[CNBCfix Fast Money Review Archive — June-July 2020]

Jim didn’t want to unload INTC at $51 because he expected to sell into ‘strength’ in the mid-50s; now it’s at $47

In another tepid edition of the Halftime Report on Thursday (7/30) (at least Judge didn't revert to Jim Cramer on WFC vs. JPM or Joe's AMZN sale), the chief target was MKM for its sell call on TGT.

Kourtney Gibson scoffed at the rating and mentioned the ability to order online and pick up at stores and said she'd buy more at 105.

Anticipating that Steve Weiss would express the same opinion, Judge made MKM's arguments, largely about online not being enough to overcome brick-and-mortar issues.

Weiss said the MKM report was "OK" but that he disagrees with it. Weiss added, "I don't recall ever buying or selling a stock based upon a Yelp rating," and we didn't know what he was talking about, but it was apparently one of the arguments by MKM, as Judge explained, "I know, but there are a lot of other reasons they cite."

Weiss said he's agreeing with Gibson on a lot of things and told Judge to keep Kourtney on the program, but "no more Lebenthal."

Judge also asked Pete Najarian about TGT; Pete took issue with "really odd" things in the MKM report, such as "aging store fleet ... I don't understand that at all."

Meanwhile, Kourtney Gibson noted FB still hasn't monetized WhatsApp. (Which, given how many years it's been, sounds like it's not really monetizable. #TWTR)

Kari Firestone affirmed PYPL is her largest position. (This writer used to be long PYPL and wishes that long position was still intact as of Thursday.)

Kari observed, "I think we look like Hollywood Squares when we look at the screen."

Steve Weiss said Stevie Cohen had "about a thousand" people working for him at SAC's peak, whereas David Tepper had "less than 40."

What?? Nothing about Jim Cramer liking WFC more than JPM?????

Unable to find many takers for his recent suggestion that tech stocks are overvalued, Judge on Tuesday's (7/28) sleepy Halftime Report enlisted Mr. Excitement, Toni Sacconaghi, at the top of the show to explain Toni's bearish view of TSLA shares.

Toni said he finds the stock's valuation "very difficult to justify (snicker)."

Nevertheless, "I think in the near term, it's probably dangerous to short," Toni said.

Now that's new material. People on CNBC saying they think TSLA's price is too high. (This writer has no position in TSLA.)

Judge claimed to Josh Brown that Judge's goal was to "not necessarily have a Tesla-specific conversation."

Judge protested to Rob Sechan that while tech superstars might have proven business models, they could still be overvalued. Rob wanted to offer a point about a lot of high-flying tech names, stating, "I very much worry that you have lower- low barriers to entry for some of these business models."

Judge at one point asked Jon Najarian why Doc has a roaring fireplace behind him, presumably in Chicago. Doc explained that he's not in Chicago, but Aspen. Moments later, CNBC's sensationally gorgeous Rahel Solomon, after delivering a report on UBER and LYFT, told Judge, "Scott, before I send you back, I have to ask: How's my ambience?"

Jenny actually claims next administration could be ‘a lot less friendly’ to AMZN than the Trump White House

Well, this was a head-scratcher.

It started on Monday's (7/27) Halftime Report when Judge, devoid of ideas and attempting to sell panelists on the idea that AMZN's strengths are already well priced in by the stock market, asked Joe again about selling the shares a while back claimed with a straight face that everyone has "multitudes (snicker) of boxes arriving at our houses."

Jenny Harrington told Judge that she thinks AMZN's business and share price are actually "divergent" things.

Jenny even said, seriously, "I think that we need to be real about the fact that the next administration could be a lot less friendly than these guys in the past administrations have been. And there could be real regulation coming in."

OK. Let's get "real." We can't possibly fathom Joe Biden (or anyone else who might be president in the next 4 years) as being more hostile to AMZN than the current occupant of the White House.

If Jenny, who mugged for the home camera much better than most people do on the set, actually thinks the stock may slide because of that reason, we'll gladly take the other side of that trade. (This writer has no position in AMZN.)

Judge said Ed Yardeni is tackling the issue of whether investors are "delusional." Yardeni, who quoted both Sen. Everett Dirksen and Prince as though no one had ever heard those cliches before, said he doesn't know that they're delusional yet but that it's "depending on the fundamentals." We have no idea what point Yardeni is making, other than he basically wants a pullback so that he can feel better about buying the stuff he's unwilling to buy now.

But maybe we're "delusional."

Kevin O'Leary basically told the government to let gyms and other COVIDized businesses go bankrupt. O'Leary knocked Jenny's endorsement of DIS, stating the time to buy DIS is when the vaccine is announced.

If INTC will be in the mid-50s over the next few weeks, then isn’t it a buy? (a/k/a CNBC graphics crew thinks it’s ‘Rascon’)

As this page always says, we want people to succeed in the stock market, and we don't cheer stock disasters.

That said, the disasters are often the most interesting stock activity to talk about, and often the most entertaining as well.

Friday's (7/24) Halftime Report presented just such a moment when longtime INTC fan Jim Lebenthal dialed in to discuss his July 6 bullish call on the shares with Judge and Friday's Halftime crew.

Jim said INTC is "screwing up operationally" and expressed frustration with being long the shares. Jim said he'll be selling into "strength" over coming weeks, in the "mid-50s," but that ... this is the really curious comment ... Friday 7/24 wasn't the day to sell.

Hmmmm ... OK ... if someone believes a stock trading around 50 is going to the "mid-50s" over coming weeks ... then isn't the stock a buy???

This is a trading show, isn't it? (Ah, OK, sorry.)

Judge told Jim that Stacy Rasgon (that's correct, a "g" and not a "c" in the last name) calls INTC "basically unownable," and Judge wondered if Jim isn't concerned that the shares will drop further.

Jim insisted the shares shouldn't have dropped 15% but only 5%; "that's really where the delta lies."

OK. So there, hidden beneath some carping and cliches, is an actual TRADE. Jim's saying a stock is oversold and is expecting a quick bounceback.

So INTC is a buy. At least that's our interpretation. (This writer has no position in INTC.)

But you didn't really get that message from Judge's show.

Meanwhile, Judge continued the week's refrain of questioning megacap tech valuations, so much of it rehashed material that we don't see any need to report it.

"Tech is so incredibly crowded," said Stephanie Link.

Josh Brown referred to "the continued breakdown of the dollar" (snicker).

In the second half of the show, Judge returned to his favorite subject, even more than tech valuations: omg Jim Cramer likes WFC more than JPM!!!!!!!!!

Judge referred to the "really credible and cogent points that have been made by everybody."

Stephanie Link actually said WFC, BAC and MS are all "story stocks" (snicker).

Judge assured Shannon Saccocia that "Jim is not gonna be offended" by the fact Saccocia prefers JPM to WFC.

If you missed this portion of the show, don't worry, Judge will bring it up again on Monday.

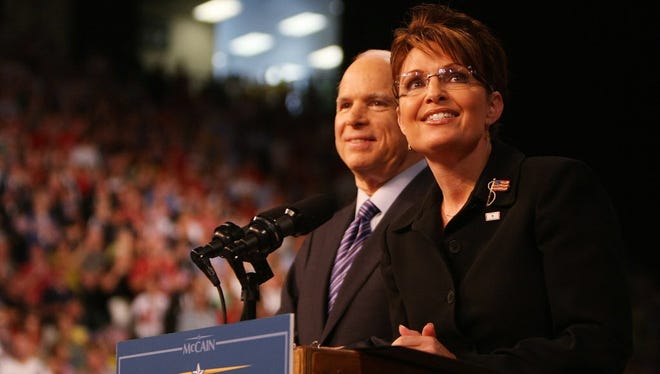

Steve Weiss wasn't on the Halftime Report but did turn up on Closing Bell. Weiss had the line of the day about the 737 Max, stating that once approved, "It's gonna be able to fly from the assembly line to the storage shed."

(Note: This country and world and flying public need the 737 Max, but that was an accurate line, and this remains a very complicated situation that isn't fully appreciated by Halftime Report panelists who since last year at this time have been repeatedly predicting recertification in the next 1-3 months.)

Weiss also made an interesting observation about Hillary Clinton's drug-price tweet of ... how many years ago? ... and how it hurt certain drug stocks for a long time. Weiss' connection got interrupted, but he said someone (um, we think that means Elizabeth Warren) becoming Treasury secretary would be a "disaster."

Why does CNBC need any other shows; can’t they just put Jim Cramer on-air for 10 hours straight?

Thursday's (7/23), and Wednesday's (7/22), editions of the Halftime Report illustrate CNBC's long-running problem.

There's evidently an entrenched management belief that Jim Cramer is special and that all the rest is generic, Financial-News-Network-esque programming.

Even the other hosts are in on it, as Scott Wapner missed no opportunity Wednesday or Thursday to not only re-inform viewers what Jim thinks about what but even announced Thursday he was trying to get Jim to join the rest of that day's program.

Early on, Judge was trying to turn Goldman's sell on AAPL into kindling; Judge insisted it was "such a controversial call."

Of course, everyone on the panel said the stock's OK and that you can trim if your position is oversized.

Jim Lebenthal said the analyst's $299 AAPL target implies a "bear market" for that stock.

"I admire a contrarian call. I admire Toni Sacconaghi," Jim said, even though Toni didn't seem to have anything to do with this episode, but it's "too big of a hill" if you're calling a bear market in AAPL.

Tiffany McGhee said AAPL's competitors are "nobody."

Steve Weiss said Jim Cramer (yep) talks of AAPL as a stock you "buy" but don't "trade," but Weiss said Cramer "sold some Amazon from risk- for risk-control purposes. You have to do the same with AAPL." Weiss said AMZN "has performed much better fundamentally than Apple."

Regardless, in this market, "It's a valuation holiday," Weiss said.

Jim said the Goldman call is that AAPL is "a lot" ahead of itself, not just "a little."

Jon Najarian explained his history of TSLA call transactions, for those interested in a backstory.

But Doc said he closed half of his position in afterhours Wednesday, not because he doesn't like the story, but "this one just became too much of an overweight." (Translation: He sells everything after gains regardless of whether he thinks it's still going up.)

Tiffany McGhee said Elon Musk's earnings call is "pure entertainment."

Jim pointed out Tesla's market cap compared with other automakers as well as Tesla's cars sold compared with other automakers (we don't understand what number of cars sold has to do with stock price or gains, but the skeptics have embedded that refrain) and said shorting TSLA is "like suicide, frankly."

Anyway. Seeking to really get Jim Cramer back into the mix, Judge spent the latter half hour discussing Jim's opinion of a day earlier that WFC is a better stock now than JPM, which Jim said is not a stock for this market (stop the presses).

Jon Najarian on Thursday called JPM "relatively stable" with the "best leadership in the business," then gushed about how you can sell out-of-the-money calls 6 times a year and get 18% on the name. (We're hardly experts, but it seems to us like 1) you can also get called away during good times or 2) the stock could drop enough to offset those great call premiums.)

"So that's why I own it," Doc said.

Borrowing a page from Joe Terranova, who wasn't on Thursday's program, Jim Lebenthal said WFC is in the "penalty box."

Judge said he somehow was wondering if Jim Cramer was "in the building" or whether Judge might have to "call Jim out" to continue the WFC-JPM conversation. (Note to Judge: There is zero chance of Jim not being able to find a camera.)

Sure enough, Jim Cramer took a seat on camera at Englewood Cliffs and explained that WFC has more upside in the tech area than JPM. Jim said of Charlie Scharf, "He is more ESG-focused than anybody I know in terms of uh, uh, a bank."

(Um, for the record, Barron's this week profiled an ESG investor; his fund's top 8 holdings are MSFT, AAPL, GOOGL, PYPL, ADBE, Roche, V, TSM, or basically cherry-picking the Nasdaq 100.) (This writer is long V and QQQ.)

(Why not just tell viewers to buy the QQQ and "diversify" it with some of Marc Lasry's distressed debt that sells for 84 cents on the dollar rather than tell viewers to buy Action Alerts Plus stocks?)

Jim called Scharf a "great person."

Jim Lebenthal said he doesn't think Warren Buffett is "washed up."

If it’s a show about tech topping, shouldn’t Joe be on hand to discuss his AMZN sale?

For the 2nd day in a row, Judge, just back from a remarkably lengthy vacation, opened the Halftime Report Tuesday (7/21) stating that some people are (supposedly) wondering if tech is getting "closer to a top."

Basically, Judge was referring to CNBC colleague Jim Cramer, who gets plenty of publicity on the network but apparently also needs promos on the Halftime Report.

Judge was not only quoting Cramer's tweets, he aired a clip of Jim from the morning saying "this is animal spirits like I've never seen" and that ETF buyers are "insane."

Judge asked Steve Weiss if tech names are "way too frothy." Weiss insisted there's "no resemblance to 1999." He agrees there are some "animal spirits" but noted there are fewer stocks than in 1999 and that "index players generally buy and hold forever."

Weiss said what "scares" him is that tech has momentum "on 2 fronts," one being fundamentals, which he's fine with, but also there's momentum in price action, "and that I'm not so happy about." (Hmmmmmm, too bad. Hope he can make it through the day.)

"I don't think energy is really ever investable," Weiss added, citing Andrew Hall, though Weiss used to trumpet the Floyd Trade (Halcon) and talked about how much he made on Floyd companies.

Jim Lebenthal affirmed tech is "hot" but assured "this isn't 1999, it's not a mania, it's not a bubble."

Jon Najarian bluntly told Judge, "Scott would you have bet against Tom Brady? I mean, these are the Tom Brady stocks."

Doc said his portfolio has climbed from 8 stocks during the March lows "to now back up to 44 names."

Jonathan Krinsky suggested there's a "breadth paradox" (snicker). Krinsky said the "upside is a bit limited, um, in the near term."

After Phil LeBeau delivered a not-really-newsworthy update on federal regulation of the 737 Max, Jim Lebenthal said of BA, "I think the market doesn't care as much about the 737 Max these days."

Judge gave considerable airtime to The Most Interesting Tech Hardware Analyst On The Street, Toni Sacconaghi. (Note: That's not a serious dig; we think Toni's great. It's just that his TV appearances aren't exactly loaded with fireworks, despite the fact he's constantly labeled as "No. 1" this or that.)

Scott Nations and Bill Baruch said gold can go higher though it might be a bit overbought now. One thing we've discovered is that people always like gold when it's going up, not so much when it's going down.

Jon Najarian said his NFLX call spread ended up being a "stinker."

On the 5 p.m. Fast Money, Karen Finerman's video started to go bad, so then Mel promised Karen on the phone, but Karen couldn't be heard on the phone either.

Joe smiles as Judge brings up that famous AMZN sale

They used to call Jim Taylor and Paul Hornung "Thunder and Lightning."

Neither one of those elements was present Monday (7/20) in Judge's long-awaited return to the helm of the Halftime Report, which carried on with little more than a sleepy continuation of the supposed huge reversal in megacap tech last week.

The show had trouble getting out of the batter's box, as Judge initially couldn't get volume from either Josh Brown or Joe Terranova, then Joe was heard speaking, and both Joe and Josh went on to lambaste (that's a little strong) those thinking that tech has topped based on last week's trading.

Amy Raskin though said megacap tech is overextended, stating the stocks are "too big" and "getting too expensive." Judge saw a chance to pit Brown against Raskin, but Brown, in a serious bit of parsing, actually said he agrees with Raskin and that big tech is "overowned."

Hopefully, viewers noticed Joe smiling at the 11-minute mark (yes, it took that long) when Judge mentioned that Joe sold AMZN recently, the strangest and most curious fascination about a largely irrelevant trade we've ever heard.

"Thank you for reminding me," Joe chuckled.

Tom Lee said we're having "the biggest depression in 5 (sic) lifetimes." Given that (thankfully) there are still many folks around from the 1920s and 1930s (as well as the teens and even before), we think it's safe to say Lee meant "generations" and not "lifetimes."

Amy Raskin said she's been adding to energy (snicker) since the price of oil went negative a couple months ago.

Joe suggested HES, which he typically likes to say is "tethered"® to the price of oil, as a possible takeover target. He thinks Chevron's NBL buy was a "fantastic" deal.

Um, an ‘unforced error’ is one in which the participant is totally to blame

Here's a bit of information that kind of flew under the radar on Thursday's (7/16) Halftime Report.

Star guest Bill Nygren, a Chicago investor with a conservative investing approach, stated, "I would note, on the CDC site that tracks excess deaths in the United States, uh, we've got a series now of about 3 weeks where total deaths in the U.S. have been below where they've been last year. So despite COVID, deaths have been down, maybe arguing that some of this excess death was pulling forward deaths of people that were really sick anyway."

Food for thought.

Nygren explained he sold AAPL because even though he made "over 25 times our money on it," he thinks the multiple's a little ahead of itself and compared it with COF, which has a much cheaper P.E. ratio.

"I think there are a lot of companies in the technology space with multiples that are 3 or 4 times what the S&P 500 is at, that a lot has to go right just to justify the prices they're trading now," Nygren said.

Nevertheless, the most quotable voice on the program was that of Steve Weiss, who's still a little perturbed apparently by the vaunted Robinhood gang that Jim Cramer (whenever he's on air) thinks are leading us to March 2000.

Weiss said the notion of an "efficient market hypothesis" is "absolute crap."

Weiss said the inefficiencies are "just so blatant" and that "the market is trading on, on, you know, basically ETFs ... it's trading on relative value." Weiss touted his call a day earlier of TSM and insisted, "In normal times, in times spent, markets trade more on fundamentals (sic grammar apparently), that would lift the entire tech sector."

Weiss turned his attention to the "morons" giving Norwegian Cruise Lines more money. "That equity's gonna be worth nothing," he insisted, nevertheless calling it "opportunity" for someone, though "you can't short a lot of these stocks" and "from a karma standpoint, it's bad to short," because "these are not errors by the management; these are unforced (sic) errors."

So there's an "opportunity" to play the NCLH capital raise, but 1) you can't short it and 2) it doesn't really feel right to short it either.

But it's "opportunity" of some kind.

Weiss tried to get Bill Nygren to slam Weiss' favorite target, the airlines, but Bill didn't really go there.

Jim Lebenthal, on the phone before appearing via video, said Weiss sounds "awfully angry."

But Jim picked up on the airlines where Weiss surely wanted to. Jim's final trade was owning puts on AAL. "Wow. Betting against American Airlines," Sully said. We'll take the other side of that one. (This writer is long AAL.)

On the 5 p.m. Fast Money, Karen Finerman said she's "very concerned about the airlines." Exxxxxxactly. When there's blood in the streets ...

Whoever coined that silver slogan on TWTR doesn’t need to rush to the trademark office

One of those cliche-type questions you often hear on CNBC is "What keeps you up at night?"

If we had to guess, we'd say Steve Weiss would probably say "Elizabeth Warren's Cabinet prospects."

Weiss on Wednesday's (7/15) Halftime Report AGAIN brought up the possibility of a Cabinet post for Warren, stating, "Elizabeth Warren as Treasury secretary, I mean, that's like Lizzie Borden, you know, to, to banks."

Um, we've never heard of a Treasury secretary unilaterally sinking banks (particularly one that got 7% in Iowa and New Hampshire from her own party), but if Weiss wants to be concerned, fine.

Weiss also offered his daily slam of airlines. (This writer is long SAVE and AAL.) Hey, if you don't want the gift of AAL under $10, be our guest.

Joe Terranova got things off to a head-scratching start, suggesting, "The stay-at-home trade is the dominant trade for today," before clarifying, "Uh, the- rather, the back-to-normal trade is the dominant trade."

Citing a "continued volatile environment," Joe said, "The exchanges are the proper way to allocate to financial services." That's the long-running, occasionally heard-on-the-show argument about how the exchanges work for volatile environments but also somehow work when things aren't volatile.

Tiffany McGhee stated, "I am still wearing Lululemon leggings, even as we speak," and that is cute.

Tiffany backed PRPL. Guest host Sully complained that previous mattress investments have been "garbage," which he called a "fair statement." Kevin O'Leary admitted he wished he owned PRPL and praised the company for digital marketing that "figured it out."

Jim Iuorio (whose fur coat was the subject of needling from Jeff Kilburg years ago) endorsed silver, calling it a "FANG stock of the metals complex (snicker)" and argued it "fits into a COVID world and a post-COVID world."

Iuorio admitted he "stole that from somebody on Twitter" (which line he was referring to was unclear), and he wishes he felt guilty about lifting it, "but sadly I don't."

It's OK. We won't tell anyone.

Joe actually made CVX his final trade.

Remember, there’s a ‘risk of some sort of correction in July and August’

Josh Brown, launching into a speech at the top of Tuesday's (7/14) Halftime Report, claimed, "As I've said repeatedly on the show, I think what's going on with the stock market away from technology, much more accurately reflects the condition that the economy is in, which is terrible."

Well, perhaps. But on July 2 (just hit PgDn a few times), he did say that there's a "misconception" that the tech rally is only concentrated in a few names.

So basically, tech broadly is great, but non-tech is "terrible."

Nevertheless, Stephanie Link, citing liquidity, asserted, "I think you will continue to see the markets outperform."

Mike Farr said consumers still have "artificial spending power."

Guest host Brian Sullivan contended, "I don't think people are afraid to fly. I think it's, there's nowhere to go."

Josh Brown asked Pete Najarian if Pete would be "first in line" for a vaccine. Pete said "probably" not the first, but at some point, "I'd absolutely be in line."

Stephanie Link called WFC's report "atrocious."

It’s possible they went a day without mentioning the ‘arrogance’ of FB

Guest host Sully overstuffed the panel for Monday's (7/13) Halftime Report; our attention had drifted elsewhere by the time Sue Herera delivered the news update.

To provide some visuals for a current TV environment that desperately needs them, Joe Terranova first spoke about selling AMZN shares a few weeks ago (snicker) ripped up a balance sheet and income statement and then marveled at the volume in TSLA 2,500 call-buying and finally stated, "It is clearly a chase for performance."

Jim Lebenthal took a page from Jenny Harrington, stressing he's not calling for a crash in megacap tech, but he thinks the "left behind" stocks can gain some ground.

"It's really a tale of 2 markets (Zzzzzzzzz)," concluded Rob Sechan.

Jim and Joe both touted GS. Joe said megacap will at some point have a pullback, but, after delivering a speech, summarized it best by stating, "Timing it is nearly impossible."

Mike Mayo, bullish on banks

Stop us if you've heard this before.

Mike Mayo, on Friday's (7/10) Halftime Report, said the banks are going to be in "earnings hell again," probably the worst quarter since the financial crisis.

Nevertheless, "We think this is as bad as it gets," Mayo said.

Wilfred Frost, who rounded out a celebrity week of guest hosts that included Melissa Lee and Dom Chu, asked Mayo if banks truly are "cheap, outright."

Mayo has for nearly a dozen years, as far as we can remember, been recommending buying bank stocks nonstop, so it was hardly a surprise when he stated that "in absolute terms, on relative terms ... bank stocks are inexpensive (Zzzzzzzz)."

"If you're a long-term investor, this is the time to buy bank stocks," Mayo asserted.

Meanwhile, Jenny Harrington stood by her forecast that the bottom "495" of the S&P 500 will catch up with the top, but she reaffirmed that she's not saying megacap tech will crash.

Josh Brown noted how well the buy-the-dip approach in tech giants was working Friday, which makes him think "we have 2 different markets happening."

Pete Najarian tossed in an "each and every day" about call-buying in tech stocks.

It's not often we get Brag Trades these days, but Stephanie Link said she doesn't own DIS because she "sold it at 145 earlier in the year." (Guess Stephanie timed the pandemic.)

China trade is back in the news. Josh Brown said, "With all due respect to the president, there never was a trade deal," stating it was nothing more than "sideline conversations" about buying more soybeans.

Thursday's (7/9) Halftime was pretty sleepy. But on other CNBC Thursday afternoon shows, Phil LeBeau said airlines are at a "base level in terms of service." (This writer is long AAL and SAVE.)

Dan Niles said there's a "decent shot" one of the airlines goes under.

And Niles offered an acronym trade of shorts: MACH 4 (Malls, Airlines, Cruise lines, Hotels). (He explained the 5 words about 3 times.) (See, it's helpful if you coin a stock-market term that ends up getting uttered on CNBC multiple times a day.)

Judge claims he won’t look at his Twitter account until he’s back from vacation

What we really wanted to hear (snicker) on Wednesday's (7/8) Halftime Report was someone else asking Joe Terranova about selling AMZN (snicker).

Sure enough, guest host Missy Lee came through, reporting that Joe "actually sold Amazon recently" (snicker) and asking why. Joe admitted it was a "bad sale on my part" at 2,555, but, "I'm OK with it."

OK. We look forward to the next update on this trade, as soon as possible. (Snicker.)

Meanwhile, Steve Weiss, who did virtually all the talking on the show, caught our ear when he dubbed the chairman of NKLA "the P.T. Barnum of public companies."

That's quite a distinction.

Weiss said he's "sticking with" FB, though he thinks the "arrogance" of Mark Zuckerberg is taking precedence over his business brilliance.

Weiss said "arrogance" or some form of the word at least 4 times.

Joe said FB shares get a "free pass" from the market because it's a performer in this market.

Liz Young said we're at a "critical precipice" where people might start to abandon stocks such as FB because investors aren't hearing the "social answers" they want to hear.

Mel suggested to Jim Lebenthal that FB benefits from being in the QQQ, where "nobody is distinguishing one stock from another" (Huh???).

"It's not unheard of for one or two names within that group to sputter," Jim explained.

Weiss claimed a company like FB is worth more broken up.

Weiss explained his history of owning AAL (or whatever the previous ticker was) in tough times; he said that this time, "I question whether equity investors are going to have anything left because everything is collateralized." Weiss pointed to David Calhoun's prediction of an airline bankruptcy, "and I think it may be more than one."

Well, we'll gladly take the other side of that ... (This writer is long AAL and SAVE.) ... The government has already made clear that airlines aren't going to fail because of COVID-19, and we're wondering if AAL will reach the gift level of sub-$10. (See, you buy 'em when the rhetoric's bad, like right now.)

Joe Terranova defended the Morgan Stanley purchase of E-Trade (snicker), calling it a "good one."

Joe said there's "further upside" in ORLY.

Jim Iuorio said gold's price is telling us that "there might be limitations (snicker) to how much stimulus they can actually throw into the system" before creating a dollar problem. (We'll take the other side of those concerns.)

Weiss again mentioned how he's worried about Liz Warren (snicker) becoming Treasury secretary.

On Wednesday's 5 p.m. Fast Money, Mike Novogratz claimed Joe Biden would "win by a landslide" and "jack up capital gains taxes." (We'll take the other side of "landslide" — we have no idea who will win but are sure it won’t be a landslide — and the "jack up capital gains.")

Mel said that when she saw the Levi's news Tuesday, she wondered, "When was the last time I pulled on a pair of jeans." (We have no doubt, none, that Mel looks phenomenal in jeans.)

With Jim Cramer apparently on a holiday break, Mel is doing 2 hours (snicker) of Fast Money duty this week.

We hope Judge is having an outstanding vacation. Based on his recent Twitter posts, he's apparently had enough of the "idiots" plaguing his account. (This site has nothing to do with Twitter.)

‘Risk of some sort of correction in July and August’

The star guest of Tuesday's (7/7) Halftime Report was Mike Wilson, the guy who says January and the end of 2019 was a bear market but who now is a bull.

Wilson's initial comments couldn't be heard, but he referred to the "story stocks" (presumably tech giants; guest host Dom Chu didn't ask to clarify) as legitimate kingpins.

Wilson said the strength of these stocks leads to the view that "these trends that were already in place have just been accelerated."

Well, that's basically true ... but imagine if computers were having a big virus problem instead of human beings. There'd be a lot less shopping online and a lot more brick-and-mortar.

"We're in a bull market," Wilson affirmed, and he noted the speed of the market and unemployment bottom (so far) as a signal of strength but said he'd argue the broader market is "kind of stretched."

Then he claimed, "I think the biggest risk for the market right now is right around this fiscal stimulus bill (snicker) that has to still get passed."

Well, we don't view that as much of a risk. This government loves doling out money.

He really got our attention when he said there's a "risk of some sort of correction in July and August." Really. There's a risk of a correction in this month or next? What months are there no risk of correction?

Wilson said the Southern U.S. might only be in the "first phase" of the virus.

During Wilson's commentary, viewers heard, "Hey, it's Stephanie Link, I just got kicked off the show."

Josh Brown gave a speech to Mike that included the theory that the presidential election "may end up being contested" (snicker). Mike said he doesn't know how the election will turn out (so why forecast), but he said a Biden win and strong GOP Senate would be worse for markets than a Democratic sweep.

Dom Chu suggested UBER's deal could be a "paradigm shift" (snicker).

Stephanie Link said she's sold FB because it's up 64% since the March lows and because "their multiple is capped." Stephanie also said Facebook is "a little bit anti-ESG-like."

Jon Najarian crowed that he and Pete "doubled down on Facebook" when the boycotts pushed the stock under 215 (that really helps out viewers with the stock at 240); Najarian asserted that "an awful lot" of Facebook's controversy is "just hot air."

Doc said we should see how many of these companies are still boycotting FB in the fall.

Mike Farr said you have to say names such as FB are expensive, but he'll continue to hold the stock.

On the 5 p.m. Fast Money, Karen Finerman said she's "definitely still long" FB, but she sold some at-the-money calls. (We don't know why Karen dabbles in options, but whatever.)

"I feel like we're- we're visiting sorta Cambridge Analytica 2.0," Karen said.

Jerome Powell in 2018 = Anthony Fauci in 2020 (a/k/a BRK-A joins the ranks of the have-nots)

Jim Lebenthal conceded from the get-go at the top of Monday's (7/6) Halftime Report that he was sort of arguing both sides of the stock market, stating, "I do think this market is ahead of itself," though "the trend is your friend right now."

Jim said he's got a little "dry powder" for when the correction hits. (The thing is, he's had "dry powder" since March 24.)

Joe Terranova, via phone, opined that there's "money flow" that's "trying to find a home," and he asserted, "It really is momentum that right now is the predominant strategy."

Joe said there's a chase for performance, "And I don't see for the foreseeable future that that will change anytime soon."

Shannon Saccocia said the market has remained strong, but "as soon as the narrative (translation: Anthony Fauci) starts to pivot a little bit," you'll see some selling.

Jon Najarian stated that Warren Buffett making a deal was a bullish move for stocks, though, in a bit of a dig, he said Buffett "actually missed pretty significantly the buy on the dip."

When guest host Dom Chu tried to follow up with Doc, Jim Lebenthal cut in (always a risky thing in this era of delayed home video connections) to make a comparison about Uber and Berkshire Hathaway that seemed to refer to Berkshire Hathaway as a "have-not" and made absolutely no sense. (This writer is long UBER.)

Jim noted both the YTD and Monday gains of UBER and BRK-A. Both were up on the day. For the year, Jim noted UBER was up 3% as of last week and BRK-A was down 21%. Apparently from this disparity, Jim sees a market of "haves and have-nots." He said the market wants companies that deliver chicken wings but not companies that deliver natural gas and fossil fuels. But he just said that Berkshire went up. And 1) he didn't say that Dominion fell on the report. And 2) Berkshire is far more than a natural gas company.

Apparently referring to Nasdaq favorites such as UBER, Jim said it's "a little unhealthy" that this much money is being "funneled in just to a narrow segment of this market."

Jim also claimed of TSLA, "You have to remember that at some point, this runs out of steam. At some point, there are no more buyers."

Well, not sure we buy that argument. Will the stock decline at some point? 100% yes. There are always going to be buyers of it. Maybe in the next 12 months, they'll buy it for $2,000, or maybe they'll buy it for $200. But there will always be buyers. (This writer has no position in TSLA.)

Jim concluded on Tesla, "This does have the hallmarks of a mania."

Nothing against Dom "Vespa" Chu, but we wanted Judge to be there to ask Joe why he sold AMZN a couple weeks ago (snicker). In a hint that Dom was indeed going to venture into that area, he asked Joe if other stocks besides NFLX should be downgraded to neutral, as NFLX was. Joe said of NFLX, "I did have ownership of it" (sic formality) (snicker), then he went on to give a speech about if you have a stock going higher, does it create "more risk," and if so, you can trim, it doesn't have to be a "binary" buy/sell decision. (Whew.)

Jon Najarian contrasted Jack Dorsey's two companies. "I think Twitter is nothing compared to Square," said Doc.

Dom Chu called Doc a "trafficker (snicker) of Square."

Jim Lebenthal said the Goldman downgrade of INTC "seems a little bit dramatic" (snicker). Commenting on INTC, Joe Terranova said, "To be nourished, sometimes you have to eat something that doesn't taste good at the moment (snicker)." But he said INTC will pay off in the long term.

Shannon Saccocia said she doesn't like VIAC (that was 4th on Jim's "3 stocks for the 2nd half" list of last week); she prefers CMCSA.

Joe said MAR is the only name he likes in the hotel/leisure/casino space, at a price between 80-85 (why not just say "under 85"?).

Is it really harder to beat the market now than it was in 1987?

On Thursday's (7/2) Halftime Report, Jon Najarian opined that, barring a reclosing of the whole economy, "I think we do make a run at new highs."

But before anyone takes out a second mortgage to buy ZM, know that on the 5 p.m. Fast Money, Steve Grasso said, "We probably need a vaccine to break through old highs."

Jenny Harrington on the Halftime Report stated that the data has "all improved dramatically." But she has "no doubt" there will be disappointments before year-end.

The Halftime Report included panelists offering their top 3 stocks for the 2nd half of the year, a typical feature of late June/early July episodes of this program that longtime viewers are well aware of.

Jenny Harrington said she likes VIAC, "as professional sports return ... hopefully football." Jim Lebenthal said he was "tempted" to include VIAC for Thursday's show and that it was "probably 4th on the list."

OK, we can't see how anyone at this point has inside knowledge on the state of pro sports. In other words, everything Jenny and Jim think about the return of pro sports is already in the market. And the gut feeling here is that there just as easily could be a no-return of sports as a return.

Whatever. After Jenny touted NNN and MMP based on an economic uptick including more driving, Josh Brown said "I'm kind of like on the opposite side of Jenny," because "I really see that the environment that we're in continuing through the end of the year (sic grammar)."

When Jenny said "something's gotta give" with the top 5 Nasdaq stocks, Josh said there's a "misconception" that the tech rally is only concentrated in a few names, though he assured Jenny that misconception is "not by you," even though she was the one who just brought it up.

Jenny also said, "I just finished the first draft of my quarterly letter to clients." (We wondered if she's gonna mention Joe's AMZN sale (snicker).)

Jon Najarian gave a robust endorsement of CHGG.

The day's star guest, Jim Reynolds of Loop Capital, said he's been "stunned" by the market's strength. He rattled off stocks that he's bought but said he didn't buy ZM around 100 or PTON at 22.

But, responding to several thoughtful questions from Scott Wapner, it was Reynolds' thoughts on the state of the industry that were most compelling. He said he hasn't seen the evidence that companies having African American board members equates to companies doing things for African American youth. He said Loop Capital, which is also represented by show regular Kourtney Gibson and sounds like an excellent place to work, especially for those just starting out, is viewed as a sort of United Nations of personnel. But he concluded, "There were more African Americans on Wall Street in the 1980s when we all came in then there are today."

Reynolds said he's in Arizona and is "pretty-well quarantined," but he lives in Chicago and is returning next week. Later Thursday afternoon, Chicago's mayor, like those N.Y./N.J./Conn. governors, announced that starting Monday of next week, anyone flying in from a state deemed a hot spot will have to self-quarantine for a couple weeks. "I can't wait to get out of the house," Reynolds said, but hopefully he'll get back before Monday and not have to isolate.

Leslie Picker reported on John Paulson's decision to go family office. Judge referred to a "Mount Rushmore" of hedge-fund figures who have made or are making that conversion.

Then Jon Najarian caught our ear, concluding, "It is much tougher as an active manager ... with the, you know, high-frequency trading and the algorithmic that drive where the markets are going on any given day, makes it much tougher to get in front of that and not get run over by it."

Hmmmm. Is that true? It sounds like Najarian is saying it's tougher to beat the markets than it was before high-frequency trading.

We doubt that. First of all, everybody can't beat the market, whether now or 50 years ago. Second, we can't believe all high-frequency traders beat the market either. Why were HFT programs selling on March 20?

Here's what Najarian should've said: The fees for active management are melting like ice cubes on 90-degree days. If this particular job pays 10% (or higher) less than what it used to, then why wouldn't it be seeing an exodus of talent?

On the 5 p.m. Fast Money, Karen Finerman didn't sound totally sold on the jobs report. "It makes me wonder if we're gonna see a reversal of that data," Karen said.

Karen suggested Mark Zuckerberg "will say the right things" about Facebook's ad boycott.

How about long Nasdaq 100,

short Dow?

Wednesday's (7/1) Halftime Report was little more than a round of cheerleading for the pandemic's brightest stocks — kind of like at basketball games, when they announce the starting lineups.

We're wondering when someone's going to suggest an obvious trade — long QQQ, short DIA.

Yeah, we get the whole mean-reversion thing. What we don't get is any sense of excitement when we look at the Dow roster. Its best stocks are Nasdaq linchpins — AAPL and MSFT — and then there's IBM, MMM, KO, TRV, etc.

Belief that Nasdaq stocks will outperform Dow stocks is hardly contrarian. The risks are twofold, 1) the one everyone knows, that in a big selloff, the Nasdaq will take steeper hits than Dow stocks, and 2) if Dow stocks really suck, and many do (GE), they'll just replace them with whatever the current flavor of the month is that happens to have a manageable nominal share price so as not to shake up the long-term calculation.

This all came to our attention when we happened to notice the Nasdaq Comp is at 10,000 and the Dow is at 25,000 and couldn't help but wonder how many years until they're equal.

Meanwhile, on Wednesday's Halftime, probably the most intriguing stock call came near the end, when Kevin O'Leary said he sold BA and indicated the week's 737 Max test flights are a sell-the-news type of event.

O'Leary said he thinks the stock will trade "in sync with airlines."

Joe Terranova did NOT mention "revenue derivation" (snicker) but said he'd avoid companies with "some form of a desire to raise capital (snicker)."

Coming through for viewers who expect it, Judge mentioned that Joe sold AMZN and said that's among the "tough decisions" that money managers make.

Joe also mentioned "Eli Illy — uh Lilly rather." (Stop taking digs at Joe's commentary.) (It was funny, we laughed when we heard it; that's the only reason we mention it.)

If the strategy is buying the dip, is anyone buying Donald Trump?

On Tuesday's (6/30) slightly preempted Halftime Report, Steve Weiss wondered, "Why make it so hard?" to pick winners in the stock market; go where the growth is.

That actually prompted Judge to complain, "I've said that repeatedly when we've- we've had these discussions and conversations and debates," when he really hasn't.

As CNBCers in the last couple weeks seem to be conceding a Joe Biden victory, we had to wonder: Is Donald Trump really done?

(Yes, people keep saying, "Remember, Hillary was way ahead at this point in 2016," but they really don't believe this is the same thing.)

Well, it definitely doesn't look great for Donald Trump right now. But this is now.

People actually talking up a Joe Biden landslide might be a little disheartened by how well this fellow performs in public in August, September, October.

As recently as March 5, Jeffrey Gundlach stated on the Halftime Report, "I think Joe Biden is completely unelectable."

This page has no idea whether Donald Trump will win. He seems like a beaten-down stock who could be either JCP 2019 or TSLA 2019.

So we can't help but wonder, if you want to take a flier on the Trump selloff, how do you do it? It seems like presidential betting is mostly an offshore activity that this page isn't going to recommend or take part in.

In terms of stocks, there's one that comes to mind: Facebook. The gut here is that a Trump victory would renew the theory that Facebook enabled brainwashing of people in upper Midwestern states. And then we'll get more congressional hearings and a bigger-than-$5 billion fine in 2021.

On the other hand, if Joe Biden wins, FB is probably in the clear.

Nevertheless, if one believes Trump will win, shorting FB now still seems foolhardy. It could be up another $50 or more by November. Maybe the trade would be to wait until late October, then unload.

On Tuesday's Halftime, Pete Najarian called FB "inexpensive" under 220.

In perhaps a bit of hyperbole, Mike Mayo told Josh Brown, "Wow, I am so excited about being a bank analyst during this transformation."

Brown was asking what, if any, advantages big banks have over fintech upstarts. After a lengthy speech, Mayo claimed the big banks have "much larger customer bases (snicker)."

Tip for Weiss: When people start getting really interested in who the VP pick is, the campaign has no chance

We often get a chuckle when people on the Halftime Report or Fast Money start issuing new slogans.

Joe Terranova did just that on Monday's (6/29) Halftime, stating he trimmed some stocks to achieve "revenue derivation" (snicker) in other names. (Joe even used the term twice.)

Judge said that sounds good, but he wondered why Joe was touting MAR, just because it gets overseas revenue.

Steve Weiss predicted that in the 2nd half of 2020, we'll see "even greater volatility than we've seen."

OK. We can hardly remember anytime a panelist on these shows did NOT predict higher volatility ahead (maybe in March 2020 or September 2008), but whatever.

Weiss actually wondered, "Who's gonna be Biden's running mate?" But he added, "More importantly, I'm focused on Elizabeth Warren (snicker)," suggesting she could be Treasury secretary or attorney general, bad for markets or certain sectors.

The fact Weiss and others are supposedly wondering who Joe Biden will pick strongly suggests that the top of this ticket is in trouble.

(Now, can Republicans talk Donald Trump into stepping down and handing the nomination to Mike Pence? That's a tough ask.)

Weiss said that while Wall Street people fear Democratic administrations, the biggest gains came during the Clinton and Obama eras. "The president's like a baseball manager — very little to do with the outcome," Weiss chuckled.

Shannon Saccocia suggested investors prepare for "value fatigue" (snicker).

Judge marveled at Tony Dwyer looking 12-18 months out.

Judge said the Street is "tripping over itself to defend Facebook today." (We're wondering who gets blamed if Donald Trump wins again.)

Weiss said the statement released by Facebook on Friday was "beyond comprehension."

Jim Lebenthal said LUV will be the "high flier" of airlines coming out of COVID-19. However, he likes ALK better.

On the 5 p.m. Fast Money, Karen Finerman said she's been buying WFC and that the idea of cutting the dividend "is not news, in any way at all."

Melissa Lee actually wondered with a straight face if FB is "investable."

Rob Sechan says coverage of pandemic has been ‘broadly wrong’; Judge has no idea what Rob is talking about

Rob Sechan on Thursday's (6/25) Halftime Report definitely got Judge's attention, and not because Rob wanted to talk about Joe's sale of AMZN shares (snicker).

Rob opined on the pandemic: "I think the coverage has been broadly negative and in my assessment, broadly wrong. If you look at hospitalization rates, you look at death rates, you look at the amount of testing we're doing, we've clearly flattened the curve. So we're on this progression Scott to opening the economy."

"What have you been watching??!?" Judge demanded. "I mean, we're heading towards a second peak, hospitalizations are up, record number of cases in California, Texas and Florida. Record number of cases yesterday in the U.S., I mean. What are you talkin' about?"

"I watch the data every day, every single day, and I will tell you, from peak, hospitalizations are down significantly," said Sechan, acknowledging spots of "increased contagion" such as Houston.

"Are you looking at things just through New York?!? Because that's not the way to look at it now," Judge snapped.

"No. No. I, I, frankly I follow one of- I follow Tom Lee on this data and I think he's got a pretty good, good handle on it," Sechan responded.

"Maybe that's your mistake. You should follow Tom Lee on the market, not the virus. I follow Dr. Gottlieb on the virus," Judge boasted.

"The data that Tom Lee's firm provides is absolutely fantastic on the virus," Rob insisted, before asserting there's "no will" to shut down the economy again.

It might've ended there, but Rob kept going.

"There's not a disconnect between Main Street and Wall Street," Rob asserted, explaining that "some parts of the economy are not participating."

"Some??? What do you mean 'Some'??? There's like- I don't understand what you're talkin' about, man," Judge said. "What do you mean there's not a great disconnect between Wall Street and Main Street. There's a HUGE disconnect between Wall Street and Main Street. You've got 30 million people out of work. And the stock market, and the Nasdaq is at record highs."

"OK, let- let- let- let me give you what I mean by that," Rob said, and while we would've preferred to just summarize it in a few words, we feel obliged to report the entire statement: "I think it's a- this is a really important discussion. So the Fed providing the stimulus they've provided has lowered interest rates. It has created a desire for investors to chase certain assets, certain stocks. So the average stock in the S&P is actually still down. It's feeling pain. But the stocks that drive a market-cap weighted index like the Googles, like the Facebooks, like the Microsofts, their cash flows have been durable, their businesses have actually gotten better. And so what that has done is led the headline indices to reprice higher. OK. That is an unintended consequence of the policy that rate suppression has created. And it has created price gains because investors have to put money somewhere. Right? And so that is what's happened on the price disconnect between Wall Street doing so well and Main Street not doing well."

Apparently unsure how to respond to that, Judge said, "Investors have to put money somewhere, right- The- The- The Fed has made it so that people have to put money somewhere and that somewhere has to be the stock market because there's nowhere else to get yield with rates that are this low."

OK ... Whew ... Where to start ... Well, Judge is definitely right and Rob definitely wrong about the "disconnect" or lack thereof. However, if Rob had said "so far there's been a safety net helping a lot of Main Street that isn't going to be there forever," he would've been on to something.

Also, Sechan said there's "no will" to re-shut the economy. That's true NOW, but it won't be true if hospitalizations start spiking again.

Finally, both Judge and Rob wrongly stated that the Fed is responsible for low rates. Rob said, "The Fed providing the stimulus they've provided has lowered interest rates." The Fed's stimulus hasn't lowered rates. The Fed sets the rates in accordance with economic activity. It's not the Fed's fault that there's no inflation. Rates are zero or close to zero because there's little economic activity, relatively speaking. Judge's claim that "the Fed has made it so that ... there's nowhere else to get yield" is false. The Fed hasn't held down GDP for 12 years; the Fed has set rates in accordance with that level of economic activity.

Blaming the Fed for low rates is like being in a traffic jam and blaming your car's brakes for going slowly. If you listen to the (often tiresome) Fed critics such as Guy Adami (Guy is not a tiresome panelist in general, only on this subject), the beef is on the narrow margin, for example, whether it should be 1% or 1.5% or 0%, NOT whether it should be 6%.

On the rest of the show, Pete Najarian said he trimmed "about half" of his DIS stake and said he has "a lot of nervousness going forward about the sports world." He called DIS a buy at $100.

Speaking of $100, Kari Firestone said she'd buy BA at that price.

And speaking of nervousness about the sports world, Judge brought back Marc Lasry; all of their chats this past spring amounted to Judge asking if NBA hoops will return and Lasry saying yes. Lasry on Thursday told Judge he "absolutely" thinks the NBA will resume play this season. It wasn't very convincing, and we doubt Judge believed him.

‘33% of people 65 and over sold all of their stocks at the end of March’ (a/k/a Judge lets A block run for 55 minutes)

Oh my.

Wednesday's (6/24) pulse-less Halftime Report had already been turned into a Mad Money Auxiliary by the time Judge, for reasons we can't fathom, felt compelled to once again ask Joe Terranova about selling AMZN a week ago.

"Just give me your thoughts," Judge asked.

"My thoughts are, I had a significant gain in Amazon, and I've explained to you, I was long Apple and I was long Microsoft, and I just could not continue to have the risk exposure, uh, in technology to the Big 5 as we continued to move higher in price," Joe said. "That's portfolio risk management."

Judge asked Joe at what time does one have to "call b.s." on paying higher and higher multiples. Joe said the virus' spread will "further bifurcate the S&P 500."

But Stephanie Link asserted, "The economy is definitely getting better."

Judge rattled off all of Heather Bellini's upgrades. (This time, the Najarii weren't around to knock Heather's years-ago lack of enthusiasm for MSFT.) Jim Lebenthal said the "punch line" is that "there's been a little froth in the market." But Jim Cramer had just knocked something over at his desk, which distracted Judge and Jim Cramer into laughing. Jim Lebenthal nevertheless assured, "It's highly unlikely to have a crash."

The line of the day came from Kari Firestone, who stated, "33% of people 65 and over sold all of their stocks at the end of March. Big mistake."

OK. We don't doubt that a lot of people did unload in late March. However, we question how anyone knows what 33% of people 65 and over did with their stocks. Is the government (or Facebook operatives) monitoring our trades and portfolios? And does "all of their stocks" include ETFs or mutual funds that represent the S&P 500 or Nasdaq 100?

The guess here is that Kari is citing a survey that someone took, and that 33% sounds high.

Prior to the beginning of the show, both Carl Quintanilla (in the lead-in) and Judge said there was a "special guest" on the Halftime Report — Jim Cramer.

Judge promised that Ivy Zelman would be on and declared, "This is a big (snicker) program." (Hard to believe he didn't say, "We got a lot of good stuff.")

When Ivy did appear on the show, around the 47-minute mark, Judge told Ivy, "It's been a busy show; I sincerely appreciate your patience." Does that mean that, at other times, when Judge tells guests he appreciates their patience, he's not necessarily sincere?

Stephanie Link was allowed to offer an advertisement about her new employer.

Judge mentioned a report of "multiple positive tests" on the PGA Tour.

Unclear how Judge thought this time would be different with Toni

Tuesday's (6/23) Halftime Report was so devoid of new material, we were basically hoping Judge would bring up Joe's sale of AMZN again Judge had to admit during his A block conversation with AAPL watcher Toni Sacconaghi, "I don't want to, frankly, Toni, I don't want to have the same conversation that we always do."

But they did.

Judge wondered when Toni was last bullish on AAPL. Toni stressed that he was bullish a little while ago though apparently not when it fell this spring to $200. "Shame on us for, for missing that move," Toni said, but he said it's possible there'll be "another retrenchment" that creates a similar opportunity.

Josh Brown said of the tech giants, "They're all conglomerates; we just don't call them that." Brown touted the QQEW and KWEB.

"Growth stocks are here to stay," affirmed Rich Saperstein.

Jenny Harrington, stunning in her home office, opined, "I think the valuation gap has to close," suggesting a "plateau" of the tech giants and a catch-up by the value stocks.

Rick Rieder called the 10-year at 0.72% "not exciting."

On the 5 p.m. Fast Money, Karen Finerman, asked about BA, reacted a bit like that banker Warren Beatty visits in "Shampoo," explaining, "I'd be more inclined to fade it" and basically, "meh."

Karen said of Peloton, "I'm on the bike a lot."

The highlight of Fast Money was the presence of CNBC's gorjus Aditi Roy sampling the Impossible breakfast sandwich that's coming to Starbucks.

This is about the 3rd or 4th show where we’ve had to hear Joe explain why he sold AMZN

Hard to believe, but the Halftime Report is so hard up for material that Judge and Joe Terranova had to revisit Joe's AMZN sale about 3 or 4 times (seriously) during a sleepy Monday (6/22) episode.

Judge asked Joe if he regrets selling AMZN. Joe said it's a "simple answer ... of course I regret it." But he said he had to do it at the time "in terms of managing my risk."

Joe explained that he's not managing a portfolio like Warren Buffett, in which case he could hang on to AMZN. "My individual portfolio is not as big as his (snicker)," Joe said, for those who might not've known that.

Liz Young tried to help, explaining to Judge that if Joe "had already spent his risk budget (snicker) in other places," there's no reason he has to hold on to AMZN.

Steve Weiss started doing his daily Don't Buy The Airlines routine, but Judge actually cut him off and demanded to know about banks instead. Weiss said he expects banks to go up, but he doesn't expect a big return, but he likes V.

Joe said an "added dimension" to the strength in megacap growth stocks is "the element of ESG investing."

Sure wish we could watch some more testimony from Jerome Powell (a/k/a Evel didn’t officially cross the Snake River)

Not trying to be Debbie Downer here.

But assessing what we heard on Thursday's (6/18) Halftime Report, honestly, we couldn't really uncover a headline, unless you count the presence of gorgeous Meghan Shue (above) or gorgeous Rahel Solomon.

Shue told Judge, "It's really hard to ignore the typical recessionary playbook," and she said she would argue for more exposure to value (snicker).

"I wouldn't be chasing junk," said Shue, who would look for "top-shelf cyclicals."

Josh Brown seemed frustrated at the value-vs.-growth conversation and sought to redefine it, stating, "We're discussing which segments of the economy tend to have large companies that fall into the value bucket."

Steve Weiss bluntly said he doesn't like the "labels and discussion" about what's "value" and what's "growth." Weiss said value is something like FB but not an "airline stock that's gonna lose money."

Well, we'll make it easy for all of them. Growth and value may be marginally useful categories, but what really matters with any stock is whether this company's business outlook is getting better or worse. You want to buy the former and sell the latter.

There you go. You can thank us later.

Steve Weiss doesn't think the pandemic is really behind us. "I think you'll see a greater spike," Weiss said.

Mike Farr got our attention in the Pop Culture Dept., stating, "Just because Evel Knievel landed safely on the other side of Snake Canyon (sic omitted "River") doesn't mean it was really a good idea for him to jump over the damn thing to start with."

Um, hate to mention this to Mike, but Evel didn't exactly get to the "other side" of Snake River Canyon; at least he didn't land there.

(A lot of folks don't know that Evel's famous jump at Caesar's Palace was filmed by gorgeous Linda Evans.)

Farr said you shouldn't be "reckless" in this market, but it "doesn't mean you go to cash either." (That sounds like standard advice one should employ at all times.)

Farr said FDX is a "core position" for him, and he'd put new cash in today.

Josh Brown said he's planning to hold INVH for "5 to 10 years." He said the idea of paying rent to live in one of these homes is a "megatrend."

Brown warned about being long the biggest stock in Canada, citing Nortel, Research in Motion and Valeant.

Judge forwarded a tweeted question to Meghan Shue about whether someone who's up 15% on the year on the strength of tech names he heard discussed on CNBC should start trimming tech. The Princeton swimming captain said "you have to diversify" from just secular growth into "some areas of industrials" (snicker) and "spots within" consumer discretionary such as certain restaurant chains, as well as "high quality, bigger banks."

Steve Weiss said now's a good time to get "re-engaged" in LULU.

On the 5 p.m. Fast Money, after Grandpa Guy Adami complained again about how it "infuriates" (snicker) him that the Federal Reserve prints money "out of thin air" and suggested that other people are supposedly deciding not to pay bills after observing what the Fed is doing (snicker) (ask someone who just skipped his student loan payment if he knows who Jerome Powell is), gorgeous Karen Finerman pointed out, "The Treasuy is the actual one who's just sort of giving the money away, right, and the fund- I mean the Fed, is sort of funding that debt that the Treasury will need to take on, right."

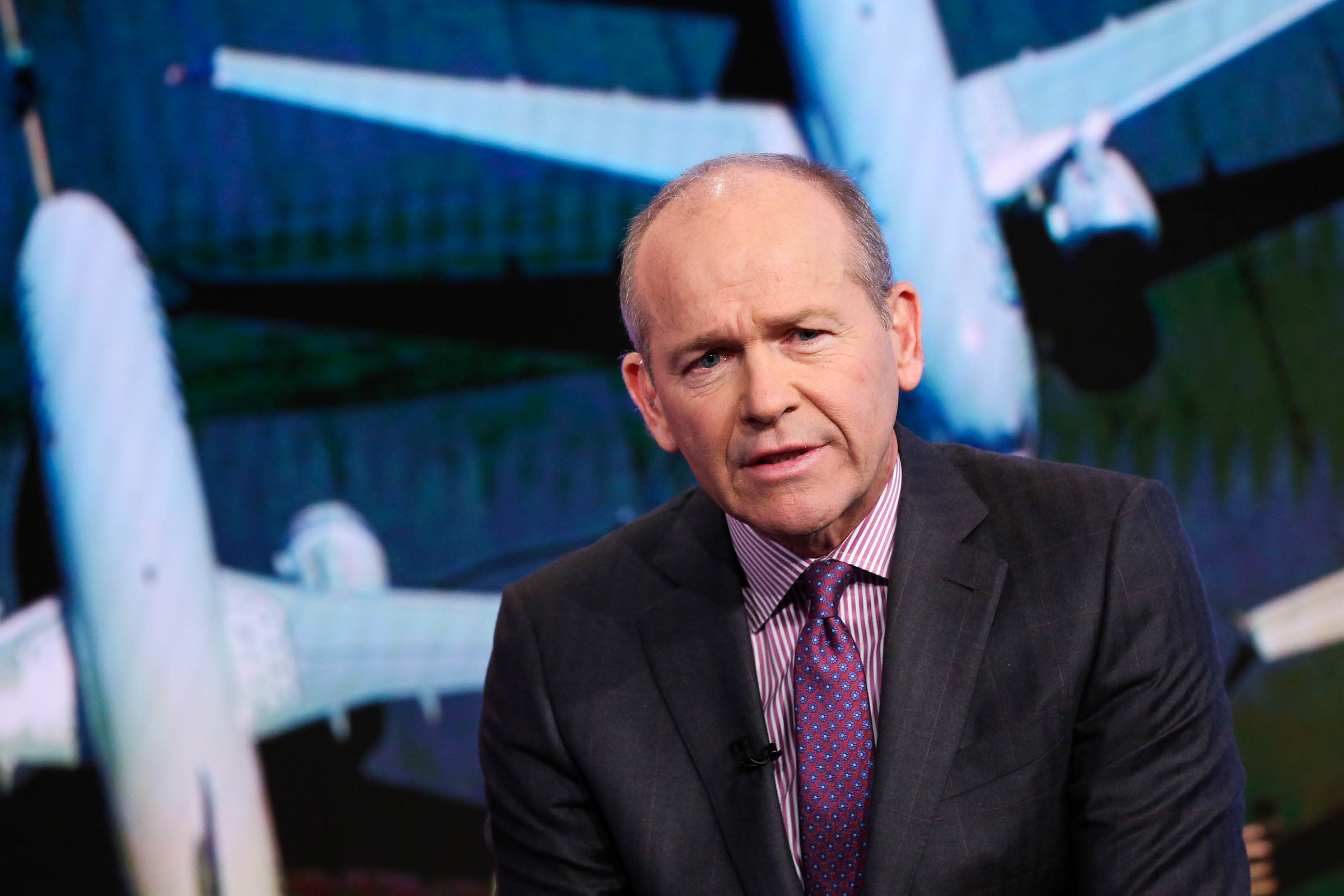

Stephanie predicts 737 Max will be recertified in a ‘couple’ of months

It's one of the more curious Fast Money/Halftime Report parlor games in recent memory: Every BA long declaring when the government will recertify the 737 Max.

It's a little like Charlie Brown kicking the football or Gilligan getting off the island. We've been hearing "a couple months" or "a few months" for basically the last 12 months.

On Wednesday's (6/17) Halftime Report, which like Tuesday's episode was partially preempted by Jerome Powell testimony, Stephanie Link claimed the recertification of the 737 Max is "gonna come in the next couple of months."

OK. And she knows this because ...

Just for reference, Link on Dec. 17 was actually hinting at a January recertification: "If you get recertification in the next 2-3 months, 1-2-3 months, then this stock flies."

So we'll believe it when we see it.

On Wednesday's Halftime, Jon Najarian said you can "add to" travel stocks and said they can be traded in a range for now. Stephanie Link said those are "trading stocks," but, "I'm more of an investor," and so "the way you go" if you're interested in airlines is BA, which she owns (which basically trades with the airlines, but whatever).

Guest host Mike Santoli, who did a fine job on an abbreviated show but seems better suited to observer/pundit role, asked Joe Terranova if anything negative, such as rising coronavirus cases, can get this market's attention. Joe indicated that's a tough ask. "Liquidity, Mike. Unprecedented," Joe said.

Joe reiterated that he unloaded his AMZN stake — the move that got Judge hopping for some reason last week (see below) — and stressed that his sale is not a "referendum" (snicker) on AMZN's direction.

Doc said the extra $600-a-week enhanced unemployment benefits runs out at the end of July, and Doc was expecting that the subject will be a popular one during Jerome Powell's testimony and that it might get "a lot more play with the House" on Wednesday than it did with the Senate on Tuesday.

/cdn.vox-cdn.com/uploads/chorus_image/image/46832234/TG-C-5003.0.jpg)

Lee Cooperman: Shutting down economy was ‘colossal mistake’

Last week, the crew at CNBCfix HQ got to catch up with a capital markets superstar on the state of stocks, economics and even business television.

Among the many topics discussed in what proved to be WAY too little time were interest rates, Donald Trump's Cabinet, the coronavirus ... and deficit spending.

Which allows us to fast-forward to Lee Cooperman's commentary on Monday's (6/15) Halftime Report, when Lee said that when the nation was founded in 1776, "we had no debt."

We're not sure about that; we'd have to ask some Revolutionary War historians.

But we do know that debt was embraced enthusiastically — by both parties, basically — back in March, a continuation of a decades-long trend as massive as some of those ice ages. There was basically a grand total of one Republican who tried to get in the way. David Stockman is barely heard from anymore (though he was on CNBC's Trading Nation" in March). Everyone's got credit cards. People have borrowed since the beginning of time, but never with this much blessing.

Basically, the reason we've all been working from our living rooms for the last 3 months is because A) the Internet and B) debt; without either one, say, if this were 1967, we'd all be trudging to the office in masks and gloves and punching the clock.

The overwhelming tidal wave of the Internet will pick and choose its survivors, but the tidal wave of debt basically protects everyone, forever, unless and until someone has the gall to attempt "austerity" (snicker) or until financial markets reach Carl Icahn's "Day of Reckoning" (double snicker).

Around here, we don't believe in buying things we can't pay for, or, as they say in the philosophical "Top Gun," minds writing checks that the bodies can't cash.

But Western governments, helped along by the likes of Art Laffer and others, have grown more and more comfortable with this concept, so here we are.

Anyway. Lee Cooperman on the Halftime Report started off mentioning Scott Minerd's 1,600 S&P prediction (snicker). "He appears to be bright," Lee said, "but I don't see 1,600 in the market."

Lee added that he heard Minerd use the term "bubble."

In his strongest commentary of the program, Lee said he thinks governments made a "colossal mistake" in shutting down the country. "We're not gonna make that mistake again," Lee asserted.

We're not sure it's been a "colossal mistake" but maybe more of an "understandable reaction." The record shows that leaders worldwide, in February and early March, didn't want to believe the worst of this tragedy and were reluctant to upend ordinary life. That was the right move during SARS, not so much in 2020.

Anyway, taking a "fully valued," middle-ground approach on this market, Lee contended, "I don't think we will break the lows of March" but that the S&P won't see its February high again in 2020. Lee said he normally wouldn't agree with a 20 times S&P multiple, but he's OK with that now, especially with tech's inclusion in the S&P 500.

Lee gave too long of an analysis about the supposed "3 markets" in the economy. He mentioned, as one of them, the Barron's article on Robin Hood (the brokerage firm, not the charity, Lee stressed a couple times) and young traders, who Lee said are doing "stupid things."

"In my opinion, they will- this will end in tears," Lee said.

Lee said the HTZ trade "makes no sense," pointing to Carl selling at 72 cents a share (snicker) (that only gets a snicker because Carl is very wealthy and successful and maybe needs some ticker comeuppance every once in a while).

Jim Lebenthal asked Lee about a "very known, social-media investor trolling Warren Buffett, saying he's washed up." Jim said he saw people saying similar things about Mr. Buffett in the 1990s and the 2000s, "and both times, Mr. Buffett came back, roaring."

Lee, though, sort of conceded that the Oracle of Omaha is in a slump. "Warren has gotten older ... he's having trouble figuring out what to do," Lee said, though Lee would "not in any way write him off."

When Judge told Lee that Judge had to cut it off for "breaking news," Lee said, "CNN has breaking news every 5 minutes on things that are about 4 days old."

Tom Lee is ‘not wavering one BIT’

Judge on Monday's (6/15) Halftime Report said maybe the "most interesting" thing (other than Judge wearing a tie for a change) he'd heard all day is "almost an aside from- from (you guessed it) Cramer" in the morning.

The comment was Jim saying that, because "the science is coming together faster," people who are selling stocks now could be "whipsawed."

Judge said he didn't want that "pretty profound" (snicker) comment to "fall by the wayside."

Steve Weiss, however, said Cramer's opinion is "not new news" but rather "consensus."

Well, here's one thing we know: predicting medical breakthroughs is basically impossible. Remember in the early 2000s, when they were supposedly mapping the whole human genome and all the cures were going to rain down immediately ... we're all hopeful of a stop to this scourge, but no need to day trade on hints of what Jim Cramer's hearing off the record, which Judge claims is really important stuff, as if Jim is spending his free time in research labs looking at microscopes.

Weiss bluntly declared, "I know I'm not gonna be one of the first to take the vaccine."

Referring to United Airlines, which he enjoys bashing for some reason lately, Weiss said "these companies are insolvent" and that it's "pure folly" to believe they (presumably airlines) have any equity in the time being.

Joe Terranova said "the foundation" of how he views this market is "consolidation, optimism based on liquidity." (Hope he doesn't try to trademark that catchy slogan.)

Judge rattled off how a bunch of strategists, including the Morgan Stanley 800-point-range guy, are saying buy the dip. Judge said Tom Lee is "not wavering one BIT (sic that's how Judge said it)."

Jim Lebenthal predicted the S&P falls to "2,900 or maybe less."

Casual Friday: Judge tie-less

While Judge on Friday's (6/12) Halftime Report took a detour from his typical fashion statement, it didn't take impromptu (snicker) guest Jim Cramer long to utter the two most offensive words on Wall Street these days: "airlines" and "cruise lines" (that's 3 words).

Jim said he's "hoping" that the market simply "trades sideways for a while." (Honestly, that doesn't really make any sense. What Jim's saying is that he's really hoping there's no big crash. That's how he should put it.)

Jim explained why he joined Judge's show at the top of the hour: "What else is there to do??!!"

We think it's kinda funny that Jim trashed airlines and cruise lines but gushed about NVDA. (Because 66 P.E. stocks are far more safer than bailout stocks.)

Assessing how the market cratered on Thursday, Rob Sechan pointed to a "negative narrative" on the virus and suggested "some of the coverage of that was, was, was overstated."

Pete Najarian thundered, "The biggest option volume day this year was yesterday." How that helps anyone make money, we don't exactly know.

Josh Brown said he was on a conference call with a "major asset manager" who announced a "playbook" for this market. Brown said he "started laughing" and "hung up the phone." (We highly doubt that it actually happened that way, but it's a good story.)

"There is no playbook," Brown asserted.

There has been a lot of speculation since March about the work-from-home economy. Jim Cramer, without citing any evidence, claimed that companies have found, "People work better at home. Uh, people who (sic grammar) work better where they are happiest."

Hmmmmm. Shouldn't Judge, upon hearing that statement, asked aloud to Mark Hoffman whether Mark (likes Judge's appearance without a tie) should let CNBC anchors permanently work from whatever location makes them "happiest"?

Judge told Jim Cramer at the end of the A Block that Jim was "gracious" to take part in the show.

Sue Herera delivered news on the Oscars with video of a ceremony. Sue said to Judge, "Scott I wonder if we'll ever gonna see (sic grammar) big crowds like that in a theater again." Judge said Georgia seems to be going "all in" on a return to normal. So, if you're wondering about seeing big crowds, you might want to start in Georgia.

Greg Parsons, CEO of Semper Capital, told Josh Brown that the buzz about an exodus of people to the suburbs is just "chatter" and "noise" for now.

But Marc Lasry said housing prices in Fairfield County "have moved up 15-25%."

Pete Najarian addressed a Twitter question, saying, "I don't do a whole lot with LEAPS, quite frankly, Scott," because of the costs, though Pete somehow also thinks LEAPs are a "great tool" (snicker).

Rob Sechan was also tie-less, but he does have that autographed Steelers helmet in the background; we'd like to know whose signatures are on it, but Judge apparently isn't going to ask.

Judge promised Lee Cooperman on Monday.

Joe apparently had a tough day. He sold shares of AMZN.

Judge opened Wednesday's (6/10) Halftime Report announcing that shaggy-haired Joe Terranova had ... unloaded AMZN (which now evidently passes for headline material).

Joe said he has "too much risk exposure" in this market, citing as one reason the "Federal Reserve meeting" (snicker).

"There's a lot of hot money in the equity market right now," Joe said, affirming he's not interested in the "dash for trash" in sectors such as airlines and hospitality.

Judge actually concluded of Joe's AMZN exit, with a straight face, "It's a hard thing to do to get out of one of these high-flying stocks."

So, better go easy on Joe. It sounds like it may take some time to get over this.

Judge actually stated, at the "26½"-minute mark, that at the top of the show, when Joe was talking, "We said that you had sold Amazon, we did see on an intrabay- (sic) intraday basis (sic redundant), that stock give up some of its gains."

Joe, who looked about as grim as Travis in "Paris, Texas" throughout the show, said it's "incredibly foolish" if anyone is selling based on his revelation at the top of the show.

But during this conversation, we heard something that made the ears tingle when Steve Weiss offered: "It's never a wrong thing to take profits, uh, most people tend to sell their losers and don't live with them as they come back."

We don't have any data on this, but we think what Weiss said is true, even though Warren Buffett warns about the folly of selling your great stocks while keeping the bad ones.

Judge turned to CNBC's gorrrrrrjus Seema Mody for a report on corporate diversity.

Judge says that if coronavirus cases spike, another shutdown is ‘just not gonna happen’

Judge on Wednesday's (6/10) Halftime wondered how anyone could make a "fundamental" case for FB with the stock being up 60% since the low, AMZN up 40%.

Steve Weiss curiously said he's not going to sell right now if a stock is "20% overvalued, and I've gotta pay taxes on extraordinary gains, then I'm behind the 8-ball."

How in the world is anyone "behind the 8-ball" by taking a gain???

Especially when they're selling the stock at an undeserved 20% premium???

Jon Najarian differed with Judge, stating "definitely" these stocks should be where they are, because of opportunity created by the "pandemic panic."

Doc also trumpeted that an AMZN 2,600 put can be had for $75, so someone concerned about taking taxable gains could just buy the put instead for downside protection. (He could've also said, "These puts are so cheap, makes you think they'll probably end up worthless.")

Judge demanded to know whether Tom Lee sees tech stocks' strength as a sign of "froth."

Well, "If you can't kill a cyclical" in this environment, Lee said, they've got staying power; he expects them to see upside going into 2021.

Judge explained that Lee is saying, if there's a dreaded spike in coronavirus cases, "There is not gonna be any wherewithal to shut down the economy again. Right? That's, that's almost a given."

As to whether, if cases start to rise again, the economy could get shut down again, Judge bluntly declared, "It's just not gonna happen."

Steve Weiss butted in to take issue with Lee's emphasis on the high-yield market. Judge said he didn't have enough time for Joe to ask a question of Tom Lee.

Phil LeBeau reported that AAL reported its daily cash burn is dropping from $50 million to $40 million, which Judge scoffed at (20% improvement, guess that's no good for Judge).

Phil claimed, "There's not a single person (sic) in the airline industry who expects these companies to be back to the same levels of passengers that they were pre-coronavirus at least until 2022, late 2022, if not 23 or 24. There's no- nobody at all who believes that." (This writer is long SAVE.)

Hmmmm. Beg to differ. We bet there's at least one person who believes it'll happen in 2021.

Steve Weiss said airlines were fine for a trade but still face serious headwinds; "If you dissolved these companies today, there'd be no equity value." (Right. They've got something better than a balance sheet — a bailout.)

Judge said 4 times that markets can remain "irrational," then conceded not everyone believes stocks are "irrational."

CNBC's Meg Tirrell, who has been profoundly effective (and profoundly cute, if it's OK to say that) reporting from home the last few months, conducted an interview with a JNJ bigwig that frankly kind of went over our heads. Judge said JNJ shares were rising during the interview.

Dan Nathan on the 5 p.m. Fast Money called Larry Kudlow a "charlatan." Guy Adami warned about day-traders who have gone from "sports gambling to market speculation" getting lucky in airline stocks.

Judge adamant that retail money might be driving rally (a/k/a how about Joe Charbonneau vs. Wayne Gretzky)

On Tuesday's (6/9) Halftime Report, Judge kept trying to promote a Jim Cramer theory about a potentially dangerous retail surge in this market and asked Jon Najarian to verify.