[Monday, July 31, 2017]

Judge quizzes panelists on best big-bank stock of the year; good thing he didn’t bring in Dick Bove for a 10-year assessment

In a curious call, Donald Trump hired Anthony Scaramucci as his communications director Brian Wieser told Judge on Monday's Halftime he rates FB a sell because "it hasn't gotten a lot better in the last 8 months."

Wieser outlined several reasons for his sell, which makes us skeptical, but he made a couple of interesting comments about the "viewability" of ads and the looming "saturation point" for digital advertising.

This page's readers are spared those problems. #free

Stephen Weiss congratulated Wieser for taking a stand rather than following the company higher. But he pushed back on the fundamentals, prompting Wieser to push back on the "viewability" of ads.

Jim Lebenthal said of FB, "if you own it, you continue to hold it." Jim said he doesn't get Wieser's argument that TV is a better way to advertise.

Meanwhile, Judge decided that SNAP hitting a new low constituted "news." And with Ross Levinsohn around, why not. (This writer is long SNAP.)

Levinsohn said the Street is going to be focused on Snap's active users and faulted the company for not expressing a positive narrative. Josh Brown said app downloads are "atrocious," down 22% in the last 2 months, so why would anyone think the active user numbers will be strong. Judge cut in and told Brown that he's making Levinsohn's argument.

Weiss disagreed with Levinsohn that SNAP should be saying anything now, suggesting any good news will surface in the report. Levinsohn said he totally disagrees, that the company needs to talk about what's working and that it's been "completely silent" even though "I bet you there's something good happening there."

Weiss made a good point, that Jeff Bezos never addressed the critics of his stock. Levinsohn retorted, "Different, completely different story."

Elsewhere, Joe Terranova said the upside for big banks is still there. Josh Brown suggested you could effectively own C just by looking at the chart and not knowing anything.

All the panelists seemed to know that the best big-bank stock of the year is C.

Joe said of HTZ, "Don't touch it."

Josh Brown said Morgan Stanley upgraded GPRO with a $7.50 target, below its price.

Guy Adami on the 5 p.m. Fast Money predicted a "significant bounce" for SNAP in the short term though the company is "destined for failure."

[Friday, July 28, 2017]

Howard Marks apparently said the same thing in 2011 and 2013

Scraping for material, Judge led Friday's Halftime with Robert Shiller's observation from a day ago that the 1929 crash was preceded by low volatility.

Josh Brown wasn't having any of it, stating Shiller is a "genius," but added, "Bob Shiller has been making cautious comments pretty much his entire career. Um, and then he'll, you know, say, 'Oh by the way, I'm just indexing anyway.' … So, put that aside."

As for "The Memo" from Howard Marks that prompted Shiller's appearance a day earlier, Brown said that in Marks' 3rd paragraph, he wrote, "By the way, I said the same thing in 2011."

Steve Weiss said Marks made the same forecast in 2013 also. (See, that's why we said a day earlier (hit PgDn a few times) that if a meltdown happens in 2 years, Marks looks like a genius; if it doesn't, (virtually) no one will remember anyway.)

Weiss shrugged that Thursday was no "selloff." Judge insisted there was an "interesting reversal."

Weiss said it's a mistake to time the market; he's sitting in "about 30%" cash.

Weiss talked about pluses and minuses of the stock market and even mentioned Greece NOT issuing debt. (Yes. CNBC hasn't sent MCC there to report on the green lasers being flashed outside the parliament building.)

Mike Farr dialed in and cited a comment from Chuck Prince (haven't heard that name for a while) about "When the music's playing, you've gotta dance," perhaps signifying pre-2008 euphoria.

Jim Lebenthal twice said, "This is a stock-picker's market."

Jim says his channel check has found strength in JCP’s women’s apparel

In the 15th minute of Friday's Halftime, Judge brought up AMZN.

Stephen Weiss said there's no guarantee of a better entry point in AMZN, so if you want the stock, buy it now.

Referring to Howard Marks' FAANG skepticism, Weiss said a "value investor" such as Marks isn't going to be on board the FAANGs anyway. Judge punched back that Stephanie Link bought AMZN. (omg … the GREATEST stock purchase in the show's history.)

Judge asked Mark Astrachan some good questions about what's going on with SBUX; Astrachan mostly just offered the company's explanations but said perhaps there's a "share shift" going on where people are choosing independent coffee shops.

Judge said that in New York and San Francisco, "independent coffee shops are literally on every block."

We doubt it's really "literally."

Weiss said someone who has "250 locations in the Midwest" (presumably SBUX locations) says "traffic is way down."

In other matters, Weiss said, "I don't even know why cigarettes are still legal."

Jim Lebenthal said INTC has "a lot more room to run."

Josh Brown said there's no reason to get out of EXPE.

Weiss asked American Airlines CEO Doug Parker about fuel costs and whether he'd hedge again. "We don't feel the need to hedge," Parker said, "because we think we have a natural hedge — in our revenue stream."

Phil LeBeau, who began the interview with Parker, said Parker got a World Series ring from the Chicago Cubs.

Dana Telsey said JCP has "a lot of catalysts" for the back-to-school season.

Jim Lebenthal said that, based on his own observation at a Michigan store, JCP might be improving on "women's apparel and handbags."

Josh Brown scoffed, stating SHLD started bouncing the same time JCP did. "This is just short-covering; the entire retail sector hit a low in June," Brown said.

Steve Weiss said advertisers might abandon SNAP because they've seen the stock plunge. (This writer is long SNAP.)

Jim Lebenthal's final trade was PFE for "a little pop." Stephen Weiss mentioned AKAM.

[Thursday, July 27, 2017]

So if the crash happens within 2 years, he can say he called it; if not, nobody will remember anyway

Howard Marks played the financial media like a fiddle, and Judge fell for it like a ton of bricks.

The first 20 minutes of Thursday's Halftime Report was spent on "The Memo."

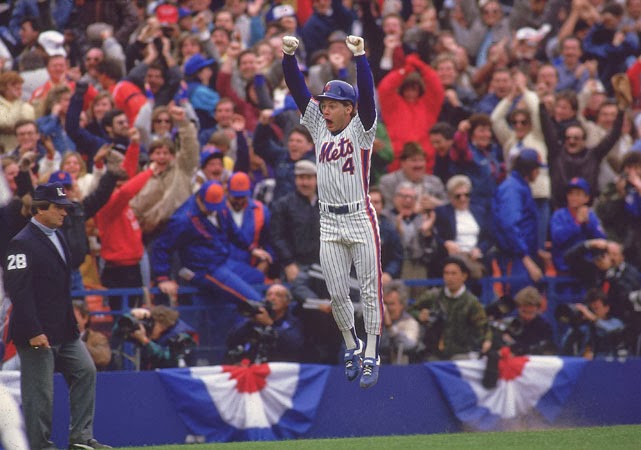

"The Memo" is apparently the title of a "warning" … of something … during this 1986-Mets market … from Marks.

The gist of it, apparently, is that Marks said he'd prefer to be cautious too early "rather than wait until it's too late."

Judge of course responded to this vague pronouncement like the traders in "Wall Street" who heard "18 for 400,000" in the BlueStar pit, reciting Marks' doomsday stats and asking panelists if the end is indeed near.

Jim Lebenthal tried to have it both ways, stating, "Well, he is right in concept. Now this is not bubble territory. … I think he's wrong to execute right now."

Jim for some reason apologized to gorjus Leslie Picker for saying this doesn't look like a "real rip-your-face-off" bear market ahead.

Leslie Picker said the difference between previous generations' hot "superstocks" and the FAANGS is that, for the FAANGs, "these companies do have a pretty significant moat around their businesses at least for now," even citing troubles of Snapchat (sigh) (this writer is long SNAP) and Blue Apron.

Grandpa John Fichthorn said Marks' message is "everything I believe in right now." He said we're "definitely at lofty levels" on "any historical measure." He mentioned 1930s, 2000 and 2007.

During these ridiculous exercises (how'd Carl's "Day of Reckoning" work out?) (what about Marc Faber in every appearance) (when was the last time you heard Meredith Whitney's theory on the wealth of the country shifting from coasts to flyover country), no one ever mentions that Fed (and presumably congressional) precedent was set in 2008, the Fed will act aggressively as soon as any downturn's in sight, there's a permanent Fed put. What would really be an empty-the-account-for-cash moment would be A) $12 oil, B) a currency crisis, C) notable war.

Marks is a great investor who obviously has a lot more money than this website. Anyone who takes this advice and sells the '86 Mets in August is a chucklehead.

‘Housing bubble’ appeared on nytimes.com 18 times in 2004, 13 times in 2002

Judge on Thursday's Halftime actually brought in Robert Shiller and asked Shiller if he shares some of Howard Marks' sentiments.

Shiller said, "Yeah I have for a few years now, and so, uh, I'm wondering why he came out with it right now."

That's odd. Just 2 months ago (visit our archives in the right rail), Shiller sort of told Judge the stock market could (that word supposedly was the key, according to Jeremy Siegel, who said he spoke to Shiller about the interview afterwards) rise 50%, though it was anyone's guess as to whether that was a 10-year timeline or less than 10 years.

Judge actually said that Shiller wrote, "One indicator has you lying awake, worried." (For those who thought that question on CNBC is always a figurative one.)

"I think that it actually relates to worries that people have that they might not bring up in discussing the stock market," said Shiller, who added this is a "time when people are worried about technology … a deep, underlying fear." (Would like to know how a Yale prof measures the level of worry about technology among people.)

"It doesn't matter what job you have, there's always some robot out there about to take it. And that is just relentlessly in the media," Shiller said. (Is there a robot set to replace Judge? In and of itself?)

But, as for the market, "It might go on for years like this," Shiller said.

Shiller also provided history lessons. Of 1929, he said, "The crash kind of triggered itself." He said there may have been "underlying fears" at the time, but those are "hard to document." (Translation: Judge wasn't on TV every day in 1928 asking people about the "Day of Reckoning, in and of itself.")

Shiller said that if you search for "housing bubble" in 2005, "Practically nobody, almost nobody said it," though he said "late 2005," it started to appear.

Grandpa John Fichthorn said he's curious about factoring in "adjusted earnings." Shiller chuckled, "I don't factor those in," then launched into a brief history of corporate accounting.

Judge said Marks thinks bitcoins are "perhaps even a pyramid scheme."

Absolutely no consumer ever buys anything except the ‘experience’ of Amazon Prime

Mark Mahaney on Thursday's Halftime said to (big surprise) stay long FB; "estimates are up more than the stock is."

Mahaney admitted he's got a sell on TWTR, but he doesn't want to write it off.

Mahaney said he doesn't see a "gap-up opportunity" for AMZN into the print, a good call (this review was posted after market close).

Jim Lebenthal said he doesn't feel any "sadness" about getting out of BA much too early. He said the stock is priced for perfection.

Grandpa John Fichthorn grumbled that at Boeing, "A lot of cash was pulled in this quarter from deferreds and from customer advances. So, that's not really cash."

Pete Najarian said a bunch of calls were being bought in airlines.

John Fichthorn had "no opinion" on Ackman taking a stake in ADP.

Jeff Kilburg thinks gold will stay over $1,250. Scott Nations said gold will "bounce around" in the 1,215 to 1,315 channel.

John Fichthorn touted his ANET short and called the stock "pretty rich" and suggested it's "personal" for John Chambers to "put these guys out of business."

Jim Lebenthal said he's sometimes accused of being a "dinosaur."

Pete Najarian's final trade was C and DB; Jim Lebenthal called INTC a "sleeper long."

[Wednesday, July 26, 2017]

Professor Siegel mentions Bob Shiller, but Judge doesn’t bring up the 50% ‘call’

Wednesday's Halftime Report began pretty much as they all do these days: Everyone's reasonably bullish, vol's probably gonna remain low, the market will keep going up by rotating leadership, the banks are INCREDIBLY AWESOME, active management will start to outperform, etc.

So we sorta tuned it out.

Jeremy Siegel, who thinks tax reform is giong to happen, did say 10% higher for the rest of the year doesn't sound like Judge's "euphoria," though 20% maybe would.

Josh Brown suggested BIIB might break out, and then we could see 350, 375 "before there's any real resistance."

Rich Saperstein said the risk of an executive order on drug prices is "overstated." Judge questioned the impact of a headline, "in and of itself" (sic redundant/useless).

Josh Brown said telecoms are beginning to become media plays, and that's not so bad. But Pete said they're "leveraged beyond words."

Pete Najarian said September 135 calls in WYNN were being bought. He said he's in the stock, not calls.

Addressing DPS, Josh Brown said, "Beverages is just a bloodbath."

Brown said the CMG dead-cat bounce is already being sold. "I just don't think management's very good either," said Steve Weiss.

Weiss said he bought AKAM calls on the "Greater Fool Theory."

Scott Nations said the RSI says crude is "not yet overbought." Jim Iuorio doesn't think it will cross 50.

Josh Brown shrugged that FB is "the best stock on the planet."

Pete Najarian touted BABA on "huge call-buying." Stephen Weiss said he owns FB stock and calls but will sell his calls. Josh Brown's final trade was AMGN, and Rich Saperstein said ABB.

[Tuesday, July 25, 2017]

Karen questions why KORS wants to buy Choo at high multiple instead of its own stock

On Tuesday's 5 p.m. Fast Money, Karen Finerman, dynamite in gray, said of KORS, "I'm not a giant fan of this acquisition," questioning what it means that KORS isn't buying back its own stock at a 10 multiple while it's buying all of Jimmy Choo at a 27 multiple.

On the Halftime Report, Steve Weiss said the Choo deal is what we'll be seeing in this space.

As for retail, Rob Sechan said to avoid "those companies that will continue to be completely disintermediated by technological evolution."

We'd have to agree, it's probably a good idea to avoid any company that's being completely disintermediated.

But Judge asked if that sentiment has been "overdone" among retail stocks.

Jim Lebenthal insisted "the bottom" in retail was 2 months ago.

Kari Firestone said if GOOGL were down 4%, she'd buy more, but it was only down 3%. Judge said "But seriously," is there a difference between 4% and 3%. "I mean, really," Judge said.

Pete really tries to assure viewers that somebody buying a bunch of VIX calls is ‘far more of a hedge’

Joe Terranova was asked by Judge at the top of Tuesday's Halftime Report what he thought about the day's market action.

"I find it all impressive," Joe said.

Rob Sechan said, "The pillars of support are still in place."

Jim Lebenthal said with a straight face, "This should lead to a good, active, stock-picker's environment."

Pete Najarian said he looks at options bets for the VIX as "far more of a hedge" (he used that term 3 or 4 times, seriously) than a downward bet and even mentioned 50 Cent.

Steve Weiss grumbled, "I'm not sure the VIX is what it was."

Weiss said Steve Easterbrook "pulled some other levers" besides all-day breakfast.

Weiss said CAT's management "underpromised and overdelivered" for a change while the previous management "really had no clue" about the "dynamics" of their business.

Jim Lebenthal cited MMM as an example of how a stock can still give back if they "trip up." But Guy Adami on the 5 p.m. show said MMM was "unduly punished."

Back on Halftime, Steve Liesman reported survey results on what people think about what investors think that hardly proved or showed anything. #wasteoftime #talkaboutGratefulDeadinstead

Liesman said he's "pretty sure" that Gary Cohn to the Fed is not yet a done deal.

Joe Terranova said that partly because of the presence of Anthony Scaramucci, he's "more than comfortable" that if Yellen is replaced, the "right person" will get the job.

Still trying to come to grips with Jim Gorman as ‘the Babe Ruth’ of money-center banks

Pete Najarian on Tuesday's Halftime fell into the timeline trap on UA.

Pete stated, "If you're willing to hold it for 3 years, then I think you've got a great runway for ya. But if you're actually looking for something in the next 6 months, couple of quarters, I don't think it's there, Scott."

That makes zero sense.

The stock is either going up, or down, or nowhere. The stock doesn't know or care whether its buyers have a 3-year plan.

If it's not a short-term buy, then it's not (yet) a long-term buy either.

Stephen Weiss said the UA multiple is "lunacy." Joe Terranova said there's upside risk, that a "significant bounce" in UA is possible.

Weiss said he bought the XBI on Monday.

Jim Lebenthal said it's "less and less likely" that Obamacare will be "wholesale" thrown out.

Pete Najarian actually said a buyer of SMH August 84 puts is probably looking for downside and isn't hedging.

Pete said "something is going on here" in SGMS, citing January calls.

Judge slammed for ‘funeral look’

Brian Stutland on Tuesday's Halftime said he sees more upside in copper; "we could be looking at $3 here."

Joe Terranova said materials can work now "for a trade." Steve Weiss said he agrees, but there's still "too much capacity."

Jim Lebenthal cautioned there's a lot of things that can trip up BA.

Weiss said he's in CMG puts; that wasn't a great trade late afternoon. (This review was posted after market close.)

Joe said he's adding to CXO. Weiss likes AKAM. Jim touted C, and Rob Sechan likes XLE.

Weiss said Judge has the "funeral look" day after day after day.

[Monday, July 24, 2017]

Karen: ‘Something’s kind of off’ in the sporting goods space

Judge kept warning viewers of Monday's Halftime that they were about to get a statement from Jared Kushner.

It — like the Day of Reckoning — didn't happen (during the program).

So Judge spent the hour taking the temperature of the panel.

In a notable understatement, Joe Terranova said it's "important that the FANG stocks deliver."

Paul Richards said the dollar is "about what Washington's going to do." He predicted "consolidation" for a couple months.

Erin Browne said the dollar will continue to weaken, then, Pete Najarian-esque, asked herself a couple of questions.

Stephanie Link has been buying EBAY.

Joe said he's "not ready" to buy P.

Pete Najarian said someone sold SGMS calls at a profit and is now buying the January 35 calls.

Josh Brown said "Today provides that opportunity" for HAS, but he cautioned not to get "hasty."

Joe said there are better names for energy's recovery than HAL.

Stephanie Link said the reaction to SWK earnings was "silly."

Erin Browne said "you should be loading up and buying" industrials.

For final trades, Josh Brown pounded the table again for ALB (Zzzzzzz). Steph Link said HDS, Erin Browne said EEM, and Joe said MS.

We weren't going to do any pictures, but on the 5 p.m. Fast Money, Karen Finerman was soooooooo gorjus in fabulous new hairstyle and new outfit, we couldn't refrain.

Karen, a chatterbox on this program, said GOOGL had a "good quarter." She lamented being long FL but, pointing to the Hibbett revenue problem, stated, "The carnage this created in the entire space is many, many, many multiples of that, so something's kind of off there." (This writer is long FL.)

Guy Adami said to take profits in NKE.

[Friday, July 21, 2017]

Josh Brown: Scaramucci getting CNN reporters fired was the ‘clincher’ for Trump

Friday's Halftime Report was a blast from the past.

Panelists talked about stocks — but the main event was the breaking news that former longtime CNBC contributor and Fast Money semi-regular Anthony Scaramucci has somehow, after a considerable setback in January, ascended to a top White House position.

CNBC's hardy political reporter Eamon Javers declared, "This would be a significant political comeback for Anthony Scaramucci," except Scaramucci didn't previously have an official political stature, but nonetheless, it's an impressive rebound from a tough January and dubious experience at Davos that nearly knocked him out of the presidential circle.

Josh Brown opined that Scaramucci recently taking on CNN and "actually having 2 reporters get fired" had to have been "the clincher" for this White House.

Javers made a point of reading a note he received from a source, explaining, "This is happening with some resistance uh from people close to Spicer if not to (sic grammar) Spicer himself."

Later, Javers said his source carped, "This is a joke. Trump wanted Scaramucci on television as a surrogate for the White House and wanted to give him more of a formal title."

Judge offered, "Anthony Scaramucci's not afraid to take people on."

Judge added, "I've been trying to get in touch with uh, Anthony, haven't been able to do that. Uh, he may be a little busy at the moment."

Stephen Weiss said that in "every" Wall Street trading room right at that moment, "Thousands and thousands of dollars are being wagered as to who's going to play Anthony on 'Saturday Night Live.'"

On the 5 p.m. Fast Money, featuring Mel's sharp new hairstyle, Guy Adami called the hiring/elevation of Scaramucci a "home run," with consensus backing from the panel.

Weiss: Markets would prefer president who’s more ‘stable mentally’ than Donald Trump

Then again, does Anthony Scaramucci know what he's in for?

Steve Weiss on Friday's Halftime bluntly suggested this might not be a 4-year president, stating if Donald Trump is impeached or resigns, "the market would trade higher," because we'd have someone "who's more stable mentally in there."

Jim Lebenthal asserted that we're in a "meltup," but Weiss challenged that term, stating this is "more of an orderly progression going higher," not a "meltup," which to him is 2% in a day.

Jim Lebenthal said the market leadership is broadening out, and maybe telecom will start participating.

Mike Wilson, who resembles Peyton Manning, said "I'm feeling very good" about the stock market, citing in part interest rates remaining "pinned."

"The Europe trade is still on," said Kevin O'Leary.

Josh Brown singled out GILD as having "tons of room to the upside," and then CELG; "this just looks absolutely amazing."

Judge wanted panelists to rave about MSFT and MCD. Pete Najarian hailed Satya Nadella's leadership as driving MSFT. Pete said MCD under Steve Easterbrook "started to care more about the customer" and pointed to (yes) all-day breakfast.

Kevin O'Leary said Microsoft is the "premier license for every seat in a small company." But volunteering a different name, O'Leary said GE is "where money goes to die."

Jim Lebenthal called GE a "value trap" and said it has been for a long time.

Jim says an analyst should be applauded for making the wrong call

Stephen Weiss and Josh Brown on Friday's Halftime said BTIG & Atlantic Equities analysts did the right thing by lowering JNJ from holds to sells.

Jim Lebenthal said splitting up JNJ would put "some life into this stock."

Jim said to "applaud" the Berenberg analyst's courage for his WFC sell, which is "not just a wimpy sell" but a $35 target.

Even so, "I don't think it's the right call."

Josh Brown said he'd rather buy OXY when it's going up, and that it's going to follow the price of crude.

Stephen Weiss said TXT is in a tough space but will still participate in a growing economy.

Pete Najarian said September 92.50 PG calls were being bought.

Jim Iuorio said gold got the "green light" from Draghi on Thursday; he plans to ride it to $1,300.

[Thursday, July 20, 2017]

Mel bungles Fast Money opening (as Karen gets deeply philosophical)

She looked great — but it was a teleprompter train wreck.

Melissa Lee on Thursday's 5 p.m. Fast Money said at the opening, "First we start off with the big story of the day. After 9 years in prison, the parole board (sic misplaced modifier) (apparently not covered in Harvard English classes) voting today that O.J. Simpson will be officially released in October. Just kidding. Just kidding. Here's the real big story for us today (sic redundant word): It's Amazon's world, and we're just living in it."

1. She said "just kidding" as though the Simpson news were false. It wasn't.

2. The parole board didn't spend "9 years in prison."

Whoever writes this material needs to work on the basics.

The only thing saving this disaster of an intro was Karen Finerman appearing in stunning white. (And the hit from CNBC superfox Deirdre Bosa.) (And, to a lesser extent, Guy Adami's spectacularly hilarious expression deftly caught by the cameraman when Dan Nathan said "I know you like Dick's.")

But then there was this: "What is the ultimate end game (sic 1st of those 3 words redundant) for Amazon," asked Karen. "I doubt it's very much about money at this point. You know, how much money do you possibly need."

Seriously? Amazon doesn't care about revenue very much?

The "end game" question is an outstanding question. Not just for Amazon but … virtually every human and every entity.

For example, what is Karen's end game … the next Warren Buffett … the next Maria Bartiromo … the next Harvey Weinstein …?

We don't know. It's never really been discussed on Fast Money.

(She's the one who brought it up.)

SNAP got its daily CNBC spanking on Fast Money. (This writer is long SNAP but has emotionally written it off.) (#gofacebook #ohjoy) Because its first quarter was the most important company quarterly report in history.

A day earlier, Kayla Tausche called Melissa "Michelle" on Wednesday's 5 p.m. Fast Money.

‘Definitely upside

and downside’ in UA

On Thursday's Halftime Report, Jay Sole of Morgan Stanley predicted NKE's North American growth rate will start to improve "after this quarter." He has a 68 target.

Josh Brown said the "new normal" for sporting-goods clothing is "more of an all-day, um, situation." (So wear your track suit to breakfast.)

Judge asked if the worst is over at UA. Sole said the stock has "adjusted" to the "realities" of the company.

Then, in a phenomenally bold call, Sole said, "There's definitely upside and downside from here on Under Armour."

Joe Terranova asked if LULU bottomed at the end of May. Sole said he doesn't cover the name; Kimberly Greenberger does.

Jim doesn’t want to be ‘sanctimonious’ (but he’s no stepchild)

On Thursday's Halftime Report, Judge mentioned "Amazon" in less than a minute, then launched in to the day's excuse for bringing up the name.

Judge curiously stated, "Sears is gonna begin selling its Kenmore brand and appliances (sic redundant) on the shopping site," and of course "the shopping site" was confusing (whose shopping site?) instead of just saying "Amazon" again. (But it all wasn't as confusing as Mel's opening.)

Josh Brown said the spread between online-shopping multiples and brick-and-mortar multiples has never been wider. Citing NKE, Brown said the "reality of life" is that sometimes you have to "partner with Jeff" in order to do the online thing right.

The only thing about that, Weiss was recently trumpeting how great it is to buy things on nike.com.

In the purebred portion of the show, Jim Lebenthal said it's "indisputable" that "more people are buying online than in stores."

Jim said he hasn't done his research on HD.

"You've gotta do a lot of research to know if you're gonna buy Home Depot down 7 bucks or not?" Judge asked.

Jim said, "I don't wanna be sanctimonious, but, I do a lot of research before I buy a stock."

Judge said the president has thrown "fireballs" at Jeff Bezos.

Jim said, "Home Depot is a little bit immune to this."

Josh Brown pointed out HD's high multiple.

Joe Terranova said, "I wouldn't buy Amazon here."

He added, "That disruption is going to lead to someone finally saying, 'OK, we are going to go out and we are going to try and compete against Amazon.'"

Joe said HD and LOW began falling after quarterly earnings in April; he'd wait to buy until after August earnings. He didn't express interest in WHR but said "this is an opportunity in Best Buy."

Josh Brown said there's "no other retailer" with Amazon's financial/logistics capability to deliver the product.

How come Judge didn’t ask Stacy Rasgon for his ‘best superlative’ about QCOM?

Stacy Rasgon on Thursday's Halftime Report said the QCOM licensing results (Zzzzzzz) were even weaker than people thought.

Judge asked Rasgon why he didn't just rate the stock a sell rather than market perform. Rasgon didn't answer the question but only sounded like he was answering the opposite question, stating, "I never seem to be negative enough. Every time I think it's as bad as it can get, they keep surprising me."

Rasgon said AAPL could even stall the QCOM case "for the next 3 years."

"At best, I think it's probably dead money," Rasgon said.

Josh Brown said QCOM is a "dog" and noted it's down 18% in a semiconductor bull market.

Jim Lebenthal said "Historically (sic about to be redundant), this has happened before," referring to the AVGO-QCOM fight 10 years ago. "These things get settled," Jim assured (though he didn't go as far as to call QCOM a "stepchild").

Joe Terranova questioned what happens if QCOM loses "in totality" and predicted in that case, "it's a $30 stock." Jim said "for them to lose in totality, you've gotta basically throw out IP rights."

Jim admitted he's in QCOM at 62, so "I'm underwater on it."

Pete Najarian said someone's buying 14,000 MU July 33 calls.

We’re still coming to grips with James Gorman as ‘the Babe Ruth’ of banking CEOs

Josh Brown on Thursday's Halftime said he's not bullish on CMG, but, "There's probably rats falling from the ceilings at fast casual, uh, and quick-service restaurants all over the country, and, it doesn't make social media because it's not Chipotle."

Mario Gabelli touted MSG; "it's my FANG equivalent; it's live sports." Jim Lebenthal said he's in MSG.

Gabelli also outlined the BATRA situation and touted the value of "live entertainment."

He called MGM a "buy" but said WYNN is a "much better buy." He also likes ERI and FLL and GDEN. He said he likes those names better than CHDN.

Gabelli likes NAV and said CNHI "has gotta be aggressively bought."

Jim Iuorio said he thinks the dollar visits the 2016 lows of "92-ish."

Joe Terranova, who brought his A game despite not saying a whole lot, made V his final trade. Jim Lebenthal said CSCO.

Judge aired clips of young CNBC superfox Jane Wells; Wells referred to O.J. saluting the "grande dame" of L.A. court reporting, Linda Deutsch.

[Wednesday, July 19, 2017]

Jim says Goldman Sachs makes some workers feel like a ‘stepchild’

Wednesday's Halftime Report served up a purebred-y scoop of elitism during an otherwise robust discussion of Goldman Sachs.

It happened when Jim Lebenthal said, "If you wanna actually change this company and actually make it somewhat different, focus on the investment management division. I was there 15 years ago, and I can tell you, you felt like a stepchild in that division."

Whoa. How inferior. Hope Jim came through that experience OK. (Surely none of his investors is a stepchild.) (Wonder how Jeff Bezos felt.)

Moments later, the conversation heated up — not over stepchildren, but what it's really like at Goldman Sachs.

"The culture has not changed at Goldman Sachs. The culture is one of the strongest on the Street," Stephen Weiss told Jim.

"I completely disagree," Jim said. "It's not long-term greedy anymore."

Jim insisted trading is about today while investment management is about the long term. "That is fundamentally, culturally different between those 2 divisions," he said.

"That is so untrue," Weiss said.

"That's completely true," Jim said.

"How much time have you spent in an investment bank. On the sell side," Weiss demanded.

"Plenty," Jim said.

"No. Working at an investment bank," Weiss clarified.

"5 years," Jim said.

"OK, which one," Weiss wondered.

"Goldman," Jim said.

"Which position were you in?" Weiss persisted.

"I was in private wealth management," Jim said.

"OK, great," Weiss said.

"What is this, 'Ironsides' here?" Jim said.

"When you're in a trading desk, and running a trading organization, and I've had trading desks report to me, OK, you align perfectly with the investment bank," Weiss explained. "You know why? Because nobody wants to take their company public or do a secondary unless they're sure- unless they're sure" there's interest in the stock.

"That's 20 years ago. That's, that's pre the Chinese wall, that's pre-Henry Blodget," Jim said.

Dick Bove says Jim Gorman is a ‘Babe Ruth’ of banking

Dick Bove's GS conversation on Wednesday's Halftime Report was so wide-ranging, it's hard to know where to start.

"It's not, you know, a couple of quarters, it's a decade," Bove said. "If you go back to 2007, the company was making more money than it's making today. … The reason for the problem is that they made a business decision, you know, 10 years ago, which is that, 'This market is gonna come back.' Well it didn't."

"This company has simply gotten more and more insular," Bove added. "It's, it's a private company that's running under a public, uh, if you will, name."

Bove said the shares were 250 when Lloyd Blankfein began as CEO. "Which company can you find out there that has a record as consistently bad as this one where everybody loves it," Bove asked.

Judge was the first to push back. Showing a chart of 5-year ROE among banks, Judge said, "The way that Blankfein guided Goldman through the crisis; is there a better risk manager out there …"

Dick said, "You're picking your point of entry, right. You decided that you want to take a point of entry 5 years ago. Why don't you take your point of entry 10 years ago."

As a matter of fact, Steve Weiss did just that, telling Bove that GS revisited its pre-2008 high, and, "I challenge you to give me any other bank in your universe that did that over the last 10 years."

"JPMorgan was selling at a higher price than it was in 2007," Bove said.

"JPMorgan I agree with," Weiss said, insisting MS and C are not.

Judge said, "If anything, Dick, it feels like you're fixating on a couple of quarters, rather than a longer-term story."

"10 years of no earnings increase. That's 1 quarter? 6 years of not showing any revenue increases, that's 1 quarter?" Bove responded.

Things got a little loopy when Judge and Dick started drawing comparisons to ballplayers. "James Gorman, you know, is the Babe Ruth, if you will," Dick actually said with a straight face. "Jamie Dimon is a Babe Ruth, if you will. You're seeing even Brian Moynihan, at uh, you know, Bank of America, who's a Baby Ruth- Babe Ruth, if you will. These people have done something with their franchises … they changed their company in a fashion to benefit their shareholders. Goldman Sachs did not."

Judge said "some would suggest" (without naming anyone) that without Blankfein, Goldman might not be here. "I have no idea why they would suggest such a sit- such a thing," Bove scoffed. "I have no idea how this board gets away with doing what it's doing."

Weiss told Bove, "In some regards, every time you come on, it's like watching Hamas, because all you do is lob hand grenades."

CNBC struggles to correctly

spell Lloyd’s name

Jim Lebenthal opened Wednesday's Halftime stating of Goldman Sachs, "I think the question is, where are the investment bankers picking up the slack."

Josh Brown said FICC has always been a "mercurial" business. "This is like the first bull market I can think of where Wall Street wasn't absolutely just feasting," Brown said.

Dick Bove said Goldman Sachs is "not even questioned by the marketplace." Judge said the GS share price "in and of itself" (sic pointless and redundant) shows the market has questioned the stock.

As for FICC, "33% decline is outrageous," Dick said, complaining often about the "insular" nature of the company.

Dick said GS was asked Tuesday about what the buyback program looks like, and the answer was, "We're not gonna tell you."

"That board of directors cares nothing about the shareholders of this company," Dick asserted.

Judge said Goldman Sachs had no comment on Bove's opinion, but, "They are likely watching uh right now because we alerted them that you were coming on."

Jon Najarian said there will be a target on the folks running FICC at GS. "I don't think this takes down Lloyd," Doc said, but the FICC bosses are "worried right now."

Stephen Weiss stated, "You don't have some of those blowout quarters in, in fixed income, commodities and currencies that you used to have. Lloyd Blankfein is to be commended for changing, for morphing that company as well as he did without losing major profitability."

Bove noted Weiss' mention of the GS partners. "It's not a partnership. It's a, it's a shareholder-owned company. … They run it as if it's a partner-owned company," Dick said.

Weiss said that based on stock price, "I'd say that's a pretty damn good record." Dick chuckled that, "If you bought the stock when Lloyd Blankfein took over, you didn't make any money."

Bove makes some quality observations, but he'd be best off sticking to the vision angle, as in, banks have none, except buybacks (if that's even a "vision").

Doc buys CMG calls

Stephen Weiss on Wednesday's Halftime said he sold his CMG puts after a "great trade." He said the stock's still overvalued.

Jon Najarian, though, said he bought CMG calls Wednesday, calling this "way overdone" if it's just 1 store in Virginia.

Josh Brown said, "This is as oversold as a stock can get" and that Doc will have to sell the "vicious bounce" with "3 hands." Josh said it already started rolling over in June.

Kari Firestone isn't interested in CMG.

Weiss said United Airlines is "still suffering" from the "public relations problems that they've had." But he likes the space.

Jim Lebenthal called IBM a "value trap" and said to "stay away."

Josh Brown said the CSX uptrend is "still intact" and that the stock deserves the benefit of the doubt, but he'd give it a "very tight leash."

Jon Najarian said it's been a "good day" for TRIP options.

Kari Firestone said she likes PYPL and said it's growing "particularly with millenniums (sic)." (So much for that Ira Sohn short call that won an award, which this page noted yesterday (see below; good to see the show catching on).)

With a lot of intro about takeover rumors, Doc said December 65 PF calls were popular.

Doc also said VIPS calls "more than tripled" and that Pete has taken off half.

Kari Firestone said LULU's recovery is no guarantee for the longer term. Josh Brown said he'd sell LULU.

Stephen Weiss insisted LULU is "an incredibly strong brand" with "lots of room for expansion."

Judge asked if LULU is "Amazon-(43rd minute)proof." Weiss said, "I think to a certain extent it is."

Kari Firestone reiterated that SHW isn't susceptible to Amazon because "paint can't fly." Firestone is also looking at HBI and auto parts names. Weiss likes the auto parts space.

Josh Brown said of the pressure on retail, "It's not just Amazon, it's ecommerce."

Weiss brought up the pre-Amazon-Effect narrative, which this page noted recently hasn't been mentioned for months since AMZN shares went higher, stating, "Consumer spending, all the studies show, have gone more towards experiences and away from consumption." (What exactly are "all" those studies?) (And what kind of "experience" does someone get from buying Prime?)

Jeff Kilburg said the "dollar drubbing" is lifting crude. But he doubts crude can top 47.50 or 48. Scott Nations is looking at 47.40 as key resistance.

Kari Firestone said VRTX's big day "gives life to the sector." She owns BMY and RARE. Josh Brown is long AMGN.

Rod Hall of JPMorgan told Judge about iPhone supply and pricing plans and said "a lot of this is in the stock right now; in fact, we think the stock is very attractive at these prices."

Hall said "nobody really knows" what the iPhone price will be.

Jim Lebenthal's final trade was AAPL. Weiss said he bought FB calls. Kari Firestone touted FRC. Josh Brown said ALB, and Doc said ECA.

[Tuesday, July 18, 2017]

PYPL up 19% since May 9 when Ira Sohn champ called for a short on Halftime Report

Judge on Tuesday's Halftime asked Scott Devitt for the best "superlative" he could offer on NFLX.

"I'm sorry?" Devitt said.

Judge asked for the "best superlative" on the results. Devitt didn't really offer one, saying it was best 2nd quarter in Netflix history.

Doc said he had some NFLX calls and was short puts. "It is a blowout," Doc said.

Steve Weiss admitted he was worried heading into the NFLX quarter "and sold part of my position yesterday" (oops). He wanted to buy more at 170 or 173.

"It's being valued like Amazon," Weiss said.

Pete Najarian predicted there'll be a better opportunity to get into NFLX.

Judge said he doesn't know what else to say about APRN other than you can be "nothing but dour."

Incredibly, Judge said with a straight face, "It's not fun to kick something when it's down," even though his show does that every day.

Judge questioned Maxim Group's upgrade of CMG on "queso" while the Virginia restaurant debacle was occurring. Weiss said, "I've owned puts on this stock for a few weeks now, and, um, it's a good day."

"This could not have been worse timing for this analyst on this buy. I mean, literally, just an hour or so into trading," Pete said.

Doc said someone bought a bunch of August 40 calls in TRIP.

He said October 26 calls in CIEN were popular.

Pete said VIPS July 11.50 calls were popular.

Doc said we can see volatility go even lower.

Joe Terranova hailed the dollar falling 7%.

Doc said Goldman Sachs has been "absolutely wrong" on its energy calls, pointing to $60 oil.

Judge finally settled for a commercial at the 34-minute mark.

On the 5 p.m. Fast Money, Karen Finerman said the one thing about United Airlines that doesn't affect her view of the stock is the David Dao dragging incident; "I don't think that matters at all." Mel opined, "It seems very rear-view-mirror at this point."

Karen said, "I am very skeptical that we will get any kind of meaningful tax deal done."

Guy Adami finally took a cue from this page and complimented Karen's "stunning blouse."

If Jamie Dimon is bummed out, he should campaign for a different president

Kevin O'Leary, who can be tiresome at times (especially on those endless CNBC "Shark Tank" commercials) (try watching those 17 times a day along with the Marcus Lemonis commercials) but is undeniably a savvy market watcher, made the most sense of anyone during Judge's soporific discussion of big banks on Tuesday's Halftime Report.

O'Leary called the big banks "regulated utilities" and questioned why anyone would own any of them.

O'Leary even claimed GDP can't grow 3% because banks are "so highly overregulated."

(Sigh) That couldn't derail the predicted commentary on NIM — Najarian Interest Margin — as Jon and Pete somehow both were positive on the big banks.

Pete said he doesn't feel any worse about bank stocks after the BAC and GS quarters.

Pete called the GS stock reaction a "misread."

Doc said MS has appreciated 59% in the last year, and JPM is at 42% and GS is at 37% and "Apple and Amazon (9-minute mark) can't even match that."

Doc said the only big bank he owns is JPM. He suggested 2.20 might be the bottom for 10-year yields, then the outlook would improve shortly.

Judge suggested JPM goes to 80 before 100. Doc took the other side of that. (No surprise.)

Steve Weiss said he feels the same as Pete but thinks it'll take longer to work out, then observed, "Private equity has had a record raise of capital," predicting it will lead to fees for investment banks. (And then clarifying that's what he meant even though we (and presumably most viewers) got it the first time.)

Joe Terranova said he'll hold BAC and MS because they've proven to be "slightly immune." But he's surprised some banks aren't down even more than they are. Joe said he doesn't want to buy GS because of "difficulties in the management of their trading business," nor does he like regionals.

Pete curiously said if you're going to focus on trading volume for banks, then "don't be in these." (But the stock goes up or down regardless of what you're focused on.)

Wilf Frost took everyone back to GS, reporting on the CFO's comments. Pete thundered that the revenue was fine even though trading was down, so "if that improves at all …"

Joe said the problem is "the trading seems to matter so much" at GS.

Joe pointed out financials have the highest corporate tax structure (in case anything happens in Trump-land) (Snicker).

Weiss: Donald Trump is

‘considered a lame duck’

Tuesday's Halftime Report provided some impromptu stark assessments of the state of the White House.

"President Trump is weak," said John Harwood.

"He's considered a lame duck at this point," said Steve Weiss.

Weiss said the "base case" political outlook is nothing happening. Harwood said of tax reform, "It might happen, but I wouldn't bet a lot of money on it." (So why wasn't anyone saying of Trump, "You are what your record says you are"?) (See below.) (#wisdom)

Moments later, Kayla Tausche flagged down Steve Schwarzman, who used to be so unreachable that CNBC had to resort to endless clips of him walking in a door to illustrate the BX IPO but now is on TV frequently to discuss the current government.

Given a chance to ask his own question, Judge gave Schwarzman a long windup speech, then asked about Jamie Dimon's remarks. Schwarzman said, "I just saw Jamie walking in the door," and Schwarzman mentioned the remarks (bet nobody else asks Jamie about it) and told Judge there are very few Americans "who are really proud of the functioning of the U.S. political system."

Schwarzman said "nobody thinks were batting a hundred" (sic meant "thousand") but added "out of a hundred."

Schwarzman put a Q1 2018 timeline on … some kind of government agenda action.

Weiss said Schwarzman being "hopeful" of something of the Trump economic "agenda" getting done "sounds like a downgrade."

Pete Najarian wondered about Scharzman's time frame for "hopeful."

Schwarzman called the stock market "pretty fully valued."

Kevin O'Leary said separately, "This idea of revenue-neutral tax cuts is insane."

More from Tuesday's Halftime later.

[Monday, July 17, 2017]

Where and when exactly did Bill Parcells invent the ‘record’ quote?

Judge on Monday's Halftime said this could be a "kitchen sink" quarter for GE.

Leslie Picker, stunning in green, offered both sides of the Peltz-P&G standoff.

But then things really got interesting when Judge corrected Jim Cramer's bungled quotation of Bill Parcells on records.

Just out of curiosity, we tried to determine when this quote supposedly occurred. According to an online search, the first time the New York Times printed it was in October 1994, but that reference suggested the quote was already well-known: "That brings home one of Parcells's sayings: 'You are what your record says you are.'"

The quote does not appear on Parcells' Wikipedia page.

In this strange 2011 YouTube interview amid the sounds of Billy Joel's "Tell Her About It," Parcells acknowledges the quote and says he heard several such quotes from his father, but there's no indication of where the "record" quote originated.

Yes, there could be poorly labeled press-conference footage or smeared pdf'd newspaper pages somewhere. But for all practical purposes, the origin of this quote — and any proof of Parcells actually saying it or being the first to say it — does not exist in cyberspace.

Which honestly isn't much of a loss, because, under close scrutiny, it really doesn't mean anything at all.

If it were PAST tense — as in, "You were what your record says you were," that might be legit. But the fact a football team is 9-1 does not mean it will win 9 of its next 10 games, just like a stock that has risen 30% in half a year will rise 30% in the latter half.

So maybe Cramer should try again.

Doc actually claims LinkedIn is a ‘huge’ part of MSFT’s strategy

Not too far into Monday's Halftime Report, viewers' jaws were dropping as Jon Najarian spoke about MSFT.

"Don't forget about LinkedIn as part of this now," Doc said. "When this strategy plays out even moreso Judge, this is gonna be huge for them."

"Even moreso?"

This page hasn't heard anyone tout LNKD in a MSFT recommendation since the $26 billion (snicker) deal occurred.

"Huge"? (snicker)

(By the way, panelists used to talk about FB wiping out LNKD the same way they chortle about SNAP right now. Guess LNKD was actually a great "strategy" of some sort that FB hasn't wiped out.) (This writer is long SNAP.)

It’s an effect, Stephanie,

more than a cause

It took until the 22nd minute for Judge on Monday's Halftime to mention AMZN (Mel mentioned it within the first minute on the 5 p.m. show), noting the price target upgrade to $1,200 from UBS.

Stephanie Link, who has to be congratulated at least once a week for buying AMZN shares for TIAA-CREF, began a speech to viewers stating, "People who are Prime members spend 2 to 3 times as much."

Correct. Because they're the biggest shoppers on Amazon in general. Just like the folks at the casino with the players cards tend to be the ones who gamble the most money.

Jon Najarian called Amazon's WFM purchase "brilliant" (funny nobody called WFM a "brilliant" stock before Amazon bought it) but admitted "a lot of these people might already be Prime."

Jim Cramer said of Prime, "I was with someone this weekend who didn't have it. And everyone laughed at that person."

o.

m.

g.

Expressing a rare bit of panel skepticism (aside from the fact no one including Link can explain what price the stock should or will reach) was Pete Najarian, who said the AWS competition is "coming more and more at them," and he doesn't necessarily think that's a good reason for the upgrade.

Judge actually asked with a straight face if AMZN is "the most bullet-proof stock in the market." Cramer said, "Wow, that's really rough."

Jon Najarian said you can put in an AMZN buy order "somewhere between the 927 that it got down to in June and 950. And, and if it gets there, you pull the trigger no matter what else is going on." (If you put in a buy order at those prices, doesn't it pull the trigger automatically?)

Doc suggested AMZN could just wipe out APRN.

Grasping for material, Judge suggested Ryan Leaf had a worse debut than APRN. (Perhaps Ryan Leaf had some memorable quotes for Judge and Cramer to share.)

Analyst who happened to be assigned to AAPL a decade ago is just. so. great.

Pete Najarian on Monday's Halftime hailed Katy Huberty; "she's been right … she hasn't been shaken out."

Jon Najarian said bulls were buying September 97.50 calls in V.

Pete Najarian said buyers of AA August 32 calls were rolling up into August 38 calls.

Pete predicted a breakout for CHD.

Doc didn't say whether to buy RH.

Stephanie Link likes EBAY under 35. She called MT a play on global growth.

Rich Greenfield said people had been expecting "big deceleration" in NFLX subscriber growth that hasn't happened this year.

Judge asked Greenfield about Einhorn's opinion. Greenfield said the amount of "heated bulls and heated bears" on the stock is what "makes it so much fun" as an analyst.

David Seaburg took a modest victory lap on the 5 p.m. Fast Money for touting NFLX but said he wouldn't necessarily chase the stock on Monday's afterhours gains.

Link's final trade was FDX. Doc said he bought AMC calls during the show. Pete touted HD, and Jim Cramer suggested XPO.

[Friday, July 14, 2017]

Tom Lee warns market’s at a level unmatched except in 1929 and 1998 (then says there’s gobs of money on the sidelines)

Tom Lee on Friday's Halftime Report admitted his S&P target is actually below Friday's level; it's "a little bit of egg on our face."

Then he tried to pull a Robert Shiller, stating the market-cap-to-GDP ratio is 91%.

"The only time in history it's been higher is 1929 or 1998," Lee said.

The odd thing about that … 1929 was pretty bad, but if you bought that 1998 market, you still had a year and a half of glory.

Nevertheless, Lee at one point said, "High-net-worth individuals haven't really owned equities in a big way until recently. So I think there's still a lot of money and liquidity on the sidelines, yes."

Kevin O'Leary advised owning AAPL, XOM, JNJ, MSFT, PG, PM and PFE in the 2nd half of the year for their "bullet-proof balance sheets" (Zzzzzzzz).

Tom Lee endorsed energy.

Brian Stutland said the dollar is driving gold; he thinks gold stays over 1,200 until the dollar really strengthens. Anthony Grisanti said if long gold, he'd stay long, though it's "tough to buy right here."

Sully lets viewers know how many patents QCOM has

Tom Lee was the first on Friday's Halftime to say "Amazon" (at the 16-minute mark), suggesting "not everybody" is going to be a victim of that company.

Well, he's right. (Unless you listen to CNBC all day.)

Guest host Brian Sullivan said, "Amazon is only a tiny percentage of overall retail sales. I mean, we've got to remind ourselves of that."

Jim Lebenthal said that in terms of time of year for buying the stocks, retail is kind of in a "dead space," with many quarters ending in July.

Sarat Sethi likes LB. Jon Najarian met the daily quota for touting PVH. Josh Brown said, "The stores that are reliant on mall traffic are in very big trouble."

Kevin O'Leary said, "I've increased my exposure to Wal-Mart." O'Leary said he's "willing to forgive" Wal-Mart for buying Jet; Josh credited O'Leary for recognizing the value of that transaction after their debate a while back.

Mel on the 5 p.m. Fast Money gushed about Jeff Bezos' body and kept wanting to show it; oh joy, now he can beat up everyone too. (Bet he had some really fascinating conversations at that conference.)

Sarat Sethi at Halftime had to answer for backing QCOM, predicting gains once it settles with AAPL. He actually said he's been in the name for 15 years. Sully said "last time I checked," QCOM had 77,000 patents.

Dick Bove correct,

banks have no vision

On Friday's Halftime Report, Sarat Sethi curiously said to "wait a little bit" to buy banks, but they're "great opportunities" to own later, "If you believe that our economy is gonna have steady, slow growth; if you believe that interest rates will slowly move up over time."

Actually, it doesn't matter what anyone believes; either they'll go up, or they won't.

Jim Lebenthal said C (Zzzzzzz) is trading at tangible book (Double Zzzzzzz), a "good" but not "great" stock.

Taking his time to deliver a narrative, Josh Brown touted how much money JPM has made.

Brown explained that there's "hard deregulation" and "soft deregulation."

Tom Lee said banks are worth buying over the next couple of years. (Zzzzzzzzzz)

Kevin O'Leary said he sees nothing happening in financials for 6 months. O'Leary said C needed "financial engineering" to make the numbers.

Anton Schutz said "we've gotten so myopic" about bank earnings, and, "I did expect the group to trade poorly today, regardless of what they produced."

"At the end of the day, I think that you, you buy pullbacks in these names," Schutz said. His favorite of the big banks is BAC. His favorite regional is PFNP.

Doc unfairly Fast Fired on FL, actually predicted a quick bounce; it did, but went lower only days afterward

Josh Brown on Friday's Halftime said SNAP will get "closer to 10 than 20." (Oh joy, Facebook copied someone's popular product and ensured the world and the stock market and the Internet can be run by 4 companies whose stocks we own.) (This writer is long SNAP.)

Jon Najarian said WYNN and MPEL "bounced pretty significantly" after a harsh morning selloff.

Sarat Sethi said FFIV will tread water for a while.

Jim Lebenthal said there are "a lot of risks" to BA. (He said it was doing too well in the upper 100s.)

Jon Najarian said someone got into the July 76 MSFT calls that expire next week. And you know what? IT WAS SOMEBODY WHO HAD LOWER-STRIKE CALLS WHO CAME BACK FOR MORE!!!

Doc said July 96 calls in WDC were popular, and he also hailed Pete's great trade in NRG, "20 times your money on this one," Doc said. (And does anyone ever lose money on options?)

Doc, who correctly touted STZ in April, said he'd stick with the name.

Doc unfairly got Fast-Fired on his "terrible" pro-FL call. "I still am long it," he said.

Josh Brown said he thinks MCD can keep going unless there's a big shift in sentiment. (Always an important qualifier.)

Jim Lebenthal said to own GOOGL, but he said the question is, is it a growth stock; he says it is, for 2 reasons that aren't worth reporting.

Sarat Sethi said things still look good for UTX.

Josh Brown no longer likes FAST.

Jim Lebenthal said he's sticking with QRVO down 2% since his bull call.

Jim's final trade was the XRT. Josh said SCHW. Sarat said to look at JPM. Doc said BAC, and Tom Lee said T.

[Thursday, July 13, 2017]

In case you didn’t know … SNAP MISSED ITS FIRST QUARTER AS A PUBLIC COMPANY!!

Judge opened Thursday's Halftime Report not with Amazon … but his panel's favorite punching bag.

Only this time, Judge brought in SNAP bull Scott Devitt in hopes of ensuring a fair fight. (This writer is long SNAP.)

Devitt did fine, but actually David Seaburg made a more intriguing case for the stock a couple days ago (hit PgDn a few times).

Judge said Devitt made a "gutsy call" to upgrade SNAP ahead of the … drum roll … turn on the fire-engine sirens … lockup.

Devitt said why don't you guys get real and acknowledge that the lockup is priced in investors are "more educated" about lockups and that he's more optimistic on fundamentals than the market is.

Addressing a favorite slam by the Halftime crew — Mark Zuckerberg just DESTROYED this company after he offered $3 billion for it!!!!! (And how's the monetization of Oculus working out?) (And the monetization of WhatsApp) — Devitt contended that Instagram's gains are actually "additive" to the space rather than zero-sum.

Then there's the fact that BOTH Steve Weiss and Pete Najarian mentioned — the first-quarter miss.

"Certainly there's some credibility issue," Devitt admitted, but he pointed to FB and BABA having their own stumbles early as public companies.

Devitt asserted that the next 3 quarters present a "quite good setup" for SNAP.

Josh Brown claimed Devitt wasn't addressing the "real issue" … which is … user growth … advertising revenue … an anti-shareholder structure (snicker).

Brown acknowledged Google and FB have the same thing but have "proven" themselves to operate that way.

Devitt shrugged, stating that kind of structure is fairly commonplace. Brown insisted not at the IPO level, but Devitt said it is.

Judge insisted "everybody" is talking about the lockup (why, if everything's "decelerating" and the stock's going to single digits) and questioned for the 2nd or 3rd time why Devitt would upgrade ahead of it. Devitt said the issue is so "publicized" that the stock's potential comes down to other things.

Stephen Weiss said he owns SNAP puts because he couldn't get a borrow to short, then wondered why Devitt is using DCF analysis. "I don't know how to value a company other than a discounted cash-flow analysis," Devitt said. "On a relative multiple basis, I think the valuation is quite sensible."

Jon Najarian said there was a big surge in SNAP calls as well as puts. "There's gonna be a lot easier borrow" after the lockup, Doc said, predicting the 15% short interest doubles after the lockup.

Weiss noted … this one's really good … "this company missed out of the gate." He said DCF is "not appropriate" for this company; "I just think the fundamentals are just deteriorating." (Judge forced Weiss to define "DCF.")

Pete Najarian asked, "How do you miss Q1" (snicker).

Joe Terranova, who had a quiet show, said he'd rather buy TWTR than SNAP, a totally fine point ... but he scoffed that Instagram has 200 million daily users and Snapchat has 1 million daily users (um, wouldn't SNAP have more upside then) and scoffed at anyone being a "hero" by riding SNAP from 16 to 17. (A. Fast 6% returns are apparently beneath Joe; B. So much for Mike Khouw pointing out on the 5 p.m. show that options are pricing in an 18% move in a month.)

Josh Brown said Devitt's target is 22 and questioned the "risk" in seeking 5 or 6 points.

Pete insists SNAP is going to ‘single digits,’ then says ‘towards the single digits’

On Thursday's Halftime Report SNAP discussion, Pete Najarian boasted, "I've been saying for a while now that I think you're gonna see single digits, and I think that happens after the lockup."

But on the 5 p.m. Fast Money (Pete did both shows), Pete was backpedaling like the DBs for Minnesota in that 1983 game with Nebraska, stating, "I'm still of the belief that this is a company that goes towards the single digits."

Ah. So within a few hours, we went from "single digits" to "towards the single digits."

Pete on the 5 p.m. show hilariously claimed, "The fact they're going after the behemoth and the behemoth is going right after them, I think that kills 'em, right away."

"Kills 'em right away" ... why weren't they killed right away years ago when they turned down a $3 billion offer? (And why do purportedly free-market champions cheer some behemoth, already mega-rich and too influential entity blatantly copying someone else's product simply so that said entity can ... control all of Americans' social (and fake news) media instead of just most of it ... then again, pundits occasionally sort of root for Amazon to wipe out entrepreneurs ("They should raise Prime to $99; I know I'd pay that!!!!") so that the whole stock market can consist of 7 stocks, so whatever ...)

On Halftime, Pete gave SNAP bull Scott Devitt a piece of advice: "I think Scott's call should've been, after the lockup, that will be the time to buy," Pete said … so lessee … the stock's going to single digits … or "towards the single digits" ... but buy it after the lockup … so presumably it's going to single digits during the lockup expiration … which means all the suckers are the insiders who will be racing to unload in single digits at lockup expiration only to have that really be "the time to buy."

Stephen Weiss said the stock is "far below" its offering price. A huge one dollar and 41 cents.

Josh Brown said the "worst thing" for a SNAP investor is to see it go to 19 and then roll over.

The conversation took the first 13 minutes of the program, which is actually better than even AMZN often gets.

Judge at least twice assured viewers that they know from ‘your experience’ that presidential joint press conferences are sometimes delayed

Unimpressed by Target's outlook, Pete Najarian on Thursday's Halftime Report said retail is "everybody and Amazon." (That Amazon reference came in the 14th minute of the program.)

(Amazon, see, is dubbed "essential" by Fish's ETF, because if it didn't exist, you'd have to buy stuff from … walmart.com, macys.com, eBay …)

Josh Brown said TGT is merely talking about beating lowered guidance.

Stephen Weiss said people who bought M at a 5% yield are "really underwater."

Weiss though said he bought AZO; "why not step up."

Karen Finerman, turning heads with a chic black/white ensemble on the 5 p.m. Fast Money, said, "Maybe for some of these retailers, I think that bottom is in. For the, for the grocery, I- I think it hasn't played out yet."

Back on Halftime, Jon Najarian would sell the GPS "dead cat bounce" but would stay with PVH.

Weiss said probably every player has owned TEVA, but it's still a "decent story."

Pete Najarian said WDC is "absolutely" winning the battle with STX. He'd stay away from STX, but he hung a 100 on WDC.

Josh Brown said YNDX moves in "lockstep" with the Russian stock market in general. He wouldn't buy it on the "smart decision" by Uber.

Joe Terranova said TROW's did an "excellent job" of defending the active-management story; he said all asset managers are "building positive momentum."

Doc said DAL missed on the profit number and said potential buyers could "chew" on the fact it's not down much.

Sue Herera did Futures Now; Jim Iuorio said we're "somewhat at the late stages" of this dollar break and predicted support at 96. Jeff Kilburg said 94 is a "significant level." But he called 98 a "cap" and said to "play the range."

Doc endorsed PVH again.

Pete said he wouldn't be long LL anymore; Judge has completely ignored this very interesting stock story.

Josh Brown said JBLU is breaking "massive, multi-year resistance."

[Wednesday, July 12, 2017]

Yellen testimony preempts

Halftime Report

Wednesday's Halftime Report was completely (that doesn't happen often) wiped out by Janet Yellen. Missy Lee returned to helm the humdrum 5 p.m. Fast Money in which Mel labeled Scott Wren as "bearish in a world of bulls," only to have Wren protest, "I am modestly bearish, Melissa, don't put me in a big bear camp." (Translation: It's an '86 Mets market.) Wren actually said there are "4 headwinds" (snicker) but as always, we can't handle more than 3, so you'll have to look up video at CNBC.com to hear what they are. For once, the rip-roaring program didn't need a 4-minute commercial break at the 25-minute mark.

[Tuesday, July 11, 2017]

How come there aren’t demands for investigations when the price of oil falls? (as opposed to when it rises)

Bob Iaccino on Tuesday's Halftime Report suggested short covering was occurring in crude and predicted Wednesday's numbers will disappoint the longs.

Scott Nations said the oil trend remains lower, and he predicts a 3-handle by year-end.

Joe Terranova said Jeff Currie, the last time he was on the Halftime Report, highlighted "the need for short-dated oil vs. long-dated oil to remove the contango, to go into backwardation. You have not seen that occur."

Joe said oil is range-bound absent weather or geopolitical shock.

Jim Lebenthal said you can buy some oil names for the dividend, mentioning 7% in Royal Dutch Shell.

Pete Najarian pounced on that, stating the dividend question is "dangerous" because, "You can give up 7% in a single trading day."

Jim tried to explain himself, but Judge kept interrupting him, a common theme of the program.

Steph Link said "certain companies" such as EOG and CXO can make money at 40-45 oil. Joe endorsed XOM.

Judge has seemingly lost interest in Bob Shiller’s ‘50%’ ‘call’

Judge opened Tuesday's Halftime with Jamie Dimon's QE warning (Zzzzzzzz).

Steve Liesman said it "should be taken seriously."

Liesman said the Fed wants the market to "behave" and not be disrupted by this and will "turn it off" if there is disruption.

Rick Santelli said the Fed didn't get the growth it wanted out of QE.

Judge told Santelli and Liesman not to talk over each other, but actually Judge was talking over both, a trend that persisted through the entire program (why doesn't he do that to Tim Seymour instead). (Tim did manage to get a pat on the shoulder on the 5 p.m. show from Karen Finerman. If only that happened to all of us.)

Judge tried to cut off Joe Terranova, but Joe said (at least twice), "I think the issue and the concern is liquidity."

Jim Lebenthal asserted that even 3.5% on the 10-year "is not gonna upset this thing."

Judge told Pete Najarian it's "so overused," but don't investors need to look at "where the puck is going."

Pete said "absolutely," then mentioned the "Fred" (sic), then said the Fed has a "pretty decent handle" on what it's trying to do.

Judge noted what a story the Donald Trump Jr. meeting is "in and of itself" (sic needless and redundant).

Karen Finerman, in chic gray and new hairstyle on the 5 p.m. Fast Money, said the most interesting D.C. news was Mitch McConnell delaying the Senate recess.

Can’t believe Scott Cohn didn’t name Amazon ‘America’s top state for business’

Pete Najarian on Tuesday's Halftime reverted to one of his favorite punching bags, the nearly daily disaster called SNAP. (This writer is long SNAP.)

Pete reiterated that SNAP was already "decelerating" at the time of the IPO. "I think there's further downside," Pete said, predicting "single digits at some point."

The only thing about that, Pete and his brother touted all the big call-buying in SNAP just a couple months ago.

Now, he's calling it based on his fundamental analysis.

Pete noted during the program that someone bought 5,000 July 32 calls in YELP. Pete's fundamental call on that name was that it has "zero debt," and people who travel "use Yelp a lot."

Jim Lebenthal said SNAP doesn't have the user growth.

"They missed the quarter right out of the gate. That's all you need to know," Stephanie Link said. "I think you wait until the lockup and then you see where the dust settles, and then I think it could get interesting if it pulls back enough."

Joe Terranova said SNAP is getting "crushed by Instagram."

David Seaburg on the 5 p.m. Fast Money articulated an interesting SNAP buy call, suggesting the company can't afford to bomb Q2 and so it's taking down expectations, and he called the Morgan Stanley downgrade "a setup for a buy into earnings when they report on August 15th."

But panelists highlighted competition from Facebook (in 2012, it was all about how "kids don't care about Facebook anymore"). Guy Adami suggested that nothing really changed from Morgan Stanley being the SNAP underwriter and now issuing a downgrade (see, if this were 2001, people would be demanding to see internal emails on that subject).

Joe also said he heard a $2 target on APRN. Link said she can't believe the IPO even got done. "This has the feel of Groupon," said Jim.

Viewers get lesson during AAPL chat of basic supply-demand

Sherri Scribner dialed in to Tuesday's Halftime, saying AAPL expectations might be too high; "they're losing share in China."

Not referring to any call-buying this time, Pete Najarian said AAPL has lost share in China but suggested there's "pent-up demand" and said "unit sales actually have been on the rise."

Judge noted there's speculation the new iPhone will cost $1,200. Scribner said, "Basic supply-demand suggests that if the price is that expensive, there'll be less demand."

Jim Lebenthal said Scribner is entitled to her opinion, but he expects a big upgrade cycle.

Did we go an entire program without AMZN?

Jim Lebenthal on Tuesday's Halftime asserted that the departure of JCP's CFO is "not a big deal" and that the story misses the lede of the press release in which the company expects "significantly improved top-line results this quarter."

Pete Najarian said he's a "bit negative" on KORS even though he owns it. (Karen Finerman at 5 p.m. had to defend that one and address the horrible performance of FL.) (This writer is long FL.)

Stephanie Link said "I kinda get" the Barclays cut to homebuilders; she likes SWK.

Joe Terranova claimed FDX is actually an "AI play." Link said she's been adding to it in the last couple weeks.

Link said she prefers UNP but likes CSX. Pete said he likes the space and is in KSU.

Addressing a spectacular recent call, Jim said "I think you've got another 15%" in WGO. "I think this goes to 40."

The lone panelist to receive a Fast Fire, Joe Terranova said SYMC actually went up to 33 after he recommended it in April at 30. Joe said if you're in it, keep holding it.

Pete's final trade was WDC. Joe said CXO. Steph said DOW. Jim said GS.

[Monday, July 10, 2017]

1-2 years ago, the retail narrative was that customers are spending on ‘experiences,’ not ‘things,’ but now the narrative is the ‘Amazon Effect’

Judge on Monday's Halftime noted that BMO downgraded COST.

Pete Najarian mentioned "the Amazon Effect" (23 minutes into program) and said he's been "patient" with COST, but he hasn't seen the "commitment" to the stock in the options space.

Josh Brown said COST has a 28 multiple but a 23 RSI. Josh said to "wait for a higher low in price."

On the 5 p.m. Fast Money, superfox Karen Finerman said "it wouldn't be so, so shocking" if AMZN bought FDX or UPS; think "how accretive that would be." (1. Imagine regulators examining whether Amazon packages were getting delivery priority over walmart.com packages on Dec. 23.) (2. Amazon probably would rather buy some entity in the Self. Driving. Car. space.)

Pete struggles to explain how he really knows that put buyers are bullish

Pete Najarian on Monday's Halftime said July 65 puts in ICE were being bought "very aggressively."

Of course, "I don't think that's somebody who's negative," Pete said.

Judge finally had the brass to ask Pete the question, "How can you tell whether somebody is protecting a position like you just said rather than taking a negative view."

(Answer: Options buyers NEVER think a stock is going to fall.)

"Well, uh, I'm just interpreting what we know news-wise, what we've seen happening with the stock, in the m- the move to the upside, the momentum of the year so far year to date, to the upside, that would be my opinion, would be, that would be what I would be doing (sic grammar)."

Pete said July 17 calls in NRG were popular.

Judge: ‘Trading sucks’

Pete Najarian on Monday's Halftime said there's more risk being out of the market than in and predicted (yep) great things from JPM's earnings and pinned a 26 on the XLF.

Judge insisted there's a "threat" from rising rates, which is curious, given that he has spent pockets of 2017 pointing to a sinking 10-year yield and asking (not exact words), "How can stocks keep going up when the 10-year keeps falling??!?!?!!!"

Pete gushed about the homebuilders but was unable to tell Judge why banks are going to be great, other than pointing to call-buying (which also indicated that SNAP was going to blow out its last earnings report). (This writer is long SNAP.)

"Trading sucks," Judge asserted.

"Trading does not necessarily suck by the way," Pete responded.

Josh Brown said of banks, "You will see a re-rating in this space," then touted SCHW again.

Brown also said "there really isn't any resistance overhead" in JPM.

Brown said investors should be "primarily" focused on stock prices, not "forecasts and headlines."

Erin Browne said "things are getting better," and "this is the time you wanna be invested in markets."

Jim Lebenthal said a recession is "not on the horizon."

Jonathan Krinsky said "it probably makes sense" to start buying technology.

Judge said Tony Dwyer raised his S&P target for 2017 to 2,510 and 2018 to 2,800. But Judge said the 5 p.m. Fast Money, not Halftime, landed Dwyer for an interview Monday. (#internecinebookingwars)

On that 5 p.m. Fast Money, Dwyer said, "The animal spirits are alive not because of politics. It's because that small businesses and large businesses are now convinced that you're not gonna have higher taxes and more regulation."

Dan Nathan said it seems there's a "level of complacency" in the stock market and "near-euphoria."

Josh thinks it’s a ‘joke’ for Jim to tout INTC’s presence in self-driving cars

Judge on Monday's Halftime not only took up Everyone's Favorite Subject (Amazon), but Everyone's 2nd-Favorite Subject (Self. Driving. Cars.).

Judge said Intel was downgraded by Jefferies. But Jim Lebenthal said the call misses the MBLY acquisition.

"I really don't see a reason to be anything other than long the name here," Jim said, not at all a surprise.

Mocking Intel's presence in Self. Driving. Cars., Josh Brown kept asserting that NVDA's "data-center customers have grown 8-fold in a year. What has Intel done in 20 years that could compare to that."

"Wait a second, wait a second," Jim cut in, adding "they're doing different things" in cars and telling Josh it's not true that both MBLY and NVDA can't succeed in self-driving cars.

Josh accused Jim of "changing my argument," adding Intel is "so far behind" that "to even compare the 2 in, in autonomous vehicles, is a joke."

Judge said "in and of itself" (sic completely redundant and unnecessary) when mentioning NVDA on the 5 p.m. Fast Money.

Judge finds another champion of mean reversion (cont’d)

Nili Gilbert on Monday's Halftime told Judge the 3 characteristics of "rocket stocks" (highly volatile, highly expensive, negative operating cash flow).

Judge clarified that "the FANGS" are part of that. Gilbert said NFLX is a "real rocket stock" as opposed to FB.

Gilbert said if the market goes higher, there figures to be a change in leadership. But she conceded "rocket stocks" did well in Q2, but in June, "we saw value start to turn around."

Gilbert likes VRSN and LYV because they are "asset-light" and touted the buybacks of VRSN. Judge asked her for LYV reasoning in "10 seconds," but Gilbert launched into a description of what the company does before touting the "efficiency" of LYV's capital expenditures.