[CNBCfix Fast Money/Halftime Report Review Archive — May 2022]

Whoever was selling AMZN played an April Fools’ joke on Joe

Josh Brown observed on Tuesday's (5/31) Halftime Report that AMZN and UBER have been "absolutely annihilated" recently.

Brown said if there's a slowing in the economy, AMZN and UBER will probably take bigger shares of their markets, suggesting a slowing economy "puts less pressure on the cost structure of these companies."

Guest host Missy Lee asked Joe Terranova about his "really interesting comment" in her notes about being in a "really bad position" in AMZN. Joe said, "On April 1st, I bought it at 3,275. Can you pick a worse buy? Like I'm down like 35% on the stock," no matter what "fundamental assertion" (snicker) he can make.

"Awful call on my part, bad buy. Stuck in a bad position. It happens," Joe concluded.

"Yeah. It does," Mel said.

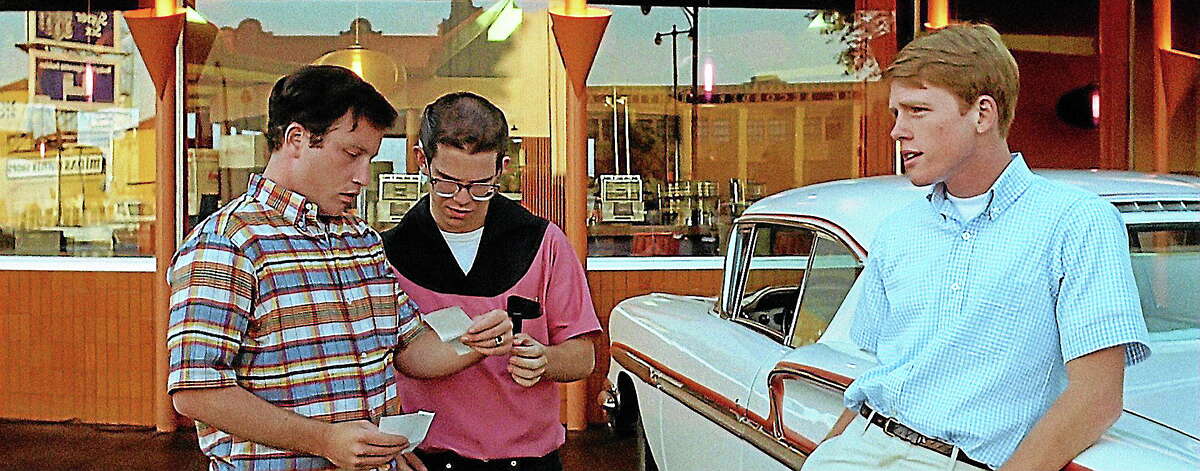

Josh Brown said the fintech revolution has been "substantially overplayed." Jim Lebenthal impressively said don't try to do the "Triple Lindy" (photo above), just stick with big money-center banks.

Jim saw "Top Gun: Maverick" over the weekend and found it "really fabulous." Josh Brown said he too saw it and it was "unbelievable."

Mel said, "I just watched 'Top Gun' the other day. Ready for 'Maverick' now."

Jim made PARA his Final Trade. On the 5 p.m. Fast Money, Karen Finerman said to sell the upside calls in PARA because the opening weekend of "Top Gun" is over.

Nothing about revising ‘Laugh-In’ this time

In a tepid, lukewarm, non-starter of a Halftime Report episode Tuesday (5/31) guest-hosted by Mel (Judge, curiously, still helmed the day's Overtime), the strongest call was to buy ... AT&T and Verizon.

At first, panelists sounded a little deadlocked over whether this week will be upward.

"Beautiful weather, but not a beautiful market," said Stephanie Link, who said she doesn't see a "soft landing" and that the "unknowns" will continue to wreak havoc on stocks.

But Joe Terranova said, "I do think there is further upside potential."

And Jim Lebenthal mentioned the Bostic "pause" comment again.

But Josh Brown insisted "it's a bear market rally" and advised getting rid of "metaverse trash" in your portfolio.

"Try to control your own emotions" (snicker), Brown added.

Brian Belski this time wasn't asked about his year-end S&P target but touted "traditional telecom stocks" as part of a barbell approach to communication services. Jim Lebenthal said he agrees with the call but thinks "almost half" of the sector is GOOGL and FB, so everything else will get "dragged along" with those names, so why not buy just those 2. Belski said people should put their FB money into T and VZ.

Trading 2023’s rate cuts

In his review of "American Graffiti," Gene Siskel observed, "Today's asininity quickly becomes tomorrow's nostalgia."

And so one wonders if the volume of complaints about Jerome Powell's Federal Reserve this year —omigod, the Nasdaq composite is NOT up every week — are destined for some kind of flip like the S&P overnight futures on Nov. 9, 2016, in which we have to spend all of 2023 hearing about the geniuses who were buying at the bottom.

On Friday's (5/27) Halftime Report, nobody was making any long-term pronouncements, but there sure were a lot of short-term ones.

Judge said Steve Weiss called him right before the show and said he bought the SMH, QQQ, Vanguard S&P, QCOM, Volkswagen, XPO, TGT and CLF.

Weiss, who was on the show, affirmed those purchases and explained that he's been at "a few conferences" in which everyone was "decidedly negative."

But "I'm not gonna be here very long," Weiss insisted, asserting that stocks may only run "for another few days."

Jon Najarian said "the volume definitely showed up" in options this week "on that huge selloff."

Brenda Vingiello said Fed notes about a possible "pause" gave the market a lift. Jim Lebenthal added on to that, stating Raphael Bostic's comments about being "ready to pause" in September was the "first hint" that the Fed's even thinking about thinking about a pivot.

Weiss said Bostic is "not a voting member," so take his comments "with a grain of salt."

Not exactly euphoric was Rich Saperstein, who said he's got a high cash position while he waits for "more clarity."

Judge opines on GPS not realizing the real-time price

On Friday's (5/27) Overtime, Adam Parker said there's "some chance" the Fed could "thread the needle without ruining everything." But he'll "lose all faith" if they "end up cutting rates next year."

We don't know why he'd be losing faith. If they announced they plan to cut rates in 2023, we'd probably see 4,700 in a week. (What does he think, that ZIRP is over?)

On Halftime earlier in the day, Rich Saperstein, who's not at all sold on the week's rally, said he sold DIS, citing streaming wars; he "didn't just want to own the stock anymore."

Saperstein offered, "A lot of money is needed to create a movie. And people are watching it once or twice. Maybe 'The Godfather' you watch 5 times."

A perfectly good point. (But one that could've been made 1, 3, 5 years ago.)

Saperstein said he bought Imperial Oil and Marathon, calling oil an "elegant" (snicker) way to hedge the S&P.

Jim Lebenthal said he unloaded PYPL. (This writer is long PYPL.) He said he bought it around 180 a couple quarters ago and, "I don't feel I know more about it today than I did when I got into it. ... I'm tired of looking at it."

Jon Najarian said he bought DELL; he didn't know the report would be so great but he thought its success from VMWare wasn't fully baked in.

Steve Weiss, who bought more CLF, said one reason he previously got out of it was because he thought it became a "momentum" stock, and "I didn't want to play a momentum stock because they don't end well," even though he announced several purchases Friday that sound like momentum trades based on negativity he's sensing at family-office conferences.

Judge asserted that GPS was "ugly." Then he said, "Take a look at the shares please," and when the graphic showed the stock up, Judge was floored. "Wow. They've come back."

Doc said he took a long position in GPS because he sensed "some sort of a washout." He said he jumped in around 9.50.

Julia Boorstin said the movie box office so far is 58% of what it was in 2019.

Jim Lebenthal said he's going to see "Top Gun: Maverick," because it "seems like it's gonna be great."

Jim cracked that the movie "Jackass" is a "biopic on Steve Weiss."

‘Amazing ... how the mood changes when there’s green on the screen’ (a/k/a NVDA as the ‘buy of the year’)

On Thursday's (5/26) Halftime Report, Jenny Harrington said she's getting "enthusiastic" about the market after the "ton of hard work" that's been done.

Judge said it's "amazing ... how the mood changes when there's green on the screen," but he's "not sure" what's changed in a week. (Well, there was Bill Ackman's tweet bottom.)

Jon Najarian said he thinks we're "probably within 2-5%" of the tradeable bottom.

Anastasia Amoroso contended this may not be a "late-cycle recession" but a "soft landing."

Judge pointed out that Jeremy Siegel's "done a 180" on how much the Fed needs to do.

Josh Brown said gasoline demand is at 2013 (non-pandemic) lows.

Jenny Harrington said her point last week about the consumer being "really strong" is "actually true," even though she got "beat up for that." (Apparently she's referring to Weiss "congratulating" Jenny for being able to predict AEO earnings that TGT and WMT can't, or the week prior, when Josh Brown said she didn't know the definition of "oversold.")

Doc said NVDA at 165 or 167 "was the buy of the year in the afterhours last night."

Doc said he bought TDOC because it "softened up" again and "virtually every target" on the stock is nearly double what it's at. He thinks this business is "here to stay." Josh Brown wondered if everything TDOC does can't be "replicated" by "every large insurance company" or AMZN. Doc countered, "They already have a big international footprint."

Why did Weiss sell DAL up 20% in 2-3 weeks if where a stock has come from doesn’t matter?

At the top of Wednesday's (5/25) Halftime Report, Pete Najarian said he bought NVDA and contended it has never been this cheap, "ever." But he said he's going to hold on to INTC also.

In a curious distinction, Joe Terranova said JOET is long NVDA, "so I'm long NVDA," even though "personally" he sold NVDA last week after choosing between exiting that one or AMD.

After letting others talk for a while, Judge said that he would turn to the "always upbeat and happy-go-lucky" Steve Weiss.

Weiss said a 20 P.E. now coming down is "immaterial" because the earnings path isn't known. Then he slammed buy-the-dip.

"It's always flawed, and it's the most flawed basis you could use, to say the stock's come down 40%, I gotta get involved now. It- it- I don't understand it. Where have earnings come? Where are earnings going?" Weiss said, adding we're in an environment we've "never seen."

"There's no playbook," and "every time is different," Weiss said.

Weiss then warned about one of those black-swan things (not China "goin' after" Taiwan this time), explaining that he's been "listening" to "a lot of" generals and found that "every general" will tell you that if Vladimir Putin uses chemical or nuclear weapons, "it's a world war."

Judge joked, "If that's the happy-go-lucky Weiss, where's the dour one."

"Scott- Scott- Scott if you want to revise (sic) 'Laugh In,' go to somebody else," Weiss said, referring to a TV show that no one under 55 or 60 ever saw. (At least he didn't say Jack Paar, or something like that.)

Weiss said to focus on the "big picture" rather than looking for "data points."

Weiss said rather than NVDA, in which you're "flying blind," he would've bought "some of the other semis that aren't trading at 45 times earnings," even though he said earlier that P.E. is "immaterial" because we don't know what earnings will be. Pete said NVDA is a great company in great industries and the stock has "taken a lot of pain" and he's being "selective" buying it now "at a dramatic discount," though he's not calling a "bottom." Pete added that he did "sell upside calls against it."

Weiss said, "You could've had the same conversation on Nvidia at 200."

Weiss mentioned "2000," when he said people were buying formerly $1,000 stocks at 500, 400, 50 ... "and guess what — you got a tin cup out because it went belly-up." (Actually we doubt very many stocks then actually traded at $1,000.)

Kari Firestone bought more SCHW, saying first "the stock's down 30% from its peak last year." (Ah, Weiss isn't gonna like that.) She also thinks worst case, SCHW trades at 13 times next year's earnings. (Ah, Weiss isn't gonna like that either.)

Gonna go listen to some generals, forecast the stock market

On Wednesday's (5/25) Halftime Report, Kari Firestone offered that "there are very few times in history where we have as much of a range between the average high and low of the day."

Ed Yardeni said he's being "realistic" in lowering his 2022 S&P target (which is actually about a 500-point range, which at least is better than the 1,200-point range) and raising his recession risk from 30% to 40%, but he thinks next year, "we're still gonna make a new high in the S&P 500."

Judge replayed the clip a day earlier of Jeremy Siegel, citing money supply, saying he's now concerned about "overreaction" from the Fed. Yardeni said M2 is still "about 3 trillion dollars above its pre-pandemic trend."

Joe Terranova asked Yardeni if we're in "stagflation." Yardeni said, "It's clearly stagflation," but he thinks we'll exit "a lot faster" than in the 1970s.

Judge said it "seems almost impossible" that Yardeni says yes it's stagflation, "and on the other hand, oh but we're gonna hit new highs in the S&P next year."

"It's a matter of timing," Yardeni shrugged.

Steve Weiss said he got stopped out of DKS "almost as soon as I put the trade on." He said it's a "cheap stock," but basically all retailers are. Joe said he got back into LULU, because "maybe a lot of the bad news" is priced into retail names.

The president has declared that his inflation strategy is to ask big companies not to price-gouge

Sometimes this page has to do the work for TV hosts, given that they seem reluctant to ask people on business television whether the stock market fears inflation or fears a recession.

On Tuesday's (5/24) Halftime Report, Rob Sechan asserted that we're in a "downturn" that's "being caused by Fed monetary tightening in response to the things that are going on environmentally related to inflation, the war, and, uh, shutdowns in China."

So this "downturn" is caused by the level of interest rates chosen by the Federal Reserve. But it's only choosing these particular rate levels because of the things "going on environmentally."

Frankly, that sounds kinda odd.

It's like saying, "The Wildcats are throwing more incompletions because Coach has been calling more passing plays because time is running out and the team is trailing by 35 points."

It's certainly not the first time that a CNBCer has struggled with cause and effect.

Later in the program, Judge quoted Bill Ackman (who wasn't on the show) in a "series of tweets" addressing the downturn: "It ends when the Fed puts a line in the sand on inflation and says it will do whatever it takes and then demonstrates it is serious by immediately raising rates to neutral and committing to continue to raise rates until the inflation genie is back in the bottle. ... Markets will soar once investors can be confident that the days of runaway inflation are over. Let's hope the Fed gets it right."

Sechan said such a move would be a quick change from recent Jay Powell forecasts and "challenge his credibility."

And as for Ackman, Steve Liesman admitted being "kinda glad he's not runnin' the Fed I guess right now," suggesting Bill is "impatient with the process."

But here's what Judge didn't ask anyone: What, exactly, does Bill think the Federal Reserve should be accomplishing?

Is Bill trying to say that we'd be at 2% inflation, 3% unemployment and 4% growth forever if the Federal Reserve had simply hiked an interest rate 6 months ago?

Or even better, is Bill actually saying gasoline would be 2 bucks a gallon if the Federal Reserve had simply stopped buying bonds in the summer of 2021?

Or, most likely of all, is Bill simply demanding that the Nasdaq can never go down, not even after (basically) 13 straight years of gains, and if it does, it MUST be the Federal Reserve's fault!

Perhaps if Judge isn't going to tell viewers whether the stock market fears inflation or recession, he could at least explain what the "victory" envisioned by Fed critics such as Bill Ackman and Jeremy Siegel and Lawrence Summers is supposed to be.

The White House also said its inflation strategy is about confirming appointees to the Federal Reserve

On Tuesday's (5/24) Halftime Report, Josh Brown pointed out that stock market sentiment has been bad for months.

Judge pointed to a "rapid deterioration" in corporate outlook.

Stephanie Link though said that Jamie Dimon and Brian Moynihan were saying the economy is "quite strong."

Steve Liesman said nobody should've thought that when the Fed began this cycle that everything would be "hunky dory" right now.

Then, there was the magic "R" word, as Brown revealed, "Google searches for the term 'recession' have never been higher, even if you include previous recessions."

It was a ‘constructive’ conversation (i.e., nothing about Judge’s Twitter account)

Judge on Monday's (5/23) Halftime Report asserted that "the market has been oversold for a while." Guess he didn't clear that with Jenny Harrington, who argued May 12 that it's "incorrect" to say the market is "oversold."

But Jim Lebenthal said we are indeed "very oversold."

Jim pointed out that the problems with WMT and TGT earnings reports wasn't revenue, but "atrocious" margins.

Jim asserted that this is a "stock picker's market (snicker)," pointing to CSCO, which is only one of hundreds of stocks that's taken a big hit here or there during 2022, but whatever.

Jim said he was "taking comfort" from Jamie Dimon's remarks because Dimon's a "cautious guy" who, if he was seeing credit concerns, would've mentioned it.

Jim said he'd be most heartened by "tangible signs of inflation coming down."

But Bryn Talkington contended that the Fed's in a "really tough position" and may not have "the right tools" to fix ... whatever everyone's complaining about. (Oh yes, the fact they're paying $5.50 a gallon.)

In the show's most head-scratching comment, Joe Terranova claimed there won't be "capitulation" until the Fed not only talks "more aggressive," but "their actions are even more aggresive."

"I don't think they can talk any more aggressive than they have," Judge shrugged. (Yes, threatening to hike rates to 20% overnight probably won't lower the price of gasoline.)

Joe almost said "tradeable blounce (snicker)" but corrected himself in time.

Joe said JPM had a "double bottom" around 115, so he's "OK" buying it around 124 1/2 as he did Monday morning.

Joe said it was a "difficult decision" to choose between NVDA and AMD last week. (He sold NVDA, citing gaming headwinds.)

Bryn Talkington said MSFT's multiple of 26 vs. 20 for forward Nasdaq "could easily come down." Jim Lebenthal said he's underweight MSFT for "exactly" that reason.

Alert Elon: Judge accused of spreading misinformation on Twitter

Things got a little chippy on Thursday's (5/19) Halftime Report when Jim Lebenthal said the jobless claims number is "extraordinarily low" and that people in that situation will "easily" find other jobs.

Judge suggesetd WMT and AMZN may have put that theory to rest.

Jim responded, "We speak in quips on the show (actually it's more often mini-speeches) and you accuse me of being insensitive. I think you know me better than that."

Jim insisted airlines and hotels and restaurants are "dying for people." Judge protested that they've discussed on "numerous occasions" that looking to hospitality and travel for truths about the help-wanted market is "the wrong place to look" because of "all of the pent-up demand."

Jim followed, "You tweeted something today like, Lebenthal has no concerns in the world."

"I didn't say that," Judge protested. "I didn't say that. I didn't say you have no concerns in the world. I said, Do you still think that we're not getting- we shouldn't be worried about a recession or a slowdown or that earnings need to come down."

Well, the first thing we wondered is, What do these 2 individuals accomplish by spending time on Twitter? Then we wondered, what did Judge actually tweet? It was this: "is Farmer Jim @jlebenthal still bullish with no worries of consumer slowdown or earnings hit and recession?"

Well, Jim was more right than Judge, who actually tweeted that Jim may have "no worries" and then claimed on TV that he tweeted that Jim may think people "shouldn't be worried."

Judge says he wants to ‘foster’ conversations that are ‘constructive’

It was fall-off-the-chair-laughing day (seriously) on Thursday's (5/19) Halftime Report shortly after Judge announced at the top of the show, "A very. Big. Halftime. Headline for you today."

That headline was ... Jim Lebenthal cutting his 2022 S&P target from 5,030 to 4,850.

Oh boy.

Jim, who conceded that some people may wonder "What the heck is this guy smokin'?," pointed out his new target still represents 24% upside from here.

With a lengthy windup, Judge made a statement (that's correct, not an actual question) to Josh Brown about Jim's market outlook. Brown's response was the show's funniest line in weeks if not months: "OK."

After a moment of dead air, Judge said, "Yeah. ... Josh ... If you wanna be a smart-alec, I mean, then we can just do something else." That led Brown not to forfeit his allotted speech time but to embark on his most recent (probably since the afternoon of the day before) market outlook speech.

In another unnecessarily lengthy windup, Judge asked Steve Weiss about Jim's commentary. Weiss said, "I don't believe he's smoking something at all. I actually think he's on much stronger stuff."

Specialty retail to the rescue

Grandpa Steve Weiss spent every one of his soundbites on Wednesday's (5/18) Halftime Report pronouncing the U.S. economy DOA.

But at least one of those pronouncements provoked a chippy little argument with a fellow panelist.

Weiss said AMZN has "some issues," including the consumer, and that's why he sold it, declaring, "The consumer in the luxury segment will still do fine. But everybody else, the numbers just don't add up."

Jenny Harrington said she disagrees, affirming she bought AEO "for the dividend strategy 2 weeks ago" and asserting that the stock price forecasts a 50% cut to earnings.

"I don't think the consumer's going to stop spending at American Eagle by 50%. Maybe a little," Jenny said, bragging that she bought AEO "down 40%."

Judge was going to cut to a break, but Weiss said he wanted to "congratulate Jenny" because "she's able to predict earnings but Walmart, Home Depot, Target, they can't and they're right in it so kudos, kudos to Jenny."

"Give me a break, Weiss," Jenny said.

The thing we'd like to focus on there is the "down 40%." Why is it OK to buy some stocks down 40% and not others? (Ah, it's OK, as long as it's not Teledoc, Docusign, Crowdstrike, Snowflake or Peloton.)

If the bottom 70% is out of money, why aren’t more $2,000 checks going out?

On Wednesday's (5/18) Halftime Report, Steve Weiss scolded all of those stock market observers who've had "disbelief" that margins could plunge or that the consumer would stay strong.

Then he said investors haven't been living in the "real world" in which (his new favorite slogan, replacing China "goin' after" Taiwan) "60-70% of the country lives paycheck to paycheck."

Now that's interesting, because other people say that there's 2 job openings for every job-seeker. If there are plenty of jobs out there, why are people living paycheck to paycheck?

Weiss also predicted that the country's urge to travel is going to "dissipate fairly quickly."

He said business travel picked up because people haven't seen their customers or suppliers for 2 years, but that'll pass and it'll be back to Zoom. (A year or two ago, it was, they're never flying again now that they've got Zoom.) "Who wants to be on a plane more than they have to?" Weiss said, predicting this as the "last good quarter for the airlines."

Grandpa Weiss also said just-in-time inventory is not only "dead," but "we're not gonna see that again in our lifetime." That's one reason he likes GXO. (He cited so many reasons, we tend to be skeptical.)

What if the Fed did a rate cut?

Joe Terranova led off Wednesday's (5/18) Halftime Report saying "we have a problem now" because of TGT's miss, "completely negating" the bear-market bounce.

"We now have to have this concern about margin compression," Joe said.

Judge asked Jenny Harrington about repositioning from some stocks to other stocks; there were too many stocks for us to keep track of.

Bryn Talkington said it's "futile" to fight the Fed.

Returning to one of his favorite themes (kind of like Weiss regarding people living paycheck to paycheck), Joe said Joe Biden could, "for the good of the country," suspend or relax some tariffs. Judge said the problem is that it's a "political issue."

Joe claimed inflation is "rampantly out of control."

Judge can't get enough of Brian Belski, who could basically offset whatever Jonathan Krinsky says, but Krinsky for whatever reason didn't actually make Wednesday's show.

‘Oh, you’ve been taking furniture orders at a call center? How about piloting some 747s instead!!!!!’

Tuesday's (5/17) Halftime Report, much to our surprise, ended up with a splendid little debate NOT about interest rates and remarks by Federal Reserve officials ... but the real strength, or lack thereof, of the U.S. economy.

Josh Brown, in his opening monologue, said reported higher growth is basically offset by inflation, and he's not interested in "nominal gains."

Brown asserted, "This is not a great environment for the consumer."

"Well for services it is," insisted Stephanie Link. "Travel, leisure, hospitality, hotels."

"The comps are 2021!" Brown said. Link said to "listen" to what UAL said about business travel reaching 2019 levels.

Judge, evidently a financial analyst now, cut in, "You've gotta believe though ... that bounce-back in biz travel is not gonna last."

Judge then turned to Jim Lebenthal, who insisted there's strength outside of the services sector.

That prompted financial analyst Judge to state, "People like Jim have been way too optimistic on not only the environment but the consumer because they're looking in the wrong places (no, Judge didn't mention the Johnny Lee song)."

Or maybe the only place Judge is looking is the tape.

Mike Farr predicted recession at some point in the next couple years because he doubts a "soft landing" by the Fed.

Then things took a seriously intellectual turn higher as Jim made the type of observation rarely heard on the program, stating "nobody's gonna like" this particular point, but "The current inflationary environment is terrible for the consumer, and it's great for stocks."

That goes a long way toward answering, correctly or not, whether the market is afraid of inflation or recession, the question Judge hasn't had the brass to ask anyone this year or last.

Moments later, Judge reported that W is freezing hiring for 90 days. Jim said it's "great news" and made this statement: "You want the stay-at-home beneficiary companies to start letting people off so they can migrate to those sectors of the economy, namely the services sector, that are desperate for workers. That will help inflation. You want these people going from the Amazon warehouses and the Wayfair warehouses over to be baggage handlers at airports."

"It is good for the workers and it's good for the economy," Jim added, explaining he's sorry if anyone thinks he's a "jerk."

Judge added, "Well nobody wishes job losses on anybody."

Jim said there's 11 million openings and 5 million unemployed workers.

"Yep. Um, I'm not gonna argue with you," Judge shrugged.

OK. Jim's got things twisted if he thinks online retailers should be "letting people off" so that they'll all immediately pursue sectors that people want to see filled, such as airlines and restaurants and nursing homes and car repairs.

See, there is something we've heard of that still (supposedly) exists and it's called a free market, which is supposed to allocate capital and labor and resources to places where it's in demand and away from places where it's not.

Jim's wrong to make that particular point about one specific company, one that's been highly debated on Wall Street for many years, while ignoring that even in the best of times, economies don't work perfectly for the consumer; lots of folks who might be good at busing tables or mowing fairways prefer to try their luck at law school or original Hollywood series.

For whatever reason, that permanent disconnect seems heightened amid/since the pandemic, probably because a lot of industries were disrupted.

Theoretically, it should work itself out.

The alternative is to let folks like the Soviet Union pick which jobs we should have.

In other matters, Judge said Joe Terranova, who wasn't on the show, "bailed" and sold WMT on the market open Tuesday at 136.26; Joe had owned it for about 3 weeks, and Judge said Joe declared it in the "penalty box" for a "very very long time." Joe surfaced at Post 9 on Overtime and first asked if Judge got "rid of" the Halftime tape because Joe doesn't want to see it anymore, then Joe said WMT had an "idiosyncratic, abysmal report."

In a numerical stumble, Judge suggested on Overtime that Joe sold WMT "at 132" after correctly giving the price on Halftime, which Joe affirmed.

Josh Brown on Halftime said that as long as major averages are under the 200-day, "every single rally is guilty until proven innocent," so "this one'll likely fall apart."

An even bigger operational misstep is simply greenlighting awful movies

At first, we cringed when Judge seemed to ask Jim Lebenthal about Paramount Plus (the streaming service with 500 "Star Treks," or something like that) on Monday's (5/16) Halftime Report.

But then Jim said something interesting — about a different company.

Jim said letting "literally 1/3 of its subscriber base just hang out, paying nothing, freeloading" is a "very big operational misstep" for NFLX.

Well, while some on CNBC have asserted that it should be an easy problem for computers to fix, this page isn't so sure. If a person subscribes to NFLX and goes to a friend's house, it seems like that person should be able to watch NFLX; differentiating between that and someone simply telling a friend about a password seems problematic.

We don't know. That's what Reed Hastings and Ted Sarandos get the big bucks for.

(We do know that if Netflix keeps churning out garbage like "The Lost Daughter," there's no bottom to this stock.)

Meanwhile, even the presence of Joe Terranova and Liz Young at Englewood Cliffs couldn't buoy a decidedly sleepy installment of the Halftime Report on Monday.

There may be a rally, but "I don't think it's going to last," said Liz.

"You absolutely wanna own energy," Joe said.

Judge said Joe sold IBKR and CMG. "I always have a risk-management process in place," Joe said, and in the understatement of the week, "I know that gets boring to the viewers."

Joe assured he's never going to take an "exorbitant" loss. #whoopdedo

Liz actually expressed warnings about ... yes, hard to believe ... the consumer, asserting, "There's been a huge growth in consumer credit, and people have spent down their savings, now they're starting to spend on credit cards."

Steve Weiss called in and said he's "still very bearish on the market," even though he's buying DAL again. He said he sold DAL recently because it was up 20% in "2-3 weeks," and he doesn't expect another trade that good, but he said there's "no seats anywhere" on upcoming flights.

‘Get real’ — IBM, CSCO, PFE to lead the stock market into a new era

Thursday's (5/12) Halftime Report was marked by a spirited debate over a ... definition.

Josh Brown had something about the "oversold" market getting ready to "rip."

When Jenny Harrington got a chance, she said, "To think about a market that's going to rip is really applying yesteryear's playbook to today. ... To say that we're oversold I think is incorrect."

Jenny's tired of the old leaders and said she wants Pfizer, Cisco, IBM (seriously, that's what she said) instead.

Jenny also twice said we should "get real" and realize AAPL is a "mature tech company," and those companies don't trade at 23 times.

Josh Brown though said it's "impossible" for the major averages to turn up if AAPL continues sliding 2-3% a day. Jenny cut in to say "It's only 7% of the index." Brown clamored for Jenny to "hold on" and let him speak.

"You also don't know what the word 'oversold' means. It's a technical term. It has nothing to do with the P.E. multiple," Brown asserted, saying an RSI of 31 is "statistically" the definition of "oversold."

"We're not arguing with each other, we're literally talking about 2 different things," Brown assured.

"OK. I'll give you that on the oversold part. I'm gonna stick with my definition of oversold," Jenny said, before Brown interrupted her.

‘Massive rip brewing’

Folks looking for optimism might've been heartened by some of the commentary at the top of Thursday's (5/12) Halftime Report.

Jim Lebenthal began by contending the market is "trading on emotions and not rational logic."

But Josh Brown ramped it up, stating, "I think there's a massive rip brewing right now."

Judge, in his scripted pushback, stated, "Some of the smartest investors that I talk to are now calling this 'The No Mas Market.' No more."

Jon Najarian agreed with Josh Brown that only the "junk" was ripping on Thursday morning.

Doc said he thinks there could indeed be a rally ahead, but, "I don't know that we're there yet."

Jim said he got out of TWLO, he's tired of it, "It's an eyesore."

Bill Miller in bitcoin hat

Maybe not everyone on Thursday's (5/12) Halftime Report thinks the stock market is "oversold," but Chris Hyzy seems to be one who does.

Hyzy observed that, "When 70% of the Nasdaq is down, uh, more- in a bear market, down more than 20% from their all-time high, and 52 weeks, and 60% of the S&P is at like (sic grammar), I think you can say there's a good portion of the market that's oversold."

Judge demanded that Jim Lebenthal concede that the world feels a little more "unsettled" than Jim's been "willing to admit to." Jim said yes but that it doesn't feel much different than 2-3 months ago. "I think it does," Judge insisted.

Josh Brown called GM "a broken stock in a broken sector in a broken market." Jim said that characterization "frankly applies to almost all of the stock market right now." Then Jim, in the theme of the day, assured, "We're not arguing."

Judge asked Josh Brown about BROS. Brown said "this chain is on fire," but dairy prices are up 25% in a quarter, and, "We're in a crashing market for growth stocks."

Joe Biden said during the Halftime Report he’s going to fight inflation by asking big companies not to gouge

Jeremy Siegel, the star guest of Wednesday's (5/11) Halftime Report and the world's greatest inflation worrywart (Then again, we've got Josh Brown saying, "The consumer has no choice but to spend, or they won't eat"), insisted there's "inflation built in," and it'll be "in the works for the next 6 to 9 to 12 months."

Jeremy really wants Jerome Powell to say, Sorry we didn't send Fed staffers to semiconductor factories or oil rigs in 2020 "We really did make a mistake."

Nevertheless, "What's strange about this bear market is there's still no signs of a recession," Siegel said.

Of course Judge didn't ask, and Siegel didn't volunteer, whether stocks are down because of inflation, or recession.

But Judge did ask one decent question. "Do you think the Fed wants the market to crash?" Siegel said, rather clumsily, "I think, no, I mean I, I don't think the Fed wants the market to crash. But they're not gonna step in ..."

Jeremy said long-term investors should be happy because the market's returning to "the way stocks should be valued." Yes, those long-term investors sure had a big problem with the Nasdaq's return from 2009-2021.

Judge had been relentlessly hyping Lee Cooperman's appearance on Overtime Tuesday (5/10); there were so many beeps, blips and buzzes, it sounded like Judge was in an arcade.

How many soft landings has the White House pulled off?

The ongoing CNBC Original Series, "Inflation Voodoo," aired again during Tuesday's (5/10) Halftime Report, this time in the form of a live speech by President Joe Biden, who happened to say some interesting things about Wall Street's favorite subject.

We took note.

"I want every American to know that I'm taking inflation, uh, very seriously, and it's my top domestic priority," said Mr. Biden. "And I'm here today to talk about solutions."

Interesting. He knows solutions to inflation. (So he's going to say that he's sending National Guard types to oil wells and semiconductor factories.)

"There are 2 leading causes of inflation we're seeing today," Mr. Biden explained. "The first cause of inflation is a once-in-a-century pandemic ... it threw the supply chains and demand completely out of whack."

Ah. In other words, IT CAUSED A BUNCH OF SHORTAGES.

"And this year we have a 2nd cause," Mr. Biden continued. "A 2nd cause. Mr. Putin's war in Ukraine. You saw- we saw in March that 60% of inflation that month was due to price increases at the pump, for gasoline. Putin's war has raised food prices as well."

OK. So there's not enough oil sloshing around. Not the first time that's ever happened.

But then, there was this: "Some of the roots of the inflation are outside of our control."

Ah. The perfect time for Mr. Biden to say, "So we're going to rely on the free market to straighten out its own problems."

But no.

Instead, "But there are things we can do ... That starts with the Federal Reserve, which plays a primary role in fighting inflation in our country (sic last 3 words redundant). I put forward a holly qual- highly qualified nominees (sic singular/plural) to lead that institution. ... The Fed has dual responsibilities: First is achieving maximum employment. And 2nd is stable prices."

OK. It's the Fed's job/fault (emphasis on latter).

Because when your defense is giving up 5 touchdowns in one quarter (that would be the Denver Broncos in Super Bowl XXII), the logical remedy is to not 1) play a different defense or 2) get some better players, but demand the referees start calling more penalties.

Finally, things got laughable, as we heard about lowering the deficit amid a problem that we all know is going to be somehow attacked with more debt.

"My plan is to lower employer- lower everyday costs- everyday costs for hard-working Americans, and lower the deficit by asking large corporations and the wealthiest Americans to not engage in price-gouging and to pay their fair share in taxes."

Eventually, Judge cut off the speech, even bluntly declaring, "His options, frankly, are, are somewhat limited ... certainly laying the solution at the feet of the Fed."

‘Shaking my head’ at Cathie’s curious GM purchase

Tuesday's (5/10) Halftime Report featured what Judge called a first in 2 years — Josh Brown taking a seat at the Englewood Cliffs table.

Jim Lebenthal conceded "it's a bear market in the Nasdaq," but "it's not the broad market overall." Jim, who favors the outlook of a correction for the broader market, said a "correction" is different than a bear market, a correction being done within a year.

Jim said he hates to say it, but Wednesday's CPI report is "the Super Bowl of economic statistics." (Usually, they just say that the upcoming month's jobs report is the most important one of all time.)

Josh Brown, on the other hand, insisted, "We have to understand the technicals" about this market.

Brown wasn't impressed by apparent strength in the consumer, resorting to hyperbole. "The consumer has no choice but to spend, or they won't eat. The consumer is on a treadmill from hell," Brown said.

"Don't interpret them spending more as them being fine."

Brown also didn't think much of Dave Tepper covering his Nasdaq short. "David could put it back on in an hour," Brown said.

Judge said Cathie Wood is buying GM. Jim Lebenthal said there's "reason" to buy the name.

Jon Najarian, though, said of Cathie's buy, "I was really taken with this one and sort of, uh, shaking my head," questioning investing in a "secondary player" in the lithium market. "Cathie didn't call me and ask," Doc admitted.

Josh Brown suggested Cathie is "lowering the beta in her ETF."

Brown observed that "Starbucks is ground zero for inflation and labor issues."

Judge revealed about SOFI, "There are some who are frankly taking issue with my characterization of the guidance as being quote-unquote bad." (Wasn't this page. Must be folks on Twitter.)

Doc said he'd only do options on SOFI. Josh Brown said, "The stadium they own the naming rights to is worth more than the market cap."

If someone has a 3- to 5-year time horizon, and they bought their stocks in 2017 ...

Despite the fact Monday's (5/9) Halftime Report veered into more of the same where's-the-bottom dialogue, guest host Mel elicited a little bit of intriguing commentary and trades.

Grandpa Steve Weiss, whose bearish case has been re-realized in the last 2 weeks (though he did miss that relief rally in early March), insisted it's "not a normal environment still," because nearly 15 years of liquidity will be "dissipating" in "less than 6 months."

Again expressing frustration, basically, that we haven't had the big whoosh down yet, Weiss again mocked the notion of "dipping our toe in the water" and asserted, "We're not at a bottom," and he'd just "stay in cash."

A little more enthusiastic was Bryn Talkington, who said she focuses on how many stocks are above their 200-day. Bryn said that, going back to 2009, it gets "really interesting" when that percentage gets under 30, a level we're around right now.

But after Kate Rooney reported on crypto trends and revealed that "about 40% of bitcoin investors are underwater," Bryn Talkington said she's long GBTC.

Weiss, however, said he shorted GBTC. "I still don't know what a store of value means. Uh, nobody can really explain it to me. What is it exactly."

Well, he's on to something there. We're still waiting for a CNBCer to explain whether it's A) software or B) a computer program or C) a storage locker or D) something else.

Bryn, though, said "there's a decent probability that it turns into an ETF."

Meanwhile, Bryn said, "I do think you have to get out your 2000, 2002 playbook."

"I do think the Fed has a limit on how much they can raise rates," Bryn added, predicting they won't get to "above 2" before they have to stop.

Meanwhile, Joe Terranova, who had a quiet show, made the case again for buybacks as companies are "exiting the blackout window."

Kourtney Gibson said people with a long-term horizon aren't panicking. (We're not sure why a stock cares whether someone has owned it for 6 months or 6 years, but whatever.)

Jonathan Krinsky said "there's a lot of history at 3,900" in terms of "volume-based support."

But he said "until we actually get there," it's "a little hard to predict" where the bottom might be.

Kourtney Gibson said she bought DIS. "You're not going to lose for the long term in this name."

Kourtney said she's "shocked" that UBER was taking a hit on Monday; she said she's buying more. (This writer is long UBER.)

OMG! S&P down 8 points in a week!

On Friday (5/6), we were all set to post a humdrum account of a fairly humdrum episode of CNBC's Halftime Report.

Then we caught the beginning of Overtime, in which Judge said David Tepper told him, "Central banks have a little bit of a credibility problem," and that supposedly taking a 75-point move "off the table" was an "unforced error."

Of course. Because the stock market has to go up every single day.

Dan Greenhaus, who was actually on the program, agreed that the sentence from Jay Powell was "absolutely a mistake" (snicker) because Powell supposedly took a "tool" off the table.

Honestly, we don't know whether to chuckle, or turn this stuff off. A bunch of folks who literally have had nothing to do in the markets this year are mad that it costs $20 more to fill up the tank and $200 more to fly to L.A., and they want the Fed to curb other people from trying to purchase those same $65 tanks of gas and $800 air tickets so that those things can go back to those perfect prices they loved in 2019.

And then if the stock market doesn't immediately resume delivering good returns for them, they'll go on CNBC and complain that "The Fed never nails a soft landing."

Honestly, the dialogue about this topic is some of the biggest bunch of voodoo we've ever heard.

Steve Liesman was on Overtime and was mostly the voice of reason, but even Steve said, "If Powell really does move to take care of this inflation problem, this is not gonna be pretty for stocks."

Saying that Jay Powell can "take care of this inflation problem" is like saying the groundskeepers at Augusta can rein in -20 or better scores. Sure, they can let the rough grow longer and put more wax on the greens, and the number of strokes will increase. News flash: The leaderboard is still going to look the same.

It's long past time Judge had the brass to ask some of these inflation/Fed critics 1) What happened to the free market and why are you clamoring for a command economy and 2) What are you so afraid of, Do you really think this is Venezuela or 1921 Germany?

Taylor, Hornung got old

On Friday's (5/6) Halftime Report, Jenny Harrington, citing "The Big Short," said "Your previous playbook is over" and "Get into new companies" and don't think you have to make back the money you've lost in the same stocks you lost it in.

Steve Weiss said if there was only "1 minute of airtime," Jenny's comment would be the comment to air.

Tyler Mathisen, who delivered the News Update, evidently noticed, as he brought this up on the 5 p.m. Fast Money while guest-hosting for Mel. (But he didn't mention the name of the person who brought it up.)

For whatever reason, that prompted Guy Adami to say Bart Starr won "a lot" (actually 2) of Super Bowls by just "running basically 4 plays."

"The league caught up to him," Adami claimed, but actually it didn't; the fading, rapidly aging Packers still won Super Bowl II before the bottom fell out on offense.

"The most memorable teams of my lifetime, I've gotta say," Tyler said.

Steve Grasso bluntly stated that for Democrats to win November elections, "the price of gasoline has to be lower."

From what we could tell, Judge did not ‘applaud’ Mike Wilson on Overtime

One guy doing a lot of talking on Friday's (5/6) Halftime Report was reality TV star Kevin O'Leary, who repeatedly stressed that it's P.E. ratios, not company growth, that have been plunging.

O'Leary said there's "zero probability" of recession this year.

He said that 20% growth stocks are being sold at "80% off retail," and he contended that Meta's "cash flows haven't changed at all."

Judge asked Steve Weiss what he thought of that. Weiss chuckled and said there are "untruths" to what O'Leary was saying, Facebook has "been decimated by Apple's policies. It has slowed. Period."

Weiss noted how many people on the show sounded bullish. Weiss said O'Leary is "so notoriously cheap."

Weiss offered, "I think we're overdue for, for a short-term rally, but, but I'm not gonna participate in it." Then he stated, "I was bearish in '08, and I made money. But I missed a major part of the upcycle in '09."

But Weiss seemed to think that a lot of people still just don't get it. "You've still got those lemmings putting in money with Cathie Woods (sic plural)," Weiss said.

Tom Lee dialed in to the program and said the recent market has "been very painful," but he thinks risk/reward for equities has "improved this week."

Weiss' Final Trade Friday was, "I actually think there's a pretty good chance the market goes green, stays green today," but he's "staying in cash." (Actually, that didn't happen, unlike his Wednesday call.)

Savita Subramanian actually told Tyler Mathisen on Power Lunch that we're in a "really pivotal time in terms of kind of a massive regime change" in the stock market.

Weiss jacked one out of the park

Judge decided, for reasons we can't quite fathom, to give Halftime Report viewers a commercial-free episode on Thursday (5/5).

Even during Final Trade time, the program was still in stump-speech mode. (Zzzzzzzzzzz.)

When we finally got done watching/listening, we were most struck by something said a day earlier — Steve Weiss' suggestion to buy the SPY and QQQ right after the show ended and before the Fed Q&A, "and only stay there for the afternoon or through tomorrow morning."

Holy. Moly.

Now, you may be wondering, why wasn't this trade trumpeted on this page when it could actually do people some good.

Well, A) We can't often do this page in real-time, so posting a trade idea that's already elapsed by the time of the post isn't particularly helpful, B) Weiss didn't fully specify this trade until the end-of-show Final Trade, which is typically where people mention stocks that have been in their portfolios for 3 years, and C) Others had predicted a rally once the statement was out, but ... (Gulp) ... We figured such a rally would at least linger into the weekend, and Weiss' advice to unload late Wednesday or early Thursday wouldn't be necessary.

For a one-day trade, it'll be hard for anyone to top this.

Bond market is being ‘disrespectful’ to the Federal Reserve

On Thursday's (5/5) revenue-lite (i.e., commercial-free) Halftime Report, Josh Brown said there could've been follow-through from Wednesday's rally if led by Big Tech, but Big Tech went down.

"This is what a bear market rally looks like ... in a bull market, you don't have +1,000-point days," Brown asserted.

Brown said the "only real way" to survive this market is to "not allow your emotions to, to swing back and forth."

Judge claimed the Nasdaq's decline Thursday is "nothing short of stunning."

Pete Najarian said it's "amazing selling that we are seeing right now."

Judge sounded incredulous complaining to Steve Liesman that Jerome Powell put himself "in a box," as if they're not just reacting to the last 3 days' worth of data regardless.

Kari Firestone made us chuckle insisting to Judge that "waste companies" can predict earnings in this environment because they have inflation clauses (snicker).

Judge joked that it's the kind of day where we have to look through "literal garbage" for stocks to buy. (Actually, people can probably make a decision on whether to buy those stocks without actually sifting through the materials those trucks are picking up ... but whatever.)

Brian Belski, who seems to be on either Halftime or Overtime about once every 3 days, said the market needs to flush out "some of this every-other-day negativity/positivity." Belski even said the bond market is being "disrespectful" to the Federal Reserve, which Belski called "the smartest person in the room."

Judge wondered "how are they the smartest people in the room" given that "inflation was screaming in their face, and they ignored it."

Belski insisted the bond market is "ahead of its skis."

Viewers got a rare revelation about inflation and whether this is some kind of phantom exercise by financial leaders courtesy of Josh Brown, who explained, "The Fed has no control over the inflation. They can control the demand situation." (Sure, they can make people not want to buy those $17 Big Macs that everyone fears.)

Jim Lebenthal made a surprise appearance and said it's probably too soon for a rally, but "there's indications that inflation has peaked."

The question Judge hasn’t asked about the 2022 stock market

This page, in coming days, is going to direct some praise at some of the things Judge has been accomplishing in his joint Halftime-Overtime gigs.

For now, though, we're still wondering about questions unanswered.

Specifically, the question we haven't heard on the Halftime Report: Have stocks been falling in 2022 because of inflation ... or because of recession?

Since we're not getting much help on that one from Judge's panel, we've been trying to figure it out on our own (snicker), which isn't easy, given that most nights, we're just trying to achieve a hot meal.

See, this is what got our attention ...

On April 27, Joe Terranova complained, "People are not having any regard what they're paying for a hotel room, or a flight, or the price of a, a tank of gas."

And it made this page wonder, could inflation be like a tree falling in a forest?

Judge has never asked any of the inflation hawks on his panel, "What are you so afraid of — $17 Big Macs?"

You know how Jessep in "A Few Good Men" had to be asked, if he gave an order not to touch Santiago and his orders are always followed, why would Santiago have to be transferred off the base?

And we gotta wonder, if they gave an inflation, and consumers didn't care ... why would the Federal Reserve have to do something about it?

It sounds like what's happening is, if a person gets a toothache, the Federal Reserve doesn't fix the toothache, no filling or crown. Instead, the Fed lessens the amount of food the person can eat ... until, theoretically, someone else fixes the tooth. But the person's probably already eating less food anyway because he/she has a toothache.

And so we couldn't help but wonder ... what if the Fed did NOT hike rates or taper or whatever.

The issue of exactly what level the Fed's overnight lending rate should be is a hotly debated Wall Street topic, all the time, forever.

We have no clue what, exactly, that rate should be, at this moment or any other time.

Interest-rate conversations on CNBC often tend to fall along political or idealogical lines, in other words, a lot of folks seem to think of the overnight lending rate as a barometer of welfare, i.e., the lower it is, the more welfare we're doling out.

And it seems like those types of conversations are not leaving any room for the free market to speak.

Last month, Politico reported that Lawrence Summers is taking an I-told-you-so victory lap on inflation. But in another interview, it sounds like his biggest beef with inflation is shamelessly political: "I think that if inflation had better been controlled, there's a real possibility that the election of Richard Nixon in 1968 and Ronald Reagan in 1980 would not have happened."

Ah. Now we're getting somewhere. (Perhaps instead of asking about inflation, interviewers might ask Summers, What exactly did you mean by those comments in January 2005? #AndpeoplethinkPowellhastothreadtheneedle)

A lot of CNBC viewers (let's be real, it's nearly ALL CNBC viewers) lived through stark inflation numbers of the 1970s.

We're still here.

Still wondering when China’s ‘goin’ after’ Taiwan

Normally the pre-Fed-meeting version of the Halftime Report has a shelf life of about, oh, 45 minutes.

But on Wednesday (5/4), Joe Terranova posed a question that has sort of been posed on this page, albeit differently.

"Why is it that when we introduce emergency measures, we could cut interest rates 100 basis points on a Monday morning ... but yet when we take away the interest rate cuts, we do it very slowly," Joe told Judge, getting no answer.

Well, one curious element to that question is the notion of "take away interest rate cuts" ... as though 3%, 4%, 5% is the "real" level they should be at, and the current levels are just "artificial."

Is Joe afraid of Denny's charging $12 for a Grand Slam®? That wasn't made clear.

In any case, "A hawkish Fed is a credible Fed. I want more," Joe said.

Liz Young later responded to Joe's question, stating, "Falling into a crisis is much different than coming out of one."

Judge told Joe that Liz "very eloquently answered your question," because "you keep the patient alive," but when they're better, "You don't tell 'em to go run a marathon right away."

Joe said May should be a rally, in part because companies can restart buybacks.

Steve Weiss, live from the Milken conference, said he's talked to old friends and new friends in California, famous people and non-famous people, and, "I can tell you that there's a buyer's strike" in the stock market. (At least, there was until 2 hours later.)

"You've been right to be negative," Judge told Weiss, wondering if there's coming a point where the market isn't so negative anymore.

"I'm very, very worried about the consumer (snicker),” Weiss said, uncorking a comment we'll gladly take the other side of, as he cited "70% of the country living paycheck to paycheck" (which is basically always true) (and if there are record job openings ...).

Weiss grumbled about "the Belskis" who keep saying "Buy, let's buy, buy, buy, buy, buy."

Joe Terranova said he'd pick UBER over LYFT if he had to, but he doesn't think we're in a "more normalized environment" for that type of service, so he wouldn't buy here. Weiss said he disagrees with Joe's skepticism of Lyft management, stating that Lyft has "excellent" management, and as for ride-hailing names in general, "I think they're puttin' the Yellow Cabs out of business, for all intents and purposes," so they should make money, but "I can't own them now" because of "elusive" profitability.

On the plus side, some elements of the pandemic are fading as fewer people end up in hospitals, and conferences are starting to come back. Weiss called the Milken event the "best conference I've been to in 30 years."

EXPE must have given a couple of earnings reports

On Tuesday's (5/3) Halftime Report, Judge reported that Jonathan Krinsky says the market is "getting closer" to a bottom, but not "quite there yet." (Translation: We still haven't had the big whoosh down yet.)

That might've been the headline, except that star guest Brad Gerstner was asked to define Cathie Wood's ARK concept.

"I know it's effectively an index fund on stuff that I view as, you know, part of the highest-risk component of the growth sector," Gerstner explained.

Hmmmm. Basically, a risk-on index fund.

Gerstner said some high-growth Nasdaq stocks have corrected more than he suggested last October, so now, "You have to find opportunities to buy."

"I think inflation has already rolled over," he said.

"We already see growth rolling over," Gerstner added.

Jim Lebenthal affirmed that he and Gerstner have a similar outlook; Jim suggested that price stability may be "closer than we think."

Josh Brown said downdrafts toy with people's "psychology." Brown indicated travel and consumer discretionary were sinking Tuesday, which is not a good sign for avoiding recession.

Brown said EXPE's revenue doubled, and the company had "all good things to say," and the company is "crushing it."

Jon Najarian, though, said EXPE earnings were "horrible."

For those wondering if people are going to volunteer free labor for TWTR now that Elon Musk is going to be in charge, Brad Gerstner revealed that Bill Gurley "sent out this tweet" stating that you can't "anchor yourself" to prices that the "most risky companies" were trading at in 2021. We think that probably means Bill doesn't necessarily think Peloton and Teladoc and Zoom are heading back to old highs.

Jim’s right — all Judge does is ‘applaud’ Mike Wilson

Monday's (5/2) Halftime Report started out as another painful example that Joe Terranova can find a win-win for ... everything.

Jim Lebenthal had been insisting to Judge that the bull case is the right case, and that now is a good time to buy stocks.

Joe claimed Jim would "ultimately" be right but is "early." While continuing, Judge cut in and said, "Come on now. When?," saying he doesn't want this too-early "nonsense."

"It's either right or it's wrong," Judge demanded.

But instead of Joe defending his own comment, Jim jumped in, stating that bears don't time things perfectly either. "Mike Wilson's been calling a bear market for a year and a half, and you applaud him. I mean, give me a break," Jim said, one of the show's greatest comments of all time, so good that Judge immediately became defensive.

"Applaud him?? What do you mean I applaud him, I've told him he's wrong! What do you mean? That's what I- that's my exact criticism of Mike Wilson, is that if you tell me it's gonna rain every day and then it's sunny and then 6 months later it finally rains, you can't claim you're right."

But Judge does generally tell Mr. Wilson "You've been right" or "It really is a rolling bear market" or "Yep, fire and ice."

But let's not lose track of things. If Joe were asked about pro football, we'd hear, "The Los Angeles Rams could have a good season, or they could take a step back, in which case they might be rebuilding for a really great 2023 season. The Kansas City Chiefs might have a good year or a year of consolidation. Both the Steelers and Ravens could have a good year and maybe position themselves to contend ..."

Meanwhile, Pete Najarian, who had a quiet show, said it's a jittery market with a lot of "weak hands."

Jim said a VIX of 40 would be an "extraordinary level." He said he "totally" disagrees with Judge's contention that earnings estimates are too high.

Brian Belski, who was the star guest, admitted "We're wrong right now" and "this is a correction," but he's maintaining his "very aggressive" S&P year-end target of 5,300.

"We think the bottom is coming very, very soon," Belski said.

Belski predicted a "rally on Wednesday."

Judge didn’t say a word about the NFL Draft

On Friday's (4/29) Halftime Report, Jon Najarian noted that AMZN's operating income "fell 58%," and he stressed the number a second time.

Then he got interrupted by Josh Brown, who claimed it's "staffing" and "they're doing it on purpose" and whose early 4-minute speech and previous interruptions weren't enough to make his point (why doesn't he just take over the show and get rid of the host and all the other panelists?)

Doc asked, "Can I finish?" and said that kind of drop is "not a small move."

Doc said it wasn't so much Warren Buffett who invested in AAPL but Warren's "team" that "pushed him" into the stock.

Brown said one bright spot for bulls is that the AAII survey this week is "more bearish than anything we've seen outside of the great financial crisis."

Doc suggested Elon Musk took an "inefficient" route to financing his TWTR buy; basically, Doc implied that he could've helped Elon borrow money for TWTR against his own holdings "without incurring that taxable event of selling those shares." Josh Brown insisted that Musk's TWTR buy is "not a financial decision" but a move of "passion" (snicker).

Doc said the Fed will "have blood on their hands" if they try more than 2 hikes of 50 basis points, "if they hit it too hard."

Brown said the first "Godfather" movie is "3 hours, 20 minutes." (That's actually the 2nd one. The first one is just 3 hours.)

Looks like we made it through a show without either ‘75 basis points’ or ‘50 basis points’ coming up

Thursday's (4/28) Halftime Report was choppy and cumbersome from the get-go as Judge badgered panelists about AAPL's upcoming report.

Steve Weiss kept saying AAPL's results are "ground zero" for ... something or other.

Judge and Weiss butted heads when Weiss argued that the market won't "fall apart" if AAPL hits 150 or lower. Judge insisted the market won't be "in a good spot" if AAPL falls below 150. Weiss pointed to Google. Judge said "Google's not Apple" about 3 or 4 times. Weiss said he disagrees with Judge's argument.

Meanwhile, Jon Najarian said he started nibbling at TDOC around 29. Weiss shrugged that TDOC's product is "completely commoditized."

Doc called PYPL in the 80s a "great opportunity." (This writer is long PYPL.)

Aside from a promo to CNBC's "Stock Draft," an annual "event" that seems like a fun idea but actually 1) makes no sense (stocks aren't "drafted"; anyone can own the No. 1 pick) and 2) is extremely tedious to watch, Judge didn't opine at all on the quality of the first round or whom certain teams might select.

Joe wants people to start being alarmed about what they’re paying for a hotel room

Aside from giving most of Wednesday's (4/27) Halftime Report to Jim Cramer, Judge turned to Joe Terranova for a market call and in the process got an interesting observation about inflation.

Judge said he's calling Joe "Joey Negative" and said Joe is shorting S&P and Nasdaq futures. Joe didn't seem to want to talk about short positions, insisting he's "fully invested" in his portfolio.

Rather, Joe's concern was, "The economy is on fire, and the Federal Reserve is way behind."

OK, fair enough, that's what people have been saying on CNBC for a year.

But Joe continued. "I think the economy's on fire, and it's on fire in a bad way ... we need the water to cool it down," Joe said, before uncorking this curious social study conclusion: "People are not having any regard what they're paying for a hotel room, or a flight, or the price of a, a tank of gas."

That set off the Spider Sense around here, as we wondered where Joe is collecting his information that people have no "regard" for prices they're paying.

Pete Najarian, for one, offered that we're "starting to see" people not as interested in flying at elevated fares — again, not really sure how he arrived at that conclusion — but also pointing out (this is more relevant) that airlines have cut back the number of flights, which helps explain why so many flights are full.

One of the reasons Joe's comment raised eyebrows is because we often hear oil watchers say on CNBC, "The remedy for higher prices is higher prices."

In the movies, there's an occasional theme about characters with problems who don't really want to be saved. And so we gotta wonder, if — according to Joe — consumers don't care about inflation, then why does inflation need to be cooled down?.

Joe demanded to know when residential real estate will correct. Judge, who's evidently now forecasting realty markets, explained, "It's gonna correct when the Fed starts unloading the mortgage-backed securities it was buying." "Exactly!," Joe said. Jim Cramer said DHI is selling at 4 times earnings. Joe insisted "the economy and the stock market are 2 totally different things right now."

Meanwhile, Bryn Talkington argued that the glory days of FANG/FAANG are over, predicting a "new group of names" for the next few years. Bryn called FANG a "clever acronym" that "I think someone at Goldman created, or whoever." Judge and Jim Cramer set Bryn straight.

Asking Pete about FB, Judge tried to make a funny comment about a "pile of rocks," then felt compelled to interrupt Pete to explain the line while Pete was trying to make a point, another example of Judge's interruptions into people's often-time-delayed web connections (Pete's connection wasn't delayed, he appeared to be in real time) in recent months that only ends in people talking over each other and having to pause through the dead air while they sort it out; meanwhile, some people are regularly given 2-3 minutes to make speeches.

Jim suggests FAA wants ‘Calhoun’s head on a platter’

On Wednesday's (4/27) Halftime Report, Judge and co-host Jim Cramer took turns bashing the BA report.

"This may be some of the worst execution I've ever seen," Cramer said.

Moments later, they brought in BA long Jim Lebenthal, who said, referring to Pete Najarian's comment above, "I'm not gonna qualify this as a pile of rocks because I don't want to be insulting to rocks. This is a terrible report."

Jim Lebenthal started to say the report indicated "frankly, the worst execution I've ever seen in my life" before Judge cut him off to demand to know what he's doing with the stock. Jim said the bottom line is that he's sticking with the stock because "Planes are needed."

But, "Calhoun has to go," Jim added. "This is an F-minus. ... There's no more runway left."

Then, adding in stark terms, "Calhoun's head on a platter would frankly, probably satisfy the FAA and get the 787 delivered again," Jim contended.

Invoking a cult movie that nobody really talks about anymore, Jim Cramer said, "Bring me the head of Alfredo Garcia," which doesn't really have anything to do with anything.

Cramer opined, "Calhoun is part of the downfall of a great business," then referenced "the documentary about Boeing," which was briefly reviewed on this page; we noted that a clip of Joe Terranova opining on the BA share price was included in it, which Cramer didn't mention.

At the end of the show, Cramer twice said it's "astonishing" that Jim Lebenthal referred to the "head" of Calhoun.

Falling for one of the show's long-running red herrings, the notion that a person's basis determines where a stock is going, Judge dodged that and said, "I don't know where his basis is ... it's questionable that he said what he did and he is still holding onto the stock, maybe, unless his basis is much lower."

Bryn Talkington said she's growing weary of PYPL and would be inclined to cut and run. "You don't have to make it back the same way you lost it," Bryn said. (This writer is long PYPL.)

Judge actually wondering about a 50-basis-point between meetings

Another insufferable Fed-watching episode of the Halftime Report took place Monday (4/25), although at least Jim Lebenthal punched back at Judge Austerity's typical hectoring.

In a long-winded opening statement, Judge told Jim he keeps waiting for Jim to say, "You know what, Judge, I was wrong."

Jim said that was a "compound statement with many clauses." Jim said there's been "no capitulation" yet, so he indeed has been early.

But Jim pointed out that the stock market's been down 7% in just a couple days, so "This feels a lot like capitulation to me."

Bryn Talkington offered, "I think we're getting really close to a tradeable bottom," but, "I think it's just a trade," because the Fed has only "engineered" a soft landing about 10% of the time.

Judge wondered about the Fed doing a 50-basis-point hike between (snicker) meetings of separate 50-point hikes. What's really ludicrous about that is that, if everyone agrees that's what should happen (and that's not necessarily the case), why don't they just go to 3% right now and get it over with so we can stop listening to this nonsense on TV?

Steve Weiss said the market would react negatively if the Fed did do a 50-bp hike between meetings.

Weiss said he would "sell any rallies" and that "the odds are that we do go into recession" and it's "risk-management time" (snicker).

Joe Terranova, equivocating once again like Hank Kimball on "Green Acres," promised "bad news for the bears" and "bad news for the bulls," the former being that stocks aren't going to drop another 5-10% from the February low, the latter being that in "presidential cycles" (snicker), "this is the worst quarter."

In another tiresome but regular feature of the program, Jim did his usual argument about CLF's $6 billion free cash flow and $13 billion market cap.

Jim insisted CLF is not one of those tech "fanboy stocks that nobody did their homework on."

Weiss said there's sometimes when earnings matter "quite a bit," sometimes when they don't, and sometimes when they matter a little.

In some sort of breaking news, Judge said Marko Kolanovic sees "risks" (a curious term) skewing toward a "near-term equity rally."

Judge also said that someone "who I really respect" just sent him a text about technicals, that the 200-week moving average is 3,462, and if the market goes there, it's 58% higher than the March 2020 low, and the market went to the 200-day in December 2018, as well as in 2015 and 2011. Judge pointed out that that's "considerably lower" than where we're at now. (And it's also probably below the level where Joe (not Terranova, the one in D.C.) and Nancy and Donald start shoveling out $2,000 checks.)

Bryn Talkington said she bought 85 calls in the money in ADM, then as the stock ran, "I just took profit."

Bryn advised buying the dip in energy; she said China headwinds can't last. Jim agreed the China headwinds are "temporary."

On Overtime, Tom Lee conceded the first half has been a bit rougher than he thought.

Is the government taxing us on our losses too?

On Friday's (4/22) Halftime Report, another insufferable episode of worrying about what the Federal Reserve might do (convert to a once-a-week show, Judge), viewers heard Grandpa Steve Weiss' typical bear case update, which was going fine ... but then Steve managed to trip himself up with a bit too much information.

Weiss said his equity exposure is "just below 30%," but he "can't go to zero," because ... (this is the juicy part) ... "I just don't wanna pay taxes, I hate paying taxes, and that'd be generating a big loss as well."

OK.

Later in the show, Weiss said he sold DAL after being up 17% in just a couple weeks: "It's a great time to take profits."

We tried to reconcile all that ... but aren't sure we made much headway.

If it's a "great time" to take profits, why doesn't he go from 30% equity exposure to zero?

And if he's "generating a big loss," why is he worried about his taxes?

And if he's so concerned about paying taxes, why is he shorting the S&P and the Q's and long SARK, which are bound to be trades that he'll be out of (up or down) in the near future?

Then there's the bigger picture — if a person is convinced, as Weiss has claimed to be, that stocks are going lower ... why wouldn't you sell your stocks now and buy them back at a lower price?

(Here's where we could launch into a previous theme on this page ... that Weiss' problem here, and many people's problem, is that he's looking at the market value of his stocks as money that's "his" without subtracting the estimated tax liability, and thus he feels like he's getting taken on tax day ... like if someone calculates their hourly wages and expects to see their paycheck for that gross amount without remembering the withholding for taxes, health plan, 401(k), etc. ... but we won't.)

Sigh ... Weiss suggested a moment of silence for the loss of "TINA," because Weiss says there are Treasury alternatives now. (Sure. That'll last about 3 weeks.)

Weiss said "the Fed is the most aggressive I recall in decades." What if we wait until they actually do something before we make pronouncements like that, given that the Fed simply trades the last 3 hours of data.

Weiss knocked "risk management" of some people who he said are like "Pavlov's dogs," who hear the opening bell and have to buy, "and if they sell something, they buy something else." (Translation: He wants the big whoosh down so that he can buy Microsoft for a hundred dollars!!, a trade that literally the whole world is waiting for.)

Josh Brown said he's been saying since January, when the VIX gets to 28-30, "find something to buy," and when it's 20 or 19, "take something off." He's right that it's been working; the only thing is, when the whole world is aware of it, at some point, trades like that stop working.

Steve Liesman said he thinks "the market is too far out over its skis on this 75 stuff."

Jim Lebenthal shrugged off the "dingbat" market's earnings reaction to CLF. "You should be buying this," Jim insisted. Weiss though insisted that CLF is a "steel company" and "cyclical" and "it is not a growth company."

For such a ‘maybe not much conviction’ trade, Josh sure made a strenuous defense of NFLX

Thursday's (4/21) Halftime Report picked up where Wednesday's left off — with NFLX.

This time, Josh Brown appeared on the show to discuss his buy-NFLX-at-the-open trade a day earlier.

"I saw the clip of you guys talking about me," Brown cracked, adding, "I thought like a lot was made out of something that maybe I don't have that much conviction in." But he does think the stock has been "de-risked."

Brown's argument began with the chart, the fact it was around 700 not too long ago, and that the multiple has come down.

Judge said he talked to Bill Ackman and Ackman told him he can't "wait around" for a Netflix turnaround. Brown said Ackman is a "2 and 20" with a "different investment time horizon."

Jon Najarian said he bought NFLX with an eye on 6 to 12 months, while selling upside calls against it, a kind of wishy-washy trade that we didn't know what to make of.

No matter what Najarian or Judge talked about, Brown kept cutting in to talk about how promising the stock is.

Brown and others touting the stock at this point may well be right. But it's one thing if this crash happened in late 2020. Buying such a name in a risk-off market, that's what this page would question.

Meanwhile, Judge jabbed Jim Lebenthal about trading ROKU several times a few years ago. Jim called that "pure momentum trading."

Doc said PLTR is melting like a "sno-cone or ice cube."

Joe Terranova said he bought WMT and predicted it tops 200 because of his concerns over food inflation, arguing for increased market share and seeing a "multiyear breakout" in the shares.

Blame ‘The Lost Daughter’

Few subjects have garnered as much all-day attention on CNBC in recent years as the Netflix Subscriber Debacle.

Judge opened Wednesday's (4/20) Halftime Report by stating that Josh Brown, who wasn't on the show or dialing in, had bought NFLX on the open.

Judge read a statement from Brown that claimed whenever NFLX crashes, it's "always a buying opportunity in the end."

Pete Najarian wasn't so eager, explaining that in situations like this, it's best to "wait a couple of days" before plunging in.

(Actually, that advice is offered by Karen Finerman and Steve Grasso all the time. From what we can tell, it's true more often than not. But sometimes, the opening trade immediately after the drop is the bottom.)

Pete said things "need to change" at Netflix, including password-sharing, which has been occurring for many years but is just now being trumpeted by Reed Hastings.

That's a very interesting point. We read some analysis on this subject, and it seems this ship may have sailed. Netflix could probably write up some algorithms to block account usage at multiple locations. But it may be difficult to enforce without playing the heavy. And if Joe Doe, who has an account, goes to John & Jane Roe's house, and they don't have an account, shouldn't Joe Doe be able to watch his account with them?

Kari Firestone was even more pessimistic than Pete, revealing she sold NFLX at the open. "Maybe Josh bought some of our shares," Kari said, saying the model's "broken" and the "party's over."

Kari said there's "too many platforms" in the U.S. that are hurling money at content.

"There aren't that many great shows or movies," not now or in the golden age of TV, Kari concluded.

Judge reported that Brown is "literally on an airplane."