supposedly is going to blur or eliminate the partnerships between CNBC and NBC so that content can be licensed to more entities.)

Weiss said he bought more QXO and made it his Final Trade.

Karen: Not sure whether CMCSA or DIS is ‘making the right choice’

It took nearly all the way through Tuesday's (6/11) Fast Money to get the most interesting commentary of the day — Karen Finerman on DIS and Iger's CNBC interview and which company is making the smart move in regard to Hulu.

"It is so interesting that, uh, Comcast is doing a different model, right?," Karen said, struggling for the right terminology. "I guess we're 'divested,' sort of, 'spinning off,' call it. But not with the linear TV. Right. And so what- what do they see versus what Disney sees and who- who's making the right choice? I don't know. I mean, the landscape's changing so quickly, it's hard to know. But it was a really good interview, though. I mean, he seems very optimistic."

Guy Adami didn't address Comcast/Versant/whatever and said to "buy strength" in DIS.

Mel said David Faber is on the "Mount Rushmore of CNBC talent." Guy said Mel is "on that Rushmore too."

CNBC San Francisco set isn’t big enough for more than 3 people

(a/k/a ‘absolutely massive excitement’ in portfolio management business)

It says something about the impact of AAPL's WorldWide Developers Conference when a business television program the day after the event is even less exciting than the one that aired a day earlier an hour before the event even started.

But one thing viewers learned from Tuesday's (6/10) Halftime Report was that CNBC's San Francisco "office" is so small (about the size of Joe's pandemic office with numbers on the walls) that no more than 3 persons can be seated at the table on camera. (That explains why Dee Bosa and Steve Kovach delivered reports from seemingly another set but with the same Bay Area background.)

When the show began and Judge was introducing the topics, a woman (we think Dee but can't be sure) was heard on open mike saying "I don't hear Scott."

Early in the show, Judge mentioned that Steve put on social media that AAPL held a "WorldWide Meh Developers Conference," which Judge said was "cold."

Steve clarified that he was "linking to uh, the Cramer's Investing Club takeaway uh when I- when I tweeted that." But Steve said, "That's what the Street is saying this morning too."

Erik Woodring of Morgan Stanley, who has a 235 on AAPL, said "we didn't get much" about progress toward the exciting goals from 2024's WWDC.

Malcolm Ethridge, who was in D.C., said he thinks we're nearing "peak pessimism" in AAPL and he's close to buying but hasn't yet. He suggested 172 is probably the "floor" for bad news. He ended up making AAPL his Final Trade.

Alex Kantrowitz joined Judge and Brenda Vingiello at the San Francisco office for what was kind of a generic conversation about the state of Megacap Tech. Judge opened telling Brenda that it seems like taking out the old highs is a matter of "when not if." Brenda conceded there's been a big "resurgence," but growth needs to "stay intact."

Malcolm Ethridge said he's "growing a little bit more skeptical of this market at 22 times on the S&P."

Malcolm Ethridge said he doesn't like any stocks now such as MCD that get 50-60% of billings from the federal government are tied to the consumer, but he said the area for growth for MCD would be its plan to "add additional franchisees and open additional stores from here," for all those who figured there couldn't possibly be anyplace in America without a McDonald's at the end of the block.

Judge said DIS got a Loop upgrade; Brenda said the Hulu deal was "a lot lower cost" than had been speculated.

Brenda said the Musk-Trump split is actually the "best thing for both parties."

Alex Harmsen, the co-founder of PortfolioPilot, was Judge's star guest. He's so excited about his line of work that when Judge asked about reaching 30,000 users and $30 billion in assets, he said, "It's been exciting, uh, absolute, uh, you know massive excitement." He said AI supplies "optimization" opportunities.

Preserving ‘mental capital’

Judge was in Cupertino for Monday's (6/9) Halftime Report, a sleepy preview show in which most of the commentary could've been recorded months earlier. (It must've been cold, because Judge was in both a thick vest and a jacket.)

Panelists were not in Cupertino. Rob Sechan, back in NewEdge offices, said it's hard to be "too pessimistic" on AAPL but conceded that the WWDC "may be a sell the news, uh, moment."

Joe Terranova, broadcasting from that pandemic room with the numbers on the walls, said AAPL is "bcoming more value tech than anything else, and it's not that exciting." Judge questioned the terminology of "value tech" when "it trades at 26 times."

Stephanie Link actually said, "What a difference a year makes."

Dan Ives, who was on Judge's Cupertino set and whose jacket got a mention by Judge, said he's still confident that "the consumer AI revolution (snicker) runs through Cupertino." Dan suggested a $4 trillion market cap.

Alex Kantrowitz joined Judge and Steve Kovach in Cupertino and said people are talking about this as an "AI gap year for Apple."

Judge tried asking Joe about the Trump-Musk war; Joe's mike wasn't working, so viewers got a bit of a Shields & Yarnell routine; then Joe's audio returned, and it sounded like Joe was in a cavern. Joe stressed how he can't change the rules for the JOET, but if he could "tweak" the strategy, he would write off some names that require "mental capital."

Stephanie Link jumped aboard UBER, which she noted is "7% below its highs," always a favorite Halftime metric. Joe said "obviously I support" Stephanie's arguments in favor of the company.

Judge said there's been speculation about some names getting in to the S&P 500, but it hasn't happened. Joe said that not getting in "stalls" the positive momentum of APP. But he asserted that the fundamentals are strong with IBKR.

Jenny doesn’t think the stock market is ‘running’

Judge on Friday's (6/6) Halftime Report seemed determined to dismiss Permabear (except in all those great non-tech stocks with low P.E. ratios that are out there for real stock-pickers) Jenny Harrington's typically not-so-optimistic outlook on the stock market, only to have Jenny pivot to a semantical debate.

Judge opened the show telling Jenny, "This market continues to run."

Jenny immediately objected, "I don't- I mean, I don't really see it as running, do you? What are we up now, 1½%, 2% on the whole year? That's running?"

"Why don't you judge it from the low," Judge suggested, adding that maybe Jenny is "trying to make yourself feel better," but isn't that "kind of missing the story."

"I don't think it can go a lot higher from here," Jenny bluntly stated, citing "serious headwinds."

Rob Sechan said he "very rarely" disagrees with Jenny, but "the pain trade is still higher" (translation: That means he thinks the market is going up) and "there are still tons of haters out there." Rob even said "one of the biggest bulls is Mike Wilson."

Rob suggested the market's in a range of 6,150 to 5,400, but it would take something "pretty powerful" to go back to 5,400.

Josh Brown said some things should provide "faith" that we won't "revisit" the lows this year. Josh said Megacap Tech CEOs reaffirmed AI spending and that we haven't had a bad jobs report.

Josh also said "the Robinhood crowd" is "buying every dip" and that HOOD is at a new high. Kevin Simpson noted that HOOD could be had for 31-32 during the April lows.

Jenny said she was at a REIT conference last weekend, and "overall," expectations were for zero rate cuts this year.

Judge asked in disbelief, "You came back from a REIT convention and that is, is shaping your view of the overall market?" Jenny answered "no," that it's only shaping her view of "where I think rates are going." (And we didn't realize that REIT CEOs are better than the markets/Steve Liesman at knowing what rate moves we're going to get.)

Jenny owns DOCU and said she's "up 80%" in 2 years and said the earnings are "fine" despite the stock's big selloff, which Jenny called a "huge opportunity."

Rob said he sold LULU last August for a "tax loss," and now, "the stock seems to have broken down." Jenny of course asserted that DOCU is a better stock than LULU.

‘We are above that sort of thing’

Fairly early into Friday's (6/6) Halftime Report, Judge turned to Eamon Javers at the White House; Eamon said Donald Trump "intends to sell or give away" the red Tesla he bought at the "peak of his hype cycle around Elon Musk."

Eamon said "a number of the TV networks" have "live cameras" pointed at the car on White House grounds, waiting for it to be moved, adding, "We are above that sort of thing, so we don't have that."

Kevin Simpson said he trimmed TSLA a day earlier. "They're not in as good a position today as they were 48 hours ago," Kevin said. He said he wrote covered calls at 270 for a $25 premium; they expire next Friday.

Josh Brown said he wasn't on Thursday's show because he was at a funeral. Josh said the TSLA shareholder base "literally doesn't care about anything," and it's a "nothing matters stock."

Stephanie Link dialed in to say she bought more AVGO.

Jenny Harrington bought LYB (Zzzzzzzz). Rob Sechan sold COP but added JEF.

Kevin Simpson bought MRK and sold CRM.

Josh Brown talked up DE.

Judge said RBLX is up in 8 of the last 9 weeks.

Jeremy Siegel on Closing Bell told Judge, "One of the oldest expressions on Wall Street is, 'Make the trend your friend.' And the trend is upward."

‘I do think it’s 2019’

The first half of Thursday's (6/5) Halftime Report was preempted by presidential remarks — and boy, was that story only getting started.

When Halftime panelists finally got a chance at Post 9, Brian Belski offered that we're getting "some clarity out of China" but still need some kind of resolution.

Bill Baruch said there was some "levitation" this week in anticipation of talks with China, but we need "more facts." Bill said there's a "tremendous amount of resistance" from 6,014 to 6,050 in the S&P 500.

Jim Lebenthal said the market's up because Trump and Xi are talking. Either referring to tariff negotiations or the congressional tax bill (we're not sure, and it wasn't clear), Stephanie Link said "this whole thing is so tiresome."

Belski said he's overweight tech but not overweight the Mag 7. Belski said "tech is here to stay" (snicker).

Bill said, "I do think it's 2019. I've been saying this, that we're gonna have a really strong 2nd half of the year."

Belski bought OKLO and CHKP, the latter being "half the multiple of CrowdStrike." (This writer is long CRWD.)

Bill cut his CRWD position in half, saying he bought last year during the outage fallout and hadn't touched it since, but there was some "shrinkage" in the earnings report and there's also "DOJ news."

As the shortened Halftime tried to gain momentum, Eamon Javers reported that after Donald Trump's remarks, Elon issued "blistering criticism" of ... um ... Republican leadership, tweeting/Xing that "Without me, Trump would have lost the election." Judge called it an "incredible, developing story."

Jim hung a 120 on DIS for his Final Trade.

On Fast Money, which was its 2nd recent production with a studio audience, Eamon Javers admitted he was "kinda out of words" to describe the Trump-Musk feud. (Except Eamon went on to report what had happened, so he obviously wasn't out of words.) There was a lot of news on this show, and not as much time spent with the gallery as in February.

‘Their belief — You can deficit-spend your way out of it’

Joe Terranova led off Wednesday's (6/4) Halftime Report with the 2nd straight day of suggesting Q3 will be the problem; "there is difficulty ahead" because the economy is "going to cool" and he's more concerned about "rapidly" slowing growth, not inflation. (Maybe that jibes with Weiss' contention (which both Weiss and Judge have seemingly forgotten about) that it's the "intermediate term" that's gonna be so awful.)

Jim Lebenthal was trying to argue with a straight face that the CBO isn't accounting for all the growth that can reduce the deficit mushroom cloud because the CBO doesn't do "dynamic scoring."

Judge cut in to say that Megan Cassella reported that the CBO said tariffs will "cut the deficit" by $2.8 trillion over 10 years, but Judge said "that is assuming of course that the tariffs are in place for 10 years."

Jim admitted, "I don't know if the tariffs will last."

Judge pointed out that even if that happens, the debt "trajectory" still isn't good. Jim stated, "The way you get out of this is not austerity. You grow your way out of it."

That's curious enough, but then Judge must've been eyeing Burger King for lunch because he really dropped the Whopper: "That's clearly their belief — is that you can deficit-spend your way out of it."

(So why not double or triple the deficit in the big beautiful bill, so we can spend our way out of it all that much faster?)

And can Jim point to any instance in the last 50 years in which the economy has "grown" its way ahead of the deficit? Has the government ever thought about spending less money?

Meanwhile, Sarat Sethi said in the short term to "expect a lot of volatility." Bryn Talkington said the bond market will serve as "judge and jury" about the country's fiscal path.

Bryn again suggested the market's in a range of 5,750 to "a little bit over 6,000," but "the pain is on the upside." (Which is a fancy way of saying it's going higher.) Bryn said she thinks there is "trade fatigue."

"I think it's a stock-picker's market," Jim said, acknowledging buys in CSCO and QCOM, both stocks that, with a certain exception of a few years for CSCO, Jim has been touting for his entire tenure on the show (but skip NFLX and TSLA; the multiple's too high!).

Joe has made interesting points about casinos, but gains can be had

In a discussion of stock streaks, Judge said UBER and WYNN are on 5-day losing streaks, but Judge is "Ubered-out," so he said they'd talk about WYNN.

Jim Lebenthal said WYNN is "stuck between 80 and a hundred." Jim predicted that when the breakout happens, it'll be to the "upside."

Joe Terranova observed that WYNN is "down 15% in the last 5 years." Joe added moments later, "Down 20% last 10 years." Jim said "I haven't owned it for 20 years."

Joe is right — but he failed to mention, as did Jim, that the stock during those 5-year and 10-year periods has had numerous bursts to the upside. It's had a lot of 6-month spans where it went straight up.

Judge said EQIX is up 6 days in a row, and so is WDAY, both owned by Sarat Sethi. Sarat said WDAY is a "great company" that's "coming off a bottom."

Judge noted ZTS, a Joe holding, is up. Joe noted VEEV is making a 52-week high.

‘Really good’ vs. ‘overwhelmingly great’

Judge on Wednesday's (6/4) Halftime Report brought up CRWD near the end of the A Block (this writer is long CRWD); "If we talk about it 10,000 times on the way up and everybody loves it, we're gonna talk about it on the way down."

Judge asked Joe Terranova, "What's the deal here?"

Joe suggested that a stock on that kind of ride has to have a report that "blows away" expectations. Joe said it was a "really good report" but not an "overwhelmingly great report." Judge wondered if positioning and valuation were "full," why does there have to be something wrong with the report. No one mentioned, as did Guy Adami the night before on Fast Money, that 450 appears to be support in the stock.

Later on, Steve Kovach reported a filing on government questions about the CRWD outage a year ago.

Joe at one point started to rehash his convoluted parsing of a day earlier about which subsectors of tech have momentum and how semis are doing (at least we didn't have another defining moment of defensive tech). (Zzzzzzzzzzzz.)

Bryn Talkington said she doesn't see a "catalyst" to get AAPL shares moving.

Bryn said V, aside from the usual "high margins, no capex," is "out of the crosshairs of the tariffs."

Santoli was at Post 9, but at first, his mike situation was a little screwed up and he sounded a bit like he was talking in a cavern.

Judge brought in NBC Sports reporer Kira K. Dixon from the RBC Canadian Open to discuss recent controversies involving Rory McIlroy.

Judge said Bernstein initiated SPOT as a buy with an 825 target. (This writer is long SPOT.) Judge said it's up "515% in 3 years." Joe said it's a "clear winner as it relates to momentum" and that the JOET bought it on Halloween and is up 85%. Joe said he doesn't like LYV as much as SPOT and that LYV has been in a "sideways pattern."

Kind of hard to outgrow anything when the borrowing never ends

The deficit surfaced in the A Block on Tuesday's (6/3) Halftime Report, and Stephanie Link suggested we could "outgrow our way out of a lot of things."

Hmmmm ... We've kind of been hearing that since the '80s. We're wondering where all the outgrowth has been while the spending keeps piling up. And which sectors (besides government spending) are experiencing great growth? Cleveland Cliffs? If it's Apple, then you get folks like Weiss claiming that's the upper part of the economy while most people are living "paycheck to paycheck" and getting killed by inflation. And if it's Dollar Tree that's got the growth, then it's because "strapped consumers are all trading down."

Stephanie said it's the country's "children" who will have to deal with the national debt. Um, by now, we're actually up to the great-grandkids.

Judge said he's talked to "a number of people" who are watching the bond market and are "fixated" on the deficit, which isn't a "new" thing, but there seems to be "no wherewithal to do anything about it." Judge explained, "It's a kick-the-can-down-the-road, until the can gets run over by a truck."

Sounds like Joe is endorsing Q4

Joe Terranova at the top of Tuesday's (6/3) Halftime Report said momentum and technicals are "way too strong" for the market to "roll over." (Which is another way of saying, it works until it doesn't.)

Joe in his opening statement mentioned "Netfix" (sic) (snicker) but quickly corrected himself. (This writer is long NFLX.)

Joe said, "Literally the pain trade is probably to the upside," which is fancy terminology for saying the market's going higher.

"The bias is absolutely to the upside," agreed Jason Snipe, but Jason noted "lack of guidance" and "pausing" of guidance in earnings, and he predicted a "range" this summer.

Joe said if there's going to be "consternation" in the 2025 "journey" (snicker) (not the rock band), he thinks it's "ultimately (sic) (not really the correct term) gonna be in the 3rd quarter."

Joe struggles to define his new niche category, ‘defensive’ tech

Judge on Tuesday's (6/3) Halftime Report said data are actually showing that tech is near a "record underweight" by big funds.

Joe Terranova suggested there's a "pivot" in the works from "defensive" tech toward semis. Judge asked for a definition of "defensive technology." Joe suggested INTU (Zzzzzzz) and IBM (Zzzzzzzz) but also said Megacap Tech is "its own class."

So apparently the market's making a "pivot" to something in tech, which Joe is parsing right and left.

Moments later, Joe kinda suggested NVDA and AVGO are "defensive semiconductor plays."

Stephanie Link has been trimming CRWD and putting it into PANW. (Uh oh. PANW is the company that either gets 5% or 50-60% of its billings from the federal government.) (This writer is long CRWD.) Joe said there's "very strong momentum" in cybersecurity.

(On Fast Money, Guy Adami said the "450 level" should be support for CRWD and the only thing not to like is the valuation. Tim Seymour said "I think there's more to this trade," but you'll have to let it "wait.")

Jason Snipe bought SNOW around 180 ahead of earnings, which was a good move.

Joe said he thinks NFLX (he didn't pronounce it "Netfix" this time) has higher to go, and he'd put SPOT "literally in the same category."

In a treat, CNBC's Pippa Stevens joined the Post 9 desk to discuss her report on META/AI/nuclear power.

Joe said UBER is now throwing off free cash flow and the company is "investment grade." Jason Snipe said UBER's got the "platform" that you want to have in rideshare.

In a discussion of CMG, Judge took issue with Joe saying "I believe in the company." Judge flatly stated, "You either own it or you don't." Moments later, Joe praised RCL as a "great turnaround story." Judge asked if Joe believes in that company. "Not as much as I believe in Chipotle," Joe said.

Judge announced that Malcolm Ethridge would be on Closing Bell; we didn't see it so we don't know if they discussed PANW billings.

‘I think the lows are in’

It took about 20 minutes to get to the headline on Monday's (6/2) Halftime Report, but to guest host Courtney Reagan's credit, she got it.

Joe Terranova had suggested that Steve Weiss may think the lows are not necessarily in, and Joe suggested it's possible they're not in.

Bryn Talkington, though, said "I think the lows are in." Bryn said April 2 was an "exogenous event" and that the numbers presented that day "made no sense."

Jim Lebenthal opened the show by listing all the world's hot spots and the conceding there's still "trade policy uncertainty" (Zzzzzzzz).

Weiss said "I agree with everything Jim said," citing "heightened issues across the globe," and Weiss even tossed in Poland.

Weiss wondered who could be "sanguine" about this market, with "valuation levels that are where they were a year ago" when we didn't have all this "nonsense." (No, just an incumbent president on the ballot who couldn't put two sentences together in a debate ... and the fellow who actually won.)

Jim said he agrees with a lot of Steve's "negativity," but Jim noted, "Companies have not been laying people off."

Joe said we've recently been in a range from 5,830 to 5,968. "You have momentum right now as a very strong factor," Joe said. But later, for those keeping score, Bryn suggested the S&P is in a range of 5,750 to 6,000, and we're in "middle ground" because we couldn't "punch through" the top.

Bryn said "May was the best year (sic) for the S&P in 35 years." Bryn said the jobs market will "remain strong" and, "We keep talking about all these tariffs, et cetera, but really we haven't seen a lot of- a lot of implementation."

Weiss said, "I actually think that the trade discussions are incredibly important, because that's what's chilling the capex market."

Weiss again in the 17th minute was bringing up his multiple of last year and demanding to know who could be bullish. Joe said "different people are looking at different things," and there's things now that inspire "confidence," but some people "change their mind." Joe said what he sees is "momentum is powering the market higher" and that it's "probably troublesome" to a lot of people.

It was probably a good day to unload CLF, but nobody asked

On Monday's (6/2) Halftime Report, which was guest-hosted by Courtney Reagan, Joe Terranova said AVGO and the semis are a "mean reversion trade" and he's "skeptical somewhat" about it continuing. More interestingly, Joe said he was "a little disappointed" in the response to NVDA's earnings with "not much follow-through."

Steve Weiss said he trimmed NFLX, but he talked it up and sees "nothing wrong" with it, but it's "irresponsible" to keep an outsized position and he said it's only a "question of portfolio management" as to how much he owns. (This writer is long NFLX.)

Joe said he agrees with Oppenheimer's downgrade of regional banks (Zzzzzzzzzzzzzz) (Zzzzzzzzzzzzzzzzzz). Joe said growth is a bigger concern than inflation. Jim Lebenthal said he was "caught a little bit surprised" by Joe's skepticism of regional banks. But Jim said there are plenty of big banks to invest in and no need to dabble in regional banks.

Bryn Talkington likened V to COST as attractive stocks despite what people consider high valuations.

Joe cautioned "be careful" in thinking that OPEC's extra supply will keep pressuring oil lower. Joe said positioning in energy stocks is "pretty light."

Joe and Weiss discussed what Saudi/OPEC announcements/moves mean for the oil market, the conversation was a little too deep into the weeds for this page to get excited about it.

Joe said if CRWD misses on earnings Tuesday, it's a buy. (This writer is long CRWD.)

On Fast Money, Steve Eisman sat in with the gang; Mel announced that Steve has a "podcast wardrobe." Steve kind of shrugged that he's a little concerned about tariffs but not much else. Steve said that "every couple of years," Jamie Dimon likes to "get on his soapbox and start uttering na- nattering nabobs of negativism." Steve said that term was written by William Safire to describe Spiro Agnew. (It was also used often by Louis Rukeyser, who liked to scold bears, on "Wall $treet Week.")

Mel actually asked Julie Biel, "What keeps you up at night about the markets?" (Julie did NOT say, "Weiss' MULTIPLE from last year!!!!!")

Note to Judge — this is the same stuff Jamie talks about all the time

From the beginning of Friday's (5/30) Halftime Report, Judge kept promising Morgan Brennan's live interview with permabear Jamie Dimon at the Reagan library in California.

And, unlike sometimes happens with these events, the interview got going fairly quickly, shortly after Judge said it would, just after nearly all panelists (except for Kevin Simpson) were given a shot at an opening market commentary.

Morgan hardly had to do any talking. Jamie started off noting debt and went on to say we basically have to "fix" everything ... permitting, regulations, immigration, taxation, inner-city schools, health care system, Pittsburgh Steelers quarterback situation: "We're not a team anymore."

Jamie said we should "Keep the Western military alliances together." Jamie said of trade negotiations, "They'll be agreements in principle. They will not be trade agreements." But they would provide a "framework ... to get things done."

Jamie sort of scoffed at stockpiling bitcoin and said we should stockpile "bullets" instead.

Jamie actually said "bulls---," as a verb, during his remarks.

After it was over, Judge restarted Halftime and said Jamie was "animated" and "always entertaining," but even Judge wasn't sure Jamie has ever been "this provocative on this many topics." Sorry Judge, we (and you) have heard it all before. (Jamie didn't actually bring up PANW's percentage of billings that come from the federal government.) (Let's hope Jamie thinks it's 5 and not 50-60.)

Jim Lebenthal said markets "sold off during the speech." Jim said "there was an apocalyptic (snicker) tone there."

Kevin Simpson took a "slew of notes" about Jamie's remarks.

Judge asked Josh Brown if the market is "ignoring" the risks mentioned "front and center" by Jamie Dimon. Josh said we're not ignoring risks, that they're "coming to fruition," but they're showing up in less important stocks. Josh pointed out how BBY got "hit hard" because it's having tariff issues, and GAP stock got "blown up, it's down 20%."

Stephanie Link interrupted Brown; "Stop, wait a minute ... Josh- Josh, the stock was up 55% from the April lows. ... The turnaround is for real ... I own it ..."

Josh insisted "I don't care" and that his point is (in reference to Judge's question), how can these stocks be falling like this if the market is somehow "ignoring" risks. (Because Stephanie can't stand the thought of anyone noticing GAP being down.)

Stephanie observed of Jamie Dimon, "He was not as negative 2 weeks ago." (#differentthingsfordifferentaudiences)

Kevin and Judge noted during Final Trades that Jamie told Morgan he'd entertain public service "If I thought I could really win." Jamie is asked this question by business media all the time. Why does the business media care. Has he indicated he wants to be a politician? When is he actually going to run for office ... when he's 110 years old?

We think Judge jumped to The Exchange a few seconds too soon, as Kelly seemed unprepared and the camera flashed between Judge and Kelly looking at notes and adjusting earpieces.

Rest of the year ‘will be OK’

In the non-Jamie-Dimon portions (that's the very beginning and part of the end) of Friday's (5/30) Halftime Report, Stephanie Link said of the stock market, "I think we could be sideways for a little while ... but I think it would be short-lived."

Stephanie said the economy is "chugging along."

Josh Brown said the Mag 7 is the "most interesting place" in the market. "They're now 8% below all-time highs," Josh said.

Josh said we got a "Goldilocks, uh, inflation number this morning."

Jim Lebenthal bluntly said "the tariff bark hasn't shown up."

Late in the show, Judge discussed his chat with Dan Loeb. Except the hook of Judge's remarks was that Third Point just turned 30, and Judge wasted some of the limited time at the end of the show reciting Third Point's résumé and touting how great Dan is thought to be. According to Judge, Dan thinks the rest of the year "will be OK" (Zzzzzzzzzz) (snicker) (if Dan did NOT think so, that would've led the program) and that Third Point ... incredibly ... owns some Mag 7 stocks. Judge said Loeb said he bought "bank debt" in X/Twitter. (But apparently Loeb didn't take a stake in PANW based on whether it's 5% or 50-60% of billings that come from the government.)

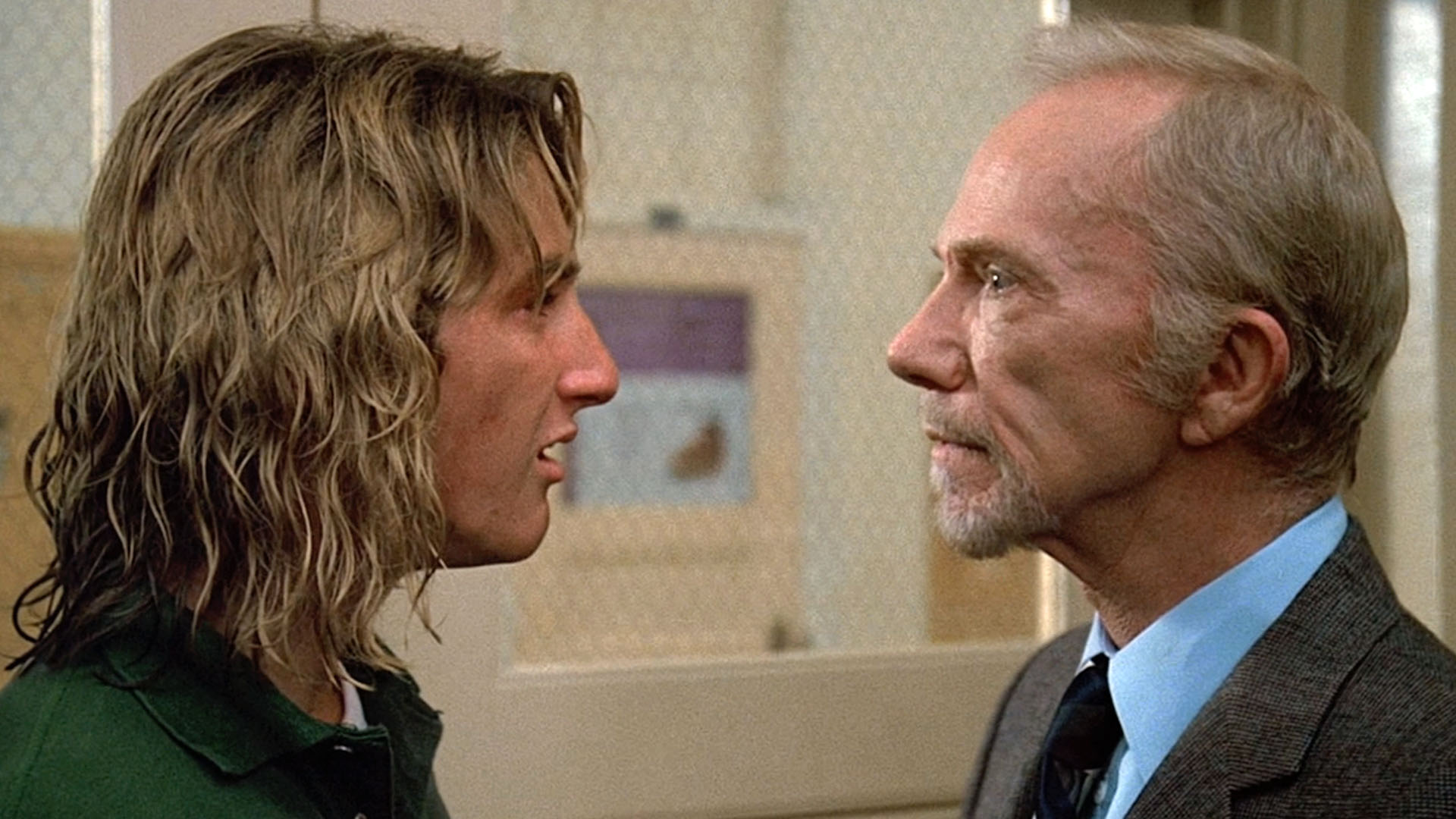

Judge says PANW CEO ‘refuted’ panelist’s argument — and ‘I think we had some issues with what Malcolm had to say’

On Thursday's (5/29) Halftime Report, Judge had a correction to air. And first, he let a CEO do the honors.

Judge was referring to Halftime panelist Malcolm Ethridge's comment a day earlier that for PANW, "50 to 60% of their revenues comes from the federal sector," a point made by Ethridge while explaining why he sold and doesn't like the stock.

(In hindsight, that does seem awfully high.) (But this page didn't think to question it a day ago.)

Ethridge also bluntly stated in his debate with Stephanie Link, "Palo Alto Networks needs the U.S. government."

Anyway, on Thursday, Judge said PANW CEO Nikesh Arora actually "refuted Malcolm's key claim in a post last night on LinkedIn."

OK. Terminology there is a big deal. Because many people misuse "refute." Including CNBCers. More commonly, something is only "rebutted." But given what Judge went on to say, it sounds like CNBC believes "refute" is in fact the correct term here.

Judge showed a graphic of Arora's rebuttal. Of the 4 points listed on screen, the first one — 5% of billings are from the government — is the only one that really matters.

Judge then spoke to the camera and indicated that not just Arora, but CNBC, had a problem with Ehtridge's comments a day earlier:

"Here's the key point to be made, and where I think we had some issues with what Malcolm had to say. 50% of government spending on cyber goes to Palo Alto. (That too seems a high number, but this page is not going to investigate it.) 50% of what the government spends on cyber goes to Palo Alto. NOT that Palo Alto itself relies on the government for 50 to 60% of its billings. What percentage of Palo Alto's total billings come from government? In Q3, the company reported single digits, and you saw what Nikesh Arora himself said in his own words, was 5%. Um, yes, there have been concerns about slowdowns in billings (sounded like 'buildings') in prior quarters, including from the government. Uh, but the numbers were way off. And, the facts matter. They matter to you. Matter to us. Matter to the companies we talk about. I wanted to get that cleared up."

OK. Hmmmm ... Normally in situations such as these, the panelist dials in the next day and says "Sorry, I misspoke." Or possibly, the panelist may dial in to explain why they think they were corerct. Ethridge, who has only made a handful of Halftime appearances but has been a semi-regular on Closing Bell for years, did not appear on Thursday's show.

Either he meant to say, "They get 50-60% of all government cyberspending." Or he meant to say exactly what he did say.

Of course we don't know, but given how emphatic he was in his reasoning, we have to think it's more likely the latter than the former.

Which then begs the question — if a Certified Financial Planner (according to his web page at CNBC.com) is selling a stock and expressing deep skepticism about it on television because he thinks the company gets 50% of its revenue from the federal government when it really only gets 5% according to its company report ... what kind of research is he actually doing?

On Thursday, after Judge's statement, Bryn Talkington said of the PANW debate, "Steph won on that one." Except Stephanie didn't argue that Malcolm's numbers were wrong — she argued that the government won't cut cybersecurity spending. On that point, Ethridge may still be correct. This page will say that any company's government contract during this administration probably shouldn't be regarded as iron-clad.

Bryn on Thursday said to just "buy the basket" in cybersecurity. Josh Brown said ZS looks "phenomenal" and added that he owns CRWD, which he said made a record high on Wednesday. (This writer is long CRWD.)

Ethridge does not appear on CNBC.com's Halftime Report "Investment Committee" portal, which lists the current holdings of panelists. He does appear on the CNBC.com page of CNBC Contributors, which includes most Halftime Report and Fast Money panelists.

On Wednesday, Malcolm had told Stephanie, "I wish I had called you before I sold my shares. You might've paid a premium for 'em." He would've been better off calling up the company's quarterly report.

At the end of Wednesday's PANW debate, Judge said, "All right, we'll leave it there. Little spicy, which we like."

Jensen read a script

Judge opened Thursday's (5/29) Halftime Report declaring the trade court ruling on tariffs is only "far, far from the end of it," so "we're gonna focus on Nvidia." (Which made us wonder whether anyone wants to buy CLF instead of NVDA.)

Josh Brown said NVDA's in a "really singular position" with a "not crazy" multiple. "Obviously, the growth rate is decelerating," Josh conceded. All that said, "This company is just absolutely on fire," Josh said.

Bryn Talkington said the options market seemed to get the NVDA move right, and to get past all-time highs, we'll need "clarity around China." However, when it comes to Jensen, "I think this is the first call I've ever heard him read a script, first of all. Very, I mean- he didn't have one extemporaneous word. It was all very scripted out."

"Is that a problem?" Judge asked Bryn. "You're not the only one who's mentioned that," adding that an analyst thought it was "closer to an Apple call."

Bryn said "it would matter" if it becomes a "consistent" feature of the earnings call. Bryn said Jensen "obviously owes a debt of gratitude to Trump for negotiating you know with the Saudi and UAE."

Bill Baruch said NVDA is "our largest position at this moment here." He said he really likes what Jensen said, "scripted or not." Bill said, "I now think 180 is the next stop up here."

Just what the world needs:

‘Mission: Impossible 30’

Bill Baruch on Thursday's (5/29) Halftime Report talked about buying more GOOGL, citing "the I/O event."

Judge noted Bill was "skeptical" of the "Eddy Cue, so to speak, selloff."

Bill said "there was levitation" after the I/O event, and the stock has a "lot of room."

Jenny Harrington though said, "I'm gonna bet you that my search on Google is down 50% in the last month, because I'm using ChatGPT, Grok, Claude, and I'm using them all the time, and I'm getting much better results. ... And I'm not seeing any advertising on those."

Bill pointed to videos "that are coming out of AO 3" and said "There could be 'Mission: Impossible 30'."

Josh Brown wondered what happens to Alphabet stock if "OpenAI files for an IPO." Josh said Gemini might not be a "total also-ran" but it's "not where it needs to be."

Judge said semis have been "on fire" in May. Jenny Harrington, of course, said, "I think we need to be careful when saying 'Hey this is a great month.'" Jenny suggested the moves are only because the stocks a month ago "were down too much."

Judge said the Mag 7 ETF is having its "best month ever." Bryn Talkington said that Jenny's point about "mean reversion trade" is "very accurate."

Jenny said you might want to own "3" or "5" of the Mag 7, "but I'm not sure you wanna own all 7."

‘Double top’ in bitcoin

Judge returned from the A Block commercial break on Thursday's (5/29) Halftime Report announcing that Bryn Talkington sold NKE and RH.

Bryn shrugged that she bought RH at 145 and sold May 23 180 calls and it got called away, "about a 39% return" in 6 weeks.

Bryn said NKE going back on Amazon "was incredibly smart," but the company needs a "refresh." Jenny Harrington praised Bryn for buying RH and NKE when they were hit last month.

Bill Baruch touted AS, which he said had a "blowout report last week."

Josh Brown touted DRI, which meant touting Olive Garden while explaining why he doesn't have to go there because of all the great Italian restaurants on Long Island.

Josh said if you're near a Capital Grille (that's Darden upscale), get the New York Strip or the ribeye.

Bryn suggested there's a "double top" in bitcoin around $109,000. Bill said gold looks "really constructive" and that moves in precious metals are "just getting started."

On Fast Money, Tim Seymour said, "Today was kinda tho- that weird day where tariffs don't exist anymore, but maybe they might." We gotta figure out how to get Tim elected to office.

‘There is no way this administration is cutting anything in cybersecurity’

Wednesday's (5/28) Halftime Report came up with a heckuva debate on cybersecurity stocks. (This writer is long CRWD.)

Malcolm Ethridge sold PANW and said he's been talking up the sector for a long time, "but Palo Alto specifically scares me," because of the "very different stance" by the Trump administration vs. the Biden administration as to paying for cybersecurity, so he'd rather be in CRWD, which he said is less exposed to the government.

Stephanie Link cut in, "There is no way this administration is cutting anything in cybersecurity."

Malcolm insisted the administration had just been "defending their stance" on cutting to Congress.

Regardless, "There is no way," Stephanie said several times.

Malcolm said, "DOGE cut 45% of the cyber workforce in the U.S. government." Stephanie brought up one of her favorite terms, "total addressable market," and she added, "You don't need the government." Malcolm insisted, "Palo Alto Networks needs the U.S. government."

While this page has no idea about the government contract specifics for PANW or CRWD or any other cybersecurity stock, it's our perception that PANW historically has had some lengthy slumps mixed around some great runs. Stephanie may ultimately have a better argument, but we're not sure there's any reason to jump in to PANW now.

Malcolm suggested that Stephanie might've bought his PANW shares at a premium.

Grasso: Sell the afterhours pop in NVDA

Maybe Wednesday's (5/28) most provocative stock call was heard early on Fast Money, when Steve Grasso said of NVDA, "I'd be a seller of this pop afterhours ... I think you're looking at lower prices tomorrow."

Later in the show, Grasso bluntly called NVDA an "easy sell."

Earlier on Halftime, Judge asked panelists about trading NVDA. Joe Terranova told Judge, "The hardest trade is usually the best trade." Which apparently means making the "hard" decision to stick with the upward momentum in NVDA that "does point towards" an all-time high in the stock.

Sarat Sethi said "the key point is visibility" and "the stock could move from here" if the company gets some China upside.

Malcolm Ethridge said the approach to NVDA depends on whether it could "ramp up production" of the Blackwell chip.

Stephanie Link didn't think this would be the "catalyst" quarter for NVDA and said if AVGO or NVDA falls on this report, you'd want to buy more. In quite an understatement, Stephanie said, "It was right to be buying these stocks in April and May." Can't argue with that one.

Joe said AVGO may "accelerate the buyback." Stephanie argued, "That's usually a 4th-quarter thing."

Joe conceded to Judge that he has criticized CRM in the past for being "serial acquirers." Joe's "undecided" on the Informatica deal.

CLF hits new 52-week low

Joe Terranova on Wednesday's (5/28) Halftime Report claimed he gets asked "quite frequently" (snicker) numerous questions about giving clients more private equity exposure; Judge demanded, "What's your answer, rather than 20 questions, what are the answers."

Joe punted on that, stating that for wealth management, portfolios are "unique to the individual."

Stephanie Link added to KKR because she thinks private markets are still in "early innings."

Stephanie gave GAP an "oh by the way." Joe suggested that in retail, so far, "The companies are eating the cost of the tariff." Stephanie said she's hanging on to TGT because "I believe in the brand. I believe in the enterprise value," even though, "I'm not sure what happens to Brian Cornell by the way."

Judge said MNST hit a record high, which we didn't realize. Joe said it used to get talked about more often, which is true, and acknowledged the JOET owns it for momentum.

"I think we're still in digestion mode," Santoli said of the markets in general.

Joe said he sold BABA; he said he gave it "basically 90 days to work" but it was back to where he bought it. Joe said everyone will say that "David Tepper's in it" but Tepper isn't going to call Joe about how he's managing his position; "maybe he'll call Weiss."

Sarat Sethi unloaded CHTR, saying "net-net, we lost money" having owned it more than 2 years. According to the chart, it looks like if you bought it 12 months ago, you've done great, but it's way down from mid-2021.

‘A bunch of Cleveland Cliffs’

On Tuesday's (5/27) Halftime Report, Judge brought up CLF. We were kinda surprised no one was chuckling about this trade. Um, good thing it was given the seriousness it deserves.

Judge pointed out that CLF is "a $6 stock" (snicker) and is at a 52-week low. Then Judge demanded of Jim Lebenthal, "Literally, why do you own this stock."

Jim answered, "Well, basically, because I think it's undervalued."

Judge complained, "The amount of social media posts, uh, regarding this name and you, on a day like this, uh, they're many. ... We need some answers here."

Jim conceded, "This is not how I expected the stock to turn out. ... It's why you build a portfolio because you can't have a bunch of Cleveland Cliffs (snicker) in it ... They have a turnaround story (snicker) in place."

Jim explained he's not selling because he thinks this is the "wrong price at which to sell it." Judge noted Jim has recommended the stock "numerous times" — that's an understatement, it actually might be the most recommended stock in show history, given how often Jim has talked about it over so many years. (But why buy NFLX or TSLA when ... CLF is "undervalued"?) (This writer is long NFLX.)

On Fast Money, Karen Finerman announced an investment not in CLF, but the WNBA's New York Liberty. It's reported as a limited-partnership investment. We did think it's kind of curious that the new money, which includes investor cash from Jack Ma and Karlie Kloss, is going partly to a "state of the art" training facility that includes a "beauty salon" and "child care."

CNBC contributor Karen Finerman buys stake in New York Liberty; CNBC’s new sports reporting team doesn’t even put a story on CNBC.com

Joe Terranova on Tuesday's (5/27) Halftime Report suggested the market's getting "desensitized" to tariff headlines. As always, Joe brought up whatever bond yields are doing.

Joe said the market appears to be making a "potential run towards the all-time highs," though as always, Joe suggested once we get there, it could be a "bull trap."

Jim Lebenthal said it's a "possibility" that the market may be getting "desensitized" to tariff headlines because the tariffs are bringing money that can partly pay for some of the spending in the new tax bill — one of the few not-so-negative assessments of tariffs that we've heard on CNBC.

Josh Brown mentioned Marty Zweig and brought up the significance of "breadth thrusts" (snicker) and said the market had "multiple" breadth thrusts in May.

Josh said there's "massive call-buying" in NVDA that he thinks is "warranted." Josh contrasted NVDA's valuation with that of AAPL.

Jim said he bought NVDA at 120 before it fell to 90, then "bought more there." (Better that than CLF.)

Jim said Alphabet has become a "battleground" stock, and he's "surprised" that it's a battleground stock.

Joe cautioned that AAPL and TSLA have "headline risk."

Josh said consumers are answering the surveys (snicker) "negatively," but that's not a reflection of what consumers are actually doing.

Jim said consumers are "getting back on the balls (snicker) of their feet."

Josh said SNOW is back in the good graces of the stock market.

During Tuesday's Fast Money, ears around CNBCfix HQ perked up when Mel mentioned "$4 bathing suits."

Steve Grasso is running away with the Call of the Year

Back on April 7 (hit PgDn a few times), this page suggested that Steve Grasso's regular buy recommendations for X had surged atop the leaderboard for Halftime Report/Fast Money Call of the Year.

After what happened Friday (5/23), we doubt anyone will catch him.

Steve on Friday explained his view on the Nippon Steel-X takeover offer. "The president had to do something," Steve said, asserting it was "definitely consensus view whether you're a Democrat or whether you're a Republican."

Steve said Joe Biden "didn't want to let the deal go through" but the "original price" of $55, "they had to do something to get it back there."

As far as what to do now, Steve said, "I'm gonna hold on a little bit longer. But this is the top for me. ... This is more of a ceiling than a, a floor. ... I'm gonna exit as close to 55 as I can."

Tim Seymour questioned why even hang on "for the extra 3 bucks," adding, "It's not like there's a feeding frenzy around these assets." And actually, we think Tim's got a good point.

Grasso was calling X a buy at least as far back as December. On Jan. 7, with the stock at $33.30, he said, "I think you'll see a bailout," and on Feb. 7, with the stock having dipped to $36.98, he said X has a "chance" to reach 50.

There may not have been many specifics from the president in his X announcement Friday. But like Guy Adami always says, "Price is truth." Grasso more than once hung a 50 on what had been a $30 stock, and he got it in half a year.

That's gonna be really tough to beat.

(This writer was long X much of this year but no longer has a position.)

On AAPL, Steve said Friday, "I think you actually buy the stock here." Dan Ives said Friday was a "Twilight-Zone day" for any AAPL investor, given that the company's "done all the right things" as far as "pivoting out of China."

Steve noted the "amazing bounce-back" of NVDA, but "I think it's time to sell it again."

Kevin says tax concerns are ‘irrelevant’ to his trading calls; ‘comes down to math’

The Halftime Report crew on Friday (5/23) started to have — but never really finished — a very interesting discussion about the impact of taxes on stock portfolios.

Frankly, Judge could devote an entire episode to this subject and provide a lot of value to viewers (but instead we're going to do another report from the CNBC Sports Team about what mythical market value the Manchester United team might have).

Friday's tax conversation centered around AAPL. Judge said Dan Ives thinks the notion of making iPhones in the U.S. is a "fairy tale" and that AAPL would have to charge $3,500 per phone. But then Judge said Wells Fargo thinks prices would only have to go up $100-$200, which Judge said is "not exactly the $3,500 price tag that we've heard bandied about by the skeptics and the critics."

"I think you hold Apple here," offered Kevin Simpson, who nevertheless said that in the "intermediate and longer term," he's more worried about Jony Ive's deal with OpenAI-ChatGPT.

Then Jenny Harrington asked Kevin what was actually Jenny's best question in months: "What do you think if you hold Apple in an IRA. Versus a taxable account. Because everyone who has it in a taxable account has a huge capital gain. So you kinda need it to go down 15 to 30%, right?"

(OK, more on Jenny's "down 15 to 30%" in a moment.)

"So I never let the tax tail wag the dog," Kevin said, an interesting comment, because panelists on Halftime and Fast Money occasionally, but not always, mention tax considerations.

Kevin continued, "It's irrelevant in all of my theses, because it just comes down to math. But certainly in an IRA, you know me really well, I would wanna write covered calls against it, actively, because you have no short-term capital gains in the IRA. We do the same thing in taxable accounts."

OK, fair enough. Kevin says in IRAs, he would hold AAPL, and he'd write covered calls, and in fact, he'd do the same in a taxable account, where you presumably would have to account for short-term capital gains on writing those covered calls.

Kevin said he sold AAPL in December "around 247 and a half," and a month ago on April 9, he bought it at "177." So he traded it absolutely perfectly. Then he got to the point: Kevin said to Jenny, "But if your clients that have low cost basis, I think writing covered calls or at least putting in stops, paying the tax is better. Think of Nvidia when it was 150 and went to 88. No one sold it, because no one wanted to, because of the tax consequences."

OK. That last sentence is curious. Maybe people didn't sell NVDA because of "tax consequences," but NOT selling was also a great trading call, as the stock rocketed higher.

It seems people held NVDA at 88 for what Kevin considers a bad reason (avoiding tax), but in fact, owning NVDA at 88 was a great move.

Kevin of course was clear: He doesn't make stock decisions based on taxes. On AAPL specifically, he is saying to hold it, presumably because it will eventually go higher, but in the meantime, either put in a stop in case it doesn't go higher, or sell covered calls.

Before Jenny could respond, Jim Lebenthal got a chance.

Jim said the reason to own AAPL "is more technical than fundamental," which prompted Judge to scoff, "Let's not act like, you know, this- this company is dead in the water. Um, they still have the most powerful installed base in the history of consumer products by a lot."

Jim asserted, "When money flows into the markets, it's going to flow into Apple."

Jenny told Jim she disagrees with that: "The market's flat on the year, and Apple's down 21%. So it's not necessarily true." Jenny added that the "dicey" part of Jim's argument is that AAPL should have an "S&P-like return."

Back to taxes. Jenny insisted on concluding, "If I had Apple in an IRA, I think you need to be very, very cognizant of what the opportunity costs of holding it are. And if you don't believe it's gonna have an S&P-like return, and you don't have the ability to write calls, and you don't have a capital gain, maybe you wanna get out of it."

OK. So there you go. Jenny is not optimistic about AAPL and would sell. That's a trading call. But Jenny is also conceding that people in taxable accounts may have steep gains in AAPL and may be reluctant to sell simply because it would incur a large capital gain. Which gets into overall Fear of Taxes that this page has taken up other times. (There would be less Fear of Taxes if people built in a tax accrual for their capital gains, rather than seeing a 50% gain in their portfolio and trying to figure out some way to somehow keep it all.) (People's favorite solution to that seems to be, Lose money in something else ... which, um, really doesn't make any sense.)

Now, as for Jenny's comment about when to sell AAPL in a taxable account: "So you kinda need it to go down 15 to 30%, right?" ... We have no idea where Jenny is getting those numbers. Maybe it's something they teach in Advisor School? As if there's some kind of formula for people with big capital gains, that you would somehow "need" the stock to tumble 15-30% to make a sale cost-effective in some way ... honestly, we don't get it. (But then again, we don't know anything about anything.)

We think, in general, Kevin's approach is correct — trading decisions should not be contingent upon taxes. With a couple exceptions. If you've held a stock for 364 days with a gain and you decide to sell on Day 364 instead of waiting 2 more days, you're ... not making the greatest timing decision.

That type of decision is pretty clear cut. Here's where it gets tough: What if you've had a stock for 10 months and it's currently on fire and you think it may be "toppy." In an IRA, you'd sell. In your taxable account ... do you sell now and take a short-term gain ... or hang on for 2 more months and hope it doesn't give back the big run you're enjoying?

That would be a good one for Judge and Mel's panels to tackle.

Addressing AAPL tariffs, Jim said, "I'm not trying to be provocative, but this is kind of thuggish behavior. Apple has been told, today, 'Pay up.'"

Jenny: ‘I haven’t been cheering’

On Friday's (5/23) Halftime Report, Judge grilled Stephanie Link over what it'll take to get her to sell TGT, noting it's hard to take the "L."

"It's hard to take the 'L,' but that's not the reason why I'm not taking the 'L'," Stephanie said, and, in fact, while Stephanie did stumble over the very tricky double-negative there (explaining why something was NOT the reason she is NOT selling), she did recover impressively. Stephanie eventually said she's not taking the L "because I still believe in the brand and I still believe in the, um, enterprise value over the long term."

Actually, that stock has become very interesting. We have no idea why it has slid so much, or what it would take to get it going again. (This writer has no position in TGT.)

On the market in general, Jenny Harrington told Judge, "I haven't been cheering. Because I've been nervous. ... I think we could have 3 and a half more years of uncertainty."

But then Jenny admitted she's "fully invested." (Translation: Can say they were right regardless of whether the market goes up or down.) Jenny said, kind of like the comment at the beginning of "The Godfather," "I completely believe in America," and she advised viewers that they can do OK over the next 3 and a half years as long as they "don't get too despondent" about the "news bombs." (Translation: Everyone should've been buying hand over fist on April 4. As Jenny surely was.)

Kevin Simpson said he's been buying AXP for months, including in the morning at 282. Kevin also said he bought BA, for growth strategy because he can't buy it now for his dividend strategy, under the theory of "return to normalization." Stephanie Link said "the story is really just beginning" for BA.

Judge asked Jim Lebenthal how he pronounces "submariner." Jim said, "'Submareener' is the way Navy people say it. 'Submarriner' is the way non-Navy people say it."

Jenny still hasn't sold OGN, which she said weeks ago she was going to sell.

Barry actually wasn’t that far off

Every now and then, bold calls get forgotten on CNBC's Halftime Report.

So we thought it was worth revisiting the market outlook of Barry Bannister last fall, or specifically Nov. 7, when Judge said Barry was warning, "The train is approaching Crazy Town," and that there's only upside to the low 6,000s and downside to 5,250.

"Crazy Town," while it is funny and we give Barry credit for that one, really never happened. At least hasn't happened yet.

But ... in terms of pure numbers, Barry basically nailed it.

On Nov. 7, the S&P 500 closed at 5,973.10. That's still above where it is today.

After Nov. 7, the market spent 3 months grinding higher into the "low 6,000s." Then it found an excuse to plunge to actually below 5,250.

Prior to his Nov. 7 call, Barry last October had predicted stocks would "crash 25%" in 2025 from whatever peak they reached. Maybe what happened in early April is indeed a "crash." But it wasn't 25%, and we were only below 5,250 for maybe 2 weeks. That's hardly like October 1929.

Skeptics may say Barry's scenario would never have happened without the tariff tantrum. Barry may well argue that his prediction of a steep selloff did indeed come true.

That's what makes a market.

Stephanie still averaging down into UNH

Judge on Thursday's (5/22) Halftime Report curiously asked Stephanie Link, who joined but wasn't one of the panelists, if she has "regrets" about buying UNH on the way down.

Stephanie said no and that she even bought more Thursday and stressed it's not a "quick fix."

Stephanie said she's never seem the stock trade at this level, and assured viewers that she's "not looking for anything heroic at this point."

Honestly, Stephanie had a chance here to sell viewers on this trade, and her arguments really had nothing new. Weiss' recent suggestion of UNH being "dead money" is more convincing.

Judge already backpedaling

on his Eddy Cue warning

Back on Thursday's (5/23) Halftime Report after several days off this week (see below), Judge brought up Alphabet's Eddy Cue setback and recalled warning Alphabet long Jim Lebenthal about being too nonchalant about the news.

Judge on Thursday pointed out to Jim that "yours truly" suggested this can't be "so easily dismissed." Judge said Jim "that day, said, 'I'm not doing anything.'" Judge said GOOGL shares are up 15% since then.

Actually, what really happened a couple weeks ago was (hit PgDn a few times), Jim said he wouldn't have a "knee-jerk" reaction to the Eddy Cue news and cited how GOOGL slid on that Gemini news of a year ago (or farther back). Judge told Jim then that the "headline story" is the "definitive usage drop" in Google search, and Judge told Jim that Jim shouldn't be "flippant" about the gravity of the situation. Jim again said he doesn't "knee-jerk" his reactions.

So Thursday, after Judge (to his credit, we guess) ate a little crow (Alphabet has bounced, but we wonder if Judge isn't throwing in the towel a little early), Jim and Judge conceded "it's not over yet," but Jim stressed that it's Alphabet, "not a fly-by-night company."

Jim said GOOGL is better than "value tech" and is actually "growth at a superior price." Josh Brown said he doesn't disagree and that Alphabet "surprised some people to the upside" with a "fantastic event this week." (Wonder if it was as fantastic as the thing that Seth Rogen and Bryan Cranston put together in the season finale of "The Studio.")

Josh did suggest the "issue" of possibly a lid of the 17 Alphabet multiple. Jim pointed out that AAPL used to have an 11-13 multiple, now it's around 26. (Well, now Apple airs "The Studio.")

During Final Trades, Judge said Jim had a "bounce in his step" for Thursday's show and was hoping/expecting Judge to give him some credit, which Judge did.

Jim ‘not freakin’ out’

On Thursday's (5/22) Halftime Report, Judge revealed where he's been all week. With an observation about those consumer confidence surveys.

"I just got back from CNBC's CEO Summit out in Arizona, and to a person, you didn't really hear much gloom and doom out there at all," Judge said. "In fact, it was quite the opposite."

Josh Brown noted the 10-year yield is up 44% basis points in May, a "very dramatic move."

Josh said it seems to him like inflation is cooling, and the 20-year and 30-year yields are the "head fake."

But Shannon Saccocia cautioned that today's rates are rising on deficit concerns, not big economic growth. In a nice nod to traditional media, Judge said there are views in Thursday's "newspapers" that rates are moving because of expectations of "higher growth," not deficit fears. Shannon said the Fed right now is a "policy taker," not "policy maker."

Joe Terranova said yields are a "global question" and pointed to Japan. Joe concluded that "we're in this moment" where the rally is "on a pause" until this yield thing is resolved. Jim Lebenthal shrugged that the market was simply looking for a "reason to consolidate." Jim said he's "not freakin' out" about the 10-year.

JOET apparently perfectly mistimed FSLR

Judge on Thursday's (5/22) Halftime Report noted RUN was getting smashed and that Jim Chanos talked about his short in this name last week.

Joe Terranova observed, "The entire industry is, is in significant peril."

Judge said the JOET sold FSLR at the end of April; Joe said that "looks like the low right now." Joe said the JOET only had it for 90 days, and it "didn't work well for us." (According to Yahoo! Finance, FSLR was $167 at the end of January, $125 at the end of April, and $156 now.) (Oh well, like they say, timing is everything!)

Josh Brown said you might want to wait until Nancy Pelosi buys one of these solar stocks.

Stephanie Link bought more PANW, which is now one of her larger tech positions.

Josh singled out EQT, calling it the "2nd-best energy stock on the year." Joe seconded Josh's arguments in favor of the stock and added a few more arguments.

Adam Parker at the top of Closing Bell said people sorta want to buy stocks but are hesitant; "I feel like there's a lot of tension in, in the investment world right now."

Bryn: ‘Ignore P.E.’

Guest host Frank Holland on Wednesday's (5/21) Halftime Report asked Joe Terranova about TSLA's valuation, which brought a pair of cogent comments from the panel.

Joe impressively answered, "Valuation is something that generally I don't believe is really an accurate predictor of where the future price action is, is going to go." (Or he coulda just said, "Valuation doesn't predict anything.")

Joe said there's a "multitude" of stocks with "single-digit valuations" that have gone "nowhere for years."

Bryn Talkington ramped it up a notch, bluntly advising viewers to "ignore P.E.," explaining, "it's completely arbitrary; it's like never gonna make you money looking at a P.E. whether it's 2 or 2,000."

Kari Firestone said P.E. "matters less in the case of Tesla."

OK. We can see Weiss showing up and demanding panelists declare "valuation doesn't matter." But Joe and Bryn are absolutely right — valuation doesn't predict stock movement. It does, however, "matter" on some level, in that it's the effect of the level of excitement that the market perceives of the company, and not the cause. You can try GoPro at maybe 150 (or whatever it was) or Ford at probably 3. Whichever you like.

Joe said he wouldn't be surprised to see TSLA make a run at its all-time high.

Honestly, we’re not really sure what CNBC’s beefed-up sports reporting team does except give an occasional estimate of the market value of a pro sports team that won't be sold for 25 years

Guest host Frank Holland on Wednesday's (5/21) Halftime Report asked Bryn Talkington about CNBC's Story of the Day (or Week) (or Day After), the David Faber-Elon interview on Tuesday afternoon (Bryn also opined Tuesday afternoon on Closing Bell after the interview).

Bryn said she owns a Tesla, as she's mentioned before, and the supervised driving 2 years ago "drove like a 16-year-old learning how to drive for the first time" and was "herky jerky," but now "it's so smooth, so intuitive."

Bryn said David noted an instance where a Tesla went through a red light, but for her, it's been "exceptional."

Bryn predicted people will pay $99 a month for self-driving and people will "continue to buy the dip" in the stock, though she again, like on Tuesday, suggested that $400 may be toppy. Frank noted BYD includes supervised self-driving with the price of the car, while Tesla plans subscription.

Bryn's commentary on TSLA (the stock) has regularly for years been excellent, by the way, so we're not going to question her suggestion that $400 may be some kind of top. (This writer has no position in TSLA.)

Steve: S&P over 5,500 is a ‘win’

On Wednesday’s Fast Money, no one seemed too scared about the day's selloff.

Steve Grasso said it's a "breather" and "if we stay stabilized over 5,500, that's a win." Steve also addressed his prediction a few weeks ago of the S&P returning to 6,000 in 4-6 months, noting, "we did it basically in a month." (Which is interesting for evaluation purposes. Steve was the only panelist touting a comeback of the S&P. But because he watered it down in terms of timeline, we're not that sure that it's really a great call.)

Karen Finerman said the selloff is "just math, if rates are higher." Karen claimed the national debt is "scary" but reaffirmed "I'm always long." Joe Moglia said the president of the United States "happens to be a narcissist."

‘We’re right where we were’

Joe Terranova at the top of Wednesday's (5/21) Halftime Report said the market is "basically pausing," and "I'm not really sure what people are afraid of."

But he said what people are "trying to identify" is that "2025 is a different market." (Later, guest host Frank Holland would ask Santoli about Joe's term of "unfamiliar market.")

"You have, finally, dispersion in terms of performance," Joe concluded, marveling at how many names in the JOET that are NOT in the Mag 7 are at 52-week highs.

Kari Firestone said the market's around the same level as the start of the year. "We're right where we were," Kari said.

Bryn Talkington said tariffs aren't even "remotely resolved," so the market likely won't "punch through" until "later this summer," so Bryn thinks the market will "rest for a bit." Joe said he doesn't disagree and said "I think we're gonna make a run at the all-time highs" but it's "up in the air" from there and maybe a "trap," which is kind of like predicting every possible scenario.

Frank doesn’t give Kari a chance to answer Joe’s UNH question

Guest host Frank Holland on Wednesday's (5/21) Halftime Report asked Kari Firestone about the latest headlines for UNH, which has somehow become one of the most interesting stocks. (This writer has no position in UNH.)

Kari said the "bad news" right now just isn't stopping and "the multiple (snicker) is down to 10." Kari said the stock has come "so far down" that over the next year, we'll "start to see things improve."

Joe Terranova asked Kari whether at some point, "does price loss supersede fundamental analysis," which we think is another way of asking "is it oversold?" Kari said, "Well sometimes it does," then Kari started to bring up BA, then Frank cut in, "We're gettin' on a tangent" and moved on to Bryn Talkington and DELL.

Bryn took a small position in IONQ. Frank said the stock moved up just as Bryn was talking about it.

Bryn, who had a great show, said crypto is benefitting from a "much friendlier environment" and suggested it's an alternative for "dollar debasement." Bryn said it's "easy" to buy the IBIT, but you can buy the actual bitcoin too. Joe chuckled, "It's probably the ultimate momentum trade" and "trades like a commodity."

Joe said PANW had tariff disruption this quarter; he says you should stay with the cybersecurity trade (this writer is long CRWD).

Joe said ZM revenue growth hasn't been there; it's been "frustrating."

Bryn offered silver as her Final Trade. Honestly, in all the years that CNBC has been airing at CNBCfix HQ, we don't think we've ever been excited about the silver trade.

Oh by the way,

at the end of the day ...

Jim Lebenthal had both a thanks and a correction to offer on Tuesday's (5/20) Halftime Report.

During a discussion of UNH, Stephanie Link said the stock may not keep surging but she likes it for the long term. Jim said he sold UNH April 4 at "about 546," though he said Steve Weiss was "very kind" for saying on the show last week that Jim sold UNH "in the 400s."

(So Weiss complimented Jim but in a shortchanging way.)

Josh Brown suggested the market could struggle a bit with retesting old highs. Jim offered, "Retail is no longer the dumb money." Jim said he's buying stocks even if the 10-year gets to 4.75%.

Brian Belski said "at the end of the day" (hopefully that one's not coming back) and that he sees the market as "significantly higher by year-end."

Belski even said with a straight face, "Golden Age of Stock-Picking."

After the A Block, we got an "oh by the way" from Belski.

Discussing TSLA, Josh noted how it makes huge bounces off of lows, but then Josh pointed out how much better UBER is doing than TSLA this year.

Josh said that Q1 earnings reports seemed to indicate that AI is more important to the market than tariffs are.

Jim said he wanted to talk about Alphabet, twice saying that it seems to him like "growth at a superb price."

Josh touted EBAY and said it's still 10% below its all-time high of October 2021. Josh said AXON has been "on fire."

Belski and Stephanie Link talked up BA. Jim again talked up the F-35.

Josh wasn't too enthusiastic when guest host Frank Holland brought up PFE. "There's almost no point in being invested here," Josh said. Belski owns it only in his "value" portfolio as a "contrarian name."

Not hot anymore

On Monday's (5/19) Halftime Report, Steve Weiss apparently enlisted Nikki Glaser to write some lines for him (OK, no way, his lines weren't that good), as Weiss knocked the "great big beautiful tariff deals" that will "do nothing" to bolster revenues.

Weiss also told guest host Frank Holland that there was a "very important ca- proclamation from Donald Trump himself about Taylor Swift not being hot anymore, so that set off the market."

Weiss said he's a buyer of the 10-year, that 4.5 is a "great rate."