[CNBCfix Fast Money Review Archive — August 2017]

[Thursday, Aug. 31, 2017]

Weiss in 50% cash, Pete 30% as everyone fears the Marks/Gundlach/last-2-weeks-of-August correction

Steve Liesman on Thursday's Halftime recapped the Steve Mnuchin interview.

Josh Brown said "The best news is that they are adamant about, um, the debt ceiling's not gonna be an issue," which shows a "level of maturity that we haven't seen in other arenas."

Jim Lebenthal said the S&P 500 has been "in a 3% range this month."

Leslie Picker was in Brokaw, Wis., to discuss local outrage against activist investors, specifically the shuttering of a paper mill blamed on Starboard, which had a stake in Wausau Paper. But Picker said a Duke U. study showed hedge fund activists had "essentially no role" in the closure of the Brokaw mill.

Josh Brown said you have to be in the "gray area" on this topic. Kari Firestone finds it "curious" that this legislation doesn't target private equity as well. Guest host Mel noted that Jeff Smith will be at Delivering Alpha, which will be a "great conference."

The 5 p.m. Fast Money crew basically said in unison, when it comes to tax cuts, "they will get something done … it almost doesn't matter what it is." (That was from Karen Finerman.) Nobody cut to the chase, which is, there's nothing to do, other than a simple vote to allocate some cash to Houston.

Looks like Pete outdueled Weiss on whether GILD made a good deal

Jon Najarian on Thursday's Halftime Report gushed about GILD, pointing out it's up $10 since last Friday and that the company has gained $13 billion in market cap for a purchase of $12 billion.

"I'd say that's a good trade," Doc said. Hard to argue with that.

Kari Firestone said she looked at JNJ "very seriously" a year ago and didn't buy, though it's a "great defensive story."

Josh Brown said he's long BMY, which is having "as legitimate of a breakout" as you get. He's also in AMGN but called JNJ a "really expensive stock primarily because of its steady dividend."

Jim Lebenthal noted health insurers and biotech are both in uptrends. He said he's long ALXN and PFE.

On the 5 p.m. Fast Money, Guy Adami questioned if Donald Trump, after pushing through tax reform, would "circle back" to nail Ken Frazier on drug prices, affecting MRK.

Jim botches CNBC Silicon Valley technology correspondent’s name

Josh Lipton on Thursday's Halftime Report mentioned invitations going out for AAPL's Sept. 12 event.

Jim Lebenthal said "this is not news" but said he's not trying to take anything from "Josh Upton (sic)."

Kari Firestone noted AAPL has a "low P.E. relative to the market" (effect not a cause). Jon Najarian said he will "guarantee" that the iPhone will go on sale "2 days before the end of the quarter."

CIEN: From hero to goat

Kari Firestone on Thursday's Halftime said she's cut back her FB position simply because it's gotten too large. But she's "still a big owner."

Josh Brown said CPB needs to "reinvent itself" and that it needs "something fresher"; he'd "completely avoid" the stock.

Jim Lebenthal said the problem with DG is that brick and mortar is a "very, very treacherous sector."

Jon Najarian said people who bought CIEN 23.50 weekly puts "nailed it." (He didn't say that while Stephanie Link last week called CIEN "very volatile," she said it could go from 23 to 29 in a day, rather than the other way around.)

Kari Firestone wishes she owned WDAY. But it's a "volatile stock" and "not without risk" (as opposed to all of the risk-free stocks out there).

Doc said bulls were buying HDS 32.50 September calls.

Kari Firestone's final trade was V. Doc said VZ because of call-buying; he didn't say what the strike or time was. Josh Brown said the Dax slipped below its 200-day, but it's because of the currency, not fundamentals. "You should not be panicking," Brown said. Jim Lebenthal suggested GM amid prospects for scrapping all those cars in Texas.

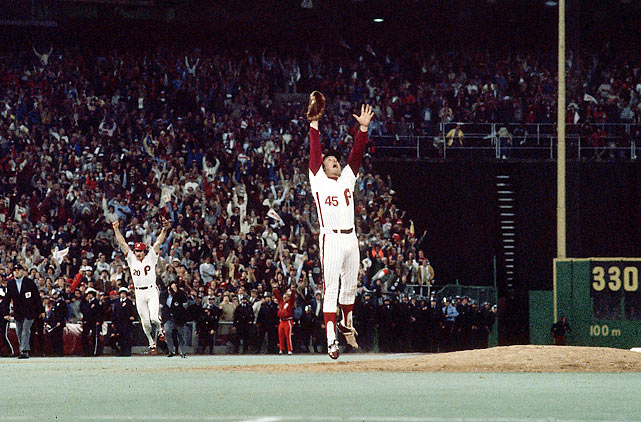

The best Tug trade since the Phils got McGraw

Scott Cohn, not often on the Halftime Report, pointed out the water levels still afflicting Texas cities on Thursday.

Jon Najarian on Thursday's Halftime Report said the RBOB September and October contracts were pulling back after a "big squeeze this morning," even though the numbers shown on the screen didn't show any pullback.

Doc said traders "were on tugboats" in the Gulf and trading with backup Marine band radios in case their cell connections went down; they made "a nice chunk of money" trading refinery activity (or lack thereof) and were rescuing people in their boats later and even giving out money "because they felt very generous after this, uh, windfall for them."

Jim Lebenthal said, "That's awesome."

Jim said he sold MPC about a month ago "at exactly the price it's at right now."

Joe Terranova dialed in and said, "You cannot get overly excited about what's going on right now and rush into the refiners."

"This is a front-month dynamic," Joe explained, lukewarmly stating HFC, Delek and CVI benefit from not being in the storm region. But Joe said those refiners were giving back gains because of the WTI rally. "It's a very treacherous trade," Joe said.

Joe said the "real opportunity" is possibly nat gas, mentioning another hurricane in the Atlantic. But then he told Mel, "Natural gas equity plays are, are, difficult uh to really get your hands around," and mentioned RRC and EOG and COG but said those are names "that have been struggling all year."

So, it's a real opportunity, but … (a/k/a let's buy these names instead of NVDA).

Tom Kloza said for drivers, the "worst-case scenario is probably about to develop," which is a gasoline spike of 40 to 60 cents. He cited Kipling and predicted "panic behavior in places like Dallas, in places like Tennessee and in places sort of along the Carolinas."

However, "It should largely be a non-event for crude oil," Kloza said, asserting Thursday's rally "makes no sense."

Jim Lebenthal said typically there's a "surge export" that goes mainly to Europe, but "those exports can be redirected" to the U.S.

"I think a month from now, this is gonna all have blown over," Jim said.

Kari Firestone said she owns PSX and thinks it's the type of name that should go up in this environment. Josh Brown said he doesn't see holiday weekend drivers changing their plans over gasoline price hikes.

For some reason, Futures Now was pushed back in the program; when it aired, Scott Nations said WTI is up because of a fear that crude will be "trapped" in the Gulf for a while. He said the government has released 500,000 barrels from the SPR, "first time we've done that in (sic meant 'since') 2012." Jim Iuorio doesn't think crude can cross 50.

More from Thursday's Halftime later.

[Wednesday, Aug. 30, 2017]

70, 400, 572, whatever

Nick Setyan on Wednesday's Halftime Report said JACK has about 70 company-owned stores in the Harvey-area market; they are losing "about 5K" every day.

But, he said, "I actually like Jack in the Box here," because the trend with the Smoky Jack had "a chance to accelerate" before the hurricane."

"He had me at Smoky Jack," guest host Mel said.

Kari Firestone said she just bought MIDD.

We found it a little hard to believe that the CNBC graphic said JACK has 400 locations in the "Houston area," but then again, the map of the U.S. showed a circle in East Texas with "572" in it, so looks like we've got the problem of several different forms of measurement of info within the same story, and it's anyone's guess which number is most relevant.

Jon Najarian's final trade was JACK; he said he bought during the show.

Pete mistakes effect for cause, claims people are buying tech for P.E. ratio

In a curious GDP assessment, Kari Firestone on Wednesday's Halftime Report stressed that all the years of low growth might be "a base that now we can build from."

Steve Liesman said the market has been sniffing out a GDP "upward shift towards the 2½ range."

Liesman stressed that "the Fed is talking about a terminal rate … closer to 2 than to 3. It is a dramatic change."

Gorjus Ylan Mui said Donald Trump's remarks on tax reform later Wednesday would be "short on specifics."

Kari Firestone revealed, "Today I published a piece on CNBC.com about surviving in the age of unpredictability." That's fine, except we wonder how "unpredictable" this "age" is when volatility's at all-time lows.

Kari explained that "every day when we wake up, we don't know where the market's going," so tax reform if it happens is just an "added increment."

Guest host Melissa Lee summarized Kari's point as "it can only be upside."

Pete Najarian said GDP numbers were "in line" and "fairly strong."

Rob Sechan said, "It's taken a long time to reach cruising altitude," but it's a "pretty good environment" now.

Weighing sectors, Pete claimed, "The reason that technology has performed so well is, what's the P.E. of Apple. What's the P.E. of Oracle? What's the P.E. of all of these companies?"

"And ex-cash," Mel chimed in.

Jon Najarian said you might get a chance to buy AAPL "several dollars" below 160. He noted Tim Cook cashing in his new shares "immediately."

Kari Firestone said "investors are saying to themselves" to put money in AAPL with its low P.E., perhaps validating Pete's non-point.

If Warren Buffett had bought AMZN instead of BAC and WFC, he’d be a lot wealthier

Becky Quick on Wednesday's Halftime Report recapped the Warren Buffett interview.

Rob Sechan said he doesn't like insurers because of pervasive "competitive pricing pressures."

Jim Lebenthal said insurers are appealing only after some short-term "earnings hits" and when a few smaller companies "go out of business," but "not now."

In a decent little debate, Pete Najarian stressed that management is the key to picking banks. Jim Lebenthal though said, "I'm not sure there's that big of a difference in the management of any of the big money-center banks."

Jim's right. Especially when the companies are all still in a straitjacket-type of environment.

Anyway, Pete was practically taken aback by Jim's management point. "I start there. That's where I start," Pete said.

Jim mentioned the banks having "more than a hundred thousand employees," which are too many for one person to supervise.

Mel asked Jim if banks are a "monolithic" trade to him. "That's a good word for it," Jim said.

Jon Najarian said BAC is the only bank he's long.

Pete scoffs at XLE dividend

Brian Stutland on Wednesday's Halftime Report said RBOB moving above 1.80 is a signal of longer-term supply problems. Jim Iuorio suggested 2.15 is "fairly reasonable" within a couple weeks.

Jon Najarian said there was "huge activity" in PBF options; he said the company just has 1 refinery in New Orleans, and it's been spared.

Guest host Melissa Lee suggested the XLE. Kari Firestone said "you can be comfortable right now in that trade." Rob Sechan also seemed to endorse it, but Jim Lebenthal said, "The shale oil production is such a fast response time that we may not get the spikes we've seen in the past" in crude.

Eventually, Pete Najarian shrugged at the XLE, "I wouldn't be comfortable there. How great has that dividend been with those stocks for the most part down 20% if you get a 4% dividend" (sic grammar).

5 p.m. Fast Money panelists largely fail to name Lightfoot songs during usual 4-minute commercial break

Jon Najarian on Wednesday's Halftime Report said November 13 calls in AMD were popular.

Pete Najarian said SUM October 30 calls were getting bought for $1.

Doc said ADI has 70.5% gross margins.

Pete said being long CHRW has "been pretty painful," but maybe it's turning.

Jim Lebenthal said HRB is a stock "that's very hard to make money in." He said full employment doesn't given him any reason to be in this name.

Rob Sechan said there are homebuilders who "benefit greatly" from Harvey rebuilding, but he didn't name any. Jim Lebenthal said material companies such as MLM are finally starting to perform when he thought that would've happened before Harvey hit.

Rob Sechan's final trade was XLF. Kari Firestone said AGN. Jim Lebenthal said KMI. Pete said GILD has been going up since the acquisition, and there is call-buying.

[Tuesday, Aug. 29, 2017]

Weiss in 50% cash, actually claims CEOs will see consumer confidence ‘erode’ and factor that into guidance

Steve Weiss dialed in to Tuesday's Halftime to say he's been 50% cash "for a while."

He said after the North Korea news, he bought the SH, a short S&P 500 instrument, but "covered on the open."

"I'm not expecting a big decline," Weiss said, just a "normal correction."

Weiss pointed out to guest host Missy Lee that he mentioned the 50% cash last week, which he did.

He said he's at that 50% level because he's watching "essentially a game of laser tag" between "two 5-year-olds," those being president of the United States and leader of North Korea.

In a curious prediction that could happen but seems a reach (we'll even call it loopy given the variables involved), Weiss predicted CEOs will downplay upcoming quarters "as they see consumer confidence start to erode."

Weiss said he added Tuesday to the XBI.

All business: Mel prods Jeff Kilburg to get to the point on gold

Guest host Melissa Lee, running a crisp (if slightly pressed with lots of stuff going on) edition of Tuesday's Halftime Report, grew impatient with Jeff Kilburg's gold speech.

"So you think it's gonna go higher," Mel finally cut in. "I do," Kilburg said, stating 1,400 is a "tick away."

Anthony Grisanti said hedge funds are "all in" on gold with the highest long/short ratio he's seen, so he thinks it's going higher.

Mel asked Chip Dillon of Vertical Research Partners how Harvey is affecting paper mills. Dillon said past experience shows mills down anywhere from a half day to 3-4 days. He said supply of cardboard boxes could be affected because mills are already running at "close to 98% of capacity" throughout the country.

Mel asked who could fill in the gap for the storm-damaged areas. Dillon said that's a "great question" and mentioned WRK, PKG and KS; he has a buy on all 3 names.

Dillon told Lee that IP estimates are at risk for 3rd and maybe 4th quarter. Doc said he might be interested in WRK.

Haven’t heard about Chanos’ CAT short for a while

Jon Najarian on Tuesday's Halftime Report said there was "very strong activity" in weekly AAPL 160 calls.

Guest host Missy Lee noticed that the graphic said "September 160" calls and wondered if that covered Sept. 12. Doc insisted it's "just this week." Mel pointed out, "We had up September," a fair point, assuming it's the regular September option (whenever that is).

Sarat Sethi said AAPL tends to run up ahead of products, and then "once the product comes out," it pulls back.

Joe Terranova said he doesn't see opportunity in JILL. Doc said "the good news" for FINL is that it rallied from its 6.90 open. Doc said you could take a shot at Tuesday's price but admitted, "The sector has just been death." (Yeah, even after Karen Finerman cheered that the sector was trading down in "integers" a couple months ago.)

Pete Najarian said it was "eerie" how close the BBY numbers were to HD. As for the day's BBY selloff, "It doesn't scare me at all," Pete said, even though Mel said Hubert Joly said "it's not the norm." Pete thinks BBY is a "great opportunity."

But Sarat Sethi later said of BBY, "I would wait for the stock to come back a little bit more" because momentum investors are getting out. Joe Terranova said he agrees but that the "very, very conservative outlook" bodes well for gains down the road.

Erin Browne said she likes Europe but advised not hedging the currency; "you want that euro exposure," so she likes EZU.

Erin Browne's final trade was FXI. Sarat Sethi said HFC, which he said doesn't have much exposure to the Gulf Coast. Doc said BAC calls for a week from Friday were being bought. Joe said he likes CAT at 116.

Eamon Javers said this is Donald Trump's first experience as "healer (snicker) in chief" or "consoler in chief."

Karen Finerman finally returned to the 5 p.m. Fast Money, in smashing new hairstyle, but was subdued.

Erin Browne: U.S. stock portfolios ‘fairly well insulated’ from an Asian war

Offering a rather copacetic view of the world stage, Erin Browne on Tuesday's Halftime Report conceded there are "irrational actors" on the world stage but contended that if war "were to break out," it would be "highly localized to the Asian region" and the Korean peninsula.

So "U.S. investors probably are fairly well insulated in their portfolios," Browne said.

Sarat Sethi said that despite the missile launch, "Nothing has really happened," and so the market trades on earnings.

Jon Najarian pointed out how the S&P crawled back after the overnight futures drop.

Joe Terranova said he was "surprised" by the day's price action, and he almost wished that there had been "further downside pressure" in the morning to draw in people on the sidelines.

Pete Najarian said he's sitting on "30% cash" before admitting, "I think that's too much quite honestly" while pointing to option buying in the metals.

Erin Browne said to buy construction stocks in the wake of Harvey.

More from Tuesday's Halftime later.

[Monday, Aug. 28, 2017]

Weiss’ timely point: Sen. Ted Cruz explains vote against Sandy relief

Nearly all of Monday's Halftime Report was rightly devoted to Hurricane Harvey; little did we know that the show would ultimately get political.

John Spallanzani questioned if Democrats and Republicans will come together for "bipartisan" (snicker) infrastructure spending.

Guest host Melissa Lee even said this could be a "crystallizing moment."

With timing that would soon prove amazing, Stephen Weiss said no, "it was Texas that voted against hurricane relief for Sandy."

Moments later, Mel turned to Contessa Brewer, who conducted an impressive interview with Sen. Ted Cruz at a Houston convention center.

Cruz said he's not going to worry about "political sniping" over Texas' response to Sandy. "The silliness of Washington we can worry about another time," Cruz said — before launching into a point about Washington.

Brewer asked Cruz if he'd rethink his Sandy vote in the wake of Houston's tragedy. Cruz said, "I didn't think it was appropriate to engage in pork-barrel spending where 2/3 of that bill was unrelated spending that had nothing to do with Sandy and was simply politicians wasting money. That shouldn't happen. The focus of emergency relief shouldn't be cynical politicians trying to fund their pet projects. It should be providing relief to people who are in crisis."

Weiss apparently doesn’t know Jeff Kilburg’s name

Brian Sullivan, one of 3 CNBCers (Contessa Brewer and Jackie DeAngelis) in the trenches in Texas, noted on Monday's Halftime Report, "The rain just will not stop."

Sully said the Galveston Ship Channel is "completely shut down."

Jackie DeAngelis said of 3 of 5 refineries in Corpus Christi were shut down.

Contessa Brewer said Texas' attorney general is going to investigate complaints of price gouging regarding bottled water for $8.50 or gas prices "jacked up" 30%. Guest host Missy Lee said it's "against the law and morally reprehensible."

Back in Englewood Cliffs, Joe Terranova said the important thing for the oil space is that the Colonial Pipeline will be OK; he called this a "very bearish event for crude oil, which is already in a bear trend."

Joe reiterated that this is an opportunity to get out of refiners.

Stephen Weiss suggested not overreacting on the hourly news. "These things typically overshoot," Weiss said, predicting price increases for insurers and stating it used to be they would sell off big on disasters and only later climb back on price hikes; now it happens "pretty quickly."

Jeff Kilburg said the Brent-WTI spread is about $5, the widest in almost 2 years. He also said cotton was popping up on flooding fears. Kilburg noted Weiss said something about people overreacting, but maybe we don't know all the data yet.

Weiss said, "Jim (sic), just to clarify, I'm not saying we're overreacting, I'm saying that you typically overreact in the middle of these things. I don't know."

Kilburg's point was fair, but Weiss is also correct, there does tend to be a lot of overreacting. But nobody knows if tomorrow will be better or worse than people think.

Josh Brown said "I agree actually with everything" Weiss said. Brown said it would take $100 billion in losses (not the $30 billion worst-case estimates) "to really have a monster impact" on property and casualty insurers.

Brown said TRV would be the insurer he buys.

Brown said Houston homes are covered by national flood insurance, and that private insurers sell flood insurers to businesses and will raise those prices next year.

John Spallanzani said the biggest fear is that Harvey will revert to the Gulf and then hit Louisiana.

CNBC manages to cross-promote ‘The Profit’ during Harvey coverage

Phil LeBeau on Monday's Halftime showed pictures of car dealer lots with vehicles "completely underwater" and said "perhaps more than a million vehicles" could be completely salvaged. He said to look at AN, GPI and KSU.

Marcus Lemonis dialed in to say Camping World is helping out.

Revisiting his point from the top of the show, Stephen Weiss said car dealers and "other stores" are getting hurt in Texas now, but "the replacement cycle is gonna be so much stronger."

Josh Brown said it's "really tough" to know which stocks are going up or down today because of the storm and not a game for amateurs.

CNBC superfox Ylan Mui, gorjus in green (below), said she didn't want to "diminish" the storm's economic impact on Texas but said that for the country, "economic shocks of this nature tend not to have a lasting impact."

Capt. Richard Russell of AET crude operation started to say they prepare for storms, but the phone connection went out and Mel deftly shifted to analyst Kevin McCarthy, asking about the impact on chemical plants. He said the plants are designed to handle high winds "but not high water." McCarthy's top pick regarding the hurricane is WLK. No one on the panel was interested in the chemical space. Joe Terranova said rail concerns are "probably" an opportunity.

Pete takes issue with Weiss scoffing at GILD’s 2.5% gain

In a tiny bit of non-Texas news on Monday's Halftime, Pete Najarian (via satellite) said Kite is the "perfect buy" for Gilead.

Stephen Weiss though said we won't know "for a long time" whether this is a good deal, but KITE was "a $17 stock about a year ago when it came public" (none of that appears to be remotely correct based on the charts we looked at), "so they took way too long," and he called GILD's 2.5% gain Monday "relief."

Pete acknowledged KITE "might be a little bit behind" rival companies, but "immutherapy" (sic pronunciation) is in the "sweet spot."

Pete said he "totally" disagrees with Weiss' comment about the 2.5% GILD gain, stating "usually" there's a little bit of a pullback.

Weiss said he doesn't think there'd be a pullback if you're buying something "tremendously accretive." But GILD wasn't pulling back, so we're not sure of the point.

John Spallanzani's final trade was the weaker dollar but gave too long of an explanation. Josh Brown suggested BRK-B even though he previously indicated people shouldn't try to trade the storm effects (though whether BRK-B has much storm exposure is a matter of opinion probably). Weiss said WDC. Joe Terranova said health care is the sector in which to "hang out."

[Friday, Aug. 25, 2017]

Rob Sechan unable to convince panel MLPs are a good idea

Jackie DeAngelis, live from Texas, said on Friday's Halftime Report that some Texans actually were planning to hunker down and wait out Harvey.

Ex-FEMA boss Michael Brown told guest host Sully, "If you listen to that last report, we apparently haven't learned anything from Hurricane Katrina."

Jeff Kilburg said it looks like the "longevity" of the storm will be worse than anticipated. Kilburg said there's "a lot of emotion" in the oil trade now and that it's an "opportunity" to get names such as VLO and SLB at a "deep discount."

Jim Lebenthal recited the history of U.S. "swing" oil production during storms that now is distributed across shale plays, suggesting a hurricane in Texas is a "non-event for the oil sector." Kilburg said he won't call it a "non-event" but conceded fracking has "changed the game."

Rob Sechan once again touted MLPs. Jim though wanted to "push back," pointing to Enbridge Energy Partners and stating the space got "hammered" in 2015 and hasn't fully recovered.

Steve Weiss said "first of all, they did have a big recovery, then it sold off." Weiss suggested those who got burned with the K-1 have "got long memories."

Jim said he's still in the space. "I'm in, but I'm not all in," Lebenthal said.

Sechan demanded to know of another sector that has an "implied return" of 16%. But Josh Brown asserted "there's been no recovery at all," citing the Alerian MLP Index. Sechan said it was up 100% last year.

Brown insisted you'd have to be "pretty delusional" to view MLPs as bonds; "essentially they're equities with high coupons."

"Nobody called them bonds," Lebenthal and Weiss said. "Take that off the table," Jim said.

Brown said you can get the same performance "with regular energy stocks without the K-1 lunacy."

Weiss tried to explain how he did research to determine which MLPs aren't highly tethered to the economy, but Brown hardly let him speak and Sully didn't break it up.

SNAP is actually better than something (but remember, Zuck is determined to obliterate it)

Brent Thill on Friday's Halftime said he launched his "Internet playbook" on Friday; it's 200 pages long.

(Um, just some unsolicited advice, but a playbook that's 200 pages long probably isn't going to be read by anyone.)

Thill, who downgraded TWTR, said Twitter has a "huge" user base, but "users do not equal revenue."

Thill even said, "Snap has actually seen better engagement than Twitter … Snap's just a better platform for video."

Thill said Josh Brown made a great point, that advertising on Twitter is kind of like putting up billboards along a highway and hoping people look. But, "They have the chance to pull this off," Thill said, before touting Instagram while explaining he went fly fishing and started following fly fishing ads or pictures on Instagram and started getting merchandise marketed to him on Instagram.

Steve Weiss revealed he's "90% out" of his "great trade" being long SNAP. He said there's still potentially some upside, "but I'll be quick to pull the trigger" with the remaining 10%.

Still waiting for Karen Finerman to explain why it was a good idea to be long FL

Pete Najarian on Friday's Halftime beamed in from Minnesota to report unusual activity in materials, specifically BHP December 45 calls.

But much more interesting, Pete said Jeffrey Gundlach is high on the materials trade and "doesn't feel like- that we're covering it enough." But Pete thinks "we are (covering it enough) on Halftime," even though we haven't heard BHP on this program in ages.

Jim Lebenthal said Janet Yellen gave a "fairly innocuous speech" with a "tepid shot across the bow" at regulation.

Jim explained, "There is talk out there of will Trump serve out his 4 years," and suggested that if the president "decides not to continue on," Mike Pence would say "I'm not messing with anything that doesn't need to be messed with."

Josh Brown asserted, "REITs are on the verge of a major breakout."

Rob Sechan said UBS surveyed 2,800 high-net-worth individuals, and somehow 80% of them declared, "This is the most uncertain time in history."

Josh Brown scoffed at that sentiment as "the availability bias" and wondered, "How certain was Sept. 10, 2001?"

Brown is still not a buyer of SBUX, calling it "trendless."

Stephen Weiss said he'd wait for a pullback on ADSK.

Jim Lebenthal said to buy AVGO and hold it into the iPhone hype.

Rob Sechan is bearish longer term on the dollar.

Jim's final trade was that gasoline won't spike. Josh Brown said to stay long GOOGL over 920. Weiss said airlines. Sechan said to buy MLPs "right now."

[Thursday, Aug. 24, 2017]

Judge adds Josh’s credentials when introducing him to ask a simple question of Nicole Miller Regan

Judge on Thursday's Halftime brought in Nicole Miller Regan to explain her purported 65% upside in CMG.

"It comes down to the unit-level economic model, which means high volumes," Regan said. "There's really nothing to apologize for for a 2 million AUV today. Albeit it used to be 2.5 million a couple years ago. … They're still better than most of their direct competitors."

Regan, who said "at the end of the day" (which thankfully has been receding in CNBC nomenclature these days), has a $510 target and says "when, not if," the recovery plays out, there's "a lot of earnings power and leverage."

Judge then allowed Josh Brown to ask a question of Regan, with such a lengthy intro that it was clear who Judge was siding with here. "You could've made the case that you're making from much higher levels all the way down," so how do we know 300 and not 200 is the turnaround point, Brown asked Regan.

Regan called that a "really fair" question but claimed "the valuation is more or less trading in line with its peer group." Brown questioned whether 27 times forward earnings is in line with peers; Regan said she's "looking at, like around 13 times EBITDA."

Regan didn't respond when Judge said "We'll see you again soon," creating an awkward moment of dead air.

Steve Weiss crowed that he "made a lot of money" shorting CMG but got "stopped out" on his short Wednesday morning. He said Regan's multiple is "lunacy."

Brown said the only bullish sign for the stock is the short interest. Joe Terranova said he's surprised the short interest isn't higher.

Jim Lebenthal said CMG's bull case reminds him of when GMCR got bought out.

Sounds like a short-term dip is consensus

Stephen Weiss on Thursday's Halftime was nonplussed by indications of yet another frozen government.

"I'd argue that the government's been shut down going into our 9th year. And it really hasn't mattered, right," Weiss contended.

Exactly. Because there's really nothing to do.

Weiss said he's in "about 50% cash" (probably because of Howard Marks) and lamented that airlines are in a bear market. "It's crazy; I don't know the reason," Weiss said.

Jim Lebenthal observed, "We're in a really dull territory right now."

Jim said we need to get past Labor Day and see if there's "real traction" on tax reform (snicker).

Weiss bickered with that, stating the base metals are showing global growth. Jim countered that copper's "been a fact for a month if not more."

"I'm not saying that value's taking over," Jim said, but "value is really hangin' in here."

Dubravko Lakos told Josh Brown the EM trade is "highly contingent" on the dollar.

Eamon Javers said Mitch McConnell and Donald Trump had a "profanity-laced conference call" on Aug. 9.

Lakos told Weiss that he doesn't see political risk as a "big shock" to the market.

Josh Brown corrected Lakos (2013, 2½% selloff, U.S. downgrade) as to when the 2011 U.S. government downgrade and stock selloff occurred and the extent of that selloff.

Lakos said in "coming weeks" there could be a "mid-single-digit" correction.

Might’ve gone an entire program without AAPL

Dubravko Lakos opened Thursday's Halftime stating he's "cautiously optimistic" on the stock market.

And when have we ever heard that before?

(Surprised he didn't say "what a difference a day makes" or "what's in a name.")

However, he thinks the market could see weakness short term. (That's the Howard Marks-Jeffrey Gundlach Effect.)

Joe Terranova shrugged at gold but said the "real story" is the FANG technicals, explaining they indicate a market "on the defensive."

Judge reported John Spallanzani also is noting the lower highs in FANGS. Josh Brown said that's "backwards," that when market leaders stumble and the rest of the market holds up, that's actually a sign of strength.

Judge said the market looks to be "spinning its wheels."

Joe insisted that if you're in the FANGs, "you have to pay attention" to what's going on. Brown said, "Joe is right." (Whew.) Brown pointed out the trade for August is long XRT and short AMZN, but he said not to allow it to "completely divert" what you've been doing. (And to think there once was a time when a company that bills itself as a one-stop venue for online shopping plunging into the grocery market would've been mocked.)

"The market's much bigger than FANG stocks," said Stephen Weiss.

Hey Edna, let’s buy Transocean instead of Nvidia

Jackie DeAngelis, stunning in black on Thursday's Halftime, brought in Jeff Kilburg and Jim Iuorio to discuss the refinery situation ahead of the storm/hurricane.

Jim Iuorio said if RBOB can settle over 1.54 in October, that's a move that's "real" and could have upside.

Dubravko Lakos defended being overweight energy, largely citing sentiment, suggesting the possibility of a squeeze.

Josh Brown insisted "the selling is just not over yet." Joe Terranova said, "This might be an opportunity, if you're stuck in the refiners, to actually bail yourself out of them."

Stephen Weiss said investing in energy is like "pushing on a string": he just sees "unending" supply.

Jon Najarian though said there was bullish buying in the MPC 52.50 September calls. Judge called that an "obvious Harvey play." Doc also said October 12 calls in CZR were popular, and that MRK September 63 calls were getting bought.

If there are ‘misunderstandings,’ why doesn’t Bill take up Judge’s offer to make his ADP case to anyone who’s interested?

Leslie Picker on Thursday's Halftime said Ackman is complaining about "misunderstandings" about his approach to ADP.

Joe Terranova revisited SJM, suggesting it's close to a "cathartic moment" that could be a buy.

Jim Lebenthal said that to get long a name like WSM, "you have to have an opinion on the back-to-school selling season," otherwise it's a "dead-cat bounce." Actually, one's opinion on back-to-school sales has no bearing on whether WSM is going up or down.

Josh Brown said HRL has been an "atrocious stock" over the last year; he doesn't see any reason to buy.

Steve Weiss said TEVA is a "fallen angel" and that people don't want to be in generics.

Dubravko Lakos affirmed health care is an overweight for him.

Joe's final trade was to note that AMZN is down 12% and that "not one analyst has lowered their price target." Jim Lebenthal said CSCO is bouncing back. Weiss said WDC and Josh Brown said to stay long GOOGL.

[Wednesday, Aug. 23, 2017]

Seema & Sara — pair

of CNBC superfoxes

Josh Brown opened Wednesday's Halftime stating WMT and GOOGL "kinda need each other."

Judge eventually cut in, wondering why WMT is flat. Brown said it's because it's just an "initiative" now.

Stephanie Link said WMT and Google Express is a "strategic move" that is really "much ado about nothing."

Brown disagrees with the "much ado about nothing premise," pointing to WMT's gains this year. But Link protested, "The stock is not up because of this news" or because of Jet.com; she said TGT and COH also have great online comps.

Brown indicated the country can't be unanimously Prime. "There is not going to be a single ecommerce giant that serves every customer in the country, and no one else gets to play against them," Brown said, adding the fact that Doug McMillan has "blood in his eyes" and is doing deals with Google "sends a signal to investors."

Link told Judge she doesn't see "a lot of value" in WMT at Wednesday's price.

Brown produced a photo of a Jet.com package in his garage on Long Island.

Jon Najarian said WMT is taking a "good step" toward challenging AMZN.

Pete Najarian dialed in later and said, "Don't forget Best Buy is beating Wal-Mart (sic meant "Amazon" but uncorrected) at their own game."

Sara Eisen (guest host) and Seema Mody (Samsung report), devastating CNBC superfoxes, lit up Wednesday's 5 p.m. Fast Money, though Sara introduced the Robert Lee announcer flap as "What's in a name," almost as bad as Judge's "what a difference" (below).

If SNAP actually doesn’t reach single digits, Pete’s gonna look kinda silly

Steve Weiss on Wednesday's Halftime actually dialed in from Denver to reveal he bought SNAP (after trumpeting the puts for weeks).

"I think it's a trade," Weiss said, even putting an 18 or 20 target on the name though saying he won't be in that long.

Josh Brown said SNAP is up 33% since its low just 7 days earlier. "This is an obvious area for the rally to stop," Brown said, so if it breaks 15, it might have some real life (snicker).

No question, the stock's had a nice bounce off the lows, a time when huge short-term gains can be made.

We'd be shocked if this ever sees 20 again. But then again, we were shocked this stock could actually have an 11 handle by August.

Weiss said he's up 6% in SNAP. He also said he shorted CMG in the morning.

Where’s Bill? Doesn’t he know Judge said he’s welcome to come on the show at any time and make his case to anyone who’s interested

Dialing in, Pete Najarian on Wednesday's Halftime said "the clock is obviously ticking" on Ginni Rometty.

Pete said Katy Huberty has been the "go-to" analyst for AAPL, but with IBM, "she's been like everybody else. She's taken the head fake."

OK. So what's the reason to follow her on AAPL. (Hint: That stock always goes up anyway regardless of what the analysts say.)

Judge said, "With all due respect," will investors follow Katy Huberty on IBM, or the exiting Warren Buffett.

Doc opined, "I certainly don't think that the cloud can get any worse for IBM than it's been over the last 6 months."

Jim Lebenthal said he can wait for an IBM "turn" before getting long the name and that its lack of revenue growth is "painful and embarrassing."

Stephanie Link said there won't be IBM momentum till next year. But Judge demanded Jim explain why you wouldn't want to start buying it now with the prospect of a back-end-loaded year. Jim's explanation was way too long, stating that controlling gross margins would lead to cutting R&D and head count.

Pete Najarian decided, "There's no reason to jump in to this thing."

Nobody addresses whether there’s really a ‘dislocation’ in trading of TRNC (after Judge sounded like he barely realized that Ross is running 1 of 8 newspapers (sorry for using that term) and not the whole company)

Coming up with a fresh idea, Judge on Wednesday's Halftime introduced his segment on the day's Dow/S&P performance with "What a difference a day makes." (Why not the old CNBC earnings staple; The good, the bad and the ugly.)

Eamon Javers actually mentioned the possibility of a government shutdown over "wall spending."

Jim Lebenthal shrugged that the market is responding to "noise" from D.C. rather than an "actual signal."

Josh Brown pointed out that KSU was down on Tuesday night's "off-the-cuff remarks."

Steph Link said the Atlanta Fed is actually thinking about 3.8% (snicker) GDP.

Jon Najarian stressed that inflation is "considerably lower" now than in 1999.

Josh Brown grumbled about building a wall "with no money to pay for it." Doc cut in that "It's a billion dollars … Cities do that all the time."

Jim actually is heeding Howard Marks’ advice (despite the fact he was apparently the ‘sell point’ panelist called out by Marks at Post 9)

Jon Najarian on Wednesday's Halftime said CIEN September 23 calls were being scooped up.

Stephanie Link said CIEN is a "very large position for me. … It's a very volatile stock; I mean this stock could go from 23 to 29 in 1 day."

Jim Lebenthal said, "I feel like Cisco is ceding the optical-router market to Ciena." Link said "it's also been speculated" that Cisco might look to buy Ciena.

Link touted ORCL, CMI and UNP.

Doc said Sept. 1 weekly BABA 175 calls were being bought.

Jim Lebenthal said he trimmed his WGO position only because it has become an outsized gain. He said he's not "recycling" the proceeds back into the market because of (yep) Howard Marks and Jeffrey Gundlach.

Stephanie Link said LOW missed despite good demand; "I'd avoid."

Josh Brown said if you're long CMG, "Don't say that you do any kind of risk management if you're long this name." He called it a falling knife but insisted he's not taking a dig at Ackman.

Jim Lebenthal said he doesn't see any catalysts for FL in the near-term.

Doc said he's "movin' on" after the AEO pop.

Jeff Kilburg said right now, "The market's not buyin'" a December rate hike. Anthony Grisanti said if the dollar breaks 92.30, we're looking to 91.

Doc said someone was buying NRG 30 calls. Jim Lebenthal said he thinks MMM continues to fall. Josh Brown said he'd fade any Mexican wall rhetoric. Stephanie Link trumpeted AVGO.

[Tuesday, Aug. 22, 2017]

Sell some ads, Ross

Oh, the questions Judge could've asked Ross Levinsohn — but didn't.

The newly appointed publisher of the Los Angeles Times, who's apparently chatting up anyone who will ask (see our home page), joined Tuesday's Halftime Report to discuss his new gig and in the process failed to mention absolutely anything that he's actually going to do.

Judge asked Levinsohn, "Why'd you take this job." Levinsohn said those who know him know he has "an incredible passion for news and information."

Levinsohn claimed he took the job for "emotional and personal" reasons as well as a "value perspective."

He said he discovered that TRNC was "trading at 2 times EBITDA. Makes no sense to me." So this is apparently a Keith Meister/Mick McGuire type of move, not somebody who just wants to run a newspaper.

"What I saw was a dislocation in the market," Levinsohn said. (This should've set bells ringing in Judge's ear, as in, What in the world does he mean, but Judge passed.)

Levinsohn said Vox and Buzzfeed "do great work" and have high valuations but don't have the "journalism chops."

He said his hope is that "2 times EBITDA turns into 6 or 10 times EBITDA."

At this point, Judge should've launched into the economics of the newspaper space and demanded to know how this isn't going to turn out like coal.

Instead, Judge barely gently asked, "I'm wondering what your strategy is going to be to try and turn things around," suggesting Levinsohn is painting a vision of a "digital-first, uh, hub."

Levinsohn said his mother reads the print version of the paper and his daughter reads it on his iPad. (Still not much of a strategy.) He said the Times has to "really focus" on continuing the great "core" of reporting, perhaps in video or "shorts" (whatever that is) and then when you think about California, "you have to think about culture at its core."

Judge sounded clearly oblivious to the fact the L.A. Times itself is not a public company but part of a newspaper conglomerate actually run out of Chicago; obvious questions he didn't ask include whether there really are any synergies between the "culture" of the L.A. Times and the Hartford Courant.

Judge did say the LAT article mentioned "flagging morale." Levinsohn said he told the staff a day ago that "change is never easy." (Still not much of a strategy.)

Attributing the number to a Steve Case tweet, Levinsohn pointed to the "average life span (sic meant 'tenure')" of an employee at top tech firms and said Google was No. 1 at 1.9 years. Levinsohn said he asked how many LATers have been there more than 5 years, and more than half the hands went up, so he knows this is a "very passionate, in some cases altruistic group of people."

Is altruism why the stock is trading at 2 times EBITDA?

Judge asked Levinsohn if the L.A. Times needs to get on Donald Trump's radar like the NYT has done. "You're making my argument for me," Levinsohn said. But he made no argument. (And no strategy.)

Levinsohn concluded with a woulda-coulda-shoulda, stating of the LAT, "In the entertainment world, it should be the bible," adding, "I actually think we have to get away from the term 'newspaper.'"

This company presumably collects revenue in only 3 ways; selling newspaper subscriptions, selling ads, and printing other companies' publications.

Levinsohn never said a word about any of those 3 things.

Judge failed to note that the same article about "flagging morale" mentioned that Levinsohn is the Times' 5th publisher in a decade.

And that he's never worked for a newspaper before.

We want Levinsohn to succeed. But …

Josh Brown noted TRNC shares were up Tuesday on news of Ross' hire.

How come we didn’t hear anything about Howard Marks?

Tuesday's Halftime Report was in Happy Land because the Dow was up a hundred points.

Josh Brown said he's "howling" about people who a day earlier were scared about a correction and on Tuesday morning were declaring it over.

Brown trumpeted the "ton of money" being made in emerging markets.

Jon Najarian said AAPL was making a "huge" move again.

Chris Hyzy said, "I just try to keep things as simple as possible," adding that all the dips are being bought.

Judge actually asked with a straight face, "Are there enough buyers who are, who are still willing to, to buy the dips."

Pete Najarian trumpeted the cash flows of Boeing, a "beast" of a stock.

Josh Brown used the term "concomitant."

Gorjus Ylan Mui explained she was with Mitch McConnell and Steve Mnuchin for their "kumbayah moment" a day ago, but she's not convinced there's agreement on the "framework" for tax reform.

"It is clear that this is gonna be a really messy progress," Mui said.

Josh Brown declared that "all of the research confirms" that a 1-time bonus or dividend from a tax overhaul plan doesn't change anyone's spending habits.

Pete Najarian quibbled with Josh Brown's comparison of being a "momentum" investor or a "value" investor. Pete said the term "momentum" implies the stocks are going up without the fundamentals, but the names Josh is referring to are all about growth.

Brown said they're not disagreeing; "momentum is not a matter of opinion. It's a technical term."

Wonder if Kevin O’Leary has been hired yet to help Evan Spiegel improve his conference call presentation

Somehow, it might've been the show's only mention of Amazon. (Then again, Ross Levinsohn brought up Jeff Bezos.)

And it wasn't a great one.

Josh Brown on Tuesday's Halftime said, "Do not fade VMWare." Pete Najarian said VMW is perhaps signaling "a few chinks in the armor quite frankly" of Amazon Web Services.

Jon Najarian said NWL January 50 calls were being bought, though "they sold the next higher strike up." Pete said October 42 calls in AA were bought in one "huge block."

Pete said he likes TOL's numbers even though the stock sold off; he thinks it has upside. Judge said Doug Yearley would be on Closing Bell; we learned once from Barron's that Yearley is a huge Neil Young fan.

Josh Brown said if you're long QSR, you stay long.

Doc said M was trading on the new approach to try to launch better private brands. Josh Brown declared, "This is going lower … this is one of the ugliest stocks you can find."

Actually, Brown's probably right, but the thing is, these stocks are capable of short-term bear market rallies that aren't often possible in more stable sectors, for example, it wouldn't totally surprise us if M reached 25 at some point. Which you'd think a trading show would care about. (This writer has no position in M.)

Scott Nations said copper technically is overbought, but there are stories about China buying all the copper it can get. Brian Stutland said he thinks copper is "a little overextended," but after a possible pullback, "I'm a buyer."

Josh Brown trumpeted KSU. Doc said AEO, based on "a lot of aggressive call-buying." Pete said AAPL.

[Monday, Aug. 21, 2017]

Judge seems to think there’s no reason to do anything ‘dramatic’ to your portfolio

Judge spent the early portions of Monday's Halftime Report asking folks if the market stalled — and then attempting on multiple occasions to provide the answer himself.

"I don't think we're out of the woods just yet," said Joe Terranova.

Steve Weiss contended, "The bias short term is, is, is a little toward the downside."

Weiss added that with this administration, "Nothing's gonna get done."

Joe tried to ask Doc a question about the market slump, but Judge cut him off. Joe continued, asking if D.C. dysfunction raises the risk of a shutdown. Weiss said there's a "50/50" shutdown possibility.

Jon Najarian noted this is vacation time for Wall Street. "People are not staffing the trading desks at full force right now," Doc said.

Jonathan Krinsky said "there's just less (sic meant "fewer") participating stocks in uptrends" but proceeded to waffle about how much of a pullback we'll get.

Judge, now a stock expert apparently, stated, "The danger though is doing something too dramatic to your portfolio because you think some sort of larger event or correction-style event is, is going to happen" while the fundamentals "are still strong."

Krinsky agreed and said he wouldn't recommend "major changes." Judge demanded to know if Krinsky is predicting a correction. Krinsky shrugged and said "no," then asserted, "We've already seen a lot of it." Judge cut him off to tell him we've had a "rolling correction" involving "hundreds and hundreds of stocks." Which is basically what Krinsky was saying.

Judge explains ‘schmuck insurance’

Stephen Weiss on Monday's Halftime contended LULU has a moat and isn't as saturated as NKE. But he said "the issue" is valuation.

Jon Najarian, who twice tried to claim market sectors are a "pyramid" in which names at the top such as adidas are great but there's a broader bunch of losers below. Doc touted LULU as one of the names at the "top of the pyramid." Judge though cut in, questioning whether "the athleisure trend is either over, ending, or about to die." Doc insisted it's none of the above. So did Weiss.

Doc referred to the Nike "swish" (sic meant "Swoosh").

Joe Terranova said SBUX optimism for a 20% 12-month gain is "all on mobile orders."

Doc said FCX was trading with heavy volume but offered no opinion on the stock.

Weiss said the auto cycle has "plateaued" and is heading down.

Leslie Picker said the ADP move against Ackman's directors "looks like it will eventually lead to some sort of a proxy fight."

Picker said Herbalife's "best defense" against Bill would be going private. Picker said the company has said in a press release it's decided to buy $600 million worth of shares and then offer a CVR. Judge said "in Wall Street parlance," that's called "schmuck insurance." Picker said Pershing Square is "not commenting" on the subject of HLF.

Doc said GLD September (2018) 144 calls were being bought. Pete Najarian said September 10.50 calls in VALE were being aggressively bought.

Pete's final trade was HD. Doc actually suggested TWTR because of call-buying. Weiss said AAPL. Joe's final trade was PKI. Joe said the 10-year yield is "about the deflationary effects of technology on the entire economy."

Shopping tips from Doc

Jon Najarian on Tuesday's Halftime Report mentioned that Second Skin athletic gear is kinda eating the lunch of Kevin Plank's (not sure too many CEOs are having a worse year) Under Armour.

Intrigued, we figured, why not give it a shot.

Second Skin apparently is sold exclusively by Dick's.

The bloke at the cash register had never heard of the product and was unaware Dick's was selling it.

(This despite the fact there's a huge sign for it right inside the entrance.)

Anyway, even though he didn't officially endorse it, Doc's onto something. Second Skin's shirts — they appear to be called Training Tops, short sleeve and long — are an excellent product. Fit like a glove, feel great. Instantly atop the leaderboard in the CNBCfix locker room.

The price point — apparently $35-$40 — might be higher than a lot of similar Under Armour and Nike products. Some of those products (we've got a few) are very good; others not so great.

It seems Under Armour and Nike might be experimenting with too many varieties of shirts. Under Armour in particular offers a lot of T-shirts with slogans.

A search on Dick's website for "Second Skin" (all products) turned up just 67 hits.

By contrast, a search for "Under Armour shirts" (not the whole range of products) produced 1,700 hits.

Surely Under Armour doesn't think the world needs 1,700 of its T-shirts?

Called shot: This page said Icahn might not be long for advisor-hood hours before he steps down

Judge dialed in to Friday's 5 p.m. Fast Money to comment on the breaking news of Carl Icahn stiff-arming Donald Trump.

Judge explained how Elizabeth Warren and others were critical of Icahn's informal role as Trump advisor "almost from the get-go" and that the criticism was "mostly centered around, you know, some of his energy-related things."

But what Judge didn't explain is that this page, overnight Thursday/Friday, barely more than 12 hours earlier, speculated in a headline (just PgDn to Thursday) that, as Trump's CEO friends take a hike … it's probably not unreasonable to suggest Carl might do the same.

This despite the fact that Icahn's name — save for an unrelated mention Thursday regarding Bill Ackman — hasn't come up on the Halftime Report all week.

Judge on Friday's Halftime chose not to follow our lead; fair enough. We're happy to provide material as often as possible. (Especially the good one-liners that we occasionally hear later on the shows.) For free. And unlike Nathan Jessup, they don't even gotta show us any respect. About all we ever suggested is a trip to Denny's for a Grand Slam.

[Friday, Aug. 18, 2017]

Judge should’ve just posted the New York Times Bannon story on the screen rather than share it with reporter on-air

Judge late into Friday's Halftime read off the Steve Bannon news and claimed it was "clearly having a, guys, a dramatic impact, uh, on the stock market," even though it didn't seem like the S&P had moved any more than a couple points higher.

Judge summoned Eamon Javers, an excellent reporter who this time had little more to say than that the New York Times and Drudge Report were reporting that Steve Bannon is out.

Judge told Javers that the bottom of the screen was showing that Bannon submitted his resignation Aug. 7, according to the New York Times. "That is new to me as well," Javers said, refreshingly candid about the nature of this scoop.

Judge suggested Trump maybe decided someone needed to go in the White House, and because the market fell a day earlier on fears it would be Cohn, that made Bannon the choice because Trump likes to brag about the stock market's performance.

Jon Najarian started to say Steve Bannon actually was a "much better leader of uh a push towards repatriation and some sort of uh, right-size of the tax" than Mitch McConnell; panelists pointed out that he meant Cohn and not Bannon. Doc said the Bannon exit seems "a further endorsement of Cohn."

Josh Brown actually said, "We don't know if they're gonna pull another psychopath."

Attending Yankee games

with Gary Cohn, Day 2

Oh boy.

Apparently irked by Thursday's exchange with Joe Terranova (see below), Josh Brown on Friday's Halftime Report doubled down on Joe's Gary Cohn narrative.

Brown on Friday said that if Cohn does exit the administration and stocks fall, don't be shocked if big money comes in buying the dip.

"Truthfully, mechanical money doesn't care about, 'Oh, Gary Cohn, I went to a Yankee game with him.' No one cares," Brown said. "The money that's coming into this market on negative headlines is index money and algorithmically driven money, and I just don't think it matters."

Well, if panelists are going to evaluate each other's commentary a day later, this program's gonna get really interesting fast.

Jon Najarian said he wants Gary Cohn to stay, but if Cohn leaves, the markets probably would only have a "very quick eruption."

Stephanie Link said "I've been pickin' away," but "it's hard to time" this market, "especially the macro."

Pete Najarian rattled off a bunch of tech names that are working. Judge warned that transports haven't been taking part in the rally and twice said "in and of itself."

Brown: NKE to 40s

Judge on Friday's Halftime unfortunately brought up the Disaster of the Day/Week/AnytimeSinceSNAP, the Foot Locker not-even-safe-for-hazmat-suit earnings report and forecast. (This writer had been long FL.) (Because Karen Finerman said to do it a couple months ago.)

Josh Brown happened to make the best point, stating, "I don't understand where management is this whole quarter; how do you have a stock go down 25% in one day. … How is this even real life?"

Honestly, gotta agree with that. How in the world is somebody not fired over this?

Stephanie Link mistakenly said of athletic apparel, "I still think you wanna go with the vendors" before clarifying to say she wants to own NKE, not FL.

Josh Brown said he sold NKE, doesn't hate it, but because it's going lower. "I think it's gonna head into the 40s," Brown said.

Pete Najarian said "the pressure and competition level" of adidas is a problem for NKE, but then backhanded UA which he said "I don't look at as, the same kind of competitive level to Nike as probably Kevin Plank thinks that they can be."

Judge brought up GPS and ROST. Josh Brown said, "Sell 'em both." Stephanie Link though defended the "outstanding" results of ROST and TJX and said "the takeaway is that off-price is not getting Amazoned."

Jon Najarian said BC is getting tarred by being in the "fitness" space; he said the December 55 calls were being bought, which sounds like a play on the next quarter.

Pete Najarian mentioned CTL September 20 calls were popular and that he's in them; "Obviously Meister sees something here." (This writer is long CTL and notes that Meister trumpeted the name on the Halftime Report during Ira Sohn when shares were around 24.)

Sarat Sethi called KSU "still one of the cheaper ones" in the rail space. Josh Brown gloated about KSU falling after the election on fears of the president's approach to Mexico, "so cartoonish," and said he's "shocked" there wasn't big hedge fund involvement in the name.

Josh Brown said he's "fine" with DE's fall because "I have a double in this." (which is something viewers might not care about along with Gary Cohn ballgames). He said DE had a "decent quarter."

[Thursday, Aug. 17, 2017]

News flash: Gary Cohn chose to serve under this particular individual

This page believes Gary Cohn is a great businessman and, by all accounts, a great guy.

We'd be honored to attend a Yankee game with him (see below).

But Thursday's Halftime Report panel practically spoke as if Cohn is a victim for having to work for a fellow who just elevated "both sides" into the national consciousness.

Anyone choosing to work for this president — or any president — knows exactly what he or she is getting.

There is no more scrutinized individual on the planet than the 2 parties' nominees every 4 years.

Here's a fair counterpoint: that presidencies often last 8 years, they often alternate parties, and so many quality human beings on the short list for high-level government service only have a limited window of time in life for such an appointment.

And so someone such as Cohn, who is 56, possibly might not see another Republican administration until age 70.

So perhaps it's Trump or bust for Cohn as far as this line of work.

And this doesn't appear to be the greatest White House of all time.

So Gary got thrown a curveball.

That's politics.

That's life.

Kayla Tausche on Thursday's Halftime said Cohn, according to colleagues, is "sort of torn" about remaining in the Trump administration.

Tausche indicated that concerns are not as much with Cohn but other aides, revealing "Wall Street executives" say that resignation of "one of the 3 generals" would create a risk of a "black swan event."

Josh Brown correctly said Donald Trump "is at his best" when surrounded by the business community, and that this is a "matter of conscience" for Gary Cohn that only Cohn can answer.

Judge asked Joe Terranova if the market would respond differently to D.C. noise this time. Joe started to answer about Gary Cohn; Judge interrupted to bring up the CEO exodus "in and of itself" (sic redundant). Joe said that's "absolutely a game-changer."

Jim Lebenthal claimed there's a "growing feeling" that Republicans could lose the House next year.

Josh Brown suggested Steve Bannon's resistance to the Goldman Sachs agenda within the White House makes it unclear what the real White House agenda is.

Josh Brown wondered if anyone on the panel could identify a single "measure" or "concrete thing" that's been spearheaded by Gary Cohn in the White House. Judge said Jim Cramer talks about Cohn as Fed chief being worth 5% on the S&P "in and of itself" (sic redundant again).

Joe has been to Yankee games with Gary Cohn, staying until last pitch

Basically, when someone tries to mess with Joe, we say, not on our watch.

But frankly, we weren't really sure what he was disagreeing with on Thursday's Halftime.

Josh Brown said Wall Street "really likes" Gary Cohn, and that the Fed would be a "great fit" and that GS shares would like that move, but "we're just making things up because anything can happen in this White House."

All of that seems fair; we don't disagree with any of it.

But Joe Terranova said, "I disagree with that," stating he's been to Yankee games with Cohn "for 9 innings" and that "in stressful times," people would be "very confident" that Cohn is in the White House as an advisor.

Joe said he doubts that Cohn is even concerned about what's happening with GS shares and added that "having Gary there" in the administration is "incredibly important to the market."

We don't disagree with any of that either … except we're not sure what Joe's disagreeing with.

Neither was Brown, who brought that up, unfortunately in a rather snarky way.

"So what are you arguing with? We're all saying that," Brown said.

"I'm not arguing," Joe said.

"OK. You said, 'I disagree,'" Brown said.

"I'm sharing an experience-" Joe said.

"I don't think the market wants to see him out of the picture. We all agree on that. We all agree," Brown said.

"Josh, this isn't about an argument between you and I. I'm sharing the experience of knowing the man, OK," Joe said. "What I disagree with is the premise that Goldman Sachs stock- it's worth 5% to Goldman Sachs' stock."

That came from Cramer via Judge. And if that's what Joe was disagreeing with, why didn't he just say something like, "I don't think Gary taking the Fed post would boost GS that much."

Joe said he does agree with Brown that "this administration needs some form of an adult in the room because there isn't one."

Brown oversnarked, making it worse. "So what about the general. The general's not the adult in the room?" Brown said.

"I don't know the general," Joe said.

Jeff Gundlach’s going to be disappointed if he doesn’t make 400% on his 3% S&P puts (cont’d)

Brian Belski on Thursday's Halftime Report didn't even let Judge ask a question during his intro, launching into his assessment of the previous commentary and stating "nobody" thinks anything's happening in D.C.

Belski said the last couple weeks of August is "typically" a time of higher volatility, predicting such over the next 2-5 weeks.

Demonstrating a comfort level with the program, Belski even called Scott Wapner "Judge" when stressing the "optics" of government are important. But, "Stop with the black swan talk," Belski asserted, suggesting no one knows in advance what a black swan will be.

Doc said someone bought a 1x5 VIX spread of September 23 calls. Doc said that could come up huge, but Judge cautioned that some of these VIX plays are "sucker's trades."

Day of Reckoning: Nobody mentioned whether Carl’s having the same advisor doubts as Gary Cohn

Leslie Picker on Thursday's Halftime noted Wall Street heard Bill Ackman's ADP plan and "didn't seem to buy into it."

Robert Chapman, who hasn't been on the program in a long time, dialed in to report an ADP short, stating his average price is around 119½.

Judge asked how Ackman's wrong, pointing out 3 hours, 168 slides, 6 months of work, 85 consultations. Chapman said those numbers suggest a focus on "quantity over quality of research."

Chapman claimed that Pershing first started buying into ADP in 2009, at the "deep, deep bottom of a horrific employment cycle. … It's a very different dynamic now."

Judge said Chapman knows the question is coming, how much of this trade is simply to be on the other side of Ackman. Chapman admitted, "Making a dollar being short an Ackman stock feels as good as making $10 on one that he's not long."

Judge asserted, "Surely their level of deep dive is greater than, than yours on this particular company."

"No question," Chapman said, but he pointed to Carl Icahn's notion of "no-brainers" and simple, obvious trades.

Judge played Ackman defender to the max, mentioning CP and Air Products and lamenting, "This guy seems to get no credit ever."

Chapman said the ADP space is fiercely competitive, predicting "the margins at ADP are screwed" and said Ackman missed that the VRX business model was "price gouging," that such a model was a "gigantic huge sycamore tree in the middle of his yard, and he just didn't see it."

V hasn’t even been publicly traded for 10 years

Jon Najarian on Thursday's Halftime said MA September 137 calls were popular.

Joe Terranova said he has stayed long V "since the mid-'80s." Judge asked if that's the 1980s or mid-80s price. "I could qualify for both," Joe said, even though V didn't go public until this century.

Patrick McKeever of MKM said TGT had a "really encouraging quarter" and contended good things are happening with merchandising lines. "They're becoming a more viable competitor, uh, to Amazon," he actually said.

"I think it will be Amazon, Wal-Mart, Target and everyone else," McKeever said.

Doc said he prefers WMT.

Scott Nations contrasted gold with bitcoin. Jim Iuorio said only if gold can get above 1,310 would he think maybe it's "shootin' through the moon," but until that happens, he'd rather look to places to short it.

Joe Terranova's final trade was DPZ, "a great low-risk trade" at 190 vs. 180. Jim Lebenthal said short IBB. Doc said DLTR.

[Wednesday, Aug. 16, 2017]

Steve Weiss says Donald Trump

should step down

Talk about burying the lede.

At the end of Wednesday's Halftime Report filled mostly with humdrum stock assessments, Steve Weiss called for President Donald Trump to step down.

"He should resign," Weiss said.

Jim Lebenthal agreed, stating, "That's exactly right. You said it; I'm gonna agree with you ... We need new leadership."

Judge asked Weiss about the "broader implications" of Trump's CEO exodus. Weiss said he was watching the ticker during the reports, and "there's nothing in the market for any of Trump's initiatives or policies."

Jon Najarian though said tax or repatriation issues might still be popular in Congress.

But Weiss countered, "Nobody's gonna give this guy a win at all."

Josh Brown bluntly stated Wall Street's reaction to a Pence presidency would be "jubilant."

The conversation extended into Power Lunch, with Jim Lebenthal telling Brian Sullivan, "I just don't see the downside to resigning."

Jon Najarian told Sully about the "deep end of the pool" VIX trade but declared, "This doesn't impact the market."

As the story broke, Sue Herera mentioned Trump's strategic policy committee being on the "verge" of dissolving (and then that it had dissolved) and mentioned a name almost never heard on the Halftime Report: Andrew Ross Sorkin.

Eamon Javers said Steve Schwarzman was "full of optimism at the beginning of the year" (snicker).

Richard Fisher refuses to take a stand, could’ve used a little backbone, actually says ‘greatest responsibility of a board member is discretion’

Shortly after reports of another CEO (MMM) exiting one of Donald Trump's panels, Judge on Wednesday's Halftime brought in Richard Fisher … who apparently was actually expecting to discuss monetary policy (snicker).

Judge said Fisher is on the board of PEP and T and asked if he believes that either Randall Stephenson or Indra Nooyi should bolt Donald Trump's advisory panels.

"You know, I never comment on the boards that I sit on, or on the CEOs that I have the privilege of working with," Fisher said. "So, I'm not gonna comment on that. How's that? But I will say that I thought that the statement by the CEO of 3M was appropriately directed purely to economics, purely to tax policy."

Seriously?

In a borderline breathtaking moment … possibly his finest hour (or minute) on the program … Judge said part of being on a board, "other than collecting a handsome fee," is to discuss difficult issues with the "steward" of the company. Fisher actually said with a straight face, "I think the greatest responsibility of a board member is discretion, and focusing on the company's business, and that's what I do as a board member … Sorry to disappoint you," Fisher said, adding he was happy to talk about monetary policy or national economics, but "this is just not my forte."

Judge said that if Fisher doesn't want to talk about Stephenson or Nooyi, "I get it, unfortunately."

"This is the first combative interview I've ever had on CNBC," Fisher decided.

Judge insisted on asking if other CEOs should step down from presidential panels. "I think it's up to them," Fisher said.

Fisher told Stephen Weiss that at the Fed, "You check your politics at the door." Weiss kept protesting that he wasn't asking for a political view but whether the Fed would be "handicapping" whether tax reform or infrastructure programs would be passed. Fisher said those things would be evaluated for economic effect and don't fall under "raw politics."

Fisher said he views Dudley's comments as, "We're gonna start moving in September."

Judge had to correct late that Randall Stephenson does not serve on a presidential committee.

Jim: Hype will ‘suck up’ AAPL to $1 trillion market cap

In the remainder of Wednesday's Halftime Report, panelists took up the notion of AAPL $1 trillion.

Josh Brown said "I don't think I'd fall out of my chair" if Apple became the first $1 trillion market cap.

Jim Lebenthal said he finds $200 AAPL inevitable, stating the next 10% is based on a supercycle upgrade. Then, "I think there's gonna be an enormous amount of hype" that will "suck it up" to the $1 trillion valuation.

Stephen Weiss said AAPL is "arguably the cheapest of the FANGS," but we're not even sure it's in the FANGS, unless you call it the FAANGS.

Toni Sacconaghi said AAPL historically does well in advance of iPhone announcements.

Toni said that applying the peak multiple to his $11 earnings, you could get $182.

Jon Najarian said 175 may be the year's top, because people are "aggressively selling calls" of November 175s in AAPL.

Jim Lebenthal wanted to talk about INTC, CSCO and QCOM.

Judge is right; dumping XLE means you think crude’s going nowhere

Josh Brown on Wednesday's Halftime Report said he exited XLE despite the "decent dividend."

Brown said he bought the INVH REIT, "an incredible story," and also bought STOR, stating it shouldn't trade with mall REITs.

Stephen Weiss chipped in ADC, citing a "major transition."

Judge told Brown, "You basically threw in the towel on energy."

Brown said he's not making a call on oil. Judge questioned how one could exit XLE without making a call on oil. Brown insisted he has no idea what crude is going to do.

Weiss questioned if Andrew Hall's investors have made as much as his management fees.

Brown: TGT trying ‘Hail Mary’

Josh Brown on Wednesday's Halftime said TGT is in the "Hail Mary phase of retailing."

However, Jim Lebenthal said the price action is "just the algorithms piling it on."

"There's nothing exciting happening at Target," Brown insisted, pointing to the WMT chart instead.

Brown called Tencent "one of the biggest winners you'll ever see" and suggested the KWEB.

Jim Lebenthal said HD is in the "sweet spot" of … something or other. Steve Weiss said the 21 multiple would normally be high for a retailer, but not the way this company is executing.

Jon Najarian said September 33 calls in MU were popular. Weiss said he's back in WDC and MU; no surprise, because Tepper likes them.

Weiss said David Tepper is not just looking at the current market, but "2 years and 3 years."

[Tuesday, Aug. 15, 2017]

Wonder if Joe has to pay the Najarian Family Office for telling him to buy AAPL calls

Viewers often wonder how Fast Money/Halftime Report panelists trade in real life.

Apparently, they sometimes just turn to each other.

Joe Terranova on Tuesday's Halftime revealed that last week at the NYSE, Pete Najarian "completely bailed me out" of Joe's QQQ put position because he "walked me into the August 25 calls in Apple," and somehow, "that literally saved the entire position."

Honestly, we don't have a clue how buying weekly AAPL calls "literally" saved Joe's QQQ puts.

But if it worked for him, great.

Psst … This is the North Korea endgame, boasting and testing a military device and showing the world its technological limits while doing absolutely nothing of significance

Judge opened Tuesday's Halftime Report trumpeting his "exclusive" chat with David Tepper, who apparently called this "nowhere near an overheated market" and dubbed comparisons to 1999 "ridiculous."

Well, can't argue with that.

As for rate moves, "50 basis points is not going to make a difference," Tepper is said to have told Judge.

Judge said Tepper likes MU and WDC as well as BABA, FB and GOOGL.

Tepper apparently told Judge that the North Korea situation "might not go away." (Ah. Yes. So real bombs might really start falling then?)

Steve Weiss basically said Tepper is the greatest investor since sliced bread.

But Weiss, naturally, felt obliged to tangle with Kevin O'Leary when O'Leary declared, "Tepper is a credit guy."

"That's wrong, Kevin," Weiss blurted.

O'Leary tried to insist that Tepper does something about evaluating credits.

"He goes where the puck's gonna go," Weiss explained.

O'Leary insisted that shorting bonds is making a call on credits.

Whatever. Stiff-arming some recent guests, Joe Terranova said "no disrespect" to Howard Marks or Jeffrey Gundlach or Lee Cooperman, but Tepper's comments are the most "relevant" he's heard about the market.

Joe praised Tepper for removing himself from a narrative or "predetermined bias" toward the market.

Jon Najarian called Tepper "a very wise investor." As for the possibility of rising rates, "Maybe we get to 2.60 this year" in the 10-year, Doc shrugged.

Pete Najarian insisted today's market is "nothing" like 1999, pointing to CSCO, which of course makes Howard Marks' point, that nobody's saying the market's toppy.

Joe pointed to AAPL and NVDA and said we're "resurrecting that momentum once again."

Judge said Tepper's message is, "Don't get out too early."

Kevin Plank quit manufacturing panel before Steph Curry could make a comment about it

Pete Najarian on Tuesday's Halftime called HD the "opportunity" in retail names.

Judge said it's done "nothing recently." Stephen Weiss said the "marginal buyers" in HD have "dissipated," but he thinks it's surprising that the stock's down on the numbers.

Jon Najarian said COH November 45 calls were popular; "I jumped in." He said he likes spending 95 cents for the calls better than buying the stock.

Pete said October 65 calls in LULU were popular.

Doc said the Second Skin line is sort of eating the lunch of Kevin Plank's product.

Steve Weiss said he bought more BABA last week and said the biggest fear is that you wake up some day and, "Where's Jack Ma?"

Weiss said of the hedge fund world, "So many big names are there" in BABA.

Judge said that "some hedge fund hotels do well."

Movie theaters need to adopt airline-like pricing; for some reason, they can’t

Julia Boorstin on Tuesday's Halftime had a heap of trouble sputtering out the "$9.95" Moviepass fee.

Jon Najarian noted that concession sales, not tickets, are where theater chains actually make money.

Joe Terranova said the industry's in "secular decline" and said he's surprised there hasn't been "significant activism" in the space.

Stephen Weiss said he's not sure it's a good activist target.

How come Judge didn’t ask Tepper if Ackman was seeking 1 week or 45 days?

Explaining that presidential viewpoints don't really affect stock markets, Stephen Weiss on Tuesday's Halftime said Barack Obama was "oppressive to business," but the Obama markets were better than Reagan's and Clinton's.

Still grasping for the last week's Most Incredible Trade of All-Time, a meager puff of the VIX, Kevin O'Leary asserted there's a "pent-up concern about volatility" that won't go back to old lows, insisting the "noise in the universe" of equities will rise.