[CNBCfix Fast Money Review Archive — May 2017]

[Wednesday, May 31, 2017]

For 4th day in a row, Judge mentions Robert Shiller’s

‘50%’ call

In an unexpected clunker, Judge brought Marc Faber to the set of Wednesday's Halftime.

Whatever Faber said about the stock market, who cares.

Faber seems like a nice guy; we wish him well, but like all his other market commentary, this interview was downright embarrassing, a colossal waste of time (and no ads for 29 minutes somehow) and potential ad revenue, particularly a day after a crisp, impressive go-round with Lee Cooperman.

Incredibly, Judge mentioned Robert Shiller's supposed "50%" call again.

Meanwhile, panelists took halfhearted cracks at AMZN-vs.-NFLX. "I think the growth is still there with Netflix," Jon Najarian said.

Joe Terranova said "the better buy is Amazon" over Netflix. Judge for some reason asked him again at the end of the conversation.

Kevin O'Leary questioned how much profit Netflix can get from content; "they're getting into a business that has a very crappy return long term."

Kari Firestone picked AMZN over NFLX.

Steve Weiss said he owns NFLX. "Netflix has a more reasonable valuation than Amazon does," Weiss said, adding, "At some point, Amazon's really gotta worry about antitrust concerns."

Kevin O'Leary again slammed banks and said "you all owe me an apology today." Doc though touted V and MA. Kari Firestone suggested banks will start to outperform again. O'Leary scoffed that financials are "a dog in the making."

Anthony Grisanti said if gasoline doesn't pick up, crude hits 45 before 55. Scott Nations said crude is in a range.

Kari Firestone's final trade was AGN. Weiss said bonds will trade down.

[Tuesday, May 30, 2017]

Lee Cooperman ‘would’ve

accepted’ the same offer

from the get-go

First things first:

Judge got the interview; no one else on CNBC did. That's significant.

Early on Tuesday's Halftime Report, Lee Cooperman said, "I've entered into what's called a no-admit, no-deny settlement, which prohibits me from commenting on the government's allegations or the strength of my defenses. I believe that the outcome speaks for itself, um, and I'll leave it at that."

But he didn't actually "leave it at that."

In 20 minutes of conversation about his recently concluded SEC case, Cooperman repeatedly 1) questioned why the SEC offer changed after 7 months and 2) mentioned how much he gives to charity.

Judge asked if Lee worries that some people may "think that you're guilty that you did something wrong, because you settled."

Lee said, "There's always that possibility," but, "You know, you get emails, tons and tons of emails, and most of 'em are congratulatory."

Judge made 2 mistakes (we'll get to those later) in an otherwise stellar interview; one question he didn't ask … and it would've been a toughie, would've made us cringe even … is whether Cooperman actually thinks he got off easy.

Because Lee admitted, "If they asked me initially for the final ask, I would've accepted it knowing it would've saved my business."

That's interesting. So this person who was vowing a fight in September characterized as a "no-holds barred legal battle" now says he would've settled immediately with a $4.9 million fine and a trading monitor.

The only time Cooperman interrupted Judge was when Judge asked, "Had you been banned; you mentioned they, they were seeking at first a 5-year ban-."

Coop said, "The biggest question you should ask and get the SEC to sit here and ask it- answer it, I can't answer it. What happened in the 7 months between your original ask, where you said 5-year bar, admit you're- effectively admit you're guilty, give us $9 million, OK, to, uh, no admit, no deny, give us 4.9 million, and no ban. What did they learn? Now I have some theories, which I'm not at liberty to discuss. But what did they learn?"

Well, we can answer that. 1) Nobody including prosecutors opens with their best offer; 2) The SEC might've deemed the ongoing headwind to Omega's AUM a suitable punishment, and 3) There was a change in presidential administrations during the timeline of this case which might've affected the office's perception of it.

It's possible the presidential election might've been the best thing that happened to Cooperman.

As in his previous Halftime appearance on this subject, Cooperman complained about being subjected to this case — and this time, how the SEC characterized it.

"The SEC person who got quoted that Friday is disgraceful," Cooperman said. "I didn't admit to any guilt. I didn't- I didn't say I denied guilt, I didn't admit to guilt. So what is she saying; she left out the word 'alleged.'"

Honestly, we're not sure how else the SEC should describe it. "We don't really think there was wrongdoing here; we're glad he paid a fine for nothing"??

"The process was extraordinarily abusive," Cooperman said, adding his business was affected "dramatically, way out of proportion to what was, uh, reasonable."

Nevertheless, he indicated he's been getting favorable treatment in the media. "I could tell you, all the stuff I've read has been highly favorable," Cooperman claimed.

Lee said he was once advised not to fight wars with the press and how he probably shouldn't fight wars with his regulators. "Donald Trump is you know crappin' all over the press, fake news, this and that, and then he wonders why the press treats him like he's been treated," Cooperman said, but he feels it's "incumbent" on him to speak out.

"Why did they change what they asked for over a period of 7 months," Cooperman asked again — and then he suggested the SEC isn't about justice … but resume-building.

"And I think what they- the game plan these people play with the SEC and other regulatory bodies frankly is bring down a guy with a reputation, get a notch on your belt, and take that notch and get a job in the private sector making a million dollars a year as a defense attorney," Lee said.

He suggested Hank Greenberg was also abused by the system. "He spent $100 million dealing with this problem," Lee said.

As before, he referred to the giving pledge. "As you know, my money is earmarked for charity. I've taken the Giving Pledge with Mr. Buffett and Bill Gates," Cooperman said.

"We lost $4 billion of client assets," Cooperman added.

Judge noted Goldman Sachs pulled money from Cooperman. "Did it hurt? I was disappointed, but, uh, they again were advised by fiduciaries, and they felt they did what they had to do," Cooperman said. "I'm not bitter, I mean, uh, they did what they thought they had to do."

Lee indicated that no matter the redemptions, he's got money to invest. "It's like a glorified family office," Lee said.

He also said his lawyer "really cared about me" and "focused on me." That's impressive, that a lawyer was "focused on" and "really cared about" the person who is most likely the wealthiest client he'll ever have.

Judge made a couple mistakes. He said in the intro that Cooperman was "settling insider-trading charges with the SEC," which is true. But he never told viewers what those charges were or that the case (discussed on Fast Money last September with a New York Times reporter) included "family drama" involving a son and a grandson.

Judge opened with, "When you were here earlier in the year, you made it clear you had no intention of settling this case. … Why did you settle."

But in fact, as this page observed after the Jan. 5 interview, Cooperman did vow to fight the case but also let slip, "I'm here ready to cooperate and present a case."

And when someone says "cooperate," that means he/she is open to a deal. So the idea of "no intention" is absolutely bogus.

In fact, if Judge actually believed his own opening question, he would've turned the tables on Lee and asked, "You question why the SEC changed its offer after 7 months, but why did you change your willingness to settle over the same time period?"

Anyway, Cooperman actually told Wapner, "Well, uh, it's very simple. My lawyers told me that, uh, the probability of my winning would be overwhelmingly high, and if I didn't win, it had nothing to do with the merits of the case. It would have to do with the fact that uh I'm a former Goldman partner, I'm a hedge fund manager, I'm wealthy, and those are (unclear) factoids and impress juries. Um, and, uh, that the cost of a trial would be probably 15 to 20 million dollars and go on for a couple years, because if we did win, uh, we would likely see appeals."

So he was worried about the cost of appeals after winning. (He also said on Jan. 5 that the legal battle would cost "probably a hundred million dollars," not $15-$20 million.)

OK. Reviewing television, it's sort of this page's chosen responsibility to determine what this person was saying.

We don't know anything about the merits of the case, who would've won or who should've won. If there was a big witchhunt in progress, and a bunch of young regulatory lawyers looking to get notches on their belts with bogus prosecutions, then we'd see far more cases like this. (Name another one.) (At SAC, people were convicted.)

Cooperman's charity statements have always been the weakest part of his argument. Giving money, however noble or generous, doesn't put one above the law, and it has nothing to do with Atlas Pipeline Partners. Despite this SEC case, according to the New York Times, Cooperman managed to make $225 million last year. Unfortunately his lawyers failed to persuade him to stop blaming the SEC for preventing kids from going to college.

We don't know what happened. We don't know if he did anything wrong. We do know that Leon Cooperman settled a case he vowed to fight. We also know the government's punishment is seen as relatively light and that the New York Times suggested Cooperman is the "victor" here. He says he's not allowed to deny the allegations. The guess here is that, in his late 60s at the time, he got careless.

Lee Cooperman mistakenly suggests an effect is a cause

Lee Cooperman said something on Tuesday's Halftime that should really make viewers cringe — and it had nothing to do with the SEC.

Stressing the importance of a college education, Cooperman stated, "The lifetime earnings of a college graduate is in excess of a million dollars more than a non-college graduate."

Sure.

Because the world's highest-earning people tend to go to college.

Not because college turns Average Joes into high-net-worth individuals.

Being a doctor or lawyer requires going to college. Being a financier virtually does.

Founding a unicorn does not. Trading real estate does not. Does anyone think the president of the United States went to Princeton to learn how to build hotels?

Cooperman: Paul Singer doing a ‘good job’ of warning investors for the last 5 years

Judge on Tuesday's Halftime showed a graphic depicting Robert Shiller and Jeremy Siegel in the bullish camp and Paul Singer and Seth Klarman in the pessismistic camp and asked Lee Cooperman for his thoughts.

Lee called Singer a "brilliant, brilliant man who's been bearish for 5 years … I think Paul is doing a good job of warning people, and uh, but he's been warning people for a lot of years."

"I think the market for now is fully priced," Lee said.

"We're heading back to normalization," he added.

Cooperman told Joe Terranova, "What is likely to end this, would be a big turnaround in energy prices, tightening labor market, an escalation of labor costs."

Cooperman's top picks include energy names NBR, WPX, FRAC and HES.

He also likes DOW, though he referred to "Dan (sic) Breen."

Lee said he bought UAL "in decline" and indicated that settlements are no big deal. "They made a mistake; they handled something poorly; you know, they settled," he said. "It is what it is."

Scott Nations and Brian Stutland said the gasoline chart looks a lot better than oil.

The Najarii hardly had to talk.

Judge asks Lee Cooperman

about Robert Shiller’s ‘call’

Judge conducted a remarkable interview with Lee Cooperman on Tuesday's Halftime, which this page will tackle soon.

Amazingly, however, despite a crisp performance, Judge actually asked Cooperman about Robert Shiller's loopy interview last week that no one else is taking seriously.

"I caught that … be very careful," Cooperman said. "He threw out a number, and then he backtracked, and it was in terms of years."

We'll put it another way: That Shiller put out a report to attract attention only to say on TV he doesn't really believe in anything.

All he said on TV was that the CAPE ratio is not as overcooked as late 1999 and that a corporate tax cut to 15% (snicker) would propel stocks.

Honestly, we're surprised this interview has even been mentioned since the day it happened.

Much more from Tuesday's Halftime later.

[Friday, May 26, 2017]

Jeremy Siegel emails Bob Shiller, discusses definition of ‘could’

Like a bad trade, he's unable to let it go.

For yet another day, Judge somehow mentioned Robert Shiller's Wednesday interview at the top of Friday's Halftime before welcoming on Jeremy Siegel.

This despite the fact Shiller said absolutely nothing, claimed his whole assessment was basically nothing but that any number of outcomes could happen, acted like he didn't want to talk about it, and oh by the way, every other CNBCer taking part deemed it irrelevant.

Why Judge doesn't regard this the same way (sigh), we have no clue, except it was his interview, and he can't find anyone else with a more constructive opinion on the stock market.

Siegel revealed, "I emailed Bob; I said, 'Are you bullish?' He said, 'Well, I said, It could go up 50%. It could go down 50%.' I mean the word 'could' does not really mean that that's what he expects."

OK. So we're still not sure whether Shiller, despite Judge hyping this laughable interview, is even bullish. (And whether the 50% is over 10 years or between now and 10 years, etc.)

Siegel said "the momentum is there" in stocks and for those worried about overheating, the P.E. of the tech sector for 2017 is under 20.

Siegel said, in contrast to Paul Singer's caution, the S&P was at 30 times earnings in 1999 while we're at 20 now, "and in a much lower interest-rate environment."

But he did offer a bit of caution. "There are a lot of momentum players in this market," Siegel said. "Momentum is surging as a factor."

Fair enough. The point is, which no one really has the brass to say, this market for the first time in a dozen years, maybe since 1999 actually, is exciting, it's the place to be, it's like the 1980s again, and it won't always go up, but you've gotta be there regardless.

Grandpa Jim Lebenthal asked Siegel, "If this market breaks to the downside," won't growth investors look at value as a "metric." Siegel agreed they will go to those value stocks.

Jim suggested if AMZN is down 4 days in a row, "all of a sudden, people are gonna get queasy." Then people who sell will decide, "Hey valuation matters, let's look at some attractively priced stock" (snicker) (double snicker).

Josh Brown though said there could be a "big gap" between when the value stocks start to climb after the market meltdown. Brown also said the market doesn't have to crash but could just stagnate for a while.

Josh shrugged that the argument about only a few stocks carrying the market is a "forever thing."

Jon Najarian said he doesn't see the "steam" that would indicate an overheated market.

Judge said at the opening that the "top trade" for Friday's show is whether the market is "overheating" or going into "overdrive" (sic CNBC compares verbs and nouns, not exactly punchy).

Steve Grasso on the 5 p.m. Fast Money called 2,450 the level that the S&P will "vacuum back up to."

CNBC superfox Landon Dowdy appeared on Fast Money (after appearing on every other program during the day) on a boat in Florida. Hopefully, Dowdy packed a swimsuit. Mel said Dowdy's assignment was like "slave labor."

Back in the day, when you heard that opening horn from the theme song on Saturday night, you knew your weekend was rounding into shape

Karen Finerman on Friday's 5 p.m. Fast Money said, "I'm long Valeant," acknowledging "it could go to zero."

Karen, dazzling in new black top, admitted she "lost a fair amount of money" on M; the balance sheet isn't that great but "they do have asset value for sure." Tim Seymour said he finds M interesting.

Karen said she finds ULTA "too expensive for me."

Stressing the challenges of HTZ, Karen revealed, "When I go to L.A., I no longer rent a car. I use Uber; it's so much easier." She said it wouldn't be "shocking" for Carl Icahn to make a bid for HTZ.

Fast Money impressively aired some tunes from "The Love Boat." Mel said she's like "Julie the cruise director."

Jim: Young people going ‘gaga’ over makeup

Jim Lebenthal on Friday's Halftime said he finds ULTA "fascinating," because "young people are just gaga over makeup. … If the price breaks, get in."

Jon Najarian said June 31 MU calls were popular.

Najarian also gushed about MSFT and said he'd stay long the name.

Doc said to stay with CTSH.

Jim said he's "a little miffed" for selling BA at 182. "At this price, it's too high," Jim insisted, saying he'll get back in around 165-170 (or whenever NKE hits 49).

Josh Brown said MCD has made 30 all-time closing highs in 2017.

Josh said he's not really into KORS; he doesn't know why someone would look at it when there are so many other names doing well.

Tim Seymour: ‘I like to buy other people’s problems’; Grasso asks about Tim’s shirt

Jon Najarian on Friday's Halftime said he wouldn't give CVX a "sell," but he thinks there are better energy stocks, such as NBR.

Jim Lebenthal said he prefers buying the rest of his NKE position at 49 energy plays not tied to the price of oil such as refiners and pipelines; "I think oil is stuck in a trading range."

Jim said at the end of the program he thinks oil will continue to come down.

Josh Brown kind of agreed with Doc, there are better plays than CVX.

Jon Najarian said someone was buying RRC June 24 calls and selling the June 26 calls. He also said there was buying in WPX.

Judge apparently starts going

to the movies again

Hollywood mogul Peter Guber, for some reason a phone guest on Friday's Halftime (apparently because he's a part owner of the Golden State Warriors), said the NBA Finals ought to be exciting.

Catching up with the turn of the century in entertainment, Uncle Judge told Guber, "It certainly seems like superheroes now are all the rage and that's where the studios are putting their money behind."

Guber said "there's 2 audiences for sure" for today's movies.

Meanwhile, Jon Najarian reiterated that he likes PANW, but Josh Brown said the stock tends to disappoint at earnings and he'd rather buy after earnings.

Doc said, "If something's bad here and things fall apart, you could get a chance around 100. That would be fantastic."

Jim Lebenthal warned that if LULU disappoints again; "I think you're gonna see the bottom fall out of this stock."

Jim suggested FIVE may not match the hype in its next quarterly report.

Josh said he'd rather not buy WDAY ahead of earnings and risk a tumble.

Doc said October 105 calls in MAR were being bought. Josh said the XLF is trying for a breakout.

[Thursday, May 25, 2017]

Doc now claims Steph ‘correctly’ observed that the Trump Trade rolled over

As usual, the Halftime crew offered barely a tepid endorsement for this raging stock market.

"We're not significantly overvalued," said Stephen Weiss, who added the VIX "means nothing now" because of "algos."

Joe Terranova admitted he "went defensively" last week during the Impeachment Selloff.

Pete Najarian at least said he's more inclined to pick "overdrive" rather than "overheating" (sic CNBC comparing verbs and nouns) for stocks.

Judge said the risk to the market "seems to be to the upside."

Judge even invoked Robert Shiller's suggestion, during the laughable 50% thing nonsense that Judge and his producers somehow took seriously (but Cramer and the panelists didn't), "if you want to call it a call," that maybe we're only in the "middle innings" of the bull market.

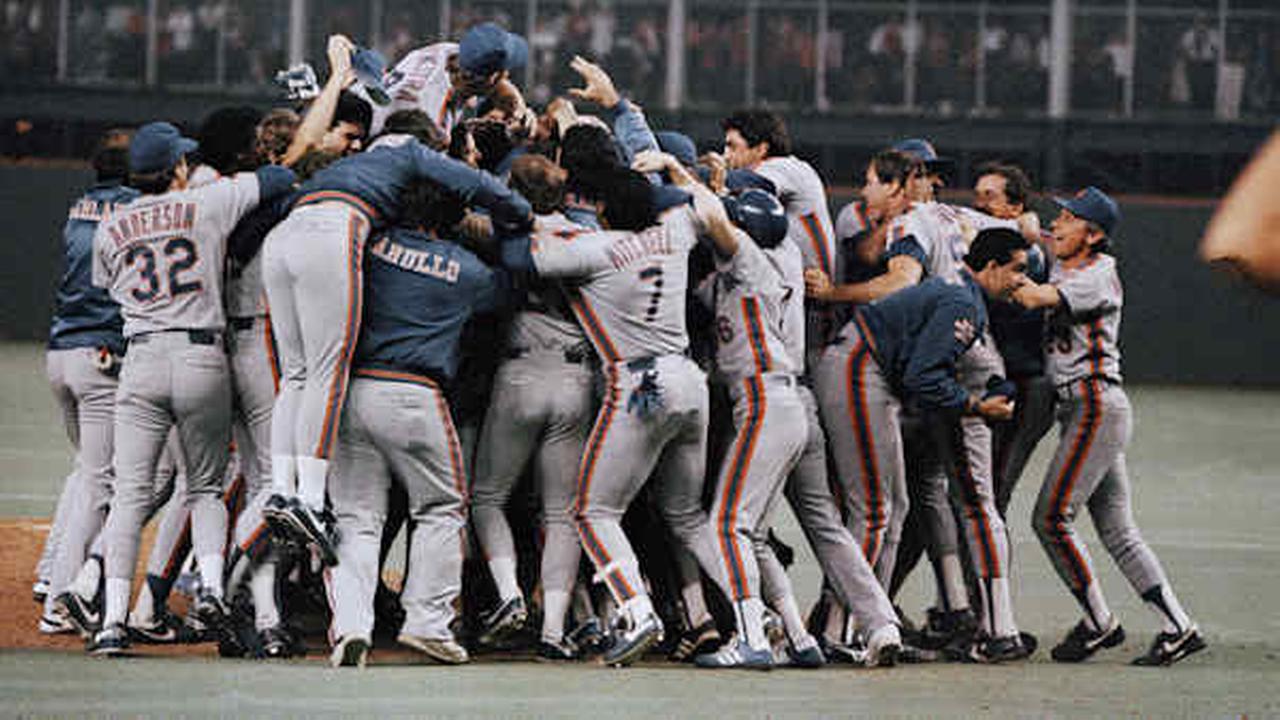

(Sigh.) It's not a question of what inning. It's an answer of, this market is to stock players what 1986 was to Mets fans, and if you bail, you're a moron. (That doesn't mean every day is up — there will be disasters too such as retail or auto-parts shops — only that collectively, this is the place to be.)

"The old playbook doesn't work anymore," said Steve Weiss in a mumbo-jumbo refrain that means absolutely nothing.

Joe Terranova said "the asymmetric risk to the upside" is that taxes get done this year, retroactive to the start of the year.

Pete Najarian said financials "have quite a bit of room to the upside," and that's what takes the market higher.

In the show's howler, Jon Najarian pointed to GS last week going from 225 to 212 and said with a straight face, "Stephanie correctly called that you know, a lot of these stocks were rolling over on that particular day."

Actually, 1) she wasn't stressing 1 particular day, and 2) Najarian was right in that argument.

But 3) he's being a TV gentleman, which we'll applaud him for.

Jackie DeAngelis said "sideline conversations" continue in Vienna.

Judge calls AMZN the ‘most disruptive force in, in modern business history’

Jon Najarian on Thursday's Halftime said he's in AMZN calls, but as 1,000 nears, he's planning to lighten up.

"I'm not saying I'll get out," Najarian explained. "I'm saying I'm gonna sell at the money calls into it Judge, to take some of that money off the table."

Doc suggested selling AMZN 950 puts.

Joe Terranova suggested AMZN could reach not just 1,000 but 1,250.

Making up for his "old playbook" refrain, Steve Weiss made a great point about buying AMZN, explaining he'd feel "a lot stupider" if he bought it and it went to 600 rather than if he didn't buy it and it went to 1,200.

Although, it's also fair to say that missing a moon shot (which everyone does every day) is NEVER as significant as buying a dog.

Meanwhile, Pete Najarian and Doc hailed BBY; Doc noted the "discipline" of making cuts that AMZN has forced upon BBY.

Joe Terranova noted that BBY has benefited from the hhgregg closure. "They've done the right things within the store … I think this is a multiple-quarter story," Joe said.

Weiss was correct again, saying of BBY, "We're talking about 1% revenue growth … that game ends at some point."

Congrats to those who have been long BBY, and the BBY management. But enormous trends are working against them. We can't imagine a loopier stock thesis than chasing BBY on Thursday; months from now, CNBCers will be agreeing that "You can't outrun Amazon forever."

Apparently CNBC still hasn’t gotten any of those calls returned by Herbalife

Matt Boss of JPMorgan gushed about PVH on Thursday's Halftime, saying it has "diversified their distribution" and has a "huge runway" internationally.

"Numbers are too low, multiple's too low," Boss concluded.

Jon Najarian said the key is that PVH has "iconic names" and not bricks and mortar.

Boss also likes TJX and the off-price sector.

Doc pointed out liking PVH a week ago at 96, a great call, and while he likes the name, he suggested selling "aggressive calls into it."

Weiss thinks Robert Shiller was really making an anti-bond call; Shiller says that ‘sounds right’

We weren't particularly interested in hearing Mick McGuire spend 20 minutes of Thursday's Halftime talking about how important franchising is for BWLD.

Judge said McGuire got a "pretty decent victory" from ISS recommendations. (Zzzzzzzz.) McGuire said it's "certainly a very good start."

"There's enormous appetite for these, uh, for these restaurants," McGuire said.

Phil LeBeau reported on the GM class-action suit. Jon Najarian wondered aloud, "Where do you get 700,000 people to sign on to that lawsuit Scott if there's no, no fire at all, just smoke."

Joe Terranova praised the "diversification" of products at BLK.

Stephen Weiss said of CMG, "I still don't get it" and called the stock "way overvalued."

"Restaurants don't keep this valuation for any period of time, ever," Weiss asserted.

Pete Najarian said "turkey's the problem here" at HRL. Pete also hailed TTC even though it was down Thursday.

Pete said there's been very aggressive buying of CL August upside calls.

Doc said someone was buying a lot of September 32 calls in MGM. Doc said someone bought January 8 calls in S, sold the 9 calls, "and then they sold a whole bunch of puts." He added, "If it's 9 or higher by January, they make 10 times their money."

Jim Iuorio hung a "42-ish" target on crude. Jeff Kilburg though said, "I don't see crude oil going lower here," and he's a buyer at 49.

Weiss said he added to DATA. Pete said he's "amazed" at the speed of UAL's recovery; he touted PEP. Doc endorsed SWN, and Joe touted MSFT.

[Wednesday, May 24, 2017]

Karen actually claims Jeff Immelt is a ‘great CEO’ victimized by ‘things that are beyond his ability’

She looked, as always, dynamite.

But Karen Finerman had jaws dropping on Wednesday's 5 p.m. Fast Money not for her appearance … but lunkheaded endorsement of Jeffrey Immelt.

Karen said of the worst Dow laggards, "GE is probably the most interesting to me." Fair enough; Guy Adami agreed.

But Karen actually with a straight face called Immelt a "great CEO" plagued by "a lot of different things that are beyond his ability to, you know, the financial crisis, and GE being in that situation they were in."

Really. What did his stock do in in his first 7 years before the financial crisis?

And how much money has Metropolitan Capital invested with this "great CEO" in this century?

Guy Adami said he too finds GE interesting but noted, "they basically got out of GE Capital at the wrong time and they got into energy at the wrong time."

Pete Najarian, refreshingly blunt, knocked it out of the park, calling Immelt a "great guy," but wondering, "How many bad moves do you get as the CEO?"

Pete said the company needs changes "on the management side."

Exactly. We've never met Immelt. We've read articles about him (Vanity Fair actually once hyped him up, in a sweater surrounded by stiff-looking GE department heads). We've seen him on CNBC. No doubt, this is an engaging fellow. His heart's in the right place. If you are going on a retreat to talk about the New Economy, this is possibly your No. 1 invitee.

That, and the fact GE owned CNBC for a long time, is why CNBC personalities have regularly somehow defended him.

But when it comes to running a conglomerate, he sucks. Obviously. Look at the chart.

This site has pointed out multiple times that for some unknown bizarre reason, Immelt's most passionate public endeavor had nothing to do with GE but pleading with people at Notre Dame not to walk out on President Barack Obama's speech in 2009. (Notice how long that article is.)

Credit Jim Cramer on Wednesday's Halftime for revealing that CEOs of top industrial companies deem GE's cash flows a "real bad sign"; Cramer says it's "do or die" for Immelt.

Judge wastes viewers’ time on bungled, pointless interview with Robert Shiller

It started with Judge stating that Robert Shiller is saying stocks could go up 50% "from here."

But veteran viewers of CNBC know that 1) Shiller is going to backpedal from whatever headline CNBC assigns to his call and 2) a 50% call is meaningless without a time frame.

It took 8 minutes of Wednesday's Halftime before Stephen Weiss, not Judge, pointed out that Shiller is actually making a 10-year assessment. Weiss said it sounds more like an anti-bond call than bullish stock call. Shiller said "Yeah, I think that sounds right, yeah."

Yeah. Whatever.

Nevertheless, Judge actually claimed his jaw dropped when he heard Shiller's 50% upside call.

Pete Najarian said of Shiller, "He said 10 years, but he said somewhere between now and 10 years."

OK. Even more whatever. (Nice choice for interview subject, Judge.)

Shiller said his CAPE ratio is at 30, and in the late '90s, it went from 30 to 45, and it could do it again.

Judge asked if earnings and the economy alone, "in and of itself" (sic singular for plural topic), can carry stocks higher without Washington help.

Shiller said if they cut corporate taxes to 15%, that "gets you a good way there."

Shiller confirmed to Weiss that his assessment is based over 10 years; Weiss noted that 50% over 10 years is actually underperformance.

Eventually, Jim Cramer, who was on the panel, said what Judge somehow failed to notice, that Shiller "obviously wanted to walk it back," and "what he's really basically saying is I wish that you guys hadn't focused on the 50."

Cramer said it's notable that Shiller compared today's market to 1999 favorably.

Kourtney Gibson claimed, "I think we're getting into a cycle now where finally, finally, stock pickers are going to come back into favor."

Cramer called NVDA the stock/company that's going to change the whole world because the CEO said so "1999" even though he thinks it's the real deal.

Pete Najarian said financials have "paused," and the next leg is up.

Weiss buys X

In the day's most interesting trade, Steve Weiss twice said during Wednesday's Halftime he bought X for a trade after submitting a low bid.

He thinks it was oversold but has limited upside; "10% and I'm gone."

Kourtney Gibson said she bought HAL on Wednesday. She later said the Loop Capital analyst has a $67 target. Actually, that reminds us of Karen Finerman stating a couple days ago that she was reviewing oilfield services stocks and found analysts highly bullish across the board, making her wonder who's left to buy.

As Jim Cramer howled for some reason, Judge said Dan Loeb is questioning whether Dow/DuPont are pushing too many assets into the Liveris unit. Cramer called Ed Breen "maybe one of the greatest value creators of our time." Weiss said he'd side with Loeb, "his track record's phenomenal … he's not satisfied with 'great,' he wants 'greater.'"

Cramer said he agrees with Weiss that the Einhorn stock plan for GM "makes no sense."

Kourtney Gibson said she wished she could've bought LOW in the morning premarket.

Jon Najarian, who had a quiet show (translation: Steph wasn't on to talk about the Trump Trade rolling over), touted PVH, a good recent call.

Doc said there was a lot of activity in NBR July 11 calls.

Pete Najarian lauded BBY's competitiveness against Amazon.

Pete said LNG July 55 calls were popular.

Jeff Kilburg said Moody's issued a "pretty mixed downgrade" on copper. He said he likes it based on Chinese infrastructure. Anthony Grisanti said if the dollar rallies, there's more pain ahead for copper.

Doc's final trade was HYG. Pete touted WDC and said he owns it.

[Tuesday, May 23, 2017]

Ron Insana spares viewers the ridiculous 25th Amendment argument, thankfully

Ron Insana briefly sat in with Tuesday's Halftime crew and said "we're certainly due for a pause" and insisted "there's a lot of political risk that is absolutely unattended to in this market."

Really.

Jim Lebenthal said the market is "comfortable" if Mike Pence becomes president.

Jim said "we're stuck in general" and said "military action" is the only thing that can break the market out to the downside.

Rob Sechan said there's a "tremendous amount of cash on the sidelines."

Insana said he's someone who "perennially" hates emerging markets, calling it an "adult-swim-only environment" that's not for viewers at home to day trade. Pete Najarian said you can find what you need in U.S. stocks. Rob Sechan though said there's a "cushion" internationally because Europe, for example, is trading 30% below peak earnings.

Insana continued to warn of political risk, but Judge said any impeachment talk is happening "way way way prematurely." Insana said that impeachment is unlikely but "there can always be a conversation" among the Republican leaders and that Barry Goldwater took a walk in 1974 that changed history.

Joe Terranova, from San Francisco, said he's "a little bit amazed" about the conversation. "This market just comes back over and over again," Joe said. Judge said "we get that," but what takes it to the next level. Joe said "the reassumption of the uptrend" in cyclical names.

Jon Najarian, also remotely, said VIX futures are now back in contango. He also said the oil VIX is down near the lows of the year.

Pete Najarian scowled at Jim's suggestion that 3 tech biggies are carrying the market. "It's not just 4 stocks in technology by the way," Pete said.

Stephanie Link said she still owns AMZN but still worries. Pete Najarian said the stock thrives on "the stickiness of Prime."

Stephanie Link said there hasn't been any progress with fiscal policy, and GDP was "worse than people thought."

A day without NKE being a buy or NVDA changing the whole world

Judge on Tuesday's Halftime said Adam Jonas is wondering about Google's competition for Tesla. Jim Lebenthal agreed that "everybody's getting into it." Rob Sechan said "there's a lot of room for multiple players if the adoption's broad-based."

Pete Najarian said CPN September 15 calls were being bought by someone rolling up the 12s.

Pete said he thinks TOL goes higher.

Jim said he's not all that surprised to see AZO slumping; he thinks it probably continues.

Stephanie Link doesn't want to be in DSW.

Rob Sechan said "value mean reversion" is the reason to buy energy.

Bob Iaccino said silver should outperform gold in the medium term. Anthony Grisanti agrees but thinks the economy needs to strengthen for a breakout.

Judge reported on HLF developments and said CNBC has "several calls into Herbalife for comment" but had yet to hear back.

Pete Najarian said with Alec Baldwin's help, he raised $64,000 for Lyme disease research by auctioning off a day with himself and Doc.

Stephanie Link bought more PM on Tuesday.

Pete Najarian made DLTR his final trade. Judge hardly let Pete answer his question about how Amazon affects discounters. Steph Link said she's been buying CSCO on the pullback. Jim touted TIF. He said he doesn't think TSCO has bottomed.

Jim didn't say anything this time about people thinking a couple years ago that JCP could be another Neiman Marcus, which oddly enough was the first time we've heard that thesis, not even during the Ron Johnson tenure.

[Monday, May 22, 2017]

Jim claims people thought a couple years ago that JCP could be another Neiman Marcus

Jim Lebenthal on Monday's Halftime Report actually said with a straight face that there was supposedly a thesis a couple years ago that JCP could "migrate" (sic) into a Neiman Marcus.

That came after Judge let Jim deliver another speech on JCP (Note: If you can't make an argument for a stock in a few words, it's not really worth owning) in which Jim said, "I got into this because I saw improvement in the cash flows, and I projected that that was going to continue, and it has continued."

But Judge noted an improving debt situation isn't resonating with investors and questioned when it will. Jim said, "At 4.7, this is a buy" before admitting his average cost is "around 6.20."

Judge assured Jim, "We get it," and promised he's "not trying to embarrass you or anything."

F, GM, FCAU might be very good companies but frankly aren’t remotely as exciting as Tesla no matter how much they talk about autonomous

Phil LeBeau was enlisted on Monday's Halftime to summarize the brief history of Mark Fields' F.

Judge said, "I just don't get it," asking LeBeau how, if you can't grow your stock when car sales are "at a record high," then "how the hell can you grow your stock price when, when, uh, sales have arguably peaked" (a question also asked by Guy Adami at 5 p.m.).

"What is Hackett gonna do that Fields couldn't?" Judge demanded.

LeBeau said the board believes "Hackett will make Ford move quicker … Look, there's a lot of institutional bureaucracy there."

Sarat Sethi called Hackett a "change agent."

Steve Weiss said "I applaud" Bill Ford's move, "however, he seems to hire people, with the exception of Mulally, that he knows."

Josh Brown scoffed at Hackett's hiring; "he's a cost-cutter when literally the only path to survival is spending more," Josh said.

Josh said "every technologist in Silicon Valley knows" that the average car sits in a parking lot or driveway 90% of the time and is thus incredibly inefficient.

But Jim Lebenthal, who likes GM, said cars should get a boost from the improving job market for millennials, and as for the future of sharing cars, he made a sippy-cup argument.

Jim insisted that fears of Silicon Valley sinking Detroit are no different than Webvan in the 1990s.

Sarat Sethi said there's "not a lot of downside" to owning the automakers now especially with the dividend.

Karen Finerman on the 5 p.m. Fast Money admitted there's some "macro issues" for all the automakers 5 years from now; "are people gonna have their own cars."

Meanwhile, on Halftime, Sarat Sethi admitted he's "missed" the run in defense stocks but called them a good buy.

Jim Lebenthal said FINL trades cheaply but he called the $500 million market cap "really risky."

Josh Brown said to "ignore" the osteoporosis news at AMGN.

Sarat Sethi called the BX Saudi Arabia position a "good catalyst" for the stock.

Sarat Sethi said this is a good time to buy QCOM but that many will avoid it until the Apple issues and the NXPI acquisition are over.

"Tech people don't talk about Qualcomm at all," said Josh Brown.

Steve Weiss said he owned QCOM in 2011, and he had an 80-85 target then, and "it's never gotten there!"

Jim's final trade was QRVO. Josh said not to trust the XRT; it won't hold 40.

Karen Finerman on the 5 p.m. Fast Money said she still has a "pretty big technology bet," touting GOOGL as well as financials. Karen also said she was looking up oil-services names and found "the analyst community, it's almost a universal buy … with price targets significantly higher than where they're trading," which makes Karen wonder who's left to buy. But Tim Seymour said he likes HAL.

Weiss felt like a genius for hedging just before Wednesday, but the market has practically recouped it all anyway

In a tepid (that's being nice) opening 18 minutes of Monday's Halftime, panelists gave the stock market a lukewarm endorsement.

Josh Brown at least stressed that there's lots of strength in this market, pointing to JNK and its "super, super-bullish chart" and noting the SMH is right back to yearly highs after fears of a blowoff top.

As for sentiment, which was Judge's opening hook, Brown said the "elephant in the room" is the quant funds that are "completely divorced from any of this nonsense about I trust Trump or I believe in the agenda."

Sarat Sethi said, "Every day, there's negative headlines," but he advises, "Don't pull out yet."

Jim Lebental said he thinks the market has been "stuck" for "many months."

"I don't particularly trust this market, but that's an opinion," Jim said, predicting a range of 2,350 to maybe above 2,400.

Mike Santoli said "there's that sense out there that it's late."

Stephen Weiss said Lee Cooperman on Friday declared equities fully valued. "I'm not so sure the VIX means what it used to mean," Weiss said, adding, "I put on some hedges last week right before the big decline and felt like a genius for about a day."

Jim Lebenthal declared himself an "active manager" and contended there are a "lot of different segments of these markets that are performing differently," calling value stocks "basically flat."

Though tech's done great, Weiss said "you really have to be irresponsible not to regard risk being in the market somewhere."

More from Monday's Halftime later.

[Friday, May 19, 2017]

Jim evidently didn’t like Judge’s NKE ‘cheapskate’ implications, won’t take him to lunch

Jon Najarian on Friday's Halftime took a small but deserved victory lap on his suggestion a couple days ago of a possible VIX peak, a premium that "virtually vaporized."

Jim Lebenthal said the market's telling us that it's not worried about whether Trump lasts 4 years, and he thinks the cash from the sidelines will carry the market further.

Doc said there is a "significant amount of money on the sidelines" and pointed to DE (we think that's one of Jon Najarian's Trump Trades© but not necessarily a MarketWatch Trump Trade).

Kari Firestone said Bob Mueller provided a "security blanket" to the market. Firestone pointed to 4.4% unemployment as a catalyst.

"Today, I bought Foot Locker," Doc said, despite the "horrendous" report. He said he put out a note touting a "tremendous opportunity" at 60-61. (It might well work out next week but didn't work on Friday.) (This item was posted after the market close Friday.)

Jim Lebenthal said NKE is on his "watch list," he has a half position and had a 53.50 buy for the rest; he said at 48-49, he'll buy the other half of his position. Jim congratulated himself for not buying NKE at 53.92 despite hectoring from Judge and cheapskate allegations and not taking each other out to lunch.

Things Ron Johnson didn’t think of: JCP could sell sheets to hotels

Jon Najarian on Friday's Halftime said WMT June 79.50 calls for June 30 expiration were popular. He said he'll be in them "2-3 weeks."

Jim Lebenthal suggested brick-and-mortar retail has potential of going "extinct." Without Kevin O'Leary in the way, Jim said the Jet transaction has "clearly transformed Wal-Mart into a real ecommerce player."

Jim touted JCP again … this time for trying to sell bedding to hotels.

Josh Brown, again without Kevin O'Leary in the way, said if Jet doesn't work, no big deal, "it's like a rounding error" for WMT. (O'Leary would say WMT could be doing its own version at a "fraction" of the cost.)

Kari Firestone said WMT is still "an enormous presence of brick and mortar across the country that may or may not survive in its current form 5 years from now."

Josh: PANW a ‘falling knife’

As viewers wondered what Judge's criteria is for taking panelists out to lunch, Jim Lebenthal on Friday's Halftime grumbled that it's difficult to "paint such a broad brush stroke" and deem all tech the same; he said IBM doesn't look anything like FB, and NVDA doesn't look anything like QCOM.

(Hmmmm … we didn't realize a big problem on Wall Street is people thinking IBM and FB are in the same business.)

Jon Najarian said he's a seller of puts in PANW. Josh Brown called PANW "the wrong one" with the "worst chart" in the space and a "falling knife," but he said CHKP looks "phenomenal."

Josh said nobody in Times Square has heard of Jen-Hsun Huang, but he's going to "reinvent the world as we know it," and NVDA's involved in "every single important breakthrough technology."

Doc said he likes NVDA and AMD, and he'd buy AMD on another dip.

Jim actually said CSCO is starting to look like IBM and said CSCO can do things with cash. "There's plenty of international companies that can be bought," Jim said.

Current longest-running cliche on Fast Money/Halftime: Citi trading below book

Josh Brown on Friday's Halftime said (again) that the lesson with DE is not to be suckered by a cheap P.E.; the growth takes off when the P.E. gets expensive.

Jim Lebenthal made SYF sound useless before concluding it "doesn't excite me."

Doc said he wishes he owned MCK.

Jim said C "should be 10-20% higher just to get to parity with its book value."

Kari Firestone said there's "at least a 50% chance" that BX becomes a corporation and no longer has the K-1 problem.

Jim’s possibly still rankled by Judge tripping him up on ‘peak auto’

Jim Lebenthal, a quote a minute on Friday's Halftime Report, said to "keep it simple" and "follow the rig count" in the oil space.

Jim said OPEC "can't afford to cut." Doc said the OPEC optimism is about extending the cut to 9 months and bringing Russia along.

Jim told Josh Brown that pipelines aren't "tied to the price of oil" now that oil's stuck in a range; it was different when crude went from 110 to 30. Josh insisted the dividends may not be as "sacrosanct" as they seem "if oil doesn't do X, Y and Z."

Doc said he's in GD and likes the name. Josh Brown said it's hard to say which defense stock will have the best quarter and suggested the ITA. Jim said to keep an eye on BA; he'd like to buy it around 170 or 165, and he said he sold it earlier at 182, for those interested in previous winning trades.

Kari Firestone said she likes LDOS and expects it to track defense stocks, albeit delayed.

Doc touted PVH. Jim expects another TIF beat. Josh Brown gushed about JPM.

[Thursday, May 18, 2017]

O’Leary: WMT could’ve done what Jet does at a fraction of the price; SHAK ‘irrelevant’

Thursday's Halftime Report was partially preempted by the Times Square tragedy; both before and after, usually chipper Mario Gabelli was flat as a pancake.

Kevin O'Leary took a minor victory lap in shrugging off the Wednesday selloff. "It was just noise," O'Leary said.

Josh Brown said Thursday's bounce was "pretty textbook" after what happened Wednesday and the smoothness leading up to it.

Mario Gabelli said that from this administration, "tax reform is totally necessary, territorial vs. global, uh, corporate tax rate."

Joe Terranova said the "one policy" the markets want from this administration is corporate tax reform.

Judge briefly yielded to gorjus Ylan Mui, who conducted a fine interview outside the Steve Mnuchin hearing with Liz Warren, whom we often disagree with, but we'll give Warren credit for making articulate points in brief soundbites and Mui for asking good questions on the spot.

Warren carped that Donald Trump claimed to want Glass-Steagall but that Mnuchin said he doesn't think commercial and investment banking needs to be split. "In other words, he just reversed position from the administration by 180 degrees," Warren said.

Mario Gabelli said he likes FCB.

Judge said Gabelli was "payin' the piper" on CSCO. Gabelli responded, "I don't own any."

Joe said if you're looking to buy a pullback, the "1st place" to look is TXN, TER and LRCX.

Josh Brown said WMT is having a "clear and present breakout."

Kevin O'Leary said WMT "overpaid" for Jet, which he called "crazy." Josh insisted "no, they didn't overpay."

Josh said Jet is the team that beat Amazon with diapers.com, and WMT was smart to buy that team. Judge called that a "very compelling argument."

O'Leary said "online, you can emulate" and that Instagram copied what SNAP does and "decimates" SNAP's market cap. (This writer is long SNAP.)

Brown said they're talking about ecommerce, not social media.

"They could've built it for a fraction of the price," O'Leary insisted.

Mario Gabelli said he owns ORLY and GPC but not AZO.

Jon Najarian, via satellite, said he thought BABA was "overdone" at 114 and said some people started buying a bunch of calls from 120 to 130.

Judge said Wedbush actually upgraded SHAK to buy. Josh admitted the high valuation "hasn't been cured" but said the stock has an "investor base."

Brown told O'Leary SHAK has "a hundred and something" stores. O'Leary said the company is "irrelevant" and called it "nothing burger."

Honestly, we gotta agree with O'Leary; we don't get that one except that it's apparently a popular spot for NYC traders, who must be the only people keeping the stock afloat. The food's fine but nothing extraordinary and highly expensive, and this is a massively competitive space.

Jeff Kilburg said you can have the "perspective" of fading the 10-year but said it'll stay in a range. Anthony Grisanti said he can see the 10-year hitting 127.01, the 200-day, in the next few sessions.

Gabelli said he likes MWA as well as RSG and Case New Holland.

Kevin O'Leary said he's intrigued by Mario Gabelli's interest in RHP. O'Leary seemed most excited by the Atlanta Braves play of BATRA. O'Leary grumbled that BATRA is merely a "tracking stock."

Gabelli affirmed he's nibbling at MGM.

Thursday's 5 p.m. Fast Money featured Tim Seymour talking over himself and stumbling into a flap with Steve Grasso; we quickly lost track and interest.

[Wednesday, May 17, 2017]

O’Leary: ‘This president will be around for 8 years’

Kevin O'Leary on Wednesday's Halftime Report called the day's correction "not a big deal" and merely the "pause that refreshes."

But Ron Insana, who decided to come back after being roped into the Trump Trade fiasco yesterday (see below), asserted, "I don't think that this is something that's gonna blow over" and predicted it gets "far worse" before it gets better.

Jon Najarian opined that Wednesday or this week could mark "peak insanity" out of D.C. and explained the VIX is in backwardation.

Judge said we're a "long way" from impeachment proceedings.

Josh Brown said stocks roared for 24 months after the most recent impeachment, and perhaps the market wants President Mike Pence anyway. Brown also said he doubts that an impeachment trial would take place over one memo, and he said Wednesday's market is not unusual, it's everything leading up to it that's been unusual. (All 4 of those being excellent points.)

O'Leary insisted that Middle America considers this little more than noise. Insana dubiously claimed, "We should be more focused on the 25th Amendment," the clickbait point he's been making in the blogosphere.

But O'Leary correctly took issue with Insana's repeated insistence that things get worse before they get better, stating, "It gets more entertaining before it gets better."

Erin Browne said she doesn't think D.C. turmoil derails the market recovery.

Jim Lebenthal contended that the market has decided that Mike Pence will become president and that Pence "will get the Trump agenda done better than Donald Trump will."

O'Leary made the day's boldest prediction: "This president will be around for 8 years. People really are starting to like a different style," O'Leary said.

But Brown said, "He has sub-40% approval."

Brown said of the Trump presidency, "There is no agenda."

O’Leary: IBB into ASCO

Kevin O'Leary on Wednesday's Halftime Report said he's always long heading into the ASCO meeting, and he uses the IBB.

Jon Najarian said he likes BMY and CELG. Josh said he'd be long IBB and said he likes BMY and AMGN.

O'Leary said he loves JNJ.

Meg Tirrell, who delivered multiple reports from JNJ's day, told Judge something many would love to hear: "You can't get rid of me."

O’Leary: TJX a ‘howling hound from hell’

Jim Lebenthal on Wednesday's Halftime cautioned about TJX, "When you get one miss like this, it's kinda hard to come back."

But Josh Brown said he'd buy TJX because "I like where the selloff stopped."

Jon Najarian said that given the trouble in retail, the discounters will be buying inventory for "pennies on the dollar."

Kevin O'Leary scoffed at TJX and said it's "not only a dog, it's a howling hound from hell."

Josh Brown said TGT upped the guidance that it recently slashed; he doesn't see a reason to buy but if so, he'd put a stop below 52.

Ascena surfaces on 5 p.m. Fast Money; Karen calls Dress Barn ‘one of the dumbest names ever, only worse than Athlete’s Foot’

Discussing F on Wednesday's Halftime, Jim Lebenthal decided to use the word "plateau" to describe auto sales.

Judge pounced on that and demanded to know how Jim can like GM; "you just made the case not to own, not to buy an automaker."

Jim said "that is not what I said," but rather, he was making a case against F, which he said has unfortunately been penalized for not entering bankruptcy like other automakers and getting union concessions.

Jon Najarian said SBAC September 150 calls were popular while the 155s were being sold.

Doc said he likes RRGB and JACK and that consumers seem to like custom burgers more than assembly-line variety.

Kevin O'Leary said every time DIS sells off, he buys more.

Jeff Kilburg said "the reason to own gold makes a lot of sense." Jim Iuorio said, "1,320 is my upside target."

Josh Brown said he'd buy JPM anytime under 90. Jim touted AAPL. Erin Browne said to buy regional banks. Kevin O'Leary touted his own product.

Karen Finerman on the 5 p.m. Fast Money said the selloff could take us back to where we were a month ago and observed, "Interestingly today, retail didn't do that badly." She also said she might buy URI on another drop.

[Tuesday, May 16, 2017]

Settled: Doc’s own personal Trump Trade DID NOT ROLL OVER!!!!

It all started when Stephanie Link opined, "All of the Trump trades rolled over, and rolled over hard."

Oh my.

That set off Jon Najarian, whose Cheerios were obviously peed in before he took a seat on Tuesday's Halftime Report.

"I disagree again. They rolled over and rolled over hard?" Doc bellowed.

"The Trump- the Trump trades? Yeah they sure have?" Link responded.

"OK, so Caterpillar, Cummins, John Deere, did they roll over hard?" Najarian continued. "Did Goldman Sachs roll over hard? Did JPMorgan. They're up 25%! Do you expect 50%?"

"Wait a second," Link protested. "They rallied from the November lows, they rallied huge … and then they took a real big nosedive. And then in March, then they started-"

"So they're still up 25%, and we expected them to be up 50 Steph??" Doc thundered.

"I- I have to tell you, that I don't think these companies are pricing in any kind of fiscal policy at all," Link offered, trying to slightly change the subject.

"Well, they did not roll over," Najarian insisted.

"Yes they did," Link insisted back.

"If you wanna tell me, U.S. Steel and Freeport rolled over, you'd be right. But you're not right about these others," Doc scoffed.

"How about energy? How about energy?" Link said.

"That's not one of my picks!! How is that a Trump stock??" Doc hammered.

"We're talkin' about apples and oranges here!" Link said.

Grasping for help, Judge summoned Ron Insana to stop the bleeding. Insana said, "In a certain sense, energy stocks have become Trump stocks." Like the deft (former) host he is, Insana neatly excused himself from the melee by pivoting to the "Xi Trade."

But still Insana couldn't resist. "Now this Trump trade I think is beginning to roll over," he said, as Doc was caught on camera smugly nodding.

Judge then made a mistake, telling Najarian, "I can pick any, any stock in the market to support my point of view on anything. (Sure. Show us a chart that proves coal is ripping.) … Financials are up 1% … year to date."

Doc astutely pointed out that Trump's approach to energy is likely to create more supply, which would theoretically hurt prices.

Then Link made a bigger mistake than Judge, telling Doc, "But that's not the point you're trying to make."

"No that is the point. I'LL TELL YOU WHAT I'M TRYING TO MAKE!!" Najarian thundered. "I'll tell you the points I'm trying to make. You don't have- you don't have this little kid inside my head telling me what I'm doing Steph."

"Stop yelling. Stop. Yelling," Link said.

"Dude you need to chill out," Judge told Najarian.

"All right, I'll chill out," Doc shrugged.

"I'm serious," Judge said. (He explained later on Twitter why he said that.)

"All right," Doc said.

Goodness knows why, but Judge made another mistake, informing Doc that industrials are up 5% this year and financials 1½% this year. "They did roll over," Judge claimed, without explaining how a 1% gain constitutes "rolling over."

"Scott, again, they did NOT roll over," Doc said.

Pete Najarian jumped in (guess which side he took), stating, "Rolling over is not what they're doing. They've paused. That's the real difference."

But Pete was right.

Link said financials fell 10% since March 1. "And then they got a bottom, and they're starting to creep back," Link said.

"It might just be semantics," Doc offered, before this goofy point: "If MarketWatch calls it a Trump stock, that's not Jon Najarian calling it a Trump stock."

Sigh. (And try watching this whole thing twice.) 1) Link was wrong, 2) Doc was kinda hyper, and 3) Judge clumsily picked the wrong side to defend.

At the end of the show, Doc said, "I'd be remiss if I didn't say I apologize Steph. Got a little heated. But uh, I luv ya" (sic spelling per 1970s Houston Oilers).

Link said, "Luv ya too."

Judge said it's "one big happy family."

Judge tweeted afterwards, "For those of you who don't know, or have never met him, @jonnajarian is one of the nicest, most respectful people I've ever met."

Doc tweeted that it was "Just a tad too much java for me today."

We said earlier that when this started, we practically wanted to crawl under the couch, but we nearly fell off the couch (in a good way) when we caught Joe Terranova's angular sideways glance (below) near the end of this exchange that he smoothly sidestepped.

Joe: DKS a ‘falling knife’

Well, when the Halftime gang needs a smile, there are few better subjects for this crew than NKE.

Guest Corinna Freedman said her NKE "buy" call is based on footwear outperforming athletic apparel.

Freedman told Pete Najarian the 70 target isn't too high of a P.E., saying NKE had higher P.E. levels a year or 18 months ago.

Freedman actually mentioned "3-D printing" (snicker) as a boost for NKE.

Meanwhile, reaffirming his belief in a more defensive posture, Joe Terranova said he'd trade a WYNN for a MSFT because the "optics" on MSFT are "far better long term."

Stephanie Link said HD is getting the traffic in stores; she curiously said she'd hold it but wouldn't buy it here. (If you own it at the end of the day, isn't that like buying it?)

Pete said Citi's "sell" on PFE "surprised me."

Doc said MLCO June 24 calls were being bought in "big numbers." Pete said he's in EOG because the January 100 calls were getting bought. Pete said he created a spread. Joe called CXO, PXD and EOG the "3 winners" in the shale space.

Brian Stutland said the euro could reach 1.20 in a year, a headwind for the dollar. Jim Iuorio said "it could be a crowded trade" and thus could gain some momentum.

Joe Terranova said of TWTR, "The right people are buying the stock."

Meanwhile, meeting the show's quota of 1 CNBC Disruptor 50 interview, Judge brought in Robinhood co-founder Baiju Bhatt, who explained that Robinhood is an "app that lets you trade stocks for free."

"How do you make money then," Judge asked.

Bhatt said they have "various" ways, including offering Robinhood Gold, which "lets customers, um, borrow money from us."

Judge said that's basically allowing people to trade on margin, and, "I wonder what that says in and of itself (sic last 4 words unnecessary and redundant) about, about where the market is right now."

Pete Najarian sighed that TJX was getting beat up a bit. Stephanie Link said, "It truly could've been a weather problem."

Joe called DKS a "falling knife" and questioned the average price target being 59.92.

Pete's final trade was AMAT. Doc said MU. Link said to buy CRM on any weakness. Joe said he bought DNKN and hung a 60 on it.

Karen Finerman, undeniably gorrrrrrjus (below) in new cream-colored ensemble on the 5 p.m. Fast Money, called the notion of a "crowded" trade "ridiculous" and said she doesn't know what it means and that such a cliche won't prompt her to sell GOOGL.

Seema Mody donned new blue dress and reported on JACK's gains.

Doc, Steph, get into

shouting match

We almost wanted to crawl under the couch — and we were only watching from home.

But we'll have to address the Doc-Steph showdown a bit later, so all we've got is the boring stuff for now.

At the beginning of Tuesday's Halftime Report, CNBC's John Harwood characterized H.R. McMaster's remarks (which encroached on the program) as a "non-denial denial."

Joe Terranova said the market resilience in the face of D.C. turmoil is "incredible." But he said it's a "big issue" as to when taxes get addressed.

Joe suggested maybe viewers "downshift" a growth strategy to a little more "value-oriented" (snicker) or a little more defensive.

"It's a stock-picker's market," declared Stephanie Link. (Ah, yes. This is the year value wins.)

Ron Insana, who's not normally on this program, conceded it's "surprising" to see stocks this resilient.

Judge decided, "There's a seller's strike on Wall Street."

Jon Najarian, amped up for this particular hour, said we've had the "best year-over-year growth" in S&P earnings in 6 years.

Insana observed that the president could be "lurching towards a constitutional crisis" but the market would just expect Mike Pence to pass the agenda without the drama.

Insana said Charlie Cook is suggesting the possibility of a Democratic takeover of the House. Doc cut in, "Absolutely no chance, Ron. No chance," adding the market would "hockey-stick to the upside" if tax reform takes place in 2018.

More from Tuesday's Halftime, including Doc and Link's rather heated debate over whether the Trump trade "rolled over," later.

[Monday, May 15, 2017]

Joe delivers message

everyone needs to hear

There was a healthy debate about colon-cancer screening and the stock of EXAS on Monday's Halftime Report, but Joe Terranova delivered the greatest public service.

"18 years ago, my father passed away. He never went for a colonoscopy. Unfortunately, the first colonoscopy he went for was the one that told him that it was too late," Joe said. "I've gone for a colonoscopy ever since. The prep is not hard. People should do it. It's a struggle."

Left fails to justify ‘most important report in years’ claim while issuing valid PSA

Monday brought one of the Halftime Report's best debates in recent memory, as Citron short seller Andrew Left dialed in to defend his short-EXAS call … and even take on the CEO.

Judge questioned if Left billing his EXAS call as his "most important report in years" is maybe a "little hyperbolic."

Left said, "Absolutely not; this report goes way beyond just the stock market."

"My phone's been ringing off the hook with hedge fund managers," Left said, but they weren't talking about money, just the importance of a colonoscopy, something Left impressively stressed during the program.

Judge asked Left for "evidence" that EXAS' Cologuard product doesn't work. "I have their evidence," Left said, stating the company did a study that showed the product is "inferior" to the standard of care. He said the company is "trying to have people think there's an alternative to a colonoscopy."

Judge notably grimaced when stating Left thinks the stock could go to zero. Left said, "Well, zero is easy," stating, "Blood-based DNA cancer testing is the future."

Left said EXAS "might be a complete dinosaur" by 2020, and that while even Valeant can't really go away without problems, "this company could go away tomorrow."

Then EXAS Chairman and CEO Kevin Conroy dialed in and stated, "Andrew is dead wrong when it comes to detecting Stage 1 colon cancer from blood … a blood-based test is very unlikely to ever displace any other test."

Conroy said Cologuard is "at parity with the other screening methods."

"I'm not dead wrong, it's his study," Left insisted.

Conroy said Left "mischaracterizes that study" and said the study says the "greater compliance" of Cologuard is actually "incrementally cost-effective relative to the fit test."

"We leave this up to physicians and their patients to choose which test is the right test for them," Conroy said.

"The patients shouldn't choose," Left argued, insisting, "The patient should listen to their doctor. And the doctor should choose."

Judge cited a Barron's article and told Left, "More doctors clearly are prescribing this company's product."

"These studies by Leerink and Barron's are from sell-side research that's taking small percentage of the doctors," Left said.

Conroy told Judge, "The study shows that our test does detect polyps," while allowing, "Not at the same rate as colonoscopy."

"Remember those precancerous polyps take 10 to 15 years to turn into cancer. We have a long time to catch them," Conroy said.

Conroy concluded telling Left his report "may be detailed," but it's "wrong." Before Conroy could conclude his remarks, Left blurted, "Tell the viewers, Don't get a colonoscopy."

Afterwards, Joe Terranova explained, "The reason you go for the colonoscopy is if you have the polyp, it will be taken out surgically at the time of the colonoscopy. That's the benefit of a colonoscopy. Cologuard, I'm not sure how you could take the polyp out at the time of the test."

Pete Najarian offered, "It seemed like Conroy had a pretty good argument, however," citing the stock rally during the conversation.

Josh Brown said there's already a 28% short interest in EXAS, so the bear case has been out there.

Steve Weiss said "you have to be careful with some of the surveys." Weiss added, "I've gone for colonoscopies, this has never come up in what a doctor suggested."

This was a fascinating conversation. Left's argument about blood-based DNA cancer testing doesn't seem a great investing thesis for 2017. Conroy, who defended his case very well, made the argument that his product benefits people who won't undergo a colonoscopy. This is a problem for Left's position. Either Cologuard provides some value, or none. If the answer is "some," it's hard to see how the stock is a zero, unless 1) everyone starts flocking to colonoscopies or 2) a superior product to Cologuard is created.

For whatever it's worth … just because we notice these things … it seems a bit embarrassing that the description of Cologuard on the Exact Sciences website includes half a paragraph repeated.

If they're not reading their own website, how diligent are these folks about the effectiveness of their product?

Weiss: ‘Political risk doesn’t exist anymore’

Judge on Monday's Halftime announced that PYPL (among other tech greats) hit an all-time high, in defiance of the winning idea at Ira Sohn (see below).

Joe Terranova said you don't need a "complicated" strategy and suggested AMD now that the "dust has settled." He also said he'll be buying TWTR above 19; he'll "absolutely" buy it in the "next day or so."

Josh Brown said blue chips in the U.S. and globally "are just going bonkers." He mentioned the EEM and VGK again.

"We're deifying the large corporations that have managed to make it through the last 10 years," Brown explained.

Steve Weiss wouldn't bite on Judge's question as to whether tech greats are overpriced; "arguably they were too rich to buy up 15%, up 20%," Weiss said.

As for owning them, "I don't think that's a bad bet to make," Weiss said, concluding, "Political risk doesn't exist anymore."

Josh Brown demanded Judge add CRM and ADBE to the list of tech leaders beyond the FANGs. Judge insisted, "I named those."

Joe said the market "never looked back" after pushing through 2,300 and suggested the same might happen at 2,400.

Joe said the market wasn't responding to the potential of Washington progress but the "removal of the protectionism fears."

Steve Weiss said the notion of TSLA as a tech giant has been the case since "200 points ago" and "a hundred points ago."

Josh Brown said a lot of things look anti-shareholder when Elon Musk does them, then shareholders cheer; "it's a little Trumpian actually."

Brown, who mentioned TAM (that's correct, not the Memphis Tams of the ABA) a couple times in the opening, sort of gushed about the prospects of Tesla selling rooftops to people wandering into showrooms looking to buy cars.

"Frankly it's a little bit Apple-esque," Brown actually claimed.

Weiss said of TSLA's price, "It's tech on steroids."

Pete Najarian said he talked to Adam Jonas "a week and a half ago about this whole thing."

What happened to

the great GE breakout?

Pete Najarian on Monday's Halftime said SBUX will be able to rapidly fix its "mosh pit" problem and is going higher.

Pete said he's long KO, and by the way, the November 44 calls (Zzzzzzzzzz) were popular.

Josh Brown said sales of homes to first-time buyers "is a very big development."

Joe Terranova said he doesn't "trust" the price of oil, but he likes the play of long OIH.

Steve Weiss called AIG a "pretty interesting story."

Stephanie Link touted MDLZ and said SBUX "makes a lot of sense." Link said she trimmed URI around 130 (for those looking for rear-view-mirror Brag Trades); she likes it now.

Link is trimming PH and SLB.

Judge suggested SNAP (this writer is long SNAP) was rising on reports of big investors getting in the name. "There's so little stock out there that can actually change hands," said Josh Brown.

Pete's final trade was HD. Weiss said CTL. (This writer is long CTL.) Brown offered MA, and Joe said FTNT.

[Friday, May 12, 2017]

O’Leary: JCP ‘going to zero’

Jim Lebenthal on Friday's Halftime Report defended one of his favorite longs, JCP, stating, "The stock is currently being priced for bankruptcy. Take a look at the debt for JCPenney. It is clearly not being priced for bankruptcy."

Josh Brown said JCP debt is a "demand issue," meaning, "people will buy any bonds right now."

Josh said the stock is "being priced for obsolescence."

Jim said "all of the players" in the JCP sector say February was the "disaster," and March and April are trending higher.

Kevin O'Leary wasn't impressed. "If every store closed, nobody would even hear it," O'Leary said. "It's a zero. It's going to zero."

Jim insisted he wasn't making a rosy retail call. But we gotta say, in this kind of department-store environment, JCP doesn't seem like the greatest buy call. (This writer has no position in JCP.)

Josh says he’s ‘not long a lot’ of GE

Kevin O'Leary on Friday's Halftime Report said the Deutsche Bank call on GE, while it didn't mention the term, is about potentially cutting the "dividend."

Steph Link called GE overvalued. Josh Brown, who has touted the stock for seemingly years, claimed, "I'm not long a lot of it" and said many of the issues raised in the Deutsche Bank note are "legitimate."

Steph Link said Jeff Immelt is "gonna retire next year anyway."

Kevin O'Leary claimed Jeff Immelt "got handed a black box of financial services that he had to work for 12 years to unwind. And he got it done." (Ah. So it's Jack Welch's fault.)

Josh Brown called recent price action in GE "atrocious" and said the bottom of the range is 27, and if it "convincingly" closes under that, there's no reason to be long for a trade.

O'Leary said he would "guarantee" GE drops below 27 if there's another "hint" of a dividend cut.

Jim Lebenthal said he doesn't own GE because, despite the fact GE makes airplane engines and airplane sales are great, "They can't make enough money to justify the share price."

Another 8 minutes on SNAP

Somehow, we're hearing better things about SNAP since the hazmat-suit earnings call than before it. (This writer is long SNAP.)

Ross Levinsohn dialed in to tell Judge on Friday's Halftime, "I'm very bullish long-term on SNAP. I think the only thing that surprised me on the earnings was the miss."

And other than that, Mrs. Lincoln, how did you like the …

Anyway, "The engagement numbers are terrific," Levinsohn added. He said he doesn't put SNAP in the "social" category. He thinks it's a "communications platform and I think it's a creative platform."

Josh Brown scoffed, "It's a camera company."

Levinsohn acknowledged, "Well, they're leveraging the camera, right."

Josh had a good idea, that Levinsohn should pitch himself to Evan Spiegel as SNAP's Sheryl Sandberg. Levinsohn said, "That's kind of you. Probably not up to me."

Judge said the point is that maybe SNAP needs an "adult" (sigh) (Drink).

"Evan is revolutionizing the industry," Levinsohn insisted, adding, "I actually think Facebook is becoming much more and more like Twitter than it is like Snapchat. And I think Instagram has become what Facebook was," grumbling about the "fake news" he gets on Facebook that's really "heavy, heavy politics" that is "sort of messing up the entire feed."

Josh Brown suggested playing SNAP by putting on a buy/limit order above the all-time high. Josh said it's "too soon" for even a "genius" to determine if SNAP has long-term traction.

Age 50 — when the end is nearer

Mike Wilson, who resembles Peyton Manning, sat in with Friday's Halftime crew and said earnings have been "spectacular" and suggested people still "aren't on board" with the idea that multiples can expand.

"The story line's been underplayed," Wilson said.

Jim Lebenthal said the Trump agenda is a "big if at this point in time." Wilson said he's "highly confident" there's no tax benefit built in the market for 2017.

Kevin O'Leary suggested 45 could be the "new norm" for oil. Wilson said he sees crude at 50-55 this year.

Josh Brown actually suggested all the euro exit threats "turn out to be beneficial in that they force some of the reforms to happen."

Judge pointed out that Wilson's 2,700 call is based on 12 months from now, not year-end.

Josh Brown said, "There's like a difference between hard deregulation and soft deregu-"

Judge said Ray Dalio thinks near term looks good, but "longer term looks scary." Mike Wilson said, "I mean, look, I'm 50 years old, I mean the long term is scary. I mean, you know what that means, I'm getting closer to the end."

Jim's final trade was long TIF. Stephanie Link said CRM. Kevin O'Leary mentioned one of his ETFs.

[Thursday, May 11, 2017]

Joe suggests store is challenged because ‘it’s crowded, it’s crammed’

When they weren't talking arrogance on Thursday's Halftime, they were channelin' Yogi.

Judge reported that Jana is skeptical of some of the WFM board nominees for lack of grocery experience.

Pete Najarian said "I took off half today" and said the company's had declining sales for 7 straight quarters.

Joe Terranova said WFM is presently trading "at probably the right price." Joe said he frequents WFM stores, "but I think the experience too has deteriorated … It's crowded, it's crammed."

Crammed stores. That's a tough problem for retailers to overcome.

Pete Najarian said June 25 calls in PPC were popular.

Jon Najarian said June 29 calls in GE were popular.

Judge asked the Najarians, "Are you guys always in the same trade." No, they said; "sometimes the interpretation (snicker) is different."

Pete said he agrees with the Atlantic Equities analyst to go neutral on HD but raise the price target.

Sarat Sethi said "Goldman's missed the whole party on YUM" (sounds like they allocated their arrogance to SNAP, see below), and he still likes the stock.

Doc suggested selling SYMC puts at 30.

Joe said CXO is a "better name" than XOM.

Doc halfheartedly agreed with Savita Subramanian's note that biotechs are cheap; he said there's unusual activity in BCRX.

Sarat Sethi said to buy CELG and BMY. Pete said he's "waiting and waiting" for GILD to do something; "they've gotta buy somebody," Pete said. He also touted AMGN.

Joe said biotech "scares the heck out of me," predicting the sector will get "annihilated" if there's a market decline.

Jeff Kilburg said Aramco will "pound the microphone" to get crude past 50. Jim Iuorio said crude could "easily" reach 50-51 before we have to make a "decision" on where it's going.

Judge said the VIX on Thursday might be providing a "bit of a reality check." But Doc shrugged off the "half a percent" move in the S&P.

Joe seems to suggest Goldman Sachs and Morgan Stanley might be even more arrogant than Evan Spiegel

Mixing Wall Street with Silicon Valley millennials, and we have the jackpot of egomania.

The Najarii since late April had been touting SNAP call-buying while dismissing the company. (This writer is long SNAP, so caveat emptor.) (Then again, this site is free.)

Obviously those calls imploded in a bad way after the "horrific" report Wednesday night.

On Thursday's Halftime Report, Doc admitted his call-buying disaster but said he bought SNAP overnight at "17.38 or something like that," an opportunity for a trade.

Judge said some people were put off by "arrogance" from Evan Spiegel, adding that Jim Cramer says Spiegel "needs to be hazed," a curious term given the recent tragedy at Penn State.

Sarat Sethi warned that SNAP doesn't have unlimited pockets. "The more SNAP spends on R&D, the more it's gonna hurt them in the next earnings," Sarat said.

Doc said when SNAP shrugged off losing more than a billion dollars, "that's crap."

"It's kinda like when Zuck was going around and he was walkin' around with a hoodie," Doc analogized. "When was the last time you saw him in a hoodie in front of the cameras?"

Doc added, "I think Spiegel can recover from this. … if he grows up and does a more grown-up conference call next time."

Joe Terranova said, almost in disbelief, that "I am amazed at the analysts' recommendations this morning," pointing to Goldman Sachs' 27 SNAP target and Morgan Stanley's 28 overweight. "It's an incredible amount of arrogance and it's unfortunate because it does not, it does not suggest or teach the proper discipline those watching the show, those in the markets need to have surrounding these companies."