[CNBCfix Fast Money Review Archive — January 2014]

[Friday, January 31, 2014]

Worth: S&P to ‘1,600s’

What can we say, we're suckers for canine programs.

So, Friday's Fast Money was a raging success.

Carter Worth delivered the troubling truth about down Januarys, that when it happens, the likelihood of a down year goes from 33% to 58%.

Worth also, with really no supporting case, said the S&P has been bouncing off its 100-day for a while, but for whatever reason this time, "it's our premise that we're gonna break."

Honestly in our opinion, where the S&P is on Dec. 31 doesn't really matter right now; the question is whether we bottomed this week, are going to bottom next week, or aren't going to bottom for many weeks.

Worth didn't address that, but told Steve Grasso, "We think we're going into the 1,600s."

Brian Kelly actually drew parallels to 1929, stating "there are a lot of similarities with the economics" which would bring the S&P, according to Kelly, to 1,700, if it turns out like 1929, a point so ludicrous it should not be mentioned on any semi-serious page, but the pooches won us over, so we're mentioning it.

Steve Grasso predicted the S&P 500 tests the 200-day, "right around 1,700."

Tim Seymour indicated the emerging markets hysteria may pass; "I've seen this before."

While no one pointed out why a certain name is being floated at Microsoft (to gauge market reaction before actually doing the deal, unlike Google and Motorola Mobility), Tim Seymour suggested they're turning a page in Redmond; "this is gonna get Microsoft out of their image of the past."

While nobody pointed out Steve Jobs' age at death, Steve Grasso said that a fresher face than Bill Gates will help; "I think without him, it probably does better."

Grasso said he's waiting for $1,060 in GOOG but maybe won't get it.

Tim Seymour and Josh Brown suggested it's not a struggling consumer that's hurting retail stocks including AMZN, but more of a pause after a series of robust quarters. "Spending has not fallen off a cliff," Seymour said.

Brian Kelly claimed natural gas and heating oil are too tricky for others; "I wouldn't be surprised if we hear about a hedge fund blowup over the next couple of weeks." Steve Grasso said it's "time to take profits" in ECA, SWN and COG.

Tim Seymour said "I would be a seller" of CMG, while Steve Grasso said he "probably wouldn't be there" in NEM.

Seymour's Final Trade was POT. Josh Brown said WOOF, Brian Kelly said EUO and Steve Grasso said SO.

Mel wore her lovely green/aqua short-sleeve top and looked stunning but it was the doggies who stole the show; if you're champing at the bit to zip out to the Connecticut Humane Society on Monday but can't make it, the site is www.cthumane.org.

Contrarian alert: AMZN board member is a ‘full-on believer,’ has ‘no questions and no doubts’

It was Simon Baker who had mike problems on Friday's Halftime Report, but in fact guest Bing Gordon didn't really need to be miked at all.

Gordon stiff-armed every one of Judge's questions about Amazon's dismal quarter and embarrassing headline-deflector of mulling Prime price increases (but no, according to Pachter, they care "not a whit" about stock price), revealing only, "I agree with Jeff's point of view ... I'm a full-on believer ... So, you know, I have no questions and no doubts."

Wow. A utopia of business.

Judge even had the audacity to ask if Amazon needs to communicate better.

"No," Gordon said.

Gordon did offer to speak a little bit about ZNGA, stating Don Mattrick is great and the games it's got are great.

He even offered a device forecast. "I predict in 10 years, um, 10% of people connected to the Web are wearing some kind of uh, visual, uh, wearable," Gordon said.

Jon Najarian said that in order to be an "aggressive buyer" of AMZN, "I need that price increase for the, uh, Prime."

Mike Murphy said he's not buying it and warned what could happen if it (snicker) starts trading at a "normal valuation." But he said hiking Prime fees makes sense; "that's just money in the bank for them."

Simon Baker said the easy money has been made in ZNGA and said to "take profits."

No ‘proper panic’ yet in EM

Extremely good-looking Sara Eisen opened Friday's Halftime Report emphasizing that emerging markets are "so not in favor right now."

Ben Willis offered the most curious comment in praise of a selloff. "Thank God, it's necessary, it'll benefit the long-term health of this market," Willis claimed.

How come it's always the corrections that are "healthy," and you never hear anyone say a rising market is "healthy," even though that is the goal of bulls.

Does that make any sense to you?

Didn't think so.

Simon Baker had an issue with the volume — not on NYSE shares, but with his microphone that apparently was turned off.

Richard Titherington told Judge that in fact, the biggest mistake people make with emerging markets is buying high, when the way to profit on them is "moving against the crowd." Steve Liesman said that in the market, "the concern is that they can't pay their external debt."

Candace Browning said Brazil in the MSCI is equal to GOOG, and Turkey is equal to SBUX. But, she contends, it's "still too early to buy emerging markets," and she's looking for "capitulation," asserting that a "proper panic" is 10-20% below the 200-day moving average, and it's only 6-7% now.

Browning's full-year S&P target is 2,000. She also likes wearable tech and obesity trades.

Simon Baker pointed out, "We just had Mr. Bing (sic) on."

Murphy: 75 ‘conservative’ in FB

Judge Wapner suggested at the top of Friday's Halftime Report that Scott Devitt was "capitulating" on his NFLX call, cementing an embarrassment by Pete Najarian who on Jan. 8 was negative on NFLX citing Devitt's (incredibly old) argument that there's a "lot more competition out there."

Jon Najarian on Friday said "kudos" to Devitt for presumably buying in at the high and being wrong again. But Mike Murphy is concerned that everyone's now on the "same side" on NFLX, and he wouldn't buy over 400.

Murphy argued that WMT is not that relevant; "Wal-Mart hasn't been that important in a long time."

Jon Najarian said he sold puts in MA as a wimpy way of getting into it; "I think this one's a buy here."

Simon Baker gushed about CMG; "this came out of nowhere ... we really like this name going forward."

Mike Murphy was hailed for the inclusion of FB in his 2014 Portfolio Playoffs (or whatever it's called), prompting a Brag Trade about how he really thinks his 75 tally is "conservative" (interesting he didn't say that before the report). The sad disclosure from Judge's Playbook rankings was that right now Joe is getting manhandled.

Simon Baker thinks now's the time to get into BBY, there has been "seller's exhaustion," and Baker said to "think Gap 2010." Mike Murphy first trashed the stock, saying "it was overpriced" in 2013, but then admitted it's now about "fair value," so in other words, sounds like not a bad buy.

Jon Najarian argued that YUM's China price hike will be "huge" and cited the India population under 35 as a bull case. But Murphy insisted it'll have to be all India because "they're way past their peak growth over in China."

Najarian insisted "the bad news is priced in," but Simon Baker backed Murphy and said, "Technically it looks dreadful."

Keyshawn Johnson told the group "I'm leaning toward Seattle," then, apparently not realizing Mike Murphy was trying to bait him into a Chrebet controversy, earnestly dubbed Wayne "the original Wes Welker."

Jon Najarian said he got into hot MON calls because the July 115s were moving and told Judge he'd be in this trade "about 20 days."

Mike Murphy's Final Trade was WEN. Simon Baker said NSC. Jon Najarian said TMO.

The cameraman forgot to give Seema Mody a close-up, but this view is great for the chic dress.

[Thursday, January 30, 2014]

Wrong: AMZN brass does care about stock price, probably more than anything else

Few things on Fast Money are more annoying than the Amazon earnings release, in which a couple panelists will say "I can't even come close to getting on board this valuation" and a couple others will say "it's not a valuation story."

At least on Thursday, some constructive opinions were offered, with Tim Seymour stating, "I say you buy this weakness," advice that proved valuable within the hour.

Brian Kelly on the other hand said, "I wouldn't be buying this at all; I'd be selling."

Karen Finerman defended long-term support in the name; "I don't think this is the time that the music stops," said Finerman, who says the stock can "always get a buy-in" when it falls.

At that point the conversation did in fact revert to its traditional loopiness, with Tim Seymour arguing the company's "certainty" is the difference-maker; "these guys are so far ahead ... the certainty is what you pay for," while Karen Finerman questioned what if anything is certain about Amazon and complaining of the financials, "it is so opaque."

Guy Adami didn't seem on board with buying but cautioned, "I don't think you can short it here."

Michael Pachter delivered even-handed commentary, saying the afterhours AMZN problem stems from "creating this perception that they're gonna crush numbers."

Pachter said he has a 330 target; "I just thought the stock was ahead of itself."

Karen Finerman asked Pachter if AMZN management cares at all about its stock price. "Not a whit," Pachter said, whether it's $100 or $500, "they don't care."

Julia Boorstin said later that Amazon might boost the price of Prime from $80 to $100 or $120, which Melissa Lee found fascinating. (But they don't care if the stock is $400 or $100, so why do they care about gouging Prime customers?)

Tim Seymour admitted his enthusiastic BBY call purchase of a week ago (how's that for a specialist in emerging-markets stocks) looks like a bust.

Guy & Mel’s bickering-married-couple routine centers on Chipotle menu, pronunciation during Yahoo comment

Martin Pyykkonen, whose phone connection on Thursday's Fast Money made him sound like Mushmouth on the old "Fat Albert" show, said that "fundamentally this is a very predictable story" in Google.

Karen Finerman, who took her first turn an hour earlier on the Kelly Evans Fast Money-encroaching Closing Bell (and still looked good enough on Fast Money for another excellent profile) and said stocks had a "relief rally," cautioned on Fast Money that GOOG is "getting a little stretched ... I would not be adding here."

Guy Adami said, "I'm surprised Google's up as much as it is," calling the quarter his favorite word, "benign at best."

Melissa Lee noted Google's sudden dumping of Motorola Mobility and questioned if the company has a practice of "buy high, sell cheaper." Karen Finerman humorously said, "A lot of times they buy high and you never hear about it again."

Julia Boorstin reported on Facebook and informed viewers that the Super Bowl is "the biggest TV event of the year." Brian Kelly said to "wait 3 days" on FB but said Instagram is the key, "they're killing it there."

Guy Adami said something about YHOO and the email hacking and clarified "the jigst (sic) of my question." Tim Seymour said "I think this is a yawn."

Seema Mody plays Clumsy Ninja

Brian Kelly, always turning to some supposedly dire international story to proclaim a contrarian call, said on Thursday's Fast Money that he was looking at European banks and then analyzed MS and GS and found "Morgan Stanley has more European exposure," which Kelly thinks will be a problem with the "contagion."

Kelly claimed that "Accuweather came out, they front-runned, uh, franned- front-ran" (sic all) Punxsutawney Phil this year and predicted excessive cold continuing.

Karen Finerman said she sees mighty "Citibank" (sic) rallying (Drink Drink).

Guy Adami said that BA's underperformance on Thursday's tape "makes you wonder that maybe there's a little more room on the downside."

Super-sizzling Seema Mody said she plays Zynga's "Clumsy Ninja." Guy Adami, invoking his favorite word again, said ZNGA's "quarter was benign."

Mel beaming in silky smooth ensemble while speaking with pro football players

Guy Adami indicated without saying as much on Thursday's Fast Money that JCP is in no-man's land.

"It's impossible to short it here. I think it's equally impossible to buy it," Adami said, suggesting that maybe the "flush" will happen on Friday.

Brian Kelly said 50 is "pretty decent support" in CTXS.

Karen Finerman said WLP was getting a "delayed reaction from some very good earnings."

Finerman said that "something smells terrible" in the Corvex-ADT share deal, and "I'd stay away; something is very off here."

Melissa Lee indicated she knew, and she didn't know at the same time, whether someone could answer her question about when an activist investor can sell after getting a board seat, "Are there any rules right now- I don't know if you guys have the answer but I'm sure one of you do."

"One of you do"?

Tim Seymour said of BX, "I think you stay in this trade."

Melissa Lee and Guy Adami did the bickering-married-couple routine over Chipotle's menu. Adami said of the stock, "You gotta say it's a little rich," while Tim Seymour said "good luck" with that stock getting through 550.

Mike Khouw said March 10 calls in JBLU were hot but he thinks Delta and American are cheaper.

The Fast gang actually took some stock-market questions from the NFL players who visited the Nasdaq (gee wonder why they're in New York right now). Tim Seymour had the insight to tell Aldon Smith that FB was rising because "people are making a bet on the future." (Which is better than making a bet on the past, apparently.)

Guy Adami told Brandon Gibson that as it relates to AAPL, "it's not a numbers question; it's an innovation question."

The curious thing was, as much as the panel enjoyed shooting the breeze with Aldon Smith, in fact Smith is well known for another kind of shooting, one that triggered 3 felony charges to go with his 2nd DUI arrest in 2 years, but while the Fast crew asked really insightful questions about whether Richard Sherman really overdid it, nobody questioned why Roger Goodell is OK with a guy who was loaded at least twice behind a wheel and also hosted a party and fired a handgun twice off a balcony and got himself stabbed in the process with thugs present missing only 5 midseason games during rehab ... while a 2-time champion quarterback got 6 games only for an embarrassing — yes it was disgraceful — tavern incident in which police determined there was no case and the purported victim announced she did not wish to pursue a case, and then despite this stiff punishment for what was determined a non-crime still got trashed in a mag article during the playoffs by the commish, who claimed the QB's own teammates didn't support him, just before Super Bowl 45 occurred. Evidently repeated drunk driving and buying assault rifles the day before a game and firing handguns off balconies and getting stabbed and other people getting shot in players' driveways isn't that big of a deal.

But that information evidently wasn't on Mel's note card.

But the backdrop made for a great endorsement for Mark Doman's money-management services for young athletes. (He wants them to think about retirement, so how come we didn't hear Brian Kelly recommending bitcoin?)

Meanwhile, Mel looked dynamite in incredibly smooth and sleek navy top paired with golden skirt.

Karen Finerman's Final Trade was to sell TKR. Guy Adami said QLGC, which he apparently just picked up about 10 minutes earlier. (See, sometimes the "Final Trade" is not something they devote a lot of effort to.) Brian Kelly said CNX. Tim Seymour said something about an emerging market but the pick was unintelligible.

Judge fails to ask Joe what he thinks of the name ‘Redskins’

Washington Redskins great Joe Theismann told Thursday's Halftime Report crew that trading stocks is one of the few endeavors to rival pro football for excitement.

"It's one of the places where you can get a great rush," Theismann said. (Has he looked at Simon Baker's portfolio recently?)

Like a play-action pass, Joe delivered a bit of a mixed message on his own trading, stating he used to trade S&P futures but "now I just trade the equities quite a bit," and then pinning everything on his advisor, Ed May of Morgan Stanley; "I let the professionals do it."

So Joe is apparently calling the plays, and Ed is the quarterback.

Or maybe it's the other way around.

Joe issued a Brag Trade, saying that unless the U.S. disappeared, stocks were a screaming buy in 2009, so "I went all in."

As for the stocks that give Joe a bigger rush than Lyle Alzado and Howie Long in XVIII, he said, I like Keryx (KERX), and SLB.

Jon Najarian seized on that to trumpet BHI in his Playbook Playoffs portfolio.

Recently it seems as though Barack Obama sees no more important issue than the nickname of the Washington pro football team. But Judge didn't bother to ask Joe Theismann about that; nor did we hear about it in the State of the Union speech.

Pete makes no sense, cites MSFT at 16 and asks Joe Theismann if owning a sports team is a greater investment than owning MSFT

Pete Najarian went down the right path, and then bungled it like a fumble in the open field.

Najarian on Thursday's Halftime Report pointed out to star guest Joe Theismann what Paul Allen paid for the Seattle Seahawks, and then cited MSFT at 16 ... which was either MSFT's price at the time of Allen's purchase in the 1990s (entirely possible), or MSFT's price in the 08-09 bottom (also entirely possible) ... and asked Theismann whether the Seahawks (apparently at today's value) or MSFT (apparently at today's value) is a better investment.

Theismann opined, "I think Microsoft has a much greater chance of going higher as opposed to a team increasing its value."

Seriously?? Maybe for 2 months, but, say, 5 years from now, we'd put our money on the Redskins or Cowboys vs. MSFT shares.

Theismann further undermined his own ability to forecast net worth in claiming he "never" believed quarterbacks or even a defensive lineman would get a $100 million contract. (Wait until it's $200 million.)

Joe said, "I like the Seattle Seahawks in this game," but then lamented the weather wrinkle for "people traveling from Seattle (snicker) and Denver," and if he had attended XL in Detroit as some of us did, he would've counted about 18 Seattle fans in the entire stadium.

Theismann indicated the proposed "union" by Northwestern University football players may not be that feasible, but it could "accelerate the process" that would lead to a "stipend."

Judge didn't bother to ask Joe exactly why a backup tight end for Purdue should get bonus money on top of a scholarship, or whether that bonus money should be the same amount that Johnny Manziel gets.

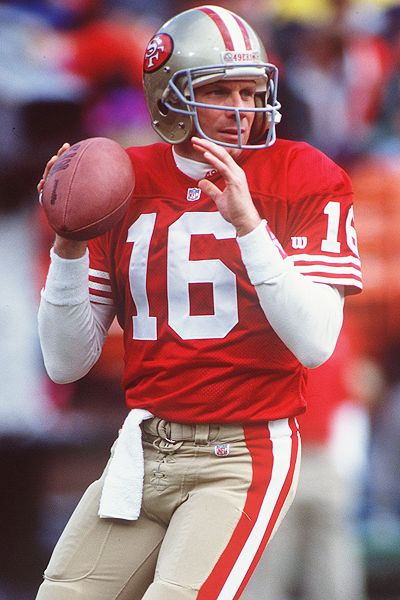

Famous Grudges: Joe Montana

Dominic Chu mentioned on Thursday's Halftime Report that groups will pay former greats such as Joe Montana, Boomer Esiason and Phil Simms $50,000-$60,000 to deliver speeches.

What no one will pay them to do anymore is be the starting quarterback.

If you saw our home page the other day (and you know you did), you saw this fascinating report from the Bay Area involving Joe Montana's scoff at skipping the final game at Candlestick Park.

"If somebody left IBM and went to Apple, if they were shutting IBM down, do you think that guy would go back and visit?" Montana said, prompting the San Francisco sports writer to explain, "It shows that Montana still views what happened as a job firing."

Greatest quarterback of all time. (See below.)

Fired.

There was tremendous drama here. The 49ers were viewed as aging fast after losing the 1990 NFC title game to New York, legendary greats Montana, Lott and Craig all north of 30, Jerry Rice about to enter his 7th season.

Age (35) wouldn't have bumped Joe to the bench. Rather, it was the combination of not playing at all in 1991, missing nearly all of 92, and seeing the younger replacement deliver an MVP season in Joe's absence that prompted the 49ers to declare Steve Young the permanent starting quarterback and ship Joe to his destination of choice, Kansas City.

Very justifiable. But if you've already put 4 Super Bowl rings in the franchise's pockets, and you would've preferred to keep your current job, you might be a little ticked.

Particularly when your replacement happens to be your own personal Public Enemy No. 1.

So, what do we conclude from here ... when you're an enormous fish in a tiny pond of greatness ... say, Joe Namath and the New York Jets ... you can be king for life ... but when that pond has a lot of other greatness and very high standards ... say, the Holy Roman Empire or the 1980s-90s San Francisco 49ers ... even the kings better expect sharp elbows.

Marc Faber just said to short TWTR

Pete Najarian thundered praise for mighty FB on Thursday's Halftime Report, stating "they absolutely slaughtered these numbers," and pointing to FB and UA as well, "that's why it's a stock-picker's market."

Well, actually, for the month of January, he's right, it has been a stock-picker's market.

Daniel Ernst, on the other hand, called FB a hold, saying its sector's stock gains have largely come from "multiple appreciation" and not growth.

"These guys are not knocking the cover off the ball in terms of pure earnings growth," Ernst said, drawing comparisons to Google.

Judge protested what else FB needs to show the bears. Ernst evidently wanted to talk more about GOOG and questioned which company Judge was talking about, prompting Judge to snap that he's talking about FB. But Ernst insisted it's kind of the same story, "they really have 1 core thing that they make money on," and went on to say that the most important metric for Google is "paid click growth," throwing in an "at the end of the day."

Jon Najarian said of AMZN (oops), "I would be holding."

Greatest stock since

sliced bread: C

On a nice day up Thursday, Steve Grasso was a sour voice on the Halftime Report, shrugging off the gains as short-covering and end-of-the-month shenanigans and pointing to Turkey's inverted yield curve as a reason not to buy stocks.

Josh Brown also wasn't jumping aboard, stating, "I don't think we're out of the woods just yet."

Josh Brown pointed out how much better BAC is than C, which got Pete Najarian's dander up. "I totally disagree with you guys," Pete said, calling C the best opportunity in big banks, which is probably what he said years ago when he and Mr. New World used to claim that once it passed $5, all those institutional buyers would step in.

Steve Grasso chimed in on Brown's side, saying we don't know how C is hedged and that those hedges could actually prove a drag if international growth does surge. But then Grasso's mike cut out and he did a little Shields & Yarnell routine.

Vince Reinhart told Judge, "We got good news on the economy," but cautioned that "capital inflows can be fickle."

Who wants to go to Utah?

Jim Iuorio said on Thursday's Halftime Report that "I don't think the upward move is quite over yet" in crude, while Brian Stutland invoked "Back to School" in citing a "Quadruple Lindy."

Jon Najarian argued that "China's the solution" for WYNN, while Josh Brown insisted that "Macau is actually gonna slow this year" and that WYNN is vulnerable to every emerging market headline.

Pete Najarian sided with Jon Najarian, predicting 230 "in a very quick time" for WYNN.

Morgan Brennan, in another example of the sloppy gaffer work in which CNBCers off-camera are heard talking over the people on-camera (some guy this time said "talking from there where would you go, to Utah?"), reported that UPS is "pretty optimistic on 2014." Josh Brown said there's support in the name at 90/91 and it's a "low-risk entry," but that there are "so many other better stories right now."

Jon Fortt said that for QCOM to rally, "China better come through." Pete Najarian likes both QCOM and MU.

Seema Mody reported on BX. Mike Murphy, practically shut out for the day, said, "I think this story is far from over," and also suggested PSP.

Pete Najarian gave Judge the obligatory expected time frame of his option play on UA, "I will be out of this before the end of the day ... who's killin' it online? These guys are."

Phil LeBeau said TSLA crews were performing an "electronic 'Cannonball Run'," and "it's not your leisurely drive across the country."

Jon Najarian's Final Trade was TPX. Josh Brown said AWAY, Mike Murphy said HTZ and Pete Najarian said C.

[Wednesday, January 29, 2014]

Guy Adami pushing his luck

He's very close to being right on 1,765 and could just spectacularly hit that number this week.

Otherwise, Guy Adami's day-by-day S&P 500 forecast looks a bit bone-headed.

On Tuesday's Fast Money, Adami predicted the S&P would be up 10-15 handles Wednesday. When, in fact, it actually went the opposite direction.

So Wednesday, Adami declared, "I'd be shocked if tomorrow we went down and tested that 1,765" ... but it could well happen on Friday.

Josh Brown disagreed, stating, "I don't think that there's gonna be a rally tomorrow" and pointing to the XRT.

Steve Grasso also said the market is starting to batter the 100-day, and "I think we're going lower."

Brian Kelly said 1,700 is "probably the next stop."

It wasn't really clear what Dan Nathan meant, but he was heard to say "very shallow pullback."

Dan Nathan implies there’s a new Google, Facebook or Twitter every 2 weeks

In a clumsy mix of GOOG/FB discussion on Wednesday's Fast Money, Guy Adami claimed the "prudent thing to do" if you're long GOOG is to "take something off the table" before the report.

Maybe, Karen Finerman was listening somewhere.

Adami also claimed that FB "wants to trade $60 now."

Dan Nathan though was the skeptic, calling GOOG a "really, really crowded trade," and then, challenged about FB and GOOG valuations, insisted "they're all very crowded trades" because people think those names are the future of the Web, while "I think there's gonna be other futures."

And how in the world is that a short-term trading call on Fast Money, was the question Melissa Lee did not follow up with.

Steve Grasso predicted that once TWTR reports, people will switch out of FB into TWTR.

Grasso also called YouTube the "crown jewel" of GOOG (Drink). But he wasn't so high on LNKD, saying the dip always has been buyable, but "I don't think it's that buyable any longer."

Bob Peck, who was bizarrely stationed with a phone in front of all those gawkers in Times Square, said Facebook's ad revenues were up 76%.

Julia Boorstin later said that Sheryl Sandberg told her something about Coca-Cola getting 3.6 times the impact of some non-Facebook ads in France, or something like that.

Mel and Guy’s bickering-married-couple routine gets started early on the word ‘rhetoric’

Steve Grasso, who enjoys making the same comment for days and weeks on end on Fast Money, struggled to say "all about Alibaba" a couple times Wednesday while reaffirming of YHOO, "I'm 80% out of the name."

"It's a placeholder for me," said Grasso, who indicated it would have to get closer to 30 for him to get back in.

Josh Brown bluntly declared the YHOO trade dead; "this is over."

Guest David Chao told Melissa Lee that it's possible China IPOs could be delayed, but they likely won't be. Chao said "the hype is warranted" in Alibaba, but Josh Brown took issue with the notion that YHOO is the only vehicle for playing it, insisting Softbank is "a layup."

Brown, tearing a page from Dr. New Land's trusty playbook (not the one that said "Buy AAPL" for the 2014 Playoffs), suggested QCOM is "probably in the penalty box" and broke hearts after failing from the breakout. But Steve Grasso said it's OK, "as long as it protects that $70 level." Guy Adami said people keep using QCOM as a proxy for shorting AAPL (Double Drink) and it doesn't work and he's sick of warning about that.

Cameraman gives Mel 360°

in sizzling new gray dress, perfectly clipped hair, lap shawl

Dan Nathan, protesting that he doesn't really like YUM that much, said on Wednesday's Fast Money that someone was buying the February 70 calls, and at this point in the range it's intriguing, so "this stock could move on slightly better-than-expected news."

Josh Brown suggested a Twitterer's query about $700 PCLN was too dire, explaining there are "various levels of support north of a thousand."

Guy Adami said "buying and holding are the same thing" while endorsing KKR, or better yet, BX.

Adami congratulated himself for his recent X range calls and said to stay long against 24½.

Josh Brown said not to credit Loeb for whatever DOW's doing. Steve Grasso said "I'm staying long" AA. Dan Nathan said if a TMUS deal doesn't happen, there's a 10% air pocket.

Rarely if ever has Dave Barger passed up a chance to join the Fast Money gang; Wednesday, while acknowledging the hideous weather this month in much of the country, Barger claimed "there's an upside to it as well" because people seek flights to Florida and the South. (Yeah sure, people in Atlanta suddenly are booking trips to South Padre Island.)

Steve Grasso gushed about getting streaming video on an airplane, asserting that email is no big deal to him. Guy Adami, as always, suggested JBLU is a good play here, with "limited downside."

Steve Grasso's Final Trade was BAC (why would he say that if, according to his earlier commentary, the markets are heading lower?), Dan Nathan said to sell GOOG, Josh Brown said buy DOW and Guy Adami said TLT.

Unhappy YHOO investor claims

Jack Ma is tanking stock

This is a good one.

Eric Jackson, the YHOO long who 2 weeks ago on the Halftime Report hung a $70, 18-month target on the stock, on Wednesday uncorked a conspiracy theory that he didn't bother to bring up last time.

"Jack Ma has basically given his senior managers a directive over there, uh, as of several months ago, to basically slow down the process, because they want to IPO at a lower valuation if possible when they do IPO this year because that means they'll be able to buy their stake back from Yahoo at a lower price," Jackson claimed.

Judge, borrowing Steve Weiss' line from 2 weeks ago, suggested to Jackson that "the bloom's off the rose, isn't it," as far as Marissa Mayer's leadership. But Jackson insisted, "I like Yahoo, and I will be buying more ... there is still upside ahead," at least in the realm of "financial engineering."

Jackson reaffirmed his belief in a big merger: "A combination with AOL makes more sense today than it did yesterday," Jackson said.

Pete Najarian said April 55 and July 50 calls in AOL are still hot.

Steve Weiss said of YHOO, "I would not own it," and then in what seemed like overkill on this subject, was enlisted to debate YHOO bull Jon Najarian, who claimed the secret sauce is now Alipay, "that's what you really want here."

Weiss said Alibaba's revenue growth was down 20% year over year and that Marissa Mayer is "over her skis a little bit."

Doc, who didn't reaffirm his point from last week that Marissa showed decisive leadership like Eisner at Disney in the '90s in booting her ridiculously bungled COO hire, insists the stock should get to $50.

Pete pronounces Gemma’s first name with a hard ‘G’

In a weak intro to Wednesday's Halftime Report, Steve Liesman predicted the Fed wouldn't pull back on its taper process because it doesn't view the present emerging-market currency issues as a big deal; "it amounts to a Bogartian hill of beans" (as CNBC courts that younger demographic).

Stephen Weiss wasn't so sure about the Fed; "I'm not so sure that they go today," oh well.

Gemma Godfrey said that evaluating countries in this current turmoil is just like evaluating companies, it's about "management and balance sheet," and that some of them have "attractive entry points."

Pete Najarian took up a couple individual stocks, stating it seems like in AAPL, the sellers are "winning," but in JPM, he sees a "lot of upside call-buying in there," before mispronouncing Gemma Godfrey's first name.

Jim Keenan said global uncertainty has affected the bond market.

Pete suggests you should be buying and selling UA at the same time

Brian Billick, hell-bent on promoting seatgeek.com, told Judge Wapner on Wednesday's Halftime Report that the Super Bowl pits "truly the best defense vs. the best offense in the game."

Um, well ...

The purported "best offense" has not scored 30 points yet in a playoff game. (As a matter of fact, neither has the team with the purported "best defense.")

And all of those games have been played at home, by 2 clubs that tend to be much different (i.e., worse) away from the friendly confines.

This feels like a Super Bowl V type of situation, a "blunder bowl" in the making.

Billick wouldn't predict a winner but did predict a final score of 24-17.

Pete Najarian questioned having a cold-weather game. But Billick said that the forecast doesn't look bad, which is going to prompt other cold-weather cities to demand to host especially when Dallas had ice storms a couple years ago (that was one game to forget).

NHL exec John Collins said fans love the outdoor games.

Jon Najarian suggested COLM as a cold-weather athletic play. Pete Najarian delivered a schizophrenic opinion on UA, advising people to take profits while owning it into earnings at the same time. Stephen Weiss said FL and FINL are the names that are working, "not Dick's."

CNBC stepping up new agenda of forcing Najarians to declare expected holding period of options plays

Jeff Kilburg said on Wednesday's Halftime Report that there's more upside in natural gas. The Ilchmeister, Rich Ilczyszyn, said "5.80 is the line in the sand" and said someone bought a "boatload" of March 6 calls.

Jon Najarian flagged WU as a possible stumble, stating "payments could be down," and affirming to Judge that he expects to be in the trade "a week to 2 weeks."

Stephen Weiss called WLP the "place to be with Obamacare."

Pete Najarian said of VLO, "I think it goes higher; I own calls."

Jon Najarian said EA is in a "very hot space."

Pete Najarian said VMW is outperforming rivals; "I love this space right now."

Stephen Weiss said JBLU and other airlines like the retailers will be trumpeting the bad-weather story.

Jon Najarian explained TUP is struggling because "these guys have massive exposure to emerging markets."

If security names are so great, why are there so many reported breaches?

Pete Najarian on Wednesday's Halftime Report again pounded the table (Zzzzzz) for security names, trumpeting INTC.

Stephen Weiss couldn't seem to make up his mind on whether he really likes QCOM's stock prospects, asserting that "smartphones continue to grow" but that Chinese taxation issues are a potential headwind.

Jon Najarian also seemed at a loss to make a call on LVS, stating a couple times he prefers MGM and WYNN and that LVS is "under pressure going into earnings tonight" but that twice as many LVS calls as puts were moving in the options market.

Pete Najarian said it's been a volatile month for FB but it's basically flat; "now we're looking for the upside."

Stephen Weiss' Final Trade was to short RIO. Jon Najarian said buy CPN, and Pete Najarian said to buy JPM.

[Tuesday, January 28, 2014]

Nobody apparently heard Brian Kelly urging Carl to short TWTR

Tim Seymour said on Tuesday's Fast Money that trading in AAPL is "gonna be sloppy the next couple of days," and made clear, "I'm not sure how much people are listening to Carl on this one."

It wasn't much of a conversation; in fact no one seemed to hear Brian Kelly uncork this head-scratcher: "If I were Carl, I'd be short Twitter," because it's "not working anymore." Even though on Tuesday it was up 4%.

We'll take the other side of "BK" and Carl's and Marc Faber's mythical short. (This writer presently has no position in TWTR.)

Karen Finerman said she wondered if AAPL might do some buyback purchases in the wake of Tuesday's selloff but then concluded it probably can't do it so soon after a report but likely would have to wait 2 days.

Guy: S&P up 10-15 on Wednesday

Around here, we'd never mistake Michelle Caruso-Cabrera for anyone, let alone former CNBC hosts.

But that didn't stop Tim Seymour on Tuesday's Fast Money from telling MCC, "Hey Maria it's Tim Seymour," before finally screwing his head on tight enough to continue with the program.

In the first of his roughly 4 opportunities to discuss emerging markets during the program, Seymour dubbed Turkey's move as "very good news" and then explained that for emerging markets traders, "it's all about currency," then stating that you "should be buying this for a trade," before ultimately suggesting TUR (big shocker there, except it can always be VimpelComm, Cemex, Embraer or Mobile Telesystems) as his Final Trade.

Guy Adami a couple times in the program predicted Wednesday would be up, maybe 10-15 S&P handles, then stated Thursday would be a "benign day," and finally called Friday a "wild card" while strongly hinting that Friday could see the south side of 1,765, which would be bad.

Jon Hilsenrath made perhaps the show's most important comment. "If they increase the, the pace of tapering, they're sending a signal to the markets that rate hikes are coming sooner," Hilsenrath said, but he predicted no earthquakes until at least the "next forecast revision" in March.

It took a Google Glass demonstration to get just the right look from Melissa (as Lance Ulanoff delivered wrong information)

Rob Sanderson told Tuesday's Fast Money that YHOO's report was "not totally unexpected" and conceded that the stock is basically just an Alibaba story; "undeniably this is a really important asset."

Brian Kelly said of YHOO, "now's a chance to get in," a point echoed by Guy Adami.

Karen Finerman, like she always does, said she prefers GOOG, but she sold GOOG 1160 calls and said she'd regret that if it spikes.

Tim Seymour waffled like l'eggo my egg'o on BIDU, seemingly liking the stock but questioning whether its issues are over in 1 day.

Guy Adami said NFLX is over its skis, and "now it gets really hard to stay with it ... ya gotta take some money off the table here."

"Sometimes there are selling opportunities," Adami said, bemoaning the fact that whenever you hear "opportunity" on business television it's almost always preceded by "buying."

Adami said he figured the T quarter would be lousy, but at 33, "the stock might be interesting." But Tim Seymour opined, "The best times for these guys are behind them."

Adami said to buy GLW at 16.

Lance Ulanoff brought in some Google Glasses (or is it just "Google Glass") and shared with the panel. What we got from this is a near-perfect image of Mel, slightly unguarded, because of the mouth. And the watch, jewelry, and gentle handling of the frames. She might not like it. People are fickle. We like it.

Ulanoff, referring to a story that was run up the flagpole on this site before Henry Blodget's $100-million-isn't-enough Business Insider bothered to aggregate it, pointed out that if you wear Google Glass into a movie theater, "you might get arrested ... as one guy just did."

Lee and the Fast Money crew sort of indicated they weren't even familiar with that story (their loss). Except Ulanoff wasn't quite 100% familiar with it either, as the gentleman in question was NOT arrested, but essentially forced to have a 30-minute "voluntary" conversation with Homeland Security agents.

Cameraman gives us an awesome profile of Karen Finerman

Tim Seymour, in one of the most lukewarm, tepid, iffy, uncertain performances of all time, said on Tuesday's Fast Money that F (Drink) is a name you can "start to nibble at."

Karen Finerman said that everything Seymour said about F is true for GM (Drink), and "I still like it."

Guy Adami said F has "gotta prove itself" and hold 15.50.

Tim Seymour cautioned not to go plunging into TTM, but "give it a day or 2."

Brian Kelly, evidently not buying Don Drapkin's Halftime spiel, said of CLF, "I wouldn't be buyin' it." Karen Finerman said she didn't know why URI was up.

Guest Nili Gilbert, in her first Fast Money appearance, curiously reminded everyone that valuation calls are dicey because "stocks can stay overvalued or undervalued for a really long time," then recommended MASI, which admittedly has "stock-price momentum," and FCH, which she called a "contrarian pick" because of its low dividend.

Mike Khouw said March 50 calls in MTH were hot.

Brian Kelly said, "I think you short EEM right here," and that was his Final Trade. Karen Finerman said buy TKR, and Guy Adami said buy YHOO.

Remembering what we were doing when JFK died, when we first bought AAPL in the 2000s, etc.

Pete Najarian said on Tuesday's Halftime Report that he's been thinking of following Carl Icahn with yet another buy of AAPL, the 2014 Playbook Playoffs head-scratcher that both he and Dr. New World somehow indulged in, but, "so far I haven't done anything."

Pete maintained that "the 14½ earnings per share; that's a huge number when you really amotorize (sic) that out for the year."

Josh Brown said AAPL represents "opportunity under 500."

Guest Don Drapkin took the panel and viewers down memory lane, explaining that he bought AAPL when he first saw an iPod and thought it was so much better than a Walkman, and for that, he "was well-rewarded."

Unfortunately, "I sold it at $200," said Drapkin, whose comment about thinking Steve Jobs had left a longer runway didn't really make any sense for someone lamenting the sale of the stock.

Guest Ken Allen said AAPL is posting some unprecedented cash flows, but the problem is there's no growth in the iPhone, though "something like a smart watch" might move the needle.

Allen was more excited about GOOG, asserting, "I think that Google over 3 years could become the largest market cap eclipsing Apple and ExxonMobil and others along the way."

But Josh Brown opined, "I think Apple is probably the better buy a few days from now."

Allen said CSCO is big enough to figure things out; "it has the benefit of time."

‘More downside to come’

What looked on Monday to be a temporary move to address rocky markets now looks like a permanent fixture — assembling several non-Fast-Money/Halftime types to open up the Halftime Report as though it's a Closing Bell roundtable.

Super-stunning Seema Mody reported that the Nasdaq Composite was actually up despite AAPL's terrible day.

Josh Brown called Tuesday a "back-to-normal day." But Kenny Polcari contended, "I actually think there's more downside to come."

Steve Liesman said the $10 tapering seems set in stone for the Fed, but he thinks GDP is now looking "somewhere between the low to high 3s."

Simon Baker sort of said he likes stock-picking and sort of said he likes industrials as a group, specifically CMI and PH, the former being his Final Trade.

Josh Brown helpfully bragged, "We trimmed when the year turned over." (But did he buy AAPL when he first saw an iPod and thought it was better than a Walkman?)

‘Early innings’ of health care

Don Drapkin took his CLF-activism case to the friendly confines of Judge Wapner's Halftime Report on Tuesday, saying he wants to split the company into an MLP and then everything else, and "stop exploration."

"This is a no-brainer," Drapkin argued.

Drapkin dangled a carrot-and-stick approach to management, insisting they didn't start this mess and "they can step up and be heroes," but that they better do either his plan or some other that gets the stock to 50.

Josh Brown questioned, "Aren't they at the mercy of what the coal market will bear," but Drapkin drew distinctions to iron ore and indicated no.

Meanwhile, Daniel Chai contended that, "We think um, health care's sort of in the early innings of a big re-rating here," and he likes MRK and NVDQ, the latter providing a "real-time operative road map for a surgeon."

Chai also thinks biotech is not cooked. Pete Najarian said Chai convinced him even more that MRK is great, and Pete likes LLY also. Mike Murphy touted UNH, GILD and TEVA.

Judge tells entrepreneur that his Super Bowl ad isn’t sleazy enough

Mike Murphy said at the top of Tuesday's Halftime, "Stay away from housing," and then tried to prove it in a lackluster DHI debate with Pete Najarian.

Pete's bull case had little more than essentially "they can keep doing it," and he actually said, "sales prices are up 10%."

"It's gotten too far, too fast," said Murphy.

But Pete said, "I think the stock goes to 28 and then tests 30," prompting Josh Brown to declare, "I think Pete is dead-on."

Phil LeBeau reported 36,522 flight cancellations in January. Josh Brown scoffed that every day in the country there's a weather-related problem for airlines, so it's not an investable thesis. But Simon Baker said that cancellation number is higher than the amount of Teslas made last year.

Brown said of GLW, "I would buy the 7% selloff," and made it his Final Trade.

Baker said ANF is doing a "good job" for shareholder value.

Mike Murphy rooted for the home team, saying of CMCSA, "I like the stock here."

Pete Najarian said of STX, "I think it's an opportunity down here at 51."

Anthony Grisanti said he doubts the extra tapering will happen but thinks gold prices "can't hold higher." The Ilchmeister, Rich Ilczyszyn, took a page from Gerry Rafferty and claimed "we're stuck in the middle" between 1,230 and 1,280, and if either is broken, "you're gonna get a directional move," perhaps toward 1,200, at which point he'll be interested.

Judge Wapner obviously didn't see enough bikinis in the SquareSpace Super Bowl ad and asked founder Anthony Casalena, "Why not try and do something a little more flashy" given that SquareSpace competes with Go Daddy. Casalena rather unimpressively said his ad is designed to draw a contrast between the "kind of a cluttered world on the Web" and where SquareSpace can take you.

Simon Baker claimed, wrongly, "If these commercials don't work, it can really hurt your image too," but nobody challenged him.

Pete Najarian said he's in the AOL options trade and made selling UA his Final Trade. Mike Murphy's Final Trade was buy WFM.

Brian Marshall tells Carl Quintanilla ‘at the end of the day’ twice on Closing Bell

It's not just a Fast Money thing.

Brian Marshall joined Carl Quintanilla on Tuesday's Squawk on the Street, and the first thing he said was, "At the end of the day."

And then he said it again.

[Monday, January 27, 2014]

Josh Brown is continuously improving his cost basis in AAPL

Guy Adami, evidently designated the AAPL expert of Monday's Fast Money, managed to keep calling the shares a buy no matter how much they tumbled during the program.

At first, it was, around $520, it "might set up pretty interesting tomorrow."

"This is a quarter where you finally got the flush," Adami suggested.

Ultimately, he predicted the shares would trade Tuesday in the "low 5-teens" and that it could be capitulation on a "monster volume day."

Tim Seymour said he wanted to see it hold 525 but insisted the afterhours action is irrelevant and it's Tuesday's trading that matters.

Jon Najarian observed, "It's hanging in right there at the November 20th low," and grasping to turn a lemon of a report into lemonade, claimed, "the biggest thing is the supply constraint."

Josh Brown said there isn't a big support level until 480, but then explained that every time it gets pounded, he buys more; "at the end of the day ... I continue to improve my cost basis."

Brown told Karen the stock should get a 9 multiple. But Finerman seemed the most skeptical of the whole panel, asking, "What is the catalyst here" and stating we're "still waiting" for the next product.

"I would let it shake out a little bit," Finerman advised. "I don't know what the right multiple is."

If Finerman wasn't the most pessimistic, then Colin Gillis surely was, suggesting "it could be a dead-money stock."

Guy Adami patted himself on the back for his recent NUAN calls and suggested that as an AAPL derivative play (and we thought we had seen the last of those on Fast Money). Josh Brown said to just play AAPL. Tim Seymour pointed to QCOM and invoked a legendary cliche, "I don't think you need to be a hero."

Dennis Gartman, lagging indicator

Dennis Gartman, who tends to wait to see how the chart goes before deciding it's going to keep going that way, told Monday's Fast Money that he's in risk-off mode.

"Now I think it's time to be somewhat frightened ... as Dougie Kass says, risk happens fast," Gartman said.

Gartman said the Japan trade might well be over, and that he was wrong to be bullish on palladium just last week in that goofy exchange with Tim Seymour that made almost zero sense (but Mel didn't bring up that angle).

Guy Adami warned that if the S&P crashes through 1,765, it'll be an outside month, so that level is critical.

Josh Brown called 1,750 a "logical support level."

But Tim Seymour said that if you're inclined to short emerging markets at Monday's levels, "you have to be careful," and Karen Finerman pointed to the rapid rise in the VIX and said, "We were net buyers today."

Larry McDonald pointed to credit-default swap correlations between HSBC and JPM and Standard and MS. "HSBC started blowing out relative to JPMorgan," McDonald said, suggesting that if that spread narrows, that would be a buy signal for stocks.

McDonald called the Chinese shadow-banking hysteria "very much like the S&L crisis in the '80s" in that the system isn't all connected; "these loans are isolated."

Tim Seymour asked Melissa Lee if she's going to a water park. Here's the correct phrasing of what Seymour was really asking: "Are you going to be poolside in your swimsuit anytime soon?"

Karen Finerman observed, "It's the worst part of parenting, water parks."

Back in black: Karen

wears new leather dress

Bob Pisani reported on Monday's Fast Money that in the ETF world, "They're weeding out some of the crazier ones," but nevertheless there are still things like the Nashville ETF, or the Forensic Accounting ETF, and the carbon-related vehicle that strikes Pisani as a fine idea but has no volume.

Melissa Lee declared, "When he called them strange, I think he was putting it politely."

Josh Brown started to say "at the end of the- " (Near Drink), he gets visits all the time from guys peddling these products (do they look him up at Ritholtz Wealth Management offices or the Nasdaq/Englewood Cliffs?), and he wouldn't buy them.

Karen Finerman said she covered her CAT short on the day's spike. Guy Adami though suggested CAT's closing level was an interesting place to put on a short.

Tim Seymour said of the VOD drop, "I don't think they're comin' back" to make the deal. Josh Brown said he wouldn't buy MRK at Monday's price. Karen Finerman, unlike Pete Najarian and his foolish Halftime call, suggested LULU "might be starting to get worth a nibble here." (This writer is long LULU.)

Guy Adami said XRX had a "monster double-top" but when it hits "9 even," you can buy.

Scott Nations reported double the average daily put volume in IWM.

Tim Seymour's Final Trade was to short UTX. Josh Brown said long GLW, Karen Finerman said buy URI and Guy Adami said to buy ABX.

Judge strongly implies that

Marc Faber has ‘credit’ on other things

Coincidentally, the 2 panelists on Monday's Halftime Report were the 2 who made the head-scratching decision to put AAPL in their 2014 Playbook Playoffs portfolios. (Hey, can't say we didn't warn 'em.) (This item was posted after trading Monday.)

Pete Najarian declared, "I expect a pretty big number tonight."

Dr. New World said the numbers he was looking for are 58 billion, 14.25 EPS, as well as "significant cost improvements."

Star guest Steve Milunovich predicted a (snicker) "strong report, decent guidance," and said the stock is still in a "correction pattern but still an upward trend."

Judge Wapner and Jon Fortt and super-gorgeous Seema Mody pointed to the tech/social media slide, with Judge even stating that Marc Faber's comments in Barron's were behind the selloff in TWTR. But Judge cracked, "I don't know about his credit on Twitter," and suggested there was another cause. (This writer is long TWTR; goal being to take the other side of the Marc Faber trade.) (The fact Judge read that entire roundtable is startling.)

Pete Najarian called CSCO a hold but questioned why GOOG was getting hit and said GE would be an opportunity on a selloff.

Mr. New Land said Royal Caribbean is even a cold-weather play; "this is a name that has worked; this is a name you stay with." Joe also said AT&T is focusing on U.S. issues and "I like what AT&T is doing here," but in fact, "I like Verizon better."

Pete seems to think Janney downgrade of stock that’s down 32% in 6 weeks is all right

Likely unleashing a bust, Pete Najarian on Monday's Halftime Report noted that Lululemon has been down since contra-indicator Janney called it a great pick, then claimed "I still love Under Armour" and that that name is taking LULU share, and predicting there's "still downside for LULU from here."

And we'll gladly take the other side of that one and, as this page previously schooled Mike Murphy when EXPE was in a similar free fall at the same price, predict that LULU gets to 55 faster than one of Pete's banking warhorses, mighty C, omg those banks are just so great and all those buyers of XLF options and all that international banking growth that's in the C sweet spot and the synergies that Mr. Corbat's doing etc., perhaps even 50 to be honest but C has a decided head start there. (This writer is long LULU.)

Pete took on Mr. New World (there wasn't anyone else to challenge; Fish wasn't gonna do it) over CAT, of all stocks. Pete claimed "it's construction and it's power" and not just mining, and actually said with a straight face that it's a "well-managed company right now."

Mr. New World shrugged and said "I actually shorted the stock today," claiming there's a "ceiling to all that financial engineering."

Pete insisted it's not all about China and hung a $100 target. Joe rebutted, "Their high was buying Bucyrus for $8 billion," but what he could've said was that Pete used to pronounce "Bucyrus" as "Buka-riss."

Twice as many Seattle folks want to attend the Super Bowl compared with last year

Mark Fisher, a guest for all of Monday's Halftime (but not dressed nearly as snappy as Michelle Caruso-Cabrera), aside from stating about 5 times which stocks/commodities put in a high for the year on Jan. 2 and which put in a low, offered an analogy about selling natural gas just like selling milk just before the expiration date and contended that nat gas is "a story going forward" and not just for the winter.

Fish established a 95-125 range for crude and suggested Canadian energy names might be ripe for the picking including by Chinese pursuers.

Dr. New Land praised HES and indicated he likes "activism" in the shale names. Pete Najarian pointed out he's got BP in his Playbook portfolio.

Joe said "I would not" plunge into coal here but would need to see Australia strength. Pete said there's a "price tipping point" at which they switch from nat gas.

Jon Najarian beamed in to say he plans to spend 5 days in his long TWX trade.

Brent Bellm, the COO of HomeAway, which apparently books homes to rent for big events such as the Super Bowl, said places near the stadium are going for $1,500 a night.

Then, Bellm went on to say that demand is "up over 100% year on year coming from Seattle." Which makes sense, given that the Seahawks weren't in the Super Bowl last year.

Pete Najarian's Final Trade was WHR. Joe Terranova revealed, "I bought Urban Outfitters today."

Pete Najarian: ‘There’s a lot

of panic right now’

The January selloff in stocks is now apparently worrisome enough to stoke talk of a rollback of the QE rollback.

Steve Grasso observed on Monday's Halftime Report that "people are selling first," but that, "if the Fed sways (sic) away, strays away, from that 10 billion, this market will- will, uh, react incredibly to the upside."

But star guest Mark Fisher suggested almost with disbelief that "if the Fed doesn't taper," after just a 4% correction on the heels of a huge year, then it shows "they care more about the stock market than they care about the economy."

Grasso indicated it would not be a sudden reversal but more about the language of the next Fed statement showing "they are capable of not tapering," because to the market it has been "so damn telegraphed."

Grasso said 1,764 is the next market test.

Rick Santelli opined, "I don't see the Fed altering course at all."

Guest sexy Michelle Caruso-Cabrera, whose best move on the show is saying "Dr. New World" or "Mr. New Land," said some people are downplaying the foreign risks as similar to 1997 and 1998 when stocks still went up.

Caruso-Cabrera and Fish agreed that trying to prop up currencies, as some countries are doing, is either a "quagmire" or hopeless or just a bad idea.

Paul Richards said the market is "very nervous" and focused on the "periphery" of the world markets, and "periphery to me is Turkey and Argentina," but he thinks overall emerging markets have suffered "contagion that was frankly unfair."

Richards claimed the next big moment for stocks is (Zzzzzz) China PMI on Friday night.

Pete Najarian believes that people who chased in late December have "puked" stocks in Janauary because they can't take the volatility. "There's a lot of profits being taken right now ... there's a lot of panic right now in the market," Najarian claimed.

Dr. New World said the "consensus" on basically everything "has been entirely wrong in 2014."

Joe also told Judge that he doesn't see a buy sign, that being the "marginal buyer" of institutions stepping in, until "early next week," and that it would be "foolish" to buy ahead of that.

More from Monday's Halftime and Fast Money later.

[Friday, January 24, 2014]

The 5 Greatest QBs of all time

We could insert a lengthy intro here.

But you know this category needs no excuse for posting.

In fact, you've undoubtedly been mulling it yourself over the last few weeks.

We put the necessary regular season, post-season and career stats through the data machine, but only the amateurs rely on that; this one sort of comes down to, "We know what we saw."

And here they are ...

1. Joe Montana

Reinvented the position, threw the most catchable ball, won 4 Super Bowls, the greatest clutch player. It wasn't all Rice; went 18-1 in 1984, a team considered by some at the time the greatest ever. It's the total package of stats and brilliant play, in blowouts and at crunch time. The only kryptonite, and not until well into his career, was the New York Giants. In 4 Super Bowls threw 11 touchdowns, 0 interceptions. A 3rd-round bargain.

2. Tom Brady

The greatest overall victory producer for the longest time. It's the will to win that's immeasurable, the toughest out of this generation. Critics will say he won his Super Bowls when he had Seymour, Bruschi, Vrabel, Law, McGinest, Harrison. The numbers somehow seem a bit inflated beyond the considerable greatness on the field, but the amount of wins, playoff record and long-term success rate are undeniable. Lacking the explosiveness of other greats, somehow shattered the league record with 50 touchdown passes. Propensity to overachieve in regular season, underachieve (slightly) in playoffs, but if not for the dual nemeses of Eli Manning and the city of Denver, might be the first to 5.

3. John Elway

The biggest victim of the AFC Super Bowl jinx, turned conqueror. Had he stopped in 1996, this would be a great career and not much more, unfairly tainted by the misfortune of playing most of his career on teams that didn't actually belong in title games. The most pedigreed, justifiable No. 1 pick for a quarterback boasted the best arm in football history (tied, with Terry Bradshaw; Doug Williams is close, but not accurate enough), a weapon that the likes of Montana and Brady did not have, and rarely if ever was beaten in the final minutes. Given the pedestrian stats, needed every win his last 2 seasons to make this list.

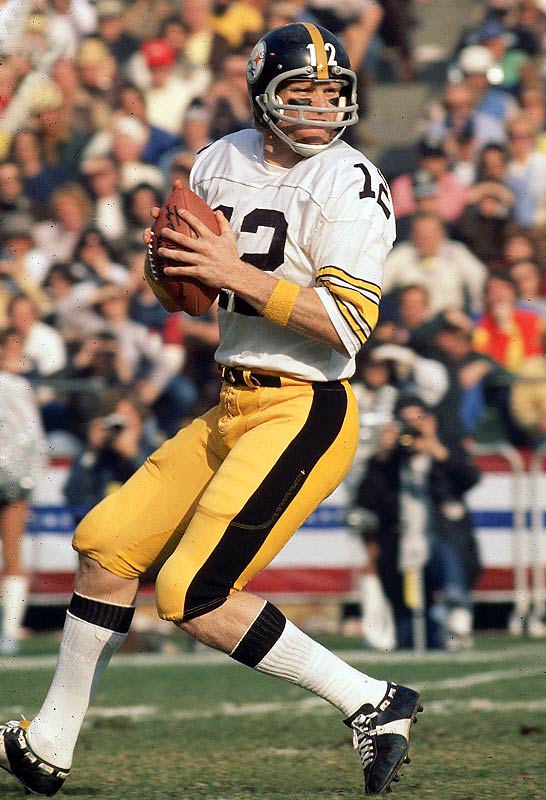

4. Terry Bradshaw

NFL's greatest big-play machine. Obliterated the boos and mistakes with a staggering onslaught of playoff points not seen since, against the most elite defenses, for 5 straight years. While even the highest highs were accompanied by costly mistakes, the reward/risk here was off the charts, a 4th-quarter machine in every Super Bowl. Threw the bomb as easily as a 10-yard slant, ran like a fullback, hit like a linebacker. Possibly the greatest physical talent in league history.

5. Roger Staubach

Football's greatest competitor, never out of any game; pioneer of the modern shotgun. The toughest call of the group, but the epitome of "it's all on the tape," as the stats don't indicate the performance here, much of it occurring in his mid- to late 30s. Strange mix of remarkably one-sided playoff results, many wins, some losses. Have to wonder, without the Naval requirement and Dallas' glut at quarterback, whether the Cowboys would've had a couple more rings.

Fleck actually comes closest of the Friday crew to getting it right

Bill Fleckenstein's notion of restarting a short fund at some undetermined point in time has been well-chronicled on this page.

And not necessarily in the most enthusiastic way.

Yet, on Friday's Fast Money, Fleck was talking more sense than anybody else.

Except he didn't go far enough.

Fleck stated that as long as the Fed can keep printing, you can't short the market.

He even suggested a possible reversal, that if they "start to back off from tapering," then the market will rally and go the "other direction" from Friday's debacle.

What he should've said was that government is more attached to the stock market/unemployment/banking/housing/general economic concerns than at any point in its history, and that (this is the big drum roll) numerous important precedents have been established suggesting that bailouts and low-interest-rate tactics will continue to be the knee-jerk reaction to blips in the data.

Fleck stated that as for shorting targets, "the most vulnerable are all the high-flying tech stocks."

That's a valid point; we don't think any precedents (other than sticking it to Henry Blodget) were established after 2000 to prevent a high-P.E. meltdown.

But anything of the 2008 variety, and expect Uncle Sam to be there.

Steve Grasso disagreed with Fleckenstein on tapering. "If they stop, that would be a problem," Grasso said. Tim Seymour referred to the "Fed crack pipe."

Only once? How come Mel couldn’t elicit an extra ‘at the end of the day’ (Drink) out of Brian Marshall?

With the "War of 1812" (see below) evidently lost on Friday, Steve Grasso predicted on Fast Money that 1,760 or 1,762 (wow big difference there) could be in the cards.

Josh Brown went much lower, to 1,665 as a possibility, and said "this is about sentiment."

Brian Kelly said this "could be" the big correction many have feared.

But Kelly's bouncing thesis that goes from "emerging markets are in trouble" to something like (possible comment) "actually it's the U.S. in trouble, or everyone's in trouble" didn't fly with Brown, who insisted, "This is not a deterioration of the U.S. economy."

Tim Seymour said stocks were "overbought," but protested, "What has fallen apart on the macro."

Seymour suggested employing IWM puts but also buying YNDX, his Final Trade. Steve Grasso suggested playing Mexico or energy-related names there including KEG and HAL. Josh Brown shrugged off emerging markets opportunities at all, stating, "this selling will probably stay indiscriminate."

At the end of the day, everyone's favorite AAPL watcher Brian Marshall told the gang that China Mobile is ramping up, it'll be 6 months before we hear about the bigger iPhone screen, and the stock's attractive.

Brian Kelly helpfully said of nat gas, "At some point it's a sell." Tim Seymour suggested coal is doable, if it's a name such as CLF. But Steve Grasso said there's "a lot more against coal" than just other forms of energy, and suggested ECA, SWN, COG as plays on this subject.

Brian Kelly's Final Trade was EUO. Steve Grasso said SO. Josh Brown said something about looking over your portfolio and consider ditching things you don't like.

Funny that Carter didn’t mention what stocks did after ‘Margin Call’ and ‘Too Big to Fail’ were released

We gotta keep an eye on Options Action.

If so, we apparently would've learned long before we read it on Drudge Report that Carter Worth last week actually claimed the December 2013 release of "The Wolf of Wall Street" is signal of a market top.

This is the most bone-headed, knuckle-headed, brain-dead comment we've heard on CNBC stock-picking programs since Simon Baker called "game over" for DAL in August.

If it were actually true, shouldn't Fleck and Chanos, instead of evaluating balance sheets and doing channel checks, just commission screenwriters to put something in motion about, oh, Bernie Madoff?

This is a joke, right? A comedy routine? Does Carter have some of Dolly Lenz's houses to show?

Joe claims that Ackman should want to invest with Carl even though Ackman hates Carl’s guts

Judge referred to Bill Ackman as "Eichmann" on Friday's Halftime Report, but that wasn't the most bizarre comment of the segment.

Dr. New World chose the moment to uncork a Trade School, explaining, "It's just a classic example of not allowing emotion to get involved in your trading ... What Bill Ackman said to Carl Icahn, 'I would never invest alongside of you.' Really? What a year Carl had; I wish I invested alongside Carl."

Seriously? That after a years-long court battle and public feud, Ackman should've realized, "OMG Carl's long Netflix and Chesapeake and Forest Labs, I'm putting $500 million into IEP!!"?

Jon Najarian pointed out that a bunch of HLF puts were bought after the stock had fallen but before Sen. Edward Markey's announcement, which "smells bad."

"The timing is very suspect," Najarian said.

Judge said they asked Markey's office for comment, but he was "unavailable."

Joe Terranova said of HLF, "I'm actually surprised that it's not a little bit lower."

‘Time to sort of

be ready to buy’

The stock market, for some reason, cratered on Friday.

Yet the Halftime Report crew sounded like the market is correction-proof.

Michael Santoli said that despite the selloff, he doesn't see that there's "any big player trapped," and that he'll be "keen" on watching U.S. credit markets for a tell.

Meanwhile, Santoli was actually endorsing the beleaguered EEM, stating, "I think it's the time to sort of be ready to buy" but play as a "multi-year hold."

Anthony Scaramucci opined that "this is not the correction that people are expecting" because steep selloffs haven't happened in QE, but this looks like a "mild 1-2% correction."

Jon Najarian offered that "people were being forced to buy protection" because they'd been lazy or greedy, but he seemed to think time's running out for shorts. "If people don't take some off the table here, that are short, I think they're foolish," Najarian said. "If you're short and you're not covering, you're stupid."

Steve Grasso said, "I don't feel like there's any real panic today either," but then cautioned, "This could be significant if we don't close higher than 1,812 in the S&P."

Mr. New Land agreed with Santoli that Friday's problem was emerging markets, but "I don't think this is long-term."

"I'm staying short the emerging markets," Terranova said, but he actually likes gold as well as Canadian and Australian dollar, and his stock remedy apparently is USB.

Pete Najarian admitted an "explosive move in the volatility index" and likewise agreed, "I think the EEM does go lower."

Sara Eisen, a stunning young woman, pointed out the impact of currency problems in certain parts of the world.

Honestly, Friday's action just didn't feel real, but we've been wrong an awful lot before.

Rick Santelli offered the most austere opinions, suggesting traders weren't running away from the markets but that it was an "eviction," and cleverly dubbed Grasso's S&P 500 level as "The War of 1812."

Bill Gates ‘clearly cares about what happens with this company’

CNBC On-Air Editor Jon Fortt opined Friday on the Halftime Report about Microsoft's outlook (that's a lower-case "o"), which seems basically now a "commercial cloud" play, and reported that Bill Gates probably isn't going to run the place heavy-duty, but is fully engaged.

"He clearly cares about what happens with this company going into the future," Fortt explained.

Jon Najarian said of the stock as the CEO machinations continue, "I don't know why you'd get rid of it ... I think this is the biggest story in tech."

Brother Pete revealed, "I never really thought quite frankly that Mulally was the right guy to run Microsoft."

Halftime Report sadly encroaching on Fast Money’s rich-and-famous liquor displays

Pete Najarian on Friday's Halftime Report argued that not only is SBUX's growth intact, it's got an "ecommerce" angle. ("I'd like a cup of coffee; please deliver within 5 minutes.")

Jon Najarian said the stock is vulnerable to China disruptions and suggested $71.50 as the target; "that's the level that I'd buy."

Asked to determine a winner, Dr. New Land indicated he didn't prejudge the case, but "I took notes on this," and decided Pete made the best arguments, because the company's opening stores in China and you don't open stores if you're not confident, also Joe actually cited "ecommerce."

Pete Najarian said activists may be seeking more cash from JNPR and may not succeed, but "I think the stock goes higher regardless."

Joe Terranova said that PG's done fine, but the question is, "what gets the stock to 85, 90."

Joe suggested playing nat gas not in the UNG, but with equity names EOG, BBG, UPL, SWN and COG. However, "coal I don't think is ready just yet."

Jon Najarian said in the gaming space, there are winners and losers, and IGT showed Friday that "this is the loser," so he likes MGAM and SGMS.

Pete Najarian said interest in EBAY feels like YHOO and that the July 57.50/62.50 call spread was hot. Pete said those buyers are looking for upside in the "near-term future" (as opposed to "near-term past").

Mr. New World said Carl's push in EBAY "could take years" and said the stock has underperformed AMZN and V/MA. But Pete claimed that comparing EBAY and AMZN is like comparing "apples and oranges."

Judge sought no Final Trades. Pete Najarian said he'll be looking over the weekend for "what can possibly turn green" in this market and has pinpointed banks; if we get "any green out of these financials," that'll be a good sign.

Jon Najarian said he'll be watching for the VIX to flatten and get out of backwardation to see a market recovery.

Judge said Pete Najarian has a healthy lead in the 2014 Playbook Playoffs and that only the Najarians are in the black for the year. Dr. New Land was already warming up the excuse machine, stating, "You have to acknowledge, you know, this is not active trading."

Mike Murphy has evidently made the first trade of the 2014 Playbook Playoffs, substituting NYCB (out) for WFM (in).

If the Halftime Report is looking to jump the shark, the Fast Money-esque whiskey/bourbon/scotch routine is a good start. Friday, Daniel Boulud and Chris Watt explained why people actually want to spend quality cash on 1973 scotch.

[Thursday, January 23, 2014]

Guy reverts to last June’s cliche, Japan ‘losing control’ of its markets (but what about how there must be a derivative book somewhere that’s blown out?)

Guy Adami on Thursday's Fast Money uttered a statement on Japan nonchalantly that taken literally would've sunk the markets overnight, except no one's taking it literally or even seriously, that being, "I think the genie's out of the bottle there, my sense is they've sort of lost control."

He insisted he's not predicting a sudden meltdown, but "it's a little dicey over there."

Bitcoin investor Brian Kelly, as he always does, claimed a certain subset of forgettable or unnoticeable international headlines are indicative of pending doom for U.S. stocks, this time tying Argentina to Venezuela and predicting that, apparently if this gets bad, "you could see a spike in oil," so the ways to play that would be to short EWZ or be long oil.

Kelly also said, "I'm still short some yen, but I'm not long the Nikkei anymore."

Sara Eisen, in stunning fuchsia

The highlight of Thursday's Fast Money discussion about SBUX wasn't the stock chatter itself but that Sara Eisen had a hand in it.

Steve Grasso does not favor the stock, "I don't like the chart anymore," and thinks it must hold $72.

Guy Adami called Thursday's gain a "relief rally."

Eisen reported late that Howard Schultz, a veteran of Fast Money appearances, used one of the magic words ("affordable luxury") (Drink) while cautioning that Starbucks is not immune to brick-and-mortar declines.

Carter Worth opined that there's "more to come to the downside" in SBUX.

Brian Kelly declared, "At 80 it's a sell."

Mel impressively asked Karen Finerman about the SODA trade. Even Karen had to smirk, "Bad trade, and just done."

Worth: Stocks going up 5% would be worse than stocks going down 5%

It seemed on Thursday's Fast Money like a few more eyebrows got raised over Thursday's selloffs as opposed to previous selloffs this month ... but nobody was exactly calling the whole market the deep end of life's pool.

Steve Grasso noted "it was such a quiet selloff," that support lines are at 1,821 and 1,815, and the "real test" will be the first half hour to hour on Friday.

Guy Adami took that further and suggested "the test comes next Friday" and that he thinks 1,755 is possible.

Karen Finerman said she's "not really" concerned about January's stumble and that, after last year's monster gain, it's "probably a good thing."

"Nothing is different today than it was yesterday," said Finerman, who added that if earnings come in OK, "the market'll be fine right here."

Brian Kelly was bearish, insisting, "I don't think it's over."

It was Carter Worth, grasping for whatever information he can find to support a selloff, who conceded that this year in the S&P, "not much has happened" but insisted, "the issue is what is coming."

Worth also claimed, "the only thing that keeps a bull healthy are corrections," and invoking the old Vietnam-style village-destruction slogan added, "what would be worse than a dip 5% if is we went up another 5."

Worth said "the emerging markets have never participated" in the years-long S&P rally, and it looks like they're now going south, so that's trouble.

Mel spends much of the program mugging for the camera

MSFT watcher Daniel Ives said something on Thursday's Fast Money that you don't always hear about the PC industry: "You're starting to see the headwinds subside there."

But he said that until Microsoft picks a CEO, "I continue to view the stock as range-bound."

Guy Adami questioned if maybe now MSFT is finally getting it right and deserves a (snicker) 14 or 15 multiple. Ives said maybe, but he's gotta know who the CEO is first.

Adami questioned, rather humorously, whether the new CEO will be able to set a low bar. "I don't know if there's a kitchen sink to kitchen sink," Adami said.

Steve Grasso said not to chase the stock but wait to see if it holds 37.10.

When we hear ‘game over’ on Fast Money/Halftime, we generally think 1) it’s Simon again, 2) Buy-Buy-Buy

Intuitive Surgical got a lashing on Thursday's Fast Money from Karen Finerman, who said it's "never a good sign" when a company suddenly stops giving guidance.

Brian Kelly registered on our contrarian meter when he added, "If people aren't using their product anymore, it's game over," and all we can say to that is that whenever we've heard "game over" on Fast Money, we've generally found the stocks in question quite buyable.

Melissa Lee pointed out that 2013 darlings BBY, GME, BBBY and SPLS are getting their butts kicked this year. Steve Grasso advised against buying those dips. "I would not dabble" in these he said; "these are probably gonna be hated names this year." (This writer is long GME.)

But Guy Adami opined that "I do think the airlines will continue to work," as well as biotech, PCLN, and look what MSFT did on a "benign" (Drink) tape.

Grasso said of BBRY, "I think it's truly overextended now."

Joe might’ve botched NFLX, but he kicked ‘BK’s’ butt on PXD

Melissa Lee, trying to overcome a lapse a day earlier, asked Guy Adami to make a NFLX call on Thursday's Fast Money, and basically got little.

It's now an "international story," Adami said again, but "I don't think you have to now chase it here."

However, he predicted it would "work its way higher" and be strong for the "next 6 months or so," and "hopefully it pulls back to maybe 355, 360."

Karen Finerman said the hit to retail was too much for her to hang onto that long JCP trade; "I'm not gonna wait around for a bounce."

Carter Worth said transports are 45% above the trend line just like they were in (you guessed it) 2007, so look out. Brian Kelly suggested shorting regional airlines such as SKYW because their pilots are going to be hired by the majors.