[CNBCfix Fast Money Review Archive, February 2012]

[Wednesday, February 29, 2012]

William Shatner tells Charlie Rose he unloaded PCLN at the bottom

If you're ever one of those people who occasionally looks at your long-term stock accounts and realized, "Gee whiz, I'm the worst trader of all time" (lotta hands going up around here), know that you've got company on the USS Enterprise.

William Shatner paid his first visit to Charlie Rose's show Wednesday, and Charlie (how does he do the interview show plus CBS mornings?) told Shatner, "Some people believe that Priceline.com has made you a very rich man."

Shatner explained "I'm a business major," and so, "I know a little bit about being locked up" with stock in an "original" company. He said, "I did indeed negotiate, uh, getting stock ... when it first started," and the shares of course skyrocketed, and then after a year, year and a half when the lockup ended, "the moment you could sell it, it was worth pennies."

Charlie wanted to make sure Shatner didn't dump it all at that time. "I sort of did," Shatner admitted, though he said he doesn't remember for sure.

By ‘I’m not sure,’ he really means, ‘I sure as hell don’t think’

Doug Kass reiterated/outlined his short thesis in detail on Wednesday's 5 p.m. Fast Money, and once again Ron Insana was on hand to stand in the way like Patrick Roy circa 1986.

"I shorted American Express today," Kass said, citing high gasoline, and said another name to look at is Regal Cinema, not because that's where Steve Cortes once reported making out for the first time, but because of the "absurdly high concession and admission costs" (gosh, when did that become a new thesis?), then RTH, then the fact he's an "anti-dentite" and suggests shorting Henry Schein, and finally China, "you can short the FXI," and maybe even MS and GS too.

"Dougie it's Karen let me ask you something," chirped Karen Finerman, wondering if his long oil platform coupled with a slowdown in emerging markets could be "at odds with one another." Kass insisted there could be moderation in emerging markets and an "exogenous event" in the Middle East.

Ron Insana pointed out that there's a number of angles Kass is suggesting that, if true, would produce a market collapse, and that bonds haven't fallen apart. "I'm not sure the premise is right," Insana said.

Once again, being long gold in non-U.S.-dollar terms pays off for Dennis Gartman

A day earlier, Dennis Gartman recommended long gold on Fast Money.

On Wednesday's 5 p.m. edition, Gartman said, "I gotta admit, this was really quite a day" in gold, and if you own it, "you have no choice" but to sell.

(And, Fast Money viewers probably have no choice but to expect a series of Guy Adami theoretical updates on whether this is anything more than a pinching of John Paulson.)

Anyway, Gartman reported a silver lining thanks to one of his patented cliches. "I lost a whole lot less being long gold in euro terms, and long gold in yen terms, than by being long of gold outright," Gartman said, while taking the opportunity to ask a lot of questions of himself. "Sometimes you play defense," he said.

Pete Najarian said all hope should not be lost in the GLD, that some "very large folks" are shifting from March to May in buying calls.

Karen predicts endurance of Fast Money franchise

In television, sometimes just airing a program for a single season can be a monster accomplishment.

And so it speaks well of Karen Finerman's optimism for Fast Money when, discussing SPLS on Wednesday's 5 p.m. episode, she said the stock should be a long-term performer, something to hold for maybe 2 years, when "we'll still be here."

(Critic's note: And that will be great, provided something is done about this 2-hour split format.)

Finerman said the company has a "valuation that's incredibly attractive," and the biggest complaint of shorts, AMZN, needs to be weighed against the fact SPLS is the No. 2 Internet retailer.

"I did buy a little more today. I probably will buy some tomorrow," Finerman said.

Ron Insana confirms Melissa’s conclusions about panel’s interest in video games

Almost every day, you can learn something new on Fast Money.

Glue Mobile chief Niccolo De Masi (we'd never heard of the company before) revealed on Wednesday's 5 p.m. show, "My firm GLUU is actually the only listed company in North America that's solely focused on making games in the free-to-play business model for specifically Apple and Google's platforms."

But ultimately, it sounded more like De Masi was speaking more to the tech giants than Fast Money viewers, assuring Mel Lee his company is shareholder-friendly, and it's "always willing to enter those conversations with uh, with any suitor."

"Uh, it's Karen let me ask you something," said Karen Finerman at one point, wondering about the company's percentage of players who actually buy something. De Masi said it's "very similar" to Zynga, something like 2%.

Lee concluded afterwards that the Fast Money panel probably doesn't fully appreciate this business because "We're probably a different generation" than the audience for this stuff.

Ron Insana said, "I hate to say this; they're all fad stocks."

Karen Finerman sort of rebuffed and confirmed that at the same time, saying, "Actually do own some at the firm. It is not my position."

Karen wonders if Greater Fools aren’t finding a home in AAPL weekly options

One of Karen Finerman's strengths as a money manager is maintaining an emotional detachment from her holdings, never more evidenced than her recent skepticism of the daily moves in AAPL.

On Wednesday's 5 p.m. Fast Money, Finerman flat-out asked Pete Najarian if the weekly 570 calls in AAPL could possibly represent fundamental changes in the company rather than just the "Greater Fool Theory." Pete sort of argued that they can, after a brief interruption from Mel Lee, that once something like a new iPad is unveiled, they sell in a hurry.

Finerman shrugged that the stock could be up $11 because people suddenly figured out there's going to be a new iPad, but Ron Insana tried to claim they're envisioning a dividend also.

Finerman said a big reason why big-cap tech has been pushing the Nasdaq to 3,000 is that "valuations were just absurd."

Ron Insana said not to fear a rising Nasdaq; "we're nowhere close to the valuations" of 1999.

Pete Najarian thundered that the "law of large numbers" argument about AAPL "just doesn't stand up." Joe Terranova said he wonders if Steve Jobs would've been interested in owning all of DIS.

Once again, another program in which RIMM is a no-show

David Pogue visited the Fast Money set for Wednesday's 5 p.m. show and delivered an appealing visual of what Microsoft plans to do to tablets.

Pogue said it's going to be about a "Start screen" rather than the Start menu button, and that it can work with 2 monitors, "the old Windows is still hiding just under the surface."

He said it gives Microsoft "a fighting chance at tablets and phones," and that the touch portion of Windows 8 is more appealing than the desktop PC version. "The people who try it will love it," he said.

Karen Finerman said there's nothing wrong with a good product, but Microsoft is already so far behind in the tablet space that it's not a big incentive to buy the stock.

Mike Khouw's Final Trade was to hedge NE; Joe Terranova said NXPI. Ron Insana advised paring down AAPL. Karen Finerman said to buy SPLS at $14.50 or lower. Pete Najarian touted INTC; "I bought more today."

Haven’t heard much about

Research in Motion and Yahoo for a while

Somebody at CNBC makes the big bucks for making tough calls such as whether to show Ben Bernanke's Capitol Hill testimony or Judge Wapner's Fast Money Halftime Report on Wednesday, and to be honest, this one is sort of a push, and we might even lean more toward Judge.

Some Bernanke hearings are more intriguing than others. Wednesday's was an utter dud.

On the other hand, having Colin Gillis talk about AAPL's market cap isn't exactly Evel Knievel hopping over 14 Greyhounds (that's buses, not racing dogs) at King's Island either.

Gillis, whose camera ultimately ran amok, said that as the No. 1-ranked market cap, AAPL, "you know, it's only got, you know, it's only got room to fall," and said MSFT is more promising at this point, partly because 47% of machines out there are still running Windows XP.

Josh Brown said one thing for MSFT and INTC is that the "shareholder base has changed" over the years and thus the stocks are "getting more interesting," but he wouldn't be buying based on Windows 8.

Ben Bernanke, but not the Fast Money Halftime gang, talked about gas prices.

Yesterday Dennis Gartman

recommended long gold

Stephen Weiss maximized the most of his meager minutes on Wednesday's Fast Money Halftime Report to say he likes TBF, the "risk/reward in bond market is terrible," and he evidently maximized his down time off-camera to buy SODA.

Brian Kelly said the Fed chairman has "taken away that Bernanke put." But Kelly said viewers can stay in stocks, but "I think you need to wait on gold right now."

Steve Cortes, whose official position on gold in Against the Herd was to avoid it in either direction, said stocks weren't doing much Wednesday but it's a day of precious metals. "I think gold and silver remain very dangerous," and "I wish I were short both of them," he said.

Josh Brown said he doesn't understand the negative reaction to possibly reduced prospects for QE3. "Why would we want QE3," Brown asked.

Guest Andrew Burkly predicted the S&P would hit 1,300 before 1,400, which is a bit at odds with Guy Adami's recent expectations. Burkly said the 2% monthly hike since the bull market began tends to slow by the 3rd year and that he expects a "soft patch" maybe over 6-8 weeks, in part because short interest is now at the lower end of the range.

"I think he makes excellent points," said Steve Cortes.

Mitch Pinheiro, with a $60 target, said SodaStream's selloff is sort of predictable and not catastrophic and that the stock is "still an early stage trend."

Josh Brown wasn't impressed. "I'm not a buyer, I, I think it's a little bit faddy," Brown said. Stephen Weiss for his Final Trade said he picked up some shares during the break (apparently taking a pass on DMND).

Weiss said "it would've been a mistake" for VVUS not to do an offering now and strike while the iron's hot.

Brian Kelly's Final Trade was short yen using FXY. Steve Cortes said to sell solar, and Josh Brown said if you're in cash, try the SPY and at least "do something." Tyler Mathisen seemed locked in a permanent grimace during a technical glitch during the Power Lunch promo.

[Tuesday, February 28, 2012]

Keith McCullough matches

Dennis Gartman desk attire standards, sticks it to Dennis’ overcooked ‘been doin’ this 35 years’ cliche

Yale 1, Akron 0.

Most of Dennis Gartman's standard cliches, good or bad, go unchecked by the Fast Money crew.

But that was before the Commodities King ran into Keith McCullough.

McCullough on Tuesday's 5 p.m. Fast Money dissected his own portfolio, explaining his month-end positions (interesting no one else on the show does that) and said the goal is to "be careful of what's being marked up."

McCullough said he's "long inflation ... and we wanna be short growth." So he said that calls for TIPs, and to be long gold, and that he swapped out of the XLF into utilities, where he would "own the dog for its dividend yield."

Mel Lee, in a sexy blue turtleneck, said she noticed that McCullough had gone from 91% cash at the end of January to 52% and wondered where it went. McCullough seemed to misinterpret the question as meaning, either way, it's a lot of cash, so why, and said there's a big difference between managing your own money and other peoples' money (certainly correct), and that the Fed is putting too much inflation in the system.

That's where Dennis Gartman jumped in, with a look of skepticism, saying that he's only been doing this 35 years, and the Fed chairman is telling you he wants you to be in, and so, "Why would you fade him ... why would you fade the Fed?"

McCullough said it doesn't matter whether one's been doing it for 35 years, or 13 years, or even a couple days, but "at the end of the day" (he said that a couple times) it's an issue of the Fed not being able to fully control what it's inflating.

Scott Minerd evidently does not believe what he would read in Against the Herd

After butting heads on Tuesday's 5 p.m. Fast Money with Dennis Gartman, Keith McCullough evidently was feelin' it when Scott Minerd moments later made the case for risk-on for years to come.

Minerd, ushering in the inaugural Fast Money Portfolio feature, said "The world is just being flooded with liquidity," that it's risk-on time and time to be long high-beta, while at the same time expect a "pretty ugly correction in Treasurys" for 2-3 years.

"It's Karen I agree with you" about the macro level, Karen Finerman said to Minerd, without seeking clearance to ask her question.

When it got around to McCullough, though, Minerd got a direct challenge as McCullough summarized Minerd's argument as meaning inflation doesn't slow growth. "How did that work for you last year?"

Minerd said last year's commodity-price-induced slowdown actually marked a "great buying opportunity for risk assets" in what was merely "temporary bursts of price activity ... transient."

Karen Finerman said she likes oil services in Minerd's scenario but cautioned that inflation could hurt financials. Guy Adami pointed to gold, which he said has seen an "unabated rally" since the Paulson-led selloff.

And if FSLR was SHLD, it would be up 12% on this news

The Fast Money open mike (you can hear it quite clearly on the Web as opposed to TV) sometimes provide interesting perspective, as on Tuesday's 5 p.m. show when preeminent FSLR critic Gordon Johnson said "their stuff is not working in the field," and fairly quiet peals of laughter were heard ... from somewhere.

Johnson said the FSLR earnings print was "much worse than meets the eye," and in a series of mortifying (for any longs) pronouncements, called this new news, "huge red flag ... this is a game-changer" and potentially a "game-ender."

Johnson said First Solar does have a contract with the Department of Energy, but notably said while it could be a "black eye" for the administration, the White House wouldn't have known something like this was coming. Dennis Gartman cracked, "It's not a DOE loan, it's a DOA."

Why put down 30% if you can get a 3% mortgage?

Doug Yearley, CEO of TOL, said on Tuesday's 5 p.m. Fast Money that the company is feeling the best it's felt in 5 years (and we're probably going to be hearing that phrase increased by 1 year every year for years) and that they're keeping their "fingers crossed," but the homebuying market is getting stronger because "people are sick and tired of waiting."

"It's Karen let me ask you something," chirped Karen Finerman, wondering if buyers are having trouble getting loans. "Not for us," Yearley said, saying TOL buyers put down 30% and "they're not even maxing out."

Yearley said TOL's toughest competition is the small regional builders, many of whom were "destroyed" in the housing collapse, and that TOL's hottest markets are New York, Hoboken and Brooklyn.

Keith McCullough scoffed at the TOL gains since October, pointing to its longer-term chart and asserting, "To me it's like comparing it to tulips." Not only that, "demand doesn't look like it's a layup from a long-term perspective."

Guy Adami said the trade in the space continues to be Home Depot.

Gartman: Oil/nat gas to narrow

Guy Adami said on Tuesday's 5 p.m. Fast Money he thinks the stock market has maybe 50 more S&P 500 points in it, while conceding the transports are "trying to warn you" that it's not all blue clear skies.

Dennis Gartman said he too is "very leery of what's going on" in that the transports are not "co-extensive." Keith McCullough opined that "A top is a process, not a point."

Gartman said "I think crude oil prices are about to come down," then later explained, "I sold some crude today," which didn't feel good right away, then the "bottom fell out."

Gartman told Melissa Lee he expects a narrowing of the crude/natural gas spread and drew comparisons to what they were at 6 months ago. Guy Adami said a TSO short could be your play, which could go to $22.50 or $23.

Fast gang sets record Tuesday for most references to talking about stuff off-camera

In a fairly interesting feature (far more interesting than all the references to conversations viewers never actually heard) on Tuesday's 5 p.m. Fast Money, panelists took up a smattering of stocks that have actually outperformed AAPL for 3 years.

One of them, BWA, suffered a "hiccup" (terminology that Mel Lee liked) last year, according to Guy Adami, and "it's not all that sexy, but it's a tremendous stock."

Keith McCullough said it's all about "performance chasing." Karen Finerman said what she wants to know about those big winners is, "What kind of leverage do they have," but then she conceded Whole Foods has none despite monster gains.

Dennis Gartman said some, such as IP, are doing it with job cuts. "They laid an entire city off frankly" in Virginia, Gartman said, and how exactly does a company lay off an entire city?

Somewhere in the conversation, Karen Finerman said AAPL "feels a little frothy." McCullough pointed out it's up "18% for the month." Melissa Lee said the Goldman Sachs survey finds just 4% of AAPL is owned by hedge funds.

Adami: ‘Step on the gas’

in silver

A Twitterer on Tuesday's 5 p.m. Fast Money asked about SLW, and Guy Adami declared, "Now's the time to step on the gas."

Guest Gerard Cassidy spent his time gushing about JP The Great, calling JPM "one of our top picks ... great opportunities for this company."

Larry McDonald also guested, with little to no dramatics, purportedly to talk about Greece default but saying systemic risk has stopped commodity rallies since 2008, prompting Mel Lee to ask for a prediction like the reporter in "Rocky III" talking to Clubber Lang. "I think there's going to be a default of some kind," McDonald said.

Keith McCullough revealed he and McDonald tweet about this stuff early in the a.m. every day, and that "they're all gaming the game." McDonald said the LTRO above 700 is bad for euro but probably good for gold.

Keith McCullough's Final Trade was to short XLY. Guy Adami said PAAS. Karen Finerman said TGT, and Dennis Gartman said to buy gold, sell crude.

Sleepy Gina Sanchez accuses Brian Kelly of not reading the ‘whole’ RGE Monitor report

We were hoping to find Patty Edwards — who sort of mocked, via Twitter, skipping the Oscars for a hockey game only to sort of sound like she wished she really was watching the Oscars — on Tuesday's Fast Money Halftime Report, didn't happen; instead we did get Gina Sanchez, who unfortunately looked to be in dire need of a couple more hours of sleep while leaning first awkwardly into the camera and then to her left in a discussion that was a little off-kilter in more ways than one.

Sanchez said RGE isn't unloading but is cautious now; "we're thinking about it ... eyeing the exits," though she said she still likes consumer staples and consumer discretionary.

Brian Kelly asserted, "It was the beginning of February that, uh, your firm turned bullish," and demanded to know what had changed. Sanchez fired back, "If you actually read the whole report of what I said, we were still cautious then as well." (Good thing she summarized, because hopefully not too many people want/need to read the entire RGE Monitor report.)

Judge felt compelled to jump in and second Kelly's question; what's different now than the beginning of February. Sanchez said the good things they thought would happen have happened.

Brian Kelly insists it’ll only take 3 big things to make investment banks ‘fly’

Brian Kelly said on Tuesday's Fast Money Halftime Report that investment banks are getting money at 2%, which is "essentially free money" given 2% inflation.

And for the stocks to go up, "all you have to do is get some kind of regulatory relief, have the Volcker Rule not be as bad as everybody's expecting, and get any kind of uptick on the housing market, and these names are really set to fly (bought XLF morning and KRE)

Paul Miller said JPM's a decent choice but "right now the environment's still tough," and it's a "tight trading range."

Zach Karabell continued to douse enthusiasm for banks. "It's not an interesting trading and/or market call for me," Karabell said.

Judge says ‘sucks’

In another sign Susan Krakower should take seriously this site's idea of an AAPL show, Dan Ernst guested on Tuesday's Fast Money Halftime Report to rattle off the last decade of Apple Computer/Inc. and said of his $700 target; "Apple is absolutely cheap."

Steve Cortes offered a note of caution on PCLN, pointing out airlines haven't rallied this month.

Herb Greenberg complained that ODP's same-store sales were actually down 5%. Judge Wapner argued that the stock is up big in 2012. Herb groaned that "year to date is a ridiculous metric." Judge then scoffed that he's sure the people who bought ODP at the beginning of the year think their 63% gain "sucks."

It was the first time we've seen the "Herb's blood pressure" graphic.

George Davis offered what might be a timely currency trade, short euro/Aussie, although his interview was anything but timely, as viewers had time to put in an order at Schwab.com by the time Davis heard Judge's question.

Joe Terranova got the lone Final Trade, OXY.

Joe exits AAPL short;

Cortes seeks ‘dry powder’

Apparently taking only minimal loss, Joe Terranova revealed on Tuesday's Fast Money Halftime Report that "I'm out of Apple, I got out of Apple yesterday. I gotta tell you Scott, it feels good to be out of Apple because it subsequently has rallied."

Judge chuckled about being happy about being out of the short. Terranova said the key is keeping the losses small.

It was an interesting try; there was a chance, had the market tanked at all in the last week, it could've been one of the biggest calls of the year, but honestly it did sound a bit at the time like picking up pennies in front of the train, or however Tim Seymour's analogy goes.

Terranova said the market keeps drifting higher, because "everyone's getting too cute trying to pick the top."

Steve Cortes, meanwhile, crowed about taking profits in bonds, not because he no longer likes the asset, but because he wants "dry powder to try to go after shares from the short side."

Zach Karabell said the bond environment actually helps make things "quite bullish for equities" because there are "very very few places to go" for a return. Brian Stutland said the "market's actually begging you" to sell upside calls.

All it took was a few comments from Mr. Folksy and suddenly housing is like AAPL

Doug Kass paid a visit to Tuesday's Fast Money Halftime Report via the Fast Line, but his wait-for-the-inevitable-pullback claim ultimately ran into a tough hombre in the form of Zach Karabell.

Kass started off claiming "the weaker regions are masking the developing recovery in housing" and said there could be a housing boom cycle through the end of the decade.

But then he stressed a couple of conditions that figure to be an overhang on the market, including the likelihood of Barack Obama's re-election ("I'm a Democrat, but most investors feel that a Republican administration would be more business- and market-friendly, and I agree with that").

Kass also flagged the surge in gasoline prices (though he didn't say people are going out of their way to Costco to pump gas and then buy more stuff inside), saying, "historically it has not paid uh, to own equities during this period."

When Steve Cortes, who got a hiatus apparently from the book/speaking tour but apparently hits Georgetown this week, challenged Kass on housing, Kass first told him to "get out of that bond market man." Cortes insisted, "I took profits on my bond longs this morning," but he still likes it in general."

Anyway, Cortes said if we're gonna be talking about bottoms, it should be "J. Lo or perhaps Ice-T's girlfriend," and that "we're not seeing an appreciable uptick in new home-loan demand" and thus there's a "systemic problem here."

Kass told Judge Wapner that he's got a "shopping list," for "if the market comes in, say, 4 or 5 or 6%," which includes HD, LOW, ETFC, and also BAC, C and XLF. Zach Karabell pointed out that Kass called at the beginning of the year for a new high in stocks, and "how long do you wait for the pullback to happen" if the market continues to rise. Kass called it a "great question" and then mumbled about his "ambitious 1,550 target" and how it's "less of an outlier" now and then invoked Rocco in a difficult-not-impossible opinion and concluded with a "wait and see" tangent that utterly dodged the question and either referred to his call for the high or the pullback, we're not sure.

More from Tuesday's Halftime, and 5 p.m. Fast Money, later.

Gary Kaminsky says notion of Moynihan inheriting a bad situation is ‘b.s.’

Gary Kaminsky addressed with Carl Quintanilla on Tuesday's Squawk on the Street a couple subjects recently covered on Fast Money, namely the notion of Ken Lewis' mess being dumped on Brian Moynihan (which was referenced by Stephen Weiss the other day in saying Moynihan's done a "great job").

"That's just b.s.," Kaminsky said. "Moynihan was part of that team."

Kaminsky also said he heard Mr. Tortoise-shell glasses say yesterday that he owned JPM but only in his personal account, and that Kaminsky in his money-managing days would've taken heat for something like that, and for Berkshire's "closed end" investors, there's "no added value there."

Only in technical analysis is a stock/ETF a buy and a sell at the same time

On a quiet 5 p.m. Fast Money on Monday, Carter Worth unleashed the biggest head-scratcher.

Worth pointed out the chart of XHB and said the short-term pop means "sell" for intermediate-term holders, but the longer-term chart shows the beginning of an uptrend. So, it's a "buy and a sale the exact same time depending on who you are in the market."

It's kind of hard to go wrong with that kind of thinking. After all AAPL on Monday was down, and then it was up, so on Friday you were sort of right no matter which direction you had it.

Worth resorted to his most popular cliche, all those old buyers at higher prices looking to get made whole, and said this is why a pause in small caps is to be expected, but should be "benign" (which we haven't heard from Guy Adami for a while) and "complacent" even in other indexes.

Worth said GNK threw a monkey wrench in his previous buy call with its secondary, but "stick with the trade." Scott Nations said options players have decided the opposite, to "collect a lot of premium at these levels" because they think the move is over.

Karen Finerman said of housing, "I think the bottom's in for the stocks," but she went to great lengths to make clear that's different than the industry itself. Anthony Scaramucci said he thinks the bottom's in housing, but he thinks the stocks have gotten overvalued.

Karen: ‘I don’t know what’s continuing to make the market go up’

It wasn't too long ago when Mark Fisher chastised the Fast Money gang for sort of feeling they've got a have an opinion on everything, and maybe there are some things you just don't know.

Karen Finerman on Monday's 5 p.m. Fast Money would've made Fisher smile, admitting, "I don't know what's continuing to make the market go up. I don't."

Guy Adami painted something of a win-win scenario, asserting the market doesn't give you this much opportunity to sell at the top if it's going lower, but that a blowoff top could be coming that will ultimately give the shorts a chance, perhaps at the May 2008 highs of 1425.

Scott Nations said there are still nonbelievers sitting on the sidelines who will be good for stocks in the long run.

Anthony Scaramucci said in 2012, "it's very hard for these hedge fund guys" (and we know tons of people will sympathize with that), because most of them are less net-long exposure than the general market. He said what's winning are "reflation trades."

Perhaps tempting fate again, Scaramucci returned again to his AAPL size theory, saying it didn't hold last year, but "they are at some point gonna get up against those big, big behemoth numbers." Dan Nathan basically agreed, saying, "Everybody owns it, you know at some point, I think something's gotta give here."

The Moochmeister said AAPL is one of the longest positions in hedge funds and so he agreed with Nathan. But even though he's a hip guy, Scaramucci still called it "Apple Computer" (they changed the name to Apple Inc. a few years ago).

How come EXPE never hired Leonard Nimoy?

Guy Adami on Monday's 5 p.m. Fast Money took up PCLN during Monday's impressive afterhours action and said he's actually not going to recommend pulling the ripcord, but in fact the stock unlike, say, CRM, does make sense at its post-earnings valuation.

Adami asked guest Aaron Kessler the profound question of how high can the stock go. "It can definitely go higher than 700," Kessler said.

"It's Karen let me ask you something," said Karen Finerman, reliably, wondering who is taking the hit from Priceline's success. Kessler, who has a $685 price target, suggested it's travel package tour operators.

Guy Adami and Melissa Lee did that William Shatner banter again. "I'll arm-wrestle him right now, I mean, winner takes The Negotiator label," Adami said. Anthony Scaramucci said he had a "Star Trek" communicator in 1974.

Karen is trading a stock none of her TV colleagues knows anything about

In the category of Stocks Discussed on Fast Money That Fast Money Viewers Will Almost Certainly Never Buy, we're gonna have to start including Australia's own surfwear maker Billabong.

Karen Finerman predicted on Monday's 5 p.m. Fast Money that TPG's last bid is not the end of this story. "I don't think it's over yet ... there's still value there," Finerman said. "We're long Billabong."

Mel Lee asked a question about a TPG's interest and said "at the end of the day."

The conversation ended on a flat little space of dead air, as no one else had anything to offer on this trade, and the transition proved a bit choppy.

Evonne Goolagong was not someone who played tennis against Bobby Riggs, but he did defeat Margaret Court.

Tim Seymour wasn’t on to say BAC stole Merrill

For the longest time, you could've said JPM was the most popular stock on Fast Money, everyone from Stephen Weiss to Karen Finerman scooping up bucketloads of the always-too-cheap stock.

Until, apparently, people finally got sick of it last year.

Jamie Cox guested on Monday's 5 p.m. Fast Money to say that Jamie Dimon doesn't have a grand announcement up his sleeve, but would "expound upon his comments on housing."

Now, that sounds even more exciting than "The Artist."

Cox said the stock should probably grind higher, but something like a $10 move in 2 months is "just not in the cards."

Karen Finerman delivered her old reliable intro, "It's Karen, let me ask you something," and returned to her most desperate refrain, when will the "normalized earnings" return. Cox said he expects a "gravitation back to the banks," and he also said he's against a breakup of JPM.

Dan Nathan said, "I think a lot of the easy money's been made."

Our favorite bank trade — not like it's a popular category — is Steve Cortes' BAC short, and it's important to note it's not because we're rooting against BAC longs, but rather just because this is one of the more competitive trading challenges you'll see, big moves happening almost every day. (But then again, he's busy not only managing trades these days but a book tour, so he might've thrown in the towel at some point.)

Carter Worth pointed to BAC's chart as making a bearish to bullish reversal, same for GS; "all financials look this way."

What the heck — nothing about rising gas prices hurting the economy, pumping gas at COST, Brian Kelly’s 4%-to-8% savings-rate spike ...

Money in Motion brains & beauty Rebecca Patterson is turning her attention to Sverige, calling it on Monday's 5 p.m. Fast Money part of "broader Europe." She wants to be long U.S. dollar and short the krona and says you can jump in right now.

Karen Finerman pointed to the Fast Money stock of the year for 2011 (our call), GLNG, as way better than Cheniere in gas exporting.

Anthony Scaramucci said JNJ maybe is more expensive than Pfizer, but "I like it a great deal."

Guy Adami hailed DIS, saying it's "definitely going to 45," and that it's all about "media content ... they're crushing it."

This page is "media content" too.

But we're not exactly "crushing it."

For his Final Trade, Scott Nations said he was buying put spreads in SPY. Anthony Scaramucci mentioned MSFT, Guy Adami mentioned WLK, Karen Finerman said "Hi it's Karen let me ask you about a Final Trade" (no, that was only a joke, she didn't say that) ... and spelled out COV for viewers. Dan Nathan recommended viewers "consider stock replacement in the banks."

Analyst actually says he’d buy BRK on naming of successor only if that person were himself

Meyer Shields took part in the best Fast Money Halftime Report segment Monday that somehow was left to the end of the program.

After explaining to Judge Wapner that the only difference between BRK-A and BRK-B is a "mathematical equation between the 2," Shields asserted, unlike Whitney Tilson, the shares are trading in the normal relative range to the S&P and so "there's no particularly attractive opportunity in Berkshire now."

Judge harped on Shields' contention in a note that Buffett's succession is a reason to be wary of the stock and asked if that's legit. Shields said that according to actuarial tables, no one lives forever, so yes it's an issue. Stephen Weiss asked Shields if the disclosure of the successor's name would give him "comfort" toward buying the stock. "Um, the honest answer is no, other than myself," Shields said, explaining that Berkshire gets opportunities that only happen to someone of Buffett's reputation.

And most of the CNBC viewers on treadmills can point to that and say, ‘Not for me’

Vivus chief Leland Wilson said the FDA advisory panel's recommendation for Qnexa sends a "very powerful signal" that approval will happen, apparently April 16-17, according to Wilson.

He told Judge Wapner Vivus will launch the drug alone in the U.S., explaining it's got $145 million in the bank.

Judge actually said later that Vivus has 145 "billion" dollars in the bank, which would surely prompt some outrage from Karen Finerman about cash deployment if true.

Wilson and Judge tangled a bit over how many patients will be prescribed the drug and whether it's just for the morbidly obese. Wilson indicated not everyone will get it, but it's not just for the morbidly obese.

Pete Najarian asked what this drug might do to lap bands. Wilson said the drug targets that gap between people trying to lose more than the diet/exercise 3-5% and people needing 20% who might pick the lap band.

Stephen Weiss: Brian Moynihan has done a ‘great job’

Stephen Weiss said on Monday's Fast Money Halftime Report that he bought JPM after Mr. toroise-shell glasses said he likes WFC.

Fair enough. But then Weiss went on to praise the BAC chief. "I actually think Moynihan's done a great job."

"Great job? He's done a great job?" challenged Judge Wapner.

Weiss said Moynihan was dealt a terrible situation but conceded he's maybe not the "best personality out there."

Tim Allen launched career in home improvement, yet to get Oscar nomination

Peter Keith said on Monday's Fast Money Halftime Report that LOW had a "good, but not a great quarter."

Keith said, we think, that Home Depot has more urban advantages with store locations. He added that a "very large majority" of pro investors prefer HD to LOW, calling that a "little bit worrisome." Steve Grasso said "this market has rewarded those consensus longs."

Pete Najarian said Keith made the case, but not for LOW. "I think you have to go to Home Depot."

Mark Mahaney said PCLN, contrary to what some may think, isn't really a William Shatner story, but the market-share aggregator that gives hotels the best cut. However, there are "a lot of headwinds this quarter related to fx," but "we like the stock."

Jeff Kilburg’s ‘prop’ trade

Jeff Kilburg, who donned his Fightin' Irish helmet on air (just in case any bigwigs didn't know he played football there and might be impressed), told Judge and the Monday Fast Money Halftime Report gang that oil is experiencing "a little bit of a breather," but it's time to "buckle the chin strap" and watch oil continue while stocks go lower.

Steve Grasso asked if oil has reached the point where it's stifling GDP. "I think we're there," Kilburg said, arguing at one point that the gas-price increase has wiped out QEWhatever.

Steve Grasso said RIG has "probably another 10 to 15% upside possible" and made it his Final Trade. He said for right now, 1,350 and 1,343 are key S&P support levels, but 1,370 is most important; a breakout there and it's north of 1,400.

Pete Najarian said he likes adding to rails such as NSC, and that it's clearly a "risk-on" market. Pete said he continues to add to AAPL, mocked those who speak of the law of large numbers, and insisted, "this is not a valuation situation." Stephen Weiss said markets are in a "consolidating phase."

Best guess is that Englewood Cliffs will be shorting RIMM

Herb Greenberg claimed on Monday's Fast Money Halftime Report he's been ahead of the curve on ESRX and MHS. "I certainly have been somebody who's been out there raising some red flags over the entire PBM world," Greenberg said.

Stephen Weiss opined the sector's a buy assuming this goes through, because of the "pretty good shot at increasing pricing."

"Think of what you just said! Increasing pricing!" Greenberg bellowed. (Update: There was a typo in this passage earlier.)

Weiss revealed that CNBC staffers can now choose between iPhones and BlackBerrys (wonder when the early results of that will be taken up on Fast Money).

Jon Najarian said for his Final Trade he likes the FSLR puts. Stephen Weiss said he's going to short ANR later Monday. Pete Najarian trumpeted WLK and HUN.

Mike Murphy’s WHR short

getting manhandled Monday

We couldn't figure out why Mike Murphy did a U-turn on Whirlpool, and maybe we were onto something.

Murphy rode a tremendous gain in the stock into January, then suddenly changed course for no obvious, first saying he was getting short in the $60s, and then defending it around $70 (see below).

Murphy told Judge Wapner on Monday's Halftime he's feeling "pain" but is still in the short and even added to it.

Just another entry in the category of Pros Continuing to Outguess Themselves Instead of Just Buying AAPL (cont'd).

Speaking of which, Joe Terranova's AAPL short, which had a decent opening Monday, quickly found buyers (hardly a surprise).

And, let's not forget Dan Dicker advised people to lighten up on RIG on Jan. 27, with the stock in the upper $40s.

Whitney Tilson ups BRK-A

‘intrinsic value’ to $180,000

In the category of Pros Continuing to Outguess Themselves Instead of Just Buying AAPL (cont'd) …

Whitney Tilson, billed as an A-lister to help debut CNBC's NYSE set on Monday, took a chair with Mel Lee and Carl Quintanilla and said he's buying more BRK-A because he's "blown away" by the performance reflected in the letter to shareholders.

Basically, describing Tilson's adoration of the stock as "unconditional" would be an understatement.

CRM didn't come up this time.

The 5 worst Oscar-winning

films of the last 40 years

We shouldn't dwell on the negative. Unfortunately, when one looks up and down the recent list of best-picture winners at the Oscars, and one sees the odds on "The Artist" claiming the prize on Sunday, one has to conclude, "it's a weak era."

How weak, and for how long? We took a crack at the 5 least-impressive Oscar-winning films since 1970 (basically ensuring we're including nothing before the time Steve Cortes started going to the Regal theater). None, by the way, involved Wendy Finerman. Note these, in descending order, are not necessarily the least-deserving; that depends on what you think of the competition. But we can say with a high degree of confidence, you've never seen any of these more than once...

5. "Gandhi" (1982), beat "E.T.: The Extra-Terrestrial," "Missing," "The Verdict," "Tootsie" — Bluntly put, careful what you wish for. The problem isn't the subject, but, at 191 minutes, the grandiosity. What could and probably should be a profile of nonviolent change floods itself with (accurate) geopolitical theory issues of the time. Movies are emotional endeavors; showing the triumph of wisdom over emotion (as opposed to, say, "Rocky") is a tough assignment. Overly ambitious script requires an understanding of the greater Indian subcontinent that most CNBC viewers probably possess but most moviegoers don't. Opening with the assassination conveys the troubling Hollywood notion that enemies, more than deeds, cement greatness. Like most biopics, too much re-creation and mimickry, more tribute than drama in a year of many excellent entries.

4. "Chariots of Fire" (1981), beat "Atlantic City," "On Golden Pond," "Raiders of the Lost Ark," "Reds" — News flash: Running is an uninteresting spectator sport. "Chariots" makes this list with regret, because the messages are first-rate: principle, tolerance, respect for others' beliefs, the value of sports in bringing people together, skepticism of fame and fortune. And, there is the unforgettable score. But the music — so superior to the film, it quickly became parodied — too easily laps the astonishingly low-stakes drama in a made-to-look-like-an-Oscar-winner production, a plan that worked, preventing "On Golden Pond" from its rightful stature.

3. "Out of Africa" (1985), beat "Kiss of the Spider Woman," "Prizzi’s Honor," "The Color Purple," "Witness" — Sydney Pollack directed a stunning amount of excellent films; unfortunately this was not one of them. Glorious visuals aside, staying awake is a considerable chore here. Another episode of wealthy gringos seeking adventure and dispensing wisdom in a land of people of color while finding their greatest challenges to be extramarital affairs. It's probably not insensitive, but belongs on the cliche pile that in return brought us "Babel."

2. "The English Patient" (1996), beat "Fargo," "Jerry Maguire," "Secrets & Lies," "Shine" — Actors Without Borders; Patton never would've stood for such a notion. World War II unfortunately gets in the way of the affairs, scheming, spying and insecurities of a UN of characters. Proof that visuals and A-listers alone could seduce an Academy not quite ready for the Coen brothers. Flashback films can be high risk/reward; this remarkably dull picture ODs on more than just the morphine.

1. "A Beautiful Mind" (2001), beat "Gosford Park," "In the Bedroom," "Moulin Rouge," "The Lord of the Rings: The Fellowship of the Ring" — A man cures himself of schizophrenia by ignoring it in perhaps cinema's most lopsided victory of nature over medication. Visually impotent, struggles more than most genius movies ("Rain Man" is possibly the best) at depicting actual brilliance. Artistic license succumbs to rewritten history, a ghastly "Sixth Sense" bastardization of an uninteresting individual whose life produced little drama, real or otherwise.

[Friday, February 24, 2012]

Hopefully KSS isn’t planning to get high on Ron Johnson-mania, or redirect its shoppers to his store

Too many times Judge Wapner practically ignores Patty Edwards on Friday's Halftime Report, but guest host Brian Sullivan refreshingly went right to Trutina-land to open this week's edition, except that the conversation ran into a logical buzz saw and then an outright quagmire of Ron Johnson-ness.

Edwards wasn't gung-ho on JCP, in one way sort of offering a defense about the numbers and expectations, but saying, with her favorite redundancy at the end, "I'm still a little bit, um, hesitant I guess to go in ... it's a financial engineering story at this point in time."

She said she'd rather be in KSS, and we were all well and good up to that point.

Jon Najarian, though, said he's impressed that JCP has held onto its gains from the Johnson investor-day spike, and that, he would "bet" that Patty would agree that like Meg Whitman is experiencing at HPQ, this is something that can't be turned around in 2 quarters, but takes "significantly longer than that."

So you have Patty sort of negative, and Najarian sort of positive, yet Sullivan somehow chose to push Patty on the subject of the JCP Q4 being bad.

Which prompted this utter head-scratcher from Edwards: "If you're gonna put this one in your back pocket, not look at it for 5 years, absolutely be buying it. In the short run I think there's more room for disappointment than there is for excitement." (But if one thinks the stock is more likely to go lower in the short run than higher, why would anyone planning to hold it for 5 years or any length of time "absolutely" buy it now rather than wait for the short-run dip??)

Brian Kelly tried to argue that JCP is in the "sweet spot" right now of having rock-bottom prices with rising gasoline. Edwards acknowledged that but insisted JCP is "trying to remake who they are," while Kohl's already knows what it is and told Wall Street it is going to "unleash the crack" and "let their buyers go for the low price," which we think — we hope — doesn't mean Kohl's is going to start selling drugs, or send customers to other retailers, but to be honest, we're not really sure what they were talking about.

‘Can’t do anything but go up’ — especially if Israel opts to unleash the crack

Dan Dicker indicated on Friday's feisty Fast Money Halftime Report that he takes news reports about military plans from government sources at face value.

Because stories from Jerusalem, from the Joint Chiefs, from Leon Panetta talking to a Washington Post columnist are all just great reporting about military strategizing, and wouldn't have anything to do with, say, certain nations wanting to float the idea of an attack merely to 1) gauge reaction to the idea from Russia, France, Germany and China (and who knows, maybe even Greece, to distract from that whole "maybe we should try the drachma again" discussion and "we need another messy parliament vote to get CNBC to spend money to get Michelle Caruso-Cabrera to come back to the Parthenon"); or 2) they are trying to prompt some kind of activity within Iran, either an internal showdown among leaders who might be split over negotiations, or simply a physical fortifying of important sites that would be detectable by satellites and spies and reveal to Western powers where the important sites are; or 3) forecast what would happen to oil in such an event, in which Dicker and Jeff Kilburg are more than willing commentators.

Anyway, Dicker said Israel's menacing posture toward Iran is like "Holyfield over Marvis Frazier," and then uttered the type of comment that should set off alarm bells, that there's a "gas situation here that can't do anything but go up."

He said "most everybody is long," and that pump prices will hit at least $4 and maybe $5 this summer, perhaps even $7 if Israel strikes.

The screen said Dicker likes APA, BP, for some ability to pick up the Iranian dropoff.

Jon Najarian asked Dicker if the SPR will be tapped this year. Dicker said it would likely happen in the late summer or fall, because the president doesn't have many tools here. Najarian said if it happens that late, it would be like "pulling the Band-aid really slowly."

Brian Sullivan mocked the panel by saying that with high oil, "every retailer's gonna go out of business," but then claimed we had $100 a barrel in November, and stocks are up since then. But Najarian said the difference isn't the price of a barrel of oil, compared with last year this time about the same, but that gasoline was $3.29 last year vs. $3.79 this year, and we can expect a "ramp of about 70 cents" even without Israeli action.

Sullivan noted — and this was helpful, because it's the type of stat we've surely heard before on CNBC but didn't recall — "the average american uses 50 gallons of gas a month." Najarian agreed with that, saying "600 gallons a year."

Brian Kelly claims $108 WTI causes savings rate spike from 4% to 8%

Brian Kelly came so prepared for Friday's Fast Money Halftime Report, guest host Brian Sullivan didn't even believe his stats.

Kelly insisted the price of a barrel of oil will have more impact now than in 2008, because when WTI hits $108 and Brent hits $120, the savings rate skyrockets from 4% to 8%.

"People start hoarding cash just because gas goes up 50 cents a gallon??" Sullivan demanded. "I don't believe it."

"You don't have to believe it, it's the data. I mean, you don't have to believe anything you want, you can stay under the desk in the fetal position but that's the real deal," Kelly said.

Brian Kelly unleashes his own version of a Meredith Whitney Trade

Brian Kelly's savings-rate data wasn't his only controversy on Friday's cracklin' Fast Money Halftime Report.

Stephen Weiss said the risk/reward in Treasurys is no longer good, and so, "I bought HYG."

Kelly, who called himself "BK" at one point (and if Brian Sullivan does that, does he say, "This is B.S."?), claimed that high yield is "gonna default more" during an era of "sustained" high gas prices, citing Stockton, Calif.

"That's a municipality, that is not a corporation," Patty Edwards correctly interrupted, pointing out the money these days is in corporations, not municipalities.

Weiss insisted to Kelly that high-yield is at historically low levels. Kelly insisted, "they're high-yield for a reason." Weiss insisted that the HYG represents "relatively safe high-yield paper."

Edwards sort of chided the 2 for making it an either-or, saying she added some high-yield herself as "spice in the stew."

Is it ‘Lions Gate’ or ‘Lionsgate’?

Patty Edwards said on Friday's Fast Money Halftime Report that "I think the Hun- ger (sic) Games is actually going to be phenomenal for Lions Gate," in part because it's a trilogy and people including herself "cannot stop reading them."

The problem, Edwards indicated, is that "Lions Gate has gone parabolic on this," and so she likes IMAX instead.

Brian Kelly agreed with LGF stock skepticism; "I'd even start taking profits here."

Brian Sullivan said what many of us were thinking, "I've never even heard of it."

Jon Najarian said he too would "take profits on this one," but then took on Edwards' IMAX call, gently, assuring he knows Patty would never just automatically rotate out of one name into another, but "I don't think this thing moves the needle over at IMAX however, this movie."

Patty rebutted that IMAX has "great trends," growth in China, and could get a "little bit of a bump."

We always like to stay on top of grammar things to keep the little ol' ladies (who read business Web sites) off our backs, but quite frankly, few entities/terms have stumped us like LGF, which, depending on where you look, is either spelled "Lions Gate" or "Lionsgate," or sometimes even "LionsGate." This site had recently settled on "Lions Gate" until noticing some John Lennon movie on cable the other night with one word in all-caps in bold block letters. A lot of corporations, especially banks, have multiple spellings for various units, etc., and so any version is probably correct on some level (the movie "The 40-Year-Old Virgin" is registered for some purposes with hyphens between the age and for other purposes with no hyphens), so we'll try not to spend much more time on it.

Brian Sullivan evidently doesn’t see any hidden meaning in those people pumping gas at Costco

Just when we figured Friday's Fast Money Halftime Report was wrapping up into CNBC promo-land, guest host Brian Sullivan tried cramming some more actual analysis — which had already been addressed at the top of the show — into the gas-price and JCP stories.

Goodness only knows why Liz Dunn was brought back to say the same thing she said a week ago about JCP. "I don't care about the 4th quarter," Dunn said. "Everything is going very much according to plan."

Stephen Weiss complained about the largesse of the EPS numbers Dunn was throwing about and argued the stock is already "fully discounted." Dunn countered, using her 2013 forecast that has come in handy for this type of multiple and arguing it doesn't anticipate a sales spike, only cost cuts, "I don't think that it's, that it's reflecting all the upside," but then again, she probably hasn't considered the impact of Kohl's unleashing the crack.

Dan Binder, meanwhile, said gasoline prices "clearly have an impact on the consumer," especially those "living paycheck-to-paycheck," the "Wal-Mart-type customer." Actually he likes TGT in part on its surge in grocery, upping his Target target (sic) from $49 to $63.

Patty Edwards said she got out of TGT in early January because it seemed "management had kind of lost the sparkle."

Brian Sullivan said at one point, "I don't think the gas prices are gonna have any impact on retail sales but that's a different story."

CRM way — way — outperforming (really worth $170,000) BRK-A in 2012

Analyst Mark Moerdler joined the Fast Money Halftime Report Friday to do what Whitney Tilson has been unable to do, throw a little cold water on the CRM story.

Moerdler asserted that the core business is slowing, and "Frankly I think they're looking for the next great thing."

Moerdler said he can't speak for how others reach their conclusions, but "I spent 30 years in the software space," while other analysts "seem to be listening to the company; they see big deals, they don't ask the questions that need to be asked, about, what's the contract term."

Jon Najarian, in what seemed sincere and not a dig, praised Moerdler for coming on the show on a day the stock was soaring, and said he actually agrees with Moerdler on the competition from MSFT and ORCL and asked if there's a "migration" to MSFT for example. Moerdler said "Microsoft is growing," and that ORCL's unit is growing faster than CRM too. He also told Brian Sullivan not to expect a CRM buyout at least from MSFT; "there's no way Microsoft's gonna buy it."

Stephen Weiss is fed up

with euro short

It didn't get much time, and normally we don't care much about currency, but an intriguing little disagreement was occurring on Friday's Fast Money Halftime Report over the euro.

Stephen Weiss, famously short for a long time, said, "I'm taking most of it off, 2/3," even though the optimism right now far outstrips the reality. Basically, the "trade's just a pain in the neck ... I will be coming back to it, when the momentum breaks."

But then Money in Motion personality Camilla Sutton argued that Weiss' sentiment and that of other shorts is exactly why you should be waiting to pounce. "They're tired, but they're underwater," so there's been dramatic short-covering Friday.

However, in the end, Sutton sort of agreed with Weiss, saying she would short but only around the 1.37s, which could be the "perfect opportunity." She thinks it could close the year at 1.25.

Commentary from both Weiss and Sutton indirectly clashed with Patty Edwards' 5-year take on JCP; in other words, if Weiss and Sutton are convinced the euro will be much lower than today's level by year-end, why not just "absolutely" buy now instead of trying to play a short-term move?

Still very early, not jumping to conclusions, but Joe’s AAPL short hasn’t had a big week

Herb Greenberg used his time on Friday's Fast Money Halftime Report concocting a little dead air with guest host Brian Sullivan in a lame showdown over the upcoming Street Signs, then reported that SodaStream is rising, even though "there is no news."

Sullivan somehow argued both sides, saying "they don't have the buzz" like Uggs, but admitted they "crushed" in a CNBC taste test.

Patty Edwards stood up for SODA, saying, "SodaStream is exactly like Green Mountain Coffee- Coffee. It's a replenishment system. ... This is something that is a long term trend."

Bill Chappell said the only problem with Monster Beverage is "there's so much good news factored into it." Stephen Weiss said Chappell sounds like "Herb Jr."

Chris Ceraso said diesel might be higher for rail, but no matter, "the rails pass that through to the customers." He said the problem is "they're not shipping as much coal," but he still likes the Eastern rails, NSC and CSX, with a "pretty compelling" risk/reward that could be maybe 5-10% down but 20-30% up.

Brian Kelly got about as tight as one could get in a long call, with CAT, saying "stay in it," but with a $115 trailing stop. Jon Najarian said MA "looks like it wants to go higher still," and Brian Sullivan mentioned yet another gas-price angle we somehow left off of our analysis of CNBC gas-price-hike coverage yesterday, that the epayment leaders such as V and MA get a boost from higher purchases being put on the cards. Patty Edwards said she will "continue to be long" of PM both personally and professionally.

Stephen Weiss recommended WLP (again) (this writer is (sigh) long WLP, a stock that apparently never will see $68 again) as his Final Trade. Patty Edwards said CBI (again), Jon Najarian said UTX (must not be any hot institutional call-buying in the biotech or E&P space), and Brian Kelly said B-U-Y G-L-D, prompting Brian Sullivan to say "TU for watching."

[Thursday, February 23, 2012]

Seeking Alpha blogger claims

Fast Money’s option traders give bad advice

This page is more about stocks than options, so we don't pay a whole lot of attention to the "Options Actions" hits on Fast Money.

But evidently, some viewers do.

One blogger at Seeking Alpha faults a recent suggestion by Mike Khouw to buy the WMB March 30 call for 40 cents. "First of all, cheap is a relative term. The option is cheap because the stock is cheap. What is cheaper: a $0.40 option on WMB or $4.00 option on Apple (AAPL)?," the writer says.

The writer also complains, "Before the last JPMorgan (JPM) earnings, the 'Fast Money' experts recommended the 36/37.5 bull call spread (buy 36 call/sell 37.5 call) at 0.40 debit." However, only Scott Nations to our knowledge offered such a trade on Fast Money, on Jan. 30, and the numbers and trade weren't quite the same; Nations was selling the February 37/38 call spread, so perhaps the writer was referring to a trade that was actually on "Options Action" and not what Nations spoke of on Fast Money.

Guy Adami recommends people don’t buy stock that is ‘probably’ going up

Guy Adami tried to bring a little life to a mostly lifeless 5 p.m. Fast Money Thursday by channeling Dirty Harry.

"You have to ask yourself, do you chase CRM tomorrow. My answer would be no. It's gonna obviously go higher, probably gonna go higher than where it is now," Adami said.

To tell the truth, we've kinda lost track ourselves. (But we doubt Whitney Tilson has.)

Clint's quite possibly the greatest film actor of all time. He's never regarded that way. We might try a post on that over the weekend, given the Oscars and all.

Wonder if the buyer of

‘The Scream’ will fill up his/her tank at Costco and then buy some stuff inside?

Mel Lee welcomed 3D Systems chief Abe Reichental to Thursday's 5 p.m. Fast Money by calling him "Al," then claiming she thought it was actually Abe, honest.

Guy Adami complained to Reichtental that his HPQ printer costs him a lot of money to operate and suggested DDD products must cost more; "What kind of outlay are you talkin' about?" Reichtental said his "price points" range from $1,300 to half a million, and fit into 3 segments in what he calls a "personal manufacturing revolution."

Honestly, this company and its products are way beyond the scope of our brainpower, we hardly had any clue what Reichental was talking about although he's an articulate speaker, and so gotta leave it there.

Karen Finerman said she's excited about the duopoly in the high-end art market in which only one player (Sotheby's) is a publicly traded stock (BID) and that it has competitive advantages because someone buying something in Beijing can't ship it out of the country. Tim Seymour questioned why the barriers to entry seem to be so high. Finerman apparently isn't planning to let Metropolitan Capital's AUM ride on Edvard Munch's famous painting up for sale at a suggested $80 million, but "I wouldn't be surprised if it went for more than that."

Mike Khouw suggested HPQ long for his Final Trade. Tim Seymour said FCX, Karen Finerman said PACD, Brian Kelly said TLT, and Guy Adami said to buy JCP on a selloff just like you could've done with TJX.

Kelly: AAPL ‘vulnerable’

Bill Lefkowitz guested on Thursday's 5 p.m. Fast Money to basically say the VIX can't go a whole lot lower.

"We don't know the event," he said. "There might be an unusual event ... go back to Europe, something can happen over there."

Mike Khouw, though, pointed out that longer-term VIX levels haven't changed recently, and only the front end has really come in.

Brian Kelly said a lot of johnny-come-latelys have bought AAPL for dividend news, and, "I really think Apple's vulnerable here ... I would be very careful."

Shaw Wu said HPQ is maybe a little like DELL a year ago. Karen Finerman said, "It's Karen, let me ask you," and then proceeded to not really ask but just declare that Meg Whitman did a "fantastic job of lowering the bar."

5 p.m. Fast Money gang takes up where Karabell-Najarian left off on Costco gasoline

Man, when we get some free time today, we're heading to the Costco gas pumps, where apparently (according to the Fast Money gang) all the smart people are congregating these days.

You know it's a slow day when Mel Lee opens a 5 p.m. program with a discussion on the encroaching negative of higher gasoline, and Brian Kelly had a less-than-earth-shattering opinion, saying it might be taking a toll but it "might take a month or 2 to get into that."

Soon-to-be-another-age Karen Finerman said that for WMT, "it is a little bit disconcerting."

Guy Adami then hailed, as Jon Najarian and Patty Edwards have done this week, the potential of COST in this environment, only Adami said COST shares may have gotten ahead of themselves. "Obviously some of these retailers are gonna take it on the chin," Adami claimed, but then said a name you might try is NBR, which "seems to be breaking out."

Brian Kelly predicted the sales balance at Casey's General Store will tilt more toward the gasoline side of the equation and maybe less toward the Slim Jims.

Guest Paul Sankey, celebrating a birthday the same day as son Max, said the "next phase unfortunately is the oil market's gonna go after emerging market GDP growth." Sankey told Guy Adami he "definitely" thinks the SPR will be tapped this year.

Things That (Quietly) Make Melissa Go ‘Wow’

Karen Finerman on Thursday's 5 p.m. Fast Money called AAPL's (you knew it wouldn't happen) lack of a dividend "absurd." Connor Browne on the Fast Line claimed that if the company initiated a 50% payout ratio, and the yield went to 3%, the stock would have almost a $900 price, which made Melissa Lee utter a very quiet "Wow."

Finerman questioned how much AAPL money is on the sidelines over this subject. Browne said the stock is "underowned" by value and yield managers.

More from Thursday's (ZZZZZzzzzzzzzzz-able) 5 p.m. Fast Money later.

A recent theme of Patty Edwards gets the brush-off from Zach Karabell

Zach Karabell was asked to field a Twitter question about the gasoline price effect on COST on Thursday's Fast Money Halftime Report.

"We talk about this all the time as if it's a certain correlation. I don't think so," Karabell said. "I'd be really careful about making any assumptions about how these things relate to each other."

Jon Najarian said he agrees with Karabell 99 times out of 100 (although on Thursday's Fast Money, it was more like zero for 2), but not this time, because gasoline is "such a strong magnet to draw people in" to Costco, where they "save 20 or 30 cents a gallon."

Then the 2 got tangled up over half-gallon interpretations (while we don't want to speak for Karabell we think he was trying to say people aren't necessarily going to drive a long ways to save the equivalent of the price of a half-gallon, while Najarian seemed to think Karabell was saying they wouldn't drive all that way merely to put a half-gallon in their tank when in fact they put in more like 22 gallons) before Karabell opted against further debate by saying "Yeah."

Patty Edwards made a COST gasoline call on Tuesday's Halftime. While we don't know enough about COST or this subject to issue an authoritative opinion, the problems with the more-people-seeking-relatively-cheaper-gas argument are that 1) why hasn't this trend already been happening for months and years and already priced in; 2) no one ever defines where the inflection point is, other than the fact gas prices are being talked about on Fast Money; when pressed it's usually "Oh once gasoline tops $3 people start changing decisions" and then "at $3.50, that's when consumers really notice," and "$4 a gallon is really the psychologically important area," and "It doesn't matter so much if it goes up slowly but when you get these sudden spikes, look out" and finally, "Oh maybe there wasn't as much change as people thought around $4, but just wait till it gets to $5" ... and 3) if the COST consumer is the JWN shopper as Edwards frequently says, it would seem many of that demographic would consider their time more important than racing across town to save a couple bucks on filling up the tank.

So, Karabell is basically right.

Brian Stutland said the names to look at are TGT and COST, saying for those 2 it "is definitely gonna be a beneficial (sic) in minor- my opinion."

Or at least 2 out of 100

Jon Najarian on Thursday's Fast Money Halftime Report mocked the "big doubting Thomases and Thomasinas" who dared question the potential of Sears Holdings stock a couple months ago, and then praised Karen Finerman for announcing a day ago she was using weekly options to make a negative bet on the stock, which Najarian said allows use of "leverage" and defines risk.

Zach Karabell, on the other hand, said, "I am actually gonna short more of this now," calling SHLD a "flawed, really broken retail model."

Brian Stutland summarized the difficulty in guessing SHLD direction this way: "Fundamentally Sears looks horrible," but there's a "short stock rebate" that forces steep covering.

For 2 shows in a row,

Pete Najarian disses the HPQ calls by the Wednesday Halftime crew

Pete Najarian complained on Thursday's Fast Money Halftime Report, like he did on Wednesday's 5 p.m. show, about the enthusiasm for HPQ he heard on Wednesday's Halftime regarding valuation, dividend, saying others have much better dividend.

(One of those people was Mike Murphy, whose WHR short — assuming he's still got it — is stubbornly clinging to $70, and his short JCP/long M was a bust Thursday.)

"It's been an absolute value trap," Najarian said of HPQ, adding that Meg Whitman is turning around the R&D, but it'll take time.

Judge questioned that. "You can make the argument that she's no closer to actually turning things around today than she was the day she sat in the chair for the first time," Wapner said.

If CRM goes to $150 the same time NFLX goes to $100, what does that do for Whitney Tilson’s account?

Guest Ed Maguire spoke on Thursday's Halftime Report with Judge Wapner and took up the controversial subject of CRM.

Unlike some noted Fast Money guests, Maguire said, "We do think that there's, there's room for it to go higher," saying "bookings" will be one of the key metrics.

Zach Karabell asked Maguire about the controversy over CRM "revenue recognition" while acknowledging it's a leader in a hot space. Maguire said the company is "a lot more opaque" than some people are comfortable with, but it comes down to "track record" of management, and he gives the company the "benefit of the doubt."

Yes, and the 37 million shares that changed hands Thursday, Friday and Tuesday also scored a gain

Judge Wapner opened Thursday's Halftime with an extended monologue on Vivus and the CEO's Qnexa comments.

Part of the presentation was Jon Najarian — and yes, this is shocking in the biotech space, that someone bought calls before an FDA-related announcement — explaining that "some people profited mightily from this move" with some options trades Wednesday that skyrocketed 6-fold (and all those people who bought $180,000 in other small biotech options Wednesday probably have made zero money on them so far).

Pete Najarian cautioned it's not a 100% done deal; "certainly there are 2 dissenters at this point in time." But guest Michael King, who said Qnexa could rake in $3 billion in the U.S. by 2020, said, "in my mind, uh, the FDA's already decided."

Colin Gillis does the math for those unable to divide by 10

Colin Gillis got back to the "basics" on Thursday's Fast Money Halftime Report in telling Judge Wapner he doubts Thursday will be the AAPL dividend day (sparing Joe Terranova some orneriness). "Basically the company's voting on 7 basic boiler-plate issues," Gillis said. "I don't think we're gonna see a dividend today," arguing in part that so much of the cash is offshore.

Pete Najarian asked about a split and if it were to happen, what the breakdown might be. Gillis said he "wouldn't even rule out a 10-for-1, you know, knock it back down to 50 bucks."

Gillis also downplayed the impact of a dividend on the stock if/when it does happen, saying it didn't "move the needle" for MSFT (and we thought that was the type of move that opens it up to a "new class of investors").

"Come on, Colin ... that seems to me to be a stretch," scoffed Judge.

Gillis argued that those $670 price targets are iffy because there's "no precedent at all" for a company hitting a $630 billion market cap (so in other words, no company apparently will ever again be worth what MSFT was in 2000).

The Ilchmeister was probably the last person on Fast Money to predict a crude pullback, and that was a short-term technical thing months ago

Jeff Kilburg predicted on Thursday's Fast Money Halftime Report that crude is going to $110.82 "shortly," because traders are seeking an "air pocket," and he credited Dr. J for pointed to the USO.

Kilburg also predicted a gold retest of the September high and cited "the strong hand of the central bank."

But then he made the mistake of saying Dr. J had been long GLD since the 150s, forcing Najarian to admit he got out a week ago (and obviously indicating Kilburg didn't see recent episodes with Dennis Gartman in which Najarian talked about flipping out of his gold position).

But, Najarian said, he's now in the SLV because of (you guessed it) option activity.

Kilburg said something has to break between stocks and bonds and admitted that he's been fighting the S&P 500 tape since 1,330, but bonds should prevail. Zach Karabell said he'd take the "opposite argument ... because yields are so low," that people have "gotta start looking at equities."

Pete would probably agree with one of our top supermarket complaints: Cashiers who throw around the Pringles cans and smash the chips

Pete Najarian said he's not that interested in the Pringles/DMND/PG/K business story, but he's "definitely an eater, huge Pringles guy."

Instead, Najarian was interested in the options activity in PG.

He also said he still likes X.

Zach Karabell said FSLR is becoming "Last Solar," and this is a "really really troubled space" to avoid.

But Karabell said of CMCSA, "I am long this name, it's actually one of my largest positions."

Herb Greenberg said the issue with KSS is that "margins really got compressed here." Judge opted to jaw with that, clamining "They can't raise prices!"

"The question is, why can't they," Greenberg said, adding he's hearing "crosscurrents" about whether JCP is really stealing share or merely dumping everything so cheap, people are going to JCPenney instead of Kohl's.

Wapner concluded, "There's just not room for everybody anymore right." Greenberg responded, "Yeah I get it ... I hear what you're saying," but KSS' slump is notable because it's been a "darling."

Macneil Curry said to sell the euro against the Norwegian krone, and today Judge didn't indicate any reticence about dispensing currency trades to retail investors who find stocks difficult enough. Zach Karabell said he's looking to short LXK for his Final Trade, Brian Stutland touted WDC, Jon Najarian said IPG and Pete Najarian said SCCO.

[Wednesday, February 22, 2012]

Karen’s birthday is Saturday

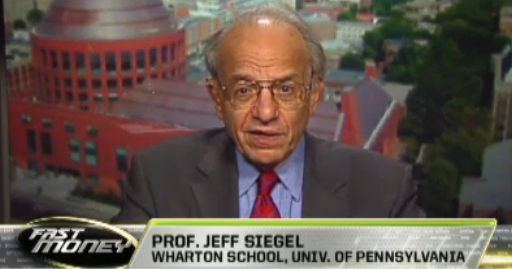

No, the picture above is not from Wednesday's 5 p.m. Fast Money.

But it's so good — look at that physique, that smashing understated dress, that air of confidence — that we just had to post it again as we give the Fast Money sphere a heads-up that Saturday is a special day for Karen Finerman.

Of course there's no 5 p.m. Fast Money on Fridays, and Karen doesn't do the Halftime Report, so hopefully Karen will be on Thursday's 5 p.m. show, and hopefully her colleagues will be able to pour it on, unlike when Joe Terranova got the cold shoulder in November for having the audacity to sneak in a "Happy Birthday" to Mel at the end of the broadcast.

Karen Finerman’s question is so good, it’s almost embarrassing that Mel didn’t ask it

Larry Kellogg is the lawyer representing Hugh Culverhouse in his suit against John Paulson, and Melissa Lee got the chance to ask Kellogg a few questions on Wednesday's 5 p.m. Fast Money, starting with, what is he "hoping to accomplish," given that "$460 million seems like a drop in the bucket."

And only on Fast Money is $460 million a drop in the bucket.

Kellogg said, "This is serious money that he lost for investors by not doing his job," and that Culverhouse may be hoping to recoup a "couple hundred thousand dollars perhaps."

Karen Finerman chirped, "It's Karen Finerman, letmeaskyousomething" (she said it that fast, as though it were 1 word), wondering what kind of negligence by Paulson would have to be shown. Kellogg said he has to show gross negligence, but "He did not analyze a Chinese timber company. This is not Bank of America or Citibank ... he has, uh, some heightened duties here."

Ron Insana in fact did wonder how it's different than losing money in Bank of America (which probably should get more scrutiny than a Chinese timber company, to be honest). Kellogg's answer wasn't particularly satisfying, essentially saying that with such a foreign security, you've really got to know what you're doing.

But then, unfortunately, the best question came after Kellogg was signed off, from K-Fine: "I wonder if they had any settlement discussions."

"That's a good question," Lee conceded.

Ron Insana asserted, "I don't think they'd do that up front, because the, that would set a horrible precedent for the future" (sic last 3 words redundancy).

"This isn't delightful either," said Finerman.

Guy Adami compared this suit to the demise of Solyndra. "That's exactly the same thing," he said, suggesting that if Kellogg is successful, "Maybe I should lawyer up."

Only when a male brings up LTD does Fast Money show gratuitous footage

Guy Adami on Wednesday's 5 p.m. Fast Money assessed the Victoria’s Secret report this way:

"This is a complete sandbag though on the guidance I believe."

At that point, the lingerie-runway-show footage appeared, and Mel Lee even said the word "bras," explaining, "We play the footage of the bras."

Adami, though, smoothly turned his attention to Karen Finerman, saying, "She's got the gun show going. She look (sic) great tonight," and you can see for yourself in the photo above, featuring new dress and hairstyle.

"She always looks great, Guy. She's Finerman," said Lee, rather cute this episode in fact in long-sleeved white top.

For Ron Insana, generational opportunities happen every 2 years

Pete Najarian said on Wednesday's 5 p.m. Fast Money that BAC is a buy under $8, because of the "huge volume" in options in which people are selling the 8 puts and buying upside calls.

Mel Lee asked Karen Finerman how she's managing her BAC position. "Crying, sad, that kind of thing," Finerman joked, saying she hopes it gets to "normalized earnings eventually," but is still "ridiculously cheap."

Ron Insana insisted there have been "2 generational opportunities Melissa to buy financials," those being 2009, and October 2011. "In October I was saying leg into the financials for a long-therm- long-term, 3- to 5-year play," Insana said.

As you can see from the chart above, the great "once-in-a-generation" buying opportunity for BAC lasted about 6 whole months in 2009, from which point you would've lost about 2/3 of that 4-fold gain, whereas had you just made AAPL your once-in-a-generation call in March 2009, you'd be sitting 4-fold up right now.

It's a little bit disappointing that such a renowned TV journalist as Insana resorts to the types of sloganeering employed by some of his most insufferable guests.

Ron Insana sticks it to Doug Kass by raising a subject Kass clearly wasn’t ready to talk about

Doug Kass was trying to call a market pullback on Wednesday's 5 p.m. Fast Money but really didn't get anywhere with either Pete Najarian or Ron Insana, despite Guy Adami's best efforts to non-defend him.