[CNBCfix Fast Money Archive — July 2021]

Josh says that calling people who buy stocks ‘gamblers’ is ‘not demeaning’

Judge opened Thursday's (7/29) Halftime Report trumpeting "new records (sic plural sic redundant) for the Dow" and "new record (sic redundant) for the S&P."

But those stumbles aside, things quickly heated up when Judge immediately turned to Josh Brown for Robinhood commentary, during which Brown grumbled about the customers being "gamblers" and the bulk of the business being payment for order flow.

Judge quibbled with Brown's characterization of Robinhood accounts as "online gambling," suggesting it's a "slight" to those accountholders.

Brown said "the average user is 31 years old," which doesn't really mean anything, and that when Brown was in his 20s, "we were gambling too," and the median Robinhood customer balance is $240 (that does mean something) and average is "about $5,000," and the company's incentive is to encourage aggressive trading "so that they can sell those orders to Citadel," though he noted "other brokerage firms use payment for order flow also."

Judge turned to Jon Najarian, who said, "I completely disagree with almost everything Josh just said." Doc said that, No. 1, "Virtually every broker on the Street takes payment for order flow."

"I just said that," Brown cut in 3 times, his usual tactic, which is to cut off or talk over anyone who's disagreeing with him. (If the other person's wrong, why not let them demonstrate it and look like an idiot instead of preventing them from saying it like you've got something to hide.)

"Can I speak please," Najarian said.

Eventually, Najarian said he doesn't like the characterization of Robinhood customers of "gamblers."

"I don't think these folks are gambling," Najarian said, but "getting used to investing in stocks, options, futures, cryptocurrencies. I think that's a good thing."

"It's not demeaning," Brown said.

"That is demeanding. Yes it is demeaning," Najarian said.

"It's not demeaning," Brown insisted.

Steve Weiss said the "critical issue" is that "you could wake up one day" (that comment in the past was typically followed by Dennis Gartman complaining about owning gold miners and how a mine could get flooded) and find that Gary Gensler (snicker) could suddenly decide that payment for order flow is against investor interest. "If that happens, this company's out of business," Weiss claimed, as if that's ever happening.

Kari Firestone opined, "I wouldn't consider it so much gambling as gaming (snicker) (snicker twice)."

Weiss and Josh both carped about Judge's assessment that they're "hating" on Robinhood.

Brady has won 7 Super Bowls

This page has been pausing a bit on the Halftime Report/Fast Money, not because we haven't been watching the shows (we have) ... but because the whole routine is getting stale fast.

Until these folks are back in the same studio, this program is tedious and clumsy, especially with markets in perpetual buy-the-dip mode.

We're tired of seeing these people in their living rooms grappling with a 2-second satellite delay.

On Wednesday (7/28), Jim Lebenthal predicted 175 for AAPL this year. "I don't think you go back to 125," Jim said.

Joe "Rolling Correction" Terranova talked up 105 for AMD and said he sees "much higher prices." Pete Najarian bought the calls, but Pete questioned whether the stock can break through 100, saying it's at the "top end of where it's been."

Jim Lebenthal talked up BA and predicted the 787 production issue "is gonna get solved probably in a matter of 2-3 weeks." Steve Weiss though faulted David Calhoun for saying "he's the one who, who drove the inspection," which Weiss called "a load of crap."

"The guy has less credibility each time he speaks," Weiss said of Calhoun.

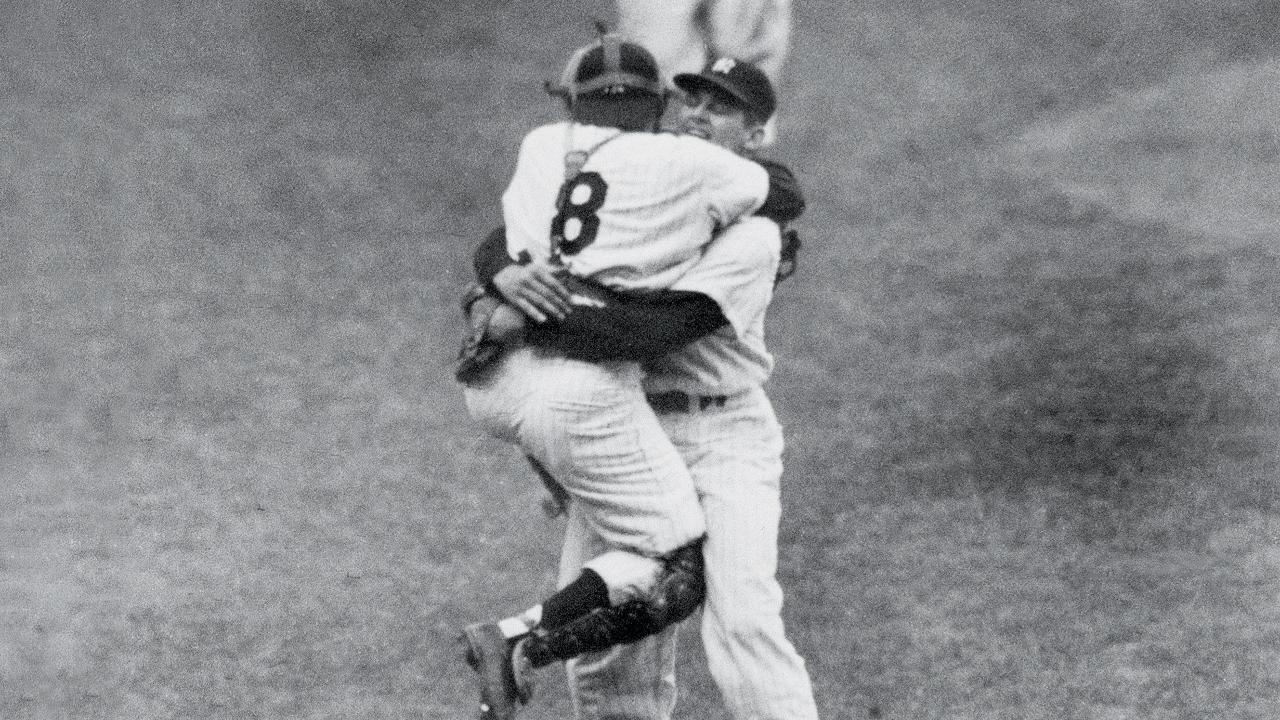

Judge told Pete that Robinhood has been a 5-time CNBC Disruptor. Pete said he didn't know about the 5 times. "It's like a Tom Brady thing, right," Pete chuckled.

Joe talked up BG again and other ag names. (But didn't say anything about the "rolling correction.")

Pete predicted 250 for MCD in a couple of weeks. (That's quite a call; it hit 247 on Tuesday.)

On Tuesday's (7/27) Halftime Report, Joe Terranova correctly said of the GOOGL quarter, "It's exciting if you're a holder of Alphabet." (Karen Finerman couldn't stop gushing on the 5 p.m. Fast Money about how great a quarter it was.)

Jon Najarian said the potential of mask mandates was hanging over the market, particularly the travel and leisure stocks.

Steve Liesman said the opinion from his investor survey is, "We've clocked the gains for, uh, 2021." (Yes, you see, everyone thinks that when the first half of a year is good for stocks, the second half can't possibly be any good.)

Weiss faults Tom Lee for not calling the short-term bottom last Monday

There are standards.

And then, there are really high standards.

Star guest Tom Lee on Monday's (7/26) Halftime Report said his latest risk-on call is based on, "We're finally getting some visibility that the Delta variant, uh, is rolling over in the U.K."

Lee concluded, "We think epicenter stocks really ignite either this week or next week."

Steve Weiss actually complained that Lee's call should've come last Monday. Lee said he remembers Weiss claiming that Lee's pro-FANG call in early June was too late, and "it's been up almost 15% since."

"But look at the move prior to that," Weiss insisted. (Well, at least Weiss wasn't trying to talk Lee into the "rolling correction" (snicker) that Judge and Joe have fallen for.)

"The variants are gonna keep comin'," Weiss added. But then he said that's a good thing. "You still want that wall of worry in the market, because if you get that euphoric, COVID is done, it's over, bang, then you get a blowoff rally, and then, hey, then we're gonna rest and retreat for a while. So, that's why I'm pol- positive on the market."

(Hmmmmm, OK. So we want to have some degree of worry about COVID — as if there isn't going to be worries about pandemics every time a new bug of any kind circulates for the next 20 years — so that the market doesn't actually go up too high, because then it'll experience this "retreat" ... except, if you know the "retreat" is coming, can't you just sell at the "blowoff" top?)

Lee charitably said, "I agree with Steve, you know, I still think there's plenty to worry about."

Lee said that because not everyone's getting a vaccine, "the real solution" to COVID will be "therapeutics," so he doesn't think the Fed starts easing until 2023. Lee concluded, "stocks may outperform people's expectations for quite a long time." (He didn't mention Lee Cooperman's story about leveling the Rocky Mountains so that cars don't have to go up an incline in an era of low rates.)

Weiss warned against owning BABA, PDD and BILI and claimed lawyers "in China and elsewhere" think the "VIE structure" in China is actually illegal.

Jim Lebenthal said SBUX has "many years of growth ahead of it," and if it goes up after earnings, buy it anyway.

"The future is truly unlimited" for MRNA, said Weiss, who said one hedge fund thinks the stock "can go 5-fold from here."

Joe ‘Rolling Correction’ Terranova on May 12 said now’s not the time to buy TDOC, ZM, TWLO and DOCU

On Friday (7/23), we took a look at some recent calls on the Halftime Report. (You can just hit PgDn a bunch of times to find them.)

On May 12, Joe Terranova stated, "I don't think the time is now to go in and buy the ARK names or the cloud names," mentioning the obligatory TDOC, ZM, TWLO and DOCU. (This writer is long ZM and DOCU.)

TWLO: then 296, now 409.

DOCU: then 187, now 308

ZM: then 289, now 359

TDOC: then 140, now 151

Earlier, on March 5, DOCU was $204 and drawing comparisons from Jenny Harrington to Ciena of 2000. "Don't look at just what they're off their highs on or you will get burnt the way I did coming out of 2000," Jenny concluded.

Which of those stocks again is the next CIEN?

Pete Najarian that day said LULU was "probably stretched" but is basically better than TDOC, DOCU. (This writer is long LULU.) Pete thundered about the big fallen tech names; "They have either no multiple, or triple or quadruple digits."

Meanwhile, on Friday's show, "It's been really an incredible week," Judge said, saying a bunch of "very influential" voices were heard on the show this week.

"This is a buy-the-dip market," attested Bryn Talkington.

"We all know that nobody's shutting down completely again," said Jenny Harrington.

As far as this "rolling correction" garbage that Judge and Joe seem to think is gospel, Brian Belski wondered, "How can we have a rolling correction Scott if the market's up 10%."

Belski said a "consistent rotation of leadership" is a "better way to say it."

Where 2020 = Y2K

Thursday's (7/22) Halftime Report was undeniably useless, unless you're one of those people who can't wait to hear the new jingles and theories from the strategist crowd to justify making the same old stock market call (be long).

Sure enough, we heard the new narrative at the top of the show, that there's been "a bit of a rolling correction really since March."

Does that mean to short TSLA? No, of course there were no short recommendations for this "rolling correction."

To make his guest feel better, Judge claimed, "We have had this rolling correction."

But even Judge expressed disbelief when the guest offered a new paradigm: "We think that last year was very similar to Y2K ... overspending on technology wares ... it's a similar situation this time around ... has pulled forward an enormous amount of technological spend."

"But Y2K was a joke," Judge said. "Now, I mean, the work-from-home thing was, was legit."

By the 16th minute, the guest said 3 times, "We're fully invested."

Weiss says he didn’t say the recovery’s in doubt, he says he said the recovery seemed to be in doubt

Viewers of Wednesday's (7/21) Halftime Report learned that Judge was actually expecting a "payoff" from Joe Terranova about Joe's newfound theory of "rolling corrections" (snicker).

Joe said, "If you're trying to create alpha within the market (sic last 3 words redundant, as opposed to creating alpha in that 7 miles of space gap between where Jeff Bezos rode in a capsule and Richard Branson rode in a capsule designed and built by someone else) ... then we have to look at this market for the entirety (snicker) of the year and understand you're going to continue to see corrections within the market."

OK ... so the stock market is not going straight up in a line.

"It is now happening for the Roaring '20s global growth trade," Joe continued. "You're seeing the unwind there." Joe mentioned C (snicker), CAT, FCX, CVX, regional banks, "they are all down double digits."

"I think now, you lean into that," Joe added.

So now it sounds like Joe is preaching buy the dip, rather than the "momentum" theory of his ETF.

Judge asked, "All right, so what does that mean? Right, you 'lean into' it. Are you buying the KRE then? Let's get specific. I'm (sic) talkin' around it."

"I'm not talking around it," Joe said. "If you want specifics, say 'What did you buy?' You didn't say, 'What did you buy?'"

"You said you lean into it. I was waiting for the payoff," Judge said.

"Please let me finish. On Monday, I bought Bunge. I told you that I bought Bunge (Zzzzz) ... I discussed with Stephen buying that agricultural name (Zzzzzz)..."

Eventually Joe said, "I bought the KRE, the ETF (sic redundant)."

Important note: Do we want Joe to hit home runs? Yes, this page absolutely wants Joe to hit home runs and dominate the stock market. Do we think Joe is making clumsy investing-philosophy statements this week based on some sloganeer's non-concept and 15 minutes of tape activity, yes.

Meanwhile, Jon Najarian said the selling Monday and the end of last week was based on rates moving at "light speed," as were selloffs during the winter. Joe spent quality soundbites making this same point.

Evidently not satisfied with how much Lee Cooperman spoke a day ago (see below), Judge on Wednesday re-aired some of the highlights (snicker) of Lee's commentary. (Those 4 stages of the bull market, none of which somehow included a pandemic.)

Judge said he was "curious" to know why Steve Weiss sold the rest of his LYV shares, saying it's interesting "in and of itself" (snicker).

Weiss said he had an "odd lot left" and "the recovery was put in doubt" (snicker) and it was "just a name I wasn't committed to." Judge asked if Weiss really thinks the "recovery is in doubt."

"No, that's not what I said," Weiss clarified. "What I said was, as the Delta was spreading, the recovery seemed to be in doubt."

Actually, that sounds like he in fact did say what Judge thought he said.

"I'm saying it was 1- like a 1- or 2-day market move," Judge said. (Translation: Judge's panel is predicting the market based on 15 minutes of tape.)

Doc made an interesting observation, that RRGB has outperformed CMG for the last couple years.

Judge noted Jim Cramer was gushing about CMG, not a surprise because it's a stock at an all-time high.

Wondering how Tuesday’s action squares with Joe’s ‘rolling corrections’

Lee Cooperman talked so much on Tuesday's (7/20) Halftime Report, it's hard to believe Judge even had time for Rick Rieder, whose appearances on this show are like having a regular table at Rao's.

Lee's commentary unfortunately was so predictable, down to the 4 stages of the bull market, a list that doesn't include pandemics (we're still wondering how "euphoria" sank the market in March 2020), that we're relegating it to the bottom of this post in favor of spotlighting the virtual giddiness of Judge's panelists.

Josh Brown stated, "A lot of people have flipped from bullish to bearish because of one rough day in the market."

Brown practically screamed, "The 10-year hovered between 1 and 2% for the 10 years, 2011 to 2020, right where it is now, and we got 14½% average annual gains in the S&P while the 10-year did exactly what it's been doing."

Jim Lebenthal said, "I still believe we are very early in an economic expansion."

Jon Najarian spent minutes telling Judge about all the great trades he made from late Monday into Tuesday (#congrats) (#notsurehowthathelpsviewers). "There is a lot of upside speculation back in the market again," Doc gushed.

Lee Cooperman joined the show in the 14th minute. It was in the 16th minute when he reiterated John Templeton's 4 stages of the bull market, which Halftime Report viewers should have memorized by now. (How that slogan helps anyone beat an index fund in their investment portfolio, we have no idea.) Of course, like every personality on CNBC, Lee said he disagrees with Jay Powell on inflation.

Lee twice called Rick Rieder a "terrific guy."

Even so, "I don't understand fixed income," Lee said, suggesting it's "the result of a bunch of academicians running monetary policy around the world."

Then again, maybe he does understand the fixed-income market. "It's very clear what's going on," Lee explained. "The central bank and the fiscal authorities are focused exclusively on unemployment."

In a curious aside, which Judge didn't even pursue, "I think we are heading for a fiscal crisis, uh, you know, one of these days, but, you know, not now," Lee said.

Well, it depends on one's definition of "fiscal crisis." If he means the government won't have enough money to spend, we doubt it (they have been spending our great-grandkids' credit cards for the past 15 months; surely they can reach for our great-great-grandkids').

Lee talked up a spectrum-related coupon bond that nobody's ever heard of that Lee said is a buy because of "political bulls---." (Except Lee didn't use hyphens.) Lee spent a couple minutes explaining this ridiculously obscure trade; Judge didn't have the brass to cut him off.

Lee also started to make an interesting point he attributed to Paul Samuelson, that in a negative-real-rate world, "almost any investment is profitable," only to go on to explain that it would somehow make sense to "level the Rocky Mountains" so that cars and trains wouldn't have to climb steep grades to get through Colorado.

Lee Cooperman wasn't the only one Tuesday rolling out the cliche train. Karen Finerman on the 5 p.m. Fast Money referred to when "things just start trading in integers."

Fine dining is in an apocalypse

The most interesting comment from Jeffrey Gundlach's interview last week pretty much escaped attention, let alone being replayed on other CNBC programs.

"I went out to dinner the other day, and the service was terrible," Gundlach said. "It's because the waiter- there was one seasoned waiter, and they had one other waiter, and he's a trainee. And, this is the case all over the place."

Exxxxxxactly.

Judge, and other CNBC hosts, should be all over this topic.

The country is beginning to realize a disturbing truth: People don't want to work in restaurants.

A months-long narrative is that it's strictly because of expanded unemployment benefits, that people are choosing not to work and collect the same money as if they were working.

There's also the reasonable notion that people laid off from restaurants in March 2020 have simply moved on to other professions.

Whatever the cause, even elite restaurants can't employ enough workers for "normal" service. Gundlach only mentioned the waiters. Consider the kitchen staff. That's why your orders are taking 40 minutes to reach your table, from still-limited "pandemic" menus to boot.

Prior to the pandemic, restaurants, even highly popular ones, always had turnover. For many employees, it's a stopgap or steppingstone; for others, it can be a road to long-term wealth-building or ownership.

But what's going on since summer 2020 is doomsday. Restaurant dining, an incredibly popular activity, suffers from a serious risk that not enough people are interested in providing the product. Which may pit restaurant owners against our government, which, for right or wrong, with our great-grandkids' credit cards in its hand, seems much more interested in erring on the side of safety net than Ayn Rand.

Bravo to all of those who are keeping our restaurants going.

Joe likes the term ‘rolling correction’ (snicker) (a/k/a Mike must not be swayed by those ‘hybrid’ commercials with that woman’s condescending voice)

Liz Young opened Monday's (7/19) Halftime Report by telling Judge the pullback will be "probably 5% or so."

Sarat Sethi said he doesn't think the pullback will be "that huge," maybe "5-7%."

"All of these pullbacks have been pretty short-lived," offered Mike Farr.

And Judge even reported that Tom Lee is saying that Monday's decline is just creating "a great set-up for a 2nd-half rally."

Agreed. Honestly, it wouldn't surprise this page at all if the S&P were up 50 points on Tuesday, but as Joaquin Andujar used to say, yaneverknow. (This review was posted overnight Monday/Tuesday.)

Joe Terranova, whose stale whiteboard background was empty again, blamed energy and said the Morgan Stanley guy is "correct" that this is a "series of rolling corrections." Joe said a lot of the long positioning in the energy market will be coming out.

Judge wondered what Joe would say to anyone who followed him into HON; Joe said he'd "stay with that trade."

Farr said the infrastructure talks aren't going that well, and it could be late in the year until there's "another sort of a stimulus (snicker) story to tell."

Judge said that Jeffrey Gundlach had just spoken last week about stocks being cheap relative to bonds; Joe said talk of tapering has been "removed."

Joe said the Russell is nearing its 200-day, which he said it hasn't done since October 2020.

Pete Najarian suggested the VIX might be trying to creep still higher in coming days and noted that from Friday through Monday, it's been a "pretty significant couple of days to the downside."

Judge promised Lee Cooperman on Tuesday's show and also said, of course, Rick Rieder will be on hand. "Listen, ..."

Pete said he got interested in NFLX once he saw the multiple not that much different from that of DIS and also because Reed Hastings always seems to get it right. Pete said he bought the stock and sold options against it because of the high volatility.

Joe mentioned "rolling corrections" (snicker) again when explaining why he bought BG.

Leslie Picker reported some details about the Robinhood IPO. Steve Weiss tweeted, "I cannot wait to short Robinhood depending on price," which Judge read on air, then Weiss called in to say that "2021, beginning of it, is as good as it gets." (Remember when Weiss in February was gushing about how his 45 March puts in GME were bound to pay off?)

Weiss had so many reasons for wanting to short the stock, we lost track. ("Any team with 2 starting quarterbacks is a team with no starting quarterbacks," is how the saying goes.)

Mike Farr said he sold IBM, "just too slow a grower." Pete said, "I think he made the right move," even though Pete somehow owns it.

Mike Santoli seems to think Jeffrey Gundlach’s ‘law of physics’ is just a way of calling the Fed ‘irresponsible’

On Friday (7/16) morning's Squawk on the Street, David Faber and Mike Santoli took up Jeffrey Gundlach's statements a day earlier on CNBC's Halftime Report about the relationship between the S&P 500 market cap and the Fed's balance sheet.

Gundlach had said, "The biggest case for stocks is that they're cheap to bonds. They still are cheap to bonds because the bond yield is so ridiculously low. And you also have the Fed doing their quantitative easing. And it still remains the case that there is almost a constant — it's almost like a law of physics, that if you take the Fed's balance sheet and divide it by the, uh, market cap of the S&P 500, it seems to be a constant. And this is true going back like 10 years."

Faber said he's never made that calculation and asked Santoli to opine. Santoli said, "It's really not worth your time to do it. ... I think it's a very convenient way to saying (sic), somehow what the stock market is doing is fake. Or somehow what the Fed is doing is irresponsible. Um, the balance sheet did absolutely nothing, went flat when they stopped QE, 2014 or so, uh, through 2018. The stock market was up plenty during that time, those 4 years, when the balance sheet did nothing. So it's not a law of physics, it's a coincident kind of indicator."

Leslie Picker chimed in, "I saw an amazing tweet this week about how a 40/60 mix of, of stocks and used cars remains an undefeated portfolio mixture."

If Lee was listening to the show, couldn’t he have just dialed in?

Judge opened Friday's (7/16) Halftime Report trying to buffalo Jon Najarian into calling a market retreat. But Doc merely said we've got a "pause," not a "weakening rally."

Steve Weiss said he'd been concerned that retail money was "pumping up" names like PTON. "People that get in at the top tend to sell pretty aggressively as the market goes down," Weiss explained.

Weiss said he sold some FCX but added to CLF (for those looking to play the nuance). (This writer is long FCX.)

Judge replayed Jeffrey Gundlach's comments from Thursday, in which Jeffrey stated, "The biggest case for stocks is that they're cheap to bonds. They still are cheap to bonds because the bond yield is so ridiculously low. And you also have the Fed doing their quantitative easing. And it still remains the case that there is almost a constant — it's almost like a law of physics, that if you take the Fed's balance sheet and divide it by the market cap of the S&P 500, it seems to be a constant. And this is true going back like 10 years."

Judge then asked his Friday panelists for reaction. "I don't often agree with Gundlach, but I think he's absolutely spot-on here," Jenny Harrington said. "Even though there's going to be tapering, that balance sheet will continue to expand."

Rob Sechan said he does believe there's inflation and it'll be "more persistent than most think" but that it'll "take time" to play out.

Judge also replayed Jeffrey Gundlach's call on Bitcoin in which Gundlach said, "I got a feeling you're gonna be able to buy it below 23,000."

Moments later, Judge brought in the show's preeminent Bitcoin bull, Anthony Scaramucci. (That doesn't mean that Anthony's the biggest Bitcoin bull on the Street, only that whoever else is out there — with the possible exception of Tom Lee, who is invited on for other reasons — doesn't regularly appear on the Halftime Report.) "Yes we are in a bear market for Bitcoin," said Anthony, "but things really move very quickly," and that bear market could be over "by the fall."

Scaramucci said he still sees a "supply-demand imbalance" over the long term.

Doc called UBER a hold, "They don't have enough drivers." (This writer is long UBER.) He said there's "a lot of pent-up demand" among people who like to go on cruises.

Discussing Bill Miller's letter, which Judge said was written "recently," or July 9 (that wasn't exactly very recent), Judge said Miller sees the market as "broadly fairly valued" (Zzzzzzzzzzzzzzzz) with some "pockets" of over- and underappreciation. Weiss claimed, "By the way, rates will go up, whether it's in 3 months or 6 months, they will go up." We'll hold him to that.

Weiss said something undeniably true about Lee Cooperman: "He's been talking about the market being fully valued for years."

Judge, who was once again without a tie on Friday, said Lee heard his name mentioned on the show, so Lee emailed Judge and said he wants to be on the show next week. Judge said he's not sure when, he's trying to figure out "exactly the day."

Meanwhile, "Everybody's being surgical," said Rob Sechan.

Doc talked up CLNE.

On Thursday, Weiss called BA a "bad investment going forward" as he and Jim Lebenthal took turns bashing David Calhoun.

Judge wore a tie last Friday

For about the past week, the most exciting thing Judge can mention is the every-other-day visit from either Rick Rieder or Jonathan Krinsky scheduled Jeffrey Gundlach interview on Thursday's (7/15) Halftime.

Meanwhile, in other news ...

A curious bit of dialogue took place on Wednesday's (7/14) Halftime, shortly before Judge had to end the proceedings to switch to Powell testimony.

Judge actually said with a straight face, "The bond market is really helping the Fed chairman out here," adding it'd maybe be a "different story" if the 10-year was "screaming" 1.75%, as if Jay Powell, James Bullard and Lael Brainerd are sitting in a lab on Mars without a TV set guessing at what the overnight lending rate should be.

That was followed by Steve Liesman stating there are "3 pillars" to Fed policy, with only the 3rd one being "The Fed does not make policy in a vacuum."

And if these fellows (and Jeremy Siegel, who makes fresh directional calls on Fed statements every month if not biweekly) (#Wharton) only realized that the Federal Reserve is an effect of something and not a cause, then, as William Hurt announced on "Broadcast News" at the end of his difference-making anchor stint, "Looks like we're all gonna be OK."

Liesman said Powell is staring inflation numbers in the eye and is "not blinkin'."

Liesman added that it kinda feels like Powell is being a little "stubborn," given that Larry Fink and Steve Mnuchin are suggesting he might be "a little cavalier" on inflation (snicker), but on the other hand, "you kinda admire his persistence on this." (Translation: Whenever the stock market's at all-time highs, you admire anyone who's associated with it.)

Joe Terranova opined, "30% of the jobs we lost in March and April of last year haven't come back, and guess what: I don't think they're coming back."

It came to our attention over the weekend that instead of an open collar last Friday as has become his norm for that day of the week, Judge for some reason decided to dress up a bit.

There is no more boring stock in the world than Citigroup

Have to wonder, if there's no 10-20% correction in the next few months (as some seem to be predicting), what Judge is going to have to do to come up with fresh content for CNBC's Halftime Report.

On Monday (7/12), Judge opened by saying it's "pretty interesting" (snicker) that Jim Lebenthal bought more DIS. Jim rattled off reasons that could've been and were made 3-4 years ago.

Judge also wondered "what's the story" with Steve Weiss rebuying TSM (Zzzzzz) after getting out of it. Weiss said the company's gotten "more and more important" while the stock has been "left somewhat for dead."

Asked about buying GS, which Judge called "very interesting" (snicker), Joe Terranova, who's sticking with the stale whiteboard background (#reopenEnglewoodCliffs) gushed about "stockie" that technicals "absolutely" work in predicting stock prices.

Judge even said "the good, the bad and the ugly" (oh my) (come on, Judge) regarding the effect of interest rates on bank stocks (Zzzzzzzzzzz).

He opened the show by mentioning "earnings, new (sic redundant) records for stocks."

"I've just completely missed fintech," Jim admitted, but now, of course, he prefers "money-center banks" (snicker). #Hello,MikeMayo

Jim's Final Trade was somehow C, which was a buy exactly once in about the last 25 years, when it was trading for $1 around March 2009.

Weiss said banks aren't able to do the same type of "bridge financing" they used to do, so that'll continue to be an "albatross" on the shares.

22 minutes into the show, Jim referred to the "Cathie Wood stocks," the first time we've heard CWS in a long time actually. Jim thinks there's more room to the downside.

Joe sells ‘stockie’ in NKE

Wednesday's (7/7) Halftime Report was just another go-round on the 10-year.

"It's the story of the market, clearly," Judge said at the top of the show.

Steve Weiss admitted his head-scratching recent TBT trade "didn't work out."

"I can't tell you that I specifically understand why yields are where they are," Weiss admitted.

Joe, in front of his stale whiteboard background (#reopenEnglewoodCliffs), again tried to claim nobody on the planet thought the 10-year yield would drop to 1.30% instead of surging to 1.70%.

But Jon Najarian said there was a "big bet" last week in the options market that rates would go "significantly lower."

Joe told Judge it's a "very scary premise" to wonder, "Do you think the liquidity ever goes away? Because it hasn't gone away since 2008."

What's so "scary" about it? The stock market has roared since late 2008.

Jim Lebenthal opined, "This rate-level conundrum (snicker) is not about the economy ... this is about technical factors like liquidity."

Judge demanded to know if Jim was calling rate moves "technical." Jim said, "Yes I am saying that's technical. That's not fundamentals."

Basically, the panel sounded convinced that 10-year yields are bound to go higher.

Weiss admitted he was wrong on SNOW but he sees those as "transitory gains," because "rates will go back up (snicker)."

Doc, who said you don't "punt out" the banks but hold, offered, "I think rates perhaps, um, hold or go lower in the short term, but longer term, I don't think rates are going anywhere but higher."

At the 33-minute mark, Jim declared, "We're early in an economic expansion."

Judge asked a great question of Jim, why be in the big banks instead of PYPL. Jim started talking about C (snicker) and insisted, "loan demand goes up" and "loan losses come down," and "probably the biggest factor, they are buying back shares hand over fist, well below book value (snicker) right now."

So basically, C needs to buy its own shares because nobody else is.

Judge noted that Joe sold NKE on June 21, but "the stock's up 23% since then."

"And I'd do it again," Joe actually responded with a straight face, adding that he owned "stockie (snicker)" in NKE since 2020 and "had a very good return on it."

In the 6th minute, Judge actually said "punch bowl" (snicker).

Judge returns, immediately starts declaring how the market will react to interest-rate moves

Judge returned to the Halftime Report on Tuesday (7/6), saying "it's great to see everybody."

Judge told Joe Terranova, who really needs to upgrade his super-stale whiteboard background (#reopenEnglewoodCliffs), "The 10-year is dragging the overall market, don't you think. I mean, if the 10-year continues to drop, stocks are gonna drop."

Ah. So now it doesn't work either way. In February and March, all we heard about how the "rate of change" of the 10-year yield up to 2% or 2.5% was going to ruin tech stocks.

Now we're hearing, if the 10-year yield falls, "stocks are gonna drop." From the host of the show, no less.

Without specifically addressing that assertion (the assertion of Judge about the 10-year and stocks, not this page's assertion about his stale whiteboard background), Joe said the 10-year was 1.60% on June 1, so "the market is just reacting and responding to that very aggressive pullback in yields."

"Reacting and responding" ... when? Since June 1, or Tuesday morning?

Josh Brown said that a couple months ago, people were gushing about the cyclical trade, but the growth trade was just biding time.

Judge pointed out to Pete Najarian that the 10-year's below 1.36%, which Pete called "something concerning" (snicker).

Judge said Rick Santelli says that with a close under 1.35%, there's a chance of a "1% retest," to which Judge added, "I don't think the market's gonna love that."

Josh Brown correctly pointed out that not too long ago, people were wringing their hands over 2.0% or 2.5%, "so which is it." Indeed, just a week ago (see below), Meghan Shue was predicting the 10-year could rise "possibly even beyond 2% (snicker) over the next 12 months."

Judge said Tom Lee predicts the market will "chop" from here because of "delta variant panic."

Judge asked Brown what happens if the delta variant spreads, "and you can't send you- your children back to school the way you, you thought you were gonna be able to."

"That's never happening again," Brown asserted. "We don't have transmission in schools. It's the safest place for kids to be ... The spread is happening at sleepovers on the weekends."

"That's fine. ... We're not gonna have a medical debate," Judge said.

Josh: AOC ‘would close Amazon’

Aside from the 10-year yield, Tuesday's (7/6) Halftime Report produced a little provocative political commentary.

Steve Weiss explained the risks of owning Chinese shares, largely because of government meddling, and basically was allowed to give a speech. Judge asked about Weiss owning BABA a while back. Weiss said he owned it 6 months ago as a "momentum trade" (snicker), and he sold it because Jack Ma got "arrogant" (snicker) toward the Chinese government.

Josh Brown said it's "a little bit hypocritical" to suggest China's the only country that's slapping around its companies. "Because we're doing the same thing," though it "looks a little bit more democratic the way we do it," Brown said. "We do it too."

"Not to this extent," Judge said several times.

"If you put AOC in charge, she would close Amazon," Brown said.

"She's not," Judge insisted.

Joe Terranova said to use the IEMG for Chinese stocks. "I got burned on PDD, PinDuoDuo; I'll never go back owning individual Chinese stocks," Joe grumbled.

Meanwhile, Brian Belski asserted, "It's the Jackie Moon Market, meaning everybody love everybody," which Belski said is basically being equal weight on everything while focusing on "core competencies" (snicker).

Belski tossed in an "oh by the way" and said he doesn't believe all the surveys about investors being negative.

Pete Najarian also said "oh by the way" when touting COF over AXP.

Jim: No taper ’til January

Perhaps the strongest call of Friday's (7/2) Halftime Report came from Kourtney Gibson, who said of DAL, "We absolutely 100% are gonna continue to see this stock rise."

You don't get an "absolutely 100%" too often. (This writer has no position in DAL but is long other airline stocks.)

Jon Najarian dialed in to say Jackson Hole is the "next point on the calendar." Well, sure. At that point ... omigod ... FED OFFICIALS ARE GOING TO SAY SOMETHING!!!!!!!

Jim Lebenthal wore a different jacket for a change (and it's a great jacket too, we should say), though it slightly resembles his favorite. "I don't think they start tapering until January," Jim asserted.

Jim said he's "definitely a yes" on GOOGL/GOOG. Kourtney Gibson stressed the importance of owning tech.

Kourtney said she'd "highly recommend" taking a look at UBER. (This writer is long UBER.) Mike Farr gushed about FDX as a "core holding."

Kourtney actually called the panel a "committee."

Doc says he has "all the respect in the world" (snicker) for analysts, but he's more interested in where the money is going, "and institutional players have been accumulating postions" in AAPL for months ... which has probably been the case for the last 15 years.

Jim said both CAT and DE should be "fine," but he'd be a "bigger buyer" of CAT.

‘Guarantee’ heard on Halftime

Thursday's (7/1) Halftime Report got off to a choppy start.

Guest host Tyler Mathisen said "Jenny let me start with you," yet Jim Lebenthal started talking just as Jenny was answering the question.

Jim, who wears the same jacket for every appearance (it's a nice jacket, but it's the same jacket every episode) (kinda repetitive, like with Joe's background with large numbers and a whiteboard), joked that he set a "world record" for cutting in (apparently, the record for earliest cut-in on the show, which is possible). "I thought you said 'Jimmy' instead of Jenny," Jim explained.

(See, if they were all at EC, this wouldn't be happening.) (#reopenthestudio)

Jenny actually said she can "guarantee" that stock market performance for the rest of the year "won't be a straight line." (No guarantees about Docusign's high P.E. ratio this time though, apparently.) (This writer is long DOCU.)

Then viewers got a double dose of basis logic. Jenny indicated that she doesn't think the stock market will do as well in the 2nd half as the first because it would mean a return of 26+% for the year, which Jenny said is "pretty unrealistic."

Jim said that he agrees because a 2nd half like the 1st half would mean a "truly monster full year."

So much for "skating to where the puck's going" instead of "skating to where the puck's already been"!!!

Judge has seen ‘smeel mainly’

at least 10 times

While Judge is (hopefully) enjoying his time off, we happened to notice that on Monday, he responded to a tweet regarding the category of Movies Seen At Least 10 Times.

None of those titles is a surprise for a category such as this, though note the absence of "Wall Street." However, the criteria for this category — whether the movie has been seen in full at least 10 times — is important; if we're talking "caught 15 minutes of this on cable the other day" as qualifying as "seen," then before you know it, you've got "Cocktail" (a fine guilty pleasure) and "Independence Day" (another fine guilty pleasure) and ...

Judge has inspired this page. We've gotta come up with a movie post this week ...

What if 1.5% starts to look like a gift? (a/k/a we appreciate Joe’s background, but we’re tired of it, frankly #timetoreopentheoffice)

It didn't take long for a provocative comment on Wednesday's (6/30) Halftime Report, as Joe Terranova said to guest host Tyler Mathisen, "Tyler, can you find anyone that believes yields are going to continue to move lower."

(That should trigger any of those "same side of the trade" warnings.)

(Actually some people do think rates are going lower, but whatever.)

Joe claimed there's no "appetite" or "sentiment" for fixed-income, which he said is "very puzzling."

Joe even brought up "Paul Junes- uh, Jones" (first time that name has come up in 2 weeks, since everyone at CNBC was foaming at the mouth after his interview) talking about inflation (snicker) and the Fed a couple weeks ago. Joe said the course of inflation is the "road map" for the rest of the year. (Which is ... kinda what you can say about any stock market in history. But whatever.)

Joe claimed that if they polled "100 so-called experts" on the direction of the next 25 basis points on the 10-year, the "overwhelming majority" would pick 1.7% vs. 1.2%. But the "current trend" is "pressing lower," Joe said.

Meghan Shue sees "further gains" for stocks, though "we do see interest rates moving higher."

Shue said the 10-year could go "possibly even beyond 2% (snicker) over the next 12 months."

Shue, who never picks single stocks and only speaks in the broadest category generalities (so really, what's the point of doing the show), likes financials and technology, though she said her shop is "neutral" (Zzzzz) on tech.

Tyler’s neighborhood friend probably didn’t know he/she was supplying a national television endorsement for FVRR

Amy Raskin said on Wednesday's (6/30) Halftime Report that the market will keep making new highs but claimed, "Under the hood, the technicals don't look great."

Raskin said "we're probably at peak growth right now." (And if we're at peak growth, how come everybody Joe knows is predicting rising yields?)

Pete Najarian offered, "I- I don't know how much more room there is for oil to the upside Tyler," so he predicted a "rotation" away from sectors such as energy or financials if crude tops out around 80.

Pete's not sure that semiconductors are "done" because of the supply constraints.

Raskin doesn't think the 2nd half of 2021 will be "as good" as the first half. Meghan Shue agreed and Joe agreed. Pete said the same thing, though he's "still very bullish," but he's concerned about the impact of the virus variant.

Pete again trumpeted COF and MSFT. He also touted FB and the "teflon" of Mark Zuckerberg. (Actually, that's an interesting point ... is there any human being who does NOT work for the government who is as accustomed to attending congressional committee hearings as Mark Zuckerberg? "Congressman, I don't know the answer, but I'll have staff look into it and get back to you ...")

Joe touted CRWD, as well as GS, "one of the most diversified financials on the Street" (as opposed to "on the beach"), and LNG.

Amy Raskin likes REGN, SFIX, EOG. Tyler also asked Raskin about FVRR. Raskin said, "We think this is the way that, that business is going." Tyler said he has a neighborhood friend who's a "voice-over talent" who gets "a lot" of gigs through FVRR.

Jonathan Krinsky, who's on the show about as often as Rick Rieder, said cyclicals appear to be "bent" but not "broken" (Zzzzzzzz).

Tyler seemed to take pride in having a 27-minute A block, saying it's not a "record" but "beefy." Evidently, he's not aware of Judge's frequent commercial-lite or commercial-free programs. (Hey, we just want CNBC to make money.)

Joe said he added to CMG on Monday and Tuesday. He also said he bought AMD under 80, "finally got myself lucky," which is all well and good, except the stock does not move up or down based on Joe's basis.

Joe is back recommending one of his longtime favorite names, LPX; he said to have a 55 stop.

Still nothing more on Paul Tudor Jones’ inflation trade

The most interesting conversation on Tuesday's (6/29) Halftime Report concerned reverse stock splits.

Guest host Brian Sullivan pointed out that GE, of all companies, has a 1-for-8 reverse split set for Aug. 2.

Josh Brown said it's a "smart move," because "they wanna stop looking like losers."

Brown explained, "Right now, the, when- when you look at GE, it looks like a loser stock, for loser investors. And it has been. It's underperformed everything."

That's an interesting assessment, because basically ever since Larry Culp was hired, all we've heard on CNBC about this company (with the exception of some appearances a while back from Stephen Tusa) is how awesome it's going to be in no time.

Anyway, back to that "smart move." Brown says he typically doesn't like "gimmicks" with stock prices, but, "In this particular case, I do think it makes sense to wipe the slate clean."

That reminds us of the supposedly really important Citigroup reverse split about 10 years ago. Remember when Joe Terranova and, a few times, Pete Najarian talked about how so many institutional investors were going to buy it after it got above $5?

And omg, hasn't C just gone through the roof?? Who needs PYPL when you've got Citi???

So apparently, people who feel like "losers" owning GE at 13 are going to feel like winners at 104 with only 1/8 as many shares.

In a related matter, Brown on Tuesday bashed "the people that came on the network over and over again and told you that ETFs and indexing and passive investing were the reason for market distortions ... GE is the best- and Exxon are the 2 best examples for why that argument is total b.s."

Making a rare appearance on anything outside of Squawk Box, Becky Quick spoke about an "FA 100" (that's Financial Advisor Summit, not "Free Agent") interview with Lee Cooperman, calling Lee "a man with lots of opinions." (Actually, it's mostly the same few opinions expressed repeatedly over the years on CNBC.) Becky said Lee calls himself a "fully invested bear" who won't touch U.S. bonds with a "10-foot pole."

Jon Najarian, who had an unusually quiet show, said he likes COF and said you can get a "gift" of a "double-digit return" writing options against banks with the strongest balance sheets.

Brown said he exited his stake of ZM. (This writer is long ZM.) Brown said he bought it in 2019 (tip: a person's basis doesn't determine where a stock is going) and is "not really seeing a catalyst anytime soon." Brown called REITs "the best inflation hedge." Jason Snipe called WMT a buy.

Jim’s not present; no one mentions CLF doing something unlike anything they’ve ever seen

Tyler Mathisen, the seasoned CNBC veteran who served as guest host of the Halftime Report on Monday (6/28), ran such a smooth show, there was basically nothing to cause any viewer to stop and scratch his or her head. (Nor was there any Rick Rieder either, hard to believe.)

Joe Terranova described market strength this way: "We're seeing a pullback in yields."

Rob Sechan predicted the reopening of the economy will "overpower" the market risks ahead.

"Quality, familiar tech" is the new defensive, Sechan asserted.

Tiffany McGhee said "one caveat" in the market is that there hasn't been a correction of about 10% since September 2020, so we're a "bit overdue."

Moments after his initial remarks, in which he said that indexes may not have had corrections but some stocks have had big pullbacks, Steve Weiss clarified that he didn't mean to sound as bullish as he did; rather, there will come a correction at some point, but "there's nothing to do about it."

In the one chance for fireworks, Pete Najarian dialed in to trumpet all the apparent option-buying in the XLF, and of course, stated that derivatives trading is "absolutely" on pace for yet another big year.

Joe got a viewer question from Greg in Chicago about GNRC, with Greg stating that GNRC is 22% of his portfolio. Joe said he wants him to get that stake down "below 10% immediately." And once again, we have to say, we don't think GNRC is going up or down based on the size of other positions in Greg's portfolio.

Weiss made a vigorous case for XPO, his Final Trade, saying he added to his stake on Monday. Rob Sechan touted LYV and Joe backed FTNT, and Tyler didn't get to Tiffany's, which appeared to be ARKK Innovation.

On the 5 p.m. Fast Money, Karen Finerman called FB a "very compelling value stock" and said its gains on the heels of its court win were simply "one multiple point" and not an overly celebratory response.

Jim doesn’t say CLF is doing something ‘unlike anything I’ve ever seen before’ but instead calls it a ‘workhorse, thoroughbred hybrid’

In case you were wondering if Cleveland Cliffs is really the greatest company of all time, Jim Lebenthal set out to put any doubts to rest on Friday's (6/25) Halftime Report.

Guest host Frank Holland asked Jim if Jim was "surprised" that CLF was down Friday. Jim said no, but the company is a "workhorse, thoroughbred hybrid (snicker)."

Jim predicted "it's going to 30, uh, in the next 6-9 months."

Jim said this is the "perfect time" to be investing in industrials.

Meanwhile, Pete Najarian said trading the infrastructure bill has been "2 steps forward, 1 step back."

Kevin O'Leary trumpeted NKE's success in direct-to-consumer. And then, with usual salesman hyperbole, O'Leary declared, "This is why you should be worried about the future of a Walmart or a Foot Locker. They don't need retail."

Jim said he's not in NKE but that he'd "concede the point to, uh, to Kevin," though Jim thinks the stock is "overpriced." Pete said he sees LULU and SKX in the same category.

O'Leary assured that there's "nothing wrong" with the FDX quarter. "If anything, it's a buying opportunity," O'Leary said.

Pete called IBM a "great stock" though many people "hate" it.

Jim Lebenthal, using curious terminology (not related to Cleveland-Cliffs this time), said reopening trades are "pick your poison," you could choose restaurants, cruise lines, airlines.

Not surprisingly, Kevin O'Leary bashed cruise lines as well as airlines and the amount of debt. O'Leary said cruise lines are "not worth shorting" either. But he didn't say anything about the short of JETS he was talking up a few months ago. (This writer is long several airlines.)

Paul Tudor Jones’ inflation theory is quickly getting discarded

Judge had the day off Thursday (6/24) — actually, it's been a long time since Judge has had a day off, so, good for Judge — and the Halftime Report didn't miss a beat thanks to the yeoman effort of Frank Holland.

However, there wasn't much in the way of news developments or star guests. (In other words, Rick Rieder actually took the day off too.)

Josh Brown opened by stating buybacks could explode. Steve Weiss said buybacks are "great," but he's "less enamored" with dividends. Weiss said he wants to see "more M&A" and "additional capex" (Zzzzzzzzzz).

Brown said that historically, owning AAPL, "You've been way better off not overthinking it." He said it could be $150 "with no sweat whatsoever."

Brown talked up LESL as a play on pool maintenance.

Later in the day, Kyle Bass, who hasn't called anything since 2008 to our knowledge (unless you count all those doomsday Greece/Japan predictions of the last decade), told Sara on Closing Bell, "I can tell you in every single aspect of life (snicker), I see inflation."

Sara said she brought home plant-based burgers for her kids recently. "My kids rejected them," Sara said.

Crediting the Fed for where the stock market is now is like crediting umpire Babe Pinelli for calling the strikes in Larsen’s perfect game

Quickly running out of ideas, Judge on Wednesday's (6/23) Halftime Report was basically asking panelists whether they'd prefer FANG to reopening names.

Liz Young says the market will enter a "new regime" in the 2nd half of the year that will reward "fundamentals" and "quality" and "active management (snicker)," and "I think we're gonna get a more hawkish (snicker) (snicker) (snicker) message" from the Fed.

Joe Terranova suggested we have seen or are about to see "peak acceleration" in reopening growth, and if that's happening, he's going to look at megacap tech.

Steve Weiss backed Joe's thesis and said the stock market has been "sensitized" (snicker) to future hawkishness (snicker) from the Fed, saying the central bank has been "as masterful as possible." (What have they done Steve except not change anything.) Weiss said we're getting a Fed dialogue, and he's giving Jerome Powell credit for "constructing that dialogue (some would call it 'noise')" that we're hearing now.

Judge said he was "a bit surprised" to see that Joe had bought TSLA. Joe predicted a "mean reversion performance, uh, chase towards both Netflix and Tesla." Doc suggested TSLA is correlated with bitcoin and will see "mid-700s" in the "not-too-distant future."

Jon Najarian said AMZN has got the workers, whereas other companies don't.

Marc Lasry, who usually tells Judge what kind of mezzanine financing he's scooped up recently (as if Judge's viewers do that all the time), said if it were up to him on raising rates, "they should do it tomorrow (snicker). (Catch the runaway inflation before it's too late.)"

Jim actually says a couple times that what CLF is doing is ‘unlike anything I’ve ever seen before’

For the 2nd straight day, Judge announced on Tuesday (6/22) that the Halftime Report would feature an "Exclusive Stock Summit" (snicker).

All it turned out to be was a wide batch of panelists (not all of the regulars, and not even Rick Rieder for a change (he was on Closing Bell Monday)) forced to cough up their top 3 picks.

And you know what they say: Any team with 2 starting quarterbacks is a team with no starting quarterbacks ...

Josh Brown opened by touting LYV, claiming that going to shows is a No. 1 priority for "probably 2/3 of Americans."

Brown also gave a speech about UPST and touted consumer discretionary. "The consumer is absolutely on fire," Brown said.

Steve Weiss gushed about MRNA, a stock he has touted all year and is probably a contender for Call of the Year, saying the company's actually got a brand name in the vaccine space and making it sound like it's going to cure everything. (Hopefully it will, but ...)

Degas Wright touted BBY, citing the millennial market. Pete Najarian agreed, of course.

On Monday, Joe Terranova predicted a "turtle pace" for stocks going upward.

Judge said "Oh by the way" in the 4th minute. Somebody else said it a few other times.

In a moment of hyperbole, Jim Lebenthal said the transformation in CLF is "just unlike anything I've ever seen before."

How come Jenny and Pete aren’t making fun of DOCU anymore?

Nobody on Friday's (6/18) Halftime Report seemed the slightest bit fazed by the stock market's limp into the weekend.

Pete Najarian, who bellowed so many "absolutelys" and "incrediblys" at the top of the show that we almost shut it off, called COF "incredibly inexpensive" and said he'd buy it on the pullback, at least the calls.

Josh Brown said it's been a "hilarious" week and noted that just a few days earlier, the hand-wringing was all over Paul Tudor Jones going all-in on the inflation trade. "I hope you didn't do that, because if you did, you had a really tough week," Brown said.

"You should be viewing this pullback as normal," Brown added.

Judge asked Pete whether the value trade is "on fumes." Pete protested that it's simply experiencing the "healthy rotation" (snicker) of the market.

Shannon Saccocia declared, "We're not reentering into a commodities supercycle."

Josh Brown gushed a couple of times about NVDA.

In a long speech, which was the theme of the day (Judge gave everyone a platform), Kari Firestone said she likes TWLO and called the Fed's message this week "relatively benign."

Judge aired a clip of Rick Rieder's comments from a day earlier about not being worried about the stock market (and, as always, mentioned how much money Rieder apparently manages).

Remember those August 35 X calls that Pete gushed about a while back? He actually said Friday that they've been cut in half and that he'll probably be out of them by the end of the show, so his advice is to "get rid of these calls." (Translation: Your loss from "measured risk" could well be 100%. Whereas if Pete had just bought the stock instead (even at the peak), he'd have at least 80% value still in it and an indefinite timeline for it to go higher.) (This writer is long X.) (This writer is long DOCU.)

It all comes down to whether you believe the Fed is a cause of something ... or an effect of something

On Monday (6/14), Paul Tudor Jones spoke with CNBC's Andrew Ross Sorkin about the Federal Reserve's approach to "material" inflation numbers.

"If they treat 'em with nonchalance, then I- I think it's just a green light to, to, to, to bet heavily on every inflation trade," Jones said.

Oh really.

In more than a dozen years of filling this screen (snicker), we're still amazed that even elite investors actually recommend trying to trade a Fed meeting.

This organization is one of the stodgiest bureaucracies in history, its moves determined not by knee-jerk soundbites but by massive governmental/financial/social consensus.

Skepticism and criticism of this entity makes one think of high school sports events, in which certain parents or observers try to bludgeon referees and umpires (often teenagers) into scapegoats for all of the spectators' shortcomings.

Trading the market based on Fed commentary is like making your Super Bowl pick based on who the refereeing crew is. (OMIGOD!!!! DON ORR!!!!!! THE GUY WHO SAID RENFRO WAS OUT OF BOUNDS!!!!!!!!! HE'S GONNA MISS ALL OF OUR SKINNY POSTS!!!!!!!!!)

We're not accusing Jeremy Siegel of trading the Fed ... but we can't help but note that he seems to be taking a larger-than-necessary interest in these irrelevant statements and press conferences.

Judge on Thursday's (6/17) Halftime brought back Siegel (his 2nd straight day on the show) to discuss the Fed predictions of a day earlier and told Siegel, "You nailed it!"

Siegel then told Judge that he thinks Fed dots will become "more aggressive" and that we'll get "an announcement of a tapering plan" in the next 2½ months and rate hikes beginning in 2022.

"I'd worry if they didn't," Siegel said.

Good call. Worry about the Fed as much as possible. Have a nice day.

Judge turned to Steve Weiss, who quite frankly is spot-on in this conversation. "I've been told to be brief. So, I'll cut out the niceties, which I always cut out," Weiss said, a good punch line to boot. "Professor, you're wrong, and here's why. Inflation has been transitory. You're acting as if this massive liquidity is brand-new with pandemic. That's not true. We've had massive liquidity, in fact zero rates in Japan, for over a decade."

"The commodity cycle? It's always boom or bust. And we're seeing it bust now," Weiss added.

Siegel responded, "You are looking just at the interest rate. You're not looking at the money supply. You're not looking at the amount- the surge in the amount in savings accounts and checking accounts, which in 2020 hit a 150-year high. Un. Precedented."

OK. We'll believe that when Joe Biden/Donald Trump send folks another $2,000 of our great-grandkids' money in the next few months. (Oops, come to think of it, that might actually happen.)

Jon Najarian said, "I am in agreeement with the Professor" because "I think it's like putting toothpaste back in a tube" (there's a Watergate punch line for you).

Judge curiously ended the discussion claiming, "It's somewhat of a perfect storm for, for some kind of selloff, given the, the somewhat of a surprise really from, from the Fed."

We'll be buying that supposed "selloff."

Siegel, like many wannabe contrarians, basically just believes in a GDP fantasy that's not going to come close to reality. Someone who gets this is Steve Grasso, who said on Wednesday's (6/16) 5 p.m. Fast Money that, "I think we're in a deflationary spiral." As Wade Garrett says, "Exxxxxactly." Once Joe Biden and Donald Trump are done spending our great-great-grandkids' money, it all reverts to 2019-land.

Meanwhile, Judge on Thursday said he talked to David Tepper and that Tepper thinks "not much has really changed." Weiss said he agrees and spoke with Tepper in the morning also and then curiously said, "I've been the victim of some of those, uh, simple comments frankly over the years."

"I don't want to be in commodity stocks," Weiss said, because "they're momentum trades on the way up," but the euphoria is only just for a "microcosm of the cycle."

On this subject (and likely a few others), Weiss is absolutely right. The commodity hysteria reminds us of the Eric Bolling/Guy Adami/Tim Strazzini/Tim Seymour original Fast Money crew trumpeting coal stocks and refiner stocks like there's no tomorrow.

"I agree with David Tepper a hundred-thousand percent," said Kourtney Gibson, explaining the Fed is doing "exactly what we would want them to do."

Guest Chris Toomey said he thinks the market "believes" Jay Powell and believes the Fed is "on hold." Judge sounded surprised and suggested the market's "a little bit scared" that the Fed will start raising sooner than forecast.

Rick Rieder, who seems like he's on the show about every 16 hours, said of the stock market, "I don't think it's goin' down very far," and he'd like to buy some of the companies that have been "repriced" if they fall further.

Rieder said the first hike could be "towards the end of 2022."

Sounds like Jonathan Krinsky is just tired of seeing oil go up

Judge and Jeremy Siegel had an excellent discussion about the Federal Reserve on Wednesday's (6/16) Halftime Report.

The problem is, pre-Fed episodes have a shelf life of about 50 minutes, and the conclusion around here is that it's not worth it to spend much time analyzing what was predicted before the Fed statement/press conference (this review was posted overnight Wednesday/Thursday).

Steve Weiss said there's "about a 25% chance" that Jerome Powell reveals the Fed has discussed tapering and a "75%" likelihood of that happening at the next meeting.

(That sent us scrambling to one of those old SAT practice tests ... does Weiss mean there's a 100% chance of that happening over this meeting and the next ... or that it might not happen at either meeting?)

Weiss said he senses "frustration" among Paul Tudor Jones and the market in general.

Jenny Harrington advised, "Just be patient," because "the long-term trend is your friend."

Judge suggested the market actually seems like it's in a "Goldilocks" scenario, but Jason Snipe said he agrees with Jenny.

Jeremy Siegel, the star guest, said he actually was expecting a surprise, what he calls a "big shift" in dot-plotting toward a more aggressive rate-hike stance, followed by a "taper tremor" by the markets.

Siegel said it doesn't mean the Fed is tapering overnight, rather, dialing back from the 2024 forecast, which he called an "insane expectation."

Judge tried to tell Siegel that lumber has "rolled over," but Jeremy said it only "rolled over" from a spiked elevation.

Weiss said Jay Powell has been "very, very adept at messaging to the markets."

Judge brought in Jonathan Krinsky by phone to discuss Krinsky's curiously bearish outlook on oil, but, in a stumble, talked over Krinsky and created dead air at the beginning of the interview. Krinsky went on to explain that he expects weakness in oil and energy despite 14 days of highs. Judge countered that David Tepper is long energy stocks; "isn't he right?" Krinsky said he doesn't relish being at odds with Tepper's position, but Krinsky suggested Tepper's position is an old one.

Judge tried to hint that Van Leeuwen ice cream is as famous as Burger King, but most viewers probably had no idea what Judge and Jenny were talking about. (The our story" portion of the website basically says little more than "If something is made good and makes you feel good (sic lack of comma) then that something is good for you. Probably.")

Isn’t every stock cheap relative to TSLA? (a/k/a What happened to Einhorn’s market peak of last Sept. 2?)

Judge opened Monday's (6/14) Halftime Report inviting panelists to take a stab at Paul Tudor Jones' inflation opinions.

"I think we are going to see further inflation," said Joe Terranova, suggesting as remedies, oil, copper and REITs such as PLD and CBRE.

Jon Najarian stated that "we're seeing inflation in commodities like crazy." (We'll see how long that lasts. Remember Dan "Oil's Endless Bid" Dicker and how Transocean always used to be a buy?)

Josh Brown cautioned that there's almost zero chance that viewers are in the same financial situation as Paul Tudor Jones, who can make huge investments and "change his mind as quickly as one hour later" and unwind those positions. (Translation: The highlight of Paul's day is not trading GME.)

Judge insisted that the "average investor" still could take a nod from Jones' favoring of commodities, so "there is a connect inside of a great disconnect (snicker)."

But Brown said you have to be "full time" to adequately manage commodities, then posed this question to Judge: "Why do you think commodities are a better inflation hedge than stocks, because the data says otherwise."

That's an excellent question. The only thing is, who aside from a few pundits actually believes inflation hedges are needed? It's like watching the Miami Dolphins win their 2021 season opener and then screaming, "CLEAR SPACE IN THE TROPHY CABINET NEXT TO THOSE CSONKA-GRIESE LOMBARDIS!!!!!"

Brown further said that "over the last 6 weeks," people who have "pigeonholed themselves as quote value investors" are now taking a "victory lap" because cyclicals have had a good few months. "Unfortunately that story is falling apart," Brown asserted. He even noted, "Docusign is on an insane run." (This writer is long DOCU.) (Usually the other panelists slam DOCU because of its HIGH. P.E. RATIO.)

Brian Belski, who seems to be on the program every other day, wasn't impressed by the interview of the day, suggesting Paul Tudor Jones is "just another macro person that, has uh really not done very well the last 10 years."

Belski, unlike the panel on the 5 p.m. Fast Money later in the day, said not to expect quick tapering; "this is gonna go on a lot longer than everybody thinks." For that, we nominate Belski, and not Paul Tudor Jones, for the Call of the Day.

Meanwhile, Tiffany McGhee said of TGT, "We own it to balance out some of the more volatile names that we own." Jon Najarian said he owns the stock.

Tiffany said she's holding RACE despite the double downgrade at Goldman Sachs to "sell."

Joe Terranova gushed about CMG for the long term but cautioned, "The comps are going to be challenged here in the coming quarters," so you could see a "sideways to lower trade." Joe said Raymond James' 1,800 for CMG this year is "clearly too aggressive."

Jon Najarian endorsed WFC, while Josh Brown called it a "challenged bank" and said he doesn't like the stock.

Jon Najarian said AAPL weekly 130 calls were getting scooped up, including ones for the following week. He also said CRSR June 40 calls were popular; he said he'd "probably" be in that position for "3-4 days," but he didn't say how long he'll "probably" be in AAPL. (Interesting that the show's options buyers, but not stock buyers, need to declare how long they expect to "probably" keep a position.)

Josh Brown said he thinks GM "is cheap relative to Tesla."

On the 5 p.m. Fast Money, Karen Finerman said she's "a little skeptical" that inflation is "completely transitory," though she's "certainly not making any big bond bets" or "big commodity bets" because "that's just kinda not my thing."

This commercial wouldn’t be so awful if it didn’t air every 15 minutes on CNBC (even worse than the IBM hybrid ‘skort’)

The star guest of Friday's (6/11) Halftime Report was Tom Lee, who Judge said at the top of the show has made a "double upgrade on the FANGs." (We're not sure if it should be spelled with 2 A's in this case, though the screen text just said "FANG.")

Lee said he took a "deep dive" into seeing what's changed since March and found that FANG took the biggest hit to the "gut" from interest rate headwinds.

Judge said that sounds like, in the course of a month, Lee has decided "rates have peaked."

Lee stated, "Uh, now I don't forecast rates," and conceded it's an "abrupt change" of outlook, but he thinks the market has already "freaked out" about inflation.

Judge insisted, "You can't make this call Tom without forecasting rates, to some respect. This call is all about rates."

"That's- Scott, you're absolutely right," Lee said, though protesting that the call is "relative to market expectations."

"It's all about the pace" of rates, said Shannon Saccocia.

Steve Weiss suggested Lee's call is "late" and asserted tech bottomed on "roughly May 13." Weiss contended that rising rates aren't bad for all tech stocks but just a "very small percentage of tech stocks."

Weiss also disagreed with Lee's downgrade of financials, arguing, "The Fed is going to start tapering." Judge said they're not going to start tapering tomorrow and perhaps not even in 2021. Weiss said he just doesn't see the "pressure on the banks."

Lee took issue with Weiss. "I mean, I don't even know what he means by late," Lee said.

Lee suggested that in the oil space, "$80 might be a floor for a while."

The day's other guest, Jonathan Krinsky, said to sell the industrials, citing the idea that he's seen CAT and DE "really start to break to the downside" after catching an "air pocket" to the upside.

Krinsky tried to suggest that his call on industrials might be similar to what Lee sees in financials, but Krinsky said rates "probably do actually head back to the upside."

Steve Weiss concluded that people who have a choice about when they return to work will wait until September, so "you'll see another leg up in the economy" in the fall. "So things look great, all with the backdrop of low rates," Weiss said.

Jim Lebenthal said he's buying BMY because drug price control is "not really on the Democrats' agenda right now."

Jim said there's "no way" he'd sell CLF at 24, though "maybe" he'd "trim it" at 28.

Weiss said "the fundamentals support the share price" in CLF and the stock is "very cheap," though he'd sell it if there's another 20% pop. Judge said he won't let Weiss "get away" with the fundamentals comment given the 20% Reddit move this week. In an exchange that really made no sense, Weiss insisted twice, "That's not what I said," saying the fundamentals support where the price is, which is the same price as a "few weeks ago," which doesn't appear to be true.

Degas Wright called MGM "definitely a buy."

Oh by the way, Steve Liesman actually called Guy Adami ‘Joe’

Judge opened Thursday's (6/10) uneventful Halftime Report trumpeting "a new (sic redundant) record for stocks." A couple minutes in, Judge repeated "new (sic redundant) record."

"I buy into the thesis that inflation is transitory," said Steve Weiss.

Dubravko Lakos predicted "the market continues to break out" this summer.

Josh Brown said he's not planning as much business travel at his shop and that the "opportunity is big enough" for ZM and he likes the stock in mid-300s. (This writer is long ZM.)

On the other hand, Steve Weiss said he's short TDOC; "I think they'll be Amazoned." (See, they normally throw in DOCU with high-multiple stocks they like to bash ... except DOCU is up $50 in a week, and no one wants to admit they're wrong.) (This writer is long DOCU.)

Pete Najarian said "UPS has plenty of more room to the upside" than FDX, but he thinks the UPS upgrade is "a little bit late."

Weiss called XPO a "phenomenal story."

Josh Brown gushed about the "experiential retail" of RH and said he and Judge were both at the location in Chicago. Steve Weiss said the multiple is "extremely high."

While people are returning to studios everywhere, CNBC gives Judge a Captain Kirk/‘Star Trek’ look

Judge opened Tuesday's (6/8) Halftime Report by reading a note from Marko Kolanovic.

"He says, 'The next leg higher is likely upon us right now,'" Judge reported.

Josh Brown chuckled that he missed Kolanovic's previous note "where he said like things weren't gonna be good." Brown gave a speech about how he follows price action, but he didn't say anything at odds with Kolanovic's outlook.

Jim Lebenthal, however, predicted "2 or 3 more weeks of sideways trading."

Rob Sechan said his shop wrote an article recently, titled "Is the Fed the new slow hand?"

Judge delivered an "oh by the way," the CNBC Slogan of 2021.

Leslie Picker's News Update (below) gave viewers a new twist on "Phone Poll (sic)."

Still wondering what happened to Einhorn’s ‘enormous tech bubble’ that supposedly burst Sept. 2

Monday's (6/7) Halftime Report couldn't have been sleepier.

Steve Liesman reported the latest Fed plan or suggestion or hint, and the Investment Committee took turns parsing "tapering" and "tightening," etc.

Joe Terranova said that to explain the stock market, he would introduce the word "dispersion," which he said Judge doesn't like.

Judge said Steve Liesman's article on CNBC.com "flushes (sic meant "fleshes") this out."

Rick Rieder was on for a while; he didn't sound concerned about anything.

Joe said he bought CRWD and thinks it's time again, "very gently (snicker)," for the "hypergrowth" trade. (Hope he's cleared that with Jenny Harrington and Pete Najarian, who like to gloat about how they'd NEVER buy these HIGH-P.E.-OR-NO-P.E. NAMES.)

Jon Najarian doesn't see "huge upside" in AAPL but maybe "baby steps." Joe predicted AAPL "underperforms" for all of 2021.

Bill’s getting ‘a pretty good deal’

Judge opened Friday's (6/4) Halftime by reporting on his call with Bill Ackman, whose Tontine (yep) is picking up a 10% stake in Universal Music.

Judge explained, "It's a complex deal as you've heard, for sure." But Judge insisted that recent analyst reports "would suggest that Ackman is getting a pretty good deal." (Of course.)

But Bill's still got leftover cash. Leslie Picker explained Bill's bonus "SPARs" or "SPARCs" are evolving from these transactions. "Now the question becomes, what do you do with the next purchase," Leslie said.

And how this is any different from Bill buying stakes in Chipotle or Valeant, we have no clue.

Leslie was maybe a little less effusive than Judge, stating she didn't ever see Universal Music "pop up" as a possibility here and adding, "It's a, you know, it's a slower-growing I- company than I think a lot of people anticipated" and was "already set to go public."

Meanwhile, Judge said Tom Lee still sees a "risk-on" environment.

But Jim Lebenthal predicted a "few weeks at least" of "sideways trading," citing "no resolution" on inflation (snicker).

Jim protested to Judge that AAPL will be "150 by the end of the year" and said it can keep buying up shares while they're relatively flat.

We've just about had it with listening to the Najarians talk about options activity in meme stocks, but Judge went to the well again on Friday.

60 hours a week on stock-picking (a/k/a Fortune’s cutting-edge headlines)

The topic for the hour of the Halftime Report on Thursday (6/3) was of course AMC shares and the "meme" stock phenomenon.

What really got us scratching our heads was Robert Chapman observing that stock trading is about the "only profession" in which a 30-year financial veteran can get "smoked" by someone with "absolutely no clue what they're doing."

We get that someone picking up a hammer for the first time is probably not going to outperform a carpenter of 30 years.

However, we're not quite sure what Chapman means by "absolutely no clue what they're doing."

Aren't they buying a stock that they think is going higher?

And didn't it indeed go higher?

What Chapman is basically suggesting is that, at least in short-term situations, the 60 hours a week that Jenny Harrington is spending picking stocks (see below) is no more helpful than spending a few minutes on Reddit.

Jon Najarian said at the top of the show he thinks of meme stocks as "rebel stocks" and asserted, "These are not regular Wall Street folks that are driving them."

But moments later, "This is not just the Reddit crowd. Um, this is a whole bunch of hedge funds," Najarian said. So it's not "regular Wall Street folks," but it is "a whole bunch of hedge funds."

Curious.

(Judge didn't notice any contradictions there.)

Doc was retracing for viewers the whole previous 24 hours' activity on HeatSeeker before Judge rightly cut in, "I know about the they. What about the you." Doc said, "OK, well, today, I've mainly, you know, just, sold a whole bunch of calls against what I had." (Translation: Not exactly "fundamental" investing.)

Steve Weiss said "there are 2 types of traders" involves in these kinds of trades, such as the Najarians, "and then there's the clown car of traders," though "I'm not gonna make fun of the Reddit traders."

Josh Brown said meme-stock investing has dominated headlines because it's got "every element you could want."

Brown added, "This is gonna go on for a while."

Judge noted that Brown, in Fortune, wrote "Your father's stock market is never coming back" (that was the headline, at least) (someone's really plugged into 30-year-old cliches) (Unfortunately, Fortune is still your father's Fortune) and penned that the market now is "a 3-ring circus."

Eventually, chatterbox Jenny Harrington got a chance. Jenny revealed, "I work about 60 hours a week on investing," and insisted that aside from this show, she'll give "no thought whatsoever" to the meme stocks.

Then Jenny uncorked a bit of a head-scratcher. Jenny said she thinks of a graduate philosophy professor and a nursery school teacher, "they're both teachers," but "there's NO relationship between what they do all day or how they look at the world."

Well, that's a curious comparison. We doubt that a nursery school student would be thrilled to hear about Jean-Paul Sartre ... but it seems that someone making 100% in AMC this week is probably just as happy, if not more, than someone who made 2% in General Motors, even if the General Motors holder can brag about his/her LOW. P.E. RATIO.