[CNBCfix Fast Money Review Archive — May 2016]

[Tuesday, May 31, 2016]

People apparently are paying 15 times for the ‘average apparel group’ stock

Erinn Murphy, who somehow has a 67 KORS target, told Judge on Tuesday's Halftime that KORS has "a lot more stability in the brand" globally than just in the U.S., so despite "kind of the challenges" domestically, there's a "very attractive" valuation.

Murphy told Steph Link that KORS is "pulling back on wholesale" to get the "inventory in check."

Josh Brown though said "a lot of the cachet" of KORS is "at least gone for now" and that the fashion bloggers think the stores aren't what they used to be. Murphy said she's not expecting the "old multiple" but that it will have the "average apparel kind of group multiple that we see right now which is about 15 times."

Josh added that the stock "just rolled over." Joe Terranova noted the stock surged from January to March but that Macy's et al. are clearly telling us that "inventory is building … the traffic is not there."

Pete Najarian agreed with Joe's assessment but wanted to talk about UA and NKE and also took a dig at Murphy's suggestion that the rest of the world can overcome U.S. sluggishness. Steph Link prefers JWN to KORS.

The camera found Karen Finerman, whose 30something smile can stop traffic, at the end of Tuesday's 5 p.m. Fast Money.

A day goes by without someone claiming Amazon is devouring all the brick-and-mortar retailers

Kate Kelly recently spent a morning at Point72 and on Tuesday's Halftime Report assessed the farm system at the hedge fund.

Josh Brown questioned whether there's a lack of talent or "too much talent" in the industry. Kelly said "hedge funds may not be people's first thought coming out of school," perhaps because they think they need bank experience first or prefer to work in Silicon Valley.

Jim Iuorio said bond yields are going higher. Scott Nations agreed.

Judge said it's a "huge deal" that Contrafund started selling CMG. Joe Terranova referred to "Chipulte" (sic pronunciation) and said the brand rehab will take a long time. "I don't think you buy this stock," Joe said.

There are few things more tiresome than Pete Najarian talking about NKE and UA (surely the most over-talked-about stock of the last 6 months or more); Judge teed it up for him again Tuesday. (Then Seema (more on her below) and guest host Simon Hobbs teed it up for Pete again at 5 p.m. Wonder if the "Shark Tank" guys asked Pete about UA on the 8 p.m. rerun.)

Savita Subramanian, who turns up on these programs as often as Steve Liesman or Phil LeBeau, guested on Tuesday's 5 p.m. Fast Money and was nothing short of megacute in sizzling outfit, if it's OK to say that about a Wall Street pro.

Pete sees ‘some sort of correction’ but isn’t sure stocks will be down in June

Stephanie Link on Tuesday's Halftime Report predicted June would be "a little bit more volatile" than what we've seen.

Judge said "literally" (sic) (Drink) there was a "bit of a selloff" as they came on the air.

Pete Najarian said he's expecting "some sort of correction" but "nothing huge," though he said he doesn't "necessarily" think stocks will be down for June.

Joe Terranova asserted the pessimism is "so prevalent" that it feels like a "short squeeze higher," and we'd need an "exogenous event" for a swoon.

Pete said he's not sure about Joe's pessimism; in fact to Pete it seems like "nothing but optimism" in stocks.

Joe said institutional money flow shows cash coming out of funds. Stephanie Link said people are in staples and utilities and telecoms.

Josh Brown said technicals are the "tiebreaker," declaring breadth and small-caps are indicating "breakout."

Russ Koesterich said the fundamentals are "OK" but said voluations are "stretched" by most measures. He said he would "lean" 2,050 before 2,150.

Judge said Koesterich was "negative," but Koesterich said he's "cautious."

Koesterich claimed gold is an "effective hedge" if volatility rises in the summer.

Judge should've let Joe and Pete have a healthy debate. We'd side with Pete; there's a lot of optimism now.

Haven’t heard about any 95% gains in call spreads recently

AGN watcher David Maris told Judge on Tuesday's Halftime that Carl Icahn's investment is "great news" as it's a "clear endorsement" of management's strategy; plus Carl has a great track record in health care. (This writer is long AGN.)

Maris said Icahn will push the company to focus on buybacks and "smart deals."

(He didn't say anything about Carl's "day of reckoning" … nor did he say anything about 61 in 61.)

Maris said there will be strategic deals in health care. But as for the roll-up action, "that business is over."

Josh Brown asked if the slide of AGN over a year gives investors pause about the space. Maris' response was curious, pointing out that AGN also shot up for a couple years from 50 to 300, so after plunging from 300 to 200, it's now being viewed by value investors as an investment rather than just a "story."

"The trade is, you follow Carl in on this one," asserted Joe Terranova, citing a "similarity" to Carl's AAPL investment. (That means Judge won't be allowed to ask what Carl had for dinner with the CEO.) Josh Brown said this is one of health care's values. But Pete Najarian said there are "other names" to be in. (On the 5 p.m. show, Pete called the biotech space "toxic.")

Stephanie Link said of AGN, "You can still buy it," and she said its pipeline is enough without another deal.

Heaven. On. Earth.

Holy … moly …

It was a sight to behold on Tuesday's Halftime Report when scorching CNBC superfox Seema Mody, fresh off a trip to China, glided onto the set in devastating black V-neck cut.

Mody said diabetes is a rapidly growing concern in China and that Eric Li, "the Andreessen/Horowitz of China," told her that the biggest company in the world in 5 years won't be AAPL but a Chinese Internet name, likely BABA or Tencent.

About 4 decades behind the times, Judge, who was far more interested in the tired EEM than Seema's travels, actually referred to "mainland China" possibly being included in the ETF/index. Joe Terranova said there's a lot that still has to happen and didn't really answer if it's a "good thing." Josh Brown said it's a "resounding yes" that it's a good thing. "This is a clear positive, not a negative," said Brown, who suggested using KWEB to play the Chinese Internet space.

More from Tuesday's Halftime later, if the knees ever stop buckling.

[Friday, May 27, 2016]

Judge invites a guest to the program, not quite sure what he does

Judge for whatever reason on Friday's Halftime Report introduced Carbon Media's David Farbman and then asked Farbman to describe "exactly" what his company does.

It apparently runs "hundreds of websites" related to the outdoors.

Farbman trumpeted Cabela's and Chevy, two obvious customers.

Jim Lebenthal said those stocks are "tough," but if he had to be in the space, it'd be DKS and CAB. Josh Brown said AMZN can "beat up" any sporting-goods retailer. Judge said Sports Authority is in the midst of a liquidation sale "literally" (sic) (Drink) as they were talking. Jim suggested TSCO.

Still not sure if SRPT can fall $8, or fall all the way to $4

In one of the boldest calls of the day that didn't get any follow-up despite the fact they had time to talk about a website featuring Cabela's that isn't actually Cabela's website, John Spallanzani said on Friday's Halftime Report that below $10 billion market cap in VRX, "you gotta buy it."

Judge forced viewers to do the math; the stock closed Friday apparently at $9.6 billion market cap.

Jim Lebenthal said BIG is "about to go through" 50 and that the discounters are working now.

Sarat Sethi said ULTA and the beauty side is "the place to be" for consumer spending.

Josh Brown said he's "really glad" he passed on buying PANW, a name The Liquidator likes to mention, last year. "The Street does not like these names anymore," Brown said.

John Spallanzani endorsed JACK. Jim Lebenthal disagreed with Spallanzani that the MCD trade is getting "tired." Josh Brown said PNRA is "about to break out in a major way" despite the fact he thinks it tastes like "astronaut food." Jim actually questioned if there are enough Panera locations.

Jim Lebenthal said MLP distribution cuts haven't been as bad as feared, touting EEP, ETP and PAA. John Spallanzani though said there are "better places to park your money" now.

Sarat Sethi trumpeted INTC. So did Jim Lebenthal. Sarat noted they also like QCOM (Zzzzzzz). Josh said QCOM is getting better, and he wouldn't short it.

Josh Brown said he unloaded SAFM in his Halftime Portfolio and added DG and CCI.

"Adobe just looks incredible here," Brown said.

Jim Lebenthal suggested the market might not believe the crude rally. Sarat Sethi said "you have to see a strong summer driving season."

Sue Herera said President Barack Obama made "an historic" (sic grammar) visit to Hiroshima.

How come nobody else reports making 95% in a call spread?

He may be right.

He may be wrong.

But Jim Lebenthal stood tall with several calls on Friday's basically holiday version of the Halftime Report in which Judge apparently found it Rocco Lampone-like to book any guests.

Lebenthal asserted, "I don't think this market has what it takes" to push to a new high, noting the perceived chance of a June hike making a "huge jump" from 12% to 40% and also that he hasn't before seen this "frequency" of Fed honchos purportedly telegraphing a hike.

Sarat Sethi, in his most outspoken program to date, said we're seeing a "cyclical move," and "I see another pullback coming."

Paul Richards, who's now president of Medley Global Advisors and always an affable chap on the program, said he doesn't think the market is ready for a June/July hike. "No one really knows," he said.

But, "There's a lot of cash sitting on the sidelines that could move," Richards said.

Josh Brown though said the advance/decline is "absolutely cooperating" and is "breaking out in and of itself (sic last 4 words redundant)."

John Spallanzani had mike troubles again but eventually said the market's "churning" and at a "7th-inning stretch."

Steve Liesman said he doubted Friday will be the "moment" that Yellen gives a policy signal, suggesting it's more likely on June 6 in Philadelphia.

Liesman said he did a previous report on how the market wants 200,000 jobs but the Fed actually prefers closer to 100,000.

He observed that people used to talk about the dollar and Brexit in CAPITAL LETTERS, and now they're talking in lower case.

How come Delta isn’t outperforming because it bought a refinery?

Phil LeBeau on Friday's Halftime Report said airline stocks have struggled despite heavy air travel because of lower fares.

Judge said LeBeau "literally (sic) (Double Drink) took the words out of my mouth," the part about the stocks struggling (or stinking).

LeBeau noted that the wait at O'Hare was "maybe" 10 minutes.

Sarat Sethi trumpeted what a great value airlines are. Jim Lebenthal though said the airlines are "not hedged" for higher fuel.

Sarat said that will open the door to fare hikes and that airlines made money with $80 crude.

Josh Brown called the airline charts "broken." Jim rebutted that airlines have a lot of debt. Sethi said they've traditionally had a lot of debt and that Delta is almost investment-grade.

Susan Li was sent to Ridgefield, N.J., to talk about the MCD Pick 2. But then again, Phil LeBeau was parked at O'Hare to count the 10-minute wait.

[Thursday, May 27, 2016]

Pete’s DLTR report

ended up crushing it

On April 25, Pete Najarian said on the Halftime Report that DLTR calls were popular as the shares hovered around 80.

Fair enough, but this page noted a week ago that the shares had tumbled to around 75, indicating that the purported options signal looked like a bust.

It wasn't, evidenced by Thursday's trade as DLTR and DG exploded.

So, congrats to Pete for flagging a winner.

Joe gets another shot to discuss whether he rang the register too early in energy and how he’s not making a bearish call but a risk/reward call

Judge opened up a hornet's nest on Thursday's Halftime Report by claiming Doc thinks there's "no chance" of a June hike.

Doc snapped that he never said "no chance," rather, he just thinks it won't happen in June.

"I said once this year, and I think it's December," Doc said.

Josh Brown asserted, "The risk is that they don't move" and if the Fed tells the market they're not data-dependent and are "not serious" about normalizing.

"If they don't (hike), it's probably worse than if they do," Brown said.

Pete Najarian, suggesting "Janet" is probably "leaning" in the hike direction, claimed, "I think she's probably directed these guys quite frankly" to make the comments that have been heard.

Brown said it could be a "dovish hike" and said he doesn't understand why people think the market isn't ready for this (snicker).

Joe Terranova said initial jobless claims are below 300,000 for the 64th straight week; "that hasn't happened since 1973." Then Joe claimed, "inflation figures are moving back towards where the Fed wants 'em to go" (snicker).

"Financial institutions and technology are coming back again. For sure," Joe declared.

Joe said the "hedge fund VIP trade" is "comin' back around again" and "it's almost a gift."

Risking another hornet's nest with Judge, Joe called the XLE a "great trade" but said of energy in the near-term, "I believe the majority of the appreciation has occurred."

Waffling like l'eggo my egg'o, Joe appeared to endorse PXD longer term but called 166-168 resistance and then sort of didn't endorse it for a trade.

Pete Najarian said he has HAL calls.

Steve Liesman wasn't so sure about a big Fed development Friday, stating that particular event would be an "odd forum" for Yellen to plunge into hike-land.

According to WebMD, ‘most experts don’t consider caffeine dependence a serious addiction’

CNBC's Kelly Evans, who normally does her thing on Closing Bell, joined Judge's gang Thursday to tout the Howard Schultz interview and discuss Starbucks' China roastery.

Judge noted a guest this week (see below) called SBUX a "staple," which the gang "took, you know, a little bit of issue with."

"A staple that's addictive," said Pete Najarian, who endorsed the name though it hasn't done anything for a while.

We didn’t know or had forgotten there’s a drunk in Random Walk

Guy Adami said on the 5 p.m. Fast Money that it's an "absolute coin flip" that Donald Trump could be president.

Karen Finerman argued that there's no trade right now based on the candidates, especially Trump. "He's sort of like that drunk in Random Walk Down Wall Street; you don't know what his policies are really gonna be," Finerman said.

Mel went to great lengths to insist, "It is not a political conversation."

Judge won the clothing competition Thursday, putting together a blockbuster suit/tie combo.

‘Giddy’ over Toni Sacconaghi’s plan to subscribe to a couple iPads for $200 a month

Jon Najarian on Thursday's Halftime reported the "biggest trades I've seen in Apple in a long time," stating it's "most probably a hedge fund."

Judge said people have been "giddy" about AAPL's rebound.

Doc a couple times noted there was both a buyer and a seller in these $99 trades for AAPL.

Doc said X wants to make a "surge" to a recent high.

Josh Brown said SIG is not his "cup of tea," but he's not sure why the stock got hit with such a reaction.

Pete Najarian said "flat's the new up" regarding same-store sales at COST.

Doc said he's "frequently a contrarian" and said he likes the online polls about the Brexit much more than the telephone polls.

Doc actually suggested Glastonbury could make a difference in the Brexit vote.

Brian Stutland said he'd be a buyer of gasoline futures below 1.60 but that demand hasn't been great. Scott Nations said gasoline is "at the top of that channel," and he thinks a better target might be the bottom end of that channel around 1.52.

Eric Chemi spoke about fitness trackers. Josh Brown said his own fitness tracker is "called a belt," which really sent Pete cackling.

Joe Terranova hung a 130 on FB.

[Wednesday, May 25, 2016]

Judge lapse — failed to ask Weiss if SRPT may fall $4 ... or all the way to $4

Somebody on Wednesday's Halftime Report boasted of a big score in the options market — and it wasn't even the Nardashians.

Stephen Weiss said "today was a gift" in SRPT calls; he says he hedged his position with the May 27/30s and "I was up 95% overnight, so I closed it out."

Whether Weiss' cost basis informs you as to how high the stock is really going to go is up to you.

Weiss said the downside risk in SRPT is "maybe down to 4 or 8 dollars, but the upside is to 50 or 60."

Note the use of "to" before the "4," for those seeking clarity but receiving only alarming ambiguity.

Not to be left out but admitting being less impressive, Pete Najarian told Weiss he put on a 20/30 call spread and was able to take it off at a gain, but "not the kind of gains that you made."

"This was just a phenomenal trade Judge," said Doc.

Herb spent so much time praising business partner Donn Vickrey, why didn’t Judge just put Vickrey on the show instead?

Herb Greenberg on Wednesday's Halftime told Judge it was "no problem" to call in.

Herb said investors should be giving "more than a grain (sic)" of thought to the SEC-BABA story because the issues are "serious."

Greenberg revealed his shop's analysis of BABA, which involved "certainly over 2,000 man hours," shows the company has shifted R&D and logistics and product development costs off-balance sheet.

He scoffed at the company's assertions of disclosure. "Where was this at the time of the IPO?" Herb asked.

Judge for once put a little pressure on Herb's motivation, asking if Herb is short BABA. Herb insisted he has no short position in BABA. "Most of our stuff is pretty much under the radar," Herb said, a curious claim.

Josh Brown said he owned BABA as a "low-conviction long," but now it's even lower conviction because he's out of it.

Brown shrugged at Herb's outrage, questioning why the stock wasn't doing worse Wednesday and suggesting nobody thought the accounting was "kosher" anyway. Brown also curiously claimed "we've got two people running for president who are caught in lies almost weekly and their supporters cheer for them; nobody even cares anymore. … People are just not as perturbed by these things as they used to (sic grammar)."

‘It’s a value stock at 110;

it’s a value stock at 90’

AAPL evidently falls under the category of "value" stock.

No matter what the price or Carl Icahn's no-brainer 240 target or whatever it was.

Pete Najarian on Wednesday's Halftime Report declared: "Apple. We all know it's a value stock wherever the stock's trading. … It's a value strock- stock at 110, it's a value stock at 90."

If deeming the shares as "value" no matter what the price helps you trade, more power to you.

Judge asked about Gundlach's "notion" of dead money in the market. Pete said he agrees with that to the extent we're talking about the dash for trash, but apparently not so much with AAPL, probably because they're going to adopt Toni Sacconaghi's notion of charging people $200-a-month subscriptions for iPads.

Josh Brown said "the tone seems to have shifted almost overnight" in the stock market.

But Dubravko Lakos-Bujas said the market is stuck in a "tug of war."

Steve Weiss said, "I'm concerned about the dollar," then said there's "so much cash on the sidelines" that it comes in and plays momentum then quickly gets shaken out.

"I haven't been short a stock in I don't know how long," Weiss said.

Weiss said the best value now is in equities; "bonds are tremendously overvalued."

Jon Najarian reported that Macy's, Dillards and Nordstrom are up a healthy amount in the last week.

Lakos-Bujas said it would be helpful if rates could rise without the dollar rising.

"I think June's gonna happen," Weiss said. Josh Brown asked what negatives are left after Brexit. "Valuation," Weiss said, then said the "mother of all negatives" is China devaluing, which if so should've been his first response to Brown. Pete Najarian pointed to the presidential election.

Judge opened the program saying, "It is the great debate for investors right now — where is the stock market likely to head in the months ahead."

Isn't that the "great debate for investors" every moment of every business day?

Herb’s estimate of work done for BABA research equivalent to 2 guys spending 25 straight weeks on the subject and doing nothing else

Jon Najarian on Wednesday's Halftime said "the weak hands lost" in TIF because the stock rocketed back after horrible earnings and guidance.

Pete Najarian suggested a floor around 61 or 62 but "didn't see enough" from the report to get involved. Josh Brown said it's a "really smart trading long" because of the $60 February low.

Pete said there might be potential for multiple expansion in WDC but then said he wasn't so sure about that, but he likes the "synergies idea with Sandisk."

Stephen Weiss said there's "lots of upside" in NBL.

Doc said NMBL has been up 42% "since the 12th of May," which isn't even half as good as Stephen Weiss' awesome SRPT options trade.

Josh Brown said the HPE move is "not my cup of tea" and said "congratulations" to anyone who was long. (He'd prefer you buy DE (Drink) instead. The cycle will trough; Warren Buffett's in it, etc.)

Judge told Pete that Pete "got killed" in the short VIX ETF in the Halftime Portfolio contest. "No I haven't been hit yet," Pete said, stating he put it on Tuesday.

"Twitter is what's weighing on my account," Pete said.

Anthony Grisanti said to expect hedge funds to keep unloading gold into the rate hike, but it would be a buy at that point. Jim Iuorio said his level for buying gold is 1,200 to 1,210 because he doesn't expect a "screaming dollar."

CNBC superfox Jane Wells reported from a Whole Foods "365" store in L.A. and found Walter Robb, who said it's a "great complement" to Whole Foods and not a cannibalizer.

Jane said shoppers noticed the low prices more than the gadgetry or anything else.

Josh Brown said they should've named the 365 stores "Half Foods."

Pete Najarian asserted it "will cannibalize."

Josh Brown said WFM should be an 8 multiple. Doc noted the presence of Amazon and WMT in the space as well as 365; "it's just a matter of time" for something or other.

Steve Weiss said WFM sells at a premium to Kroger and is overvalued.

Weiss said biotech is "still oversold" and "very attractive."

Doc said "big blocs" of July 15 calls in X were being snapped up. Pete detected aggressive call-buying in CSCO.

Brown also hailed CSCO, prompting Judge to link the space's movement to the Juniper CEO's comments.

The show closed with Judge getting the 10-second signal from the floor.

[Tuesday, May 24, 2016]

UA thinks this is 1972

It may or may not have been impromptu, but Judge put together a thought-provoking and snappy roundtable on UA and college sponsorship on Tuesday's Halftime.

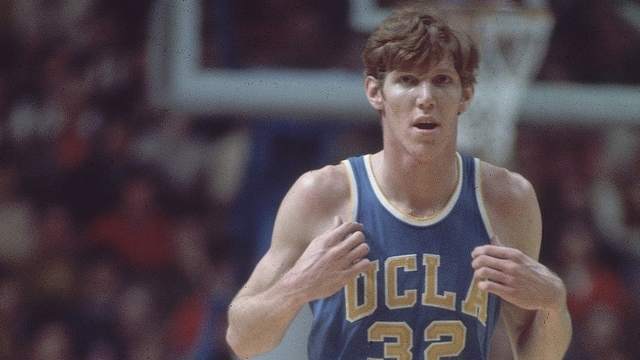

Dom Chu reported UA's deal with UCLA. That prompted Pete Najarian to curiously claim, "When you read the headlines, you'd expect this stock to be soaring. It has not been soaring to the regard (sic) you'd expect it to be."

Judge rightly wondered, "Why would you expect the stock to be soaring (on) $280 million on a college deal?"

Grasping for a response, Pete said, "Not off of just this news" but deals with Tom Brady and Steph Curry (which occurred … how long ago?).

Then Judge curiously said the deal makes him think of "the battle for L.A." and claimed UCLA has an "up and coming program." (We're guessing he means football, which may sort of be true, 'cause it sure ain't basketball, and just about every other sport, they've been winning titles for about a hundred years.)

Judge then asked a great question, if "these companies are paying too much for rights to the apparel of these schools."

Jon Najarian offered the unconvincing answer, "You always need to have some worry about it," but "this is something that people watch live."

Doc said Stephanie Link is one of those people who watch sports on a DVR "and flip through very quickly."

Steve Weiss concluded we "don't know what the economics are" and also suggested uncertainty as to whether college athletes have a right to be paid for clothing endorsements (doubt that's happening whether it's right or not).

Joe Terranova revisited his UA buy of a couple weeks ago, noting he "got quickly stopped out" and "I feel foolish about it."

Judge asked what UA has done since earnings. "The stock is down," Joe said, suggesting a disconnect between the fundamentals and the stock performance.

Weiss made a good point that should've been made on the program long ago, stating, "I'm not aware of any clothing manufacturer that's ever held this multiple or even half this multiple for an extended period of time."

Doc said AMZN is compressing everyone's margins in retail.

Joe said it'll take "3 to 5" years to determine if UA's UCLA deal is a good one.

Weiss questioned how "paying the highest price ever on record (sic last 2 words redundant) for a deal has become a badge of honor," another excellent point.

Joe noted "professional sports teams … continue to just increase in value."

Remember, SBUX is a ‘staple’ (unless you think flattening home-price appreciation will stop people from buying morning coffee)

Eric Jackson, sort of the star guest of Tuesday's Halftime gang, said he really wants to try Toni Sacconaghi's idea of subscribing to a couple iPads a month for $200 proved a 1-man gang against Philippe Dauman.

(Man, gotta say, writing Dauman's name is annoying; it's hard to distinguish all the L's and I's and make sure we got it spelled correctly.)

"Things are good for Viacom shareholders," Jackson said, stating he has always supported the Redstones.

Then, in what seems a massive overstatement, Jackson claimed Philippe Dauman "is gonna go down as I think the worst CEO in modern times."

While we don't disagree that Dauman probably sucks (not having examined his record), there are definitely worse CEOs, and Jackson didn't really point to many specifics besides stock price. (The curious thing is how many people would argue that Dick Fuld and Chuck Prince were better.)

Jackson did say Dauman has chosen to sue the folks at YouTube rather than work with them. Well, whatever, but are any media giants (besides GoPro) actually making gobs of money off of YouTube? (Didn't think so.)

Jackson compared CBS and VIAB multiples and called that an indictment of Dauman. Steve Weiss said those are "2 different companies." But Jackson said VIAB was supposed to be the "growth company" of the 2.

Jackson twice called Mario Gabelli a "hero" for VIAB shareholders and acknowledged that VIAB is an "unconventional pick" for an activist.

He said YHOO's excitement will come in the 6 months after June; "something's gonna happen" with the Asia stakes. (We've heard that all before.)

There’s ‘fully valued,’ and there’s ‘much more fully valued’

Paul Buckland on Tuesday's Halftime Report said it's good to be a contrarian in this current S&P range, so he's not as bullish as he was in February.

We thought it was funny that someone (Oppenheimer) actually has a 2,300 year-end target.

Buckland told Stephen Weiss the presidential election puts a "cap" on stocks.

Weiss said stocks are fully valued, but "every other asset class is much more fully valued."

Judge thinks ‘almost everyone’ sees 2-3 hikes this year

Joe Terranova, who had mostly a quiet show (except for the UA part) on Tuesday's Halftime Report, said "there are so many singing this chorus of negativity … and that in itself (sic last 2 words redundant) becomes a catalyst for a bullish atmosphere."

Judge, however, failed to ask Joe if he "rang the register" too soon on energy or is actually making a bearish energy call.

Jon Najarian said it was "pretty phenomenal" being able to buy AAPL a couple weeks ago below 90. (Wow. Now 7% gains are considered phenomenal.)

Clarifying another "Chinatown"-esque sister/daughter confusing situation from last week, the screen said Doc owns both MSFT and QCOM calls.

"Salesforce absolutely crushed it last week!" bellowed Pete Najarian.

Stephen Weiss said there's a "tremendous amount of money" playing "reversion to the mean" quant strategies. "I'm not so sanguine about the market; I'm still cautious," Weiss said.

"I do think they'll go in June," Weiss said.

Pete Najarian said he "basically sat on my hands" on TWTR, complaining it killed him in the Halftime Portfolio contest. "There's no reason" to bottom-fish in the stock, Pete said.

Doc explained that he's not calling TWTR a buy, but he wouldn't short it. Bob Peck explained how the "cadence" of new products will lift the shares.

Judge revealed, "My source, familiar with the company and that situation," said to treat the HLF N.Y. Post report with "skepticism," but the talks are in an "advanced stage." Doc said options players are betting for a move in "several weeks."

Surprised Judge didn’t ask Pete for an encore on his TIF bull case

Pete Najarian, unlike Josh Brown (who talks about John Deere like it's 2006 AAPL), said on Tuesday's Halftime that DE has been "churning" and needs to break out before you buy it.

Doc said MON is "in denial" about the "great offer" it's been given.

Joe Terranova said TOL has "trouble still in California."

Steve Weiss said AZO was down 10%, as management cited weather but also a more efficient distribution, which goosed the stock.

Jeff Kilburg said it's a "great opportunity" to buy gold, suggesting gold unlike the S&P is signaling a June hike. Jim Iuorio said, "I do think today is probably a time to buy it."

Pete Najarian said he got out of the GDX but still has some in his Halftime Portfolio and said "in the short term, it's hands off on gold."

Pete reaffirmed he owns KGC calls, but "that's going all the way out to November, so that does buy me time." Actually, it didn't buy him anything. He paid to have a duration of 6 months rather than 6 days.

Weiss called gold a "very crowded trade" that's "unwinding."

Doc said he's still long FIT despite its slide, and he's still long MO.

Pete said he wouldn't chase the hot activity in FEYE because the options have already doubled. Dave DeWalt hasn't been on the show for a while, so we're not sure what's going on there. (But Joe doesn't mention "Palo Alto" as much as he used to.)

Weiss said he bought some BAC and SCHW; who knows why.

[Monday, May 23, 2016]

Berkshire’s AAPL buy only about 10 years too late (cont’d)

In a sign that maybe it's not the Next Big Idea, Toni Sacconaghi's notion of AAPL charging subscribers $100-$200 a month for using iPads wasn't part of Judge's Apple discussion on Monday's Halftime.

Instead, Judge asked, "Why has the stock gone up consistently since the news of the Berkshire buy happened," and proceeded to get a non-answer from Joe Terranova.

"Because people are focusing on trading the stock," Joe curiously said, citing the possible break below 90, which it did, and then apparently some people thought 85 or 80 in a flash.

"It's less about Apple; it's more about all of those suppliers into Apple," Pete said.

Jon Najarian said he bought GLW "just in the last few minutes."

Joe thinks Warren Buffett had "absolutely nothing to do with" Berkshire's AAPL purchase and suggested people could look at Icahn and Tepper for AAPL guidance instead (Drink).

Fed fantasies: 2-3 in 2016

Judge opened Monday's Halftime Report stating "almost everyone" is predicting 2-3 hikes this year.

Jon Najarian wasn't so sure and mocked John Williams' predictions.

"This guy is an outlier and he is gonna be wrong, wrong, wrong," Najarian said.

Hypercute Savita Subramanian said the market isn't ready for 2-3 hikes and said the BAC house call is 1 this year.

Joe Terranova said the Fed wants to make sure there isn't "volatility" in the credit markets. "I think they do go in June," Joe said, but it'll be "more of a 1-and-done."

Pete Najarian said the Fed is basically saying, "June's on. … Joe and I are together on this."

Doc wasn't sold on a June move. "I still think it's way under 40%," he said.

Joe conceded the yield curve could flatten with a hike.

Doc again actually mentioned the EgyptAir disaster as a possible reason apparently for not hiking.

Joe took a half-hearted dig at government; "that's what this economy needs: fiscal policy," Joe said.

Slowing home-price appreciation said to be SBUX headwind

David Tarantino of Baird said on Monday's Halftime Report that SBUX is "a daily occasion" whose product is more "ritualistic" than most retailers.

"It looks a lot more like a staples company than it does a retailer," Tarantino asserted.

Judge said it's a "stretch" to call SBUX a "staple."

"I would, I would say it's a bit of a stretch," Tarantino conceded, but, "It helps that the product's somewhat addictive, um, being caffeinated."

Pete Najarian wondered openly, "They still have plenty of growth geographically … is it stretched? I don't know. Maybe a little bit … it's an addictive staple."

Savita Subramanian said, "It's a staple to the high-income consumer and their- that trend I see as weakening, 'cause you've got home-price appreciation slowing, stock-market gains slowing, so the high-end consumer might become a little bit more frugal."

Joe suggests everything will be OK in the presidency

Savita Subramanian on Monday's Halftime Report said "the election's a big deal" and contended, "In the 5 months heading up to November of an election year, the VIX seems to consistently rise. So buy volatility."

Judge said, "Good thought." (But he didn't ask about the bear case based in part on 3 previous times since 1970 where the Fed was tightening into sluggish earnings and stocks went down afterwards 2 of those 3 times.)

Pete Najarian questioned if we know all the positions of Donald Trump, and will both candidates get pulled toward the center.

Doc said 55% of Wall Street's money has gone to Hillary Clinton.

Joe Terranova relayed a childhood anecdote about not wanting to get in the pool and swim because the pool was cold, suggesting once the country collectively jumps into the pool, election concerns will "dissipate."

Judge fails to ask Joe if he rang the register too early on energy and/or is making a bearish call

Judge on Monday's Halftime said Mario Gabelli calls the Shari Redstone-Philippe Dauman drama "creative tension."

Pete Najarian said it's been "noise after noise after noise" at Viacom and he actually would've expected to see the stock down Monday, but it was up to nearly 41. Pete said Mario Gabelli could maybe stand to get "a little bit more aggressive."

Joe Terranova said the reason there's VIAB "concern" is that all the talk is about management and not the business model.

Doc said he's not surprised that Bayer went public for MON but that shareholders are probably "frustrated" and want the money.

Pete Najarian said "sooner or later," FCX will have to spin off pieces of its oil-and-gas business.

Joe said he thinks you can buy SQ.

Savita Subramanian predicted 1,325 gold by the end of 2017 and "a little bit of downside" this year. "It's hard to imagine a real inflation pickup from here," she said.

Doc's bear case for TIF centered on slow Chinese spending and not enough ecommerce revenue. "I think if Tiffany's pops, it's a sale here," he said.

Pete countered that he doesn't think TIF is in an "ecommerce-type world" and, in a very flimsy bull case, said "it's already been taken to the woodshed."

Bertha Coombs and Ana Gupte (in a guest clip) reported that bronze plans under Obamacare are costing insurers because people game the system by getting "a host of procedures and services" before disenrolling. Doc said a lot of sick folks are on these plans while healthy people are spurning the exchanges. Savita said to sell consumer staples, buy health care, "That's the call."

Joe said he'd "ring the register" in emerging markets currencies.

Doc said, "I'm 82% in cash right now" in the Halftime Portfolio. Judge noted that's not the "real world."

[Friday, May 20, 2016]

What they whisper about on the golf course — KPMG hilariously stands behind Phil Mickelson in CNBC ads

Karen Firestone of Aureus joined Friday's Halftime Report set and said she has started buying NBL, which she said is a bet oil prices will be flat or higher.

Firestone said she likes PYPL on the prospects of higher transactions by users and an impressive mobile product.

Firestone called TJX "a star in retail wreckage" and even suggested Sports Authority's bankruptcy as a catalyst.

Josh Brown wondered if the TJX comps are repeatable. Firestone said TJX has "weathered some of these hurdles" and is one of the "safe places in consumer discretionary."

Firestone told Jim Lebenthal that some biggie partnering with PYPL is a "definite possibility."

Yes, the president said the word ‘notion’ (Drink)

CNBC superfox Meg Tirrell visited with Friday's Halftime gang, saying the swing in SRPT could be "astronomical" depending on the FDA's muscular-dystrophy drug decision, with one analyst even suggesting $60 if it gets accelerated approval.

Jon Najarian again called SRPT "the gift that keeps on giving" (Drink). (Knock on wood.) He said options bets are "substantially" to the upside.

Melissa Lee said PTCT already has approval in Europe for a similar treatment. Tirrell explained what might hold that stock back, but it went a little over our heads.

Eamon Javers interrupted the show with the president's remarks on Zika.

Meg Tirrell said XON is being driven short term by its effort to create "GMO mosquitoes" to stop Zika.

How CNBC disclosures work (snicker) (cont’d): Doc says MSFT is the only name of the 4 he’s in; graphic implies otherwise (but at least he’s not subscribing to an iPad for $200 a month)

Guest host Melissa Lee opened Friday's Halftime mentioning CSCO, INTC, QCOM and MSFT. (Zzzzzzzzzzzzzzzz.)

Jim Lebenthal touted CSCO, INTC and QCOM (Zzzzzzz) and suggested QCOM could reach the "high 60s."

Jon Najarian said a moment later that MSFT is "the only one I own" of Mel's list. But the graphic implied he's got MSFT and QCOM calls.

Steve Weiss grumbled that "yield support" in these names could go in a "heartbeat."

Mel, not totally familiar with Weiss' line of thinking here, questioned if Weiss was saying that the companies might not have the cash to pay the yields. Weiss clarified that he means the yield isn't enough protection for share-price drop.

Josh Brown threw water on AMAT's big day, suggesting the "inflection-point talk" once again might fizzle.

Jim Lebenthal stressed that PC growth is not a catalyst for these names and shouldn't be an investment thesis, but there are other "granular" reasons such as enterprise spending.

Weiss grudgingly recommended ATVI.

Mel looked dynamite again as always, we're rooting for Mel to have a rockin' social life rather than working 18-hour days studying 13Fs, but who knows; everyone has their priorities; we've tried.

Unclear if Weiss thinks you should buy Kobe Bryant with no titles or 5 titles

In another one of those glitches that have been bedeviling Judge recently, guest host Melissa Lee on Friday's Halftime asked Jim Lebenthal about CPB. Jim said he was assigned GPS. Mel asked him for an opinion on CPB anyway. Jim said "unfortunately" it's just not a name he can opine on. Stephen Weiss bailed everyone out with a CPB comment.

Weiss said if NKE really gave LeBron a $1 billion contract, he'd consider shorting NKE. He wasn't too fond of Michael Jordan personality-wise, stating, "Michael's not a nice guy."

Weiss said he doesn't want to buy FL or the shoe sellers.

Jon Najarian failed to offer an opinion on TSLA.

Josh Brown shrugged off DE's drop and mocked those who sell on bad news and buy on good news. Later he said Warren Buffett's in the name (Drink).

Jim Lebenthal touted TIF again (but not JCP). Doc said he likes TIF.

Weiss lukewarmly cautioned against GME but said it's probably OK as long as it keeps buying back its stock.

Doc said there was strong activity in HBI as well as TJX. Jim said QCOM feels like a breakout. Weiss said he's got a bid out for ENDP.

Hardeep Walia said the Sin Motif is "heavily weighted to gluttony" as well as tobacco, alcohol and fast food. He said it was up 6% last quarter but down 2% in the last month. Mel said it seems like "gluttony" is the way to make the most money but is being dragged down by other sins.

Stephen Weiss questioned why OZM is in the Sin Motif. Walia said it's the "largest tradeable hedge fund." Jim Lebenthal noted CHD is in the motif despite also providing staples. Walia said it's "very methodical" even though there's "a lot of subjectivity" as to what constitutes a "sin."

[Thursday, May 19, 2016]

Doc claims EgyptAir disaster could prevent Fed from June hike

Thursday's Halftime Report was cut short by Preet Bharara's Dean Foods insider-trading case, but guest host Missy Lee brought her A game, having everything working regarding outfit, hair, etc.

Joe Terranova said a lot of folks were playing for "apocalypse" on Thursday morning, but he thinks that's the "wrong move" because the market is "range-bound."

Jon Najarian said the Fed is "just jawboning" about a possible June move. Doc even suggested the EgyptAir flight could be "a catalyst if you will" to keep the Fed from moving.

Jim Lebenthal said the "tea leaves" suggest Britain will stay in the EU.

Jon Najarian said "Salesforce is still a great buy."

Doc expertly nailed a day ago that Goldman might be the lead underwriter of the TSLA offering.

Joe Terranova said the Bayer-Monsanto deal is complicated and being met with rightful skepticism, and "quite candidly, I don't understand it."

Jim Lebenthal said CHD has produced "all the gain you're gonna get."

Doc said someone's making "a pretty large bet" on CMI 109 puts to happen in a week. He said he's long the puts. Later he said the stock dropped after his report. Mel knocked Doc's ripped jeans.

Pete Najarian said KGC November 5.50 calls were popular at 60 cents. "I'm in it to win it," Pete said.

Jeff Kilburg said there's a 24% chance of a June hike and noted the Fed's "pouting" session. He likes the dollar in the 94-98 range. Jim Iuorio said if the dollar closes below 95, that's a strong signal it's going lower.

Meg Tirrell reported that an Amgen unit has done some gene sequencing and discovered some folks in Iceland have a very lower heart attack risk.

Pete Najarian said there was "huge activity" in DE, but he didn't say which way. Doc said people were buying M calls.

In a self-Fast Fire, Joe Terranova admitted a "horrible call" on GPS topping 30, calling it the "poster child" of problems with mall retailers.

Jim Lebenthal reiterated his bullishness for JCP and TIF.

Her approach may be ‘uncomfortable,’ but Nili Gilbert was so comfortable on television, Mel had to nudge the segment to a close

Nili Gilbert, as part of her "uncomfortable" approach to investing, said on Thursday's Halftime it's the sentiment that should be "uncomfortable" while the fundamentals "are still good."

One of Gilbert's plays is DLX, calling it a "growing company that's throwing off a lot of cash."

Mel said, "I write maybe 1 check a month."

Gilbert also likes RAX, stating it's providing services in the cloud to customers of AMZN and MSFT.

Gilbert enjoyed discussing these stocks so much, she could've gone for a half hour, to the chagrin of Mel, who hadn't allotted a whole lot of time to this feature.

For once, nobody accused Joe of being too bearish on energy

In the category of Bored With Life, we have professional golfer Phil Mickelson.

In a Halftime Report Thursday largely interrupted by Preet Bharara, Jim Lebenthal said it's "really sad" to see Phil Mickelson involved, though "I'm not casting shade on him at all."

Nevertheless, Jim wondered, referring to people who want to ship AAPL $200 a month for a couple iPads "How dumb can they be?"

Jim warned, "You're gonna get caught if you do this, so don't do it."

Jon Najarian seconded that, stating, "Most people that would be doing this sort of activity will try to mask it."

Pete Najarian piled on Mickelson, stating if you're in his shoes, "You just cannot touch it ... He's already got all sorts of different income streams."

[Wednesday, May 18, 2016]

Bust: Judge fails to ask Toni Sacconaghi why someone would subscribe to an iPad

Toni Sacconaghi, who's on the Halftime Report about every other day, on Wednesday uncorked an idea for AAPL to make even more money.

"Over time, the iPhone business will likely decline," Sacconaghi contended. So he thinks Apple should make "all of its hardware businesses a subscription."

"The notion would be that you would sign up for an appropriate bundle of Apple products," Sacconaghi explained, suggesting his family would want 4 iPads (first "iPad" mention in weeks or months) and 3 iPhones, "and we'd pay a monthly fee for that."

Of course, our first question — never addressed by Judge — was how one actually subscribes to hardware; for example, is this just a layaway plan like furniture rental, in which case why wouldn't people just put it on their credit card and pay that monthly fee.

Sacconaghi said, "Our analysis says that Apple could come up with really compelling bundles between 100 and $200 per month per family." Don't people already subscribe to phone service? Is there some reason they need to subscribe to ownership of an iPad?

Stephen Weiss for some reason claimed this is a "great idea," but Weiss pointed to other subscription names mentioned by Sacconaghi such as ADBE or MSFT and noted "they're more business-subscription models" and questioned whether it would "push others away" who want a la carte.

Sacconaghi said "even razor blades" are being sold for monthly subscriptions. Are iPads supposed to be thrown out every 6 weeks? Do you have to return them, just like your cable box?

Kevin O'Leary told Sacconaghi that an investor should get a discount on AAPL's multiple "because you've just re-invented the company." Sacconaghi said it's not a black-and-white issue, but a "continuum."

O'Leary repeated what he said last time that Apple has to catch up with the latest Samsung phone.

Hate to say it, but this one was a mess and Judge let it get out of control; Sacconaghi never explained exactly what such a buyer would gladly pay $200 to subscribe to, or what from Apple needs to be purchased monthly. Judge should've hectored Sacconaghi for not answering his first question; "how would this work?"

Judge, Ronnie Moas disagree on definition of ‘hard’

Judge welcomed Ronnie Moas to Wednesday's Halftime Report — and immediately entered correction territory.

Judge said Moas thinks the market will go down "hard."

But, "I didn't say it was gonna go down hard; I just think it's overvalued," Moas stated.

"I think we could test the February lows," he added.

Judge asked if that's not "hard."

"I thought you were talking about like 20% or more," Moas said, suggesting Dow with a 15-handle is possible.

Moas said 90% of the names in today's S&P wouldn't be considered by him as a value investor.

But things quickly got good. Moas said he likes Twitter, just "decided to take a shot at it," because of its cash hoard and valuation.

Kevin O'Leary wasn't impressed. "It's radioactive waste. That thing is dangerous," said O'Leary.

Moas, a Tesla stock critic, said the shares merely got a "dead-cat bounce" off the Goldman upgrade and scoffed that it's worth as much as "Mazda, Fiat, Ferrari and Porsche combined."

Then things got as loopy as the Toni Sacconaghi segment (see above) as Moas stated, "That makes as much sense as comparing Kobe Bryant to Le- to Michael Jordan the day that he entered the NBA without even having played a game in college."

Judge correctly pounced on this one, asking Moas, "Do you want to buy Kobe with no titles, or do you wanna buy Kobe with 5 titles."

Moas' response dodged the question. "I was in the camp — let me speak to you in 5 to 10 years, and see what you've done," he said.

Doc, who had a quiet show, suggested maybe Goldman was signaling it would be part of a Tesla capital raise.

Meanwhile, Moas reminded the panel he "blacklisted Apple on ethical and moral grounds" on CNBC 2 years ago, so "I don't go near Apple" even though it's about to launch a $200-a-month "subscription model" that includes 3 iPads it's No. 1 on his computer model of value stocks.

The beautiful thing about options ... you can lose money just like with anything else

In a bit of a Fast Fire, Pete Najarian on Wednesday's Halftime Report admitted he sold his LC calls a day ago.

For whatever reason, Pete began to explain this decision by stating, "This is the one beautiful thing about options, Scott."

Then, he went on merely to say the calls still had some value yesterday, but as news of probes was hitting wires, "I think it's too big of a mess."

But that "doesn't mean the thing can't actually still take off," Pete added.

So ... if it takes off, he will have blown a chance to make big money in options.

Pete mentioned dabbling in SVU calls on Monday; that one's down also.

Pete also trumpeted DLTR calls on April 25; the stock was around 80 that day and has crept higher but as of Wednesday was trading $75.

Doc: Market will ‘sell hard’ on word of a rate hike

Kevin O'Leary on Wednesday's Halftime Report said sales of his 32 companies are up 30% right now, so "we're rockin' it in America."

Jon Najarian said he's not optimistic about the market's reaction to rate hikes. "The market will sell, and I think sell hard, if they raise rates, uh, after the, uh, minutes are released," Najarian said.

Some still seem to think inflation is just around the corner. "I think they should go," said Stephen Weiss, stating it's been "late already."

But, "I see nothing good about the market," said Weiss, citing an "earnings recession" and the Chinese "house of cards."

Pete Najarian suggested a selloff if there's a June hike, but it would be a "great buying opportunity."

"It's a dry-powder period," Weiss said.

Bill Baruch said "the dollar is gaining traction," and there's a possible 1-2% more. Brian Stutland said the dollar's still in a downtrend but that a Fed hike before the election "could be in the cards."

Kevin O'Leary said he's looking at "giant conglomerates" in Asia and Australia. He mentioned a Japanese company (we think it might be FANUY) and Australian company (Wesfarmers) that we've never heard of before; Judge never clarified or offered a ticker. O'Leary said he likes BHP because of P.E. compression.

Weiss at one point told O'Leary that dividends are only "1 element" of investing, then lamented that with BHP's dividend cut, he "lost more in the stock price than I'm ever gonna make in the dividend."

Eric Chemi said FB ranks 16th out of the 150 IPOs of 2012. "Pretty good, but not 'The Best,'" Chemi said. That marked the first time we've heard of WAGE.

Steve Weiss said he added to AAL on Tuesday and trumpeted airlines again.

Judge didn't mention any kind of a response from Mallinckrodt (see below).

[Tuesday, May 17, 2016]

Guest defines CNBC (a/k/a Mallinckrodt never bothered to respond) (a/k/a don’t look for Sen. Claire McCaskill to take a 9-mile walk in St. Louis)

Short sellers are not often the most popular guys in the room. But Andrew Left has quickly rocketed to or near the top of the Halftime Report's Most Entertaining Guests leaderboard.

In an appearance promoted a day ago on CNBC, Left was asked by Judge on Tuesday about calling VRX "uninvestable" a couple months ago and now being long.

"Uninvestable and untradeable are 2 different things," said Left.

Invoking curious math, Left acknowledged his March comment and asserted, "I think since we said that, the stock has probably cut in half (sic) another 30-40% (sic)."

(Actually, it was $67 that day, March 2.)

Left Tuesday called the stock a "decent proposition for stabilization. Obviously not- I don't believe Valeant is going back to $60 a share."

Overgrasping for impact, Judge moments later said VRX "immediately started to go lower" when Left said it's not going to 60. Left said, "Saying the worst is over and saying $60 are completely 2 different things Scott."

"I don't believe this company is going to go under in the next 12 months," Left added.

Judge asked Left if he's an "opportunist" or a "believer."

"We're CNBC right here," Left said. "CNBC's all about calling the market on a minute by minute. I'm not in the stock minute by minute." But he said he's an "opportunist."

Left also said it's also a "pair trade" because he's short MNK.

"If in fact Valeant goes lower, then Mallinckrodt will no doubt have to go lower," Left contended.

Left again mentioned MNK's Acthar "that's never even been tested."

Left even defended Mike Pearson and Bill Ackman against Sen. Claire McCaskill's grilling, suggesting McCaskill is overlooking issues in her own backyard. "All she really had to do was walk across St. Louis, 9 miles away from her office" to find "the real offenders of the system," Left asserted.

Judge noted the FDA has approved Acthar, even if under older standards, and asked what studies Left has looked at.

"What studies have I not looked at," Left responded, insisting that usage is not an indicator of effectiveness.

"Why hospitals prescribe it is a complete different argument," Left said, referring to a previous CNBC interview asking about the amount of meals CEO Mark Trudeau has hosted at Maggiano's and Olive Garden to get docs to prescribe it.

Left seemed to lament that the VRX stigma has become "so bad, that I think Valeant actually is talking about changing their name right now because the word 'Valeant's' become a bad word."

He said MNK is "the real offender" and that it actually donated money to Claire McCaskill's campaign.

Left said Valeant is not just the poster child. "Valeant has become the pinata," he said.

Left said he's not tossing matches on tinderboxes; rather, his move is about the "rising price of pharmaceuticals."

Pete Najarian mentioned Bausch & Lomb (Drink) and noted Left bought puts for his VRX stake but that "he won't say where and how far out or the strike."

Joe Terranova said he has "no clue" where VRX is going.

Stephanie Link called AGN "a better bet" than VRX. (This writer is long AGN.)

Josh Brown suggested VRX could be vulnerable to a short squeeze; there are "loads of amateur shorts who get their ideas from magazine articles and TV." Brown called VRX "more dangerous short than long in the short term."

Judge said Herb Greenberg was tweeting agreement with Left that MNK should be the "poster child" for drug pricing.

Judge said Mallinckrodt was contacted about Left's appearance but "wanted to see what he had to say first before responding." By the end of the show, there was no MNK response to either Left, or Herb Greenberg's tweet.

Left clearly outperformed Ackman in VRX research. Now they're sort of on the same side. Left has been harping about MNK on CNBC at least since November. He's failed to identify a catalyst to anyone who might potentially short it with him. Judge despite a high-quality chat nevertheless took a called strike 3 in not asking for one.

Pete apparently misquotes Joe, first of 2 times it apparenly happened on the show

Judge opened Tuesday's Halftime with what could've been a spirited conversation on retail but instead got tangled up in a difference of opinion between Joe Terranova and Pete Najarian.

Once again, things got started with the greatness of Jeff Bezos and Amazon.com, a stock up about $240 in 3 months.

"That's a guy right there on TV you don't wanna bet against," said Pete Najarian.

"I finally got in," said Steph Link, "from underweight to a market weight position."

Joe Terranova said AMZN is "seeing a high return on their spending."

But Joe was most enthusiastic about HD, stating you should buy it from 125-127, then later said to "take it" below 130.

Josh Brown added, "I think Home Depot is probably the best retailer, uh, in America right now."

Pete Najarian said TJX numbers across the board were an "absolute home run."

Stephanie Link said TJX guidance is "always conservative."

Then, Joe and Pete tangled apparently over where the consumer is spending his/her money, with Joe apparently trying to stress that there is money in the consumer space.

Pete said, "Home Depot is not Macy's. They are not in competition Joe."

Joe bristled, "I'm not saying they are ... a consumer has $100 in his wallet ... he's not spending at Macy's ... he's spending at Home Depot ..."

"It doesn't mean that it's gonna make the department stores that we're lookin' up on there any better," Pete said.

"No! No, I'm not sayin' that!" Joe said.

Steph Link said, "I think you can pick your spots. Just be careful when you do it." (As opposed to all those other stock transactions you make that you're not very careful about.)

Pete and Stephanie both said they're not in TJX and Pete cautioned against chasing. Josh Brown said of TJX, "I think it can be bought."

Joe accuses Judge of wrongly associating him with a bearish energy call

It's possible someone on Tuesday's Halftime was getting a raw deal.

Anthony Grisanti on Tuesday's Halftime said of crude, "I'm a buyer, at least for the next couple months," suggesting a possible 55 if there are "geopolitical issues."

Scott Nations said 45.67 is the near-term bottom, but "we are a hair from being overbought."

"I don't think you go to 55, no," said Joe Terranova, reaffirming you should be "navigating" from high-beta energy to defensive energy.

Judge then harped on Joe's fair assertion that SHAK is a mall operator recent point about trimming the high-beta energy names.

Joe accused Judge of "coming at me with this- from the framework of, that I made a bearish call," when in fact he's just "ringing the register" on energy.

Judge didn't really backpedal but concluded, "Ringing the register is better than wringing your hands, OK, over where things are gonna go. I'll give you that."

"OK," Joe said.

Meanwhile, Josh Brown said Pandora should be sold to a bigger player. Pete Najarian said if no deal happens, the stock's in trouble. Josh called it a "terrible business model" when the paying Pandora subscribers don't get ads but the "deadbeats" who don't pay do see ads.

Josh pointed to the "all-time record highs" of the ITA, the aerospace and defense ETF. He said his favorite is RTN and also touted HON and LMT. "Defense spending globally is on the rise," Brown said. "All that sequestration stuff is over."

Joe Terranova curiously said of the defense space, "This is one that you clearly wanna buy high." Judge said Link owns RTN.

Chris Caso said his underperform, $30 on INTC is a "relative rating" and he actually thinks the stock's in a "pretty tight trading range right now." He said it's "no surprise" that the PC business is in "secular decline" and that in other spaces it will have to compete on a "more level playing field."

Pete said homebuilder stocks don't have the "movement" you'd like.

SVU by the way got slammed a day after Pete reported buying the calls.

Stephanie Link likes LPX, one of Joe's historic favorites; Joe said he thinks homebuilders could move higher.

[Monday, May 16, 2016]

1 - 2 = 1 (or something like that)

Judge on Monday's Halftime said of LULU, "1 firm saying it's a buy; 2 others calling it a sell (sic)."

Then he said Guggenheim and Telsey call it a buy, while Bank of America "says sell."

Pete Najarian said he backs Telsey, citing LULU's "direct to customer."

Josh Brown said Guggenheim "could be right, and still get the stock wrong," and he's not even convinced LULU's material is that unique given other athleisure entries.

Joe Terranova said the B of A note (that's the lone bear of the day apparently) has a $50 target, and the stock's $60, so if LULU is vulnerable, wouldn't it already fall to that level as part of this "conglomerate negativity" in retail.

Josh Brown actually suggested LULU give 2% of the company to Kris Jenner (snicker), "and let all the Kardashian girls wear the clothes."

Sarat Sethi called LULU a hold.

A team with 2 starting quarterbacks is a team with 0 starting quarterbacks

Savita Subramanian on Monday's Halftime Report defended her just-for-the-heck-of-it summer bear call, stating it's the first time in years "we're really seeing signs of things to worry about" and citing things that have "only happened prior to big market selloffs."

Subramanian, who is cute, pointed to the distress ratio. "It's at levels we haven't seen without uh significant downside to stocks, uh, you know coming," she said.

She also mentioned "percentage of companies forecasting negative earnings."

"On top of that we're heading into a seasonally weak period," Subramanian said, adding "election risk." (Risk of what?)

Subramanian said she looked "over time" when the Fed has "tightened into a profits recession." She said it has happened 3 times since the '70s, "and in 2 out of 3 of those times, the market has sold off over the next 12 months."

"So I feel like that, in and of itself (Drink) (sic redundant/useless), is a reason for uh, for some consternation," Subramanian said.

Well, if there isn't enough skepticism about a laundry list 4 or 5 items deep, we're not sure we'd bet the house on a Fed-data sample size of 3 over 40 years that has produced a 2-1 outcome.

Nevertheless, the topic provoked a healthy and brisk discussion among panelists, as Joe Terranova said what's working is that "sentiment is still incredibly bearish."

Sarat Sethi said he agrees with Joe on sentiment, but, "I'm not saying buy; I think sideways is absolutely correct."

"Savita is my favorite strategist on the Street," said Josh Brown, who nonetheless said when everyone is "completely fluent" in the same risks to the market, those tend not to be the biggest risks.

Pete Najarian for some reason pointed to the "rotation" in stocks, XLE bouncing off 65.

AMZN’s up $235 in 3 months

Sarat Sethi, knocking AMZN's valuation on Monday's Halftime, made a point about high margin expansion that we didn't get.

Joe Terranova said he disagrees; "this defines a new economy."

"Share doesn't mean margin expansion," Sethi clarified.

Josh Brown said "I'm not long, but I would buy it, not necessarily at this price. I like to buy Amazon on pullbacks when they disappoint; they haven't in a while." (Actually it was barely a quarter ago.)

Brown said "they will make somewhat more money" if AMZN starts selling its own private label products.

Pete Najarian gushed about Jeff Bezos. "Name me a category that he doesn't dominate," Pete said.

Judge said it "blows my mind" when he sees an Amazon delivery van in front of someone's home on a Sunday, as he did a day ago.

Hell, AAPL’s a value stock

Joe Terranova on Monday's Halftime clearly wasn't too impressed with Berkshire's AAPL stake.

Joe said Gundlach's right; "I just don't think Apple is important anymore."

Joe said "why not" follow Tepper and Icahn on AAPL instead of Berkshire.

Josh Brown used air quotes (and said "air quotes") about the Berkshire managers having "complete autonomy."

Josh suggested 92 is likely resistance for AAPL, even though the stock was trading over $93 at the time.

"It was a value stock at 110. Hell, it was a value stock at 130 quite frankly," said Pete Najarian.

Then Pete for some reason went off on a Berkshire tangent, mocking the notion of an IBM "backstop," stating that stock has been in an "absolute free fall."

Sarat Sethi said Berkshire purchases are made with an eye on deep value.

In the 13F report, Judge asked Kate Kelly how long Tiger has owned AAPL. Kelly said she'd find out and that it's a "relevant question."

Later, Kelly said Robertson started building the AAPL position "late in 2013."

Joe Terranova made a point about viewing AAPL's price trajectory as a scorecard for active vs. passive management. Josh Brown said his ears would "perk up" when he hears someone is shorting AAPL.

Joe: BAC inert

Steve Weiss (not on the show) on Monday's Halftime wore the collar for hectoring Jim Lebenthal on JCP last week.

Joe Terranova mockingly mentioned "Sears." Sarat Sethi said to "stay away" from JCP. Josh Brown said it could be a "zombie stock forever."

Judge said Goldman Sachs has raised its Q2 WTI forecast to 45, then 50 in the 2nd half of the year.

Judge asked Joe if Joe might've "jump(ed) the gun" in calling for exiting energy a week ago. "No, I think I rang the register, which was the right thing to do in a lot of the high-beta names," Joe asserted.

Josh Brown said the XLE looks great above 65. He even said CVX "looks phenomenal" as long as it holds 99.

Pete Najarian said someone bought October 6 SVU calls "in a big way."

Joe said BAC "cannot rally," but he wouldn't short it.

Josh really likes the Barron's call on REGN, calling Monday's bounce price a "pretty good entry" for investors.

Pete said he likes the PFE-ANAC deal.

Mike Santoli examined whether stocks a year from the S&P peak can eventually resume their bull march but said at this point it's hard to see what dislodges them from this "sideways slog."

Josh Brown said the market "telegraphed" almost perfectly the flattening in earnings.

Josh said a great HD report doesn't help anyone, but a bad report would "absolutely rip down the XLY names." Pete called TJX "more interesting, quite frankly."

Pete gushed about FL again.

[Friday, May 13, 2016]

Jim thinks JCP’s brand was only damaged 2 years ago

Stephen Weiss on Friday's Halftime said it's a "sign of the times" of market volatility that retailers are getting slammed on misses, but the consumer actually "is in very good shape."

Weiss singled out JCP as "overvalued," then tangled with JCP bull Jim Lebenthal.

Lebenthal said Courtney Reagan failed to mention that JCP "actually did beat on the bottom line" and praised the company for handling expenses.

"They reported a loss," Judge said.

"Every retailer has a loss in the first quarter," Lebenthal said.

Weiss said "2/3 of their enterprise value is debt" and noted a "damaged" brand. Lebenthal shrugged, "That's 2 years ago," then said this is the "opportunity" for Weiss not to miss JCP the way he did TGT.

Josh Brown called JCP a "perennial turnaround."

There's an easy way for JCP to add 5 points overnight. #changethename #changethename #changethename #changethename #changethename #changethename #changethename #changethename

Brown also said the morning's retail number was "the fastest growth in 13 months."

Sarat Sethi said "the consumer is strong," so the question is whether you want to focus on apparel.

Sethi was the only one to point out, "Your online sales are getting less margin than your in-store sales."

Weiss touted NKE. He said HD is not cheap but suggested FL.

Weiss added, "I'm looking to fade Target." Brown and Lebenthal called GPS a "perennial turnaround story."

Still wondering about whether Penn Station buyers will wait 10 minutes for a SHAK meal

Josh Brown on Friday's Halftime Report said SHAK is "still innovating" and seeing gains from the Chicken Shack.

Judge asked Brown for a "reasonable" SHAK target. "I really don't do targets," Brown said, but "this company should get a premium multiple."

Brown said SHAK has a "fair" value. But Stephen Weiss said "it's not fair at all" but "significantly overvalued."

"I think there's more percentage loss risk in Shake Shack" than MCD, Weiss said. Brown agreed with that.

Moments later, the guy who doesn't do targets said WDC looks like "death on toast" and hung a 15 on it.

All the talk about GM; no one ever mentions the actual product

For whatever reason, Judge on Friday's Halftime entertained yet another conversation about Generic Motors, which Josh Brown summarized neatly.

"Stock's been in a range for 6 years. I, I really don't even know why we talk about it," Brown said.

During the IPO, a lot of people started to get excited, including Karen Finerman, who also seemed to spot a floor a year or two ago during the ignition-switch controversy.

Stephen Weiss said "incentives are also driving sales at this point" in the car market and mentioned the "subprime auto bubble." Jim Lebenthal said "you're wrong on this. Average selling prices have been going up, and that's net of incentives."

"Incentives have been increasing," Weiss said.

"Average selling price has been going up. That's net of incentives," Lebenthal said.

"Typical value trap," Weiss said of GM.

Sarat Sethi claimed GM has a "new management team." Weiss scoffed, "How is she new. She's been there for over- ... she's been a senior management person for a long time."

To our knowledge, Joe Terranova (who wasn't on the show Friday) is the only panelist to tout GM vehicles on the program. Pete Najarian we think mentioned ownership once.

Guy Adami on Wednesday suggested shorting AAPL

Josh Brown on Friday's Halftime said AAPL is "a buy in the 90s."

Sarat Sethi said Apple's China investment is OK, but he's "being more skeptical" because big companies when "peaking" with lots of cash can spend it the wrong way, mentioning MSFT and Nokia.

Jim Lebenthal said the panel had a "robust" AAPL discussion a day ago (except it wasn't really that robust unless you count Steve Weiss stating that the fundamentals are "fraying").

Jim called the China move is a "good idea."

Weiss said Apple's China move is to "assuage" the Chinese, but he warned about competitiveness of selling cars. But he said the stock seems to have found support around 90, even though a day ago he said it has no yield support.

Weiss announced April 6 he bought AGN (closed that day at $244), says now he ‘made some money on it’

Mike Santoli on Friday's Halftime Report said he looked at an assortment of stocks called "cheap" this year (banks, airlines, autos, etc.) and said the market is hinting they're at "peak cyclical earnings" because they haven't rallied.

Sarat Sethi tried to make a point but lost his mike. Stephen Weiss said you have to be careful of value traps. Judge pointed out that Weiss finally threw in the towel on C. Lebenthal said C doesn't have a useful dividend. Sethi eventually argued that if you get any kind of multiple expansion, "these things are gonna run."

Sarat Sethi said NVDA earnings are growing.

Jim Lebenthal said JNJ is a "great dividend payer," and value investors are "supposed" to own it.

Weiss said he's long MDVN because it's probably going to be bought in the upper 60s and is "low risk."

Anthony Grisanti said gold is "definitely taking a pause," but he thinks it's going "a lot higher." Jim Iuorio said as long as it's over $1,260, he'd be "relatively bullish," provided the dollar doesn't climb over 95.50. But if gold breaks $1,225, then the run's over.

Judge said AGN was added to Goldman Sachs' conviction-buy list. Jim Lebenthal said he likes it, but "there's a lot of intangibles on the balance sheet" and he wants a better yield. (This writer is long AGN.)

Stephen Weiss claimed he "bought it together" with Pete Najarian (wonder if that's a joint account) and "made some money on it," but he doesn't know why he's not in it now.

Sarat Sethi called CSCO a "perfect kinda value stock." Jim Lebenthal said maybe CSCO is eating JNPR's lunch.

Josh Brown said he likes DE (Double-Triple-Quadruple Drink).

Judge asked panelists at the end what they're afraid of. "Everything and nothing," said Josh Brown.

[Thursday, May 12, 2016]

Joe seems to think SHAK is a mall operator; Weiss seems to think MCD is not a ‘concept’

Josh Brown, who got in on the SHAK IPO yet still somehow has evidently never sold, said on Thursday's Halftime Report he doesn't think anyone actually believed that SHAK belonged in the 80s, "but the company continues to execute."

Josh said it's on pace to build 450 new outlets, but "it's still not cheap."

Joe Terranova raised eyebrows, chiming in that SHAK was trying to "populate all the regional malls."

Judge insisted, "They're not a mall player." But Joe said he's interested in mall percentage. Josh asserted, "They're targeting city centers in cosmopolitan cities."

Stephen Weiss grumbled, "Restaurant concepts have always been fleeting," suggesting CMG seems to have had the longest life.

"Here's one offhand: McDonald's," countered Brown.

"That's not what I look at as concept," snapped Weiss. "That's a business that built out at different time with much loyal following" and not a "fad."

Joe questioned Josh's reference to Penn Station. "Are people gonna hang around and wait for burgers to be made at Penn Station?" Brown said they have one in Grand Central, with a "line wrapped around the corner."

April 6: Laura Martin hung a 12-month 150 on AAPL; stock closed at 110

Steve Milunovich on Thursday's Halftime Report said "investors I think are concerned that Tim Cook may have lost handle (sic) on near-term demand."

Risking the wrath of Laura Martin, "We believe that this is still largely a hardware company," Milunovich said, adding there's just no "near-term catalyst."

Joe Terranova said AAPL is "obviously affecting the direction of the market."

Steve Weiss said he thinks people are "risk averse" and that people's opinions on AAPL "often overshadow the fundamentals." But he said "the fundamental story's been fraying."

Judge said there are still 41 buys among analysts.

"I don't think there is yield support" in AAPL, Weiss also said. Josh Brown agreed that it should've been there in the mid-90s and wasn't.

"It's being valued like a hardware company," said Josh.

Jim Lebenthal, who's long AAPL, said, "Samsung phones get a lot of press as being better than iPhones ... all Samsung needs to do is really develop that ecosystem."

Which is the sexier 20something

target: GE, or GM?

Josh Brown on Thursday's Halftime said JPM's "downside target" on GE is 27 and maybe not "terribly actionable." But he said if "you actually read the report" and are buying for more than a year, "there really aren't any negatives for an investor in the stock."

And even for those who didn't actually read the report, there presumably aren't really any negatives.

Brown called the stock "a buy in the high 20s."

Jim Lebenthal said it's hard to see GE breaking out if the S&P is not breaking out. Judge said Weiss called it a sell, but Weiss said "that's a little bit of a mischaracterization." But Weiss said he wouldn't buy it; it's "just not my thing."

Jim Lebenthal questioned getting JACK a day after WEN in Trader Blitz and said those 2 companies' results are about the menus. (Not sure about the "concept," however.)

Josh Brown said you should "probably sell" PRTY.

Steve Weiss said MON is a quality name that "makes sense" as an M&A target.

Joe Terranova had to deal with one of his favorite names, PANW, stating Piper did a "bad job" in lowering a price target from 208 to 180 for a stock trading 129. Joe said he's not in the name and can't recommend it now for anyone else. (But Joe didn't address that UA purchase Monday or whether M really looks washed out.)

Joe trimmed FB and DPZ in his Halftime Portfolio while adding BLK, ORCL and VIRT.

Not clear if Weiss still likes the airlines as much as he did a day earlier

Judge on Thursday's Halftime pointed out that Tony Fratto called Trump an "unelectable psychopath."

Steve Liesman said Eric Rosengren came up with a novel notion: "He is concerned about the cost of staying too low for too long."

Really. And what does he intend to do about that ... after about, oh, 7 years of this ... lessee ... probably talk about really hiking rates to get them "normalized" ...

Liesman said, "I've done some research on this, they, they have equally gone up or down during an election year."

Stephen Weiss said money managers are going to get hedged in case of a Brexit and even said the U.S. party platforms (snicker) will cause volatility in stocks.

Joe said he pointed out on Twitter that since Thanksgiving Eve 2014, the market is down 12 basis points in the S&P, but profit margins have had "6 consecutive quarterly contractions." Joe suggested avoiding high beta and getting more defensive.

Jim Iuorio said "I like the crude oil trade, medium term and longer term," though there might be a short-term "breather." Bill Baruch agreed it's tough for the bears to break the momentum.

Josh Brown asserted he's not "stocky" because he's 6-1.

Somehow, none of the Najarians was on, so there evidently was no unusual options activity.

Despite having a monster week already with his DISH debate and Theranos discussion, Judge has been tripped up by dead-air producer glitches almost daily.

Joe likened Affirmed and Alydar to AAPL/GOOG; we're not sure which is supposed to be which.