The secrets of stock trading: CNBC often doesn’t disclose Fast Money traders’ positions, rarely whether they’re personal or for clients, and never their size

Posted: Tuesday, January 31, 2012

If a person recommends a stock on television, does that recommendation have more credibility if the person owns the stock ... or does not own the stock?

A review of just a week's worth of content finds that CNBC "Fast Money" panelists' positions are often not revealed to viewers, and that show disclosures on television and online appear to be voluntary, unenforceable, and in remarkable disarray.

At best, the "Fast Money" trading disclosures, collectively, are incomplete and unhelpful.

At worst, they are misleading, could cause reasonable viewers to wonder if some positions are being deliberately withheld, and raise doubts as to whether they should even be publicized given the half-hearted effort.

On television, once-regular text listing traders' positions as they spoke is virtually nonexistent. Online, some basic terminology is not defined, such as whether "no disclosures" means a trader affirmed no disclosures, or simply never responded.

This site does not necessarily fault the traders, as the traders do not produce the program or the Web site. However, the stated or listed positions ultimately reflect on them and the seriousness with which CNBC appears to regard stock-picking.

Consider an "Options Action" trade by Mike Khouw on Wednesday, Jan. 25.

Khouw was advising viewers on how to make a low-cost "bet" on a gradual increase in D.R. Horton (DHI) shares in the form of a "calendar spread," which was to sell the February 15 call and buy the March 15 call.

Khouw spoke as though he had some involvement in this trade, saying, "I'm looking at D.R. Horton," and "the way I was looking at doing that..."

The screen text (above) actually said, "MIKE IS USING A MILDLY BULLISH CALENDAR CALL SPREAD."

But take a look at the day's official disclosures at CNBC.com, and one finds that ...

... Khouw was not "using" anything because he apparently had no position in DHI, despite all televised indications to the contrary.

What's more, a day later, talking about different stocks, Khouw's positions were described this way at CNBC.com:

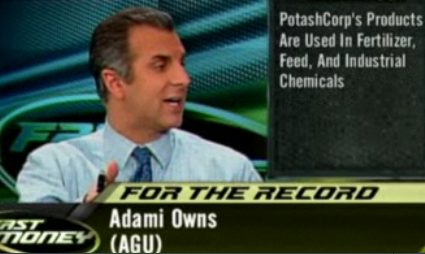

Early in the history of "Fast Money," televised disclosures were common. Host Dylan Ratigan often pressed panelists to declare on-air whether they owned the stocks they were discussing. Apparently producers required advance information, as screen text generally listed trader holdings, as in these 2008 images below:

Yet in 5 hourlong episodes of "Fast Money" and the "Fast Money Halftime Report" over 3 days, Jan. 25-27, such screen text listing a panelist's stock position was displayed once — when Anthony Scaramucci spoke on Friday, Jan. 27:

But note that 2 days earlier, when Scaramucci also spoke favorably of banks on the "Halftime Report," no such disclosures were mentioned or listed on television, and CNBC.com states (days later) that Scaramucci's disclosures for that day are "pending." (Perhaps one would believe Scaramucci became long BAC and C between Wednesday's and Friday's programs, but it seems Wednesday is more likely the oversight, given that Scaramucci's status in the Romney campaign is also not listed.)

Nowadays on "Fast Money" or the "Halftime Report," unless the host specifically asks, most positions are only revealed at CNBC.com, if there.

On Wednesday's (1/25/12) 5 p.m. Fast Money, Dan Nathan spoke a couple times about Netflix, including one remark about how, assuming content costs don't sink the company and international growth proves leverageable, investors "could see a stock in the 200 range."

That's quite a leap from where NFLX traded Wednesday.

No mention was made by Nathan of any position, nor did the screen text indicate a position. The CNBC.com disclosures, in fact, state that Nathan is long NFLX calls ...

... although it says "Nathan is long NFLX Jan calls," an interesting position on Jan. 25 given that, according to this calendar from MarketWatch.com, January options expired on the 21st, although perhaps Nathan's are for 2013; Nathan's first 5 options positions are listed with a month, but the last one, MSFT puts, is not.

Near the end of Wednesday's 5 p.m. Fast Money, Karen Finerman speculated positively that AAPL's embrace by value investors would be a net positive for the stock, while Nathan suggested the exit of growth funds would hurt the stock. Nowhere was it suggested on television what the panelists' positions, if any, were; according to the official disclosures online in the image above, Nathan was long "AAPL Jan puts," while "Finerman's fund" was long AAPL shares.

While those revelations do meet the show's apparent guidelines for disclosure, clearly they would be much more helpful shown on TV while the panelists were speaking and not subject to uncertain accuracy as in the case of Nathan's "Jan" options.

Lack of TV text disclosure is virtually standard now. On Friday's "Fast Money Halftime Report," Zach Karabell spoke about HON in "Pops & Drops" and concluded the show mentioning QCOM ("I'm gonna look at Qualcomm going into next week") without a screen reference to ownership (online it is stated he was long the stocks on Friday, perhaps buying one or both after the show aired), while Jon Najarian spoke about GDX and rumors involving RIG on Friday with no indication of ownership, on TV or online, even though online disclosures from a day earlier do indicate Najarian had a long GDX position.

Dan Dicker on Friday's "Fast Money Halftime Report" told viewers it is "time to bail" out of Transocean (RIG). Yet Dicker never disclosed his actual position on-air, and the online disclosure states he was long the shares Friday — not necessarily contradictory to his TV comments, but wholly confusing to a viewer who would wonder if Dicker unloaded most but not all of his position, or if he merely changed his mind after the program aired and opted to keep his stake.

As far as completeness, or satisfying some kind of internal policy, note that in just the last 3 trading days of last week, online disclosures of at least 3 "Fast Money" panelists were completely missing from CNBC.com: Those of Jon Najarian from Friday's "Halftime Report," Steve Cortes from Thursday's "Halftime Report" and Zach Karabell from Wednesday's "Halftime Report."

Presumably CNBC seeks disclosures — and promotes them erratically — for 3 reasons: to uphold internal policy, to satisfy any potential regulatory concerns, and (hopefully) to assist the viewer.

Given the incompleteness of this endeavor, it's hard to believe the first 2 considerations are of any great concern to the show. As for the 3rd, it can frankly be said that most of the disclosures are so limited, and sometimes conflicting, that they are of no use to the viewer and perhaps even counterproductive.

So, one wonders why disclosures are made at all.

The official CNBC.com "Fast Money" disclaimer seems mostly devoted to telling viewers how little trading help they're really getting. "You should not treat any opinion expressed on this website as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of an opinion," it says.

More telling is this passage: "The Fast Money Participants, CNBC, its affiliates and/or subsidiaries are not under any obligation to update or correct any information available on this website. The Fast Money Participants are professional traders who may be actively involved in securities discussed herein, on behalf of themselves, their companies and their clients. ... Also, the opinions expressed by the Fast Money Participants may be short-term in nature and are subject to change without notice."

So, there is no requirement that the information actually be accurate, the traders are apparently under no obligation to disclose anything beyond CNBC's own show summary, and no distinction must necessarily be made as to whether traders are "involved" in securities for their own account or for clients — although some of them do make this distinction online or on television.

Consider how this applies to positions mentioned by Mike Murphy and Jon Najarian on Thursday's (1/26/12) "Fast Money Halftime Report."

In the show's conclusion, Murphy stated, "We're shorting Fastenal, FAST." Najarian said, "DB, Deutsche Bank, I'm on the short side."

Yet ...

... the official disclosures indicate no Murphy position in FAST, nor a Najarian position in DB. (Note also that we've apparently reverted to 2011.)

When a "Fast Money" panelist declares being long or short a stock, most layman viewers wouldn't bother to seek a distinction as to the size of that position and whether it is owned personally or for clients. Yet, savvy and/or professional viewers would most certainly be interested in the nature of that position — whether, to use a fictitious example, "long IBM" means 10,000 shares in client accounts, or 50 shares in a personal account.

"Fast Money" panelists are never asked by the hosts to declare the size of their positions. Most do not address, though some occasionally do, whether they own shares for clients.

The online disclosures can be helpful in this regard. Note that in the example below ...

... Karen Finerman makes a distinction between her apparent own account, and her hedge fund (she, and not her fund, is long BAC, but the fund, and not Finerman herself, is long AAPL).

But with CNBC.com accuracy spotty at best, viewer confusion is inevitable, given, for example, what was posted for Patty Edwards after 2 appearances last week.

Note that Edwards' Tuesday disclosures (top) are all attributed to "Edwards," whereas Friday's disclosures are all attributed to "Trutina Financial." 2 of the positions, GLD and INTC, are the same. On Friday, Edwards on TV said she had been "adding" to gold positions she had never sold out of, without distinction between client or personal account; the same for when she said "I own National Oilwell Varco." (To her credit, Edwards regularly does state on television whether she owns shares for clients and is perhaps most inclined of all the show's panelists to declare long positions.)

Clearly CNBC and the business world are far more concerned about Wall Street analysts than stock & options traders. Generally when an analyst is queried about stocks during daytime programming (but usually not on "Fast Money"), the following graphic (such as this one Friday 1/27/12) is shown:

One might assume that a "Fast Money" trader would have an incentive not to disclose a certain position because 1) it was an obviously bad trade, or 2) the trader does not want clients to know he or she is in the stock.

There's another possibly more important reason to which this page is sympathetic: That a "Fast Money" trader might make an honestly spectacular call or series of calls, perhaps predicting a takeover for any number of valid reasons, and not wishing to draw attention from those who scrutinize timely trades. (Traders, in fact, have joked about this on the show.)

The issue here of "Fast Money" disclosures is not related to chicanery, but relevance. If disclosures on television are minimal, and disclosures online are temporary and quite possibly incomplete or inaccurate, and almost none of the disclosures include the sizes of the positions, then why disclose at all? How do they possibly protect or assist the viewer?

It seems clear that the burgeoning "Fast Money" franchise, still in expansion mode after 5 years on the air, does not consider it a priority to adequately pin down anywhere from 10-20 traders on a given day for stock ownership specifics which are undoubtedly unverified and clearly unedited, implying that, considering the show's responsible-for-nothing disclaimer, "Fast Money" stock picks might be intended for entertainment purposes only.

Update (Feb. 1): This site noted in a special report issued Tuesday on the incompleteness and uselessness of Fast Money disclosures, that the official CNBC.com Fast Money disclaimer contains terminology such as this:

"The Fast Money Participants are professional traders ..."

Notice that sentence is written in present tense.

Is Ron Insana, who occasionally takes a seat at the Fast Money desk as a panelist opining on stocks, actually a "professional trader"?

Insana's bio at CNBC.com labels him "CNBC Senior Analyst & Commentator" and is remarkably limited and seems outdated, though it is the profile that appears when his name is clicked. There is no mention of any career in money management or trading.

Yet as many CNBC viewers know, and Insana's Wikipedia page makes clear, he left his long-standing anchor post at CNBC to start Insana Capital Partners in 2006, a fund-of-funds (according to an Andrew Ross Sorkin article in Dealbook) intended to guide investor money to select hedge funds that was folded in summer of 2008. Insana then spent about 6 months with SAC Capital.

Insana's most recent Huffington Post bio (he apparently has not written on the site since January 2011) says he "is a CNBC senior analyst and commentator and host of a (sic) 'The Insana Quotient,' a nationally syndicated daily radio show. He is also the Wealth Advisor at Kubera Advisors, a 'whole life' advisory group that offers financial, legal, health and wellness counseling to high-net worth individuals and families."

Insana's face does appear at the Kubera Advisors Web site, with this description: "Our wealth advisor, Ron Insana, will help you: develop financial literacy; learn to work effectively with other financial advisors; make your money support a sustainable lifestyle; understand and review your portfolio and asset allocation; master the art of due diligence; find the synergy between wealth and life purpose; plan and build."

Insana's radio show bio makes no mention of money management.

Notice in the photo above Insana was labeled by the text on Tuesday's 5 p.m. Fast Money as "CNBC Business News," which makes one wonder what's stopping Joe Kernen (other than the late afternoon hours) from taking a seat at the table and spinning FSLR in one direction or another as his Final Trade.

Unlike the schadenfreudeists on Wall Street, this site applauds Insana for taking a chance at money management. Whether he is now a credible voice of trading is subject to the eye of the beholder, his money-management background being something CNBC deems unnecessary for Fast Money viewers to know.

It would seem as though CNBC otherwise sees no value to Insana's hedge fund venture, except when it needs to fill a chair on Fast Money, where Insana evidently quietly qualifies as a "professional trader" with credentialed opinions on the direction of Citigroup, which was his Final Trade recommendation Tuesday.

Whether Insana owns C, and whether he presently is managing and trading stocks for himself and/or others, is unknown, in part because not surprisingly (see the special report), Insana's name was not mentioned in the Fast Money disclosures for Tuesday, despite his recommendation of C. Which only provides a little bit more traction to that "for entertainment purposes only" thesis.