[CNBCfix Fast Money Review Archive — November 2016]

[Wednesday, November 30, 2016]

Productivity is either at peak … or ‘60-year lows’ (a/k/a not sure Joe Papa will get that bonus for shares hitting $270 or whatever it is)

As euphoria seemed to set in on the Halftime Report desk, Josh Brown on Wednesday said everyone suffers from "gambler's fallacy" in which people playing roulette see black, black, black and believe the next one has to be red.

"Professionals buy these types of breakouts," Brown explained.

Steve Weiss said what has him "really excited" is small businesses' ability to borrow from banks at "reasonable rates."

Judge brought in Mike Farr in the 4th minute of the program apparently to temper the enthusiasm; Farr said the promise of the new government is "probably still a year away."

In a bit of a head-scratcher, Atul Lele said the market hasn't gone too far but maybe a little too fast.

But things got really head-scratching when Weiss said we've been experiencing "peak productivity," only to have Lele declare "productivity right now is at 60-year lows."

Weiss revisited the subject later, and it wasn't clear whether they agreed that the level is high and the growth is low, or whether they didn't actually agree on the subject at all.

Farr said it feels like the "beginning" of excess, not the "end" of excess.

In an extensive amount of reporting, Judge said VRX's deal to sell Salix is "all but dead." Weiss said the depreciating yen made the purchase price "too high," and then there's been "spin" from John Paulson, who made a ridiculously bad investment. Doc wondered who would finance the deal.

Doug Terreson said it looks like OPEC has a "credible agreement." He's still overweight Big Oil.

Steve Liesman said what he's hearing from Fed members is that the more fiscal stimulus that happens, the more aggressive the Fed will have to be.

Doc said February 38 calls in CSX were popular; he bought a spread. Pete said he bought HD stock after noticing some options activity, perhaps (for those keeping score) the "first time" he has owned the stock rather than the options.

Scott Nations said the dollar is "all" of the story with gold. He predicted "another tough 2 years" for gold. Jeff Kilburg said the dollar is overbought and gold is oversold, thus it's an opportunity for gold, but keep an eye on the 1,170 level.

Judge said Berenberg hung a sell/$10 on FCX. Doc said you have to consider where the stock came from. The panel all called the stock a sell.

[Tuesday, November 29, 2016]

Karen cites timing of Castro death announcement as newspaper headwind

Julia Boorstin on Tuesday's 5 p.m. Fast Money reported that newspapers are seeing surges in online subscriptions.

Karen Finerman (who looked dynamite, but we had to use an equally dynamite file photo above for this post) was skeptical of growth in the space, stating this argument:

"Just the other day — Fidel Castro dies. It was not on the cover of the New York Times. Unless I'm mistaken, they missed it, it, it happened before they were able to go to print. Or after rather they were able to go to print. That's a very different world."

A very different world?

We think the news emerged around 12:30 a.m. Eastern time Saturday.

We don't know, but we're guessing it made the very latest NYT editions, though surely not all. The Daily News had it.

Everyone's entitled to her opinion, but let's not fault hard-working journalists for allowing Castro's death to be announced around midnight.

Let’s play Name the Rally

Josh Brown on Tuesday's Halftime Report said he disagrees with calling this a "Trump rally" as opposed to a "post-election rally."

Kari Firestone said this is a "GDP rally."

But not everyone was euphoric. Michael Yoshikami told Judge, "I'm not a momentum guy; I'm a fundamentals guy, so, I'll leave the momentum to your panel, your bright panel there" before predicting that a stronger dollar will hit stock prices.

Josh Brown told Yoshikami that the dollar longer term does not correlate with stocks. Yoshikami insisted the dollar will have an impact on earnings.

Joe Terranova asked Yoshikami for a strategy. Yoshikami suggested rotating into some of those names that haven't done well recently, even AMZN.

Mike Santoli said the market gain is legit enough that one doesn't need "a lot of policy hopes and wishes" to justify it.

Most of the show, a bit flat, was devoted to hailing banks and DIS.

Pete Najarian said he likes financials, but materials may pause because they're "way out in front of themselves." Later Pete said he still thinks there's upside in the recently mighty steel stocks.

Josh Brown said the XLF had a "huge spurt" of performance, then "stopped on a dime," but the consolidation looks good; the banks aren't giving anything back.

Pete said "there's a lot of reasons" he likes PFE now. Stephanie Link said she started selling JNJ last week because there are "other places" in health care to invest. She likes ALXN and also prefers AGN to PFE.

Kari Firestone touted BMY, calling it "overdone" to the downside.

Steph Link said UNH is up 33% year to date, so she prefers CI and HUM.

Josh Brown said he's staying long DNKN.

Joe said there's "really strong evidence" that things are looking up for TIF.

Pete said "everybody's looking at" the iPhone 8 for the next catalyst in AAPL. Kari Firestone said she wouldn't buy it in the next few months but did mention "repatriation" (snicker).

Pete said there was "intriguing" call-buying in DIS. Joe said he could see 105 "very easily."

Anthony Grisanti said he's a buyer of crude on expectations of an OPEC agreement. Jim Iuorio suggested 43.25 and shrugged off the OPEC meeting.

Kari Firestone touted MTSI, a recent buy, but said she sold SMG after buying at 69 and selling at "mid-high 80s." She now finds it "a little ahead of itself."

Joe Terranova said nat gas stocks are a place to look, specifying RRC (Drink), XOM, CHK and APA.

[Monday, November 28, 2016]

Cramer already predicting Justice Dept. decisions on antitrust reviews

There are powerful bull calls.

And then there are the types made by Jonathan Krinsky on Monday's Halftime Report.

Krinsky said he looked at the Value Line Geometric Index (whatever that is) and found it's "at the same level that it was at in 1998, so we've basically gone sideways for 18 years."

OK, sure.

He said a breakout from that "would be a pretty powerful signal." So in other words, if stocks continue to go up, that would indicate they're going to keep going up.

Jim Cramer, who talked a lot about virtually everything, praised CLX and GIS and suggested going long PEP and short KO.

"Penney's a piece of garbage," said Stephen Weiss, but Cramer said you can still buy it.

Weiss revealed mall reconnaissance, stating DKS has got a "whole wall" of just Nike in "little increments," and he didn't see UA shoes.

Joe Terranova said "everyone forgot about, uh, JM Smucker" (correct not plural).

Everyone seemed to like SCHW, while Weiss continues to try to reassure himself it was OK to sell LPLA.

Josh Brown referred to "CSLA" (sic), calling them "very wise" on China plays, but he likes YUMC and YUM despite the underperform initiation.

Weiss said he "nibbled" on CTSH on Monday.

Joe seemed to pronounce DIS as awesome. Guy Adami wasn't so sure on the 5 p.m. show.

Pete Najarian said he listens to the best analyst in each industry, which means he'll heed the Piper downgrade to neutral on HAS.

Jim Cramer said WBA is a Trump play that "goes through the roof" when the RAD deal is done.

Haven’t heard an update recently on Judge’s buddy Dave Ragone

Pete Najarian on Monday's Halftime Report said he sold out of COP because it's made a "pretty spectacular move" already.

Joe Terranova said COP cut the dividend and needs to sell assets, and he isn't sure "the right strategy" is to buy it on underperformance.

Josh Brown said buyers are "taking this stock right back to resistance, which is $48 a share."

Steve Weiss said it's a "chicken way" to play the OPEC outcome and later said he can't think of any more "foolish" bet to make than gambling on the OPEC outcome.

Jim Cramer said he did a lot of looking at CHK over the weekend. Joe called XOM a "great story."

Weiss: Markets did better under Clinton and Obama than they did under Reagan

It's obvious evidence that a show is slumping when Jim Cramer is repeatedly deployed to juice it up, but the results from Monday's Halftime Report are only bound to make the situation — whatever it is — even worse.

The Mad Money motormouth simply wouldn't shut up, and the overstacked panel of 4 plus Judge stumbled clumsily over itself for most of the hour.

Cramer said the Russell 2000 stocks have been "secular losers" in the regulation era and now look like winners.

Josh Brown curiously asserted that "we are very good human beings in general" at devising narratives to satisfy stock moves that have already occurred.

Joe Terranova said there could be a near-term pullback in financials, but there are tailwinds in 2017 for the first time in years.

Steve Weiss for whatever reason offered that the stock market under Ronald Reagan "didn't do nearly what the markets did under Clinton or under Obama," because "it's where the market came from."

Josh stated, "The majority of the personal income-tax, uh, cut that we hope or think is coming is going to people that don't need it, it has not stopped their spending … these are literal (sic redundant) facts."

Pete Najarian thundered that retail results had been moving up before the election and seemed personally offended for some reason that people were tying stock moves simply to the election.

Judge, reduced to a bit role, did note that Ohio State just played "the biggest football game of the year … in which they won, and now this."

More from Monday's Halftime later.

[Wednesday, November 23, 2016]

Joe doubts Jim’s ‘speculation’ that value will continue to outperform

Jim Lebenthal stumbled over multiple references to endorsing GM and value names on Wednesday's Halftime report, which caught the ear of Joe Terranova, who said he'd "much rather" own a tech biggie on the pullback than a stock that could be a value trap.

Jim asserted that value finally outperformed growth this year after 10 years of losing. "It is more likely that that continues," Jim said.

"Why? There's no evidence to that. That's just speculation on your part," Joe told Jim.

Jim stated, "You can make a very convincing case on a discounted cash flow that if the interest rate is going up, the value of the stock has to go down, and the multiple has to compress."

"I completely disagree," Joe chuckled.

"It depends what point in the cycle you are of that occurring (sic grammar)," said Steve Weiss.

Jon Najarian said he's in CLF, FCX after trading out of AKS, X and MT.

Joe said "energy became value" in 2016, and "that's why value has outperformed."

"Joe, I totally disagree … it's not just energy," Jim said.

AAPL is simultaneously a thankful and thankless holding of 2016

In an interesting feature, Judge asked panelists on Wednesday's Halftime to list stock trades they're thankful for and ones they kinda regret.

Joe Terranova hailed the shale trade early in the year and bemoaned the difficulty in trading volatility in 2016.

Stephen Weiss touted SRPT and admitted disappointment in ENDP and AGN.

Jon Najarian said he's "thankful" for being long AAPL. He lamented SPWR and the "garbage" solar space.

But Jim Lebenthal, who said WGO has "literally doubled" off February lows, complained that AAPL "really hasn't gone anwyhere."

Josh Brown wasn't there to participate in this segment, but dialing in earlier, he got to address the remarkable story of DE, one of his 2 masterstrokes of this year (NVDA being the other). Brown said of DE, "The fundamentals have not improved, however expectations had gotten so low that it almost didn't matter."

Pilots apparently have some leverage in the package-delivery space

Joe Terranova on Wednesday's Halftime said he likes FDX and UPS.

Pete Najarian said he doesn't think the pilot strike is a "major issue" for AMZN. Doc predicted they settle quickly "because they have to."

Phil LeBeau did the Shields & Yarnell routine from O'Hare Airport after microphone failure.

Pete said he bought MSFT stock (NOT the options) and hailed BLL.

Steve Weiss said HAIN has "huge upside" despite the accounting issue.

Jim Lebenthal said HPQ is "very attractively priced."

Anthony Grisanti said a Fed hike is a "foregone conclusion" and suggested 1,100 in gold. Brian Stutland pointed to 1,150 and said even 1,050 is possible.

Doc said to give gold a couple weeks; it might be affected by tax-loss selling. Joe said "let's come out of deflation first" before we start ramping up the gold-inflation talk.

Paul Richards said the OPEC meeting "could go to the wire" and warned against considering Draghi "predictable."

Doc buys the LLY plunge

Jon Najarian on Wednesday's Halftime Report said he was "rootin' for the patients" (as we all are), but after LLY's plunge, "why would you not buy it?"

Joe Terranova suggested a "next book" about "Doc's little cliches. They're good!"

One thing we gotta wonder that Judge has never brought up: How much — if anything — has Obamacare contributed to medicine's ability to fight terrible diseases and afflictions.

Pete Najarian said he's in MRK and PFE but indicated he's more interested in BIIB than LLY.

Joe said exiting SYK was "my first smart move of the year." Then as he's prone to do, he added an "s," referring to "Medtronics" (sic plural) thrice before getting it right.

Stephen Weiss said he's not sure Trump will be "hands off" on pharma. Jim Lebenthal touted BMY.

Guy Adami on the 5 p.m. Fast Money said LLY may experience a short-term bounce, but the stock's been a dog for a while and doesn't have many catalysts ahead and might well go lower.

Jim Lebenthal referred to "Nordstroms" (sic plural).

Jim: ‘This rally should continue to year-end’

Jon Najarian on Wednesday's Halftime said the dollar rise and bond selloff is "running out of steam," citing lower rates abroad.

Judge shrugged that "I'm talkin' about over here." Doc protested that we're "anchored" to what happens with overseas rates.

"For me it's about the rate of the increase" (Drink), said Steve Weiss.

Paul Richards, who hasn't been on for a while, said the Fed could deliver a "dovish hike" in December. Richards said the dollar may have "one more little leg up" before reversing.

Joe Terranova suggested the big gains might've already just happened; "this feels real late." But he nonetheless thinks the correction may not come until January.

Pete Najarian said the stock market has more upside if the dollar tapers off. But Pete said his disclosures "are half of what they were a week ago."

Jim Lebenthal sees a continued rosy outlook, however. "This rally should continue to year-end … there's still cash on the sidelines," Jim said.

Steve Weiss said the election of Donald Trump is bringing "pent-up optimism" after 8 years of "sorta gloom and doom."

Joe does not opine on Palo Alto

Pete Najarian on Wednesday's Halftime said January 40 calls in RIO were popular.

Stephen Weiss said he doesn't understand RIO and "all those trades" at this level. Pete protested that there's new demand in the space in the options.

Jon Najarian said December 80 TGT calls were popular.

Weiss said at one point that John Duskin is flabbergasted at the multiples in brick-and-mortar retailers.

Weiss said he'd "stay away" from GME, which is in a downtrend "quarter after quarter after quarter" even though it's a "cash-flow machine."

Doc said URBN could test the low 30s.

[Tuesday, November 22, 2016]

Judge impressively pulls double duty during holiday week

This site will never fault a person for showing up to work.

But we were caught a bit off-guard to see Judge helming not only Tuesday's Halftime but Tuesday's Fast Money, after he was off Monday and figured to be taking a holiday break.

Not only that, Joe wasn't around Tuesday to talk about one of his favorite names (that's back in the "penalty box" (Drink)), Palo Alto.

Steph Link said she bought PANW on the slide, citing the "deal slippage" argument.

Barbara Doran backed that and called the PANW quarter a "one-time miss." Josh Brown said PANW is finding support where it should, and that the 200-day looks like a "battleground." Doc said he bought FEYE on the PANW results and then bought PANW because of Link and Doran.

Steph Link touted PF based on synergies and said it might get "taken out."

Link likes HUM even if the Aetna deal doesn't go through.

Link is "taking some off" of BAX. Josh Brown touted SNA for its great chart. Doc touted SYF and cited big call-buying at 34. Barbara Doran likes FB (Zzzzzzzz).

Doc touted Permian Basin plays HAL, BHI, CVX.

Steph thinks rising rates will ‘kinda’ cancel out impact of tax cuts

Josh Brown on Tuesday's Halftime cheered the buyers out there, stating, "It is not abnormal to make new highs" and cautioning those who respond with "knee-jerk contrarianism in general."

To that end, Stephanie Link actually said the market has to get through the "Italian referendum" (snicker).

But Link predicted cyclical names will succeed into year-end at the expense of defensive stocks.

Link suggested that tax cuts and higher interest rates "are gonna kinda cancel out each other." Judge questioned if rising rates will keep folks from going to the mall. Link said shoppers will be "selective," then she touted department stores.

Barbara Doran said that going into the election, there was a "huge amount of cash on the sidelines."

Jon Najarian bragged about buying 3 of the FANGs around the Nov. 14 bottom. "Those have all worked out," Doc explained, predicting they keep running.

Doc noted the mere $2.7 billion market cap of AKS after a huge run this month. He also pointed out that Gundlach said rates might peak around 2.5 and then drift back.

Josh Brown said tax cuts "don't necessarily make their way around the economy," while a wage hike for the bottom 2/3 "absolutely does make its way around the economy."

Doc said it'd be a bad thing for crude to rip through 50, but when you put all those OPEC men in the room, "there's no way they're all gonna agree on something." Doc also restated Jeff Currie's backwardation theory (Zzzzzzzzzzz) from a day ago.

Doc thinks Dimon might’ve snubbed Trump because the stock’s going to skyrocket over the next 4 years

Chris Whalen on Tuesday's Halftime said "the good news" for banks is that they can make money this quarter on mortgage-servicing rights, but they might lose money on the hedge, "which is exactly the opposite of what we had all year."

Whalen said banks have to reprice their assets that have been in very low coupons, "and now they have to manage real rate risk." So he said not to be surprised about surprises in Q4 earnings. Whalen predicted the refinance market will dry up.

Jon Najarian asked Whalen if Jamie Dimon declined to seek the Treasury job because of upside prospects for JPM. Whalen said he doesn't know what "Jamie's" thinking is, but he's glad Dimon is staying.

But Whalen didn't really answer the question.

Doc revealed, "Virtually all of my banks got called out of my personal account," which we think means he would've made more money simply by being long those stocks and not writing calls.

Barbara Doran said Chuck Schumer has said he's got 60 votes to block changes to Dodd-Frank.

Scott Nations said "we're back to normal" in the bond space. Jeff Kilburg said "this is a bond-market crash" and said he's looking for 2.42% in the 10-year.

Been a while (not) since we’ve heard Chanos explain the CAT short

Pete Najarian for some reason was summoned remotely on Tuesday's Halftime to opine on Berenberg's initiation on the auto sector.

Pete said GT does have "some upside." But he disagrees with the GM sell, calling it a "hold" instead, though he seemed to agree with the sell on Ford.

Pete said February 77.50 calls in BLL were popular. Pete said he bought the stock and calls Tuesday. "I'm in this one today too," said Doc in the least surprising comment of the program.

Doc said there was strong buying in DAL December 49.50 calls. He said he's also long AAL. Pete said he took some gains in airlines recently and "missed some of that Buffett bounce."

Doc touted CPB Pepperidge Farm cookies. Josh Brown said DPS is locked into a bit of a downtrend. Stephanie Link said she'd hold CAT though we're in the process of a "trough" in mining.

Barbara Doran called MDT's report a "one-time miss" (Drink) and said she'll continue to own.

Pete touted "expense controls" at DLTR but suggested owning other discounters given the high DLTR multiple.

[Monday, November 21, 2016]

Doc: Watch TSN in low 50s

Jon Najarian on Monday's Halftime said the lower TSN falls into the low 50s, the more interested he gets.

Stephen Weiss said FINL is a hold.

Josh Brown said it will be tough to make money in MCD.

Sarat Sethi said WMT will be "hurt" by competing with AMZN on Cyber Monday, and he'd stay away from WMT.

Joe Terranova said BBY could go to 50 on technicals but that there's a fundamental story too.

Brian Stutland told Jackie DeAngelis, in stunning black, that he'd get more bullish on gasoline at 1.43 but warned of a "significant fall" if no OPEC cut next week.

Doc said FB calls were very popular Monday, including the weekly 120s. Joe said he took FB off after the election under the technology-is-ATM theory. Weiss said he likes the stock.

The World's Most Interesting Woman, Karen Finerman, on Monday's 5 p.m. Fast Money called the FB buyback merely a "gesture."

He was taken literally but not seriously by the media, seriously but not literally by voters ...

It's the latest election mumbo jumbo.

Peter Schiff on Monday's 5 p.m. Fast Money claimed that Donald Trump won the election because the recovery is an "illusion."

It may or may not be an "illusion"; we don't really have a clue.

But that's not why Trump won the election. He won the election because when presented with his rival to people who have never heard of either one, more people found him the more appealing choice. See, the next time you're on a city street, take a look at two strangers and ask yourself which one you'd vote for. That's how this thing works.

(Trump did lose the total amount of votes, which can be attributed to boorish, embarrassing incidents, but he accumulated a much more effective cross-section of support.)

Tim Seymour hectored Schiff with fair questions about the always-looming "armageddon" (Schiff's term, according to Seymour), then shook hands. But Tim looked a little tacky in jeans.

At some point, every possible combination of stocks will be an ETF (a/k/a if Judge had been there, they would’ve argued passive vs. active)

It was one of the more curious conversations in recent memory.

Eddy Elfenbein joined Monday's Halftime Report and told Melissa Lee that in his ETF, he focuses on buying "high-quality stocks," holds 20 for an entire year, and then subs out 5 of them.

He said he gets paid, and he gets a bonus for beating the benchmark, and if he doesn't, ETF owners get a "discount."

Josh Brown revealed he's been friends with Elfenbein for 8-9 years and one of Elfenbein's first shareholders. Brown called the idea of only 20 stocks "very novel in today's day and age."

Well, how "novel" is it? Can't someone just buy his own 20 stocks and change them whenever he likes?

Elfenbein said he starts with a list of 70-80 names that he considers "very high-quality companies" and looks for some "transient" reason that shares have fallen.

Elfenbein did make an excellent point, that people don't have to be "overly diversified."

Sarat Sethi asked a good question about "tax sensitivity." Elfenbein said he has "offsetting gains and losses" and that the combination is a benefit of the ETF space.

How close are we again to Carl Icahn’s ‘Day of Reckoning’?

Jeff Currie on Monday's Halftime Report cited 3 reasons for an OPEC cut and then added 2 goals from it; a total of 5 is just too much for us.

He did point out how backwardation "prevents U.S. E&Ps from hedging forward." He also said he has reduced his year-end crude target from 60 to 50.

"Nat gas already won the war on coal," Currie added.

Steve Weiss wondered why Currie wasn't talking about the dollar. Currie said there's already a "breakdown" in the oil-dollar correlation that could go to zero.

Weiss though said the dollar could just become "a much more expensive currency to transact in." Currie said he finds "zero evidence" of that.

Currie said he took his gold forecast from 1,280 to 1,200.

Joe Terranova said energy has been the place not to be in the last couple of weeks, though the SXL deal makes the space a little more "incentivized."

Joe said he bought RRC (Drink) and touted EOG and CXO. Weiss said he agrees with Joe on RRC but thinks energy as a group is "overvalued."

Sarat Sethi said refiners are a "consolidation play."

Jon Najarian touted SLCA but acknowledged it's up "150% year to date." Sarat Sethi suggested possible multiple compression in consumer staples if oil climbs.

Remember when NFLX was going to tumble as soon as Carl got out of it?

Alan Gould, who has a $145 NFLX price target, apparently sees $98 of value internationally and $49 domestic.

Gould said on Monday's Halftime Report that U.S. subs will go from 47 million now to 75 million, but international will grow to "way over" 150 million and will ultimately have the same profit margins.

Josh Brown pointed to AMZN's own content (Drink, the old Michael Pachter argument) and the price for NFLX for renegotiating DIS deals (Double Drink). Stephen Weiss said he got "stopped out" in NFLX "because it's such a small position." But, "I still think Apple should buy it," Weiss said.

Weiss said NFLX is "always goonna be essential" for "millenniums" (sic), and "everybody I know is cutting their cord."

Doc said he's long NFLX 120 calls.

Remember, have to raise the risk of interference with the Fed with this election outcome

Stephen Weiss on Monday's Halftime said financials started moving as the yield curve started steepening, and "the Fed is going to have to catch up a bit."

Sarat Sethi and Joe Terranova trumpeted regionals. Joe mentioned RF and BBT and GS but said he cut back on USB and CME. Weiss said he'd trim SCHW and LPLA but not the banks.

Joe touted TD, BMO.

Josh Brown said the prospects of a Dodd-Frank repeal are "unrelevant" (sic) to regional banks.

Sarat Sethi touted XLF while conceding pullbacks.

Jon Najarian touted JPM and WLL.

O’Leary ETFs underperforming

Kevin O'Leary on Monday's Halftime insisted to guest host Melissa Lee (in sharp burgundy and exquisite hairstyle) that dividends are the key to market returns.

Mel pointed out the O'Shares vehicles have underperformed the S&P, and a couple are actually down, since Trump's election.

"You have to look long term," O'Leary insisted.

Josh Brown cautioned that while "dividends are great," those taxed as ordinary income may not work for wealth-management clients and maybe a combination of buybacks provides more value. O'Leary said buybacks are useless "advertising" and never fully realized and that we'll be in a "better tax environment" under this administration.

More from Monday's Halftime later.

[Friday, November 18, 2016]

Judge, Weiss, Brown put together best show in weeks

While Doc and Jim mostly sat it out, Friday's Halftime Report took a stab at presidential policy and put together some of the best material in months.

Things revved up when Josh Brown and Steve Weiss tangled over whether Trump changed everything or whether markets would've had a similar rally, albeit with different sector leaders, under Clinton.

Judge said it's flat-out "impossible" to have the same "magnitude" of the rally if Clinton had been elected with a Republican Congress.

Judge tried to pin down Tom Lee on that issue; Lee offered, correctly, that "Hillary would've been viewed as easy monetary policy."

But Weiss had a good comeback, questioning if that somehow means no December hike if Clinton won. Lee said we'd be "less worried about interference, political interference at what the Fed's doing," though a better way to put it would be to say that Clinton would've been more likely to reappoint Yellen.

Lee also said, correctly, that both Clinton and Trump would be seen as "more favorable" to business than the current administration. Weiss said incorrectly, "Hillary embraced the entire Obama agenda; she wasn't gonna deviate from it at all."

"I don't know about that," Brown said.

"I agree with Steve on this," Rob Sechan said.

Wrong. One of Hillary's problems is that she had no clue whether the current administration needs celebrating or fixing, so she told various pockets of voters whatever they wanted to hear.

Clinton wouldn't have allowed the standoffs that plagued the Obama administration; she would've cut deals like Bill did.

But not the way a Republican president will do with a Republican Congress.

Josh suggested the bond activity of the last 2 weeks is unusual and not necessarily the "new normal."

But Weiss said there are "so many disconnects" in the markets right now, such as copper and the dollar, and he said not to be in emerging markets. Josh questioned avoiding EM because of a "temporary rally" in the dollar.

Doc wouldn't take a stand on whether "hard-liners" in the Trump administration pose a risk to financial markets. But he did gloat about calling WFC a buy at 45. Now, "I'm selling greed," Doc crowed.

Weiss called the BMO downgrade of WFC "stupid" and "dumb."

Rob Sechan in a long windup said millennials will produce a "growth-without-inflation" market.

2,350, 2,225, 2,325 … (a/k/a sleeping habits of Jim’s clients)

Jon Najarian had a quiet show on Friday's Halftime Report.

But he still managed to point out that "I'll break my arm pattin' myself on the back" (Drink), referring to AMZN's "709 or whatever" Tuesday low and "780 today."

Najarian called Facebook "vastly undervalued."

Josh Brown said people were "way underinvested" heading into the election and that nothing brings in fund inflows like new market highs.

Judge asked Tom Lee if Lee is "surprised" at the market's gain since Election Day. Lee said "the market's only up 2%."

But Lee said the "fat pitches" are a rotation back into stocks.

Rob Sechan said presidents don't "dictate" profit cycles but merely "magnify" or "dampen" them. Josh said he's not sure he agrees, pointing to Herbert Hoover.

Stephen Weiss said the market is just "level-setting itself."

Jim Lebenthal said "I've actually got clients" who think bonds look attractive, setting up a showdown with Weiss, who shrugged and said others can have bonds, questioning if the 30-year bull market will go to 40 years.

Jim said he's talking about clients who need bonds in their portfolio "to sleep well at night" who can now make that investment "so much easier" than a month ago.

Weiss questioned, "When they start getting those statements, how well are they gonna sleep when they see the 10-year goin' from, from 2.20 to 2.30 to 2.40, 2.50."

"We're investing now, and we're not going to 10 years, we're going to 5 years," Jim explained.

Judge asked Lee if his year-end S&P target is 2,350. Lee said it's 2,225. But the graphic said it's actually 2,325.

Look at Jackie in sizzling, sexy new dress

Stephen Weiss on Friday's Halftime Report touted FL rather than UA.

Judge said Weiss has been on that trade, "to your credit." Weiss told Judge, "you sound surprised." Judge said, "I'm starting to worry about your temperament."

For reasons we can't fathom, Glover Quin of the Detroit Lions dialed in to tell Judge and the panel about "The Plan," which apparently is to save as much as possible and spend as little as possible. Glover called the DraftKings/FanDuel merger a "great move."

Bob Iaccino said he's looking for 104.50 in the dollar index. Jeff Kilburg said the rally's not over yet; "more room to run."

Jim Lebenthal said DIS is bursting out of the "penalty box" (Drink).

[Thursday, November 17, 2016]

Andy Chase: Market could ‘easily’ see multiple expansion

Oh my.

President Barack Obama's press-conference answers in Berlin, aired during Thursday's Halftime Report, were so long-winded and dull and generic, we can't believe Judge or anyone on his panel stayed awake.

To the benefit of the entire free world, the event eventually ended, and Judge was able to proceed with … updates on Janet Yellen.

"I gotta say this show has been like the financial version of the NFL Red Zone," said Steve Liesman, who indicated the Fed pointed out that it's not like we need 2009-style stimulus.

Judge floated the notion that the Trump policies "could end up being the best friend of the Fed."

Steve Weiss said the stimulus package won't be "nearly as big" as Trump has said, nor will the tax cuts, but he thinks the Fed will be "on a faster ramp" because the economy "is heating up" (snicker).

Jim Lebenthal said Chuck Schumer "is known as a dealmaker" but he's not an "easy, rollover guy."

Jon Najarian said 2 sectors, materials and defense, would've done OK under Clinton, but when you add health care and banks under Trump, it's a "real positive boost" for the S&P.

Andy Chase (for performance) said he's "still relatively bullish" on the stock market, predicting rates will "stay down" for a "long, long time," which could put multiples "easily, easily" in the 20s.

Weiss told Chase that Trump policies "are inflationary," but "that's got nothing to do really with what the cost of money will be here, the borrowing cost, which will go up," so how do we get multiple expansion. Chase said, "Everyone seemed to think the world was coming to an end," and he has "never seen" so much pessimism.

Chase said for the first time in a year, he's gonna start adding money to tech; he had avoided it because he's a "simple guy" who isn't into the whole unicorn thing.

Jim Lebenthal said to "forget" CMG for now, until you see the growth.

Matt DiFrisco said CMG's multiple isn't justified by the growth potential.

Doc said BBY works into Black Friday. Judge said people had BBY "in the grave," but now "it's made one helluva comeback." Pete said that's "a hundred percent right."

Probably the greatest moment of the week so far is Karen Finerman's ultra-chic new blue ensemble on Tuesday's 5 p.m. Fast Money in which Karen warned against buying DRYS but then was pegged by the graphics guys (who also bungled "stocks soars") as a seller, which drew some Twitter feedback.

[Wednesday, November 16, 2016]

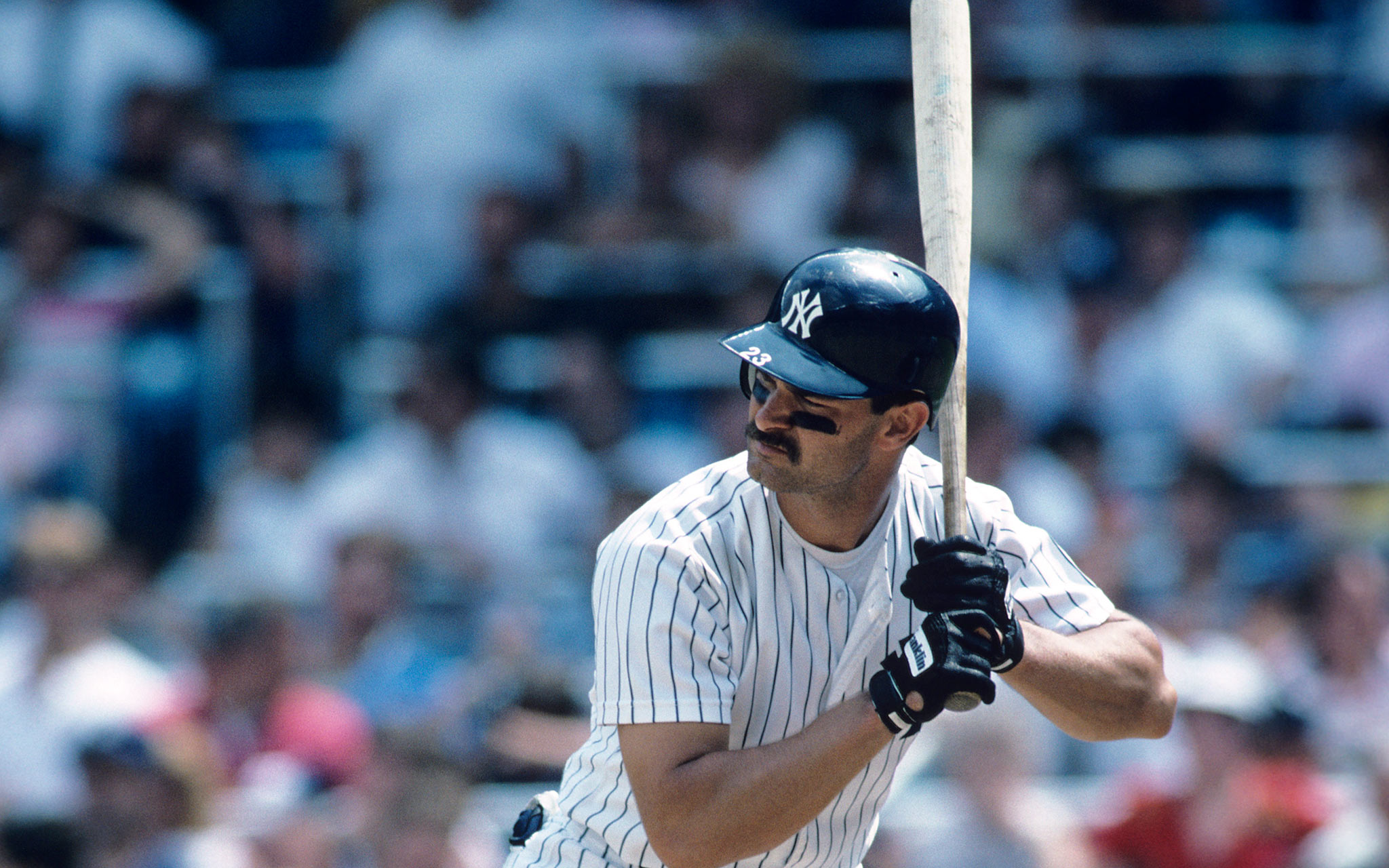

Donnie Baseball hit .307,

isn’t in the Hall of Fame

Brad Gerstner, the guy who said months ago that the battle over United board seats would rewrite the HBS curriculum, told Judge on Wednesday's Halftime that "I would like to say that I was terribly surprised" to learn of Berkshire's airline investments but that he tweeted in April that he wouldn't be surprised to see Berkshire do this.

Judge explained that United's new pricing is "customer unfriendly" and that Kelly Evans got "a lot of spin" from Oscar Munoz.

"I respectfully disagree," said Gerstner, stating United merely announced "basic economy."

"At the end of the day" (Drink), Gerstner said, airlines have to "give consumers what they want."

Seemingly carried away with the prospect of UAL gains, Gerstner made a 3-year case for "$70 of upside on a $60 stock," then suggested if the multiple goes from 5 to 7, "that's another $60 a share."

Kevin O'Leary asked why airlines won't derail themselves again with overcapacity. Gerstner said, "Very simple: Ten years ago, 12 carriers controlled 60% of the market. Today, 4 carriers control over 90% of the market."

Gerstner said there have been "4 generations of business-school students educated that the worst place to invest is in an airline."

But O'Leary said Berkshire also bought IBM.

Judge told O'Leary, "I mean, if you hit .300, Kevin, you're in the Hall of Fame, for a career (sic last 3 words redundant)."

Gerstner congratulated Judge on the "anniversary coverage."

Jeff Bezos apparently scared of Trump’s impact on stock price

Pete Najarian argued on Wednesday's Halftime that AMZN was hit by Trump-Bezos tension, which then dragged the FANGs down.

Josh Brown said Trump has a "list of political enemies," has been "vindictive throughout (sic redundant) his entire life," "sends personal notes to reporters" who write things he doesn't like and has been "involved in thousands of lawsuits." Brown said "it probably killed" Jeff Bezos to congratulate Trump after the election, "but I think he- to some extent, he was looking at his stock price."

Joe Terranova said he has "seen" portfolios where they're selling FB, AMZN and to a lesser extent "Aphlabet" (sic pronunciation sounded like), but Joe likes NFLX.

Judge struggles to find takers for fade-the-rally theory but Joe wonders why people always look for an exit

Judge tried in vain at the top of Wednesday's Halftime to get traders to make a call on the dollar/market.

Joe Terranova refused to bite, stating we'll have to wait for January to gauge the dollar's impact on the stock market.

Judge wondered, "Why do you have to wait until January??"

Joe said we won't get the "headlines" about it until then.

But Joe asked a great question: "Why is it that we are always looking for the exit sign when the market advances?"

Judge said there's question as to whether the "magnitude" of the rally is "justified."

Pete Najarian said the FANGS have "absolutely" been taken to the "woodshed."

Kevin O'Leary said banks have gotten "way" ahead of themselves and predicted yet another "head fake" in the sector. "This time seems to be different though," Judge said. O'Leary said Dodd-Frank isn't in the 2017 game plan.

Josh Brown said the breakout's "for real" and said he'd like a pullback to get in.

O'Leary actually made a good anecdotal call (that this page mocked), the wine gathering in Philly where the Trump-Clinton vote was like 50/50.

Joe questioned why Kevin doesn't get the "loosening" that's happening with bank capital. Frustrated, Judge cut in, "Why are we just talking about the banks? I'm trying to talk about the rally."

Joe said banks are "the trade."

Raising questions about Judge's premise, Doc stated, "It's a 1½% move to the upside!" Judge bluntly said again that he's only trying to determine if rising rates and dollar will kill the rally. Josh Brown made a feeble attempt to not really answer, referring to tech stocks.

Doc said he's short 115 FB puts and also AMZN 700 or 695 puts.

Josh said no one's "admitting" that they dumped FB to chase banks. But Joe said that's what's happening.

Flash: Buying interest in AAPL

Mercedes USA CEO Dietmar Exler told Phil LeBeau on Wednesday's Halftime he's "not so sure" we're in a peak for luxury cars.

Kevin O'Leary said ESPN concerns overshadowed the "diversification" of DIS' revenue streams. He called DIS a "7% home run." Josh Brown said the stock is above its 200-day, and he likes it under $100, the long-standing Pete Najarian trade.

Anthony Grisanti said he'd "still be a seller" of the 10-year. Brian Stutland said money will come in if the yield goes to 2.4%, but he sees 3% in 2017.

Doc said there was aggressive buying of December 115 AAPL calls. "I actually bought the 110s," Doc said.

Pete said TWLO December 40 calls were popular.

Josh Brown said FB is "doing the right thing" to evaluate its metrics. Josh said he thinks NVDA — a spectacular call on his part that might even somehow prove better than Steve Weiss' SRPT — "rolls up to triple digits." Joe Terranova said he wouldn't be short JCP. Pete said there are "a number of people pushing against" UA.

[Tuesday, November 15, 2016]

John Boehner twice says Trump is ‘barely a Republican,’ once says he might be ‘barely a Democrat’

The star guest of Tuesday's Halftime Report on location at the CME conference on whatever in Naples was John Boehner, who said he was "surprised" but not "shocked" at Trump's victory (for those parsing the degree of astonishment in John Boehner's life these days).

Curiously, Boehner said Trump is "barely a Republican" more than once and added that he might even be "barely a Democrat."

Of Trump's rhetoric, Boehner said bluntly, "Nobody wants to listen to all that."

Boehner said he has heard folks say "countless" times that "Donald Trump is saying what I'm thinking."

He predicted "a somewhat different Donald Trump" by inauguration.

Boehner called "repatriating" (snicker) overseas cash "a smart step" but called Dodd-Frank a "disaster."

Joe Terranova said Boehner's comments were "really, really compelling."

Ford chief sorta implies that Trump can take his Mexico carping and stuff it

Terrence A. Duffy, an obvious guest at a CME conference, predicted on Tuesday's Halftime Report that markets are "gonna hang a lot on the president-elect's words."

Really. You don't say.

Duffy said there's a "bond bubble" but he also thinks "we're gonna take on more debt to do infrastructure."

"What the markets hate is uncertainty" (Drink), explained Duffy.

Meanwhile, Gary Cohn told Judge he was "not as surprised" (Drink) as other people were about Donald Trump's victory.

"Literally (sic) (Drink), you know, the markets tend to overreact to everything these days," Cohn told Judge, warning about the dollar and harping on the need for clarity (Zzzzzzzz) (Drink).

Obviously assuming a low bar, Joe Terranova praised Judge for a "great interview" with Cohn.

Doc predicted fixed income would be "huge" for 6 months.

Mark Fields told Phil LeBeau "our plans continue to be to move our Focus down to Mexico and importantly make room for 2 very exciting products that go into our plant in Michigan."

Doc suggested getting into AMZN at the 200-day.

[Monday, November 14, 2016]

Joe claims ordinary Americans already anticipating tax cut next year

Joe DeNardi on Monday's Halftime spoke of his LMT upgrade to buy; "I think we'd be doing this even without Trump winning," DeNardi said.

Joe Terranova said he exited NOC but that the LMT gains would've happened "if Secretary Clinton won as well."

Jim Lebenthal said LMT is "an easy 10%" from here. Stephen Weiss doesn't think LMT is cheap but does like OTK.

Weiss said he'd thank Elliott for the MENT deal.

Jim said he's "on board" with Morgan Stanley's C upgrade (everyone is always on board with every C upgrade in history).

Joe said acquiring HAR is a "huge win for Samsung."

Pete Najarian said he likes HD. Jim Lebenthal pointed to rising rates and how it "damages" affordability for someone "purching (sic) a home." Pete said he doesn't agree that rates will affect home-improvement spending.

Joe Terranova actually said consumers are more confident now because they're anticipating tax cuts next year. "You really believe that?" Judge asked. Joe answered in the affirmative and touted JWN and DDS. Weiss said "more than 50%" aren't really enthusiastic about the next presidency.

Stephen Weiss said he's out of the hospital names and chalked up THC's gains to insider buying. Erin Browne said "Donals (sic) Trump" policies are going to help health care. Pete said now may be the time to buy HCA.

Pete said November 8 AKS calls were popular. He's hoping there's more "torque" in that name than in X.

"I think the homebuilders might finally start to move," Pete added.

Joe said to look at NFLX.

Joe recalls repetitive line of questioning from Judge in 2013

On Monday's Halftime Report, Joe Terranova sought to explain why high-flying tech stocks were taking hits.

Joe said Judge used to ask "all the time" 3 years ago (not verified by this page yet), "When is cash coming off the sidelines?" Joe said technology right now is an "ATM."

Judge demanded to know when to buy FB. Joe said, "How long do you believe that this rotation is going to go on for?" He said if you're "tactical," it might not be time just yet.

Meanwhile, Steve Weiss said the tech trade is "still on watch" because Trump said nothing about it on "60 Minutes."

"Clearly, near term, the market's overbought, and bonds are oversold very near term," Weiss asserted.

Erin Browne said we're in the "early innings" (twice) of a "powerful sector rotation" out of high-yielding stocks into banks and industrials; also people are taking money out of high-P.E. names.

Jim Lebenthal said some people are playing "catch-up," and they'll look to financials and health care.

Weiss mentioned "repatriation" (snicker).

Mike Santoli said some infrastructure plays seem "a little bit overheated."

More from Monday's Halftime asap.

[Friday, November 11, 2016]

Gundlach: ‘FANGs are a bubble’

Jeff Gundlach on Friday's Halftime Report took a victory lap on his Trump prediction and on his "maximum negative" view on Treasurys on July 6, at 1.32.

"Unbelievably we got it to the day and the basis point," Gundlach said, stating at that time he predicted 2% before year-end.

Much more interestingly, Gundlach said the election shows people "want something real. No more of this man-behind-the-curtain stuff."

He said he'd stay away from the FANGs and "financial engineering" stocks "in a big way."

Later, he declared, "I think the FANGs are a bubble frankly."

Gundlach said this leg of the rate rise "is about 80% through" with "really critical" resistance at 2.35 on the 10-year. He said that if rates keep rising, there will inevitably be "some correction in pricing" in residential housing.

"If the Fed doesn't raise rates in December, they're never gonna raise rates again," Gundlach said.

Doc said he sold some FB puts.

Weiss: Never see 2% 10-year again

Eddie Perkin on Friday's Halftime said Trump can dial back regulations on his own and that corporate tax reform (snicker) is "probable."

"I would fade the rally in things that are driven by unknowables," Perkin said, singling out banks.

Perkin made a reference to Japan's deficit spending not working; Stephen Weiss scoffed, stating Japan demographics and U.S. demographics are "night and day."

Then, in the shocker of the day, "I don't think we see below 2% again," Weiss said. "I think we see 3% pretty soon."

Perkin said you can "nibble" at the bond proxies while asserting, "I'm not a bond trader."

"Well you're making a case," Judge said.

Judge misquotes Jim, somehow gives him a hard time anyway

We can't figure out what's made Judge so chippy around Jim Lebenthal recently, but the trend continued on Friday's Halftime.

Jim said TIF has run "too far, too fast" and knocked the Cowen upgrade even though he's long.

Judge said Jim said "now it's time to pull the ripcord," even though Jim didn't say that.

"That's not what I said," Jim said.

Even though it seemed to go over Judge's head, Jim's point was hardly advanced physics. He said TIF has already made a big run, and it's going to pause for a while before the run continues.

Doc said LVMH, not TIF, is the name for luxury.

"All I'm saying is that the enthusiasm from this call is way early. It's just way early," Jim said.

"Or way late," Stephen Weiss said.

"OK," Jim said.

Fiscal stimulus. Oh joy.

Even though everyone now seems to think stocks have surged too much this week, the Halftime gang on Friday couldn't help but bicker with each other.

Josh Brown said the gain is not about Donald Trump but that when markets get certainty, "typically" the reaction is to buy.

"It has nothing to do with one person's policies," Brown said.

Stephen Weiss had to argue with that, stating it's "so much clearer" now that we have a pro-business, anti-regulation environment, while nevertheless admitting, "I did buy the VIX yesterday" because it feels like the market "had run its course for now."

"The economy's actually been doing a lot better than people expected," said Jim Lebenthal.

Josh insisted the market was expecting a Clinton win and a Trump claim of illegitimacy, and that didn't happen, so off we go.

Weiss said that's wrong, "We finally got what should've happened a long time ago," that the market was set up for gridlock, and now it's set up for "the final move, that handoff, from monetary policy to fiscal stimulus (snicker)."

Doc said he was taking profits in X, one of the "crazy good trades."

Jim Lebenthal noted the market still seems range-bound. "18 months we've gone up 1%," Jim said.

Doc said "somebody big" dumped a bunch of gold contracts.

David Darst actually said on Kelly Evans' Closing Bell that Hillary Clinton's concession speech "ranks up there" with Martin Luther King Jr.'s "I Have a Dream" speech.

Didn’t hear anything about buying the AMZN dip

Josh Brown, who has made a great ongoing call with NVDA, on Friday's Halftime Report said he thinks it goes higher still.

Jon Najarian said DIS made a "phenomenal" recovery since Thursday's afterhours.

Steve Weiss credited Kevin O'Leary for touting DIS a couple days ago.

Weiss called BABA "OK."

Jim Lebenthal said JCP has had a lot of "great" quarters relative to expectations, but "this quarter was not good."

Judge asked for the last "unqualified great quarter." Jim said, "How about the last 3?"

Judge conducted a fine Veterans Day roundtable with Jim Lebenthal, Matthew Caldwell, Lawrence Doll and John Martinko.

[Thursday, November 10, 2016]

Holy. Moly ...

At first we thought we were just watching the Halftime Report Thursday — then we realized we were in heaven.

Seema Mody, in white, buckled knees worldwide while reporting on the slump in emerging markets.

Quite frankly, when that happens, all other conversation — even exciting stock-market conversation — has to go to the back-burner.

Jon Najarian said people long Brazil will be "hittin' the exits for days to come."

Jim Lebenthal tried to distinguish among emerging markets; Judge was having none of it but forced the panel to admit no one was buying EEM.

Jeff Kilburg said there's an "exaggeration" in copper, maybe "a little overdone" short term. Jim Iuorio said 2.98 is in the cards.

Jim Lebenthal said, "I don't think you're going to lose money by buying IBM," but he wants to see the revenue turn first. "Just wait," Jim said.

Pete Najarian agreed and said he prefers MSFT, INTC and CSCO. Doc said Buffett "is still 36 bucks underwater" on IBM.

Doc was trumpeting a morning winner in the FANG space. "I bought Amazon on that harsh selloff today … flipped it, now I'm short at the 200-day moving average; I'm short puts," Doc said, calling that "playing the odds."

Pete said January 37 calls in STX were popular, 50/1 vs. puts.

Doc said people were buying April 27 calls in AMAT; he bought those and sold the 30s against it.

Judge promised Jeffrey Gundlach on Wednesday's show.

Judge nails it, suggests country might be overly taken by 3 a.m. Wednesday remarks

Mike Mayo joined Thursday's Halftime crew to pronounce "the end of a 7-year drought" for bank stocks.

Judge hit a home run, rightly pointing out that a lot of the rally seems to have turned on Donald Trump's remarks early Wednesday morning even though one of his final commercials showed Lloyd Blankfein. Mayo conceded Trump advocated during the campaign to bring back Glass-Steagall, and "that's not going to happen."

Mayo said Dodd-Frank will be "tweaked" but not "repealed."

Judge for some reason kept interrupting Jim Lebenthal when Jim was trying to answer Judge's question about the banks maybe getting ahead of themselves. Jim did use one of Joe Terranova's classics, "the penalty box" (Drink).

Joe said it's an "incredibly bullish" environment for financials.

Mike Block later on Closing Bell said he's taking profits in banks because they're suddenly trading like it's a "crazy, euphoric banker paradise." Steve Grasso used the term "overextended."

Mayo again likened JPM to a basketball player; we're sick of it and won't mention it anymore.

Literally, he’s apparently

a serious man

Falling for America's biggest newfound cliche (it was started by Maureen Dowd, citing Salena Zito in the Atlantic), Joe Terranova on Thursday's Halftime Report hailed Nelson Peltz's "great words" about how "The market is not treating Donald Trump literally. It is treating him seriously however."

Profound. (And when do we get the serious special prosecutor that was promised for the Democratic nominee?) (Will that come in the form of serious tweeting?)

John Harwood said the country should be "reassured" (snicker) by the Trump-Obama meeting.

Rick Rieder said there's "a lot of efficacy" to what Stan Druckenmiller said about gold or whatever. "The Fed could evolve (snicker)," Rieder said, adding rates can "elevate" here but that there's not "rampant" growth or inflation (snicker) on the horizon.

While Rieder downplayed the notion of a "bubble," Jim Lebenthal said that given the recent move in rates, it seems like a "pricking" of the bubble.

Jim Lebenthal said you can get into bonds at the 3-4-year duration. Joe Terranova said rising rates are the reason "why the register is being rung right now in technology."

Whew — actually had an episode with commercials before the 52nd minute, no active-vs.-passive debate

Les Funtleyder on Thursday's Halftime told Judge he was sorry to give him a "nuanced answer," but health care prospects depend on which sector we're talking about.

Funtleyder said he doesn't want to name specific companies that he's bearish on because "we don't like to hurt people's feelings," but he likes GILD and is looking to build a bigger position.

Jim Lebenthal grumbled that there isn't a "blockbuster" out there in the way of exciting drug discoveries and that only the "crowded" oncology space has growth. Funtleyder pointed to oncology for breakthroughs down the road.

Funtleyder likes SYK, but Joe Terranova said, "I actually sold Stryker yesterday." But Joe's still long TMO and PKI.

[Wednesday, November 9, 2016]

Aditi Roy, CNBC superfox

We gotta think the market's roaring higher.

What should've been trading heaven on Wednesday's Halftime Report instead was nap time as panelists sat on their hands and warned repeatedly about the pullback to come.

Pete Najarian said he bought the VXX in the morning. (Oh joy.) (Remember, Doc just advised against playing those hardly a week ago.)

"Be very careful about who you're listening to," said Josh Brown, citing an "abject lesson" in the commentary from overnight Tuesday to Wednesday morning. OK, sure. There are dozens of voices on CNBC in a given day. Which ones should we tune out?

Steve Weiss said he sold his NBIX position after doubling up. He said he'd be "tempted" to short X, then reiterated that point at the end of the show. "Full disclosure, I voted for Hillary, like kicking and screaming," Weiss said.

Weiss said stocks could surge, but he'll wait for a pullback (Drink).

Joe Terranova, who had a quiet show, at least said all the tailwinds are behind financials.

At least things loosened up a bit at the end of the program. Pete Najarian predicted gains in XOM. Steve Weiss touted CAVM. Joe Terranova said he rang the register on SYK and NOC. Kourtney Gibson said she "firmly" believes there's going to be a dip (Double Drink). Gibson did have a good observation about this loopy infrastructure-buildout notion (which now seems to be embraced by both parties). "How are we paying for it; are we taking on more debt?" Gibson said.

Brian Stutland called 2.25% "the next stop" for the 10-year.

Guy Adami on the 5 p.m. Fast Money said the reason for the market's Wednesday surge is a "bit of a mystery to me." Tim Seymour said it's the "full sweep" and "conciliatory speech." (Dan Nathan on the 5 p.m. Fast Money said of Twitter, "I'm sick of the trolls.")

Wonder if Hillary can ‘reboot’

her political career

The star guest of Wednesday's Halftime Report was Trump backer Carl Icahn, who in a shocker, didn't talk about corporate governance but did talk about certain regulators.

The EPA has "just run amok … killing the refinery business," Icahn said.

Carl said he's "certainly happy" about the election and that it's a step in the right direction for the economy and is going to be a "major change."

Icahn conceded, "Frankly you know Donald in different speeches has said different things." Gotta agree with him there. A couple weeks ago, we heard that the Democratic nominee is going to be special prosecuted and thrown in jail, the email thing is unlike anything we've ever seen; Wednesday morning, we heard that the nation owes her a debt of gratitude for her public service (that's correct, "service" not "servers").

Carl chuckled that he "bought a lot of stock in the overnight market."

There's never anything wrong with a Carl Icahn interview, but this one was as guarded as Tom Brady's pocket, as Carl insisted "it's not my job" to opine on who should be Federal Reserve chief.

In a couple of howlers, Carl endorsed Herbalife's products and updated viewers on his thoughts about the Pershing Square chief.

"I use the vitamin thing they have," Carl said. "It's kept me from getting a cold actually. I think." Then he added, "I have no personal animosity with Bill Ackman."

Doug Cifu said he didn't get much sleep election night, but "the markets didn't break." Cifu said he hopes the transaction-tax notion is toast.

No one was carried away with as much euphoria as Nelson Peltz, who actually predicted Trump will "do everything he can to get the Democrats to buy in (snicker)," then cited an infrastructure upgrade (snicker) (Drink) as one of the "easy wins."

"Everybody is hopefully gonna get behind our new president," Peltz actually said.

[Tuesday, November 8, 2016]

Joe banking on Schumer to keep Liz Warren in check

(This review was posted well after Tuesday's Halftime and after Hillary Clinton conceded to Donald Trump.)

Jon Najarian said his sell-everything-in-nontaxable-accounts advice last week was only for those who "could not hedge," adding he got his own hedge through Wednesday morning.

"I'm gonna buy tomorrow no matter what," vowed Stephanie Link.

"Someone actually has to win," observed Joe Terranova.

Doc said he still thinks Trump is going to win, though he struggled to tell Judge what the market would be like Wednesday morning.

Doc said GPS needs to change the company name to Old Navy.

Joe said not to get excited about the HTZ comeback off the shellacking that quite frankly resembled what happens when biotech drug trials fail.

Anthony Grisanti said crude goes higher "eventually" if Clinton wins. Scott Nations said if Trump wins, it would "be bad for crude oil unless the dollar collapses as well."

Doc said he disagrees with Evercore's BBY pessimism, citing demand for gadgets.

Doc said he likes December 95 calls in KSU.

Joe said BBT, "Regions Financials" (sic plural) and USB are working and even said, "I believe in Senator Charles Schumer." Joe clarified that to say "Senator Warren is not going to be able to enact a lot of the things that she's talked about."

In another sorta-bungle of this site, VRX actually fell enough Tuesday to validate David Maris' claim that it actually has to triple in order to give Bill Miller a double from 21 and change. (We never said it couldn't, only that when Maris made that statement, it didn't have to triple.)

Oops!

omg.

Someone dealing with this page forgot the don't-make-predictions rule that was part of the contract.

As a result, we predicted (see below) a 49-44 popular vote in favor of Hillary Clinton. (Thankfully, no Electoral College forecasts.)

Which means we have to salute Jon Najarian and Josh Brown, who both predicted a Trump victory.

Maybe the best call was Jeffrey Gundlach, who nailed this months ago.

And congrats to all who voted and took part in our democracy — and congrats to the calendar, for bringing this campaign to an end.

[Friday, November 4, 2016]

And the winner is …

One of the things we've learned (barely) about the prediction market is that to be accurate, the prediction needs to be based on something that's relevant and not on the red herrings.

To use a very basic example, a quarterback should call an audible based not on the dance routine of the cheerleaders, but the alignment of the linebackers and defensive backs.

So the question of the 2016 presidential election, like all such elections, comes down to which facts matter.

How about 2.

That's the amount of "major" newspaper endorsements bestowed on Donald Trump, a shocking number that is surely an all-time low for a Republican or Democrat.

No one believes newspaper presidential endorsements actually sway readers' votes. Rather, the endorsements reflect an almost-unbelievable establishment disdain for this individual lagging even the support for George McGovern in 1972.

He also gave up on fundraising in October.

One fact that absolutely does not matter is a summer vote in Great Britain. Everyone on CNBC likes being the smartest contrarian in the room; thus the polls-are-all-wrong-now-and-Trump-will-win theory has become like when the Meredith Whitneys, Nouriel Roubinis and Kyle Basses (among many others), after making one great call, were suddenly identifying all of the world's next financial disasters, none of which derailed the U.S. stock market in the slightest.

Please note, this page is not evaluating the presidential candidates and is making no endorsement.

We're merely assessing the situation.

Clinton 49, Trump 44.

VRX still doesn’t have to triple in order to equal Bill Miller’s double

Taking up Stephen Weiss' favorite subject — the greatness of hedge funds — Kate Kelly on Monday's Halftime said there's a "newfound confidence" in the stock market.

Weiss said hedge fund managers are "very very cautious" and there could be a "very big rally going forward" because of the amount of cash on the sidelines.

Later, Weiss declared as he always does that stock picking is back no matter what the market circumstances are; "the crowds are wrong."

Joe Terranova cautioned about "rising wages and the potential for inflation (snicker)." But Jim Lebenthal said "we're so far off" from that. Weiss said the market is "not exactly" cheap.

Jim said Piper's boost of BIIB is based on Alzheimer's research that's "notoriously tricky." But he said it's cheap. Josh Brown said BIIB is appealing for investors but not so much for traders.

Joe said "most people" don't have the "luxury" to "monitor" a stock like Sarepta, therefore, "the ETF strategy is probably the best strategy."

Joe touted TMO and SYK again. Jim said biotech is "ripe" for a post-election rally.

Buying the AMZN dip (cont’d)

Kevin O'Leary on Monday's Halftime Report said he likes DIS "because everybody hates it."

O'Leary said ESPN is baked in and that Chinese theme parks are "packed." Jim Lebenthal questioned if the DIS dividend is too low. O'Leary said it's below the S&P but they could do M&A and he trusts the management team and "maybe" there will be a dividend hike in 2017.

Josh Brown said "I genuinely hope" DIS has a disappointing quarter that will allow a buying opportunity.

Stephanie Link said she bought EL on the earnings hit. Link also touted UNP and APD. "I think you have to be patient with Amazon and buy these dips (Drink)," Link added.

Link told Joe Terranova she prefers AMZN on a pullback over EBAY not on a pullback. Joe said he believes in a P sale.

Josh Brown said to avoid TWNK as well as its signature product. Calling the IPO a SPAC, Brown said, "Typically these don't go well." Brown said his generation took Twinkies to school, but today's parents won't let their kids do that.

Judge for some reason aired John Oliver's takedown of Herbalife.

S&P surges 2% in a day just after Doc tells viewers to unload stocks in non-taxable accounts (a/k/a How are those VIX 40 calls doing)

The stock market on Monday served up a facial to members of the Halftime crew and many others predicting the most overdone contrarian trade in recent memory.

Stephen Weiss claimed Monday there's a "free pass" in stocks until Wednesday morning but said we're still within the margin of error for polls in which "anything can happen."

Yeah, right.

Jim Lebenthal said he's "got some cash on the sidelines" and that "there could be a Brexit-like surprise (Really?????) (MegaDrink)." Jim said the risk of a Trump presidency is that international relations could get "dicey" (2nd business day in a row Drink).

John Harwood, who apparently gets paid for every reference he makes on CNBC to "North Carolina was in Mitt Romney's column in 2012 but Hillary's leading and Donald Trump absolutely needs it" (not exact quote) (SuperMegaDrink), said a Trump surprise was possible, but it would take an "unprecedented failure" across the board in polling.

By the way, for those believing the Brexit hype among CNBC predictions recently, note that some people saw a market-rocking event from Jackson Hole and a "slam dunk" September Fed hike.

Jonathan Krinsky threw a twist into the market/election prediction, stating it's about the reaction to the reaction. Weiss told Krinsky that in Britain, the exporters did OK after Brexit and the small caps slumped as predicted, so to "rely on the reversion trade is a mistake."

Tom Lee said "we're poised for a rally" because stocks are "oversold," and he doesn't see a "huge selloff" no matter who wins.

Judge, thankfully smiling again after Sourpuss Friday, demanded of Lee, "Who's to say that this is the tell vs. the 9 days that went down." Lee said he agrees with Krinsky that you can't predict the future. Lee said he could see 10% from here in the S&P, enough to put a "23 in front of it."

Joe Terranova tried to get Krinsky and Lee to warn about oil. Krinsky said copper and metals are breaking out.

The biggest bust obviously was Doc's advice to viewers on Friday to dump stocks in nontaxable accounts to avoid the looming 3-5%-or-worse pullback this week. (He wasn't on the show Monday; picture above is a file photo.)

However, Doc nevertheless correctly advised on Friday not to play the levered VIX products because the VIX tends to break very quickly, a point that Steve Weiss said on Monday prompted him to unload his own VXX stake (which he originally called a "hedge;" so much for the hedge), stating he's "better lucky than smart."

Joe touted "Regions Financials" (sic plural) and BBT and said we're not seeing the follow-through in energy.

Josh Brown said the IYT was breaking out and that GS was at a 52-week high and that health care was surging even as the market seemed to be anointing Clinton.

Weiss said he added LPLA.

Weiss said he knows Tepper wasn't expecting the S&P to climb 43 points on Monday.

"There is no playbook," Weiss said, finally getting to what should have been the lede of the program 15 minutes into it.

More from Monday's Halftime, and this page's Tuesday prediction, later.

[Friday, November 4, 2016]

Who peed in Judge’s Cheerios?

Yeesh.

Judge obviously woke up on the wrong side of bed Friday.

The first notable sneerage was mostly understandable, about Doc's 3-5% selloff (more on that below). Then came the volatile trading report on WFM.

Judge for some reason snapped at Jim Lebenthal for simply mentioning the term "spike."

"Give me something on the stock!" Judge snarled, insisting he wasn't asking anyone to be a "mind-reader."

Jim calmly said WFM trades at a premium in a space with no barriers to entry and warned the stock could go lower.

(Steph Link actually suggested TGT should look at WFM. Josh Brown rightly questioned, "They want those leases?" Link said they want "the quality" and the "name brand.")

Anyway, later, Jim Lebenthal politely mocked SBUX's claim that the election might affect sales. Jim called it "possibly a value trap," then he started to call it a "great company."

At that point, out of nowhere, Judge scoffed, "We don't need to qualify it as that."

Finally, Jim suggested VIAB might have something to say about the M&A scene. Judge scoffed, stating CBS already "gave you what you needed to know."

Here come the tanks — panel scoffs that Doc can predict 3-5% pullback next week

Well, if nothing else, it's a trade.

Jon Najarian on Friday's Halftime Report said that in non-taxable accounts, he'd be selling right now because he expects a 3-5% selloff next week.

However, he said that in taxable accounts, the tax ramifications aren't worth it (which tells you something about the depth of his belief in this selloff).

Stephanie Link was in disbelief, stating, "So but who could time it this well Jon? Maybe you can. But guess what? I don't- I couldn't."

Judge was even more incredulous. "For a 3 to 5% pullback, you want people to make that move. And, and then, and, and then, time it well enough to get back in?" Judge asked.

"Most people are more concerned about losing money than about making money," Doc explained.

Jim Lebenthal said it makes sense if you're talking about a 10% drop, but, "You're not gonna have a 10% decline."

Josh Brown said, "There's a higher chance of one of those types of corrections around Inauguration Day, when the tanks are rolling down the street, um, to celebrate."

Judge asked Doc to "sort of clarify" what he's saying, because "advice from this, this desk is, is taken seriously."

Doc cited Jeff Gundlach's forecast and Citi's suggestion of a 5% selloff, adding, "I'm not saying it stops there, Judge," even though he previously said 3-5%. Then he said people with no dry powder "don't get any benefit" when stocks fall to appealing prices.

Chuckles on Power Lunch

over Sully’s chair

"When the VIX breaks, it breaks very quickly," said Jon Najarian on Friday's Halftime, stating he wouldn't play "the levered VIX ETFs," presumably even the one Weiss was talking about a day ago.

Stephanie Link said, "You certainly have to have some dry powder," but she's not selling.

Jim Lebenthal said the market isn't worried about Trump's potential effect on business, rather, "It's worried about international relations with Trump." Jim said, "Over the next few days, you should be buying."

Judge insisted the market has been "teetering."

Late in the program, Josh Brown made an election call: "I think he is gonna win," Brown said.

"I think he's gonna win," Doc agreed.

(See, that's the trendy call now, all these folks smelling a Brexit situation just like how everyone had identified the next bubble in 2009, except how do they know that it doesn't mean Clinton will win by 9 percentage points instead of 2?)

Judge reported that TWTR's board is not forcing Jack Dorsey to choose between that company and Square. (For those awaiting news reports on trees falling in forests.) Josh Brown had perhaps the line of the week, stating, "the one thing they haven't tried" is having Dorsey run 3 companies. Doc shrugged that it wouldn't matter who the next TWTR CEO is unless it's someone like Elon Musk.

Jim Lebenthal said he wasn't going to mention JCP if nobody else mentioned AMZN.

Doc said there was a big buyer of the BABA November 101 calls who sold the November 105s.

Stephanie Link said to stay long EOG.

Josh Brown said TWLO will make "outsized" moves; he's not in it but maybe it'll start going up.

Doc tried to take a hopeful lap on his $12.50-$13 GPRO call spread that he suggested might still work out.

The 5 p.m. Fast Money crew conducted a provocative chat with Michael Moore, though Moore did seem to be saying that everybody can't stand Trump and everybody's gonna vote for him at the same time. (We handled Mel's birthday on our home page.)

Evidently not 100% sourpuss, Judge gave a shout-out to Sandy Cannold.

[Thursday, November 3, 2016]

They’re catching on — Rich Greenfield barely scratches the surface of a point made here many times

Lo and behold, on Thursday's Halftime Report, someone actually touched the 3rd rail of the FANG stocks.

Rich Greenfield told the gang, "Jimmy Fallon puts his contep (sic) up — up on Facebook, gets tens of millions of views, and gets paid nothing."

As Wade Garrett says in "Road House," exxxxxxxactly.

Unfortunately, Greenfield's next comment exemplifies the bizarre lack of grasping what's going on here.

"You know, the question is, like, how is, you know, how long is that sustainable?" Greenfield said.

See, Facebook, Google and Amazon, not to mention Wikipedia, benefit enormously from the free labor that users willingly provide.

If Facebook had to pay you for your posts or Amazon and Yelp had to pay you for reviews or Google had to pay you for your search terms and IP location, um, the gross margins would take a bit of a hit.

If all of those users instead spent 45 minutes a day volunteering to work for free at M and JWN and DKS, you'd start seeing brick-and-mortar go through the roof.

Start a magazine, and imagine the response you'll get asking free-lance writers to write articles for free. Start Facebook, and expect a deluge of free material. It is what it is.

To answer Greenfield's question, it's evidently sustainable forever. There's absolutely no public concern over these business models. Nobody's demanding his or her share of these monstrous AMZN/FB/GOOG revenues. Nobody on the Halftime Report or Fast Money even mentions it.

The entrepreneurial lesson here is obviously devising a product that suppliers will provide for free.

Anyway, Judge called Greenfield's July downgrade of FB "a little early … but correct." Greenfield said it's hard to see how FB monetizes long-form video at the same rate it monetizes its newsfeed.

Greenfield said FB is chasing Snapchat, but it'll be a "real challenge" to maintain FB's own rate of growth.

Stephen Weiss said FB "can't not" (sic) be in media. Greenfield said the newsfeed has been a "printing press" but that video isn't the same in terms of monetization.

Greenfield indicated he just wants the stock lower. "We're looking for a better entry point," Greenfield said.

Judge tried to claim FB's quarter and reax seems like UA, but the panel wasn't buying it. "Major differences," Weiss said, calling Facebook the "gorilla in the room."

Slowing down his statements for effect, Judge insisted it's about "the growth rate of a great company coming down."

Josh Brown said FB gave longs the "green light" to take a profit. Brown said the company telegraphed heavier spending and a reduced ad revenue growth rate.

Kevin O'Leary argued that FB needs to think about a dividend. Weiss said that's insignificant and that waiting for a dividend could cause people to miss the stock.

Jim Jordan wasn’t asked if he joined the masses buying AMZN on the pullback last week

Judge on Thursday's Halftime was interrupted by a curious John Harwood interview with Jim Jordan that didn't seem to have anything to do with the stock market.

Jordan said there's a "great chance" of a Trump victory. Judge noted there was a "lack of answers" from Jordan to Harwood's questions about supporting Paul Ryan.

Stephen Weiss thankfully said, "Brexit is not comparable" to the U.S. election; "this is more black and white." Then Weiss even quoted Rodney King.

Kevin O'Leary argued that polls have a margin of error of 7%.

Judge said it's an issue of "potential chaos in the capital." Josh Brown agreed with O'Leary to buy the market if it plunges on a Trump victory. Weiss said if the market pops on a Clinton victory, he'd "short it."

Not exactly making a clear point about whether to buy or sell stocks, Weiss predicted a "new Brexit in terms of the trading volume."

Kevin O'Leary said tech isn't in trouble, but advertising might be.

Jon Najarian said we need to be "very" concerned about oil's slide and said it's "eerily similar" to the OPEC meeting a couple years ago when the oil market began to fall apart.

Judge started to say there's been a "stelly" (sic) selloff in stocks.

Sarat Sethi said he's holding WFC but isn't sure about adding. He called QCOM "definitely a buy."

Sethi predicted airline comps will start getting better.

Anthony Grisanti said gold will do worse than silver. Jeff Kilburg said it won't take 108 years to see 1,400 gold.

Steve Weiss said he owns VXX not just as a hedge but as an "outright investment."

Kevin O'Leary, who had a quiet show, said the market cratered 28% after Ronald Reagan's win. Judge asked O'Leary if he was predicting a Trump victory. O'Leary said he's not.

[Wednesday, November 2, 2016]

Still trying to figure out the ‘piling on, piling off’ of the ETF world

Kate Kelly opened Wednesday's Halftime Report stating Paul Singer is now actually concerned about "accelerating inflation."

Stephen Weiss said he's got his fewest positions in the stock market "in modern memory."

Joe Terranova said it's "obvious" that everyone's a little "suspicious" and "cautious" about the stock market.