[CNBCfix Fast Money/Halftime Report Review Archive — November 2022]

Steve Liesman manhandles Judge’s stale broke-consumer pushback

Judge for whatever reason was determined to say the names of Marko Kolanovic and Andy Jassy as often as possible on Wednesday's (11/30) Halftime Report, and eventually, Steve Liesman gave this tiresome refrain the Heisman with such impressive nonchalance that we were practically in awe.

After about the 15th mention of Andy Jassy's thoughts on the consumer, Steve told Judge, "I would just be a little careful about one company's anecdote being overall evidence."

"Well," sputtered Judge. (Seriously, it was a sputter.) "I mean, Steve, this is Amazon. Right? Right? This is not, you know, mom and pop shop," Judge said.

"Didn't they just say they had their best, uh, Black Friday ever?" Steve responded.

"Yeah. The consumer is spending," Judge admitted.

"So, case closed, right? Case closed, Scott!" Steve said.

"No it's not case closed. It's what lies ahead" (snicker), Judge said.

Steve rattled off auto sales and housing units sold and said "I'm having a hard time ... Scott, we can argue opinion about the future. But the future is not fact, Scott."

Judge agreed, "Nothing is set in stone."

Steve first explained about the Fed's strategy, "It is not science, Scott. It is art. Or maybe that's overstating how nice this is. It's not necessarily art. Maybe it's graffiti is a better way to put it."

Graffiti is actually not a bad description.

Steve concluded by noting all those people who bet against consumer resiliency in the 2nd half of the year, "They're wrong."

Judge scoffed at bad market in the morning, got boomeranged in a big way

Ed Yardeni, the star guest of Wednesday's (11/3) Halftime, was quoted by Judge in the intro as believing it's "hard to see" an S&P 500 record in the next couple years.

Judge said "that's changed" from what Yardeni said weeks ago.

Ed said he "worded it rather carefully," though he's still in the "soft-landing camp," but multiples are "still quite high."

Yardeni said consumers keep buying. "They continue to spend," Yardeni said. But Judge said Andy Jassy is giving a "dour" (snicker) picture of the economy.

No matter what Yardeni said, Judge was hell-bent on talking up the "weakening consumer," even pointing to the "dramatic rollover I see in the market" at the 21-minute mark. (That's like touting the Falcons' chances in the 3rd quarter of Super Bowl 51.) (This review was posted overnight Wednesday/Thursday.)

If Joe knew CRWD was overcrowded, why didn’t he unload before the earnings?

On Wednesday's (11/30) Halftime Report, Joe Terranova affirmed that for the stock market to rally, Powell must "comfort" a market that's "upset."

"We can't have a repeat of Jackson Hole," Joe added.

Judge told Kari Firestone with a straight face, "Look, the economy is obviously weakening."

Then, launching his Theme of the Day, Judge said Marko Kolanovic sounds "downright bearish" and sees "overtightening" by the Fed.

But any momentum on the show was snapped when Judge in the 3rd minute went to Andrew Ross Sorkin's interview with Andy Jassy who didn't exactly offer a lot of headline-making answers.

When the show returned, Judge kept Jassy's comments available for later use while pivoting to the Morgan Stanley guy, who is now calling for "as much as a 24% drop from yesterday's close into early next year."

Joe bluntly said, "The Federal Reserve needs to lower the speed at which the stress test is being conducted ... They're going to give the patient a heart attack."

"This is a supply challenge. There is no need for a hard landing to occur on Main Street," Joe explained.

"Yeah but that's where the greatest lag is coming from because the amount of stimulus that was in Main Street," Judge said.

"We want people to lose their jobs?!" Joe wondered.

Judge said the Morgan Stanley guy's comments are "no great surprise," but Kolanovic's opinion sounds like a "difference-maker" (snicker).

Later in the show, Judge asked Joe what he does with CRWD. Joe seemed to blame the analyst community, citing "37 buys, 3 holds, zero sells," before announcing, "On the close today, I am going to sell the stock. Do you know why? Crowdstrike is overcrowded."

Joe even claimed he told Judge off-camera Tuesday that "I saw this coming last week. ... It was completely overcrowded."

Mark Newton said 134 is the "key level" near term for AAPL.

Mike Santoli actually claimed that the market stumble of 2001 lingering into 2002 is "in people's minds" right now.

Remember when CNBCers used to say ‘Aw, that’d be so great’ if Sheryl Sandberg got the DIS job?

Halftime Report viewers likely cringed Monday (11/28) when Judge asked Jim Lebenthal about ... yes ... DIS (see below).

The occasion was Bob Iger's town hall, which wasn't broadcast on CNBC (that's a missed scoop by someone) but was known about while it was in progress, which was during the Halftime Report. (We don't understand why Bob couldn't have given a couple minutes to Julia Boorstin and Judge, or even talk ETF Edge with Bob Pisani, but whatever.)

Judge said Iger said Monday that DIS can no longer focus on adding streaming subs but has to "chase profitability," which Judge explained is the "paradigm shift" in the streaming business (which has always been a skeptical business model but traders sure love the services so people buy Netflix stock).

Jim said profitability is 12-14 months away and strangely said Iger's commentary "leaves me cold."

"What's he gonna do, move it up 2 months and be a hero to everybody?" Jim wondered.

Jim expressed skepticism that Bob Chapek was fired over "1 quarter." (Actually, he was fired because he was hired to be a caretaker CEO, not anyone's visionary, and the extended search for Iger's successor came up empty.)

Judge insisted it's no longer "number of subscribers" but "profitability" that is the "be all, end all" (snicker).

Jim countered that profitability is "generated from the subscriber growth." (What he didn't say is that the subscriber revenue is offset by the relentless content spending on even former presidents to develop hit shows.) Jim said 2024 is the year of streaming profitability for DIS and PARA. Judge said Wall Street is saying "that's too long."

"This is exactly when you wanna buy," offered Jenny Harrington, who would "absolutely" buy DIS today though she bought at $120 in summer 2021.

Joe Terranova said he doesn't understand why DIS isn't "dead money."

What exactly is the definition of ‘too far’?

Steve Liesman opened Monday's (11/29) Halftime Report saying John Williams was about to give a speech saying inflation is "far too high."

(And exactly what problem was Mr. Williams identifying? Steve didn't say. Evidently, a robust, "no-landing" economy (according to many) while prices are "running hot" is illegal.)

Jenny Harrington said the market was realizing on Monday that "maybe there's not that many reasons for significant upside from here."

Joe Terranova uncorked this howler: "Again, the Federal Reserve is not gonna allow asset prices to get too far away from them." (Actually, about the only one they actually control is the stock market (so get ready for more speeches).)

In a surely debatable call, Joe said to "forget" the S&P 500; the "only" index that can rally into year-end is the Dow, because those stocks "represent the defensive positioning."

Judge noted Apple is in the Dow and wondered how Joe can "dismiss" that so easily. Joe said the "overwhelming majority" of Dow stocks are the type that ... apparently will work.

Jenny Harrington first made it sound like not much is working, then said "real estate stocks" and "value stocks" and "health care" and "dividend" stocks can rally into year-end, and it sounded like she would've kept going if the conversation hadn't redirected.

Jenny said she called AAPL "dead money" on April 29, 2021. (That was before she bought DIS at $120.)

Jim Lebenthal said, for probably the hundredth time, "value's coming into- into vogue right now," even mentioning how businesses are "clearing land to build new semiconductor plants." Jim also mentioned "supply chain onshoring" again.

Joe told Jim that "economic conditions" aren't as important as earnings and valuations and said, "Apple goes to 130, the market's not going- the market's not going up. The market's going down," even to the "June lows."

Judge hasn’t worn the glasses for a while

On Monday's (11/28) Halftime Report, Jenny Harrington touted LAMR.

Judge shrugged that advertising seems a "strange place to be bullish on."

Jenny said there's an "enormous difference" between "broad-based" or "digital" advertising, and billboards that have a "captive audience."

Jenny said "2½ million" people drive the Jersey Turnpike every day. "There might be more," Judge speculated.

Jenny also touted SBLK, which she said is "minting cash."

Jonathan Krinsky tried to douse hopes of a rally, stating, "December in bear markets or in down markets is a much different story than the average December."

Then again, "There is no sign of recession," Jim Lebenthal insisted.

Jenny Harrington said Black Friday sales were "out of control."

Jenny talked up KSS, but Joe Terranova questioned owning apparel sellers instead of, say, grocery sellers.

Jenny said the "low-hanging fruit" of defense stocks is gone and analyst upgrades should've happened in "March of last year."

Jim admitted that Macau is "dead in the water" right now but reiterated, as he always does, that, when it comes to WYNN shares, Macau is a "zero-cost call option" and WYNN is a buy just on U.S. operations. Joe said he wouldn't buy WYNN or LVS, he's "suspicious" of China developments and it's not the right "consumer environment" for it.

Joe at the end pointed to yield curve as reflective of the consumer, indicating big trouble ahead. Jim said that's a good point, it's been a "year of conflicting signals," because air travel and unemployment are not indicating recession ahead though the yield curve is.

This page reviews Bob Pisani’s book touting index investing

It took a while, but we got there.

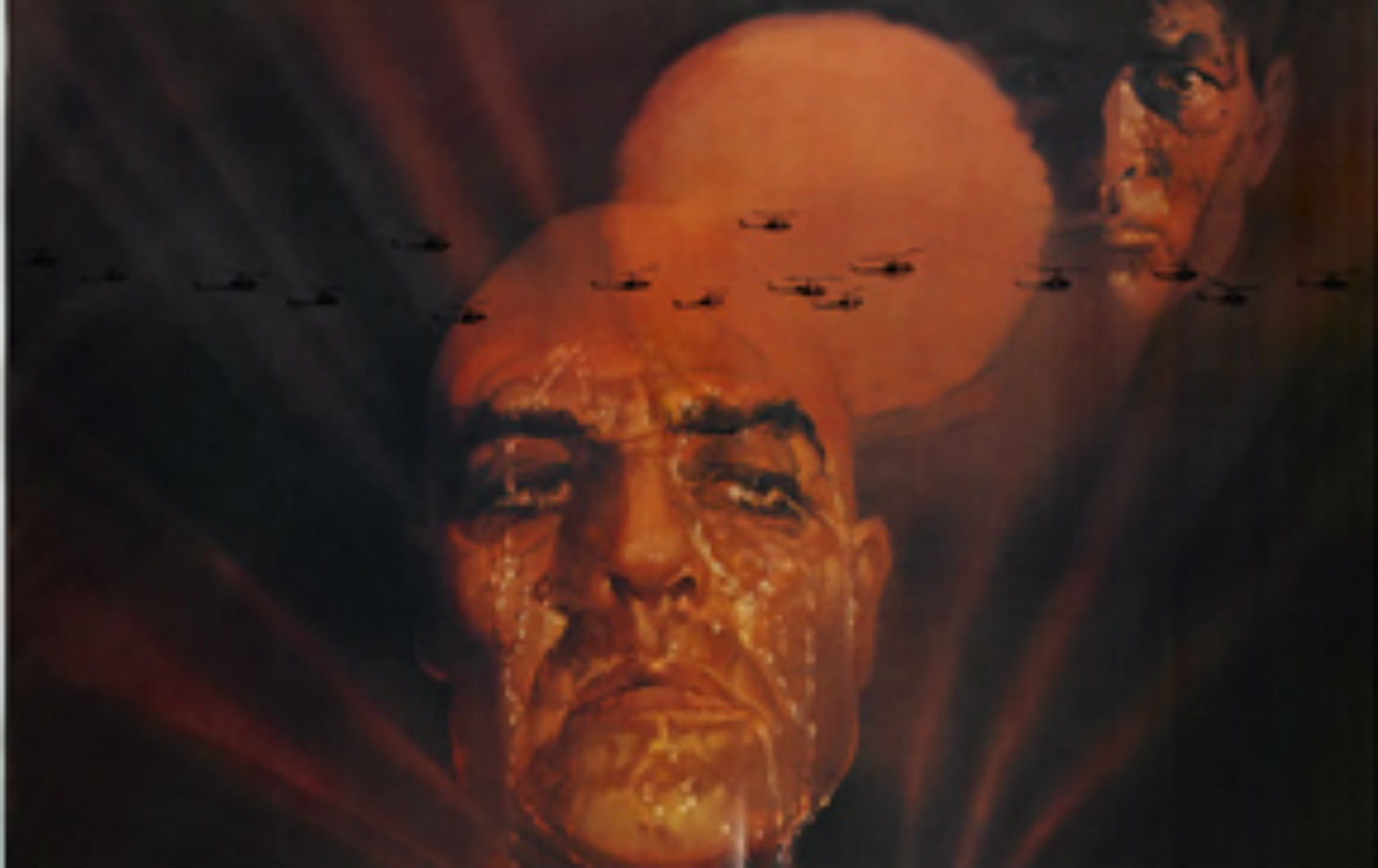

A month ago, CNBC's Senior Markets Correspondent Bob Pisani released a book called Shut Up & Keep Talking. The book has a published price of $29.99 but is sold via Amazon for $23.99. Everyone's happy for Bob getting a book done. But is it worth it?

We were surprised to find that much of the book is not about TV hits, but investment advice. Bob calls himself a "disciple" of Jack Bogle, and that's all you need to know. There are surely tons of juicy stories about behind-the-scenes moments with a cable channel, but Bob doesn't dish any dirt. Everyone at CNBC is basically the smartest person in the room. Fair enough. (Judge and Melissa Lee and most CNBC on-air figures and producers are mentioned in a lengthy tally at the end.)

What's disappointing is that Bob, who gained notoriety during the pandemic for the great concert poster collection he's got on his walls, barely opines on that scene. Nor does he reveal much of anything about his academic or pre-CNBC professional background, which is helpful information when reviewing someone's investment recommendations.

See for yourself at this site's review.

Did the prior CEO ‘screw up’? (Or did Iger, who resisted streaming for years, neatly get out before the big streaming rabbit hole and hang the new guy out to dry?)

This page had recently concluded, based on several factors, that CNBC had sadly given up on conducting shows like the Halftime Report and Fast Money the old way — everyone in a studio seated next to each other.

But the seats are gradually getting filled (even with ample space between), and the face-to-face dynamic is adding some serious octane to the shows' debates.

Such was the case Tuesday (11/22), for the 2nd time this week, as Stephanie Link and Josh Brown picked up where Judge and Jim Lebenthal left off a day earlier on ... yep ... DIS.

Judge opened the show saying Link bought DIS. "Reminds me of Starbucks," said Stephanie, who mentioned the stock being "down 37% year to date." (And if Melissa Lee were hosting, she'd say, "Maybe it didn't DESERVE to be that high!!!!!")

Link would "not be surprised" if Bob Iger is on the job for more than 2 years.

Brown said Link may make money in 2 years, but DIS is "not a cheap stock."

Brown said Bob Iger is "gonna do something big" and even "maybe they make a run at Netflix," but "I think there's another leg down."

Link said she wants DIS to buy Hulu (oh joy) and make deals. "He's gotta get size and scale," Link said.

"He's gonna go for more size and more scale," Judge wondered.

"I think they could," Link said.

Brown pointed to the "magnitude" of spending $30 billion on film content in the last year while the ROI is "negative."

"The prior CEO screwed up," said Link, who said it's "very rare to get a stock like this caliber ... even at this valuation." How is it "rare" to get this stock or any stock? Does she mean it's "rare" to get it down this much from the high? (Then let's revisit Mel's would-be quote above.)

Judge said, "The prior CEO wasn't left with the most pristine environment either ... mistakes obviously were made, but let's not act like he made all the mistakes." (How about, let's act like Iger knew all along that streaming just isn't profitable or very profitable and is a rabbit hole of cash and resources and he knew the company was being pressured to go into it whole hog and didn't want to be the one holding the bag when the "paradigm" starts to shift back and figured this fellow would fit the bill as someone who wasn't going to be the long-term successor anyway.)

"He made a lot of them. And that cost structure is huge, what he did, and the reorganization didn't work," Link said. "He couldn't get the talent that Iger I think can get."

Brown pointed out the stock has only gone from 92 to 95 this week and said "the market had like 8 hours to get excited about this, and it's already rolled over."

"It's a challenged, um, property at the moment. Trying to figure out the streaming thing, right," Judge said. Brown said DIS is "stuck with this environment," pointing to significantly tougher comps in travel and leisure in 2023.

"I can say the exact same thing about Netflix, and you're in Netflix," Link said.

"Does Netflix own theme parks?" Brown said.

"If it's tough for the consumer on parks, it could be on streaming too, and it's not just Disney specific. And this stock is down 37% and I'm buying it down 37%," Link repeated. (Back to Mel on that 37% argument again.)

"$10 vs. $,5000," Brown said.

"Whatever," Link shrugged.

Judge said "Netflix obviously has a, a, a, a lead in the race." (It's no longer a "race," it's a rabbit hole of wasting money and resources that's never going to reward stocks again like it rewarded NFLX in the last decade.)

"Netflix is the only profitable streamer!" Brown said.

"It didn't help the stock. It's down 53% year to date. Disney has actually outperformed Netflix," Link said.

Judge said Barry Diller said a couple weeks ago on Squawk Box that "game's over" in streaming, in favor of Netflix.

In-person attendance starting to pay off for Halftime Report

Here we were, getting excited about another spirited DIS discussion on Tuesday's (11/22) Halftime ... and then we saw Jim Lebenthal was back at the table just a day after driving the subject into the ground with Judge.

Jim suggested current multiple and enterprise value aren't that relevant and said there's some "paradigm shifting," and eventually sub spending will "pay off."

Thankfully, Judge, who was rather benign Tuesday, moved on to other folks.

Anastasia Amoroso opined that "Maybe it takes a couple of years" for the DIS repair.

Anyone know that DIS is down 37% year to date?

On Tuesday's (11/22) Halftime Report, Judge said Carl Icahn still has a "fairly large position" shorting GME but that Carl "wouldn't comment at all when I spoke with him by phone this morning."

Judge said what he's "gotten to learn about Carl" is that when he "does a short like this, he stays around."

Jim Lebenthal said Icahn has the cash to take a short position, but "it ain't easy" to short stocks.

Josh Brown said many GME fans have "moved on to other things" and it would be "weird" to believe "history will repeat" with the stock skyrocketing.

On other subjects, Anastasia Amoroso said, "The rates are 5%. Housing market is not gonna rebound anytime soon." Stephanie Link said "We have a lot of momentum in the economy still."

"The markets are down 16% year to date and the Nasdaq's down double that," Link added. (That's another red flag for Missy Lee.)

Jim said he unloaded MDT, a "bad investment." Jim said he's looking at "interesting retail" names to buy such as NKE, DKS, WMT (whew — none of them are streaming names). "I'm underweight there" in retail, Jim said.

Shannon Saccocia wasn't on the panel but she owns BBY and celebrated the day's gain with a remote appearance.

The semiconductor trade (Zzzzzzzzz) was also briefly discussed.

Ann Berry said she finds the "expensiveness of the S&P right now, uh, slightly perplexing." She said she's "not particularly bullish" on where DIS is going "until I start hearing some really strong execution plans." Judge said Berry owns DIS personally.

Stephanie Link said the IBM CEO is doing a "great job."

Jim said CRM is "not one of these crummy companies like a MongoDB or a Datadog."

Josh Brown said insurance stocks are a reason "you should be studying the 52-week high list."

Even Josh was speechless: Jim says talking to Judge is like ‘speaking to a brick wall’

Hoo, boy.

Monday's (11/21) Halftime Report figured to be another gentle, holiday week lead-in to the Courtney-Reagan-and-Bill-Griffeth-or-Tyler-Mathisen-production-from-a-New-Jersey-mall routine on every Black Friday.

Instead, DIS jolted the Wall Street-Hollywood axis, and just a few minutes worth of exchanges on the Halftime Report sent us to the typewriter for about an hour.

And somehow none of it addressed the real problem here, which is that streaming really isn't very profitable, if at all.

Anyway, DIS backer Jim Lebenthal served as the day's pinata but wasn't exactly dispensing candy once Judge got on his case in the 14th minute.

Before we get into that dialogue, let's try to explain who got the better of this exchange without perhaps making both sides want to hurl eggs at us.

1. Jim correctly flagged Judge's increasing tendency to pronounce every one of his own assessments that he suggests or floats on his show as "fact."

2. Jim can be a frustrating (Psssst: Let's call it "boring") panelist because it's generally the same message month after month, year after year, regardless of whatever the trend — possibly long-term trend — may be. Almost every panelist has this problem to some degree but most give up on bad stocks far faster than Jim does. Judge in these instances is correctly trying to shake things up. Figuratively speaking, he's trying to get the Pittsburgh Steelers to make a lineup change, and they just don't want to hear it.

3. Jim and Judge debated the difference between "execution" and "strategy." Both were right. (Sigh.) (More on that in the next post below.) Here's an analogy: A football coach decides he will only call running plays and no passing plays. The offense rushes for 300 yards a game. But the team is 2-9. Jim would say the execution is fine; the strategy is what's questionable and in his estimation will eventually work. Judge would say the execution has not succeeded.

4. Jim and Judge debated the difference between "fact" and "opinion." (Yes, that too.) This is where frustration is getting the better of Judge; Jim has a right to affirm faith in his favorite stocks even if they have a bad week or month or decade.

OK. At the 14th minute Monday, Judge began a spiel: "The whole problem here is that the, the, the industry, the narrative is changing from a subscribers-at-all-costs environment where it's just not going to be that anymore. Hastings alluded to that with Netflix. ... Chapek redirected all of Disney's focus and cash towards growing subscribers, profitability be damned. Got burned by it this last quarter. When the losses were so much higher than Wall Street had, had anticipated. They tried to compete with Netflix in a too-short period of time. That's what I'm told was the most misguided thing. And he wasn't able or willing to pivot away from that. That's execution."

"No that's strategy," Jim said. "What you just said is strategy."

Judge said, "Jim, the environment- you said that the stock is not being rewarded for the investment. That's what you said. Because the degree of investment is now being viewed as a detriment. Not as a benefit. That's factual."

"That's opinion. Jesus," Jim said.

"It's FACTUAL!" Judge insisted.

"It's opinion! I mean, is it that hard for you to understand the difference between a fact and an opinion?" Jim said.

"I'm looking at the what's happened in the- what's happened to the, the business. That's a fact. That's a fact," Judge said.

"The business has grown," Jim insisted.

"Well have they added subscribers from n- nothing? Yes. You're right. It's grown," Judge scoffed.

"I mean, what do they have, 125 million subscribers in 2 and a half, 3 years?" Jim retorted.

"My point is that the total number of subscribers isn't the thing to look at anymore. It's how much you're spending to get 'em. And how profitable you are. Or not," Judge said.

"And profitability is approaching, Scott," Jim said.

Then they tangled over Nelson Peltz being "in there," which Judge brought up. Jim said that means Nelson has "got my thesis too!"

Judge wondered, "You think he thinks execution is so fabulous."

"Well why else would he invest in it, Scott?"

"To try and effect change to the execution. What do you mean?" Judge said.

Joe Terranova leaned in and asked Jim, "Do we know if they support the change in management?" Jim said he doesn't know; he hasn't talked to Nelson Peltz. Joe said, "Well if he doesn't, that's a problem."

Jim said if it was a "permanently broken company," Peltz wouldn't be invested. "It's not a permanently broken company, that's for the fact of what he does for a living," Judge said.

"OK," Jim said.

"Why would he invest in a permanently broken company?" Judge persisted.

"I think now we're just throwing rocks at each other. I really do. You tell me from time to time that you think you're speaking to a brick wall. I will tell you I feel the same way to you," Jim said.

"Wow," Judge responded.

Moments later, Jim said they were in "Thanksgiving dinner mode." Judge said, "If that's how your Thanksgiving dinners are, don't invite me to your house." Jim chuckled, before going on to say, on the question of rates, he's on "Team Siegel," and making clear it's an "opinion" and not a "fact."

"Glad you're not defensive," Judge said.

At that point, we were still kinda wondering if this episode might get Jim, like the Najarians, tossed outta the union. (That's said jokingly ... but only half-jokingly.)

Apparently not. Moments after, Judge told Jim, "I'm sorry if I threw some cranberry sauce at you."

"We're fine!" Jim said. "All of us threw rocks for a little while there and nobody got badly hurt so we're movin' on."

"Yeah. All right, good stuff," Judge concluded.

Jim didn’t know of Iger’s return until after seeing the ticker

At the top of Monday's (11/21) Halftime Report, Jim Lebenthal revealed that he woke up and saw DIS up 9% in premarket without actually knowing the CEO news, which he said wasn't "worthy" of that kind of gain.

Jim suggested the company is "executing well," but Chapek was felled by "the spat that he got into with Governor DeSantis, uh, earlier this year," which "put a crosshairs on his back."

Judge said "executing well" is the "whole reason" for this conversation, not the "spat with DeSantis."

Judge cited recent earnings and said that NFLX has "pivoted" to the "changing environment" of direct to consumer, and it's been "portrayed to me from the people that I've spoken to today" (translation: ignored the hints that this page left in the last 12 months until Monday morning) that Chapek "never got the memo, that he played the wrong game too long and he never course-corrected, thus being the execution in and of itself was poor, not well."

"OK, so I disagree. Where we will agree-" Jim answered.

"What are you disagreeing on? I just gave you facts, this is what we do all the time-"

"Let me finish here," Jim said.

"I argue facts. You push back with fiction," Judge said.

"Whoever's in control can't change the fact that a hurricane came through and destroyed some of the revenue that otherwise would've been produced in DisneyLand (sic), uh, over the course of the last quarter," Jim said, a curious excuse for DIS' earnings report.

"I think the company is executing well. I think the company is fine. It's the share price that's broken," Jim added, asserting, "These are opinions that we're disagreeing on."

"OK, according to you," Judge said, pointing out Joe Terranova sold DIS 2 weeks ago.

"If execution was so great, we wouldn't be having this conversation today," Judge told Joe, while conceding, "Chapek wasn't exactly left the greatest hand to play at the table, OK."

Judge said, however, Joe selling the stock was a "statement in and of itself."

"I had had enough," Joe said, explaining DIS has "significant operational challenges," including cord cutting, "ad spending contracting" and challenged consumers.

A streaming service for a company like Disney is like a print newspaper setting up a website

Before Jim Lebenthal tangled with Judge on Monday's (11/21) Halftime Report, it was Josh Brown sticking it to the Farmer.

Regarding Jim's defense of DIS, Brown said, "Jimmy's problem is not picking good companies and picking stocks. I think he's very good at it. The problem is, he doesn't know what time it is. This is not a time that you wanna be, uh, levered to a weakening consumer and a weakening economy. ... You could make Pluto the CEO. You don't wanna own Disney going into a recession."

Brown said he'd "take the T-bill" over DIS.

Judge said he'd allow Jim to make a "retort."

Jim said the "important" thing about what Josh said was "the word leverage." Jim said, "These companies are investing, right now in the future of the business," and next year will be the "peak" in streaming losses for DIS and PARA.

Kari Firestone, who was practically shut out, said she was following DIS "back when Josh was in about 4th grade." Kari said Eisner and Iger achieved "growth through spending and acquisition."

"Iger has never cut costs. He has never really streamlined the company," Kari explained, one of the most insightful comments about the company on CNBC on Monday.

"He's gonna have to do it," Judge asserted.

"Phase 4 Marvel was a critical disaster and a box-office flop," Josh Brown said.

"Didn't we just get 300 million on Black Panther?" Jim Lebenthal asked twice in response.

"Dude, dude, it's melting away," Brown said. "Each successive show that they add is leading to less and less subscriber growth."

"The shelf life of that film is a huge problem for Disney. Huge," Brown insisted.

Basically Chapek didn’t impress anyone as a great leader (while Loretta Mester claims she represents the public)

Elsewhere on CNBC on Monday (11/21), we heard David Faber in the afternoon explaining that for Bob Chapek, there was "heightened concern" at Disney about "costs associated with direct to consumer efforts" as well as "growing disenchantment at the very top of the company amongst some executives at least with his leadership as well."

On other topics, on Closing Bell, Sara Eisen asked Loretta Mester, "It almost feels like a concerted effort by the Fed to talk down the market's very positive response to the inflation number. Is that what's happening?"

"No, when I come on your show, I'm not trying to channel anyone except my own views (which doesn't answer Sara's question) ... I am not an elected official, I think I owe it to the public that I represent so they understand how I'm thinking."

On the Halftime Report, Joe Terranova stuck it to people who complained that he talks about MRK too much.

This page twice implored Judge in the last 12 months to ask people if Chapek would be DIS CEO in 3 years

Well, whaddaya know.

A year ago around this time (see screen grab below of what the archive headline looks like — yes it looks like a fresh headline on this page), this page, sensing that Bob Chapek wasn't such a natural fit as Disney's CEO, posted a headline suggesting Judge ask Halftime Report guests about whether this Chapek fellow is going to be the next Brian Moynihan ... or the next Léo Apotheker.

And a couple months later, we again suggested Judge ask that question.

Judge never did.

Not then, not recently.

And now, like the rest of the world, he's playing catch-up on this story.

This page, as always, is happy to lend our punch lines/scoops to CNBC on-air talent for free usage.

You can lead horses to water, but ...

Not the first time that Judge has been scooped by this page, and certainly won't be the last.

Congrats, Joe

There hasn't been a lot of good news on Wall Street in 2022.

But on Friday, there was, as Judge announced that the JOET, marking its 2-year anniversary, is up 12.4% since inception, while the S&P 500 is up 11%, and the Nasdaq 100 is down 2%.

Joe Terranova graciously said the JOET "evolved very quickly" away from a tech concentration, selling NFLX at 513 in April 2021, CRM at 230, then later unloading NKE at 167 and PYPL at 163 and META at 200.

Steve Weiss said he invests in JOET because it gives him "great diversity" and "some juice" in his portfolio.

But Weiss isn’t asked to opine on Carl’s ‘already’-in-recession call

After a beatdown year on Wall Street, expectations are kinda low.

"If we end the year here, I'll consider it a huge victory," said Jenny Harrington on Friday's (11/18) Halftime Report.

Jenny said 4,100 is "not really that exciting" but just "really incremental."

Judge said the market is a "tale of 2 timeframes" (snicker).

Steve Weiss, as always, insisted "1st quarter earnings are gonna be punk."

Weiss again compared Jay Powell to Moses and said Powell is not going to like the "complacency" in the market.

Weiss said, "By definition ... you don't know you're in a recession until you're comin' out of it. ... Unless you have a, a major event like 2008 or 2000, it just sneaks up on you."

Joe Terranova said the yield curve inversion is "not a good place to be."

Ron Insana said on Power Lunch on Friday that 7% would "most definitely drive us into recession."

Judge basically knocked one out of the park (a/k/a Steve, please tell us whether we’re in a recession or not)

Shortly into Thursday's (11/17) Halftime Report, Judge started bringing up what was obviously his theme of the day, and ultimately took Steve Liesman to the cleaners.

In a question to Bryn Talkington, Judge wondered, "Maybe Bryn it's just as simple as Bullard & Company, they just don't want stocks to go up. They don't want to crash the market, but they just don't want stocks to go up. They're trying to crush demand, not increase it through increasing the wealth effect. Maybe it's just as simple as that."

Indeed. Why in the world would they otherwise be compelled to go around giving speeches on their latest hourly opinions of government statistics? (Or is that part of the "mandate" too?)

Judge posed the same question to Josh Brown, then turned to Steve Liesman and stated, "Maybe the issue is just real simple. The Fed just doesn't want the stock market to go up right now."

"I don't think that's right, Scott. I think the Fed wants the economy to cool and it's not getting it," Liesman said, of course.

Steve noted that Jim Lebenthal and Josh Brown had criticized James Bullard for his 7% comment. "I don't think what Bullard said is reckless," Steve said ... of course ... adding that housing and autos are "both strengthening."

"Which is exactly my point," Judge said. "Why they can't afford to have the stock market continue to go up because it only increases the wealth effect and doesn't hit demand like they need it to be hit."

Which prompted this howler: "Again Scott, I just don't think the stock market is so much their focus," Steve said.

Judge told Steve that Bullard's mention of 7% seems "reckless" because it makes the Fed appear "clueless." Steve's response was, "You got Jeremy Siegel, who wants to, basically wants the Fed to use, um, what do they call it, 10 times odds behind the come line at the craps table."

"I don't know man, I mean, if you want- If your goal is a massive recession, then, OK, go to 7%," Judge responded — and actually, this is the point where Judge went a bit too far.

Judge eventually asked Steve, "What happens if all they're doing doesn't work?"

"They'll do more until it does," Steve said.

And NOW we're getting somewhere ... we've got this organization that's been handed a curious "mandate" — which in the 2022 case is basically "People are ticked about gas prices, do something about it" — and is autoprogrammed to push buttons and pull levers to address this "mandate" even though those buttons and levers, despite what Larry Summers says, may not have much affect on this "mandate" and may only serve to disrupt other things that have little or nothing to do with this "mandate."

Then again, if Judge thinks hiking to 7% means a "massive recession," he may want to dial that down a bit.

What Steve didn't acknowledge is that these silly speeches have no impact whatsoever on gas prices ... but they seem to have a lot of impact on stock prices.

It sounds like — even though Judge didn't ask him directly, unfortunately — that Steve would disagree with Carl Icahn (see below) that we're "already" in a recession.

And Steve wasn't asked, "If the economy is humming along so great, why is this purported inflation considered such an enormous problem? (And the answer better be something more than "it's a mandate.")

Judge indicated to Steve that the market's had enough of the speeches. "They're calling you-know-what on Bullard's comments," Judge said.

Jim Lebenthal said he finds Bullard's comments "reckless."

"Inflation clearly is coming down," Jim stated. "The odds of a soft landing are increasing."

Josh Brown agreed with Jim that Bullard's comments are "a little bit over the line," adding that Bullard "should probably be doing his private equity firm job interviews at this point, and not saying things like that."

Brown said the market has been viewing 2023 "as a recessionary year."

Bryn Talkington said, "We definitely have a cap on the upside. But just remember, the Fed has really no idea what is gonna happen with inflation. ... The Fed cannot print humans. The labor market remains tight. ... And second, they can't print oil."

The inflationary non-recession (cont’d)

Wednesday's (11/16) Halftime Report was assuredly sleepy, including the moment when Joe Terranova must've said "the analyst community" about 14 times during a discussion of semis.

One bit of commentary did get our attention. In the show's 15th minute, Kari Firestone stated, "This is the struggle between inflation and earnings. Over time, stocks follow earnings. We know that. But over this past year, it's really been about inflation."

That made us think about the "R" word. For example, what if they threw enormous amounts of Inflation ... and no Recession came?

See, Carl Icahn on Thursday (see below) told Judge we're "already" in recession ... and Judge hasn't asked a single soul since that comment whether they think Carl is right or wrong.

We'll continue waiting for ... someone to offer an opinion.

Meanwhile, Joe Terranova said Wednesday he doesn't know that there's "universal contagion" in retail, though he affirmed to Judge he doesn't want to dabble in apparel retailers.

"Retail actually does pretty well, consistently, in November," said Liz Young.

In the 20th minute, Jim Lebenthal brought up "supply chain onshoring."

Judge never asked Steve, ‘What problem is the Federal Reserve actually solving?’

Eyes around CNBCfix HQ lit up Tuesday (11/15) when we noticed Steve Liesman was back on the Halftime Report, presumably to tell us how the market is inferring it wrong from the Federal Reserve and also providing an update on the Fed's mission to lower prices for everyone keep Americans from spending record amounts at casinos.

Judge asked Steve if the Federal Reserve may be influenced by the S&P possibly getting to 4,100. Steve responded, "I think there's always a little bit of narcissism involved in a question like that, Scott, which is, you think the Fed thinks about you more than they do ... I don't mean you of course-"

But Judge persisted that Fed members "continue to talk about the need for financial conditions to tighten."

"They do," Steve allowed. "I think if the market were to rise based upon a perception that inflation is cooling and the Fed might need to do less, I think the Fed would not have a problem with that. I think what having a problem with (sic hard to know if a word was left out) was back in the summer, when the Fed still had a few 75s in its pockets, and the market took off, then that was not narcissism, that was I think appropriate paranoia at that point."

Ah. So now we're getting somewhere. They felt like, for the hell of it, they had to drop "a few 75s" (which will be rolled back in less than a year) and were offended that the market didn't seem that impressed.

And how exactly does Jay Powell describe this economy that he's saving, an economy that in 2022 has had "high consumer demand" that is bringing "record success" to ... home sellers gas stations grocery stores ... casinos.

Steve also opined on free-market economics.

"One of the ways that inflation will be beat here is a compression of margins," Steve asserted.

Judge demanded to know whether companies will actually lower prices. Steve stated, "In a competitive market ... a higher-than-normal rate of return should not stand." Steve went on to explain that if socks (that's correct, socks not stocks) are selling for $5 and someone can make a profit selling socks at $4, "Yes, prices should come down."

Stephanie Link, maintaining the CNBC tradition of always assuming demand for earth-moving equipment is unstoppable (except when it's China's fault), insisted "Caterpillar is not going to lower prices anytime soon."

No matter what interest rates are, every financial transaction — whether it's a Big Mac or a 737 Max — is a negotiation. And just because one company may be the only one making a certain product, it doesn't mean all of its potential buyers are willing to pay the price that's being asked.

Caterpillar won't be lowering prices if there is surging demand for earth-moving equipment.

If some of that demand decides "we've already got enough earth-moving equipment," then those prices won't be rising.

Meanwhile, Judge reported that Jeremy Siegel is saying, "I think this moves up the pivot." Steve Liesman conceded that "it does" put the Fed on the clock toward the pivot (which will pave the way for more people to visit casinos).

Steve said of the 25-bps hike in January, "That quarter could be the last quarter before the pause." (Because that 25-pointer is really going to be significant for "breaking the back" of inflation long-term.)

Almost got through a show without mentioning Powell (but for Weiss)

Judge on Monday's (11/14) Halftime Report dug into trading right away.

But he said nothing about the elephant that he essentially invited into the room last week with Carl Icahn — whether we're actually in a recession.

About halfway through Monday's show, Amy Raskin happened to say, "I don't think that we're going into a particularly deep recession if we go into a recession in the next 6 months at all which, I- I- I- I'm (sic) still don't think is the- is my base case."

"The market has some wind at its back here," Raskin said.

We couldn't determine from her comments whether Raskin's base case is a recession in 6 months or not.

But we could determine that Judge didn't ask her any follow-up question about that comment.

Which makes sense, because last week (see below), Judge listened to Carl proclaim we're "already" in a recession and presented zero pushback, including how recession- and/or inflation-ravaged Americans are spending record amounts at casinos.

Weiss has said throughout 2022 that people who aren’t on CNBC or watching CNBC are the ones feeling the disastrous economy; hasn’t explained how casinos are breaking records

About the only person being clear and concise on Monday's (11/14) Halftime Report was Jason Snipe, who told Judge, "I think in the short run, we can see a rally."

That was basically the opinion of not only the Morgan Stanley guy whom Judge was quoting again but Steve Weiss, who stated, "At this point, everybody's looking for 50 basis points." And Weiss said if that's true, then Jay Powell would have to be "more hawkish than he's been in the past to derail the rally."

Judge didn't bother to ask Weiss, who has somehow known for the past year how bad it really is out there particularly for the kind of folks who aren't guests on CNBC, whether 1) We're in a recession or 2) Going to be in a recession or 3) How either of those scenarios could square with Americans pumping record amounts into casinos (not the casino stocks, but the slot machines).

In an opening statement, Joe Terranova waffled like L'eggo my egg'o, questioning, "has (sic) liquidity conditions improved?" He doesn't think the answer "internally" in equities is "yes," so he's looking for places of "confidence" in the market. Thus, Joe recommended staying with "defensively oriented sectors."

Joe added, "You've seen a pause in the tax-loss selling." (We think all of that means Joe sees potential for some sectors to rally or continue rallying, namely defensive ones.)

Judge said the Morgan Stanley guy is saying the "upper end" of whatever his most recent range is (that range is the key; it's always broad enough to drive a Rivian truck through) "will be reached" and can even go higher if the yields go lower.

Judge and Weiss tangled when Weiss insisted there's still "volatility" in the market.

"No, no, no," Judge said, explaining that the "extreme volatility" in bonds (as well as stocks) "has certainly cooled."

But Weiss insisted, "The market is showing extreme volatility today," insisting for the 2nd time that markets can be volatile going up as well as down, and that's what "scares people."

Judge pointed out other sectors recently outperforming tech and asked Weiss if investing dollars will return to tech. Weiss called it a "phenomenal question" that he tackles "virtually every day" and admits "I don't really know the answer" and says you have to be "careful" in tech.

Weiss struggled to answer how long he'll hold GOOGL (or maybe it's GOOG) and finally said it's "uncertain."

One of Judge's guests Monday was Bobby Turner, who practices "impact investing" that aims to address social issues in communities via real-estate investing. Judge said it's "fair to say" there's a "backlash" against ESG or "impact" investing that some people call "woke investing." Turner said he tries to "ignore it" and "refute it with proof and evidence."

If American casinos just had their best quarter ever ... how could inflation possibly be ravaging our economy?

This week, there was a very interesting article from the Associated Press that somehow escaped Scott Wapner's attention.

The article — posted on AP's website on Wednesday — says this:

"Figures released Wednesday show the U.S. commercial casino industry had its best quarter ever, winning over $15 billion from gamblers in the third quarter of this year."

We've been kind of wondering if Judge was ever going to bring up this information on either one of his programs.

On Thursday's (11/10) Closing Bell Overtime, Carl Icahn spoke with Judge and proclaimed, "I think you do have a recession already."

Now, that's interesting ...

We're already in a recession.

And people are spending record amounts at casinos.

Let's be like Tom Cruise in "A Few Good Men" and ask Judge and Carl (and Steve Liesman) a question:

Can you explain that???

Like Mr. Cruise in that movie, we'll provide the answer: There was no transfer order. 1) Neither Carl nor Judge nor Steve knows whether we're in a recession, 2) Neither Carl nor Judge nor Steve can explain what is being accomplished by jacking rates up 75 points every couple months, and 3) Neither Carl nor Judge nor Steve can even identify the problem that these 75-bps hikes are supposed to address.

Ron Insana: A lot of bitcoin backers ‘have failed miserably in other endeavors’

CNBC's extensive coverage of the crypto crisis took an interesting turn on Friday's (11/11) Power Lunch, when former anchor/current pundit Ron Insana weighed in.

Insana bluntly told Tyler Mathisen, "The whole thing is nonsense. There is no there there. These are fake tokens. This is fake currency. This is not real money. It's not backed by anything."

In what was an interesting question that anchors on CNBC generally never delve into because they're obsessed with "pushback," Tyler asked Insana to explain how bitcoin is "different in quality" from the dollar. Insana didn't fully answer the question but said the dollar is backed by a $20 trillion economy and you can put dollars in "interest-bearing securities" and dollars have the "full faith and credit" of the government and "the Federal Reserve stands behind the dollar" and the dollar is 65% of global trade.

Morgan Brennan said she'd push back against Insana, stating Michael Saylor and Mike Novogratz and others believe in bitcoin, so "There's going to be a market for it and there is a limited supply."

Ron said, "A lot of the people who support bitcoin have failed miserably in other endeavors," and he advised Brennan to read about Saylor's background. Morgan said, "I have."

‘I’m not reading Tom Lee’

Somehow ... even though we're well into November ... Halftime Report panelists keep saying the same things they've been saying all year.

On Friday (11/11), Steve Weiss claimed "My view has not changed," even though he made some buys because he sees stocks in a "seasonal window."

"This is not what he wanted to see," Weiss said of Jay Powell.

Jenny Harrington, whose advice for years running is to avoid high-P.E. tech stocks but stick with the general market in tough times, said we're not in a "bull market" or "bear market" but in a "bottoming process."

"Well we've been in a bear market, I mean, let's- what do you mean we're not in a bear market-" Judge started to ask.

"We're not down 26% anymore. In fact, we're not even down over 20% anymore," Jenny said, explaining it "gets into nuance and gray areas."

Judge and Jenny then tangled over ... this is kinda how it went ... whether getting to 4,800 or not getting to 4,800 is the benchmark for this market. Judge basically just wondered why Jenny sold AMAT.

Jim Lebenthal, matching his views since the beginning of this year, said "Yesterday mattered a lot," adding, "This is a very strong economy."

"Gas prices are up again," Weiss stated, adding, "You're still at ridiculously high levels of inflation." (Yes. So there's all this money going for gasoline, groceries ... and slot machines, apparently.)

Judge replayed Carl Icahn's bearish comments from a day earlier; Jenny said "we need to really put parameters around comments like that."

Weiss claimed a "normalized multiple" is 14-15. "No it isn't," Jim said, suggesting Weiss "read Tom Lee's-"

"I'm not reading Tom Lee, who's a perennial bull," Weiss said. (Sure, but he'll read Carl Icahn, who's a perennial bear.)

Jenny accused Weiss of saying a couple months ago she was using "fuzzy math."

"I never said fuzzy math," Weiss claimed.

Jenny insisted he did, but in fact, "it's all fuzzy math."

Jim said "These are the facts," in the whole of the 1990s, the multiple was 19 on a forward basis while the 10-year averaged about 5%.

Anyone got an alternative aggregate price index? (a/k/a ‘A lot of people don’t wanna work’)

Fireworks went off in the stock market Thursday (11/10), but not so much on Judge's Halftime Report.

Steve Liesman again tried to crash the party, saying Loretta Mester is "not necessarily all that sanguine" about the day's CPI thrill.

Judge told Steve that Jeremy Siegel just called inflation "basically over." Steve said "I'm a big fan of Professor Siegel," but if Jeremy has an "alternative aggregate price index that he'd like to share," then "many other people would follow it."

But, Steve said, the CPI and PCE are "among the best we have."

Steve concluded that the "operative phrase" for the Fed remains that the risk of doing too little outweighs the risk of doing too much.

For his part, before Liesman's appearance, Siegel took a bit of a victory lap, stating, "Inflation is much lower than the Fed thinks" and that the "actual" home and rental price index shows "negative core inflation."

Siegel said the pivot should've been "yesterday" and that inflation is "basically over."

Josh Brown opined that inflation is "still overstated."

Evidently trying to sound bullish and bearish at the same time, Rob Sechan gave mixed signals about being long stocks by suggesting taking "advantage" of this move but noted valuation and said "Bonds have become infinitely more attractive from a price standpoint."

Judge said he might "translate" Rob's remarks as investors should "sell into this." Rob said yes, but he's not sure they should sell at "this level right now."

Meanwhile, Judge said Dan Ives dropped TSLA from his "best ideas list" and that Ives called the TWTR deal an "albatross." On Overtime, Judge spoke with Ives and bluntly stated that taking a stock off the "best ideas list" but reiterating outperform "feels kinda lame." Ives said, "Our concern's the near term."

Addressing a recent trade that Judge tried to make a big deal out of at the time, Josh Brown said he sold META "a couple of days ago," buying it at "about 99" the day it collapsed, calling it a "small trade, didn't really mean that much."

Brown touted BROS again and said it'd be "much higher" in a "normal market environment."

Judge promised Carl Icahn on Overtime. Indeed, Carl led off the show, stating he's "quite bearish on what is going to happen (sic last 6 words redundant)," explaining we're in a recession "already" and citing wage pressure; "a lot of people don't wanna work, (chuckles), it just comes to it." Judge had to speed things along when Carl started rambling, quite frankly, about his favorite energy stocks.

Jim says bitcoin ‘shouldn’t have been 6,800’

In a show featuring Sam Bankman-Fried walking through a parking lot and opening a door, Wednesday's (11/9) Halftime Report caught fire on the subject of crypto long before we got to Santoli's Midday Word.

Joe Terranova told Judge that if Bitcoin continues to slide, "technology's going down."

Jim Lebenthal said, "I just don't buy into it," arguing crypto is "not that big of an effect."

Joe insisted it "changed market sentiment." Judge sided with Joe, stating we don't know the "full fallout" yet.

Later in the show, Joe said he's "not sure" leverage in crypto world is in a "precarious position." But he reiterated that sentiment will have an impact on the market.

"Why is there no regulation in the crypto market?" Joe said, though he said it as though there were a period after each word.

Jim Lebenthal said that what Joe was saying "actually enrages" him.

"I can go in the back alley and roll dice," Jim explained. "I can do that. OK. Anybody can do that. If there was ever a market where caveat emptor applied, this was it. I mean, this was all about greed. It was all about greed. There was no way to value these things. ... You can easily tell me the utility of blockchain-"

"Why is he upset at me?" Joe asked. "We're sayin' the same thing."

"But how you gonna regulate human emotion of greed," Jim said.

"Take the human emotion out of it!" Joe said.

"Bitcoin should never have been 68,000. It shouldn't have been 6,800. There's no way to value this thing," Jim concluded.

Judge seriously overpromised and underdelivered on the JPMorgan data assets and alpha group CPI predictions

As elections and CPI hover over stocks this week, Joe Terranova opened Wednesday's (11/9) Halftime stating, "I can't wait for 2022 to be over."

Liz Young opined, "The rally that we've seen up until this point hasn't really made a lot of sense."

Liz predicted "one big flush before we are done with this bear market."

"There's so much bearishness out there," sighed Brian Belski. But, "If this thing comes in hot tomorrow, look out."

While Judge warned about CPI, Jim Lebenthal questioned the reaction to a "softer" report. Joe said the panel is "making this more complicated than it needs to be," that the 2-year will tell us "where the market's going."

Judge brought in Bill Baruch to discuss the all-important JPMorgan note about CPI and explain how it's about the Cleveland Fed forecast.

Discussing WYNN, Contessa Brewer said she expects to see that "Las Vegas and Boston are subsidizing Macau."

Liz Young correctly noted every CPI report this year has been "THE most important" report.

Joe accuses Kari of saying that Joe said 3,200, after Judge had made clear that it was UBS saying 3,200

Monday's (11/7) Halftime Report was discombobulated from the opening moment — when Joe Terranova was unable to offer remarks, asking for a sip of water, then mentioning "gridrock" — and never got untangled, likely prompting viewers to think Santoli's Midday Word couldn't come fast enough.

Joe eventually made the argument that the market will go where megacaps go, before Steve Weiss claimed Barry Diller agrees with all his market views and Victoria Greene agreed with what Judge said was UBS' 3,200 call.

Kari Firestone said she didn't want to sound like "the bullish person on the panel," but everyone else is "bearish" (which prompted head-shaking from Joe) and "overly negative." Kari suggested META may be turning the corner. Kari also referred to "Brad Geistner (sic)."

Weiss called META a "value trap."

When Joe got another chance, he said, "I never said the market's going to 3,200, I don't know where Kari got that from."

"I heard Victoria and Scott say it," Kari correctly said.

Judge asked Weiss why the VIX is under 25. Weiss said the VIX hasn't been a "reliable indicator of the markets" for a while.

Weiss says he was late to the momentum in NFLX (a/k/a Ed Yardeni says some Fed members have had enough)

On Friday's (11/4) Halftime Report, Steve Weiss said Jay Powell is like Moses: "He wants to see 3,200."

"The market is taking its cue from the bond market," Weiss said, adding that stocks are still coming off a "sugar high."

Bryn Talkington was rather blunt, stating, "let's be clear" about the central bank; "the Fed has no idea what inflation's going to be in the next 6 or 12 months."

Bryn explained that the Fed can't "create humans" and "can't print oil," so the job market will remain "incredibly tight."

Talkington said we'll see "the 2-year get well above 5%."

Judge claimed Jackson Hole was "8 minutes of hawkishness that sort of changed the whole paradigm."

Dubravko Lakos, the star guest, was rather subdued, explaining that buybacks could help in the short term, but he didn't express a whole lot of enthusiasm about 2023 or even his own $225 earnings projection.

Dubravko said if you buy into the soft landing, next year's multiple could be 16-17, but if not, maybe 14-15.

Judge kept saying "in and of itself," one of his favorite expressions (like Joe with Palo Alto or LPX).

Meanwhile, Judge grilled Jason Snipe on TWLO; Snipe conceded the disaster but said he's only got a "very small position." But he likes PYPL, as does Bryn Talkington, who said "the quarter was great" and marked a "turning point."

Regarding COIN, which most people gave up on, Bryn said you can "actually buy this name here" around 60, and sell the January 75 calls (as if anyone is actually buying those January 75 calls).

Shannon Saccocia touted TW. Regarding NFLX, Steve Weiss said this will be his "anti-Kyrie moment" where he's both "intelligent and contrite." He admitted a "mistake" in NFLX and said he was a sheep rather than a shepherd and got led to "slaughter" because the "momentum already happened."

At the end of the show, Judge had a heckuva time communicating with Shannon and Jason about getting a call from them on DIS.

Judge promised Ed Yardeni saying the bottom is in on Overtime. It took until the 33rd minute of Overtime to hear Yardeni's call; Judge claimed a bottoming call is "pretty gutsy" this week. Yardeni said he originally thought the June low would stick, but he went on to predict 75 bps in December, shrugging that the market has "discounted" that number and then a "pause," after Powell's "peak hawkishness" gets pressure from other Fed members.

Doc thinks Powell’s bark is worse than the bite

A lot of people have wondered, since the Najarians disappeared from CNBC, how to find Doc's daily options calls (in some manner other than that literally endless ream of marketing teasers he puts on Twitter).

Turns out, he's getting an occasional soapbox on Charles Payne's Fox Business show. Rather than flagging unusual activity, Najarian so far has been delivering general options advice and a smattering of calls on options and the broader markets.

On Wednesday (11/2), Najarian suggested this is how Jay Powell operates: "I think he's gonna talk tough, quite frankly, because he'd rather talk tough than act tough, Charles."

"And by the way, jawboning has worked," Charles said, but "has it worked too well."

Najarian also cautioned against extremely short-term trades. "These 1-day options, the speed of time decay in there Charles is so great, that I think the odds are really stacked against you."

Charles has not yet asked Najarian what he thinks about Brad Gerstner's open letter to META management.

Compliments for Jay

Thursday's (11/3) Halftime Report was helmed by Frank Holland, as Judge makes his way back from Denver.

In the category of Low Bar, Jim Lebenthal said he'd "compliment" Jay Powell for "kinda having his cake and eating it too," by suggesting they'll go higher than the market expects but offering "kind of a wink and a nod" that they might slow the hikes.

Jim said Powell has "tethered" the Fed to the CPI, but Powell's given himself some "wiggle room."

Seth Carpenter of Morgan Stanley said Jay Powell was trying to "reinforce" a previous message, but the "subtle" part was indicating it will "take some time."

Meanwhile, Josh Brown predicted "tax-loss selling" in November and December.

Brown took aim at what he called the "Ouroboros" argument, noting stocks don't go down and then people sell; rather, stocks go down because people sell.

Jim said that was a "high level" reference, "like a Police song."

Jim made another case for QCOM, and Josh made another case for LNG.

Josh Brown predicted a "decent reception" and "a lot of uptake" for NFLX's ad-supported option, saying "most people" are happy to save a few dollars in exchange for getting ads. Jim, who's been defending PARA for a long time, said, "The whole industry just stinks this year."

Kari Firestone said she doesn't need anything "heroic" from the PYPL report.

Josh Brown mentioned his Thanksgiving fundraiser that his daughter now oversees.

Sully makes a funny

Brian Sullivan, CNBC's Funniest Anchor who is getting extensive duty filling in for Kelly Evans, on Thursday's (11/3) edition of The Exchange knocked one out of the park when bringing up a certain commodity.

"I used to trade fertilizer at a previous job before TV, although some people say I still sling fertilizer," Sully said.

Not sure why Jay Powell wasn’t asked about Brad Gerstner’s open letter to META

Wednesday's (11/3) pre-Fed Halftime Report was just as tedious as every pre-Fed program on CNBC as panelists correctly guessed exactly what the Federal Reserve was going to announce in a couple hours.

Only this time, everyone on the show also said all the same things they say every time they're on the program, extending to Jeffrey Gundlach's interview on Overtime.

The strongest comment came on Halftime after Judge, who's in Denver for some reason for a Schwab conference (presumably because Schwab sponsors stuff on CNBC), said Jay Powell doesn't want to "crash" the economy.

Steve Liesman responded, "He doesn't want to crash it, Scott, but I think he would, and I think that, it's probably worth thinking about that."

Steve once again warned viewers that the Fed might indicate they don't have to keep doing 75s, but "do not mistake that Scott for a sense from Powell that they're done raising rates."

Judge said some people are thinking we'll get a "wink and a nod" from the Fed about post-October moves.

But, "The data isn't there" to do anything other than what the Fed's been doing, said Jim Lebenthal.

In other matters, Judge went through so many transactions of Joe Terranova (personal and JOET), we quickly lost track.

Jim said it's no longer a question of whether Boeing will turn it around; "They have turned it around."

Judge cut off Stephanie Link because he claimed a problem with Stephanie's audio, but when they went back to Stephanie with "fixed" audio, it sounded not really much different.

Judge asked Jim, again, about PARA. Jim admitted, "This stock makes me look like garbage." Joe was allowed to give a speech during his Final Trade.

Jeffrey Gundlach said the year's spike in CPI will be "rolling off," ending the year around 7% and probably "below 4½" by May's reading.

Gundlach, who said the Fed has played "catch-up" in an "admirable way," made a "conditional prediction," that if the CPI falls to 2% by the end of next year, "It's going to go negative I think."

A day without anyone mentioning Brad Gerstner’s open letter to META

Tuesday's (11/1) Halftime Report was sleepy, which was great, because we've got our hands full with Robert Pisani's book right now.

Dom Chu took the reins as Judge was not present on either Halftime or Overtime.

The star guest, the Morgan Stanley guy, said the Fed is "closer to the end than the beginning" but, whether the rally continues depends on what comes out of this week's meeting.

Of course, much of the talk was about the Federal Reserve. "They still need to hike through the end of the year and not necessarily stop after that," said Liz Young.

"It's a foregone conclusion. They have to," added Dom Chu.

Josh Brown said rather than trying to predict whether the market's going up or down, "chop and flat" has been the "best bet" for the markets this year.

Liz Young asserted, "As inflation falls, it's going to fall faster in goods than it is in services."

Bryn Talkington said energy is cheap and "does really well" in an inflationary environment.

‘Those truisms are true because they’re always true’ (a/k/a That Phillies-World-Series-Coinciding-With-Bear-Markets story is getting old really fast)

Monday's (10/31) Halftime Report would've been a lot more interesting simply by discussing the Najarians' latest crypto ventures was little more than a rehash of the same commentary these panelists have been delivering for an entire calendar year.

(Perhaps that's why Judge skipped it and surfaced instead on Overtime.)

Jenny Harrington, who basically says every time to stick with the market but don't buy high multiple tech stocks, spoke quite a bit (not unusual) and stunned in green while once again leading the league in hair and said "We are reconciling 10 years of excessive returns. ... I see this all as an extremely healthy process that the market's undergoing." But Grandpa Steve Weiss warned about China invading Taiwan. (Which means Tepper must still be talking about it at dinner parties.)

Jenny asserted, "This is nothing like '08-'09" and suggested that those old saws such as Buy when there's blood in the streets will work (see headline).

The show had its glitches. Moments after Joe Terranova botched "trust but verify" in his opening sentence, guest host Frank Holland mistakenly cut off Jason Snipe when Frank thought no one could hear Snipe, except viewers could hear Snipe just fine.

Josh scoops up META (a/k/a ‘New home’ is a good way to get your note read on television

On Thursday's (10/27) Halftime Report in which Judge skipped the glasses, Josh Brown said he bought META at "8 o'clock this morning," though it's "not that meaningful a position."

Brown pointed to what NFLX has done in recent months and suggested META could do the same kind of listening to "outside voices" and have an "about-face."

Jenny Harrington said she initiated her META position in 2016 at 116 and "trimmed" around 260 and 230. (Which doesn't exactly help anyone make a trade.) Jenny said the stock is "crazy cheap" and could "almost be in value trap territory."

Jenny suggested META management is like friends who are beautiful, athletic and smart "but they keep dating losers."

Joe Terranova said "There's something called mental capital" (snicker) and questioned why anyone needs to buy META and obsess over it. Jenny said maybe Joe's right, but it's "not that hard to fix" and why doesn't the board just say, "No more."

Judge suggested Brown wouldn't hang around long enough on META to see 150. Brown agreed with Judge and Joe and said the stock's "on a leash."

Amy Raskin said Brown's META buy is "probably" a good trade.

Meanwhile, Joe said investors have been "intoxicated" by the premiums in megacaps "for a little bit too long."

Josh said he's not sure Andy Jassy has figured out "how to effectively communicate, uh, in terms of guidance."

Judge said NOW got an upgrade from MoffettNathanson. Josh rightly questioned the Moffett notion that megacap investors have a "new home."

Brown said there's a "recession" in tech but it's "not everywhere within tech."

Discussing Intel and semis, Jenny suggested "perhaps these share prices have already bottomed."

During Final Trades, Josh Brown pointed out that they never talked about the Federal Reserve.

Josh Brown: We’re going to have a ‘lame-duck president’

Judge's 3-person panel, all at the table, plus Brian Belski on Tuesday's (10/25) Halftime was a nicely effective alternative to having 7 people wired in remotely.

Brian Belski said the same stuff he always does that utilities are "the most expensive asset in the world," and "we would be short utilities with respect to the next 3-5 years."

Jim Lebenthal asserted about CLF, "This thing is not done beating the market for the years to come."

Jim claimed infrastructure spending is "gonna go on for the rest of this decade."

Josh Brown countered, "You're gonna have a lame-duck president, there'll be no more bills, uh, after next, uh, 2 weeks from now," so is there really going to be an "onshoring renaissance."

"I don't think you need more, more legislation," Jim said.

Mike Mayo, who almost never says anything besides bank stocks look great, brought a baseball glove to the set. He said it "symbolizes" that banks are "World Series ready." Judge used the glove as an opportunity to take a shot at the New York Yankees.

Mayo said this will be the "best recession for banks" in the "last half-century."

Josh Brown didn't seem to think banks are doing anything special, other than experiencing the effects, good and bad, of the economy/rates.

Scott Nations suggested buying the 157.50 Nov. 25 AAPL call and selling the 165 strike call.

Josh again brings up ‘straw man’ in conversation with Jim

Sometimes, a CNBC debate makes you wonder, "Can both people be right?"

That was the case on Tuesday's (10/25) Halftime Report as Jim Lebenthal and Josh Brown tangled over the importance of AMZN's multiple, which Brown said is the "absolute worst metric" for evaluating the stock.

"I feel like you and I have had this discussion," Jim said.

"I've always been right about it," Brown insisted, explaining that AMZN has gone down this year simply because every stock and bond has gone down.

"This whole year has been about valuation matters, whether it's Amazon or the stock market," Jim said.

"Once again, straw man, I'm not saying valuation doesn't matter, I'm saying, that is not the crux of why the stock has gone up or down, ever," Brown said.

Hmmmmm ... Well, we agree with Brown, though he didn't actually say it Tuesday, that P.E. ratio is no predictor of where a stock is going.

But at some point, valuation must matter, doesn't it?

Here's how it matters (based on decades of watching people talk about this on CNBC):

Stocks with the highest multiples tend to be younger companies of which much is expected.

If those revenues don't pan out, those stocks — and their multiples — will likely take big hits.

Ones that DO pan out, such as Tesla, Amazon, Netflix, can make massive amounts of money for shareholders.

But if you think that a lower multiple protects a shareholder from a big stock decline, take a look at long-term charts showing what names such as X can do TO you as well as FOR you.

When Jim says the "whole year" is about "valuation matters," he's really just saying it's been a risk-off year for everything in a tougher economic climate.

To say that AMZN's multiple is, perhaps, "too rich" is simply saying that its near-term future is not going to be as great as the market anticipates.

That's a fine opinion to have.

It seems as though rather than being a debate about the multiple, Brown and Lebenthal simply have differing views about how great the next 6-12 months or so will be for AMZN.

As Josh, Jim, Stephanie Link and even Judge talked over each other, Jim concluded, "We're in a growth to value transition."

Brad Gerstner made a bad trade

Needing a headline for Monday's (10/24) Halftime Report, Judge took advantage of Brad Gerstner's "open letter" to META management.

Kevin O'Leary, who claimed he used to spend "many hours" talking with Sheryl Sandberg, sold META. O'Leary said everyone knows the metaverse idea is "way out there," but he's selling the stock because he's starting to see "activists beat it up" and push on "every single angle," so with that kind of "pressure" on the stock, he unloaded, taking a "huge hit."

Judge relayed Gerstner's letter and "3-step plan" (snicker) for success. Steve Weiss said Gerstner's got good ideas but they won't "take hold" at META.

Brenda Vingiello said she's not ready to sell META yet and that the company can still "change the narrative."

Joe Terranova said he wouldn't buy META, that Gerstner joining the board is "exactly" what META needs, that META has "completely lost its focus," and that metaverse consumers want the games, not a "1,499 VR headset."

Hours later on Overtime, Judge called Gerstner an "influential shareholder" of META. (Is there any evidence of that?) Bryn Talkington, who sold META Monday, called him "Brad Gershner (sic)."

Elsewhere on Halftime, Kevin O'Leary said "I need to have exposure to streaming" because it's "never going away" and this will be how it is "forever." So he sees 2 choices, NFLX and DIS, and he picked DIS.

Steve Weiss told O'Leary that owning BABA is like owning a "Cayman shell."

Sully on The Exchange interviewed Ken Rogoff

In the 9th minute of Friday's (10/21) Halftime Report, Judge connected with Steve Liesman and asked Steve to "react" to Mary Daly's comments.

As he always does, Steve said the market's being too optimistic about what was said.

"They are still I think headed for that 4½% range," Steve said.

Judge said it was no "accident" that the WSJ article came out Friday and that apparently the Fed is "preparing investors for a decision in the weeks after the November meeting, as he says, without prompting another sustained rally."

As Judge kept floating the notion of rate hikes causing liquidity concerns, Steve said, "I'm sorry, I just can't come on air here and say the Fed is gonna pivot because of comments from Daly."

Steve asked Judge if Judge interviewed Rogoff this week on CNBC when Rogoff "said 5%." Judge had to admit it wasn't him.

Meanwhile, Joe Terranova asserted he's going to buy or sell the QQQ, "We are completely hostage to where Treasury yields are going to go."

Joe said, "I've spoken in the last 2 days with several taxable fixed-income money managers who are telling me that there are liquidity concerns in the Treasury market, and in the high-yield market. It's real. It's in the wake of the events, uh, over in the U.K."

Then Judge suggested with a straight face, "I'm thinking, well maybe the Fed is held hostage too."

Judge linked the day's rally to Mary Daly's comments about being at or close to a neutral rate and possibility of "smaller increments" of hikes. Kari Firestone said these kinds of market rallies based on optimism about Fed moves have been "wishful thinking."

Judge said UAA has had a "crazy decline" this year and is "under 7 bucks." Joe called the stock "the ultimate trap."

Joe agreed with an analyst that META is the "ultimate value trap." Joe said management "literally" is "void of any clear direction," and "they should go back to Facebook."

Kari Firestone drew a distinction between Robinhood and Charles Schwab.

Judge says he spotted Jeremy Siegel on the NYSE floor and summoned him up to Post 9

Thursday's (10/20) missable edition of the Halftime Report started off with Steve Liesman relaying the latest hawkish Federal Reserve comments. (Translation: They're all going to be hawkish until something they're doing actually works.)

Jim Lebenthal indicated that as far as the prospects of recession, we're hearing from businesses that they're "frankly just not letting workers go."

Shannon Saccocia agreed, "They're not laying off people."

Judge said David Einhorn, citing nothing happening in fiscal policy while the Fed drives down equities, is "bearish on stocks" and "bullish on inflation." Jim Lebenthal said he wanted details on Einhorn's "fiscal policy" complaint.

"I think he is obviously referring to excessive spending on the fiscal side. I think it's fair to assume that," Judge said.

Jim insisted to Judge that he's not going to get "excited" about restaurant stocks.

On Overtime, after a tedious conversation about SNAP, Judge welcomed Jeremy Siegel to the set; Jeremy said he hasn't been to the NYSE floor in 30 years. (See? Complain about the Fed on TV, those kinds of things happen.)

Judge asked for a market call but got no more than what Jeremy has recently told him. "The market wants to rally, and it seems like the Fed wants to keep it down," Jeremy offered.

Jeremy repeated that he thinks 75-75 is "too high."

Weiss claims no free money ‘again in our investing lifetimes’

As CNBC continues along its Post-Najarian Era (see below), Judge on Wednesday's (10/19) Halftime Report first went to Jason Snipe, then Joe Terranova, on NFLX, but it was Josh Brown who got to do all the talking about the stock when he dialed in moments later.

Jason said "the risk/reward plays pretty well here," citing shares being down 54% this year, while Joe said NFLX still has "another 10 to 20% here potentially," while DIS doesn't have that short-term potential.

Judge asked Joe why he doesn't buy NFLX. "I would have to sell out of Disney to do it," Joe said, claiming he's not making moves 9 days ahead of the "rebalance and reconstitution" of the JOET.

Josh said that from Netflix's report, he "heard enough to keep me interested for the next quarter." So even though it's "still on a leash," it's "house's money." (Note: NFLX shares don't care what price Brown bought at.)

Grandpa Steve Weiss, pointing to Jason Snipe's 54% observation, insisted, "It doesn't matter where it came from ... that was free money in an environment we will never see again in our investing lifetimes unless disaster strikes again."

Joe was asked to opine about CRWD; Joe tossed in PANW, historically one of his favorite names to talk about. He said "the bad news has been priced in" for both names, then went on to give a speech that basically said CRWD has a higher multiple because it's got greater potential.

Judge questioned why CRWD's 2022 loss in share price is "double the loss of Palo Alto"? Joe said he's "being convicted in a moment of time." Judge said, "You want me to go back a year ... Crowd's down 44½% over a year, Palo's only down 5." Joe said he'd "argue the case" that PANW is the "better stock" for a "more conservative investor," but if you're "focusing on growth," CRWD is the place to be.

Joe pointed out, "Most of commodities are in decline for the year."

Judge actually touted IBM earnings on Overtime.

Najarians scrubbed from

CNBC contributors page

It looks like it's official.

Not only have Pete and Jon Najarian been absent from CNBC's Halftime Report for (essentially) months, they're now absent from the CNBC Contributors page. (That list is in alphabetical order.)