[CNBCfix Fast Money Review Archive — August 2014]

[Thursday, August 28, 2014]

Who was Mel looking/pointing at when complaining about angry AAPL tweets?

There's 1 thing the Fast Money crew dislikes more than pesky online critics:

Twitter's AAPL fans.

Mel revealed Thursday that the tweets were "vitriolic" once she leaked word that Pavel Molchanov was going to discuss his GTAT opinion on the show.

It's "as if I had an ax to grind when it's this analyst note on GTAT," Lee grumbled.

Steve Grasso said that GTAT is the way to play AAPL with beta.

Sticking it to the hecklers, Mel at one point invoked an old standby — air quotes (mostly off screen) — in quoting Molchanov as saying the iPhone 6 "is, quote-unquote, amply priced in" and getting Molchanov to acknowledge his belief that wearables are priced in also.

TWTR has no bigger defenders than Steve Grasso and Dan Nathan, who performed a bullish tag-team on the stock Thursday, but Nathan said it's not a bad time to take profits.

Brad Erickson, who has a $316 price target, said he wanted to remind viewers that Tesla is still a "startup." He also mentioned "pent-up demand" (Drink) in China.

Dan Nathan said that if you actually believe SPLK's guidance, then you can own it with a "very hard" $40 stop.

Derek Manky was the show's designated hacking commentator who did the obligatory (not an actual quote; his number was a bit lower) "there's 10 million attacks every minute but most of them get blocked."

Guy Adami effusively said the TLT has more room to go.

Meg Tirrell, in striking light blue, indicated the Ebola vaccine might be limited; "we would only want to vaccinate the really high-risk folks."

Guy Adami called "Kashmir" "1 of the top 5 songs of all time" and "might be No. 3."

Dan Nathan said somebody bought a bunch of EBAY puts, but he thinks it's only protection for a long position.

Guy Adami handled an excellent viewer question (see, this is basically the same stuff they had in the early days when Roger Neshem and Gene Simmons and random viewers would Skype a question or comment but since Susan Krakower left, there's been an idea drain) about why a head-and-shoulders pattern is bearish. Guy's answer was a joke, "you're failing to make a new high on that 3rd time," when he really means that a bunch of algorithms have calculated these charts over time and simply found that stocks in the head and shoulders variety tend to go lower short term.

Nobody asked whatever happened to Fleck's short-fund plan for 2014 (cont'd).

Carolin Roth on Friday's Worldwide Exchange, which will soon be co-anchored by Seema Mody, pronounced the actor's name as "Dan Ache-roid."

Mel ("weak effort at jawboning") and Brian Kelly mocked the breaking news of increased sanctions on Russia. Kelly was given a Final Trade of JJG.

At least they don’t all want to be Marc Faber

Ben Willis joined Thursday's Halftime Report and either praised or dissed (depending on your view) Elaine Garzarelli, saying every pundit wants to be the one to call the crash and that you shouldn't be "fearful" of a correction, but "hopeful" for one.

Doc said he bought WSM over 66 because the haircut was "too much." Mike Murphy said the inventory increase of over 20% is the problem.

Doc correctly trampled on Herb Greenberg's bizarre case that ANF's CEO is the worst of 2014, pointing to the share performance.

Doc said CHS calls were hot.

However, Doc did not tell viewers that they should've bought BBY on Tuesday (Drink).

Jon Najarian's Final Trade was SLV. Stephanie Link said OKSB and Mike Murphy said IR.

[Wednesday, August 27, 2014]

Possible Bust of the Decade:

Fleck’s ‘restarted’ short fund

Face ripped off ... carried off on a stretcher feet first ...

Those are terms people on Fast Money tend to use about short positions that fail.

Which, given the S&P's rise to 2,000, is presumably how one could describe legendary Fast Money guest Bill Fleckenstein's long-promised short fund ... if it had/has ever happened.

If it has, it's been kept a secret from Fast Money viewers.

It started Oct. 11, 2013, when Fleck told Fast Money he was planning to restart his short fund — but with no immediate timetable.

"You have to plan to do it," said Fleck, and then be "moving parts forward," with the goal to "restart my fund, early next year."

He also said at the time that "the Fed is starting to lose the bond market" (sic).

On Dec. 18, Fleck revisited this idea with Judge's Halftime crew, suggesting according to the screen graphic that his "Playbook for 2014" was to "take profits," as the "bubble will pop," then "get short."

In that appearance he implied a May timeline. "That may take till May; may start in January, I have no idea," Fleck said, adding he was hoping the bond market will "make it clear that it no longer condones the Fed policies."

On March 10, Fleck told Missy Lee he would restart the short fund "probably in the 2nd quarter ... I'm gonna be ready for when it's actually time to get short."

He said this would be "when the bond markets finally take the printing press away from the lunatics at the Fed ... I've waited 5 years for this."

On May 20, Fleck protested that he's not expecting a Flash Crash, but, "What I, what I think is that, we could have one any time," before adding, "At some point the S&P and the Dow are gonna join the Nas- the Nasdaq Composite, the high-fliers, on the downside. Now, will that be tomorrow, will it start, or will it be after another round of tapering? I don't know."

Fleck, in the semi-outraged way he tackles difficult financial-market questions, remains one of the most likable Fast Money guests.

But when you trumpet a thesis 4 times in 8 months and promise real capital to take advantage of the situation ... and what's really happening is the opposite of that situation with no indication of any capital allocation ... you deservedly get the "bust" tag.

Guest suggests concerns over ‘lack of adult supervision’ at AMZN

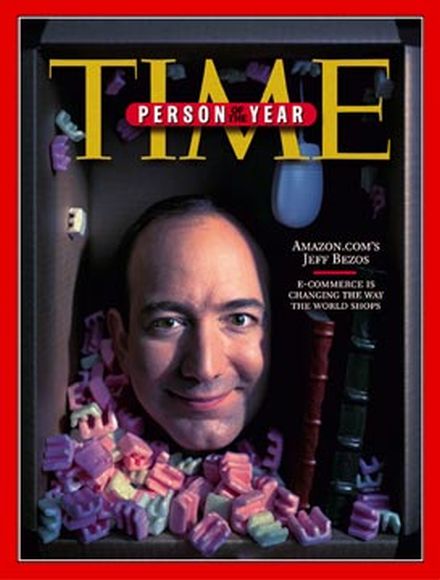

Usually, folks on Fast Money worship the ground on which Jeff Bezos walks.

That wasn't the case Wednesday, when Jim O'Donnell contended that money managers will have to create space for Alibaba at the expense of other names such as AMZN ... and even floated the notion of "lack of adult supervision" in Seattle.

Guy Adami claimed he was "shocked" that YHOO spent so much time below 35, then he hung a 45 "handle" on the stock.

In other large-cap tech, Doc said AAPL's pending products will be a sell-the-news event because of a glass shortage.

Brian Kelly complained of AAPL that (after painfully shorting it and being totally unable to explain why to Melissa Lee), "Nobody thinks the stock can go down."

Guy Adami called GRMN "really interesting" ahead of Apple's rollout because it will "survive this and flourish."

Guy balked that Tony Wible downgraded FB while keeping an 82 target.

Been a while since we heard the gold-works-in-inflation-and-also-deflation argument

Mark Cuban used Wednesday's Fast Money to strike back at the SEC, claiming it created its "own context" for his texts, including how he hates to lose as owner of the Mavericks.

That's why Cuban says he now sends "80%" of his texts via Cyber Dust, in which they disappear in 30 seconds.

Honestly — and we know very little about Cuban's case — Cyber Dust sounds a bit like one of those psychological terms, projection or rationalization or overcompensation or whatever, whereas 1) most people probably find it more beneficial to have those messages linger, and 2) if prosecutors of any kind really want to nail you for something, they'll find deleted messages anyway.

Cuban also told the gang he won't buy Chiquita bananas or Sara Lee products but he'll give Burger King a pass for tax inversions.

Meanwhile, Charlie Anderson said the most expensive, $300 and $400 versions of GoPro were sold out at one store that had a Christmas display, and he thinks the GPRO accessories will be a popular stocking-stuffer. The conversation entered fantasyland when Anderson told Guy Adami that GoPro's "ambition" is probably to have "their own, you know, television series."

GG chief Chuck Jeannes claimed gold stocks have been doing better because investors are "getting a little more nervous" about the market at all-time highs.

Mel tried to drag Jeannes into the stupefying strong-dollar discussion, but Jeannes deftly sidestepped it as having "varying impacts."

Brian Kelly uncorked a cockamamie chart that we could barely understand linking gold and the dollar, then uncorked another all-time great that foxy Karen Finerman likes so much: Gold works in a rising-rate environment, and in a non-rising-rate environment (which Kelly called a "phenomenal time" to buy gold).

Pete picks bottom in WSM

During the opening mind-numbing chat on Wednesday's Fast Money about a strong dollar, Doc said it wouldn't kill commodities but make them "soft."

Pete Najarian actually said with a straight face that WFT is his top oil pick because "they're- they're- they're growing in just about every a- aspec- aspect of their business right now" rather than just stating that he saw heavy options activity.

Mike Khouw reported buyers of the September 52 calls in DOW. Pete Najarian said there indeed has been activity in the name, and — brace yourself — because of that activity, he thinks the stock has upside.

Guy Adami said GES must hold 22½.

Pete Najarian called WSM "way oversold" in the afterhours and said he bought some; Guy Adami predicted a washout in the name Thursday and said it's not a down-12% quarter.

Doc bragged for the 3rd time in a day about endorsing BBY on Tuesday.

Mel showed up in another orca outfit, a color scheme also favored by Kelly Evans.

Pete Najarian said WFM October 40 and 43 calls were hot.

Doc cited a big buyer in TRW calls.

Guy Adami said "a lot of people" think JCP could be the turnaround story not just of 2014 but 2015 and are floating an 18 handle.

Pete Najarian's Final Trade was PFE, Brian Kelly said GDX, Jon Najarian said DOW with a reference to HeatSeeker® and Guy Adami said WFT.

Doc saved the ‘Labor Day is the time to buy retail’ speech for Kelly Evans’ show but told CNBC viewers in 3 shows that they should’ve bought BBY yesterday

Kate Moore visited with Judge's Halftime crew Wednesday and indicated she's still positive about the market and kinda sounded like she likes everything.

Kurt Wagner summarized Snapchat's valuation as: "They're worth what people are willing to pay for it."

Doc claimed Snapchat's investment is a "mark-up" because you don't see it trading heavily on the private stock exchanges.

Judge said he would "take issue" with Mike Murphy's bizarre claim that Amazon has grown into its valuation; Murphy responded that if you "invested in Amazon" ... then apparently you made money (which has nothing to do with "growing into" a valuation but whatever).

Josh Brown said "there's absolutely no sell signal anywhere" in the TIF chart. Mike Murphy warned that the stock has already fallen from 105 to 102 and it's one you "fade hard."

Josh Brown bungles ‘literally’

Anthony Grisanti on Wednesday's Halftime Report predicted crude falling to 88-85 and said the only thing that worries him is that it's a "very crowded trade right now."

The Najarians said October 27 calls in WFT were hot. Judge bungled the disclosure, stating both Najarians are in the options while Doc clarified he's actually in the stock.

Traders whiffed on putting together an informed dialogue on Vegas/Macau casinos.

Mike Murphy struggled to make a point about DHI ... still likes the builders in general, but DHI has already bounced, Zzzzzzzz ...

Doc said he's "delighted" to see a retailer as bullish as EXPR.

Josh Brown eyeing Tim Hortons Burger King for lunch, uncorked a whopper, telling Judge, "You know, the, the streets around here on the exchange are littered with literally the bones of people that have been calling a top in Facebook" (and we didn't realize any FB analysts are now deceased).

Pete Najarian guffawed that Dom Chu's pants "makes me wanna buy Clorox! Let's bleach those things!"

"They might not even be men's," cracked Doc.

Doc's Final Trade was VLO, Pete said WFT, Mike Murphy said HTZ and Josh Brown said MAS.

[Tuesday, August 26, 2014]

Tim Seymour predicts ‘big impact’ on something or other (presumably corporate tax rates, yeah sure)

While the Halftime gang was tripping over themselves to endorse the market, Tuesday's Fast Money crew played Who's the Biggest Grandpa.

Brian Kelly invoked Warren Buffett and said we've only had this kind of market cap/GDP ratio in 2000 and 2007.

Dan Nathan accused Tim Seymour of predicting a market "slingshot" up another 10% ... when Seymour actually never said such a thing.

Seymour protested, with a visual aid that seemed to more resemble archery.

Guy Adami said if you're a bull on stocks, you "absolutely need" an IWM close above 121.

Ari Wald said he's getting questions about whether it's too late to get into the rally, and the answer is no. Wald is looking at 2,080 on the upside and also likes HAL as a "catch-up" trade. Tim Seymour said there's nothing wrong with HAL but balked at the notion of it as a "catch-up" trade.

John Jannarone said BKW is basically paying a 57% premium for THI, about double the typical North American takeout premium. Guy Adami sort of admitted he botched the call a day earlier that BKW goes higher, explaining he didn't see Tuesday's selloff coming, but he still thinks it goes higher.

Tim Seymour predicted Warren Buffett's involvement in the THI deal will have a "big impact" in Washington.

Mel opts to answer her own question for Itay Michaeli

In the Not Very Helpful Department, Dan Nathan on Tuesday's Fast Money indicated a reasonable question from David from Israel about how an amateur investor shorts a stock was beneath him; "You place an order, um, with your broker, and you short it."

Brian Kelly did better explaining how a P/E ratio is calculated, except when he suggested there's a "correct" number gleaned by comparing similar companies.

Itay Michaeli hung a $48 on MBLY and then got a question from Mel that was answered by Mel before Michaeli had a chance, which was, where would the "price pressure" come from. (Evidently automakers are going to start doing it.) Guy Adami called MBLY a "really interesting stock."

Tim Seymour took advantage of the chance to meet his daily quota of a TSLA reference, but without the valuation this time.

VMWare chief Pat Gelsinger, who snubbed Mel a few weeks ago, returned to face a grilling over his guidance.

"What's going on here," Mel demanded, except it sounded like VMW had only stopped giving guidance for 2015 or 2016.

Guy Adami pointed out how VMW and EMC have done since 2011 compared with the S&P 500, so there's "clearly some disconnect."

Dan Nathan said of BBY, "It's goin' to zero, I mean, it's just a matter of time."

Guy Adami modestly took a victory lap on ISIS and said he thinks it's going higher. Dan Nathan said DSW can get back to the mid-30s. Brian Kelly said to sell SAFM, prompting Mel to say, "Well I am Chinese."

Dan Nathan actually suggested the U.S. Open as a catalyst for TWTR.

Dan Nathan reported that someone bought a weekly 47.50/50/52.50 call butterfly in ANF.

Guy Adami resurrected the bickering-married-couple routine regarding the new James Brown movie. Mel indicated — without saying directly — she didn't have a date for such an event, something this site has been trying to help correct.

Tim Seymour's Final Trade was BBY. Dan Nathan said S, Brian Kelly said SLV and Guy Adami said THC.

Doc likes striped jacket so much with tan pants, he’s going to wear it every day this week

Everyone's on the bandwagon.

In a shocker, standard-bearer Jeremy Siegel told Judge on Tuesday's Halftime, "I see the bull market continuing" and thinks we're "on track" for 18,000 by year-end.

Josh Brown invoked the "cognitive foible" of the "gambler's fallacy" and said that just believing stocks must go down because they've been going up doesn't work.

Pete Najarian brought up that a bunch of people (we'll leave the names out although one of them has the middle name of "Braxton") spent the summer pointing to the Russell or transports or the Nasdaq as breaking down.

Stephen Weiss insisted from the outset, "I still think the market's going higher."

Rick Rieder expressed confidence in the Fed's ability to handle rates. But he suggested "the curve is gonna flatten."

Doc argued that BBY is doing "better, not worse" among electronics retailers. Stephen Weiss drew a negative analogy to Toys R Us.

Stephen Weiss endorsed GILD and CELG.

Pete Najarian repeated that he thinks NFLX is "a little in front of itself."

Doc said whoever downgraded DSW is "looking pretty foolish."

Josh Brown said MBLY "practically owns the space" of cars sensing other cars.

Stephen Weiss informed Sara Eisen that Tim Horton was a hockey player.

Pete Najarian said October 55 calls in Citigroup were hot. Doc said somebody in LNG rolled their 75 calls up to 80 calls. Doc said he's in the name and he'll "probably be in for about a month" (Drink).

Steve Weiss suggested that in the short term, the worst is over for SEAS. Doc touted DO, while Pete Najarian chased a winner in TWTR.

Josh Brown's Final Trade was "way too hated" RIG. Pete Najarian said MRK, Jon Najarian said VLO and Steve Weiss said to short NDLS.

[Monday, August 25, 2014]

‘Might be something’ to

October call-buying in LULU

Robyn Karnauskas, who tends to get amped up and whose mike Monday on Fast Money sounded like Freddie "Curly" Neal dribbling a basketball, projected a possible 100% upside in ACHN and ICPT.

Guy Adami said it's not crazy to think of ICPT that way and even speculated that the chances are 75/25 in your favor.

Tim Seymour said the Burger King-Tim Hortons thing is just "1 more message" to Washington about our "tax structure." (Translation: Tim thinks taxes are too high but won't suggest what to cut or how much debt we should take on in their place.) (Translation II: Those latter concerns can be made irrelevant; "if we just had a more pro-business administration, the economy would grow and those things would take care of themselves.")

Steve Grasso, who bungled mightily over the summer predicting a healthy pullback, said we're in an environment of "never short a dull tape" (Drink).

Pete Najarian, who found time for 2 shows Monday, said he thinks NFLX has seen "too much, too fast."

Guy Adami said X has "probably moved too much too fast" but he thinks 43½ or 45 (sic no 44) are still "in the cards."

Andrew Thompson of Proteus Digital Health explained what a digestible sensor looks like. Mel unleashed an "at the end of the day" (Drink) at Thompson.

Dennis Gartman advised being long nat gas against a crude short.

Peter Keith has a $34 target on BBY and suggested iPhone 6 as the catalyst.

Tim Seymour said he'd buy BIDU.

Guy Adami said to sell HD and look for it around 84.

Pete Najarian said December 37 calls in QEP were surging.

Mike Khouw reported a big buyer of October 40 calls in LULU. "There might be something to this," Khouw said.

Tim Seymour said he owns MO and LO.

Tim Seymour's Final Trade was sell POT. Pete Najarian said HPQ, Steve Grasso said KBH and Guy Adami said ISIS.

Doc predicts ‘investigation’

of ITMN call-buying (assuming it’s not all hands on deck for Herbalife)

Chris Hyzy, in an apparent shot across the bow at Barry Bannister during Monday's Halftime Report, told Judge, "I don't believe in raising forecasts," even though his S&P 500 forecast has already been met.

Rather, Hyzy seemed to warn those who are enthusiastic, rekindling a punch line from last autumn that we hadn't heard again until now, that stocks might be "eating into next year's multiple."

Nevertheless, Hyzy says we're just in the beginning of another "elongated business cycle."

Doc rather dubiously suggested BKW's pursuit of Tim Hortons is a good idea because it gets Burger King into breakfast.

But the designated bear, Josh Brown, insisted, "Quite frankly, there are no synergies." Judge felt compelled to weigh in on Doc's side and "right a wrong" in Brown's argument.

Matthew Boss contended that JCP has a "big opportunity here on the expense base."

Jon Najarian said you've gotta be a "little bit of a believer" in the JCP story.

Pete Najarian predicted 52-week highs for GS.

Bill Pulte actually said of Diana Olick's realty report, "I think a lot of it's true."

Doc said ITMN January 50 calls were actually hot on Aug. 8 and predicted "something happens" in the form of an "investigation."

Susan Li is getting the Mandyesque (circa about 2011) or even Simonesque introduction to U.S. viewers presumably because there's a plan down the road to install her as an anchor of something or other.

[Friday, August 22, 2014]

Guy: Sell AAPL

In a quiet (to say the least) episode of Fast Money on Friday, Guy Adami said "I think you take profits here" in AAPL. But Tim Seymour called a "backfill to the 80s very hard to expect," a curious way of putting it.

Brian Blair predicted the new iPhones might be in short supply.

Brian Kelly said now's a great time to re-short the DAX.

Tim Seymour's Final Trade was MCD. Steve Grasso said TWTR, Brian Kelly said USO and Guy Adami said KFY.

Jackpot: Jane Wells in Vegas

Halftime Report viewers on Friday got a treat when Jane Wells, in black dress, revealed how her night in Vegas went.

"I stayed at the Wynn last night. I was walking through at 3 o'clock this morning. It was the most crowded I have ever seen a casino at 3 a.m. in a decade here," Wells said.

Elsewhere, Josh Brown suggested that GMCR "might be the easiest stock you could trade right now," with 128 as support. That's when Judge finally got around to mentioning Cramer, in the 2nd segment of the show.

Dominic Chu was heard to say "a tale of 2 companies" (that's not going to help him out with Seema Mody).

Jon Najarian helpfully said if you put $1,000 in LUV in 1977, it'd be worth almost half a million today. So basically, if you know which stocks are going to have a great 37-year run before it begins, you can make a lot of money.

Star guest can’t remember the last time he was on Halftime Report (a/k/a when was the last time you heard about the ‘fiscal cliff’?)

A couple years ago, Barry Bannister instantly became one of our favorite Halftime Report guests because of the way he comically stiff-armed a couple of skeptical questions from Steve Weiss and Joe Terranova like so much debris.

Judge welcomed Bannister onto Friday's Halftime, as "the biggest bull on the Street" now that Barry's got a 2,300 S&P target.

Nevertheless, Barry proclaims this a "pretty ordinary market."

But in a shocker, Bannister actually told the gang, "I don't know if you remember the last time I was on the show, but it was in mid-2012, about 4 days before the bottom, and we went to a 1,600 target."

Actually, it was Dec. 4, 2012 (he appeared on the 5 p.m. show in the spring of 2013).

Bannister did indeed tout his 1,600 target (it closed 1,407 that day). But we have no clue what he means about "4 days before the bottom," given that the low (not official) for that year was practically the first trading day of January; at some point it returned to kiss that in the spring and then continued roaring ahead.

Judge told Bannister that Judge had dinner the other day with a "very big money manager" who questions how Bannister could make such an extreme upgrade in S&P points.

Barry again delivered a patented stiff-arm to this anonymous critic; "I think a lot of strategists give you piecemeal, mealy-mouthed changes in their target," he said, while he prefers to make "very large changes."

And Patty Edwards is a U2er

Josh and Judge insisted on Friday's Halftime that Yellen is not the story of the day but Draghi at 2:30 Eastern, which according to Judge could give the market a "goose."

Steve Liesman told Judge that Judge's panel made some "smart comments." (Translation: Rick Santelli wasn't around this time.)

Dennis Lockhart told Liesman that his staff tells him, "You are a U6er, not a U3er," which rekindled memories of when this page did a Fast Money music survey.

Mike Santoli said the issue with ARO is "about what could private equity potentially do with this."

Steph Link endorsed both TJX and ROST. Doc added a 3rd, but it was unintelligible.

Doc said October 11 calls in TLM were hot and he bought into it.

Doc said FL is "hittin' on all cylinders" (Drink).

Doc's Final Trade was LINTA. Mike Santoli said to sell AVB. Steph Link said AIG.

[Thursday, August 21, 2014]

Trader actually declares on television that nonexistent disclosures are on CNBC.com

Normally, they just ignore the subject.

So it was bizarre on Thursday's Fast Money when Jon Najarian actually declared to the camera that one of his purported positions is actually in the CNBC disclosures (snicker).

Najarian referred to the red herring — trader positions at CNBC.com — in telling viewers, "I do own Synopsys, and it's on my disclosure."

Seriously? Check the screen grab from the show's site above.

Doc later said FNSR calls were hot, and "I bought this one" (sic) (Yep, again check the image above).

That's some "CNBC disclosures" he filled out.

Perhaps he can explain in his next appearance why this purported exercise is undertaken?

Meanwhile, Tim Seymour said he's long DSKY and is staying long. That one's actually on the page.

Also, Karen Finerman told Clean Energy Fuels chief Andrew Littlefair that owning CLNE has been "a little bit of a frustrating ride."

That one, too, is actually in the disclosures.

Tim Seymour invokes air quotes

for ‘retail’ names; that’s what Doc should’ve done when he brought up ‘disclosures’

Karen Finerman, in a twist on her favorite, curiously said on Thursday's Fast Money that sometimes companies in HD's situation attempt a "reverse kitchen-sink" quarter to make things look as rosy as possible for the departing great (um, maybe MCD and Jim Skinner?) and not go out on a "crappy" quarter, but she doesn't see that happening here. Guy Adami said "there's nothing to kitchen sink."

Jon Najarian said he was recently in an Old Navy store, and "the line was so long, I had to walk out."

Doc said he likes GOGO's service but not the stock so much.

Guy Adami said it sounds crazy, but GME is actually worth chasing, even though he wrongly said "everybody thinks GameStop must be a huge multiple." But Karen Finerman said, "I wouldn't touch it."

Mike Khouw said October 33 SHLD puts were hot.

Karen Finerman declared SHLD "uninvestable."

Doc said that if you want to trade retail, buy around Labor Day and sell around Black Friday (Drink).

Mel quiet, does question

toppiness of BAC

In what sounded like a case of wishful thinking, the banking permabulls on Fast Money Thursday tried to claim that it's clear sailing for BAC and others.

"I think we are now at an inflection point," contended Karen Finerman, who really likes the fantasy of "normalized" bank earnings.

Tim Seymour said a "slow normalization of interest rates" is good for banks but admitted neither he nor anyone else knows what that term means.

Only Guy Adami seemed skeptical of the stock. Mel pinned down Guy on whether BAC stock is truly "ahead of itself." Guy said maybe not but called it a "trading vehicle."

Karen unable to generate

fresh Final Trade

Chris Rolland contended on Thursday's Fast Money that FCS is his No. 1 pick in the chip-takeover space. He also thinks ATML could be an Infineon target.

Guy Adami endorsed AMD with "sort of a" 3.85 or 3.90 stop.

Tim Seymour said he loves EBAY at 49, but in the mid-50s, "I don't know." Jon Najarian claimed Carl would be in EBAY until they do the spinoff, and at that point it'll be "north of 70."

Andrew Fung, who has a $300 target, said he expects Tesla volume to double next year and said it only has 5% of the U.S. luxury market now.

Clean Energy Fuels chief Andrew Littlefair said his company benefits from a low natural gas price, and that a lot of companies are "coming to the party."

Guy Adami said if you want coal, go ANR for the "binary play."

Scott Crowe said "we're gonna get a lot more rental growth than what people think." Karen Finerman admitted that her short-mall-REIT theory hasn't worked.

Jon Najarian congratulated himself for scalping a profit on HPQ.

Tim Seymour's Final Trade was sell RSX. Jon Najarian said to buy CRM, Guy Adami said GPS and Karen Finerman redid Wednesday's Final Trade, buying SPY puts.

Regulators, prosecutors didn’t share mortgage information until 2012

Talk about government priorities.

Eric Schneiderman contended on Thursday's Halftime Report that BAC's $17 billion penalty is deserved because the company was "at the heart" of the mortgage mayhem and if nothing else, he claims he's hearing from "a lot of people" who say "this is not enough."

He also seemed to contend that this particular governmental arm-twisting (that's the nice way of putting it) wasn't exactly atop the agenda before 2012, when they apparently decided they could use the cash.

Schneiderman tried to dismiss Judge's assertion that it was Countrywide and perhaps Merrill Lynch at the heart of the problem and not Bank of America, stating whatever, there's an "egregious pattern of misconduct over a period of years."

Kate Kelly first used her generous time allotment to second Judge's editorial comment about BAC and JPM buying Merrill and Bear not so much because they wanted to but because they had to, then wondered why this case took so long. Schneiderman admitted, "that's a good question," then admitted he "held out" from the deal struck when he arrived in 2011.

Kelly impressively persisted why they didn't have this done by 2011. Schneiderman curiously said the U.S. attorney's offices didn't start providing "extra resources" until 2012, including information that "we hadn't been sharing prior to that."

Look out, big tobacco: They're running out of other targets.

Possible Mount Rushmore of CNBC hair on grooming wall

Stephanie Link predicted on Thursday's Halftime Report, "I do think Dollar General comes back with a higher bid," stating that at 90 the deal is still accretive.

Josh Brown pointed out that JNK is up 12 of 14 days.

Doc said "a lot of us are waiting for" SHLD to spin off its auto centers. Nobody else on the panel was very impressed.

Josh Brown pronounced himself an "aristocrat."

The Nardashians (above) said somebody bought "big numbers" of WMT October 77.50 calls, prompting Pete to make it his Final Trade.

‘No surprises’ at Jackson Hole

(unless Gasparino decides to crash a private party at a restaurant)

The Halftime Report group clamored on Thursday for Jackie DeAngelis, who looked great (above), but unfortunately her dollar discussion was a bit light.

Rich Saperstein predicted "no surprises coming out of Jackson Hole."

Peter Marber said now's a good time to put money into emerging markets "almost anywhere" and that "a lot of people have gotten it wrong."

Doc's Final Trade was ERIC, Josh Brown said BAC and Stephanie Link said SYF.

[Wednesday, August 21, 2014]

Karen garrulous

Mel returned.

But it was Karen Finerman who did (nearly) all of the talking.

In one of her slew of comments, Finerman said on Wednesday's Fast Money that she won't trade around Janet Yellen's remarks because even if she knew exactly what Yellen was going to say, she couldn't exactly predict how the market would react.

Finerman complained that TGT didn't trade with the "kitchen sink multiple."

Finerman was heard to opine that BAC can get to 20 "over the next year and a half."

But, Finerman said she's "not sure" when interest rates will rise.

Finerman said CMLS remains "painful" for her but she's still long.

Finerman dismissed Dan Nathan's financial-engineering complaint about AAPL, calling buybacks a "valid value creator."

And, "I resent being called a genius," Finerman protested, which opens the door to license to describe Karen; lessee, we'll start with "brilliant" and "gorrrrrrjus."

Brian Kelly admitted he covered his AAPL short Wednesday.

No. 386 said he bought more AAPL to give himself a "full position" (Drink).

Mel buys new outfit

during vacation

Melissa Lee said on Wednesday's Fast Money that she hates (yes, that's what she said) to use the "baseball analogy" but asked Brent Bracelin how far we are into the HPQ turnaround. Bracelin said "3rd or 4th inning."

Karen Finerman halfheartedly said Meg Whitman has done "a (sic) good a job as one can do," but Karen is not interested in the stock because of too many "headwinds."

Referring to HTZ, Mel said "at the end of the day (Drink) trading" and then corrected it to "at the end of the trading day." Karen Finerman showed how she reads a 13D and said it appears "very unlikely" HTZ will be put up for sale.

Steve Grasso said he's still long LNG.

No. 386 said he'd buy JBLU.

Brian Kelly said to stay "far away" from JASO.

Dan Nathan said not to "bottom fish" in HLF.

Brian Kelly helpfully declared, "When the market decides that they no longer wanna pay for that future growth, then Amazon's got a real valuation problem."

Joseph Spak said there's a "coming inflection" in the MBLY business model. Steve Grasso said the stock has to hold 35, and "unfortunately" he didn't buy any Tuesday.

Dan Nathan's Final Trade was sell IWM. Steve Grasso said to buy AAPL, Karen Finerman said to buy SPY puts and Brian Kelly said to sell HYG.

CNBC females should consider proper attire for ice bucket challenge

Here's a question we gotta ask, and we'll try to do so without blushing.

If women at CNBC are going to be doused in ice water ... instead of risking ruining pricey business outfits ... shouldn't they dress a bit more, uh, recreationally (just say "swimsuit" and get on with it) for the event?

For example, up above, we've got Kelly Evans, then Louisa Bojesen. Bojesen at least donned chic black.

But what would be wrong with Evans, for example, wearing something a bit more water-appropriate for this particular performance?

Everybody would have fun; lots of viewers would watch ... Uh oh. Bad suggestion. Withdrawn.

Judge basically portrays Adam Scott as the greatest thing since sliced bread

In what proved to be only the 1st baseball reference of the day, Josh Brown said on Wednesday's Halftime Report that TGT's problems are "in the 2nd or 3rd inning," and he'd fade the rise.

More impressively, Brown observed that the Fed has been using "structural" quite a bit.

Maureen Bausch said "sales are up" at Mall of America.

Mike Murphy said he bought HTZ under 28.

Murphy said "there are a thousand other names I'd rather own" than LOCO.

Josh Brown scoffed at the importance of 1 quarter from DNKN and said he'd love to buy more on a selloff with a 3 handle.

Jeff Kilburg told sizzling Jackie DeAngelis that "at the end of the day ... we have a lot of supply" of crude.

[Tuesday, August 19, 2014]

Sara Eisen sticks it to Brian on Hong Kong dollar (but at least Brian is right about HBO tracking stock)

In the update everyone knew was coming from the moment he announced his AAPL short on Fast Money and then was unable to explain to Melissa Lee why he was putting it on, Brian Kelly said Tuesday, "I am getting ready to cover that short."

Will Power said AAPL's rise to $100 is a "bit of deja vu."

Guy Adami suggested EXAS as an "intellectual property play" with 35% short interest; he said he thinks it's a "$25 name."

Dan Nathan had trouble saying "I like Dick's" and calling it a "very oversold stock" without smirking, declaring that "if they do have a turnaround in golf," it'll be fine.

Nathan said he decided to "dip my toe in the water here" in S.

Guy Adami said you can own LZB on the dip.

Brian Kelly tried to claim that "you could get the Hong Kong-dollar peg break," but Sara Eisen told Kelly, "Um, everybody's been wrong on that trade for a long time."

Tony Wible claimed that somehow if HBO is spun off into a tracking stock controlled by Time Warner, "you basically get people to value it more on par with how Netflix is being valued," a concept we've never understood given that it'd still be the same company. (This writer is long TWX.)

Brian Kelly flat out scoffed at the notion and said he doesn't understand how such a move creates value.

Tim Seymour stated, "Netflix is a sell; Time Warner's a buy." Guy Adami endorsed TWX; "I think this is headed right back to 85."

Howard Silverblatt pointed out that Google essentially rocketed up the market cap ladder from basically nothing, just a concept, not at all like U.S. Steel.

Dan Nathan said to look for 30 on the downside, 40 on the upside for HPQ.

Tim Seymour's Final Trade was EPU. Dan Nathan said S, Brian Kelly said FCX and Guy Adami said MCD.

Judge apparently doesn’t know that Alan Greenspan and Andrea Mitchell are married

Dr. New Land on Tuesday's Halftime Report once again lamented he has more gray hair than in the CNBC pictures, "I'm in too much cash," then lamented calling AAPL a "generational buy" a couple years ago.

Joe said he's not able to "trade around" AAPL, but that didn't stop him from hanging a 105/110 target over the next couple of months.

Pete Najarian said that if AAPL closes above 101, then "I think 110's in the cards."

Carl Icahn told Judge, "at the risk of being corny," he really does care about corporate governance, and insisted that whatever Dollar General or Family Dollar was saying about him wasn't true.

Pete Najarian argued the bull case for DKS, while Josh Brown said his bear case for Dick's from a few months ago still stands. Judge questioned if the golf slump is weather-related, but Steve Weiss said "there's a golf course closing every 48 hours" and that he's got a greater chance of "hitting somebody with an errant shot" than of being in a Golf Galaxy.

Then Weiss said, "I like Dick's," but he doesn't think you buy the stock.

David Hirsch (Employee 101) and Sean Dempsey talked about the greatness of Google, with Dempsey pointing out that the risks Google has taken are "quite commendable."

Josh Brown said the notion of the "Internet of things" is a little "Zeitgeisty" (sic).

Pete Najarian said GNRC November 55 calls were hot.

Judge mentioned a couple times that Alan Greenspan was dumping ice water on Andrea Mitchell as though the two were strangers.

Robert Shiller seems to think everything’s overpriced

Robert Shiller protested to Judge on Tuesday's Halftime that he's not sounding a "new alarm" and that his own personal P.E. ratio is 26 and that it's been over 20 for basically the last 20 years.

Judge cracked, "Maybe you need a new ratio," but said he was only saying that "in jest."

Shiller admitted it's not an "exact science."

Shiller barely conceded the notion that stocks are actually cheap relative to bonds, because "the bond market's looking expensive," Shiller said.

And, "We are seeing a sort of boom in the housing market," Shiller said.

Stephen Weiss said you never want to say this time is different, because, "At the end of the day, it's never gonna be different," but he thinks the stock market is right to be where it's at.

Pete and Joe agreed that housing-related stocks are climbing.

[Monday, August 18, 2014]

Dennis Gartman: I was right about aluminum, so trust me on coal

It's not often we find the most intriguing Fast Money commentary coming from Dennis Gartman.

Yet, that was the case Monday as Dennis made a bull case for ... coal.

Unfortunately, he didn't really supply any catalysts, other than "reasonably good bases" in the stocks.

He acknowledged his opinion is "certainly one of the penultimate contrarian views," and no, we have no clue what that means.

Attempting to justify this position, Gartman said that a year ago he started buying aluminum, which "created laughter" among some, and look at it now.

Steve Grasso countered that the EPA can "ratchet up those regulations on carbon, and then it's game over a lot quicker for coal than it has been already," which also doesn't make a whole lot of sense, but whatever.

Gartman said the stocks seem to have found a bottom.

Guest host Sara Eisen impressively suggested coal might be a play on a Republican administration. Gartman said that if Republicans controlled the Senate, the EPA would probably not be so aggressive.

Pete Najarian suggested that those who like coal could try playing Caterpillar.

Karen Finerman pointed out that WLT debt is trading at 58 cents on the dollar, so there's considerable doubt about these names.

We gotta think that, within a year, Gartman will be correct. But these stocks have been a cascade of lower highs and lower lows for at least a year, and attempting to time the bottom could bring some pain.

Karen: Ukraine getting old

In a most curious assessment of the stock market, Pete Najarian claimed on Monday's Fast Money that "I think the only red flags out there obviously are news-based."

To that end, Karen Finerman predicted "less and less of a reaction" every time something happens in Ukraine.

Steve Grasso, who's been overly skeptical the last few months to his own detriment and had a quiet show Monday, grumbled, "You never short a dull market."

In a wearisome promotion of CNBC's coverage of the 10th anniversary of GOOG's IPO, Guy Adami whined again that YHOO is getting no credit for its "core business" and cited Gene Munster's 44 target.

Pete Najarian said he likes YHOO over GOOG for a short-term pop.

Scot Wingo, who tracks e-commerce sales, said AMZN grew at 40% and EBAY grew about 10% in July.

Wingo said EBAY forced users to reset their passwords, which didn't help results.

Guy Adami more excited about seeing Phil LeBeau than Sara Eisen

Guy Adami said on Monday's Fast Money that those not already in AAPL should wait for a "clear, decisive breakout," which means he's actually calling it a sell (because if you're already long, what's the difference to that advice?).

Karen Finerman questioned if there's lots of pressure on call buyers for AAPL to exceed $100. Steve Grasso said GTAT is the better play for beta.

Karen Finerman suggested looking somewhere besides ARO for a retail pop, it's "too far gone."

Steve Grasso said FDO is "probably going higher," to the mid-80s.

Guy Adami said to buy HD if it trades down to 80. Steve Grasso said KBH "seems like a layup to me" given the easy comps it supposedly has from last year's government shutdown.

Pete Najarian said November 22 calls in STLD were hot.

Pete said to stay away from SEAS.

Karen Finerman called MNST "too expensive for me."

Guy Adami predicted GE could see 30.

Phil LeBeau said out of the 85 million cars built this year, 142,500 will be electric, which is interesting but doesn't address whether TSLA's valuation is "too rich" or not.

Nik Raman, co-founder of uSell.com, said about 50% of the phones are iPhones and 25% are Samsung.

Mike Khouw said TJX was trading 9 times average daily call volume.

Pete Najarian's Final Trade was HPQ. Steve Grasso said AAPL, Karen Finerman said M (Drink) and Guy Adami said KORS.

Guest host Sara Eisen (above) unleashed one of the best outfits we've seen in years but once again performed the read and react defense, not till the end of the program hanging a deflation bust on Guy Adami.

Judge finally realizes that Pete will sell options instantly if they double

Jim Keenan on Monday's Halftime Report was as reluctant to hang a target on the 10-year as Barack Obama is to shake Vladimir Putin's or Hillary Clinton's (take your pick) hand, but he still thinks high-yield is attractive.

Jim Lebenthal, one of our favorite panelists who isn't on enough, predicted a 4th quarter chase for performance.

Sarat Sethi, "at the end of the day" (Drink), likes the market and especially BWA, QCOM DAL, UAL and ILMN.

Joe Terranova lamented, "I think I'm in a large community right now who is underinvested."

Steph Link said it "didn't really make a lot of sense why so many stocks had fallen."

Pete Najarian scoffed at the semiconductor downgrade from Goldman Sachs. "Nothing against this particular gentleman but he's been wrong the whole way up," Pete said.

Jim Lebenthal said to buy TGT and that the breach was "last year's news, folks."

Joe seemed to pick LOW over HD.

Seema Mody (above) sure looked good but happened to say "substentive" when likely intending "substantial" or "substantive."

Herb Greenberg said he once pointed out on CNBC.com that there were "earning qualities" (sic), er, "earnings quality issues" at Tesla.

Dr. New Land asked Phil LeBeau an outstanding question, whether GM, F and TM "truly believe" the future of cars is electric. LeBeau said he hates to qualify his answer, but "yes and no," that they believe it, just "way down the road."

Pete Najarian said he jumped aboard the hot NUE options, which of course he would "expect" to continue going up for "1-2 weeks," but if they soar, he's "gone." Judge discovered that's "usually the caveat" for Pete's holding period.

Judge said the latest hot Motif investment is the tax-inversion variety, featuring GWPH, SIMO, VPRT, LOGI and ICON plc. What Judge hasn't explained to viewers is whether CNBC personnel are allowed to invest in motifs as with mutual funds.

Demonstrating impressive knowledge of the space, as well as a grammatical blunder, Joe was heard to say, "I don't know necessarily if the Dollar Tree customer is the Family Tree (sic) customer."

Mr. New World also asked, "What happens to Dollar Tree in a scenario where Family Dollar and Dollar General gets (sic) together." Pete Najarian only lukewarmly agreed that they might accept a look from WMT.

Jim Lebenthal was heard to say "Nordstroms" (sic). Then, he echoed that theme in suggesting WMT could be interested in "JCPenneys" (sic).

Pete Najarian's Final Trade was ADSK. Jim Lebenthal said JCP, Joe said X and Stephanie said TCBI.

[Friday, August 15, 2014]

Seymour: ‘De-escalation’ in Ukraine

Tim Seymour, who just recently said "the complexity is more complicated than people think" in Ukraine, raised eyebrows on Friday's Fast Money in suggesting what really happened on the eastern border Friday was a "de-escalation approach."

Thomas Vitiello said gold is a "muted" trade right now, but that didn't stop Brian Kelly from pounding the table on GDX.

Tim Seymour offered MO as a defensive trade, while Pete Najarian floated both MSFT and KO and Guy Adami said LMT.

Tim Seymour said junk bonds are a smart choice in a low-rate environment. Brian Kelly said he agreed but then made a bear case anyway. Guy Adami said this rally is an opportunity to sell.

Pete Najarian said September 40 calls in SWN were hot, and that the 97-101 September call spread in AAPL was being bought.

Pete said he bought ADSK near the day's lows.

Tim Seymour gave the green light to JCP longs.

Tim Seymour's Final Trade was to sell ORCL. Pete Najarian said MSFT even though the screen said AAPL. Brian Kelly said JJG and Guy Adami said HAIN and congratulated departing page Amanda Garcia.

‘My hair does not look that black anymore’

Dr. New World on Friday's Halftime Report decided to spread around energy stocks like backyard fertilizer, starting with UPL and SWN and then adding CXO, EOG and PXD.

The rest of the crew joined the party, with Josh Brown touting XLE and IEO, Pete Najarian pounding the table for DVN and Jon Najarian doing the woulda/coulda/shoulda on pullbacks such as BHI.

Joe stumbled a bit on his Fed commentary, referring to "Jallen" (sic short for Janet Yellen) and even brought up Kocherlakota; in any case, Joe said to "forget about" yields spiking.

Refreshingly unlike typical television vanity, Joe seems determined to get a new picture of himself for the Playbook Playoffs standings, telling Judge, "My hair does not look that black anymore."

Fyffes too much for Judge

Judge's star guest for Friday's Halftime Report was Russia expert Ian Bremmer, who senses an "escalation" in the Ukrainian situation.

"At this point I would probably make a bet that Europe is gonna be forced back into recession on the back of this Ukraine crisis," Bremmer told Judge.

Hardly in rapt attention, Pete Najarian started cracking up during Bremmer's remarks.

However, the panel made up for that lapse by handing Judge a good one about Elvis' peanut butter and banana sandwiches.

Rick Santelli provided a tight, low range for the 10-year but didn't mention the "steak and potatoes" Fed this time.

Doc has the ‘Jackie Brown’ headwear down pat, but not the NFL résumé

Judge finally got a chance on Friday's Halftime to air the "when I'm not trading" feature of Jon Najarian.

It was a fine profile of Doc's considerable interest and expertise in the wine space and a tasting excursion on Lake Michigan.

It also featured Doc telling the camera, "After my 4-game career with the Bears was over, I decided to uh, give trading a shot."

(Sigh) And now it's our turn to (Drink), because this is probably the half-dozenth time this page has taken up this subject.

Doc didn't have a "4-game career" with the Bears. He was signed to compete for a roster spot. That, we've long acknowledged, is a major sports accomplishment. But, until one actually makes the team, one does not actually have a "career" with the team.

Doc writes in his own book, How I Trade Options (you can look it up online and read excerpts), that his last preseason game was in Kansas City, and that he was cut after the 4th game. But in fact, Kansas City was only the 2nd preseason game, so we really have no clue when he got cut, how many preseason games he actually played in, or what he means by a "4-game career." Only that, from his own book and a search of nfl.com records, he never made the Bears roster.

It'd be kind of like Stephen Weiss going to qualifying school, getting paired up with Phil Mickelson for a round or two, and then implying he was on the PGA Tour.

Meanwhile, Pete Najarian said of AMAT, "I don't think you have to chase it here," but look for it "50 cents lower."

Josh Brown said the CQB battle is "only in its 4th or 5th inning."

Joe Terranova said of GCI, "I'd sell half, stay with the other half" (sic last 5 words redundant; if one sells half a position, what else could you possibly say about the rest of it?).

[Thursday, August 14, 2014]

2 & 20 insight: Hedge funder apparently just told John Jannarone he ‘can’t wait 2 years’ for a MNST pop

Unfortunately, but to be expected, much of Thursday's Fast Money involved 1) 13F reports (Zzzzzzzzzzzzzzzzzz) and 2) the Coca-Cola-Monster Beverage deal (Double Zzzzzzzzzzzzzzzz).

Guest host Michelle Caruso-Cabrera tried to make John Jannarone's day by crediting him for calling the KO investment. Jannarone said KO is "more likely to just keep buying more of this," then said that a hedge fund manager was getting frustrated about MNST's growth and said "I can't wait 2 years."

Guy Adami said (warning; this is an even more tiresome subject than the first 2 things on this item) that "you wonder" whether SODA will be in play (Drink) in the wake of the MNST deal.

Nik Modi said Coke is just "tipping (sic) their toe in the water," but for Monster, "this is a huge, huge development."

It was only late in the show when Karen Finerman said that if you were buying MNST in the afterhours at 86 or 87, "you are paying a huge premium."

Something MCC is good at: Identifying which guests belong on different shows

Paul Hickey visited the Fast Money set on Thursday to explain that when heavily shorted stocks fall, it's a sign of a risk-off market.

Hickey suggested CNVR as a heavily shorted stock that might be appealing. Guy Adami mentioned GME.

Guy Adami said CSCO's August was repeating itself from 2013.

Tim Seymour said DANG has potential, but don't buy it Friday.

In the program's promised showdown moment, Guy Adami revealed that Kevin O'Leary is "a brilliant guy and has become a friend."

Adami and O'Leary conducted a lukewarm (at best) follow-up on whether dividend-paying stocks are the safest choice. Like Tim Seymour, Michelle Caruso-Cabrera didn't seem impressed by O'Leary's 40-year results, stating, "That's the slow-money show."

Speaking of MCC, Karen Finerman said RAX got a "nice pop," probably from Loeb's filing.

It’s also a business the U.S. government likes to bail out

Karen Finerman, who in the last year or so has dabbled in JCP both directions, said on Thursday's Fast Money that the company is "not in the death spiral anymore," but it's not exactly cheap either.

MCC and Guy Adami were heard to say "Nordstroms" (sic) (Drink). Guy Adami said the opportunity in JWN will be at 63½ or 64 but called Macy's the "most interesting stock on the board" (Double Drink).

Mike Khouw said EL August 72.50 puts were active.

Michelle Caruso-Cabrera said that GM is an "old school" choice for Warren Buffett, "it's a business he can understand," but there's another benefit (tip: it's in the headline of this item).

Guy Adami suggested GM is probably "dead money" but predicted upside in COV.

Tim Seymour really thought MCC’s AGN joke was funny

Guest host Michelle Caruso-Cabrera, with a straight face, claimed to be suspicious on Thursday's Fast Money that Tim Seymour was calling Karen Finerman an expert on AGN "because she's a girl."

Tim Seymour mentioned China data and came close to but didn't quite reach his holy grail, PMI.

MCC apparently said Guy Adami looked "pretty sheepish," though — honestly — it sounded a lot like "pretty sh---faced" even after several rewinds.

Tim Seymour's Final Trade was to short FXC. Brian Kelly, who has been on too often and yet still can't explain why he shorted AAPL, said EWZ. Karen Finerman said M (Drink), and Guy Adami said TLT.

‘Being long bonds is

the right trade’

At least it wasn't Marc Faber, but Judge's decision to open Thursday's Halftime with Mohamed El-Erian was enough to make viewers hope Barack Obama would hurry up with that press conference.

"I'm getting more and more nervous that this bet on bad news is good news (sic didn't complete sentence); there's a limit, the higher valuations go," El-Erian stated, before twice stating "these valuation" (sic singular).

Later in the program, Mike Harris suggested the S&P 500 might be toppy because we're challenging the long-term support line. He said he's still long S&P and Asian equities but "net short the European markets."

Maybe most intriguing, Harris asserted that "being long bonds is the right trade here in our minds."

Dr. New World said that "probably one of the better things I did a month ago" was give up on his rising-rates thesis.

Seema Mody wore an off-pink dress (that photo is actually from moments later on Power Lunch) while detailing U.S. companies with significant European exposure. Joe said, "The ECB is going to be there" and will "go all out" and defended names such as BMW and adidas as buyable.

OMG ... Cramer’s charity sold a stock, one of his toughest decisions ever

Dr. New Land said on Thursday's Halftime Report that he's reiterating that WMT "is dead money," but he likes COST, which was just what Judge needed for a Cramer cross-promotion, revealing Jim unloaded COST and called it "one of the toughest decisions they've ever had to make."

Joe insisted COST is best in the space, unleashing a counteroffensive from Pete Najarian about WMT's great report.

Later, Doc pushed a bull case for JCP, while Dr. New World contended the stock is running out of steam but that he wouldn't short it.

Joe — who recently said the buzz about GoPro shares would prompt more people to buy the cameras — insisted GPRO is different than other so called 1-hit wonders. Doc said Red Robin burgers (RRGB) is simply in too crowded of a space.

Pete Najarian said KING is in trouble as long as it only has 1 hit game (Drink ... or is that multi-Drink nowadays), while Jon Najarian said he buys retailers around Labor Day (now THAT's a multi-Drink for sure).

Pete Najarian said he thinks "all these names have upside" in the chemical space.

Joe was heard to say "commertary" (sic) and said he likes ABT, AMGN, MCK and PKI.

Judge praised Dom Chu's golf swing but the Dominator insisted "I gotta work on mine; we gotta work on ours together here."

Brian Stutland told Jackie DeAngelis (in green gown) that if nat gas storage build doesn't improve, a tight supply situation could drive the price higher. Jeff Kilburg contended, "I think we go lower before we go higher" and said the Marcellus Shale region set a "new (sic redundant) record" for 1 day and tossed in a reference to the Gibsons meat locker. Mr. New Land suggested RRC.

Final Trades — and the "when I'm not trading" feature on Jon Najarian scheduled to air — were preempted by Barack Obama's statement in which the president said that police officers should not shoot peaceful unarmed civilians, and people should not riot when such events occur.

[Wednesday, August 13, 2014]

Brian Kelly decides during the commercial break that Russia might back the ruble in gold

Robert McEwen told Wednesday's Fast Money that his gold-mining company (MUX) is outperforming this year because shareholders "trust" what they're doing.

He also predicted near-term tailwinds because September and October are "usually a strong period" for gold.

McEwen, like the guy with a 10% gold position on the Halftime Report (see below), took a page from Peter Schiff's book and hung a $5,000 target on gold within 3-4 years, which caused Mandy to crack up and practically sputter. Pete Najarian said the $5,000 to him sounds "a little bit out there."

Brian Kelly said moments later that his Final Trade was GDX because if Putin backed the ruble with gold it would be "overnight, boom, 5 grand."

Jon Najarian cracked that his Final Trade was GNRC but that it's "just as likely" that Vladimir Putin would buy every generator as back the ruble with gold.

Gotta hand it to Jeff Bezos: He knows how to suggest things that get talked about on TV for months or years

Re/Code's Jason Del Rey said on Wednesday's Fast Money that Amazon's mobile payments are just another attempt at undercutting others in the space.

Mandy Drury, who was heard to say "cod (sic accent) reader," liked Del Rey's point that Amazon is "sucking everybody into the Amazon ecosystem."

"They actually can gather more data," Pete Najarian said of AMZN. Guy Adami said you can get long, perhaps against 320. Doc informed viewers about what happens to a put when the stock price goes up.

Someone made a drone crack, furthering the mileage of that concept for the benefit of a certain retailer.

Meanwhile, Pete Najarian cited Macy's "huge commitment to the online world" as representing a "buying opportunity" (Drink).

Brian Kelly referred to "Nordstroms" (sic) and predicted "If they miss at all, it's gonna be a disaster."

Guy Adami said M has had trouble with 61 for a couple of months but at Wednesday's level, it's a buy for a trade.

Guest forced to defend

‘hold’ on TSLA

Mandy Drury like previous Fast Money guest host Sara Eisen looked great on Wednesday but also like Eisen played right into the panel's scheme as just another prompter reader while their shaky calls and predictions of recent days went once again unchecked.

At least in terms of entertainment value, Mandy by the end of the show managed to make up for ground lost by the dubious decision to open the program opining on CSCO.

"I'm not at all unhappy about these results," was how Doc Najarian kicked things off.

Guy Adami suggested a possible double top in CSCO and to look to buy around 22.50; he also said he likes VMW better.

Brian Kelly said he'd "just be a little worried" about Cisco's layoffs and somehow urged viewers to use some level of caution towards the overall market (as opposed to buying stocks based on the darts you threw at a board).

Jon Najarian said "a lot of rumors" were swirling about P and in a nice facial of Dan Nathan said that this time it was those mentioning the "Death Triangle" who got burned.

Doc later pointed out that YELP was hurting the shorts too.

Guy Adami said he still thinks FB is going to 75.

Guest James Albertine said his favorite pick is actually LKQ but he likes Ford because it's "very far ahead" with the new F-150.

Albertine insisted that Stifel's hold on TSLA is not "the wrong short thesis" even though "the Force is strong" right now with the company.

No indication if Michael Burns has tracked down the folks who leaked ‘Expendables 3’

After warning that its run rate is increasing and not good unless it produces an Ebola breakthrough, Doc said on Wednesday's Fast Money that if you're in TKMR for its possible cure, then you stay in it.

Guy Adami warned of "severe double tops" in DE.

Adami said that if XONE reaches 25, "you buy it with both hands."

Jon Najarian cited "strong, unusual activity" in GNRC, specifically 52.50 November calls.

Pete Najarian cited "huge buying" in October 52.50 calls in NUE.

Guy Adami said SEAS has been a "no way go near it" since the documentary.

Mike Khouw said the September 90 calls in MPC were hot.

Pete Najarian's Final Trade was MWE and Guy Adami, who pronounced the show "fun tonight," said KORS.

Best short case for GPRO is not made; when analysts get asked for autographs at SBUX, then get death threats

No group of money managers does more protesting about how great their performance is ("you see, that one worked against us, but we've actually been making money ...") than the short sellers who appear on Halftime/Fast Money.

The latest victim was GPRO short John Fichthorn who, despite being good-natured about everything on Wednesday's Halftime, didn't seem terribly amused by Judge's intro about his position not being a "pretty picture."

"Ah yes," said Fichthorn, who claimed "you can't find the word 'camera' in their SEC filings."

Josh Brown suggested GoPro could be like the iPod of a dozen years ago. Fichthorn said he doesn't see the same type of iTunes infrastructure with GoPro.

Adding fuel to the fire, Judge told Fichthorn it's a tough market for shorts and suggested solar "more than any other" trade has gone against him. Fichthorn protested that solar stocks haven't even gone up since his last appearance and tried to assure that they're all going to miss in the 2nd half of the year.

Fichthorn for some reason is short TSLA but not before rattling off a list of qualifiers that included "risk management" and "humility." Switching to offense, he carped about the term "demand-constrained."

Steve Weiss said he agrees with Fichthorn on TSLA but he's not short himself because of its momentum; the key is determining when it's ripe to fall.

Jon Najarian praised Fichthorn's acumen but seemed to doubt the practice, stating that to short these names, "You gotta be doing it with out-of-the-money puts."

Dan Nathan thinks Kara Swisher article marked a tech top (but still thinks TWTR is in the ‘very early innings’ of a great story that Google should buy to lock up real-time search for 10 years)

In what was more of a head-scratcher than the short-GPRO call, Matt McLennan told Wednesday's Halftime Report that he's got 10% in gold/gold miners and 20% in cash because there's "some cause for caution" around the world.

McLennan suggested that with all the central bank money-printing, gold is "nature's" way of providing monetary balance. (No, we are not rehashing a Peter Schiff episode from 2007.)

Speaking of reruns, Doc reaffirmed his long-standing theory of buying retail around Labor Day and selling around Black Friday.

Yet, foxy Courtney Reagan told the gang she's not sure the "consumer funk" will end anytime soon.

Steve Weiss, though, downplayed Judge's concern about the retail environment, stating, "To me, this is just temporary and should be bought."

Josh Brown said he'd be more inclined to buy M than sell it around its 200-day at 55.

Brown said he'd avoid KING even after the crush.

In a bizarre guarantee (designed to convey to everyone how tight he is with Ackman), Judge said if Pershing Square did an IPO, "I can tell you absolutely it would not, would not, be listed, uh, in the United States."

Anthony Grisanti told Jackie DeAngelis (hair pulled back, crisp white top) that he thinks WTI will narrow the gap with Brent.

Jon Najarian's Final Trade was NUE. Josh Brown said M, Mike Murphy said KMI and Stephen Weiss said PCLN.

[Tuesday, August 12, 2014]

Sara needs to put the

pedal to the metal

Sure, she looks dynamite.

But, her show is putting viewers to sleep.

Our instant assessment of Sara Eisen's first 2 days at the guest helm of Fast Money is that we've got a typical case of read and react/Cover 2 going on here; Eisen needs to start playing offense even if she hasn't spent much time with these characters.

Most Fast Money hosts, like Eisen, try to get too chummy with the entourage and all of its ridiculous in-jokes, and the tails end up wagging the dog, the animals running the zoo. Managers can't be the ballplayers' friends. It's a far better show when someone lays down the law and demands to hear a trade, or at a minimum, a serious explanation as to how a recent call ended up on the Bust of the Year list.

Opening segment on strong-dollar trade bores Karen as much as viewers

They had lemonade, and made lemons.

Sara Eisen opened Tuesday's Fast Money with a mind-numbing go-round on whether the U.S. is the best place for investors.

Karen Finerman even admitted that basing trades on a strong dollar makes no sense to her; "I don't really get that," said Finerman, suggesting it's the "cart leading the hor-" (sic unfinished).

Morgan Downey said the fact oil isn't rallying on the Iraq situation is a "very strong indicator" that it's going lower.

KATE still looks rich,

unless it trades lower

In a remarkably confident call, Corinna Freedman joined Tuesday's Fast Money to say that in the wake of KATE's slide, "absolutely it's a buying opportunity" and that Tuesday's move was a "complete overreaction."

Karen Finerman hilariously said KATE traded like "a failed drug trial." But she wondered "who's left" to buy it.

Karen and Dan Nathan said they might be interested in KATE if it has another bad day, and in fact Karen made it her Final Trade (with the qualification of not to chase it if it goes up). Tim Seymour cautioned not to lump in KATE with KORS.

Karen Finerman started to say PLCE is an LBO candidate, then said that's unlikely because of recent moves in the credit markets.

Michael Burns initially insists they’ll figure out who leaked ‘Expendables 3,’ seems less confident of that by end of interview

Morgan Brennan reported on Tuesday's Fast Money that the word "transition" came up on the KING call and is becoming a common word with other gaming companies.

Assessing Apple and Samsung, Toni Sacconaghi invoked one of the sorriest of cliches, that "this is a tale of 2 markets." Then he predicted Samsung will have to get more aggressive on the lower end. Tim Seymour said this is the type of stuff we all heard a couple years ago.

Brian Kelly reaffirmed that he's short AAPL.

Dan Nathan, who apparently just realized Twitter has a search component, initially said he thinks we're in the "very early innings" of the TWTR story, then later claimed it "should be bought by Google," and concluded by making it his Final Trade.

Elsewhere, Nathan put P in the "Triangle of Death" and said if a couple things happen you definitely don't want to be long.

Nathan said a bunch of CSCO September 27 calls were bought.

Nathan said RAX is sitting at key levels, so be careful.

Karen Finerman pointed out that ICPT's performance was not a pop, but a drop, from Monday's afterhours.

Tim Seymour said he doesn't like what TSL just did out of their bailiwick.

Seymour said AMCX has to be "on people's watch lists."

Michael Burns, who's always a tough ticket (snicker), tried to downplay the impact of the "Expendables 3" leak, stating "it's happened before," and "maybe it's 500,000 people that have watched it 4 times each."

Tim Seymour said you have to be "at least neutral" on LGF, and he happens to be "very positive" about the stock.

Tim Seymour's Final Trade was NOK. Brian Kelly said to sell HYG.

Meg Tirrell is cute getting a dousing, shares high-10s

Gemma Godfrey kicked off Tuesday's Halftime Report calling the decline in German sentiment (Zzzzzzzzzzzzzzzzzzzz) an "overreaction."

Jim Lebenthal said "I'm not that worried about Europe to begin with" and predicted, "from about 3 to 6 months from now, we're not gonna be talking about Ukraine anymore, and Germany will be just fine."

Michelle Caruso-Cabrera said there's potential for a "Shia on Shia" conflict in Iraq.

MCC brought up everyone's favorite new Ukraine term, "Trojan horse."

Stephanie Link revealed that the gang discussed the 10% contraction in oil prices at its morning meeting.

Jane Wells said corn's price is at a 4-year low.

Biogen's Doug Williams (not the Super Bowl quarterback) said the company has "doubled down" on the ALS space, ahead of the big splash for Meg Tirrell. (A lot of journalism watchdogs will harp upon this type of cozy reporting, but it seems fine.)

Bears ‘firmly in control’

of the gasoline market

Rich Ilczyszyn on Tuesday's Halftime Report told Jackie DeAngelis that gasoline could fall another 5%; "the bears are firmly in control."

Josh Brown called KING a "1-trick pony" and said he'd stay out of it.

Sandy Miller painted a rosier picture for game makers and said gaming is the No. 1 application on smartphones. Brown contended that a lot of upstart game makers have "flamed out" and that the "platform partners" such as the Apple store can pull the plug at any time. Miller said the game companies follow the Asian model of making the games free with premium extras for a price.

Steph Link downplayed the Tesla quality report; "I don't think it's a big deal."

Link said ANF could get "maybe to the upper 40s."

Judge puts together mouth-watering chef feature, unfortunately overdoes fine water challenge by bringing up Zuck and Dick Costolo

Kate McShane, who is very pretty and attended Notre Dame, was given barely time for a soundbite on Tuesday's Halftime Report to explain to Judge why WSM is her top back-to-school pick as Judge did most of the talking expressing skepticism.

We did hear McShane say "Pottery Barn Teen and Kids" is gaining momentum, so maybe there's more going on here than we realize. Jim Lebenthal said he could "get behind" this call as a housing recovery play but not as a back-to-school play.

Judge's home movie clip from the kitchen was impressive, warm and well-done, though 1) we sort of wonder if the kids wouldn't just prefer pancakes and 2) why in the world weren't Dr. New Land and Josh Brown invited/able to attend and 3) were people actually seated at this dinner or was it standing room only. (Lessee ... if we were organizing such a dinner, the guest list would have to include Seema Mody, Sara Eisen, Mel, Karen Finerman, MCC, Jackie DeAngelis ... like Chuck Noll used to say, it's not a question of where to start but where to stop ... Mary Thompson, Julia Chatterley, Mandy, Nicole Lapin, Trish Regan, Melissa Francis, Louisa Bojesen ...)

Judge also made a fine gesture for Paul Najarian; unfortunately he capped it off by trying to gin up publicity for CNBC via guilt trip for Zuck and Dick Costolo.

[Monday, August 11, 2014]

Carl doesn’t do the 5 p.m.

Viewers got an instant treat Monday with the realization (albeit including a technical glitch with Kelly Evans) that magnetically gorgeous Sara Eisen would be guest-hosting Fast Money in Missy Lee's absence, and surely, with Karen Finerman back in gray T-shirt (see below), the 3 male panelists enjoyed putting on a show with a pair of foxes.

Early in the program, however, Eisen's lack of time in the Fast Money sphere surfaced upon reports that NUAN was falling afterhours.

Pete Najarian said he wouldn't be chasing it, but around 15½ or 16, it's "probably gonna be a great opportunity."

Dan Nathan agreed, "I think it's probably dead money," and said he'd look for it around 15.

Karen Finerman suggested it'll be interesting to learn if Carl Icahn backs up the truck. That's when Eisen said "he can come on the show and let us know," not realizing that Carl is now Judge's guest, not Mel's.

Pete assures Sara that

panelists don’t hate TSLA

Tim Seymour, who loves to complain about every other show that TSLA has a high valuation, called the notion that Tesla cars may be "more cost-effective" than the internal combustion engine a "huge leap of faith" on Monday's Fast Money.

Karen Finerman said she couldn't get near a valuation like TSLA's but "I wouldn't short it either" (Drink).

Pete Nardashian protested to Sara that nobody on the panel owns it because no one is sure when Tesla makes money; "it's not that we don't believe in the company."

Tim Seymour rambled that he owns KNDI.

It seems like Scott Adams’ call for investment-advice warning label got a bigger endorsement

Shots CEO John Shahidi came across as impressively humble during his appearance on Sara Eisen's Monday Fast Money — but he didn't seem to have much luck convincing the panel that Shots is where it's at.

Shahidi said the goal is a platform where you see "nothing but people," but where comments are nonexistent so nobody can make fun of your face.

Karen Finerman asked Shahidi how Shots can police photos that aren't selfies. Shahidi admitted, "We can't," then threw in an "at the end of the day" (Drink).

Shahidi said Floyd Mayweather was the first Shots investor, but he didn't say whether Floyd's friend, CNBC reality star "Steve Stevens," is also an investor.

Dan Nathan scoffed at Shots' biggest backer. "Justin Bieber's not a positive image," Nathan said.

Carter Worth said the January Effect means losing year for stocks

Mark Newton of Greywolf, who earnestly spoke as though he were being paid by the word, pointed to a 2-year S&P 500 chart and said the rally has been "remarkably pretty well-contained" and figures to bounce off the bottom of the range, although it's a "bit overdone on the upside" recently.

Newton also pointed to 2003, when he cited a rally following George Bush's invasion of Iraq (boy, those were the days) as evidence that stocks can go up when the cannons are fired. "These days people are saying, well, why can the market rally, you know, we're goin' into Iraq and yet the market's rallying," Newton said.

Newton also hilariously stumbled in saying "former July ho's (sic)."

Dan Nathan wasn't impressed by Newton's XLI chart and warned it could see 50 soon. "It topped out in June," Nathan said.

Dennis Gartman didn’t say anything about gold in yen terms

Karen Finerman on Monday's Fast Money uncorked the first "inured" we've heard in a while, stating, "I sort of think that we get inured to some of this macro news."

Pete Najarian actually suggested markets were selling off because of Gaza (if you've ever sold a stock because of Gaza, you should have all your money in CDs) and said the only thing that concerned him Monday was that financials were not participating. "I think you buy volatility," Pete said.

Dennis Gartman though actually made it worse in asserting (with a straight face), "I think we need to pay attention to what's going on out in Libya" and its "tribal warfare."

Gartman said he's long WTI vs. Brent for reasons that aren't worth explaining.

Pete Najarian said NUE September 52.50 calls were hot.

Tim Seymour had to tell viewers that the song they were hearing was "When the Levee Breaks."

Karen: MLPs may have topped

Meg Tirrell joined Sara Eisen's gang on Monday's Fast Money to report 1) a bunch of Ebola projects in the works and 2) that ICPT was soaring because of its treatment for NASH, "one of the biggest binary events left this year in biotech."

Karen Finerman said it's "too dangerous" to invest in these names with such extreme "binary" outcomes.

Tim Seymour said JBLU has been lagging "for a number of different (sic redundant) reasons" but had an "impressive" move.

Dan Nathan said P options activity runs out to January, which suggests it's possibly based on a takeout. (This writer is long P.)

Karen Finerman admitted she didn't "really know" what was the catalyst Monday for ADT.

Pete Najarian had the audacity to say that KING would go higher on Tuesday if "some of the numbers are good" during the earnings report.

Tim Seymour endorsed big-cap gold miners as opposed to small-cap gold miners.

Dan Nathan said there was a big buyer of December 30 calls in IMAX.

Tim Seymour's Final Trade was long YNDX. Dan Nathan said T and Pete Najarian said HA. Karen Finerman's Final Trade was the most provocative call of the day, suggesting a short of AMLP.

‘Massive’ insider buying in HLF

Monday's Halftime Report was sunk from the opening seconds when Judge played a clip of Marc Faber, and moments later when Pete Najarian urged everyone to buy protection when you can and not just when you need it (Drink).