[CNBCfix Fast Money Review Archive, August 2011]

[Wednesday, August 31, 2011]

Answer is: Not Vancouver

Mel Lee indicated on Wednesday's Fast Money she hasn't spent much time chatting up Patty Edwards and Joe Terranova about hobbies.

Guy Adami asked Lee who won the Stanley Cup this year.

"I have no idea," said Lee.

Most insider buying

— since ‘sometime in 2008’

Charles Biderman's commentary-in-a-blender on Wednesday's Fast Money basically required a magic decoder ring to interpret, if interpreting it was even possible.

There were inflows, then outflows, of gold; there was a lot of CEO buying but then all that buying continued but slowed ...

Dr. J, Jon Najarian, tried asking a fairly simple question but gave up.

Biderman said the last time there was a large amount of insider buying was March 2009, but this is "much bigger than that" and the most since "sometime in 2008," which "probably was a mistake.

Which means, they tend to buy when things get low, but sometimes they get lower.

Except Biderman tried to joke at one point that these insiders actually know what they're doing, because, "in a casino, is the house better at playing the game than the players?"

Tim Seymour scoffed at the implications and returns of the AK Steel CEO's buying now and previously in March 2009. "I may sound like a broken record here," said Seymour, but this doesn't mean jack.

Flash: Analysts might be wrong

We basically agree with Tim Seymour's market call, but listening to Tim Seymour is getting old, so it was refreshing actually on Wednesday's Fast Money to hear Stephen Weiss talk about actually buying something.

"I actually bought, uh, Freeport yesterday," Weiss said, as well as TCK this morning, thoug he did allow that he expects the market to go south again by mid-September.

Jon Najarian, who has been in the "maybe it's not so bad" camp recently, said he expects "data points in September that could be a lot better."

Guy Adami retracted a comment he made a day earlier on the "50% correction" level for the S&P 500, saying "it's more like 1,235."

Guest Paul Hickey said there's a "crisis of confidence" that has caused the analyst community to go berserk in slashing forecasts.

Hickey conceded there are "genuine causes for them to cut estimates," but he hasn't seen this level of takedowns since 2009 (see, that's a theme now), and that we may not be headed for recession, and it "could set the stage in October for a really nice bounce."

Brian Kelly revealed, "I am short JJC."

You could've made a trip to the fridge when Tim Seymour began his opening statement, and then, when you got back to your chair, still heard him talking, after the tiresome "first of all" segue, because Melissa Lee refuses to get down to business and cut off/refocus the speeches.

Had about enough

of wireless provider analysis?

Guy Adami said on Wednesday's Fast Money that the selloff marks a "huge opportunity to get into letter T."

Guest Clayton Moran said performance by affected stocks shows the Justice Department's AT&T position was "correctly addressed by the market today." Moran said it's "unwise" for Sprint to try to team up with T-Mobile because it's apparent the Justice Department doesn't want T-Mobile acquired. He said he likes SBAC as a result of this.

Another guest, Craig Moffett, said much later, "I think this is actually bad news for Sprint," and that he likes Comcast and Time Warner.

Dennis Gartman addressed a topic we didn't really know about: whether the Canadian housing market is overheated. "I don't think it's bubbly yet," Gartman said, but it's on his radar screen, though he said Canadian banks weren't as foolish in handing out loans as American banks were.

Gartman said he doesn't want to fight history by buying stocks in September and early October and the trick is to make a list for late October. Why this trend occurs, he said, "is really quite beyond me."

Dick Bove called in the Fast Line Wednesday to explain why Bank of New York Mellon is rightfully making a change at the top, citing an "excessive amount of conservatism that just doesn't belong in a public company."

Do you remember ...

the 21st night of ...

Fast Money on Wednesday did a sweet tribute to "See You in September" by The Happenings.

Dr. J not sold on ‘coincidence’ of Randall Stephenson comments

After Gary Kaminsky was defending AT&T chief Randall Stephenson (see below), Jon Najarian sounded not quite so sure on the subsequent Fast Money Halftime Report Wednesday.

Najarian said that with Stephenson being on CNBC Wednesday morning, "that smacks of something way beyond coincidence to me," and "I don't think he was being completely honest."

"Both A&T and Verizon are going to be hurt by this," Najarian said.

Steve Cortes did some extrapolating, saying, "Among these names, I really prefer Verizon," strictly for dividend, but that bigger picture, "Washington remains I think in an anti-business environment … that is not productive in general for risk assets."

Zachary Karabell said "I think that's an overstatement Steve," and defended the DOJ, saying they have to do something like this under every administration, "that's their mandate, that's what they do."

Cortes insisted it's "part of a broader theme that is very anti-employer."

Patty Edwards said it's a rare moment but she agrees with Cortes; "I like Verizon."

Steve Grasso said he's been buying Sprint as a "falling knife" but that this move is a "huge catalyst to the upside." Karabell said that even though some people on CNBC have said Sprint should try the T-Mobile deal now because it might work for them, "I don't think they go for an equally big merger that's equally likely to face anti-trust action."

Karabell said "I own American Tower." Jon Najarian said he likes AMT as well as CCI and SBAC.

Steve Cortes wonders again how emerging market stocks can go down if U.S. stocks are going up

While Zachary Karabell trumpeted Joy Global and worldwide resource demand on Wednesday's Halftime, Steve Cortes couldn't resist a question about India's stock market, which Judge Scott Wapner said he anticipated.

Cortes questioned the demand from India given its stock performance. "I don't think national domiciled stock markets necessarily track or need to track underlying economic activity," Karabell responded.

"We can't trade GDP; we trade stocks," Cortes concluded. (Good thing he didn't say MON is in big trouble and that Roundup is being slaughtered by Chinese or Japanese competitors, or the conversation would've been a really long one.)

Karabell and Cortes also traded jabs about the S&P direction. Cortes complained about an "overexuberance about QE3," but Karabell said that even if the recent rally seems false, stocks fell an "equally unmerited" amount at the beginning of the month.

Karabell told Judge Wapner he should trademark the "Bernanke Blanket" comment before someone else does; "you gotta do the ™ thing with the circle," Karabell said.

Patty Edwards said she owns JOYG but "I am not adding today," but that she also likes AXE.

Jon Fortt said of Facebook getting into music, "I'm not really sure this is bad for Pandora," which is exactly what Facebook wants everyone to think.

Patty Edwards said at one point "I cannot be a specialist in everything," which prompted Zach Karabell to crack, "if being a specialist at things stopped people from saying things on television, we'd have a lot of dead air time."

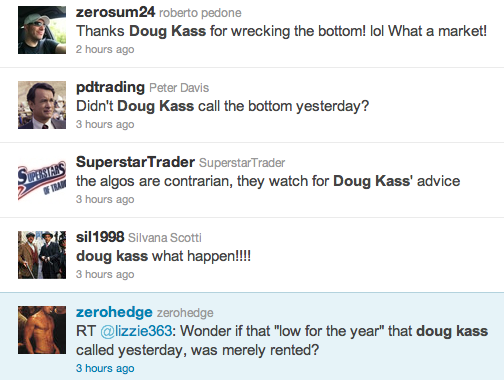

Skeptical viewers forced to pick between CEO & government apparently pick government this time

Most of the time, people on CNBC tend to side with business in disputes with the government.

Gary Kaminsky apparently caught a backlash on that Wednesday, explaining on The Strategy Session that "the nasty e-mails I have received in the last half hour would make people think I'm either dumb or naive, and I'm neither."

Guest host Brian Sullivan asked, "You're getting nasty mails? Congratulations. you've made it."

Kaminsky, referring to comments about the AT&T deal early in the day, insisted, "not all CEOs in this country are dishonest," and he believes the AT&T/T-Mobile plan is truly intended to be pro-growth.

Guest Keith Moore said "We expected this proposed transaction to encounter a lot of problems," except he didn't expect this problem to happen so soon. Referring to the breakup fee which Sullivan cited a couple times as enormous, Moore suggested AT&T would be inclined to spend money to fight because it would "cost a lot less than the $3 billion."

Gary Kaminsky said there are "unbelievably interesting ramifications" from the Justice Department action.

Brian Sullivan reported during the broadcast that the CWA union issued a statement saying "the decision to fight the deal is wrong" and "bad for jobs." Sullivan cracked that it was nearly 30 years when the government broke up AT&T, and now Uncle Sam is "making a return call."

No 3-handle on 10-year

for ‘a couple years’

Jeff Kronthal returned to The Strategy Session Wednesday to talk about those bond yields he's been forecasting to be low, asserting that despite certain personal stats, "our total leverage in the system really has not come down over the last couple years."

Kronthal said don't expect a 3-handle on the 10-year soon. "I think it's a couple years away," he said, saying the "upper end of high-yield" is the place to look now for yield.

John Harwood delivered breaking news about Barack Obama giving a speech next week in which (this is our assessment, not Harwood's) he's probably going to say we've got a crisis of confidence and Congress was "silly" to let this debt debate thing paralyze the public and that "make no mistake," JPMorgan isn't going to stop opening branches just because the Dow's down 500 points.

Harwood said it'll be a "fascinating moment next Wednesday."

Sure.

Brian Sullivan brought on ISDA general counsel David Geen to clarify/rebut the zinger about the Greek bank guy who's calling the shots that Sullivan crowed about a couple times yesterday but apparently now regrets slightly. "I did not mean to imply that he was the single guy making the decision; maybe it came out that way," Sullivan told viewers, then praising Geen profusely for speaking for about 90 seconds and insisting he's dying to have him back on again sometime.

[Tuesday, August 30, 2011]

They can laugh, but he’s likely making more money than the

Fast Money gang, and not losing it in the stock market

Guy Adami said that Icahn-related slide in LGF marks a "tremendous opportunity to get back in the name."

Jon Najarian cracked that if BKS doubled its Nook sales, it must be to "17." (But how would they sell a half-Nook?)

Dr. J told a funny snake joke for his Final Trade.

Darren Rovell, with a few too many graphics and numbers crammed into such a short segment, said that Michael Vick is only going to get $1.88 million, or 11%, of his $17 million salary.

Guy Adami said he's not trying to be a "wise guy" but wondered if Vick knows this. Rovell said "I doubt it." Tim Seymour, apparently auditioning for "The NFL Today," questioned "how did the Eagles give this guy this kind of a contract" given Vick's propensity to "break down."

It’s almost unanimous,

but for Jon Najarian

While basically everybody else on Tuesday's Fast Money warned (in various ways) people to stay out of the market, Jon Najarian gamely tried to offer reasons to buy, only to be shot down by his colleagues every time.

Najarian told guest Kevin Giddis that the consumer confidence number is just a "poll" that doesn't reflect actual spending. "We keep seeing people pushing us, trying to knock the consumer off the edge and push them into a recession ... but we're not actually seeing it," Najarian said.

So, while we wondered who all these "people" are who are exhorting Americans not to go shopping (lessee ... SPG shorts?), Giddis didn't really answer or fight that assertion but concluded that confidence is important as somewhat of a forward indicator. "Without confidence, you're not gonna get people to spend," Giddis said.

Najarian also posed the question to Tim Seymour whether the Dax is so "hammered" that it must be a buy now. Rather than agreeing, Seymour said the opposite: "If global growth is shot, Jon, I think the Dax remains shot ... I think you stay on that Dax short; I think it's a great short."

Dr. J, citing "this guy Cooper down in Florida" who's in the OptionMonster circles, insisted that with housing, "there's bids under the market," and that all the people who were "underinvested in this sector as it fell off a cliff, now they're trying to get back in." Steve Grasso seemed not terribly impressed by the bids under the market and said it happened from a "humongous short squeeze."

Najarian gave a rather mechanical take on the VIX and didn't seem nearly as concerned about its implications as his colleagues were, saying futures show people are betting that volatility will remain in the market. Tim Seymour said that's a noticeable change in market sentiment from 6 weeks ago. Najarian said if you have a lot of positions, maybe the best way to lock them in is to "sell a whole bunch of premium into it," and that for those insulated people it's "manna from heaven."

All well and good, but Mike Khouw took it much further, saying he would've expected volatility to come in a lot more, and it's actually "really quite extraordinary" for implied volatility to be this high, and it's all "boding ill for September."

Dan Niles: ‘I don’t think the holiday season is going to be that great’

Anyone watching Tuesday's Fast Money looking for market encouragement from Dan Niles had to be disappointed.

"Quite honestly we went back to a short position today" for the whole market, Niles said.

Niles said that, contrary to Melissa Lee's assertion of this being a good time for tech names, this is actually the "season where you have the most risk ... this is the time period where you have some of the ugliest preannouncements."

He said "we've bought some RFMD" and that he also bought AAPL on the Steve Jobs news, but "we've hedged that out with other shorts in the PC chain." He also opined, "I don't think the holiday season is going to be that great."

Hilariously — more hilariously than he undoubtedly realized — Niles closed with a dig at P.E. ratio-watchers, pointing to HPQ and saying it might have a good dividend and look cheap, but if the fundamentals aren't there, "that's a really stupid reason to own a stock."

Years and years later,

Fast Money still worried about AMZN’s P.E. ratio

Melissa Lee asked her Fast gang on Tuesday whether they think Amazon can meet Sarah Rotman Epps' lofty tablet sales forecasts.

"No. Not unless they give 'em away," said Jon Najarian.

Steve Grasso argued that the tablet is still a plus for Amazon; "it's a whole new reason to buy this stock."

Tim Seymour couldn't get past the 93 P.E. ratio, saying "this is where Amazon kills you," and that with consumption headwinds, "I don't think is sustainable at Amazon."

Guest Neil Herman, who said he appreciated the chance to make his case on Fast Money for a much bigger MSFT dividend, says the 1-time variety has "not much of an impact on the stock."

Tim Seymour said hiking the dividend is "waving the white flag" and that's not what the company is doing, evidenced by the Skype deal.

‘This market is about gaming the Fed’

Guy Adami on Tuesday's Fast Money predicted stocks could continuing rallying into month end, but "I think it's gettin' a little long in the tooth here."

Steve Grasso agreed, saying "I think it's clearly overdone to the upside" but that he can't get in the way right now.

Tim Seymour said "I don't think hedge funds have been all that active," and then said he wants little part of what's going on. "First of all, this market is about gaming the Fed ... not what I do for a living," he said.

Steve Grasso said actually "it's pension fund rebalancing."

Seymour said the rally of the last few days "is all going on with credit spreads widening," then revealed he's an alumnus of the "Hackley Day Camp."

Jon Najarian referred to Melissa Lee as "M. Lee" (not "Emily") and said the "universal trade" is that around the world, "everybody's buying gold," which Dennis Gartman just recently said is a massive bubble.

Guy Adami made what these days is a rare "benign tape" reference, saying he thinks Church & Dwight can go higher. Brian Kelly said "I think the euro goes higher" but that money that's going into German equities rather than bonds is "dumb money."

Tim Seymour is better at making points to guests than asking them questions

Mark Zandi, who according to Melissa Lee at the end of his interview on Tuesday's Fast Money thinks there's now a 40% chance of recession in 6-12 months, said he expects more QE, but it'll be late in the year or next year.

He said "that was a really bad number" for confidence and blamed it on the "spectacle in Washington."

Tim Seymour argued the number is based more on the decline in stocks. In what rapidly became a circular conversation, Zandi said it's a "lack of confidence" that has affected stocks and there's a risk of it being "self-reinforcing" that is "very scary if they can't stem it."

Kevin Giddis said the Fed has gotten a "little bit disturbing with the dissension" not seen since 1992, and that indications are that it's "gonna be a long economic growth pattern, at worst a double-dip recession."

Tim Seymour, in a clumsily handled question, told Giddis that Europe must be responsible for bond yields this low because U.S. activity doesn't merit it (even though he also said the stock market's all about "gaming the Fed"). Giddis said the bond market is affected by many factors and "it's got yields where they probably should be."

Giddis concluded the Fed, investors and consumers are all "confused." Brian Kelly agreed and said you can buy the TLT.

After this page makes an

‘Eight is Enough’ reference,

Steve Cortes mentions show on air

Early Tuesday morning, this page actually sort of complimented Steve Cortes on his BAC short last week — despite the fact the shares went up 3 days in a row — because we speculated he likely got it right after the huge Buffett bounce and thus had gains through Monday even if he was still holding.

On Tuesday's Halftime, Cortes confirmed that trade worked, saying, "I shorted it that day, I added to shorts here today again at 8 and a quarter," saying the risk is to $8.50.

He said he's short because of "the Treasury yield curve ... it's actually flattening." And so, "I think BAC is very overvalued here."

Coincidentally enough, also early Tuesday morning, this page (see below), referring to Rich Ilczyszyn's corn forecast, made a Dick Van Patten-"Eight is Enough" reference, and imagine our surprise at hearing Cortes say hours later on Tuesday's Halftime that BAC was topping out and, "When I was a kid, one of my favorite shows was 'Eight is Enough'."

(One of these days we'll look it up, but either Susan or Elizabeth was the hottest. Also David's girlfriend Janet, played by Joan Prather, was a fox.)

We'll keep doing what we can to supply the Fast Money gang with punchlines.

Let’s hope the Amazon tablet doesn’t have a 3-second delay like Sarah Rotman Epps’ video connection

When Forrester analyst Sarah Rotman Epps and Judge Scott Wapner weren't talking over each other on Tuesday's Fast Money Halftime Report, Epps managed to say that "Amazon, if they play their cards right, could be the strong No. 2" in the tablet wars.

But she conceded her 5 million sales possibility in Q4 requires a lot of ifs, including a price "significantly below" the iPad. But she said the Kindle is proof Amazon can do this sort of thing.

Patty Edwards also cited the Kindle and said "I absolutely think that they do" have a chance to succeed at this and, in the obligatory tech-device-derivative-trade chat, said the "component suppliers" such as Nvidia are worth a look.

Steve Cortes said "optionality" twice and that MSFT is appealing for the dividend and any possible innovation that might accidentally happen. "I would get in," he said.

Apparently that ‘false, safe harbor’ in gold is the real deal

Brian Kelly said on Tuesday's Halftime, "I still think that we are in a bear market rally here" but that the market caught a bid.

"It's more like a sugar high to me," Kelly said. "I'm not shorting anything right now."

Steve Cortes said the U.S. is still the place to be, "If you have your hopes pinned on emerging markets you're gonna continue to be disappointed," but he couldn't get too excited after the S&P's weekend run.

"1,200 I'm not nearly so enamored," Cortes said, adding he "put some risk-off trades on," and "I'm actually long gold."

The funny thing about that is, just last Wednesday (see below), Cortes claimed, "I think the public was sold a very false, supposed safe harbor in gold" and predicted a "very painful down move."

So much for that.

Pete Najarian on the other hand said "I think silver goes higher."

Patty Edwards said everybody's hoisting the "gone fishing" sign but she does think ags are strong; "I like Potash, I like Syngenta here," although she didn't delve into the curious Zach Karabell-Scott Nations MON/Roundup Chinese/Japanese flap (see below).

You know it’s a tough

economy when ...

Guest Brian Sozzi made the most eye-opening comment on Tuesday's Fast Money (other than that "Eight is Enough" thing) when he claimed "Wal-Mart is being viewed an expensive shopping trip."

Sozzi said the rise in dollar stores is fueled by the "rapid rise in food stamps."

He trumpeted Dollar General, saying they have some fruit machines and "they're gaining more of the total consumer shopping visit."

Patty Edwards said those stocks look fine, but "I just haven't had a good opportunity to get in," a comment that brought her some mild flak on Twitter.

Edwards scoffed that homebuilder analysts have called 8 of the last 2 bottoms. She did say "I'm long" CBI.

Pete Najarian said MCD's Europe headwind could be offset by emerging markets gains. (This writer is long MCD.) "I think there's still upside," Najarian said.

‘Diversify’ is one of those

Wall Street slogans devised for retail investors that sounds sophisticated and is always heard when markets stink

JPMorgan's Michael Falcon guested on Tuesday's Strategy Session and had 1 word on the mind:

"Our story is one of diversification ... diversifying ... diversified ... diversified ... diversifying ... diversify."

(Yes, those are all the times he said it.)

See, pros call it "hedged," but that doesn't sound safe enough for retail investors.

Falcon almost flat-out refused to give specifics about where markets are going and what sectors look best but only stressed basically that one should be dabbling in everything to get the cream of the crop in yield, and that it's too easy to make rash decisions. "If you run to cash now, that's a bad thing," Falcon said.

Gary Kaminsky asked twice about how Falcon's advisers would've projected 10-year S&P returns a decade ago, hypothesizing it would've been 7-8% which didn't happen, and how they'd project them now. Falcon suggested for the former that selective dabbling could've been better than Kaminsky indicated, and for the latter he simply isn't making any market calls, which is an indirect and perhaps oddly refreshing example of a money manager frankly admitting he doesn't know if a sector of securities he thinks you should be "diversified" into are actually going to make any money for 10 years or not.

Falcon and guest host Brian Sullivan, who's a self-deprecating comedy machine and also gets to work with Mandy, had a briefly hilarious misunderstanding about the definition of "savings rate," with Falcon defining it in the way we'd expect, the percentage the average person is saving, which he said is 6%. Sullivan meant the return those people are getting presumably for basic "saving" and said, "I was like 6%, hand it over."

Steve Liesman interrupts discussion on definition of ‘default’ with discussion on definition of ‘dissent’

Throughout this summer's market tumble and Euro crisis, Peter Boockvar has been looking better and better.

Boockvar said on Tuesday's Strategy Session that banks holding Greece paper were told to write it down 21%, but it's actually trading at 50%, and "probably even worse than that."

But the thrust of the segment was the uncertainty not around the global economic/U.S. banking system, but the definition of "default," which makes one wonder how governments could spend all these decades issuing debt and apparently never thinking about that one.

Brian Sullivan said "I was just diving into the ISDA Web site because I've got nothing better to do" and twice pointed out with incredulity that it's a former Greek banker who's enlisted with the responsibility of determining default and whether something is a "credit event."

"There's a lot of semantics around the question of default," Boockvar agreed.

Sullivan said, shocker, "The banks are using shoddy accounting," and Gary Kaminsky opined, "Mark to market only is relevant if the actual market is there to absorb the mark that you've put."

Steve Liesman broke in with breaking news about household name Narayana Kocherlakota (he's a Fed bigwig) "defining his dissent very, very narrowly" regarding easing or whatever it is the Fed is doing.

Gary Kaminsky said he heard Peter Boockvar say in the background, "This is pathetic," and Boockvar affirmed that he thinks the Fed doesn't get it and that "cheap money has gotten us into more messes." Liesman said to the contrary, Kocherlakota disagrees with Boockvar; "he thinks QE2 worked."

[Monday, August 29, 2011]

Rich Ilczyszyn: Bernanke gave stocks, commodities ‘green light’

Most of the panel was cautiously bearish on Monday's Fast Money.

But not Rich Ilczyszyn.

The odd thing was, it was Tim Seymour who basically twice in the program scoffed at what he thinks are ridiculous bullish weekend characterizations of Ben S. Bernanke's statements Friday, before praising agriculture, which brought agreement from Ilczyszyn, who went on to make just the opposite point about Bernanke. (Yeah, that was even confusing to write.)

"Let's quote Wapner's Bernanke Blanket too," Ilczyszyn said. "You look at, uh, the meeting over the weekend, giving us a forecast for their 2-day meeting in September, I think that gives the green light for stocks. I think that gives the green light for commodities. This could be your bull story now."

Unlike Dick Van Patten, the Ilchynmeister indicated 8 might not be enough, for corn, telling Melissa Lee, "Well listen, short term, I think we gotta get an 8 print out," but "veterans" are saying "you could see $9," before hinting he might want to get as adventurous as Tommy Bradford: "This is also carrying up soybeans and other markets, as I think we could potentially go a lot higher," said Ilczyszyn, who appeared to be saluting the Carolina Panthers in choice of shirt and tie.

Melissa Lee for some reason slightly condescendingly re-addressed Ilczyszyn with both names as "Rich Ilczyszyn," which means she ultimately said "Ilczyszyn" 3 times, and asked how likely the CME would be to raise margin requirements on corn. Rich Ilczyszyn responded that he hasn't seen any price activity to warrant that yet but they've probably got an "algorithmic equation" for deciding on it.

Scott Nations, Zachary Karabell debate Monsanto with dueling Brag Trades

Scott Nations on Monday's Fast Money unloaded on MON, saying its products "don't do what they're supposed to do" and that the company's in a "ton of trouble."

Zachary Karabell sounded almost offended by this analysis, responding, "You take that short, I'll take that long. I disagreed with you in the high 40s, I disagree with you in the high 60s, and we'll see if I disagree with you in the high 80s."

Nations insisted, "It's, it's, you know I hated when it was 70 and went down to 40."

Evidently Melissa Lee was oblivious to this long-running dispute, opening the segment apparently expecting a bull call by saying to Nations, "You're looking at Monsanto."

Even more bizarre, Nations first said Roundup "is getting killed by Chinese generics."

Moments later, Nations said Roundup "is getting killed by Japanese generics."

Steve Cortes’ embarrassing flip from bull to bear looks even more embarrassing Monday

Monday's Fast Money really put that old "price is truth" saw to the test.

Tim Seymour utterly refused to believe it, twice mocking the weekend analysis of Ben S. Bernanke's remarks and insisting the global financial situation was no different than several days ago.

The financials Monday represented a "massive short-covering rally," Seymour said, and "I'm at least cynical on the market's interpretation of facts and fundamental analysis, and therefore, I think today's rally is something you sell."

Todd Gordon was next most emphatic, predicting an S&P slide and saying "I think the Swiss franc, uh, is going to weaken as the overall risk trade heads lower ... I think the yen is still gonna be the new safe haven currency."

Dennis Gartman, who said there's obviously no "new manna from monetary heaven," and Guy Adami said they agreed with Seymour but less emphatically, and indicated they didn't really want to fight this tape, at least not yet.

Zachary Karabell agreed with Tim Seymour on financials but not necessarily on the contagion/fallout to the rest of the markets. Stephen Weiss said he agreed with Seymour and Adami but "I'm not much like Zach, although I have the amount of hair that Zach has, almost, actually better."

"That would be a good stock," Karabell said.

BAC still yet to reach

high of Buffett Day

We might as well get used to BAC getting 5 minutes of every Fast Money episode for at least the next month or 2, and even us amateurs recognize quite well that when a stock with obvious signals pointing one direction ends up going the other direction however temporarily, the frustration can be maddening as hell (and we're just not gonna take it anymore).

Guy Adami carped that with news of the China Construction Bank sale, "the timing to me seems odd," either "visually or optically."

Zachary Karabell pointed out it's ultimately about the share price, which is a "capital-raising issue" if the shares get too low.

"It was really clumsy," said Tim Seymour, arguing that strong buyers will rip off desperate sellers.

Steve Cortes said on Thursday he shorted BAC Thursday morning, which might've actually been a good trade depending (as always) on the price he got despite the stock's productive last several days.

Flash: Irene wasn’t as bad as a lot of people feared

Dennis Gartman said when it comes time for Germans to vote on further bailouts for Greece, it'll be "very ugly," and Greece just needs to get out of the euro.

Zachary Karabell downplayed the likelihood of that, insisting Germans recognize the risk and can't afford to take it, and telling Gartman there's a "binary thing that you're maybe underestimating ... there's really no way you can get to a scenario of Greeks- Greece leaving the euro, without a complete unraveling of the system in a truly cataclysmic fashion."

We're getting sick already of the endless speculation about insurance stocks in the wake of Irene (what does it matter when 499 of 500 S&P stocks, or roughly that, go up?), but that didn't stop Monday's Fast Money from bringing on Randy Binner to estimate that Irene's damages are probably at the "low end of that range."

Seamus Fernandez at the end of the show predicted PFE will get a boost from whatever the new drug is and that he hasn't raised his target but there's "still about 20% upside from here," with a target of "22-23 bucks."

Stephen Weiss for the umpteenth time recommended COP and goofily said maybe he was supposed to sing his Final Trade.

Zachary Karabell drew a sharp red state/blue state divide between Dunkin Donuts and Starbucks, which quite honestly seemed a stretch, and then indicated it should be a no-brainer where he stands. "I think that that probably is an obvious answer to all," he said. "I mean, seriously, you know ... I would clash in a Dunkins wearing this."

We’re out of the woods

Carter Worth, feeling the momentum from his recent seen-the-low-for-the-year call, said on Monday's Fast Money Halftime Report that the risk-on trade is back, and "we're thinking 1,250 on the S&P."

Worth recommends a long SPY, short XLP position, though he allowed that people could also do the version of going long higher-beta and short the S&P.

Worth said while September and October have historically been rough, "we can have a decent September" because of the sharp tumble in August, and that "by all accounts," the indicators show we've bottomed for 2011.

Notably, no one was declaring Monday "sell the rallies," though Steve Grasso, who unlike last week didn't talk about European "Depression" and said 1,210 is the next level to watch on the S&P (that'll probably be exceeded by the time the 5 p.m. Fast Money starts), said "I'm a little hesitant to call in a bottom just yet."

Stephen Weiss disagreed with Worth's suggestion of abandoning the staples, saying he's staying with Coca Cola. "I won't get crushed if the bottom falls out," Weiss said.

BAC closing in on Anthony Polini’s price target

Last week, Brian Kelly was about as gloomy as one could get on Europe and the banks. Suddenly on Monday's Halftime, he was touting the Greek bank deal like it was Peyton Manning returning to the Colts lineup, pointing to JPM and WFC as beneficiaries of BAC's rise and saying "I'd buy both of those on pullbacks."

Zachary Karabell was skeptical of the whole Greece catalyst thing and asked if this was something like a "2-day trade." Kelly conceded "this is a trade only," that it merely made the Greece banks "too bigger to fail," but then he allowed that it's "maybe even a weeklong trade."

Stephen Weiss called the Greece deal "lipstick on a pig" and said JPM should not be bought for that reason but because it's "dirt cheap on earnings."

In case you missed Greg Locraft on Friday, he did the same thing Monday

Judge Scott Wapner missed Friday's Halftime Report, so he brought back Greg Locraft apparently for a redo.

We've practically got Locraft's insurance basket picks memorized now, Travelers, Chubb, Ace, Renaissance Re and Axis.

Locraft insisted these stocks despite hurricane season "tend to outperform in the 3rd quarter" and people have been able to "lean in to the Irene fears." He said, "At the end of the day, the last few days of media coverage has really been probably one of the greatest advertising campaigns in history for the property casualty insurance industry."

Steve Grasso said D-RAM was fueling the MU push, and in the refiner space he likes CVI and SUN.

Stocks up; not a word about how the ‘machines’ are running things

When things look bad, maybe they're actually good.

Guest host Brian Sullivan, using charts from a hedge fund guy who told him "don't use my name," spent a healthy amount of time on Monday's Strategy Session trumpeting how great Russia and Indonesia bounced in the '90s because "defaults can free up capital to reinvest in the domestic economy."

Whatever the case, the notion of the Greece bank deal as justifying Monday's market move, "I find it completely unviable," Sullivan said. "This whole thing could be scuttled by Finland."

Gary Kaminsky, back from a London trip, said that meanwhile, 47% mutual fund managers in the U.S. who are paid to beat the S&P 500 are actually "missing the benchmark by 2 and a half percent," but he wasn't as excited about the Jack Bogle argument as Brian Sullivan was.

Kaminsky said if those managers for whatever reason are not long a name like AAPL, it's the same as being short, and "you can relatively underperform for only so long."

"That was the feeling that drove a lot of the equity performance in the last part of 2010," Kaminsky said.

47%, "that's a big miss," said Sullivan. "Throw a dart, man."

Kate Kelly finds Gary Kaminsky’s Citibank quip remarkably funny

It was all Kate Kelly could do on Monday's Strategy Session to not crack up during what curiously became a Laff-a-lympics on BAC and Zynga.

It started when Brian Sullivan, insisting he was only being sarcastic, asked if Bank of America could sell Countrywide.

Kelly actually said that for Countrywide, "Chapter 11 has been a discussion, uh, that's been bandied about for quite some time," in probably the most interesting sentence of the day, adding Brian Moynihan actually was asked about that on a conference call, to Sullivan's great surprise. "The charge for that would be monstrously huge," Sullivan conceded.

Gary Kaminsky asked rhetorically, "What is a core business, and what is a non-core business." Kelly listed off bits and pieces of company (needless) capital-raising, including one $700 million deal, and then, apparently running light on material, felt compelled to toss in the filler copy, "they touch 1 in every 2 American households" while suggesting either Kaminsky or Sullivan must do business there.

"Not me. I'm at Citibank," said Kaminsky, which got the smirking going.

Kelly said Zynga's having timing issues and a "back and forth" with the SEC that is pushing the IPO to "October at the earliest," but could barely keep a straight face as Sullivan said "I bank at Zynga" while she added amid giggles, "I bank at Facebook." (It wasn't exactly George Carlin.)

Gary Kaminsky said not to forget about Buffett as a source of BAC direction now; "he's gonna have a say too."

Hopefully Karen Dynan

wasn’t paid by the minute

Karen Dynan of the Brookings institute was asked on Monday's Strategy Session to make a call on the Fed, and just like the question, she punted.

But she did manage to stress a couple times that there's a "2-day meeting" in September.

Brian Sullivan reached for one that didn't work, saying it's maybe not good if the Fed punted back to Congress, because "Congress has about 72 men on the field right now."

That sounds like a bench-clearing brawl.

Sullivan asked if the economy's in a mere soft patch or trending downturn. Dynan said, "I don't know the answer to that question," saying we've "gotten better economic data recently," but that's apparently what 2-day meetings are for, and that a "lively discussion" is "appropriate right now."

Brian Sullivan started to refer to Herb Greenberg as "Greenf-" then called him "Bob Greenfield" on purpose.

(Like we said, it wasn't quite a George Carlin-caliber production.)

Gary Kaminsky experiencing

power outage

Gary Kaminsky rolled back onto Monday morning's Squawk Box from his vacation a little electricity-challenged. "I am without power," Kaminsky told co-hosts Andrew Ross Sorkin and Michelle Caruso-Cabrera, whose hot red top was capable of charging up several city blocks.

Kaminsky said Europe is just waiting for Germany to sign off on a bank fix. "There still needs to be a massive recapitalization at some point; I think it's gonna be a TARP, TARP-like event. It has to happen. It just has to happen," he said.

[Friday, August 27, 2011]

Superfox Michelle Meyer

surfaces on ‘Money in Motion’

We've been lamenting for years that Michelle Meyer, The World's Cutest Economist®, hasn't been on Fast Money since Karen Finerman joked about that "after-school job" thing.

Fortunately, Double-M hasn't abandoned CNBC altogether, and in fact turned up on Friday's Money in Motion, which seemingly every week is providing such quality Web site fodder (although nothing as great as Rebecca-Patterson-bikini-shower-in-gold-gone-wild references) that we can't help but watch.

Meyer said of the next jobs report, "I think it's gonna be a pretty soft report, sub-50,000 for total payrolls. I think it's likely that the unemployment rate increases further," but all you really care about is the picture, right?

Jeff Kilburg does the

résumé-style, name-dropping

Brag Trade

Jeff Kilburg, who needs a little more time with the Fast Money gang to reach Rich Ilczyszyn/Andy Busch status, said on Friday's Halftime that "I don't think the market- the equity market truly grasped the severity and the gravity of the Aug. 9 remarks of keeping rates at zero out till 2013," which we think means he believes the market thinks the economy is better than it really is.

Then Kilburg went off on a weird tangent, saying, "Back in my Lou, uh, Holtz days," the coach used to insist of players, "WIN," or "What's Important Now." And so, "all eyes are on Trichet," Kilburg concluded.

In the 1970s, "WIN" meant "Whip Inflation Now," not one of Jerry Ford's most successful ideas.

Pop Tarts are a buy here

Patty Edwards, to her credit, was offering gobs of trades on Friday's Fast Money Halftime Report.

Unfortunately, nearly all were reaches as 1-off Irene plays, an observation made by guest host Simon Hobbs.

Darren Rovell, stationed at a New Jersey Wal-Mart, said everyone's leaving the store with bottled water but asked, "How do you invest in this."

Edwards took this question a bit too seriously — fortunately not quite as seriously as in her prime time appearance this week where she trumpeted runs on toilet paper — and said Coca-Cola and Pepsi are in the bottled water business, Hormel's a name to look at "because of Spam," plus "Pop Tarts, I believe that's Kellogg," and of course, chocolate, though it's worth noting she didn't mention one of CNBCfix's official favorites, Fudge Stripes, which is Keebler, which is Kellogg (but the last pack we got from the grocery store was stuck together or broken in every row, so we vowed not to write about them this month).

"Seriously Patty-" said Simon Hobbs.

"Seriously!" Patty actually insisted.

"Do you think there will be a real bump in these guys' profit streams as a result of this," Hobbs continued, skeptically.

"Well you gotta balance it with the fact that they're also going to be closed," Edwards said, but then she noted WMT beat the government into New Orleans post-Katrina, but that sounds like more a WMT play than a Pop Tarts play.

Later, Edwards suggested Alaska Air, because there's little East Coast exposure, as well as TAL, but Brian Kelly said in regard to airlines, "oil's much more important than a 1-day storm."

Edwards Called the Close by saying "discretionary mall stocks" may take a hit from a lake of sales this weekend on the East Coast, which feels like her best argument of the bunch.

Simon Hobbs’ graphic of Manhattan underwater didn’t seem to faze Steve Grasso or Pete Najarian

Steve Grasso on Friday's Halftime also had an Irene shopping list, but he curiously doused it just about as quickly as he trumpeted it.

"Look at my list here," he told guest host Simon Hobbs. "I have Holly Corp., HOC," plus WNR, CVI, TSO and VLO. "You wanna stay away from those East Coast refiners; you wanna go to the mid-cons. And if you see them all, they're up 6%, 5%, 4 and 3/4%. Those are the ones that you get bang for your buck. They also are higher beta plays, so you have to be careful here. And depending on how this storm shakes out, you could see a reversal in these names."

Given all that, pass.

Grasso also was skeptical of the insurers, saying that after the day's pop, if the storm is bad, "these are the first ones that probably reverse."

Grasso said that amid the central banker speeches, "I don't want people to rush out and buy this market straight up."

Pete: Expect 8-10% moves daily in BAC (while it continues to not raise capital)

Pete Najarian implied, without taking this point far enough, that people who want to be a hero should maybe zero in on BAC, because we can "expect to see 8 to 10% moves each and every (sic, redundancy) day."

Patty Edwards backpedaled from that one, saying BAC is "way too volatile for me and my client base."

Brian Kelly questioned the Chinese Construction stake sale (see below), asking, "Why are they selling off one of their growth assets?"

Steve Grasso, who has bought the shares recently, said "I am a little skittish with the last couple days' headlines."

Andy Busch awaits with

arms crossed the next question from jacketless Simon Hobbs

Andy Busch, quickly becoming one of our Fast Money favorites for various reasons though he's not quite at the level of the Ilchynmeister Rich Ilczyszyn, was asked by Simon Hobbs on Friday's Halftime about the Swiss franc and barely got going before launching into a Brag Trade regarding CHF/euro.

"Last time I was on I believe I, I mentioned that it was a good idea to take your longs- I'm sorry, to take your shorts back at 105, anything below there was a good deal ... we're gonna have some resistance between 118 and 120. If you want to sell this thing, that's the place to do it," Busch said.

Busch, echoing a common CNBC theme Friday, said the central bankers aren't really the fall guys here, but that "politicians have refused to lead fast enough and strong enough."

Kelly: ‘High chance’

the Greece bailout fails

While Judge Wapner was presumably battening down the hatches somewhere on Friday, Fast Money Halftime Report guest host Simon Hobbs ... ugh ... actually said that Ben S. Bernanke was "kicking the stimulus can into September."

Pete Najarian followed moments later ... double-ugh ... by saying, "kicking the can to September."

Brian Kelly said "Your trade off of this is most likely TLT again, but only on weakness." Patty Edwards said "Take at least a little bit of your hedges off at this point in time (sic common "in time" redundancy) ... we've got Trichet tomorrow."

Kelly said he thinks there's a "high chance" the Greece bailout fails, but Edwards said she checked the Greece credit default swaps, and "it's not as bad as we thought it was 3 weeks ago at least in some people's eyes."

Luckily for Kelly, Simon Hobbs didn't announce on-air this time whatever e-mails Kelly has been sending regarding his more deeper thoughts on the European situation (see below).

Steve Grasso suggested Europe is sort of wagging the tail here, pointing to the Dax Thursday. "It was a heavy short squeeze, and we followed," he said.

Brian Kelly once again refers to himself in 3rd person

Either a sign of out-of-control ego or simple cluelessness, Brian Kelly Called the Close on Friday's Halftime with an eye-rolling way of taking a dig at Patty Edwards, saying, "BK's not a buyer of canned meat or this market."

Pete Najarian said the VIX tumble is an opportunity. "I absolutely would be long premium at 34 levels ... something could happen over the weekend," Najarian said.

Patty Edwards did have one non-Hurricane trade in her arsenal Friday, which was TIF. "I think you could actually step in and buy at this point," Edwards said.

Pete Najarian said he got his wife an iPad rather than something from Tiffany for her birthday, which prompted Brian Kelly to ask how he pulled that off, a risky joke that was endorsed by the sight of Patty Edwards chuckling about it, so Kelly's off the hook.

Najarian said "I think there's more upside to come" in AAPL. Steve Grasso said retail names can get bid up, then sold off hard. "I think you have to wait a little bit," Grasso said.

And now, another episode

of The John Paulson Session

Apparently there wasn't enough news in the business world Friday to preempt another CNBC report on John Paulson's account balance, rapidly becoming the network's 2nd- or 3rd-favorite subject after 1 or 2 of those drinking games that Jane Wells tweets about.

David Faber pointed out that "Paulson had cut his holdings in Bank of America." Kate Kelly, who, if it's OK to say this, was huggably cute in her baby-on-the-way gray top, said that Paulson's last redemption report wasn't bad, but "there will probably be a new round of redemption requests as we head toward the end of the year."

But then Faber and Kelly chatted about how well Paulson had done in gold and that he offers "gold-denominated" entry into his fund, and in fact given all that he might actually be coming out ahead.

Make of that what you will.

Meanwhile, it’s 2008 in Europe

Tim Backshall returned as a guest Friday to deliver what's become The Strategy Session Meal Ticket.

Backshall pointed out there's "quite a continuing disconnect between the way equity markets are behaving and the way credit markets are behaving," which is another way of saying what Kevin Lockhart and Gary Kaminsky and to some extent Jeff Gundlach were implying more than a month ago, that bond indications are not exactly bullish on the economy.

"In the paaaast, we've tended to see the credit market is correct," said Backshall, who noted that if you go beyond Greece and looked at a weighted balance of sovereign risk index spreads in Europe, it's twice last year at Jackson Hole time. He said the ECB liquidity measures are the spookiest, that when banks are pulling $500 million a day, "that tells you that there's issues over there."

As far as U.S. high-yield, Backshall said there are certain signals "We're heading into a very tough environment ... We hear a lot about a heavy issuance calendar coming after Labor Day, and this market is just not ready to soak up that kind of supply right now."

Meanwhile, subsequent guest John Ryding asserted "The economy isn't as weak as it's been portrayed in the GDP data" and that there's a "pretty healthy gain in profits" in Q2. He said of GDP, "2%'s not at that stall speed that people are worried about," but that "fear has really filtered our view of the world."

Brian Moynihan raising more (needless) capital (Part 2 or 3)

Kate Kelly reported Friday that Bank of America apparently is going to raise some more nonessential capital with a "sale of at least half of its 10% stake in China Construction Bank," which Kelly said could bring $8.5-$9 billion, "to a group of about a dozen sovereign wealth funds and institutions."

Kelly pointed out BAC originally got this stake at $3 billion, and as David Faber noted, maybe it won't actually raise that much (unnecessary) capital because there will be a "significant capital gain."

Kelly played the report straight, as she probably should, saying the company insists this isn't motivated by a need to raise capital, "this is the company sort of line (sic) that we're hearing ... more of a BASEL 3 thing."

[Thursday, August 25, 2011]

Léo should call Berkshire

Many times for the layman it's best to do the "Rounders" Trade®, based on the really-not-great poker movie that continues to provide us with adequate metaphors, the "Trade" meaning essentially not paying attention to information, but the reactions of the pros who are paying attention to the information.

And so, based on how the Fast Money gang spoke Thursday on Halftime and the 5 p.m. show about the BAC-Buffett deal, we've gotta think this is neutral-to-negative for banking stocks, BAC included, even though Whitney Tilson's e-mail suggested otherwise. (And if paying Warren Buffett money is really what it takes to stop a share slide, shouldn't Léo be doing that with his PC proceeds?)

Brian Kelly echoed Doug Kass (see below) but not as effusively, saying it's "not a smart deal" for Bank of America, and if it was somehow a smart deal, then the truth was "they needed capital."

And so, "I think Moynihan is probably on his way out," Kelly said, saying he agrees with Kass, although Kass had sort of already indicated that Karen Finerman and Whitney Tilson had talked him out of that belief (but Kelly can take heart because Mr. C. Gasparino predicted that on Twitter this week).

Karen Finerman never trashed the deal but unleashed all of her admiration not at BAC but Buffett for securing these terms. "In other businesses, besides financials, you can let the rumor-mongering go," Finerman said, explaining why Brian Moynihan did this, but for Buffett, who got a 10-year warrant, "that's an incredibly valuable piece of paper."

Nick Colas: The next

Warren Beatty

Nicholas Colas visited Thursday's Fast Money set to talk about volatility. He said there are fears in the high-yield market of liquidity drying up, and quite frankly, his segment was quickly drying up, by the time he told Pete Najarian that gold would bottom once there was a cataclysmic high in fear, but "we're not there yet."

That was when Melissa Lee called on Steve Grasso, who replied, "No I'm good. Thank you though for checking. His voice- his voice actually relaxes me." Then Grasso turned to Colas and asked, "Are you on valium?"

"Do you want some?" Colas joked (and let's hope this segment wasn't under the influence).

Anyway, we suddenly couldn't help but notice, as Colas cracked a smile during that segment, there was a slight resemblance to 40-something (maybe late 30s) Warren Beatty. Not a perfect match of course, but something that makes you think, "I know I've seen this before ... in 'Shampoo,' or something."

Which now makes us 100% convinced it's long overdue for a Who-Would-Play-The-Fast-Money-Stars-In-A-Movie post, and we're particularly eager to roll out the selections for Karen Finerman, Melissa Lee, Patty Edwards, Jane Wells and Rebecca Patterson, for the latter quite possibly being a certain "Mighty Aphrodite" Oscar winner ... pushing Gary Busey for Tim Seymour might be a stretch but seems doable ...

Hopefully, it'll go over better than the John-Denver-and-Gordon-Lightfoot-in-the-iCloud thing.

Colas, unfortunately, closed with a way-too-nerdy joke that drew not a single laugh from even Pete Najarian, who chuckles at everything: "Without Paul Volcker, how do you call a top in gold?"

Brian Kelly insists Fed should boost FDIC insurance to $1 billion

It's curious how the Fast Money gang will go on and on about how there's very little the Fed can do, only to offer their own suggestions anyway.

Thursday on Fast Money, Brian Kelly sounded like he must've been sampling some of Nick Colas' valium, claiming it would be a big boost to the world financial situation if the Fed raised FDIC insurance from $250,000 to a billion dollars.

"There's so much money out there, it needs a safe home," Kelly said, while his colleagues recoiled in amazement.

Mel Lee brought Mike Khouw in to ask why. "I don't see how that helps," Khouw said.

Kelly insisted it would stop money from sloshing around in search of safety and provide a stabilizing place for people to put their money.

The camera caught Khouw laughing this one off.

Kelly said he was looking to buy some TLT going into Friday morning.

David Carr tries too hard to make a cultural statement

We always get suspicious when someone is labeled a culture critic or pop culture expert or any other similar title for people who really just specialize in churning out quotes, some of them dubious.

So the Spider Sense started tingling when Melissa Lee brought on David Carr of the New York Times on Thursday and introduced him as "business columnist and culture reporter."

Sure enough, Carr described Steve Jobs' AAPL quite loopily: A "secular religion of sorts that we've all bought into," but "it's lost its illusion of infallibility" and will now be treated like any other company.

Guy Adami, who expertly snuffs this stuff out like few others, argued that Apple hasn't been getting an "infallibility" premium but in fact is already actually treated worse than most companies because the multiple is much lower than what a company of this success should command.

Carr first tried to argue, "Where do you think that discount comes from" and said it's because they keep beating the comps and "the market just shrugs," before conceding that Adami's right.

Steve Grasso said if you start hearing rumblings about a dividend or buyback, "that's probably your sign to exit the stock."

A rare Karen Finerman joke that wasn’t that funny

Melissa Lee was dressed a little overconservatively Thursday as is often the case, but hit a home run in that navy dress, which will be a hit for whoever got to take Melissa to dinner.

Martin Fridson said on Thursday's Fast Money that the high-yield bond market indicates there's a "62% probability of recession in the United States. I think that's somewhat overdone."

Gregory Locraft said he's puzzled why insurers are trading as low as they are, saying Irene is throwing "another log on the fire" amid what's been a tough year, but there are "improving fundamentals" and right now seems like an "excellent entry point." He said he likes Travelers, Chubb and Ace, plus Renaissance Re and AXS.

Karen Finerman joked that "it's sort of ironic that Omnivision didn't see this coming."

Doug Kass: Moynihan either

‘lied’ or is ‘plain stupid.’

Grasso: ‘Depression’ fear in Europe

In a startling, action-packed opening to Thursday's Fast Money, Doug Kass denounced BAC's deal with the Oracle of Omaha.

"Moynihan did get fleeced by Buffett," Kass said, citing the "extraordinarily heavy cost of capital."

Sounding almost personally offended, Kass said Brian Moynihan either "lied" or is "plain stupid" regarding his capital-raising comments.

Kass even chided Karen Finerman's analysis, saying the price of the warrants is a "lot more than a billion dollars Karen."

He concluded, "I sold my Bank of America stock … this is a company that buys high, and they sell low."

K-Fine though fought back, telling Kass she completely disagreed with his contention that this means the end of Moynihan. "I really gotta take the other side of that," Finerman said, saying no board is ever gonna fire a CEO for doing a deal with Warren Buffett.

Kass conceded Finerman was probably right.

Guy Adami sort of scoffed at the deal, suggesting it was done by people "in a little bit over their head." Finerman said it's a good deal, at least, "for Mr. Buffett, yes."

Adami even brought up a Jackson Hole conspiracy theory. "The timing strikes me as a little bit odd," he said.

Meanwhile, Steve Grasso said, "This is really turning into a depression, with a 'D', in Europe," and this page will have more on Thursday's Fast Money later.

Cortes: BAC-Buffett deal

is ‘frightening development’

The Fast Money Halftime gang seemed almost unanimous on Thursday re: Bank of America, and Steve Cortes was the most quotable.

"I shorted it this morning," Cortes said. "To me that is scary, it's reminiscent of 2008 … I think this is a frightening development."

Guy Adami was nearly as quotable, saying if Brian Moynihan has been correct about his capital needs or lack thereof, he could've just said to Buffett, "BAC trades on the New York Stock Exchange, knock yourself out."

Judge Scott Wapner said, "This sort of questions Moynihan's credibility."

Pete Najarian gave a too-long description of trading in the BAC August 8 puts and even included a Brag Trade; "they've exploded as the session's gone on … I've already taken some profits there," but most notably, he predicted, "I think we may see Bank of America ease back toward $7 in the next week or 2."

Steve Grasso said he didn't want to be the "last animal in with the shot at the carcass" but that actually turned out to be guest Josh Steiner, who pointed out, "Not a lot has changed here … all these problems can't be solved by Warren Buffett's investment." Steiner said the flattening yield curve will bring "enormous pressure" on banks and "snowball into the 1st half of next year," and that longer-term bank forecasts are dubious because the "assumptions you have to make to get there are pretty ridiculous." He did say he likes "some of the large regional banks" including PNC and USBancorp.

Judge Wapner calls out Cortes for embarrassing bull/bear market flip

For the last week or so, Steve Cortes has been trumpeting the "Jeffersons" market (you know, "movin' on up") and preaching the U.S. as an island of calm.

Apparently not any more.

Citing Bonasera, Cortes told Scott Judge Wapner Thursday he got royally spooked by the Dax. "I believe in America. But I do not believe in Europe," Cortes said.

"You were bullish 2 days ago and you were bullish yesterday," Wapner complained.

"Scott it's Fast Money baby," cracked Cortes, saying he now even thinks Europe can provide a bid for gold, where he has covered his shorts.

Guy Adami said the ultimate trade in this turmoil is "get back into the gold market," and he said he thinks silver bottomed May 5. Steve Grasso said for S&P traders, "1,155 is your next level of support."

Jon Najarian said he likes BRCM and OVTI, the latter unfortunately proving a disaster afterhours.

Guy Adami said Qualcomm is "finally" giving people a chance to get in.

Peter Misek said the AAPL selling was weak; "we'd be buyers." Steve Cortes admitted, "I do have an iPhone, I'm a terrible trader of Apple … it does not make money for its partners."

Steve Grasso didn't seem too concerned about Irene from a trading standpoint because it's not in the Gulf. Jon Najarian said to look at BGG. (And remember, Patty Edwards predicted runs on toilet paper.)

Taking away the ‘echoes’ of 2008? This sounds exactly like 2008

Kate Kelly on Thursday's Strategy Session offered background on Buffett's BAC purchase that actually really makes you wonder what's going on here.

"It does go with his folksy image," Kelly said of the bathtub part, conceding it was "clearly a whirlwind deal … 24 hours … early yesterday morning seemingly out of the blue … exceptional in nature."

Hmmm. So a company that had no need to raise capital is suddenly doing an "exceptional" transaction pieced together in 24 hours.

She said for BAC, it "isn't a ton of capital to raise," and that for Buffett, "I think it's still a pretty sweet deal."

David Martin curiously said this deal happened because they're "trying to take away some of the echoes of 2008," which is odd given that famous GS deal, but that the banks "really have 2 problems," first being the economy, and then "Bank of America's biggest issue is litigation."

Kelly asked Martin what he thinks of the "borderline hysterical" trading recently in BAC.

"It is August … markets can get somewhat illiquid," Martin said, but then he took an odd tangent, saying there's "clearly lack of confidence" in "good leadership" worldwide, with people wondering "who's in charge."

Martin did say he sees "extraordinary opportunities" in emerging markets, which sounds like those CNBC commercials we hear, and said in the U.S. we're just "trying to get to the root of some of our problems," specifically "housing market," and we don't see why it's tricky to get to the bottom of that; no one wants to buy one.

Keith Bachman said he still likes Apple and only lowered his price target because "we think the multiple's a reflection of longer-term earnings power" and there could be some pressure there after Steve Jobs' exit despite the company's ongoing greatness.

Meanwhile, if you’re interested in some real trouble …

Scott Minerd on Thursday's Strategy Session said the Dax drop feels like a "tremor before a major quake."

And that didn't sound too good.

Minerd said there's a "degree of uncertainty around the bailout" and then proceeded to knock what sounds like a ridiculous Greece-Finland deal in which Greece apparently got debt that its previous debt doesn't allow.

"The policymakers don't get it," said Minerd, adding there's a bigger question anyway as to, "is there enough collateral there anyway" for more debt, prompting David Faber to note the Parthenon is still left.

Minerd warned further about the state of the Eurozone and how they're going to have to deal with structural problems, because "there is not enough capital in the system to take the haircuts on sovereign debt."

David Faber initially said the Dax drop was "reminiscent of our Flash Crash" and then questioned "how much the machines are running things," but backed away from that HFT boogeyman angle.

[Wednesday, August 24, 2011]

It was the City of Champions,

Sister Sledge was playing

‘We Are Family,’ and the

Steelers brought home XIII and XIV

Jeff Saut, who's a fine CNBC guest actually even if he tends like Jeff Harte to be a little too bullish maybe, demonstrated mightily on Wednesday's Fast Money that there is such a thing as taking chart analysis too far.

Saut indicated he's convinced the market is bouncing back, because "I have been using the October '78 and October '79 declines as a pattern."

So, with a sample size of 2, from a distant economy and geopolitical time that is as relevant today as Samantha Sang, what could possibly go wrong?

The best patterns from '78 and '79 were the ones run by Stallworth, by the way.

Saut said he likes energy names with yields, specifically EP and LINE.

When it comes to gold,

Dennis Gartman sounds

a lot like a Steelers fan

The gold battle on Wednesday's Fast Money pitted Dennis Gartman vs. Tim Seymour and Guy Adami.

Seymour complained, "Everybody that's saying gold is a bubble, um, is wrong. ... I'm gettin' kind of sick of the bubble chat," which was actually brought up by Gartman at Halftime.

Adami followed, arguing, "Central banks are not trading gold, they're buying gold and they're putting it away, it won't come back out .. this is just a hiccup I think."

Gartman took issue with that, saying, "Guy just said that central banks don't get rid of gold. Well that's just- that's not true," before Adami immediately interrupted him in a race of who could be the fastest to quote previous central bank gold sales, with Adami acknowledging Britain did it in 1999 under chancellor of the exchequer Gordon Brown but claiming 9 out of 10 times the banks are buying.

Gartman said Bank of Canada "emptied their coffers" at some point. "Central banks do indeed sell gold," he said.

"This was a bubble that did in fact burst," Gartman concluded, using the term "extant" a few times while suggesting the U-turn in gold is based on movement in Washington on entitlement reform.

The funny thing is, a week ago, Aug. 17, Gartman was asked if gold was a bubble and he said "I suspect not yet."

And a day before that, Aug. 16, he complained mightily not about the U.S. debt debate that he now thinks is so significant, but the Sarkozy-Merkel press conference that he found disastrous and summarized as, "it really is bullish for the gold market." Evidently Europe has cleaned up that problem, and the U.S. has achieved a significant milestone in Social Security restructuring in the last 8 days.

It's a lot like hearing how Lawrence Timmons can't tackle, then cheering the sack the next play.

Worth: S&P low in for year

Carter Worth on Wednesday wasn't quite as bearish on gold as Dennis Gartman, but he was bearish at least in the short term.

"The presumption is that gold's gonna come in to around 1,600. That's the bet," Worth said.

"At the rate we're going, that would be tomorrow," joked Karen Finerman.

Worth said that as one alternative, "We like platinum here." But more significantly, he also dabbled in an S&P 500 forecast, saying it's "better to be buying than selling" right here, and "the lows were made just this week or 2 ago, 1,100 in our estimation."

At the end, Tim Seymour questioned, "How many cliches do you think he can get into 1 sentence there?" But Worth is not a cliche machine, certainly nowhere near the level of Dennis Gartman.

Adami: ‘We’ll probably rally again tomorrow’

Guy Adami said on Wednesday's Fast Money he's not really bullish, but, "You have to be impressed by the S&P ... It feels like we'll probably rally again tomorrow."

Tim Seymour said people have been getting the ducks in a row prior to the Fed announcement, which he thinks might disappoint despite revised expectations. "I don't know anybody that thinks he's actually gonna come out and give a QE3 announcement," Seymour said.

Karen Finerman, wearing an exquisite outfit (above) estimated to cost roughly seventy-four hundred dollars, also cautioned against belief in the Fed put. "I really do hope that this is not a rally with a hope of 'Bernanke's gonna send us another lifeline.' Because if it is, I think it'll end up being really disappointing," Finerman said.

Guy Adami said that out in "J-Hole ... the reality is, nobody knows."

Terranova: AAPL will be

$400 in 2 weeks

Guy Adami said given all the trading volume of the week, he's finally thinking "BAC starts to look interesting."

Karen Finerman said it was "absurd" to think JPM is going to take over BAC.

"Baseless is a very nice powerful word there," agreed Melissa Lee.

Karen Finerman said activity in PSS suggests there's an activist involved.

Tim Seymour made a couple jokes about boat shoes or was on the receiving end of the jokes; we can't remember.

Joe Terranova said, "See you in 2 weeks and Apple will be 400 when I get back."

Fast Money came dangerously close to reporting John Paulson's account balance again Wednesday, but Dennis Gartman only referred to him without naming him, and while the hedge fund gold positions chart was shown twice, nobody actually mentioned Paulson's name.

Mike Block so thoroughly tramples on the Raymond James BAC call, Judge Wapner flails at defending it

Mike Block has been away from Fast Money for ages but roared back onto the scene Wednesday demonstrating more homework than Steve Cortes did in 3rd grade and much more than Judge Scott Wapner obviously bargained for.

Wapner brought Block into the BAC conversation by actually arguing what Block was about to say, that the Raymond James call about valuation by Anthony Polini really doesn't matter if the economy struggles.

"I'll tell you what Scott. This thesis sounds very familiar to me," Block said. "Now Mr. Polini has had a strong buy on the stock since October 13th, 2008. And at that time the stock was trading with a 22 handle, and he slapped a $36 target on it. A month- a little more than a month ago, he had a $24 target on the stock. Now there's nothing in his thesis that's incorrect ... but this is not a new call. This is a valuation call, this is a recovery call, and I think this is the perfect value trap right here."

A $24 target just more than a month ago. By a pro who's paid to assess these things. And to think yesterday, the Fast gang was calling Henry Blodget "irresponsible."

Hearing that, Judge evidently felt sorry for Polini and stammered, "I understand but to put- but to be fair to, to the analyst, look, everybody is, is dumping on the stock, he comes out and points out specifically A, B, C and D, why may, why now may be a good time to take a look at it. I-I-I understand, look, I understand he's had a strong buy on it, uh, you know, since, uh, 10 years ago, whatever ..."

"The story's still the same. You know the risk/reward is better down here," Block said. "I'm not trying to disparage him, this is very difficult."

"You're not trying, but you just did," Judge cracked.

"Sorry pal. Give me a call. Buy ya a drink," Block said.

Guest predicts new S&P low

Moments after the Anthony Polini conversation, Judge Wapner brought on Keith McCullough, who wasn't exactly singing the praises of banks.

"Well I think Mike's right," McCullough said. "Raymond James is not the source of financials. Uh, I think you be short all the financials and particularly the big ones like Bank of America. ... They already need to raise capital."

Moreover, "I think the S&P's going lower. I think it's gonna make a new year-to-date low," McCullough said, which puts him at odds with Doug Kass.

McCullough said "we're short the financials" and that "The Bernank's in a box" and simply can't and won't do anything. "There's a reason why nobody remembers Arthur Burns very well," he said, and he's right about that; we don't remember Arthur Burns.

Steve Cortes then joked, "Keith put Bernanke in a box. Nobody puts baby in a corner, right? I mean come on," and 3 of his 4 colleagues — Mike Block and Brian Kelly and Judge Wapner — chuckled, while Patty Edwards merely rolled her eyes like it was the worst joke she'd ever heard.

Gartman on gold: ‘one of the great bubbles of our time’

Wednesday's Fast Money Halftime Report was as action-packed as they come and included this startling comment from Dennis Gartman on gold.

"This was in fact one of the great bubbles of our time," Gartman said. "I think this thing could go down another $150 in a very short span of time."

Steve Cortes claimed, "I think the public was sold a very false, supposed safe harbor in gold" and predicted a "very painful down move."

Cortes then cited a chart going back to 1980, prompting Scott Judge Wapner to say "This isn't 'The American Experience' Cortes, this is Fast Money Halftime my man."

"I don't know if you can remember 1980 if you're old enough, I don't remember a lot, I was in 3rd grade, I had a massive crush on my teacher, who was very cute," Cortes continued, eventually claiming that if you overlay the recent gold chart with 1980's bubble peak, it's the same thing, and how's that for a sample size of 1 based on the 1980s economic scene that is as relevant today as Supertramp.

Patty Edwards was wise to this, saying, "If you look at a chart of the Nasdaq going into 1999 to 2000, the gold chart looks eerily similar. August of '99 was actually a bear trap, and the market went a lot higher. Just sayin'."

Dennis Gartman said, "I bet we go to 1,650 in the course of the next month and a half."

Judge Wapner asked Mike Block to comment on "Newport Mining" in Pops & Drops.

Kelly: ‘People are confused’

Steve Cortes once again seemed to be the only one gushing about buying opportunities on Wednesday's Fast Money Halftime Reprot.

"I added to longs yesterday on Johnson & Johnson," Cortes said.

Brian Kelly on the other hand asserted, "People are confused. And when there's confusion, that is a correction."

Mike Block told Judge Wapner, "I think we're stuck in the mud Scott, and that's the big problem here," adding Bernanke won't announce a QE3, but perhaps "mechanisms," but "there's a lot of wishful thinking."

Patty Edwards predicted, "I don't think Bernanke's gonna say anything ... the safest place frankly is on the sidelines with a list."

David Faber doesn’t ask Glenn Hubbard about that ‘Inside Job’ interview

David Faber divided his Wednesday Strategy Session time between Glenn Hubband and Wayne Lin and managed to put together one of the sleepier episodes in recent memory, which might've been spiced up a bit had Faber asked Hubbard his reax to having a notable role in an Oscar-winning film.

Hubbard spoke to this week's Fed activity and said, "I'd be very surprised if there were a radical QE3," because it would probably only have a modest effect on growth while raising inflation fears.

If it did happen, Hubbard said, "I don't think it would have a big positive effect on the economy," and that, "going forward, I think inflation remains a concern."

Hubbard actually claimed, "Uncertainty is really holding back a lot of households."

Lin also referred to "uncertainty," specifically regarding the status of the EU and the euro, but also complaining about the debt-ceiling handling; "our leaders were not able to negotiate that."

He said he thinks Europe is favoring austerity at the expense of growth but cautioned, "I think default is a really severe word … my personal opinion is they're headed down the wrong path."

Lin a couple times mentioned allocating a portfolio among equities and commodities and REITs, because "nominal bonds don't preserve purchasing power."

David Faber also slightly pressed Lin on CNBC's every-other-day boogeyman, HFT. Lin offered a "pragmatic" thought as well as a broader market thought, saying "that last hour of the day really moving like you wouldn't believe," and that his firm makes sure of the strategies it uses, "they cannot be front-run." But he said trading and computers evolve and people will ultimately figure this out.

[Tuesday, August 23, 2011]

Tim Seymour: If rumors true, BAC is ‘absolutely something’ that could be nationalized

This site has no opinion/position whatsoever on the merits of Henry Blodget's Bank of America article. (And to that, as LeRoy Neiman said after the "Rocky III" Thunderlips match, "thank God.")

We're more than happy to let others duke it out. And while most on Tuesday's Fast Money were slamming Blodget's post, Tim Seymour indicated there's some smoke here ... the type of smoke that could lead to what Seymour described as the Geithner-indicated "nuclear option" in which "the government just takes it over."

"If Bank of America is all it is in terms, in other words, the allegations right now their (sic) balance sheet, it's absolutely something that could be taken over," Seymour said.

Karen Finerman seemed slightly taken aback. "But we are so far from anything remotely close to that," Finerman said.

Seymour argued that this is why BAC is a popular short. "This could go to, you know, the proverbial zero if it's nationalized," he said.

Score one for Tim Seymour

Once again, we have no clue about BAC finances and no opinion on Henry Blodget's conclusions.

But we got a tingle in the spine at hearing how Tim Seymour described the Internet and Blodget's presence during Tuesday's Fast Money.

"What I think is goin' on here, is first of all you have a circular situation, where again, you have- this is what's goes (sic) on in the blogosphere. And you know, say what you want, but this guy has an enormous audience, and, and it was very interesting that Bank of America made this personal ... you do with that what you want at home. I mean, that's what bloggers are for."

It's not quite like those "I am loved" buttons of the '80s. But it's close.