[CNBCfix Fast Money Review Archive — December 2014]

[Wednesday, December 31, 2014]

‘She’s So Perfect’

This page cut the cord with the 5 p.m. Fast Money B team (see below).

But, Sara Eisen happened to be guest-hosting on the New Year's Eve edition. (And whoever got to ring in the New Year with this gorrrrjus superfox is already the 2015 winner.)

We hate to say it but couldn't help but hear Sara at one point refer to a "harbinger of what's to come (sic redundant)."

It certainly caught our attention that Sara mentioned one of the show's Wednesday music choices was "She's So Perfect."

Indeed.

Joe skips December

In a quiet, humdrum ending to the 2014 Halftime Report, Stephen Weiss said January 2014 opened poorly because people didn't want to take gains in 2013.

Paul Richards suggested we're still in for "6 months of fun" but questioned whether Europe will do as much QE as Ben Bernanke did.

"This was not a euphoric year," said Steve Weiss.

"No not at all. I wasn't suggesting it was," protested a ridiculously hypersensitive Scott Wapner.

At odds with what Dennis Gartman says daily on CNBC, CNBC.com, CNBC Futures Now, CNBC Asia, CNBC Europe, etc., Morgan Downey stated "I think we've seen the bottom" in oil.

But Jim Iuorio contended, "I think we're goin' lower."

Downey suggested names such as CLR and WLL will be attractive takeover targets.

Stephen Weiss predicted the credit markets will be the source of excitement in the energy markets in 2015.

Doc warned that it's possible that AAPL "rolls over" early in the year as people take profits after a big year.

Stephen Weiss said the Dogs of the Dow "just doesn't work."

Peter Bardwick assured Judge "the pipeline's very full" for 2015 IPOs and rattled off a bunch of the usual suspects.

Squeezing in one last Brag Trade for 2014, Doc explained "I was lucky enough to uh, make a decent call on Facebook when the stock was in the low 70s," but Najarian pronounced TWTR "in a world of hurt."

Doc claimed "I still kick myself" for getting out of AAPL at 88 but took credit for projecting a low-rate environment. Stephen Weiss called AAL his best pick and TBT his worst, "just a disaster."

Doc said, "I respect the heck out of Steve."

Doc and Judge both mentioned the "iWatch" (sic).

Jim Lebenthal said his best 2014 play was INTC and worst was IBM.

Doc's Final Trade was CLF. Stephen Weiss said VXX. Jim Lebenthal said long IBM.

Judge pointed out that Mike Murphy had a chance by the end of Wednesday of overcoming Dr. New Land in the Playbook Playoffs Portfolio.

But in a bizarre sign of the strange attention/inattention given this feature, 1) there was no announcement of such a contest for 2015 other than Jon Najarian's statement that traders will be able to make weekly moves, 2) no portfolios have been suggested yet at all (last year they started in mid-December, that's how Pete got screwed by that awesome KKR call), and 3) this year's leader hasn't even been on the show since Nov. 24 and hasn't even dialed in, though thankfully his mug shot is still on the program's Web site.

Brian Stutland predicted more volatility in 2015.

But it was on the show we don't bother with anymore that Gordon Johnson on Monday invoked the annual Fast Money year-end cliché, the one about last year you could get away with buying the market but next year you're really going to have to be a stock-picker (Drink).

[Tuesday, December 30, 2014]

CNBC graphics crew has

trouble spelling ‘disperse’

Celebrating 50 years and not going anywhere, Art Cashin opened Tuesday's Halftime Report pronouncing the market in "reasonably good shape," stating that going back to 1885, "a year ending in the numeral 5 has only been down once" and citing the year-before-the-presidential-election theory.

Jon Najarian actually claimed he "never heard that one before" about the years ending in 5.

Jim Lebenthal reaffirmed "high single digits" for 2015.

But John Stoltzfus said he has a 2,311 target for 2015.

Kate Moore told Judge, "We think it's a little too soon to re-enter the energy trade."

Josh Spencer told Judge "there's still some opportunities" in the market with stocks that have fallen "out of favor," such as AMZN, GOOG and WDAY.

Doc said Apple has an "iWatch" (sic) coming out, but "I'm not a big fan."

Doc admitted he bought CSCO and INTC on the way down after the dot-com bubble burst. But Doc crowed that he and Pete both bought EMC under $5.

Jim Lebenthal described Russia as a "nuclear superpower."

Jim Iuorio said oil is putting some "nerviness" (sic) in the stock and bond market.

Anthony Grisanti said that below 2.14, there's no support for the 10-year until the 1.8 level.

Jon Najarian said he likes RIG because "it's just down too far." Jim Lebenthal countered that he doesn't think the dividend cut is priced into the stock.

Doc said he was taking off his COH January 35 calls but that someone bought a bunch of January 127 calls in MON. Doc said he bought them too and that his holding period is "a couple weeks" (Drink).

Diana Olick reported that Pittsburgh rents are up 11%, and that other cities are seeing spikes as well. Olick said that makes the rental REITs appealing.

Judge said he "literally" was just going to ask his panel about that. Jim Lebenthal cautioned that he sees rates rising (snicker) but said REITs can be a buy upon raising payouts. Doc recommended Zillow over the builders.

Judge, Doc struggle to phrase their remarks to Rob Sanderson in the form of a question

Rob Sanderson on Tuesday's Halftime Report said the new markets for Yelp are creating a "prolonged, uh, period of high growth" beyond what the Street forecasts.

Judge pointed out, without actually asking a question, that Sanderson's $86 price target reflects a 60% rise in 12 months.

Sanderson responded, "Yep," leading to a moment of dead air.

Perhaps irked, Judge protested Sanderson's contention that making a call on Dick Costolo's future is "outside of our scope of knowledge," stating it would have to have a bearing on Sanderson's outlook. Sanderson said it merely matters whether the company makes improvements or not.

Sanderson told Judge that insider selling in recent IPOs is "always unnerving."

Doc, who like Judge pretended his statement was actually a question, said it caught his eye that TWTR insiders have been unloading the stock down from 42 to 36 in recent weeks and "apparently don't believe in the story anymore." Sanderson said there's not much he can say about that.

Doc's Final Trade was long BYD. Jim Lebenthal said SJT and Kate Moore said to "take a good look at China."

[Monday, December 29, 2014]

For those still wondering exactly what David Tepper said ...

Taking up a rather dubious topic for the 2nd episode in a row, Stephen Weiss on Monday's Halftime Report opted to clue viewers in on what exactly David Tepper meant last week (aside from, honestly, "nothing.")

Weiss said Monday he wanted to "underscore" what Tepper said because it was "misunderstood."

"He said 2015 can rhyme with 1999. That's not meaning he's calling a top on it. That's meaning he's looking for a very positive market," Weiss said.

So, why didn't this individual simply state, "I think 2015 will see 1999-like returns"?

Floyd Trade back on

Guest host Sully, who's quite possibly CNBC's best at handling the numerous technical glitches, pointed out on Monday's Halftime after Dom Chu's mike didn't work "This is not a good first 2 minutes" for the "Fast Time (sic)" show.

But, Sully quickly started referring to "camp," so we quickly tuned him out.

Stephen Weiss said he's "puttin' a position on in the Russell."

Josh Brown called European valuations "worth the buy."

Mike Santoli said this year looks "somewhat similar to last year end."

Jim Cramer, who doesn't get enough airtime on this channel, was summoned to complain about Manitowoc's conglomerate tendencies.

Jerry Storch said there's a "strong correlation" between stock performance and high-end spending.

Storch also said the Fast Money Word of the Month, "Omnichannel."

Josh Brown and Stephen Weiss both dismissed GM.

Jon Najarian likes MU into next year.

Stephen Weiss said he sees "nothing wrong" with RCL but prefers the airlines.

Doc said he'll be bottom-fishing in energy names in "a few days."

Steve Weiss said he has "small positions" in ATLS and OAS.

David Miller has spotted "very aggressive, unusual buying" in CHK, TDW and BBG. But he said CIE has seen "huge" insider selling.

Stephen Weiss claimed "huge insider buying" in The Floyd Trade, HK (snicker).

Mike Santoli (it was his Final Trade) and Josh Brown claimed to find EWU interesting.

Josh Brown's Final Trade was long IWM. Doc said DHR. Stephen Weiss said to short OCN.

[Friday, December 26, 2014]

CNBC gals behind Dana Telsey share pair of high-5s after holiday

Stephen Weiss on Friday's Halftime Report tried to help out those who were scratching their heads at David Tepper's purportedly important comments this week about 1999.

"Some people took it as that, that's gonna be the end," Weiss said. But no, "Markets can get irrational, is the point."

Really. David Tepper informed everyone that markets were irrational in 1999.

Weiss expressed confidence in stocks, stating, "What we've got is a global liquidity event."

But expectations for next year seemed muted. "A high-single-digit return for 2015 is probably likely," said Jim Lebenthal, who predicted a rising-interest-rate environment (snicker) next year.

"There just aren't a lot of sellers here, Scott," said Jon Najarian.

Sarat Sethi suggested that rates are only rising if "things are getting better" and that the consumer will lead.

Dana Telsey suggested that retail has easy comps from last year when the polar vortex dominated conversation.

‘Victoria’s Secret was crowded’

Dana Telsey got right to the point during the retail conversation on Friday's Halftime Report.

"Victoria's Secret was crowded," said Telsey, who pronounced TIF, FL and BBY among the winners and declared herself a "believer" in the LULU story.

Stephen Weiss said his daughters like KATE, but "They will never buy Coach again."

Dom Chu said a consulting firm reports that 13% of last-minute online orders didn't arrive in time for Christmas but that another firm found that Apple, Dell, Nordstrom, Zappos actually through Dec. 23 guaranteed Christmas delivery and apparently scored 100% success.

Dana Telsey agreed with Doc's annual point that TJX is a big winner for post-Christmas.

Telsey actually likes GME and said, "Don't count Burlington out."

First-name dis

Well, whaddaya know.

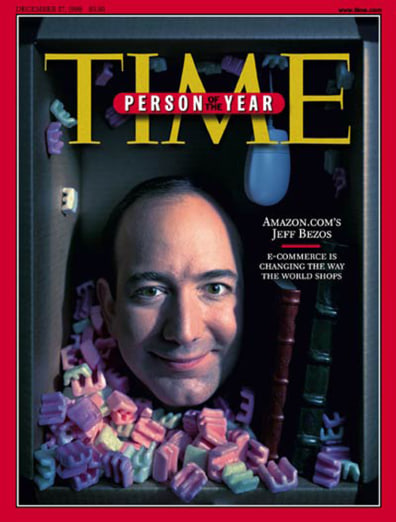

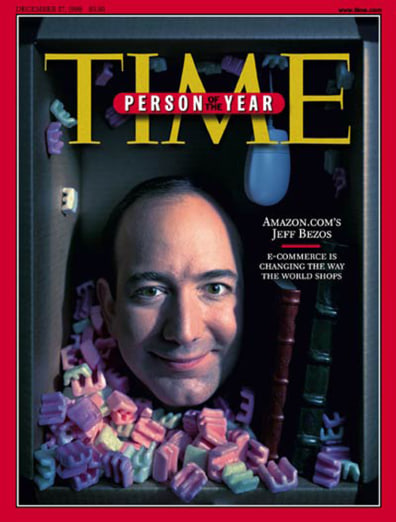

Dana Telsey, and other panelists on the Halftime Report, suggested Friday that perhaps brick-and-mortar, or at least the "omnichannel" model, is going to prevail over mighty Amazon.

"All of a sudden, we're hearing Amazon is gonna open stores," Telsey said, noting that "at some point, you have to make money."

Stephen Weiss said Amazon's apparent contemplation of brick-and-mortar is "almost an admission of defeat" for the online-only model.

Jim Lebenthal, who referred to "Scott (sic) Bezos," said AMZN is a great company but "terrible" stock, "simply because it doesn't make money."

Sarat Sethi said, "I think the stock's gonna come down, and I wouldn't wanna be in front of it."

Apostrophe conversion bungled as CNBC works out new graphic wrinkles

Stephen Weiss on Friday's Halftime Report contended that "emerging biotech" is in "bubble territory."

However, Weiss likes hospitals, managed care and big biotech.

Weiss said he sold GILD on the Express Scripts news because it struck him as a "game-changer."

Sarat Sethi said to avoid GILD and the sector.

But Sethi pounded the table for QCOM and SSYS.

Jim Lebenthal said to stay away from RIG; even though the dividend cut seems priced in, "it never is."

Stephen Weiss: Tom Herzfeld ‘was smoking something, and it wasn’t a Cuban cigar’

A week ago, this page was close to saying that the symbol CUBA was a short on the day of Barack Obama's detente announcement.

We didn't, thankfully, because it shot up for a couple days after that, even topping 14.

But now the chickens apparently are coming home to roost for the fund and Tom Herzfeld, whose presence on the show last week was noted by Stephen Weiss.

"He was smoking something, and it wasn't a Cuban cigar," Weiss said, asserting, "He's been a seller of the shares of CUBA."

Weiss said he'd sell CUBA and suggested buying perhaps RCL; "I don't know what CUBA fund is."

She got a green jacket

Kate Rogers said on Friday's Halftime Report that some folks said that watching "The Interview" was a "once in a lifetime experience."

Stephen Weiss said his daughter saw "The Interview," and the theater was packed.

Jim Lebenthal said of bonds and specifically munis, "Keep your duration at the short end of 3-4 years."

"I would not be short bonds," Sarat Sethi said.

Jim Lebenthal contended that IBM has "thrown in the towel" but that "it's a good multiple to own it at."

But Stephen Weiss countered, "IBM isn't going anywhere ... They're reaching more and more for sales."

Ignoring the CEO's elevation to Augusta, Weiss added, "Gina (sic) Rometty, hasn't really done anything."

Sarat Sethi doesn't like IBM, but Lebenthal contended that January earnings will be a catalyst.

Aldo Sohm told Judge you have to spend "40 to 50 dollars minimum" for decent champagne.

Doc said TSLA has moved "almost 18% in about 8 days."

Stephen Weiss' Final Trade was to short OCN. Jim Lebenthal said long natural gas. Sethi said QCOM and Telsey said LULU.

[Tuesday, December 23, 2014]

Throwing in the towel: One more reference to camp by Guy Adami ...

Discussing the bond market on Tuesday's Fast Money, Guy Adami said "camp."

Later, Guy said he's "in the Timmy camp" on SAVE, and then said "camp" again.

If we hear "camp" from Guy Adami again before year-end, we're cutting the cord on CNBC's Fast Money.

Had it.

Karen seems to think Williston isn’t the next Malibu

In an intriguing trade reminiscent of the early days of Fast Money, Karen Finerman on Tuesday's program said she was looking for another way to play sinking oil and came up with a short of North Dakota housing via IRET.

Finerman said IRET has been "building a development portfolio of rental, multifamily properties right in the heart of energy country."

Employing an impressive pair of maps, Finerman showed where the oil/residential development projects are in the state and explained that IRET has a big project called Renaissance Heights under way in Williston, near Sloulin Field International Airport.

"I'm not saying it's a bust," Finerman protested, despite the enthusiasm with which she was advocating this trade.

She fended off the notion that housing in this area should've already been tumbling. "I gotta think that maybe the rental weakness hasn't started yet," said Finerman, essentially calling a top in adding, "We don't have a lot of risk that rental prices there will skyrocket."

Tim Seymour questioned why the stock hadn't been doing anything in the months before the oil collapse and during "the boom for Bakken."

Finerman said "It's not that well-followed," then suggested that the write-down of 1 property caused a "black eye" and "hiccup."

The difference between now and 1998 is that in 1998 we didn’t already know about 1999

Who woulda thunk that the hero of Tuesday's Fast Money would be Tim Seymour.

The moment came when Mel, as many CNBC hosts did throughout the day, pronounced David Tepper's ambiguously useless comments as Gospel.

Seymour revealed, "I'm not really exactly sure what he said."

Guy Adami credited Tepper for getting the Fed right but then correctly sided with Seymour, "I'm not exactly sure what he said though."

Karen Finerman didn't offer a lot of clarification on Tepper but did offer some appealing visuals. "I remember 1999 very clearly," said Finerman, evoking images of a young Karen throwing on swimsuit and sandals and heading to the beach in her Jeep on weekends while at DLJ or whatever.

"I remember 1999 as pretty- as a pretty good year," Finerman concluded.

Steve Grasso said equities are the place to be "if things stay exactly the same."

Yet, Grasso predicted a correction coming in "January, mid-February."

Analyst claims stock with 228 P/E is ‘universally’ hated by investors

GPRO fan Michael Pachter contended on Tuesday's Fast Money that "The market just universally hates this thing, and consumers universally love it," prompting a "huge mismatch."

"I have yet to meet a female who posts on Facebook and Instagram who doesn't want one of these cameras," Pachter said.

Pachter downplayed GPRO valuation concerns by calling the addressable market in the tens of millions and asserting, "If they're making 3 or bucks a share, it is not expensive at all."

Mel and others were heard snickering while Pachter conceded that Steve Grasso's question/observation about Garmin succeeding in this space is a "great point."

Guy Adami said he likes both GRMN and GPRO.

Karen said she'd go with AAPL over GPRO "by a lot."

Steve Grasso called GRMN the "hidden gem."

Tim got too little;

Karen paid too much

Mark Mahaney on Tuesday's Fast Money recapped BABA's chart and affirmed a 130 target. (This writer is long BABA.)

Mahaney said most stocks after an IPO experience volatile swings, so the fact BABA has had a slump since Singles Day, "I don't view it as a big issue."

Guy Adami said to "hope" for a YHOO selloff into earnings and buy at 47.

Tim Seymour said he got out of BABA "around 105" and would like to see a pullback to 100 or 98.

Karen Finerman said she's still long BABA and paid "maybe 108," and "I like it right here."

Consumer Reports

is still influential

SAVE chief Ben Baldanza, who always says his higher fees aren't "fees" but "options" and then gets chided by Mel for that, joined Tuesday's Fast Money to assure Mel that Spirit's adding of 15 airplanes is not going to be "the cause of overcapacity" in the airline space.

Baldanza complained about getting a "bah, humbug" from Consumer Reports about a $2 bag-fee hike.

Tim Seymour said to buy SAVE on any pullbacks. But Steve Grasso said SAVE has underperformed LUV, AAL and DAL and recommended trying those names instead.

Still no answer on whether FDX hedges oil

Meg Tirrell said on Tuesday's Fast Money that people are concerned that "it could get worse" for GILD.

Karen Finerman said she trimmed some IBB and XBI because the sector is experiencing "a little bit of a new environment here."

Guy Adami again defended GILD's 1-drug treatment vs. ABBV's "5 or 6 pills a day."

Tim Seymour said to stay in GMCR. Guy Adami agreed.

Steve Grasso said "maybe there's an opportunity" in MSFT given that schools are buying Surface tablets.

Karen Finerman said of Hertz's price hike, "this may be just the beginning of the synergies" in the rental-car space that's now down to 3 players. She likes the stock.

Tim Seymour said of CHK, "I don't know if you buy it tomorrow."

Steve Grasso said he's "not sure" why anyone would be long AVP.

Guy Adami said ZU has "huge short interest," but he doesn't expect a pop.

Mike Khouw reported a big buyer of KKR January 2016 27 calls.

Guy Adami said LMT is still a buy or at least an "own."

Tim Seymour's Final Trade was to sell XOM. Steve Grasso said BBY, Karen Finerman said GOOGL and Guy Adami said SU.

Jim Lebenthal shocker: Untested commanders could bump U.S., Russian submarines

As Tuesday's Halftime Report got under way, Jim Lebenthal agreed with the panel's consensus that the stock market's path of least resistance is higher.

However, Lebenthal said that in particular, he's worried about Russia.

That might not have even merited mention, except for the downright "Hunt For Red October"-esque scenario Lebenthal uncorked, suggesting that today's military planners don't have Cold War experience navigating submarines around the Arctic — and he in fact is worried about the "risk of a collision" underwater.

Jon Najarian countered that he sees Russian bank bailouts as a bigger risk.

Bill Nygren still avoids questions about the 400 premium he thinks AMZN deserves

Bill Nygren, who enjoys telling Judge that he looks for stock values over 5 years, not 5 minutes, lived up to that reputation on Tuesday's Halftime.

Nygren stated that he's looking for stocks "selling at a big discount" to what they'd be worth in 5 years.

But the first thing he said in recommending APA was how far it's fallen to its current price.

Nygren contended that "it's really unlikely" that oil is $55 a barrel "several years down the road," which flies in the face of Fish saying a day earlier that nobody thinks crude is going higher in a few years.

Judge pressed Nygren as to whether he has been buying APA on the way down. Nygren said it'd be a "fair guess" but said he can't reveal the answer until after his quarterly report comes out in January.

Jim Lebenthal said he didn't necessarily disagree with Nygren's oil thesis but questioned, "How do you actually pick one name."

Surely, the most important element of this conversation was when Stephanie Link asked Nygren about GOOG and AMZN, which, it's fair to say, have remarkably different valuations.

Yet, Nygren was spared direct follow-up on his woeful summer AMZN call, merely saying of both AMZN and GOOG, "You don't have to look out more than a couple years to believe that the stocks are cheap."

Nygren said he owns no biotech because "we generally don't own the stocks that are most popular" (except for AMZN oops that's right it's had a tough year so despite 700-caliber P/E it's not a popular stock).

Nygren likes BAC, a play on getting rid of those mortgage legacy costs.

Doc actually requested Josh call him "Dr." rather than "Mr." (yeesh).

Isn’t it 1,000 points either way?

Josh Brown opened Tuesday's Halftime Report with a bogus math lesson.

"In fairness mathematically, 17,000 to 18,000 is not quite as far as 16 to 17," Brown told Judge.

In fairness, it's not quite as "far" in terms of percentage, but it's just as far in absolutes.

Dan Greenhaus then took a crack at this unfolding kangaroo court, referencing Tony Dwyer recently saying the price target of a strategist doesn't matter.

"What does matter," Greenhaus said, "is how you're viewing the investment landscape."

Or, so in other words, whether you're just "bullish" or "bearish"?

Nick Tiller told Kate Kelly he's actually bullish on oil prices; "we're poised for a tradeable rally."

But Tiller disagreed with Mark Fisher's Monday buy-buy-buy-Canadian-oil-names recommendation, stating he's "not particularly bullish on Canada."

As word broke of "The Interview" screenings being back on, Jim Lebenthal warned, "Ya gotta think these theater chains are gonna get hacked as well."

Scott Nations predicted prolonged strength in the dollar. Anthony Grisanti said oil will go higher even if the dollar's strength continues, another blow to Fish's assertion a day ago that nobody thinks crude can be 120 in 3 years.

Pointing to biotech winners, Josh Brown said, "People do make sales for tax reasons," which would make sense for buyers of GILD north of 100, but we can't figure out why someone with healthy 2015 gains in the sector would be selling in late December to lock in that profit for 2014 taxes.

Josh Brown pounded the table for SCHW and AMTD. Jim Lebenthal predicted JCP would succeed in 2015 without growing the pie.

Doc said he's staying into COH January 35 calls and that he jumped into KO January 43.50 calls.

Reid Walker said that gold stocks carried his Portfolios with Purpose portfolio.

Judge took a moment for some reason on the Halftime Report to bash Rex Grossman's decision not to suit up for one hopeless game for the sad-sack Cleveland Browns (thanks to those early wins, for once they're not getting a top 10 draft pick), then turned to Jon Najarian for help with this really-not-particularly-true statement, "You used to be in the league."

Stephanie Link's Final Trade was ALSN, Jim Lebenthal said BP, Josh Brown said SCHW and Doc said ESRX.

[Monday, December 22, 2014]

Karen struggles to get straight answers regarding the world of online shopping

Ron Shah, a sidekick of Tim Seymour on "Trading the Globe," visited the Nasdaq for Monday's Fast Money and said of Flipkart's cash raise, "it really is expensive" while trumpeting the size of India's youthful population, an argument we hadn't heard much since about 2007 (that was "the people gotta eat trade" in which panelists told you every night about ALL those people in India moving to the middle class and demanding meat in their diets and so buy Potash and Agrium every day).

Karen Finerman, despite wearing a sizzling white T-shirt ensemble, didn't get an answer from Shah regarding her excellent question, which was, given Amazon's margins, what exactly are the expectations for Flipkart.

Guy Adami said AMZN is in "total no-man's land."

Later in the program, Karen ran into another obstacle in the form of Bill Taubman, otherwise a fine guest, who told the gang that upscale businesses are leading the pack.

Karen asked Taubman if "A" malls are "immune" from the online threat. Taubman indicated that they're not immune, but then he said something about retailers being unable to tell the difference half the time as to whether a sale is "occasioned" by the store or online that made very little sense. (If you bring in a coupon printed out from a computer, that should be fairly obvious.)

Tim Seymour said of TCO, "I stay in this name."

Dennis Gartman apologizes

for natural gas’ slide

Tim Seymour on Monday's Fast Money mumbled terribly while making his purported recommendation on X; assuming there is one, we couldn't understand what it is.

Karen Finerman asked Tim a follow-up question, and this time Tim said "somewhere around 23-25 dollars, there's pretty good support there."

Guy Adami admitted he recently thought the stock would hold 30, saying "it's overshooting to the downside."

Meanwhile, clear as day, Dennis Gartman observed, "The demand for natty is simply disappearing," adding "I'm sorry," it could see a "2-handle."

Tim Seymour pointed to SWN's purchase of CHK assets recently at peak pricing, a sign of "huge balance sheet questions" in the sector.

No matter what hits GILD, Fast Money crew always rushes to insist it’s going right back up

Brian Skorney visited the Nasdaq for Monday's Fast Money and told Mel "it's really ambiguous what the market share is" for Gilead's Hep C drug that got nudged out by Express Scripts' Abbvie choice.

Skorney added, "At the end of the day (Drink), I don't think it's a shock."

Guy Adami took the mantle of Day's Chief GILD/CELG Defender, stating, "I think the move is overdone."

Tim Seymour, as he's prone to do, basically endorsed that but then warned of a "pricing war" and asserted "it's hard to know where this is gonna go."

Karen Finerman smartly observed, "It's very seldom that the very first day of a pricing war is the day you have to buy it."

Shoot — we forgot to do a post on Pete’s birthday (not to mention Guy’s from a few days earlier)

Karen Finerman on Monday's Fast Money admitted she was "very, very frustrated" with the FINL release Friday and called the stock "very ripe for activism."

Tim Seymour reported news on CZR without making a call.

Guy Adami suggested TASR pushes toward $30.

Dan Nathan said someone put on a Dec. 26th weekly straddle of GPRO at 58, meaning that buyer expects it to be either below 53.50 or above 62.50. Dan Nathan said nothing about his utterly boneheaded call of Dec. 17 when he suspected the S&P 500 high was in for the year.

Karen Finerman hung a $100 on DIS.

The producer came up with a spectacular music choice with "I Put a Spell on You" for the school sign gag.

Mel wore a dynamite leather jacket that probably cost twenty-three-hundred dollars and took off 5 years.

Tim Seymour's Final Trade was SBUX. Brian Kelly said TLT, Karen Finerman said CVS and Guy Adami said GILD.

Guest, Fish trying to strike a blow against the Free Labor Trade

Since its inception, this site has occasionally made reference to what we call the "Free Labor Trade."

Those would be the various Internet contraptions producing serious revenue simply because millions of regular Joes volunteer to provide free work and images daily.

It's quite a business model: Imagine how much money law firms could make if scores of lawyers rushed to provide daily services for free.

(Another issue is why people pay AT&T for Internet access, but AT&T unlike a cable operator doesn't have to pay DrudgeReport, nytimes.com, cnbcfix.com (snicker), etc., for the material that prompts customers to pay AT&T for Internet access in the first place, but that's another topic.)

Well, we're apparently not alone.

On Monday's Halftime Report, Judge welcomed Sebastian Sobczak, founder of Tsu, which Sobczak described as "a fully featured social network with an embedded payment platform."

That apparently means you get a financial return on your posts.

"We feel royalties should be paid to content creators for the commercial use of their content, likeness and image," Sobczak said, explaining Tsu returns 90% of the ad revenue to the providers.

Judge and the screen text noted that Mark Fisher is a Tsu investor.

"To me just logically, why are you gonna post if you don't get paid?" Fish said, one of the most staggeringly simple yet important statements ever heard on Fast Money/Halftime.

Sobczak added an analogy, "Why don't you just take zero royalties on a radio station and have them play your song?"

Couple reasons to remain grounded here: 1) It's hard to see an upstart, however ideologically correct or noble, displacing much of the base of Facebook, Twitter, LinkedIn, Yelp, Amazon or even (nonprofit) Wikipedia; and 2) Sobczak never smiled on the program and seems perhaps a bit of a grim fellow, while this stuff is supposed to be fun.

Bob Peck sure seems to think ousting Dick is the right move without explicitly saying so

Bob Peck joined Monday's Halftime Report to parse in ways few have done since Bill Clinton circa late 1990s.

Peck said the "No. 1 question" from TWTR investors is Dick Costolo's job security.

"Should he step down," Peck cautiously offered, someone like Ross Levinsohn or Neal Mohan would be considered an ideal replacement.

Judge, having the right idea but lacking the oomph to pull it off, pressed Peck for whether he thinks Dick really will be gone and not whether Dick should be gone.

"We think there's a good chance that he's not there within a year," Peck answered. (Even we could've come up with that one.)

Judge, flustered at getting no results on this topic, at one point insisted to really no one that "the stock's saying, right now," that "they don't think the CEO works."

Honestly, we hope Costolo stays. (This writer has no position in TWTR.) Levinsohn in fact has been on Fast Money/Halftime before and is very impressive and should be running something far bigger than wherever he is. But we like Dick. Dick's a funny guy. When it comes to comedy, he gets it. The WSJ calls him "affable." He works out with Carl Quintanilla. If we have our say, Dick's not going anywhere.

Josh Brown said, "I would love to see Ross Levinsohn be installed here."

Elsewhere, Peck said the 2015 tech trend will be (sigh) what's "the next Alibaba," stating that it could be in India.

Fish: ‘Buy every Canadian oil stock there is’

Judge finally landed Mark Fisher for an hour, as promised, of the Halftime Report on Monday, and not only did it allow us a chance to update our photo library (that's an important subject around here), Fish impressively opened by conceding his previous oil forecasts were off-target.

"Up until 6 months ago," he said, he figured crude was in a long-term range of 95-110.

What changed that? "2 words: Saudi Arabia," Fish explained, citing a "perfect storm" of events in the oil landscape that have rocked the price of crude.

The Saudis, he said, are tightening the screws on the rest of the world's oil producers: "They're gonna go ahead and see how much pain they can give to all the participants," Fisher said.

Fisher suggested 40 as a possibility for crude but said the trade is really to think higher, longer, stating he likes out-of-the-money calls on the possibility of 120 in 3 years.

"3 years from now, there's going to be a surprise," Fish predicted, one of those statements that might come back to haunt, except this page will be the only one keeping a scorecard, so the "business media" probably won't care one way or the other.

For stocks, Fisher said, "My bet is, you should buy every Canadian oil stock there is," implying deals will be made to cement a bottom.

Fish swept aside Josh Brown's suggestion that the Canadian government will block M&A and called Canada the "safe haven."

"If I come back here next year and they're down 20%, you can all shoot me," he offered.

Doc suggested that even though many energy stocks enjoyed a nice recovery recently, they're going to be "pushed out" by investors who don't want them on the books at year-end, which means he'll be looking to scoop them up.

Fish: Petrobras reminiscent

of Citigroup at $1

Jackie DeAngelis on Monday's Halftime Report introduced another Mark Fisher session by pointing out how Mother Nature is sinking the price of nat gas.

Fish suggested big opportunity in nat gas names, declaring some have taken hits merely on short-term warm-weather forecasts.

"You're going ahead and knocking down a stock 5% based on what happens to the price for the next 12 days. That company's in business for the next 20 years," Fish said.

But more assertively, Fish questioned if anyone knows why Morgan Stanley ditched the Rosneft deal and pointed to the shellackings of PBR and Gazprom. "To me it reminds me of Citibank (sic) when it was a dollar, and Bank of America when it was $5," calling those stocks now an "optionality on sovereignty."

He revealed, "I don't like airlines," citing Chuck Schumer's questioning of "high" ticket prices. But Doc pointed to AAL's pure gains on oil because it isn't hedged.

Elsewhere, Fish pointed out, "If the Japanese yen is gonna depreciate, the yuan can't go up, right? I mean I don't care what anybody says."

Stephanie Link called GILD's slam an "opportunity."

Josh Brown said OCN "looks like they invented like a new type of cold sore or something" and indicated he's not buying that one anytime soon.

Mark Fisher freely admitted he doesn't know much about biotech but recommended OPK.

Judge overran his time allotment so Final Trade came down to Fish offering CME and ICE.

[Friday, December 19, 2014]

Judge announces Fish

appearance on Monday show

Judge Scott Wapner said Friday that Mark Fisher will sit in for the full hour of Monday's Halftime Report. (But note Judge said on Wednesday that Rob Sechan was in the house, and we never saw him until Thursday.)

Reed Hastings silent on Facebook; sure sounded from Julia Boorstin’s report that NFLX isn’t racing to distribute ‘The Interview’

The stock market might as well have been in no-man's land Friday, as most Fast Money traders seemed to be in the camp of I'm Not Making A Call.

Given Tim Seymour credit (snicker) for actually expressing a view, declaring, "I would be selling the market for Monday."

"Oil price is not truth," Seymour said.

Brian Kelly cited the USA Today headline on Yellen in a feeble attempt to explain why stocks roared on Wednesday, prompting scorn from Tim Seymour, who asked, "Is the market trading on USA Today headlines?"

Guy Adami merely rehashed which stocks have had good bounces.

As security names got the halfhearted, obligatory mention, Pete Najarian delivered a verbal stiff-arm to Dave DeWalt, saying he wouldn't want to be in FEYE and said it's a "risky bet" to buy the stock on takeout potential.

Pete really overdid it on the yuks about Mel's joke to Guy about not looking a day over 65.

Neil Doshi has 3 explanations for everything

Neil Doshi on Friday's Fast Money listed 3 reasons why GOOG is slumping (no need to repeat them); after hearing him out, Mel asked the relevant question, whether those reasons are valid.

Doshi said he learned that in fact, "advertising dollars are staying with Google."

"Facebook is our No. 1 top pick," Doshi said, but GOOG is No. 2, and of course he had 3 reasons for that also.

Tim Seymour admitted, "I've been wrong for the last 60 bucks on Google," but said to buy it down to 490.

Pete Najarian said someone was buying the March 120/140 call spread in BABA. (This writer is long BABA.)

Mel suggested the Apple doc on BBC as newsworthy as an excuse to showcase Eunice Yoon, a star of CNBC Asia who's auditioning at the home office.

Pete Najarian credited Katy Huberty for being bullish on AAPL; he said she has a $126 target.

Guy Adami said FB is within a "whisper" of its all-time high and made it his trade into year-end. Tim Seymour said EWG, and Pete Najarian said UA and NKE.

Fast Money comedy: Dan Nathan said 2 days ago, ‘I suspect that the high for the year is already in here’

Brian Kelly, who about every other day expresses a daffy idea on Fast Money, on Friday tried to make some cockamamie point about Lloyd Blankfein being half-right about high yield because there supposedly aren't bids for ballooning corporate debt.

Guy Adami led the rest of the panel in a group counter-charge that the debt has been "put on at record low levels."

Tim Seymour said not to run back into FL "tomorrow" (sic meant Monday).

Pete Najarian thinks MSG is going higher.

Guy Adami predicted RIG "trades north of 21."

Brian Kelly said to stay away from JCP.

Tim Seymour's Final Trade was FM, Pete Najarian said CVX, Brian Kelly said to sell HYG and Guy Adami said SAVE.

Josh Brown says Santa

is carrying a ‘kilo’

Steve Grasso, undaunted by his spectacular bust of a lower S&P call this week, insisted on Friday's Halftime Report, "I do think you're gonna see a correction, come maybe the 1st or 2nd week of January."

OK. We'll write it down.

Stephen Weiss said he'd compare today's markets to 2011, citing comparisons to the Swiss and negative rates.

In a strange analogy to say the least, Josh Brown said "Santa showed up, with a briefcase full of cash and like a kilo."

Brown said if the Russell takes out 1,200, "that's a whole new component to this market."

Paul Richards told Judge "Steve Lieshman (sic) really nailed something here" but warned that "perfection is almost priced" into stocks, and he'd take his chips off the table.

Colbert Narcisse, who wore a great suit, told Judge, "I hate to be a trader in this environment," but he's looking at markets with a 2-4-year horizon, citing natural gas plays.

Narcisse found agreement with Stephen Weiss about money-managing fees. "I've yet to come across a client that's uh, had a 22% net return and say that the fees were too high," Narcisse said.

Jim Iuorio suggested that 54 in the February WTI contract is significant. Brian Stutland said he'd buy oil and the dollar together.

‘Sounds like momentum’

Friday Halftime Report guest Sam Barnett was described by Judge as a pro tennis player, CEO of a $177 million hedge fund, a Ph.D. candidate, and 24.

Barnett though said he's actually 25.

Honestly it wasn't totally clear to us what type of methodology Barnett claims to be using to pick stocks, but we did hear him tell Stephen Weiss, "We're not doing anything from a human basis because we don't want to be biased, there's so many dif- there's a lot of evidence that investors are biased, uh, and so we remove that bias but still have fundamental data going into our systems."

Josh Brown then told Barnett, "It sounds like, you're probably running some kind of a fundamental screen and then it sounds like momentum."

Barnett explained, "We try to identify patterns that could be fundamentally driven and could be, uh, technically driven, but there might be things that are not even based on financial data."

Which sounds like, anything he thinks might be important. But with no bias.

"I'm really optimistic about 2015," Barnett told Judge.

Let’s hope Judge hasn’t

made Dr. New Land disappear

As the Halftime Report carries on throughout December without Joe Terranova, Pete Najarian on Friday said he agreed with Citi's call on FB and predicts 91.

Stephen Weiss said he bought FB on Thursday and he agrees with Oppenheimer's call on TWTR; he said he'd be short TWTR as opposed to long but isn't short now.

Doc said TWTR has to make a move in 2015 or "pull a rabbit out of the hat" and faulted Dick Costolo for not snapping up WhatsApp or Instagram.

Stephen Weiss though called Dick a "genius."

Chefs Eric Ripert and Daniel Boulud expressed optimism toward the fine dining market.

Ripert said "more and more people" need gluten-free diets.

Steve Weiss and Pete Najarian made FB their Final Trade. Josh Brown said XLE and Doc suggested the Invest Like a Monster conference.

[Thursday, December 18, 2014]

‘Chanos will probably be right’

Karen Finerman, downright gorjus in new dress, new hairstyle and necklace for Thursday's Fast Money, tackled this bizarre CAT short of Jim Chanos, first complaining again about how management's quarterly estimates can be so far off (Drink).

Finerman said a short is kind of appealing but noted the stock did great earlier in the year, so she doesn't have the "resolve" for it.

"Chanos will probably be right," Finerman said, but "At the end of the day (Drink), I just don't have that resolve."

Steve Grasso called CAT a "no-touch."

Karen Finerman explained why NAV is up but didn't offer a recommendation.

Steve Grasso still thinks

‘overall market going lower’

If you were asked on Thursday what was the funniest thing you heard on Wednesday's Fast Money, it might well have been Steve Grasso's, "I think we're going much lower (sic) in the S&P."

But that didn't stop him in the slightest on Thurday.

No. 386 said that because he doesn't see a crude rally, "the overall market is probably going lower." But he qualified that by recommending not shorting a dull market.

Karen Finerman had fewer answers. "I couldn't begin to explain what happened today," Finerman said.

Tim Seymour thought it made some degree of sense. "I don't think the price action here is all that crazy," Seymour said.

Grasso admitted he's "married" to MBLY and TWTR.

Dan Nathan dialed in for a Brag Trade on his sell-TLT call, but it was a good call.

TSLA ‘going to 180 next’

Colin Langan, who has a 230 neutral on TSLA, on Thursday's Fast Money called the stock a "very volatile name" and acknowledged the mass-market vehicle will be pressured by cheap oil.

Tim Seymour said of TSLA, "this thing's going to 180 next."

Seymour told Brian Kelly, "It's certainly not priced for an autocar (sic)."

Steve Grasso said TSLA needs to cross 233 for him to get bullish.

Kensho sighting

Sam Poser told Thursday's Fast Money that NKE was down because the backlog results were ho-hum.

Poser said he thinks the run in athletic wear will continue through 2016, even though "this almost becomes the law of large numbers" (Drink).

But Poser suggested NKE is "probably dead money for a little while."

Mel mentioned Kensho (Drink) for the first time in days, stating NKE returns on average 5.06% over the 20 days following an earnings report in which it beat by 4 cents or more ... over the last 10 years.

Karen Finerman said, "I'd be long Foot Locker on the heels of this."

Providing his own version of Kensho, Paul Hickey said it's "very rare" to have this kind of divergence between the S&P 500 and energy over the last 6 months.

But he said "usually more than 2/3 of the time," a pounded sector such as energy outperforms the market over the next 3, 6 and 12 months.

Steve Grasso suggested that strength in utilities and SO is a sign things aren't so great.

Still no answer on whether FDX hedges oil

Tim Seymour on Thursday's Fast Money set off on reciting War and Peace in his story about an SBUX/DNKN pairs trade.

Eventually, Tim said, "I think Dunkin's growth is unsustainable."

Which led him to conclude he has had the trade on, and "It hasn't been a home run, but I wasn't directionally short Dunkin' Donuts."

Steve Grasso predicted the divergence between the names will continue.

Mike Khouw said January 95 calls in MCD were hot, perhaps related to Bill Ackman.

Karen Finerman questioned why an activist would buy a short-dated call. Khouw didn't really answer but said that buying the options would be a way to "lever your bet."

Happy belated to Guy (who was in the day-off camp Thursday)

Breaking new ground in Fast Money/Halftime commentary on GoPro (it's a media company/it's a hardware company), Steve Grasso on Thursday's Fast Money identified TASR as a competitor.

Tim Seymour said of GPRO, "Stock's going to 45."

Reached by Mel on the phone, Joe Sanderson said, "The industry has not built any houses, uh, for a long time," but Mel didn't seem quite sure whether Sanderson was talking about chicken coops.

Mel said SAFM short interest climbed in the 3rd quarter because of oversupply concerns.

Tim Seymour said not to jump in to MGM.

Brian Kelly said to wait "at least 2 weeks" before doing anything in RAD.

Steve Grasso said he's "not sure" why you'd buy CAG today.

Tim Seymour said the Aussie is overbought and he's short FXA.

Karen Finerman indicated the CFR headwinds she cited remain, but the stock is down enough that she wouldn't charge into a new short just yet.

Someone actually asked via Twitter if the Fast Money gang likes financials.

Mel wished Guy Adami a happy birthday, one that often sneaks up on us on this site. (That means someone else on the show is due Monday, which we'll try to remember.)

Tim Seymour's Final Trade was to sell EEM. Steve Grasso said to buy DISH. Karen Finerman said FL below 57 if it trades down on NKE's report. Brian Kelly said GDX.

Josh Brown is able to ‘get’ why international criminals would hack Sony and threaten another 9/11

A pair of interesting opinions about movie terrorism were heard on Thursday's Halftime Report.

Jon Najarian cracked, in a joke that was too possible to really be that funny, "It turns out, uh, North Korea got Colbert to stop his broadcast effective tomorrow, I guess Judge."

Josh Brown, on the other hand, said of "The Interview" that in the end, "they blow up his head." And so, "I get why this- whoever's involved went out of their way to try to put a stop to this. It's not quite a comedy."

Well, you know what military TV pundits like to say: We're always fighting the last war.

Underrated

Gene Munster spent part of his Thursday with the CNBC Halftime Report, saying margin expansion is the element that "stings" investors in AMZN, but he considers the stock his top pick for 2015.

Munster based this outlook on "fractional improvements in their margins" (Drink.) (No, make that a Double Drink.)

Stephanie Link reiterated she likes AMZN. Josh Brown opined, "This thing breaks 280 to the downside, it's dead. It's just dead."

Stock market’s MVP: Janet Yellen

Josh Brown on Thursday's Halftime Report declared the market — unlike North Korea — seems to have a short memory.

"It's very, very much like 2011," Brown said.

Rob Sechan, who was promised by Judge on Wednesday's show that was partially preempted by Barack Obama's speech, joined Thursday's crew (and apparently was shown above the same time a CNBC production chap was giving the stop sign to someone apparently about to walk into range of the camera) told Judge, "Vol is picking up" and said he was "surprised" at the recent December shellacking.

Sechan said some of the babies have been thrown out with the bathwater in energy, specifically MLPs, but he thinks it's too early to plunge into the entire space.

Doc said someone sold a ton of January 20 VIX calls. He insisted that oil being down so much is "unambiguously bullish."

Ben Willis said the Fed crafted a "brilliant 2-sided statement" and predicted a 2015 rate hike, "but only to a quarter of a point."

Jim Iuorio said of Yellen, "She absolutely threaded the needle." Jeff Kilburg asserted "rates are gonna stay lower for longer."

‘Frontier market country’

Restraining himself as the nation rushes to embrace our newest island friend, Josh Brown said on Thursday's Halftime Report, "At the end of the day (Drink), you're still talking about a frontier market country" with per-capita income of "about $10,000."

Doc suggested WU, GPM, MGI and EBAY as Cuba trades.

Doc gloated that LYB, flagged by Pete for options activity days ago, has been a "moonshot." Then he said April 77 TGT calls were being bought "in big numbers."

SoulCycle co-founders Elizabeth Cutler and Julie Rice told Judge they just opened their 36th location in Bethesda, Md. Steph Link and Josh Brown gave it a try.

Link said she would "stay on board" KRFT if you're long.

Doc trumpeted an "all-time high" in WM for no real reason.

Rob Sechan suggested positive surprises out of Washington (snicker) next year.

Doc's Final Trade was KING. Josh Brown said DNKN, and Stephanie Link said CRM.

[Wednesday, December 17, 2014]

Guy: Fed operating on ‘hopium’

Guy Adami took the opening moments of Wednesday's Fast Money to slam the Fed (Drink).

"A lot of it is hopium," Guy explained.

"If you think recession is a bad thing, then you're all for what's going on here, with Janet Yellen and the Fed and all these policies. If you think it's a normal part of the cycle, then you're really angered by this, and you're outraged by this," Guy said.

"It's good times (sic) Charlie right now," he concluded.

Karen Finerman decided that "the Fed just backed themselves out of a corner."

Maury Harris told the gang that "at some point you've gotta pay the piper on the Fed and the bond market" but contended that Yellen was able to "postpone" the bond market's repricing of longer-term rates.

Sony’s bungle delivers

shout-out to Dave DeWalt

Julia Boorstin, reporting on the Sony "Interview" decision, was asked a good question by Melissa Lee as to how much revenue Sony could possibly hope to recoup by releasing the film on pay-per-view only.

Boorstin cracked that she could determine how much money a pay-per-view release would bring by combing through all those leaked Sony e-mails, but "that's probably uh not an appropriate joke at that- at this time."

Porter Bibb, long one of our favorite Halftime Report guests (even though he hasn't been on for a while) said the "serious" financial risk to Sony Pictures is not the low-budget film by Seth Rogen and James Franco but "the class-action litigation by Sony employees and the loss of confidence."

Karen Finerman pointed to the security names and suggested, "That's where the money is going to be made."

Guy Adami agreed that all it took was this particular movie coming down the pipeline illustrating "the ease in which they did it, which leads you to believe that maybe people are more vulnerable than they think," which allowed him to mention FEYE and PANW.

Grasso: ‘Much lower’ in stocks, oil

In a notably stark assessment of the financial world, Steve Grasso declared on Wednesday's Fast Money, "I think we're going much lower in oil, and I think we're going much lower in the S&P."

Grasso suggested crude will find the "$40 mark."

He insisted, "I don't think with oil at this level that the market can rally substantially from here."

But Grasso allowed there could be a short-covering rally in oil names into year-end even if crude keeps falling.

Dan Nathan in a small way backed up Grasso; "I suspect that the high for the year is already in here."

Guy Adami carped about Janet Yellen's use of "transitory" to describe oil prices.

Guy suggested that maybe some drillers have "put in a bottom," but Karen Finerman cautioned that some of them in serious distress won't survive.

Guy Adami thinks there's "still room on the upside" in SDRL.

Cigar trade back on

In the understatement of the day, NBC's Claudinne Caro, reporting for Fast Money from Little Havana, told Mel that "the conglomerate" of people gathered around her "are not at all happy" about the latest end-of-presidency outreach to a bitter enemy.

Mel brought in Manuel Medina, who said he's "skeptical" of détente with Cuba because every time the island nation's economy struggles, leaders make promises that aren't fulfilled.

Medina however stressed that Internet penetration in Cuba "is less than 5%," and changing that would go a long way toward bringing that nation into the 20th century.

"Once that begins, it's irreversible," Medina said.

Mel said that "at the end of the day" (Drink), Medina would be reluctant to invest in Cuba.

Steve Grasso said his partner is long CUBA and while many "hurdles" remain, Wednesday's move is a "screaming positive."

Mel does ‘The Price Is Right’ hand-modeling thing again

ORCL watcher Richard Davis told Wednesday's Fast Money "the story's getting less complex now" because of the company's focus on the cloud.

Guy Adami said ORCL's quarter shows you how "lousy" things are at IBM.

Dan Nathan said not to chase ORCL on Thursday but it might be worth a look on a pullback.

Karen Finerman acknowledged that PAY has been "an old name for us on the short side but they've really turned it around."

Colin Gillis took a victory lap on BBRY, claiming he called it a sell all the way down, then went to a buy as it surged past $10.

Dan Nathan asked Gillis for a sum-of-the-parts valuation. Gillis consulted his notes, then really didn't answer except to say it's burning less cash than before, so maybe his 12½ target is too low.

Nobody knows if FDX hedges oil

Karen Finerman said on Wednesday's Fast Money she "would imagine" FDX uses an oil hedge, but Guy Adami admitted he doesn't know whether it does, and Mel didn't know either.

But Guy thinks FDX has another $5-$6 "at least" on the downside.

Steve Grasso said he wouldn't buy AKS until there is more prolonged strength.

Grasso also said, "I wouldn't touch Cliffs."

Karen, Mel complain about angry AAPL fans on Twitter as Mel tries to convince Dan of the extent of the problem

On Wednesday's Fast Money, Melissa Lee aired Lee Cooperman's Halftime comments about AAPL, then complained that "whenever we say anything like, maybe take some profits from (sic) Apple, people get really angry."

Dan Nathan observed that Cooperman "manages money professionally."

In a minor slam, Steve Grasso pointed out that Coop has been long SD and S.

Karen Finerman wondered if Lee has a Twitter account, because if so, "He's gonna just get bombarded ... by haters."

Dan Nathan said someone was selling January 88 puts in NKE.

Nathan said he wouldn't chase GIS. But Guy Adami made it his Final Trade.

Steve Grasso's Final Trade was GOOG (but said to exit below 490). Dan Nathan said to sell TLT. Karen Finerman said WFM as a play on lower gasoline.

Sounds like Tom Herzfeld has heard MCC’s question many times before

It's not every day that the Halftime Report is half-preempted by a reversal of 50 years of U.S.-Cuba policy.

Judge was able to get ahold of Tom Herzfeld, whose fund with the ticker symbol CUBA seems like more of a play on "The Love Boat" than anything else. (Perhaps he needs to add COST, based on the item below.)

Herzfeld called Wednesday's announcement a "major historic event," asserting "it will be one of President Obama's greatest achievements."

But what raised the eyebrows of Judge's striking associate, Michelle Caruso-Cabrera, was Herzfeld's comment that "we are fully prepared to make direct investments in the country."

MCC pushed back, "They still don't have rule of law there, right. Even if the embargo were to go away tomorrow, sir, if you put money into the country, you're not sure you're ever going to have enforcement of private contracts."

Herzfeld was unfazed. "To the extent that it's legally permissible, that's exactly what we're looking at. And of course we're going to be careful about doing it," he said.

Unfortunately, Judge’s attempt to elicit some stock-picking from Lee was a bust

Lee Cooperman, who last time brought something like a 10-point analysis of the economy to the Halftime Report, informed Judge in Wednesday's extended appearance that he went to Cuba 6 months ago on a "humanitarian mission" with Mario Gabelli and their wives, after loading up "goodies at Costco."

Lee acknowledged he was allowed in his last appearance on the show to go through a "tutorial" about the economy that we quickly lost track of.

This time, Lee insisted there's "no recession on the forecast horizon," the Fed remains "accommodative," and non-stock investments still look unattractive.

Cooperman told Wapner he hasn't been adding to previously hyped pick SD, though he thinks it'll be OK if oil stays at this level for years.

Instead, Coop said he has been adding to ATLS but delivered more of a case for TRGP with too many details of the trees without him or Wapner clarifying the forest.

In TRGP, "the stock price allows room for further reduction in dividend," Cooperman explained.

Judge asked Coop to discuss what apparently is a pick for 2015, GRPN. But, "I wasn't prepared to talk about Groupon specifically," Coop admitted, though he did say he thinks there's 40-50% more upside in the name.

Judge noted Omega is out of AAPL. Lee shrugged and said there were simply better opportunities, it's "no indictment of Apple."

Cooperman rattled off a series of charitable endeavors and revealed, "My parents left Russia a hundred years ago."

[Tuesday, December 16, 2014]

Dan Nathan: Amazon

full of ‘garbage’

In this site's (the only one doing it) ongoing struggle to elicit a convincing answer as to whether Jeff Bezos 1) doesn't care a whit about stock price (that's Michael Pachter) or 2) only cares about stock price (that would be Bob Peck), we got another vote on Tuesday's Fast Money.

Dan Nathan informed his colleagues and viewers, "He doesn't really care about valuation, he doesn't really care about what Wall Street thinks."

That came during a segment with John Jannarone, who said a research note that AMZN should spin off Amazon Web Services reflects frustration in the stock among bigwigs and that one outcome of such a move is that the "stock would go up."

Jannarone downplayed the likelihood of such a move but said it's "symptomatic of a bigger problem at Amazon," which is that "these guys are not giving investors what they want."

Nathan curiously said that Jeff Bezos "has got so much garbage just to, kinda bunched up in here," and "I don't think it makes sense, and I don't think there's any trade here on that, to be very frank."

Jannarone said that's fine, but nevertheless, "the complaints keep piling up."

Guy Adami said the stock at 295 is in "absolute no-man's land."

Tim plays ‘The Price Is Right’

game with Guy’s S&P level

Guy Adami, citing a 110-point range in the S&P 500 on Tuesday that takes some calculus to get to, predicted on Fast Money that the market tests 1,950 on Wednesday.

Tim Seymour, however, offered 1,920.

Steve Grasso endorsed 1950 but said that what the market is doing in this pullback is "pretty much, uh, standard procedure."

Dan Nathan predicted that if the Fed removes the "considerable time" language, bonds will actually pull back, which is why he made sell TLT his Final Trade.

Guy Adami said he'll "stay in that camp" (Drink) that rates are going "significantly lower" (Drink).

Brian Kelly, who 1) either gets paid for a show appearance just by dialing in or 2) regretted not being on the schedule Tuesday, told Mel that if he were Russia, the first thing he'd do is start selling U.S. Treasurys. "You could have a spike in interest rates that nobody's expecting," Kelly actually claimed.

Tim Seymour on Russia is sorta like Jets fans in 2014

Tim Seymour, who spoke of all sorts of Russia scenarios and as usual made each one sound like his own opinion before going onto the next, asserted on Tuesday's Fast Money that "Russia is leading oil."

So, "I do think Russia can rally," Seymour said.

Seymour said we can start to see "stabilation" (sic) in crude around a level he drew on the telestrator that seemed to be around $60.

Guy Adami said SDRL might "finally" have turned the corner.

FT correspondent Jack Farchy, in a very interesting though choppy Skype hit from Moscow, said "people don't want to hold rubles" and are rushing to banks to cash in, but meanwhile, lines are huge at Apple stores.

Mel invokes air quotes,

asserts market punished ‘risky’ stocks

David Hilder, visiting the Nasdaq for Tuesday's Fast Money, suggested Citigroup's exposure to energy/EM/Russia isn't a major concern.

Hilder even said Citi's Russian exposure is "de minimis."

Tim Seymour, who had just spent several moments in a roundabout way suggesting Russia is, or soon could be, way oversold, questioned the possibility of Russia triggering a "Lehman-style event."

"To me, it certainly doesn't feel like 1998," Hilder answered.

Guy Adami tried to talk Hilder into fearing a flattening yield curve. Hilder didn't bite, saying the rates that matter to banks are short-term rates, so flattening "doesn't really bother me."

Dan Nathan opted to disagree with virtually everything Hilder said, suggesting Brazil, Venezuela is "where the contagion happens."

Playing the momentum, Steve Grasso said to just buy WFC among the banks because it's been the best performer.

Guy: Buy TSLA at 180

Steve Grasso, who had kind of a quiet show on Tuesday's Fast Money, said even though "obviously, crude has the effect" on Tesla, he thinks it's "more about competition and more about China."

Guy Adami said you can get long TSLA if it touches 180.

Dan Nathan said you've got a "Triangle of Death" in the stock, and went on to some lengthy technical explanations that weren't interesting.

Yet, Nathan said not to short it now, wait for a 10% bounce, and then he actually said that with a 1-handle, "I'm actually gonna start building a long position" ... but he hasn't done it yet.

Tim Seymour said of TSLA, "I think this is where you absolutely trade it on valuation," and called the stock "overpriced."

IBM had mojo

Steve Milunovich visited the Nasdaq for Tuesday's Fast Money and said AAPL will take a small hit from currency fluctuations, but he said demand in China looks strong.

He said IBM is "probably most vulnerable" among tech multinationals but while it's "probably in the process of bottoming," it'll take 2-3 years "to get its mojo back" (snicker).

Dan Nathan, not surprisingly, downplayed AAPL's potential in China and warned of "decelerating growth" there.

Nathan suggested GOOG could offer a "guide-down miss."

Guy Adami said to wait for DRI to break 60, then you can buy it.

Tim Seymour said he's "interested" in SPWR at current price but wouldn't say whether to buy it.

Steve Grasso said to sell CROX.

Guy Adami said to buy ISIS at 50.

Tim Seymour ‘offended’

by multiples in dining stocks

Dan Nathan on Tuesday's Fast Money said someone was floating the notion that MCD of all companies would actually spin out its real estate into a REIT, but actually 80% of the locations are owned by franchisees, so "I don't really get it." In any case, December 90 calls were active.

Tim Seymour, asked (instead of Pete Najarian, who somehow wasn't present on Tuesday's program) to address LOCO, revealed, "I've been particularly, you know, I guess offended by the multiples in, in some of these casual dining stocks."

Tim Seymour's Final Trade was CHL (Drink), Dan Nathan said to short TLT, Steve Grasso said buy DAL and Guy Adami said SAVE.

Retail legend: Athletic wear

improves women’s bodies

Well, if gals needed an excuse to head to Lululemon, Allen Questrom gave them one on Tuesday's Halftime Report.

Questrom told Judge, "People are going into athletic wear ... I think it enhances particularly women's figures."

Nobody was heard reacting to that comment, not even Josh Brown.

Elsewhere, Questrom said he's still "skeptical" of a JCP turnaround, but "my hope is they will ... it's an uphill battle."

He said for retailers, "I think it's gonna be a good holiday season." But he said the mall apparel sluggishness isn't the fault of online shopping, rather, it's just a lack of hot fashion.

Judge refuses to ask Mike whatever happened to Gerspach-must-go while Mike suggests theme of ‘Fast Money’ could be yesterday’s news

Mike Mayo, always one of the best CNBC guests, sat in with Tuesday's Halftime Report and asserted, "The bank that's most exposed to Russia is Citigroup ... but this is not new news."

Rather, Mayo said the company reported in its 10Q that "substantially, they're completely hedged." So, as always, "We think this is a buying opportunity."

"You want banks to make manageable mistakes," Mayo said.

Judge only half-heartedly challenged Mayo as to whether he has previously complained that C's mistakes haven't been manageable, and waved through a non-answer. (Translation: Unwilling to ask Mayo whatever happened to that demand months ago for John Gerspach to step down.)

Mayo said it's a "tough question" as to when the U.S. changes its "Japan-lite" approach to low interest rates. Judge asked Mayo what his reaction would be to "never." Mayo said, "You might want to change the theme of your show."

Jeff Kilburg seems to think no one knows the definition of ‘culture’

Steve Liesman on Tuesday's Halftime Report suggested the Fed still plans to start hiking mid-2015 but that world events would dictate the pace of those hikes.

Jeff Kilburg invoked 2014 Webster's dictionary ("culture") before saying the Fed will move the 10-year "lower for longer," except he never specified whether he meant the bonds or the yield.

Somehow making a dumb joke even worse, Scott Nations said, "Kilburg just told you everything he knows about culture. So let- That is it, that's as much as he can tell you," then said crude has "managed to make bonds at these levels look cheap."

Judge cracked, "Thank God Nations is a, uh, trader, not a comedian."

Paul Richards, meanwhile, insisted the ruble crisis is "very different to '98."

Richards said with lower gasoline, low rates and prospects of an ECB move, it's "great for stocks, if you can get comfortable with Russia."

Michelle Caruso-Cabrera briefly sat in with the gang.

Jonathan Corpina pronounced the market "very exhausted and confused."

8½ on a scale of 1 to 10

In a comment that a lot of folks would've liked to hear several months ago, Wilbur Ross told Judge on Tuesday's Halftime Report that a while back when he was appointed by Bill Clinton to the board of the U.S.-Russia investment fund, he realized Russia was "too tricky a place" to invest in.

Meanwhile, Ross told Judge he's been looking "more at the credit side of things."

Ross suggested China selling is overdone even though growth may be lower than advertised.

He said he's invested recently in the Bank of Cyprus.

But for the markets, Ross put the worry meter at "maybe 8, 8½" on a scale of 1 to 10.

Josh Brown said an analyst sees a 50/50 chance that SPWR does a yield co.

Pete Najarian said "it's almost time to start looking at GM again."

Stephanie Link sort of endorsed BA, saying the aerospace cycle "is still alive and well."

Josh Brown said AMZN and GOOG were moving Tuesday on "this Wall Street Journal speculation" that Google might test a "Buy Now" button.

Pete Najarian said quickly expiring December 72½ calls were being bought in LYB.

Pete Najarian's Final Trade was AGCO, Josh Brown said XLE and Steph Link said CERN.

[Monday, December 15, 2014]

Karen says ‘balls’

Karen Finerman was given a moment on Monday's Fast Money to explain why she wisely avoided the IPO for fast-fizzling W (that's Wayfair, not Bush), citing "very expensive acquisition costs."

Finerman went on to say she does like OUT, the safest IPO of this batch, but not EPE, given that "anything in the energy space, absolute disaster."

To get long that one, "You gotta have balls of steel," Finerman said.

But Guy Adami endorsed EPE "for a trade."

Then, Guy went on to endorse SDRL as soon as RIG cuts its dividend (Drink).

Dennis Gartman: Oil with

a ‘3-handle’ within months

Michelle Caruso-Cabrera reported on Monday's Fast Money that the ruble's tumble was its worst 1-day plunge since 1998.

Which meant, of course, it was time to summon Dennis Gartman for the opportunity to say that a 2% currency move in a whole year is a really big deal, let alone in an hour, and also that he remembers the days when it was 150 to the dollar so don't think this can't get a lot worse commentary about the "unbelievable panic" in the Russian currency on Monday.

We were most interested that Gartman told Guy Adami he was "not surprised at all" of rumors of Russia selling gold; in fact Gartman would be "surprised if they weren't selling gold."

That apparently prompted Karen Finerman moments later to bring up Brian Kelly's cockamamie theory that Russia could back its currency in gold. Kelly feebly asserted that it's still an appealing option.

Gartman called the Russian central bank's rate hike a "rear-guard action."

He added, "I think you see oil with a 3-handle, no question ... within the next several months."

Brian Kelly tries to impress colleagues with purported under-the-radar observation about Monday’s market

Karen Finerman on Monday's Fast Money said she was "a little bit disappointed" to see oil rising only "marginally" before sellers took over.

Pete Najarian rightly shellacked Brian Kelly's loopy point that stocks traded on homebuilder data Monday. (Mel could've brought in Kensho to decide it, but she didn't.)

Guy Adami hung a 108 on the IWM.

Later, high-yield expert Greg Peters said energy represents "quote-unquote (sic) contagion risk across all fixed income."

Peters told Finerman "it's a touch early" to start jumping in but a lot of "good opportunities are being created" in non-energy high-yield.

Of HYG, Peters told Melissa Lee one of the standard business television punch lines that makes no sense, "I think it's too early for a trade. I don't think it's too early to invest." (Drink)

Peters said he likes utilities and tech.

Karen Finerman said she put on a play in North Atlantic Drilling bonds.

Dan Nathan and Tim Seymour weren’t around to say TWTR has support at 30

Youssef Squali suggested on Monday's Fast Money that TWTR's quarter is going "pretty well" and that expectations are "muted," but he first made sure everyone knows this is the most volatile stock in his sphere.

"Facebook is actually our top pick," Squali explained.

Squali predicted TWTR will grow monetization of users because so much of it right now is international.

Guy Adami said "chompin' (sic) at the bit" rather than "champin'" and said he likes FB more than TWTR.

Ramon Llamas said "the pieces are coming together" for Xiaomi in the lower-end smartphone market. Karen Finerman called the low-cost phone business "scary" and "sort of a race to the bottom."

Mel has ‘average stature’

Guy Adami said on Monday's Fast Money you can be long F against 14.

Karen Finerman reminded viewers she tried GM "a couple times" (Drink) and "I think I lost money both times" (whatever happened to that all-the-bad-news-is-baked-in-at-34), and she's concerned the auto cycle is over because automakers have put up great numbers and "they still can't get out of their own way."

Brian Kelly said to sell bounces in BA, but Pete Najarian told viewers that the monthly slide in that name is "the opportunity that you're looking for."

Guy Adami said PETM ushered in a green day for brick-and-mortar retailers.

Pete Najarian said CRUS has more upside despite its big move.

Karen Finerman said GLNG was down because it's "an energy stock."

Mike Khouw said someone was buying January 30 calls in the VIX. Khouw suggested the VIX is "front-running" the S&P decline.

Mel said she is of "average stature." Guy Adami asked if that's in "Oz."

Pete Najarian's Final Trade was ISIL, which had some kind of unusual activity. Brian Kelly said to short TM. Karen Finerman said buy DECK, and Guy Adami said KO.

CNBC botches both elements

of TWTR outperform call (and appears to misspell ‘has’)

The CNBC graphics crew on Monday's Halftime Report said it was "JPM" hanging a $59 target on TWTR.

Oddly enough, Dominic Chu said it was actually "JMP" hanging a 49.

Josh Brown and Stephanie Link defended the stock, then did a low-5 (below).

Nili Gilbert contended, "The growth rate may be good, but the prospects for Twitter are going to have to be on point to justify that kind of valuation going forward (sic last 2 words redundant)."

Judge tried to squelch the fun by bringing up Dick Costolo's job security.

"The average user of Twitter is not connected to this man," Brown said, as though the average user of Google is connected to Larry Page.

Tobias Levkovich explains why he’s not expecting Santa as Judge insists Halftime Report has longer-term horizon

Pete Najarian said on Monday's Halftime Report that December has been "absolutely awful" for oil, which falls "each and every day."

But Pete said there are "folks getting flushed out" of the "profitable areas," which presents opportunity.

Judge and Pete spoke of a "medium-term horizon," prompting Judge to stress, "I don't want people to think that everything we talk about here is a 5-minute time horizon."

Stephanie Link said there are "better values in the majors" than XOM.

Michael Kelly cited 3 things (the maximum we can understand) that will keep U.S. oil production "stout," those being efficiencies, declining service costs and 3rd, "these guys just don't wanna stop."

Kelly said "$50 seems extremely overdone" in the crude space, and he has buy ratings on CXO, CRZO and SYRG.

Tobias Levkovich said some people actually claim energy accounts for 90% of the job creation over 5 years when it's really like "maybe 5%," so "people are taking this too far."

Judge asked Levkovich if he thinks Santa Claus won't show up before year-end. Levkovich responded, "I don't know, I'm Jewish, he never shows up in my house."

Brian Sullivan impressively calls out his own TV cliché

Brian Sullivan, on location at Janus, welcomed Gibson Smith to Monday's Halftime Report, then asked himself, "Why am I welcoming you to your own business."

For his part, Smith said Janus greeted Bill Gross with "open arms."

Should Smith's assessments of the bond market differ with Gross', "We'll be able to get on the phone and talk to each other," Smith said.

Sullivan asked Smith why bonds are trading where they are given the apparent strength in the U.S. economy. Smith cited emerging markets, Europe and "global stress."

Josh goes bottom-picking

during commercial break

Nili Gilbert, special guest of Monday's Halftime Report, trumpeted AMP as a winner in next year's low-rate, increased-volatility market. She also likes LOW, which was questioned by Pete Najarian for "by far" outperforming HD recently.

Gilbert also likes the insider ownership of OSTK and calls it a business with "a lot of efficiency."

Gilbert said BOBE has become a real-estate play, but her shop is neutral on the name.

Josh Brown said PETM has "been a great trade if you're long."

Pete Najarian said he bought NKE calls Monday.

Stephanie Link weakly said you'll see "kinda strength continue" in F next year.

Stephanie Link said she likes the upgrade on ALSN.

Pete Najarian said AGCO December 45 calls lit up like a Christmas tree; he made the shares his Final Trade (typical).

Josh Brown's Final Trade was XLE, which he said he bought during the commercial break. Stephanie Link said HDS and Nili Gilbert said MRO.

[Friday, December 12, 2014]

Dan Nathan: ‘No one has a vested interest’ in markets erasing YTD gains

Pete Najarian said at the top of Friday's Fast Money he wants to buy the dip, specifically COST, the same name he touted at Halftime.

But Dan Nathan scoffed and predicted 135 in COST in the next week.

Tim Seymour, pointing out the S&P actually has fallen 60 points in less than 2 sessions, insisted, "I don't think price is truth in oil."

Dan Nathan claimed "no one has a vested interest" in a stock crash (snicker) into year-end.

Melissa Lee almost used air quotes with "tradeable."

Brian Kelly asserted 56 is "major support" for WTI.

What happened to Pete’s

averaging down into LOCO?

Dan Greenhaus dialed into Friday's Fast Money and apologized to Mel for not being on the set in person, then — in not a very original point to be honest — said of oil and stocks, "at this point I think you really do need to see some level of a stabilization before people calm down."