[CNBCfix Fast Money Review Archive — October 2017]

[Tuesday, Oct. 31, 2017]

AMZN is ‘not gonna have any issues for the foreseeable future’ on the antitrust front

Late in Tuesday's Halftime Report, Judge brought up potential regulation risks for the tech giants.

Stephanie Link said AMZN only has 5% of the market, so "they're not gonna have any issues for the foreseeable future."

But Link said GOOGL does have an "overhang" of potential European threat.

Jim Lebenthal noted the possibility of antitrust concerns for the tech giants.

Jim mentions ‘existential risk’ in conversation about Under Armour

We brought this up during GE conversation recently, and it bears repeating.

Talking about cratering stocks, what's wrong and what they might have to do, is a blast … provided one hasn't owned the shares all the way down, in which case, talking about it can feel like grim death.

So, no one's taking any satisfaction here in the Under Armour debacle. (This writer has no position in UA/UAA/whatever they did that now looks silly.)

Nobody on Tuesday's Halftime was touching the stock. "You're hoping uh that Kevin has thrown in the kitchen sink here," said Joe Terranova, but as for buying the stock, "absolutely not."

Stephanie Link said the UA turnaround will take "a lot longer than people thought" and said UA has "product issues" and lacks lifestyle.

Jon Najarian called Kevin Plank "a great leader" and stated, "My thoughts and hopes are with you Kevin even though right now I'm not a shareholder."

Najarian said the stock needs an activist.

Joe noted how the corporate governance structure was recently changed.

"He needs a friendly activist," Doc said.

The conversation was interrupted for a lengthy period while Judge aired remarks by Donald Trump. When they returned to the subject, Jim Lebenthal said "I wouldn't touch it" and even brought up the term "existential risk."

Judge brought in Bernstein's Jamie Merriman, who unfortunately added little to the UA dialogue. "I think it's gonna take some time," Merriman said, pointing out that UA has expanded distribution into mass-market retail.

Judge asked if the massive stock slide is fair. Merriman said it's "definitely justified."

Judge asked if "reset" is the appropriate word. Merriman said it'll be a "prolonged reset."

Judge, who has experimented with commercial-free formats recently (#lostrevenue), finally took an ad break at the 32-minute mark.

Steve Grasso: AAPL ecosystem ‘starting to lose its grip’

In a completely predictable and routine product review, Judge on Tuesday's Halftime brought in CNBC's Todd Haselton to call the iPhone X the "best phone I've reviewed."

Haselton shrugged off pricing issues. "It sounds like a lot of money but it's really not that much as you pay it off," Haselton said.

Ultimately, that's the issue; someday people will consider that amount of money ridiculous for a phone.

Haselton called the facial recognition "incredible."

Doc mentioned AAPL's bounce since 149 and how QCOM was getting hit. Jim Lebenthal addressed the AAPL-QCOM battle, stating, "I don't think that this game is over." Jim added, "Qualcomm needs to settle this."

Steph Link prefers LITE and AVGO to AAPL.

A day earlier on Monday's 5 p.m. Fast Money, Steve Grasso revealed, "More and more, as things go to the cloud, that ecosystem is, is starting to lose its grip on me. … I don't need the laptop anymore." He's still long the name.

Remember back in the day when Pete would tout ALK and HA during every airline discussion?

On Tuesday's Halftime, Stephanie Link said "the big wild card is margins" for CRM. She said the stock "usually trades very well" into analyst day. Jon Najarian said CRM options cited Oct. 23 on the show have tripled.

Doc said November 27 calls in X were getting bought ahead of earnings later in the day. He also said PXD 155 calls were popular.

Brian Stutland said he'd look to take profits if long the dollar. Bob Iaccino said he's got a target of 96.

Stephanie Link said she ditched CAG and put the cash in PF.

Doc revisited buying GE last week at 21.50, stating he got in because he thought it was cheap and because he can sell calls, and (citing Kinder Morgan) he thinks it will rally after a dividend cut.

Joe Terranova said it's OK if you want to ring the register a bit on V and MA.

Stephanie Link is buying CMI. Jim Lebenthal predicted the AGN downtrend continues. Doc's final trade was either Softbank or TMUS, we're not sure.

Judge interrupted much of the program to air remarks from Donald Trump; Ylan Mui pointed out that Kevin Brady said there won't be relief on the income-tax deduction but that they would keep the local property-tax deduction.

[Monday, Oct. 30, 2017]

Mebane Faber threatens to write Weiss a white paper on benefits of low-P.E. stocks

Mebane Faber on Monday's Halftime asserted that "U.S. stocks are expensive" and then curiously claimed: "There's only 2 states for the market: It's all-time highs or in a drawdown."

Stephen Weiss said he disagrees with that "supposition." Faber insisted, "That's just math."

Faber, who kept referring to what he said 1 year or 2 years ago when he was last on the show (even we didn't remember that) (#notparticularlyrelevant), pointed back to 1993, stating if you had avoided expensive U.S. stocks in favor of bonds or the "cheapest quartile" of foreign markets, you would've done better.

Weiss questioned if Faber was saying that investors should've been in foreign stocks since 1993. Faber said you should be "market agnostic."

Weiss demanded Faber explain if we've ever had an investment climate such as this with growth and low rates. Josh Brown cut in to say 2003, but Weiss for whatever reason haggled over Italy.

Faber said, "There's low rates in 1930s (sic grammar)" plus Japan in the 1980s. Weiss said Faber is just picking "one element."

Faber said he doesn't know the answer but could write a "white paper" later. Weiss said he just wants "a little research."

Would-be investment advisor Steve Liesman opined that "most people are overly invested in their home market and are leaving money on the table that they could get from diversification." But Josh Brown said the home-country bias has been "reinforced" by great returns for 5 years.

Liesman said Powell is the favorite for the Fed. Judge said every president is thinking he/she wants to "put my own stamp" on the central bank.

Liesman said Powell wants to do more about deregulation "than the average Fed person."

Josh Brown said "everyone's a hawk until they get the seat by the way." He said it's "all automation" and has nothing to do with cyclicality. He's part way there but missing the complete picture: It's a massive consensus that has to deal with all kind of constituencies (largely congressional but also Wall Street) and is hardly the place for Steve Jobs-like innovation.

Slow week for Steve Liesman

After Ylan Mui reported on talk of a phase-in of a lower corporate tax rate on Monday's Halftime, Judge asked Joe Terranova if taxes are priced in to stocks more than people think (and threw in an "in and of itself").

Joe said it's a "very difficult question to answer" given Friday's tech results, but he's "not gonna speculate" about what happens with the tax plan.

Judge then quickly summoned on the phone Peter Boockvar, who said a lower tax rate makes the U.S. a "more attractive" place for business but that the "stimulative part" of tax reform is speeding the write-offs of capital investment.

As for the prospects of tax reform, Boockvar claimed "a lot of it's been priced in," pointing to gains since the election.

Josh Brown questioned Boockvar as to whether corporate tax cuts acutally make us more competitive with … Ireland? And what if monetary policy could "subvert" fiscal stimulus.

Boockvar said the first point is "more of a location decision." He agreed that an economic boost would push up labor costs and offset tax benefits.

Steve Weiss wondered if he heard correctly that Boockvar said that the market started pricing in tax reform "directly after Trump was elected." Boockvar said he would assume that the immediate Russell rally "priced in something."

Weiss said, "I don't think it priced in anything other than the fact that Obama was no longer president." Weiss said "every investor" (stressing "every") that he talked to has assumed something in the market for tax reform "only in the last few weeks."

Judge said maybe investors need to "temper their enthusiasm."

Steve Liesman actually said he "spent a week" looking at high-tax vs. low-tax stocks and found the high-tax stocks "have underperformed the broader market the entire year."

Judge, who has been experimenting with commercial-free format (#lostrevenue), rang up the first ad Monday at the 21-minute mark.

Judge: Why would JCP

bounce at $1.50?

Citi's Paul Lejuez earned a chat on Monday's Halftime by virtue of downgrading JCP and M to sell.

Judge questioned if it's "a little late" for the JCP call. Lejuez, who has a $1.50 target, said the stock still has 50% downside.

Josh Brown asked Lejuez, "Did Bill Ackman kill the company?" Lejuez said Ackman's group "maybe took a little bit too hard of a swing."

Judge said it's a "serious question," but, "why stop at a dollar-fifty" for JCP. Lejuez said "there's always a range of outcomes" but that $1.50 is his "best guess."

Lejuez predicted M is going to "struggle this holiday season," putting the dividend at risk. But he said it's got a much better position in cash flow than JCP.

Lejuez concluded, "We're in an overstored environment."

Judge noted UA was downgraded by Bank of America. Stephen Weiss said, "It's still not a cheap stock" and predicted more downside.

AMD holders, don’t worry; it’ll bounce between 10 and 14 forever

Steve Weiss on Monday's Halftime said of GM, "I'm glad it's got back to where it was 20 years ago."

Weiss said he agrees with the Goldman call, that "it's a good time to take profits," but he doesn't think the stock is a short.

Joe Terranova though said "picking tops um is, is, is really the wrong strategy going forward (sic last 2 words redundant)."

Joe said the LEN transaction is a "good deal" and called the stock a good one to own.

Josh Brown said the lesson in AMD is not to buy a stock because a CEO is using "all the right buzzwords."

Weiss said he doesn't think ODP works even though value players "keep getting sucked in here."

It's great that they're promoting the Veterans Day episode on the Intrepid, though Judge in "Top Gun" gear is a bit of a stretch.

No debate this time over whether ‘it’s different this time’ is accurate or dangerous

CNBC's Meg Tirrell on Monday's Halftime recapped the bad week for MRK.

Steve Weiss said there was growth built in to MRK that might not be happening, and, "They're sort of getting biotech multiples, mature biotech multiples."

Joe Terranova suggested BMY and contended it's "rather odd" that Merck's Friday announcement wasn't included in the earnings.

Kari Firestone beamed in from Boston to tout ZTS, "the only pure play in animal health." Firestone said she would "definitely" add on an earnings pullback.

Pete Najarian beamed in from Minneapolis, stating MLCO November 24 calls were getting scooped up and also that November 35.50 PFE calls were popular.

Pete said 50 "seems to be a base" for MRK, but he hasn't seen any option buying at that level, so he'll "wait on the sidelines to add."

Jon Najarian, beaming in from Chicago, said NVDA 205 weekly calls were getting bought and that ABBV November 91 calls were getting bought.

Steve Weiss' final trade was AAPL; he said he was buying the calls. Josh Brown's final trade was TWTR. Joe Terranova said FANG (the symbol for Diamondback Energy, not Tom Lee's tech trade).

[Friday, Oct. 27, 2017]

Weiss insists he didn’t say something that Josh says is true

It was Happy Tech Stock Day on Friday's Halftime Report.

"It's too early to think about selling these," said Steve Weiss, adding that analysts are "tripping over themselves" to raise price targets.

But Weiss said he bought WDC, and "my luck," it's the one name down 5% Friday.

Jim Lebenthal owns GOOGL, and "I'm very happy with the price action."

Josh Brown said, "This has not been very difficult"; these are well-known tech stocks doing great.

Kevin O'Leary opened the show stating "this year was the year of FANG," calling it "FANG-ology."

But O'Leary suggested the good times might not roll: "I don't think we're gonna get 40% out of them next year."

Steve Weiss opined about AMZN's stature, prompting O'Leary to say, "The most dangerous words ever uttered in investing is (sic grammar), 'It's different this time.'"

"You didn't hear me say that," Weiss said.

"You're insinuating that this is a new kind of company," O'Leary said.

"I'm not insinuating at all," Weiss said.

Josh Brown told O'Leary, "It's always different," saying it twice and then saying it again 5 or 6 times in various phrases over the next 10 minutes.

Weiss trumpeted BABA. O'Leary grumbled about "accounting issues."

Judge strongly implies virtually anyone could see that JCP stock is toast

Tackling a stock that somehow was not working on Friday, Judge sent JCP Jim Lebenthal's way on the Halftime Report.

Jim conceded. "I was wrong … I'm selling it today," he said.

Kevin O'Leary asked if JCP nevertheless is a good bond play; Jim said yes.

Jim said there are 5,000 stocks, he's got a portfolio of 20, "the other 19 are doing terrifically," but JCP is an "eyesore."

"This stock could double from here (see, he doesn't actually believe that), and it's not worth the risk to me," Lebenthal said.

At that point, stock-picker Judge muscled in, stating, "The writing has been on the wall. I don't need to look at where a bond is trading in JCPenney to know that the writing is on the wall."

Josh Brown suggested "bonds are a terrible indicator" of stock direction.

Judge said he'd like to think "that's part of the point I'm making."

"The issue here is not the methodology," Jim insisted. "The issue is that this was the wrong call."

Judge explained that GE's issues "seem to be related to General Electric itself (sic last word redundant)," while JCP is "emblematic" of what's happening in retail.

Panelists actually had a pretty good debate over whether playing the JCP bonds is a good idea.

Judge called Jim a "stand-up guy."

Judge, who reinvented the cable news format a couple weeks ago with his commercial-free approach (#lostrevenue), finally went to break at the 25th minute.

Brian Belski claimed value is going to start working, but even so, ‘greed is good’

Scott Kessler, who has a "strong sell" on TWTR, dialed in to Friday's Halftime to state, "This is just overvalued," and also that the Q3 results aren't "sustainable."

Josh Brown tried to make a show of explaining how great TWTR is, asserting it's "hated more even than SNAP" but has 50 million shares short and just had an island reversal.

Brown stated that "usage is all that matters" for ultimately growing revenue.

Damning the company with faint praise, Kessler said "perhaps they're not dying … I think they're not in some ways all that much different than a zombie."

Brown questioned how daily average user growth equates to "zombie." Kevin O'Leary chipped in that it's a "revenue zombie."

Kessler said people getting "involved" in TWTR right now are gonna get "very hurt" with a long position.

O'Leary seemed to agree. "It's a short cover," O'Leary said. "There's no good news here."

Instead of just asking Brown a question about TWTR, Jim Lebenthal had to give Josh an intro about how much of an expert on TWTR Brown is that of course prompted needless semantical debate.

Steve Weiss questioned if Twitter's user data "growth" was simply a recalculation; Brown's answer wasn't terribly convincing, but Weiss seemed to buy it.

Been a long time since those dudes protested the 1% for weeks in Central Park

Josh Brown on Friday's Halftime said some of the people in Congress are "dumb enough" to take a whack to 401(k) contribution limits.

Judge asked Pete Najarian about Amazon; of course, Pete mentioned AWS.

Pete said March 1035 GOOGL calls were getting bought. And of course, someone was buying MSFT calls.

,br>

JPMorgan's Lisa Gill told Judge that there's scuttlebutt that the CVS-Aetna possibility is a "defensive move against Amazon," but in her opinion, it's really about United Healthcare and Optum.

Jim Lebenthal said to "stay away" from MAT.

Josh Brown said the "wealth effect" plays a role in ALGN results.

Weiss said EXPE missed top and bottom line, but he complained that the effect on airlines (yep) is "kinda ridiculous."

Kevin O'Leary said he likes XOM for 2018.

Weiss' final trade was WDC. Jim Lebenthal said AAPL. Josh Brown said NVDA. Kevin O'Leary said "anything small-cap."

Josh Brown said that even though he likes Macy's and Bloomingdale's stores, we'll someday have to have this "existential conversation" about the company. Weiss said the yield indicates something's wrong with the stock.

We're going to catch up with the good stuff from earlier in the week and determine if there's anything to report.

Taking a break

We never really got a summer vacation. We'll check in with the Halftime Report and CNBC goings-on throughout the week.

Update: Still breakin', but we'll get to the good stuff this weekend.

[Friday, Oct. 20, 2017]

Rob Sechan seems to think it wouldn’t be a bad idea to roll student loan debt into mortgages

Homebuilders have been one of those great sectors that no one seems to talk about much (nor is the minimal amount of conversation particularly exciting).

But a comment from Rob Sechan on Friday's Halftime Report certainly got our attention.

Sechan revealed, "The mortgage industry too is working on a solution in terms of how to figure out how they deal with student loans, and student loans potentially rolling into mortgages."

OK, the word that really gets our attention in that sentence is "solution."

Solution … to what?

Jim Lebenthal opined, "This sounds awful."

"It does not sound awful," Sechan said. "It will completely change the pace of household formation."

"I admire your optimism, but that sounds a lot like what happened 10 years ago," Jim said. "That's a bad idea."

Jon Najarian astutely noted that student loans can't be discharged in bankruptcy, but you can "walk away" from a mortgage. "So if you could roll student loans into a mortgage and then walk away, I think you'd accelerate the walkaways."

"The devil is in the details," Sechan said.

Indeed. We're trying to figure out how in the world this would work.

We can see the concerns of the mortgage industry. Someone graduates, gets a decent job, but with $75,000 in student debt, it's a long time before he or she can buy a home.

But that's life. "Rolling" debt together doesn't make it go away.

There's a bigger question, which is whether a college education should necessitate borrowing gobs of money and whether loans should be easy to get as politicians demand every 4 years.

Anyway, Jim Lebenthal said the only thing that would worry him about the homebuilders is if rates started to "meaningfully" rise. But he thinks, rather than the Citi call of buying LEN and selling PHM, the sector will move in unison.

Jon Najarian said he disagrees with the call, "and it's not just because I do have a personal relationship with the folks at Pulte," which he said has 24% margins.

Josh Brown said you can just own the ITB.

Rob Sechan said there are a "lot of tailwinds" with homebuilders, including "potential impact of tax reform (snicker) on the marginal tax rate."

GE analyst on Bill Nygren:

‘I don’t know the guy’

First, let's not annoy anyone. #goodstrategy

There's probably an unfortunate level of schadenfreude in stock-market conversations.

Analyzing some notable, falling stock that you don't own is a blast. If you do own it and have ridden it down, of course, just thinking about it can be grim death. As always, this page hopes everyone makes a profit in every stock he or she owns.

Anyway, on Friday's Halftime, Judge had several great discussions about GE, including a chat with JPMorgan's Steve Tusa.

Tusa said he respects John Flannery but that Flannery has a "very high hill to climb." Tusa explained that the $7 billion in cash flow that Flannery mentioned is from operations, and after capex, it's $3 billion, and then after pension obligations, it's "basically" just $1 billion, while the dividend commitment is $8 billion.

"On a true GAAP basis, you're looking at 65 cents of industrial earnings," Tusa added.

He said there's "no way" GE can maintain the dividend unless it sells assets, which would be dilutive.

Tusa said if he were in the boardroom, he'd try to "engineer a soft landing."

Addressing the term of the day on CNBC, Tusa stated, "This is not a kitchen sink," instead calling it an "indication" of "severe secular pressures" in certain segments.

He said every indication is that the power division is bad, "and I believe it's getting worse."

Judge noted that Bill Nygren likes GE and thinks it's still a company with great assets. Tusa said, "I'm just a kid from Connecticut trying to do a bit of analysis here. I'm not sure- I'm not Warren Buffett or anything like that."

Tusa said it could've been called a great company under Jack Welch, "but I believe the game has changed here."

As for Nygren, Tusa said, "I don't know the guy, but, uh, you know, we can discuss my model. My model says it's going lower."

Judge chuckled, as always, that this is how they make a market.

Tusa was earnest and delivered chipper, quality commentary, but the way he looked around at things besides the camera hinted he might be on the verge of snark, but it never did happen really.

Kevin O'Leary credited Tusa for "well-done" analysis and asserted that the dividend cut will be Nov. 13. Tusa said it's "definitely" going to happen before Nov. 13.

O'Leary asserted that the $1-$2 billion in cash flow is "reflected in the stock." But Tusa said he "completely" disagrees that's the case.

Nygren lacks a catalyst. The valid bull case is that this name is still so big that enough minds are going to come together to straighten it out. But in terms of a bottom, it's got a lot of currently unsexy businesses, and turning over the keys to longtime insider Mr. Flannery isn't exactly like hiring Elon Musk.

So both Nygren and Tusa may well be right, but Nygren will have to wait.

Tusa closed by saying, "Hey guys, by the way, uh, I know your former guest said he was No. 1 since 2010, but we crushed him this year, so we're No. 1 this year, just wanted to clarify that." We had no idea what he was talking about.

Humdrum panelist commentary on GE obliterated by Cramer’s ‘disgrace’ assessment

Meanwhile on Friday's Halftime, Josh Brown said "maybe we've seen the worst of the news" in GE, though "I don't feel like there's any rush" to get in.

"They kitchen-sinked it," Brown said.

"There is this problem of the dividend," said Jim Lebenthal, who called that an "overhang" through the end of the year with the tax-loss selling.

Jon Najarian said 18 million shares changed hands in premarket, "a fair amount of it below $22 a share."

Kevin O'Leary said "I'm a buyer today" in GE, not just stock but 2019 25 calls.

O'Leary predicted a dividend cut of either 50% or (gulp) 100%. "I don't care if they pay a dividend or not," said O'Leary, the guy who always champions dividends. "I see a good 20, 25% upside on this story," O'Leary said.

Judge questioned why "Mr. Dividend himself" O'Leary would buy this name and that if they announce a cut, the stock might drop lower than where O'Leary bought it at.

"No no no no, if they cut the dividend, the stock's going up," O'Leary said.

We tackled that one a day or two ago. The gut feeling here is that, if it's viewed as one of the final pieces of the puzzle, the stock would go up … but it's more like the first piece, not the last.

The panelist remarks on GE were watered-down enough that Judge was compelled to air Jim Cramer's comments (OK, he would've aired them anyway) of GE being like a country club and buying oil at the high and selling financials at the low and being a "disgrace."

Jim Lebenthal said there are "indisputable truths" in Cramer's commentary.

Josh Brown said "don't be surprised" if GE is flat on the day. Judge said it made "one helluva comeback."

We couldn’t help but wonder how much Angela Ahrendts makes; turns out she’s the company’s top-paid exec

Josh Lipton on Friday's Halftime Report did his hourly hit from Apple's new Chicago store.

Jon Najarian reiterated his AAPL call of mid-160s to 170 by year-end. Jim Lebenthal said he's waiting for the day AAPL goes up in response to a rumor, which will "open the floodgates."

Jim said the negativity about AAPL ordering/supply issues is "sequentially getting shrugged off earlier and quicker and quicker and quicker. That means the stock is going higher."

Kevin O'Leary said he's going to "step aside" from AAPL for a while and will "look at it again in March."

Josh Brown took a potshot at Weiss' grumbling about AAPL innovation. (Weiss wasn't there.)

Kevin O’Leary thinks Brexit might not actually happen

Judge on Friday's Halftime noted Third Point is in DOV.

Leslie Picker reported that Loeb is bullish on stocks. Josh Brown said Loeb "totally gets it," that there's a global recovery.

Kevin O'Leary said a lot of European stocks have "the wind at their back."

O'Leary also brought up Brexit, stating, "I'm beginning to think that these London guys aren't gonna exit."

Josh Brown observed, "This week might be the first perfect week since 1998. 5 days in a row of the S&P going up. … There have only been 17 occasions of a perfect week in 90 years, and 94% of the time, we've resolved higher after."

Jon Najarian said CTL call buyers were buying November 20 calls as well as 21 and 22 strikes out to January. (The Najarians have been trumpeting call-buying in this name for months, but it hasn't gone anywhere.)

Doc also said November 29 calls in X were popular.

Josh Brown said he has no CMG position, though it "seems to have found a bottom." But he thinks it's still a "battleground" stock, and he's not sure the permanent bottom is in, suggesting a 2-handle if the report is anything but queso being a stunning success.

Jim Lebenthal said GM will go higher if it holds gains that he expects in the early morning Tuesday.

Doc predicted a "fabulous" quarter for MSFT.

Doc said he likes TXN. Josh Brown's final trade was NVDA. Jim Lebenthal said CSCO. Rob Sechan said KRE.

Karen Finerman (above) stunned in new lavender ensemble on Thursday's 5 p.m. Fast Money while decrying how bad the United Airlines conference call was.

[Thursday, Oct. 19, 2017]

Who woulda thunk — world’s biggest market cap will be one of the last companies standing in its space

Desperate to drum up drama, Judge spent the key opening minutes of Thursday's Halftime hoping to hear a headline-making comment about AAPL.

His scare tactics didn't produce one, though he accused the panel of being "dismissive" of the Apple Watch issue in China.

Josh Brown said that if the Watch sales are part of the "fulcrum" of your AAPL analysis, then, "Find a new profession."

Brown shrugged that after previous iPhone launches, there have always been cautionary research notes in the weeks and months following.

Stephen Weiss said, "I don't think it's a surprise to anybody on this desk" that iPhone 8 orders aren't particularly robust. He said he'd like the stock 5% lower.

Joe Terranova said he's not in AAPL, and, "I think you wait."

Weiss said this AAPL quarter will be "another freebie."

Judge then brought in Brian White from the NYSE and asked White why he's "dismissive" of the Rogers Communications CEO saying iPhone 8 sales are "anemic."

White said it's because the story isn't the 8, but the X. "No one is buying iPhone 8. But there are a lot of people waiting on the iPhone 10. And I will tell you, there are also a lot of people buying the iPhone 7," White said.

Judge twice harangued White for not being concerned about Watch sales in China (snicker) and for basically saying the quarter "doesn't matter."

White said, "I think the quarter will be fine."

Judge persisted, stating, "You're basically telling me, and you're telling our viewers, the quarter doesn't matter."

White said, "I think the September quarter will be fine."

Judge said, "You're essentially saying, 'Who cares.'"

White agreed, "Who cares. Doesn't matter."

White told Josh Brown his price target is 208. He told Judge that number includes "some type of repatriation."

In the strangest comment of the program, White said of AAPL, "They're gonna be one of the last companies standing in this industry. One of the last."

Brown credited White for being bullish "the entirety of the last decade." (But what about Katy Huberty?)

Once again, time was wasted on whether Apple is innovative. Weiss insisted it's not. "Name one thing that's on the X that's not been on other phones already," Weiss challenged colleagues.

Brown said, "Facial recognition."

Weiss said, "It's on other phones, you're wrong. Facial recognition is on Samsung."

Joe Terranova said, "You have to admit they have pricing power." Weiss said he's not disagreeing with that.

Jon Najarian said White is "too aggressive" with a 208 target. Doc said it might get to low 170s after shopping season.

When was the last time anyone talked about the assignment of ESPN football announcer Robert Lee?

Steve Liesman on Thursday's Halftime said he thinks the Fed favorite is Kevin Warsh.

Liesman put odds on Yellen "below 50%," partly because of GOP resistance and because Yellen has been neutral about tax cuts.

Liesman mentioned all the people who "have a say" in the Fed selection — but didn't mention Ivanka or Jared Kushner.

Judge asked if Yellen would accept the job if offered. "I think she would take it," Liesman said.

CNBC’s 20-year coverage of the 1987 meltdown probably didn’t include chatter about ‘By the way, Bear and Lehman are toast’

Doing the obligatory hourly mention for CNBC, Michael Santoli on Thursday's Halftime said there are "more differences than similarities" between now and Oct. 19, 1987.

He said the markets globally were "under a lot of stress" in months leading up to the crash.

Judge said it's "unthinkable for many" that an equivalent one-day drop in today's Dow would be 5,000 points.

Jon Najarian pointed out the difference in AAPL valuation and volume between October 1987 and October 2017.

Doc said he was a market maker in IBM on Oct. 19, 1987.

Stephen Weiss made a good quip about having access to the Playboy Mansion.

Brown: Closets in general getting emptier (a/k/a Jim would’ve said he’s waiting to fill the other half of his position at 49)

Judge on Thursday's Halftime said NKE got a downgrade from Goldman though the price target remains 54. (Zzzzzzzzz)

Joe Terranova said he doesn't see "anything actionable" in what Goldman did.

Joe said adidas has been "way stronger than everyone expected," and he doesn't think the rally is ending.

But Josh Brown shrugged that adidas merely "caught a fad" at the right time and that he doesn't want to own any of the names.

Steve Weiss agreed with Brown that it's a "fashion business." Weiss said he'll get back in NKE when the global inventory from all the brick and mortar stores is "bled out."

Judge said there was a story going around on "one of the online (sic redundant) blogs" about NKE offering "unprecdented" website discounts up to 40%.

Jon Najarian said he gets an email every week about adidas sales.

Brown said each generation is "accumulating less apparel" every year.

"This whole sector is atroche (sic pronunciation)," Brown said, predicting a breakthrough below 50 for NKE at some point.

Weiss said, "Nike's good for an activist to come into," because "I think their products are inefficiently run."

Whew — a day without debating whether tax reform is priced in (though Brian White just barely went there)

Phil LeBeau on Thursday's Halftime said Cadillac came in dead last in auto reliability rankings.

LeBeau also said Tesla people didn't like the Consumer Reports prediction.

Jon Najarian said LC November 6 calls were getting bought. He said January 16 calls in FCX were aggressively getting bought. But he said he's buying the 14s and will be selling the 16s.

Brian Stutland thinks it's time to take profits in crude, it'll fall below 50, though he likes it longer term. Jim Iuorio said the uptrend is still intact.

Doc's final trade was BHF. Joe Terranova mentioned ADBE and said it bodes well for MSFT, SAP, RHT. Steve Weiss said UAL; "you gotta buy it here." Josh Brown said AAPL.

[Wednesday, Oct. 18, 2017]

Desperate to manufacture drama, Judge turns to Kyle Bass

At the top of Wednesday's Halftime Report, Steve Weiss said 1) we shouldn't pass a tax bill just to support the stock market, and 2) Mnuchin made an "irresponsible" comment, and 3) the U.S. is lagging other markets.

Obviously, Mnuchin is merely warning Congress — however weakly — that 401(k)s will fall if they don't vote for tax cuts.

Jim Lebenthal said Mnuchin is "choosing his words carefully."

Jim said "there's not a lot of volatility" to be driven by the tax cut.

Kari Firestone said tax cut numbers aren't in the market's economic models.

Jon Najarian said he disagrees with Mnuchin and doesn't think tax reform is baked in.

For the first time in a while, Judge invoked Kyle Bass (when's the Greece/Japan meltdown coming by the way), stating that Bass said, "If you see the equity market crack 4 or 5 points, buckle up, because I think we're going to see a pretty interesting air pocket, and I don't think investors are ready for that."

So if the market suddenly tumbles 5%, then it's going to fall more, and then investors won't be "ready" for that, so it'll presumably fall still more.

So he's predicted about 7 of the last 1 meltdowns.

What about the classroom survey when he was dismayed that students didn't know enough about Greek debt?

Got it.

Jim Lebenthal said he doesn't see a 4-5% drop before year-end.

John Harwood said, "They've got a lot to overcome" in terms of passing tax reform.

Mike Farr, who resembles former Gov. Gray Davis, spent the hour with the panel.

How come there wasn’t all kinds of bullish options activity in IBM prior to the earnings report?

Jon Najarian on Wednesday's Halftime Report said IBM results are a "turn" but still could be a "tease."

Surely his opinion was influenced by what Pete Najarian reported later, which was (after invoking Katy Huberty's 192 (snicker) target) that IBM November 160 calls were getting bought.

Jim Lebenthal said the IBM turnaround is "just one quarter," and there could be a short squeeze driving the stock.

Kari Firestone was shaking her head about IBM's gains. "I don't see where the catalyst really is," Firestone said.

Pete Najarian said Warren Buffett might've "made a mistake" by selling IBM too soon.

Mike Farr says people will start to feel like a ‘moron’ if they buy CMG

Stephen Weiss on Wednesday's Halftime Report said he loves the Bank of America downgrade of CMG and wonders why he's not short it, given the "egregious" valuation.

Jon Najarian noted that CMG could "pop significantly" if tax reform gets done. He said it gets interesting around "roughly" 300.

Kari Firestone said, "Malls are becoming just food courts," pinching the restaurant space.

Mike Farr said "emotional momentum" is going to work against CMG; people will be considered a "moron" if they try picking a bottom in this name.

Day 2 of (supposedly) Donald Trump tweets sinking the drug space

Kari Firestone on Wednesday's Halftime Report said she owned AGN for "quite a while" but got out for a few reasons, one of them being the prospect of botox alternatives.

Jon Najarian said ESPN's NFL numbers "may be troughing."

Pete Najarian said XLF November 26.50 calls were getting scooped out.

Doc said PG October 93.50 calls were popular. He also said November 94 ABBV calls were popular. Doc also noted that GWW took off.

Jim Lebenthal said "Abbott is going higher from here (sic last 2 words redundant)." Jim made ABBV his final trade.

Steve Weiss said EA actually looks attractive on the selloff.

Mike Farr said he owns CVS and will buy more.

Doc said ANTM has done great over 5 years.

Jeff Kilburg said the flattening curve suggests a "credit event on the horizon." Scott Nations said the Fed should be unloading the longer-term bonds first, but, "They're not."

Weiss said he likes UAL. Doc noted Warren Buffett didn't sell after the passenger was dragged off the plane and that the calls are getting bought.

Jim Lebenthal again touted WGO after Thor earnings.

Weiss' final trade was MU. Kari Firestone said SHW, and Doc said WYNN. Mike Farr actually said XOM.

[Tuesday, Oct. 17, 2017]

Not sure what numbers Doc is talking about regarding Colin Kaepernick

Judge on Tuesday's Halftime Report said a "well-respected executive" told him he's seen "bomb-sniffing dogs" at the NFL owners meeting.

Pete Najarian said unfortunately, "The NFL is being reactive," and he faulted Commissioner Roger Goodell.

"$44 million a year this guy gets paid, Scott," Pete said.

Jon Najarian curiously stated, "Kaepernick has no future because you know, he blew himself up in San Francisco. The numbers were among the worst ever in league history in his final year there."

Seriously?? Did Doc ever notice what Stoudt, Kordell, Kent Graham, Tommy Maddox and Dennis Dixon put up for Pittsburgh??

Oh well. "I don't think there's collusion on the owners' parts," Doc stated.

Judge told Doc there are "many people out there who would disagree" as to whether Kaepernick is good enough to play in the league.

Judge tries to tell Bill Nygren what Bill knows

Judge opened Tuesday's Halftime with Bill Nygren, who called GE "a very different company looking forward than looking back." (Translation: Immelt blew it.)

Nygren conceded, "You have to think there's some risk in that, uh, in that dividend," which proved a contentious subject.

Judge told Nygren that if GE cuts the dividend, the stock will "get hit hard," and, "You know that."

"I don't know that," Nygren responded.

Actually, Nygren's right. Remember when the Najarians used to mention every other day that Kinder Morgan took off after announcing the dividend cut? GE isn't the same type of situation, but still, clarity on that subject could bring in buyers.

A cut indeed might hit the stock. But it also might not.

Regardless, Judge claimed the panelists "visibly (sic redundant) almost jumped out of their seats" at Nygren's comment.

In an excellent point, Josh Brown questioned why Nygren thinks GE is "out of favor," citing average analyst price target of 28.

Nygren admitted to Judge, "We started buying it almost 2 years ago, when it was about this same price. And clearly made a mistake not selling it 6 months later when it was in the 30s."

Also long NFLX, Nygren said P.E. doesn't reflect the value of the business. "If Netflix charged $15 a sub, the P.E. would be about a market multiple right now," he said.

Jim Lebenthal asked Nygren if he fears a contracting multiple and competition for NFLX. Nygren said unfortunately, he worried "a lot" about competition a few years ago when the stock was a lot lower.

Joe Terranova said he doesn't think GE has "financial flexibility" right now; "the dividend cut totally makes sense." Joe also mentioned the burden of pension liabilities.

Josh Brown said of Nygren's GE bullishness, "I don't know why he thinks it's gonna get a market multiple, let alone a premium."

Pete Najarian predicted "heavy pressure on the sell side" if there's a dividend cut.

Famous Hillary tweets (revisited)

Judge on Tuesday's Halftime bickered with Josh Brown over whether the stock market cares about Donald Trump's comments/tweets on drug pricing.

"The stocks dropped like a stone yesterday," Judge said.

"Talk to me next week," Brown shrugged.

Pete Najarian said Stifel's target hike to 415 on BIIB really stands out about the call.

Jim Lebenthal said ALXN is very attractively priced.

Jon Najarian said XBI calls were popular but said CELG is his favorite. Doc said BIIB isn't a stock that gets traded because of the high bid/ask. Joe Terranova said his top pick in the space is XLV. Pete said there was "large buying" in November 84 XLV calls.

Doc practically does cartwheels just because someone bought calls in FB

In a curious comment, Josh Brown on Tuesday's Halftime said there are "massive bubbles being blown," perhaps in crypto or private equity, but "not necessarily in the S&P 500."

Jon Najarian pointed out how well Japan is doing right next to North Korea.

Jim Lebenthal said he's "comfortable" that QCOM will settle with AAPL (sigh).

Josh Brown predicted "another leg higher" for INTC.

Jon Najarian said HOG was trading almost $2 higher since the open.

Jim Lebenthal said "just be careful" with BA because it's hard to see how much better things can get.

Josh Brown said SONC, bigger picture, is still in a downtrend, and he likes pizza names and SHAK better.

Joe Terranova said he likes CNC better than UNH.

Pete said SAVE has "absolutely lagged the rest of the sector."

Doc said he likes that FB November 180 calls were getting bought. He also said November 190 GWW calls were popular and were already making money in the morning.

Pete said someone in the FAST November 46 calls was (yep) rolling up into the 48s.

Scott Nations said gold was down on hints of the Taylor Rule. Anthony Grisanti suggested 1,254.

Doc's final trade was IRBT. Pete said AMAT and hung a 60 on the name. Josh Brown said ALB. (This writer is long ALB.) Joe said LRCX and hung a 200 on the name. Jim Lebenthal said C.

[Monday, Oct. 16, 2017]

Fast Money/Halftime ignores the word that really sank Netflix in 2011 (a/k/a ‘FANG stocks only work in odd years’)

On Monday's 5 p.m. Fast Money, viewers were treated twice to the now-incomplete-but-regularly-heard-on-CNBC history of Reed Hastings' (limited) mistakes.

Guy Adami repeated the narrative (and referred to it twice actually) about "the only misstep that Mr. Hastings has taken in the last decade or so was 6 or 7 years ago when they raised prices under the cloak of darkness one night, and the stock got obliterated."

It wasn't that simple.

See, here's the deal … words can be really lucrative. "Google" is a great and funny term for the Internet Age; that's the reason people used/use the search engine. And how much "Spanx" would anyone buy if it was called "Gurdle." (We don't know and aren't going to opine on that one.)

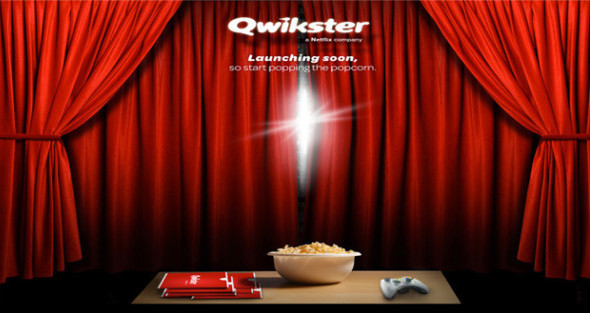

What Mr. Hastings did in 2011 was announce a split of his company into a streaming service and a DVD service. The split would result in price increases. The hook was that the DVD service would be called "Qwikster." People on CNBC laughed.

That's why the stock was "obliterated."

The price increase was dubious only because NFLX was very much a "battleground" stock then with legit concerns (that still exist) about spending obligations; streaming didn't have the presence it has now. That would've just dinged the stock. Announcing it with a name that sounded kind of manufactured hip made people think "what are these chuckleheads doing."

NFLX earnings just came out Monday night, so we expect to be hearing more of the incomplete story Tuesday.

He mentioned DuPont (but not the ‘Joan of Arc’ thing)

Taking up what has to be one of the biggest wastes of recent investor/corporate time in recent years, Judge on Monday's Halftime brought in Jeff Sonnenfeld to address the PG fight.

We didn't know or couldn't remember Sonnenfeld's position on this subject but got a crash course quickly when he stated that the battle is "inspiring a number of boards" to stand up to activists.

Judge, who bungled his own recap of Donald Trump's remarks earlier in the show (see below), quoted Sonnenfeld as saying that Peltz has "tantrums" over defeats such as this. "This sounds especially personal," Judge told Sonnenfeld.

Sonnenfeld insisted that when challenged "on rational grounds," Peltz gets "quite personal."

Judge said "the average holding time" is 44 months for Trian funds and then rattled off a bunch of impressive returns compiled by an objective source as Sonnenfeld tried to get a word in.

Sonnenfeld at one point referred to "your superb collar (sic meant 'colleague'), Andrew Ross Sorkin," who apparently reported in the New York Times that Trian interests TIF, LM, IR, LAZ underperformed over 2 years.

Sonnenfeld twice mentioned Mondelez and said of Chemtura, "They loaded it up with so much debt, they drove it into bankruptcy."

Judge cut off Sonnenfeld, insisting, "We've got to go," but instead of going to a commercial, he just let the panel shoot the breeze for the remaining 4 minutes.

Joe Terranova said "I just don't understand" why there's a conversation about Nelson Peltz's track record.

Jim Cramer said he's known Sonnenfeld since age 5.

‘It’s eerily reminiscent of ’99’

Once again inserting his opinion into the dialogue (even though he's not exactly a pro stock-picker), Judge on Monday's Halftime said the Soc Gen cut of C to sell/65 "seems like a very peculiar call to me" because it's "so against the grain, the crowd, this desk."

Stephanie Link said she's been buying because even though C is not JPM, "I don't think the story has changed."

Jim Cramer likes it for the "capital return story."

Judge said the show wanted to land the Soc Gen analyst but wasn't able to do it, but, "This analyst has been on the wrong side, offsides on this one … for a while."

Pete Najarian said he's not sure he gives the analyst credit for upgrading it a while back to a hold.

Joe Terranova (trading) and Steph Link (NIM) briefly bickered over what was most disappointing about C's report.

Meanwhile, Jeffrey Sherman of DoubleLine said the market reflects a "growing global economy" but cautioned about moving in the direction of "global coordinated tightening."

Cramer said people in Europe don't care about rates but the "immigration problem." But Cramer assured this won't be like the 1930s.

Judge noted the Jets got robbed by a pathetic call and that Colin Kaepernick filed a grievance.

Mike Francesa, who was rushed into this abbreviated program for some reason at the expense of commercial revenue, said Kaepernick's collusion argument will be "very difficult to prove."

Francesa said Kaepernick's NFL career is over. "They might pay him to go away, but he is not gonna get another job," Francesa asserted.

Pete's final trade was RTN. Jim Cramer said JPM. Stephanie Link said EMR. Joe said FMC.

Karen Finerman, who looked great in hunter green on the 5 p.m. Fast Money, said the selloff in PCG "does seem overdone to me."

Out to lunch: Judge misses Trump’s comments on California fires, conducts an entire 60-minute show without a commercial #lostrevenue

In an extraordinary episode of the Halftime Report — extraordinary because it went commercial-free despite only losing about 20 minutes to breaking news — Judge apparently took a lunch break during the 17-minute clip of Donald Trump's remarks from the White House.

Trump at one point mentioned the "devastating wildfires like we've never seen. And we mourn the terrible loss of life. We have FEMA, first responders there. We have our military helping. It's, uh, very sad to watch how fast, how rapidly they move and how people are caught in their houses. It's an incredible thing, caught in their houses."

Afterwards, Judge said, "You've got 41 people, uh, now dead in California. Uh, businesses that have been burned to the ground. And no mention at all, uh, by this administration, the president, about what's taking place there." (Gulp — that's how some come up with the "fake news" thing.)

Eamon Javers though explained, "We did hear the president talk about it, Scott."

Javers actually said the president, "to my eyes, seemed a little bit in awe of the power of nature."

Judge offered "my apologies" for "mishearing" what was said. (Translation: He didn't "mishear" anything; he obviously wasn't listening to the whole thing.)

Otherwise, Trump said the Vegas monster "was a demented, sick individual; the wires were crossed pretty badly in his brain, extremely badly in his brain."

Trump said "some people are really taking advantage" of America's welfare system.

He also complained about prescription drug prices that have "gone through the roof," explaining, "The drug companies, frankly, are getting away with murder."

Jim Cramer said Trump's "Nielsens" are the stock market.

John Harwood said Trump's remarks about the Senate are "not an auspicious political sign" for getting tax reform.

Steph Link said, "Most of the HMOs have gotten out of the exchanges."

Meanwhile, Joe Terranova said he feels good about the market. Joe trumpeted his software plays, MSFT, RHT and SAP.

Judge (picture above not from Monday), who called Mike Wilson a "Halftime regular" even though he's been on the show by our estimation 2 or 3 times this year, said Wilson is seeing a greater risk for a correction (snicker) than he's seen in a while.

Jim Cramer called this a "Cleveland" market. He said ITW and LRCX tumbled but shouldn't have.

Joe observed, "No one has energy right now."

Pete Najarian showed up late.

More from Monday's Halftime later, including the panel vs. Jeff Sonnenfeld on Nelson Peltz's track record.

[Friday, Oct. 13, 2017]

Admittedly, we had to look up ‘mishegas’ (a/k/a Weiss buries the lede, but at least he had the brass to bring it up)

Judge on Friday's Halftime gave Josh Brown a platform to talk about an essay Brown wrote on single-stock positions in wealth management.

(Actually, the article is rather disjointed, distorting its quality points.)

Brown (picture above not from Friday) contends that it's downright impossible to fully analyze all kinds of single stocks for various clients and deal with the emotions involved.

The basic argument, and it's a fine one, is that if you buy a stock for 100 clients and the stock does well, and you're inclined to trim, then you get a new client, do you actually buy it for the new client while selling it for others.

Sarat Sethi observed, "Where you get into trouble … is when clients dictate what to do in your portfolio."

Brown gave Jim Lebenthal another example. If someone has 100 clients, and he bought them all GM, the stock goes up, the advisor sells, then 6 months later, 3 clients say, "GM just went up another 10% since you sold it. Why did you sell my GM? Put it back."

But that seems like an age-old problem that has nothing to do with increased use of ETFs.

Jim Lebenthal, who initially sparred with Brown over whether they were defining asset management or wealth management, explained, "You have to have rules … You have to be willing to fire a client. OK, If you've got one client who's taking up half of your day …"

Steve Weiss said he agrees with Brown but also thinks it's true on the institutional side.

Then it was Weiss who finally got to the point and asked Brown the million-dollar question: "Why would somebody need somebody like you if you can just buy the ETF, reduce your costs, what do you charge, 1% of assets, I don't know, because markets go up 80% of the time, and that's been a great trade."

Brown's roundabout answer was that the "real value to clients" is the "financial planning aspect."

Judge promised a link to Brown's article at CNBC.com. That was kind of nonexistent, though you can find the Twitter link at the Halftime Report portal.

Tom Lee actually says ‘FANG stocks only work in odd years’ (after admitting, ‘We basically

got steamrolled’)

Tom Lee, who called a 4-5% selloff in September, dialed in to Friday's Halftime and admitted he took his cues early this year from the credit markets suggesting caution, and, "We basically got steamrolled."

But he said this week, "high yield finally confirmed the rally in equities." So that's why he's shifted from cautious (snicker) to neutral (snicker). Lee's new target is 2,475 (snicker).

Judge noted that's lower than today's S&P. "How does that square up?" Judge asked.

Lee said there's "positives and negatives" but didn't answer the question, pointing to extremely low yields in Europe.

Judge asked Lee if the market is "ready" for what the Fed's going to do in the next year (snicker). Lee said there's a "recognition" at central banks that unemployment may not justify such low rates.

Judge asked Lee about Lee's recent notion that FANG will do great while the market stalls. Lee actually said, seriously, "FANG stocks only work in odd years … FANG for whatever reason works in alternate years."

The NFLX trade was to buy when Carl plunged in, but even Carl got out way too early (Day of Reckoning etc.)

Judge opened Friday's Halftime saying NFLX hit a "new (sic redundant) record high."

The thing is, nobody on Friday's panel was rushing in to buy the stock.

Josh Brown admitted that he never really believed NFLX would get this big in terms of market cap.

But Brown said, "They're making native content shows all over the world in a way that HBO couldn't even dream of right now."

Jim Lebenthal contended the price increase "is already in the stock."

Steve Weiss said he sold NFLX in the 170s but "made some really good money on it." Weiss said NFLX still has pricing power. "I hope they miss bad, so I can get in," Weiss said.

Sarat Sethi doesn't own NFLX either. But he does own YELP, which he says has "a lot more room to grow" (snicker) than NFLX does.

Nobody on the panel owns CRM either. Judge asked why not. Jim hilariously told Judge, "I don't think you're gonna go through all 500 stocks."

"I'm trying to make a point," Judge protested, though we're not sure what that point is.

Judge quibbled with Brown's contention that investing in high-P.E. names involves an educated "guess." Brown insisted, "At the end of the day, it- you're making a guess. You have to be."

Weiss: ‘It’s eerily

reminiscent of ’99’

Josh Brown on Friday's Halftime said he bought NVDA at 50 when trading at 50 times earnings.

Extending the "guess" argument, Judge said, "You're not guessing, you feel like you're making an educated decision based on-"

"I think this one was easy," Brown said.

Judge said he's wondering "if things are starting to get a little hyperbolic" in the momo-stock space.

Stephen Weiss admitted he sold NVDA below 100 after his calls doubled.

Jim Lebenthal said value can work as well as growth and pointed out that INTC is "making good money for me."

"It's eerily reminiscent of '99," Weiss said.

Remember when it was news every 8 minutes on CNBC who was controlling the National Amusements shares ...

Erin Browne on Friday's Halftime said the bank space is "a little bit more of a stock-picker's market."

Stephen Weiss is sticking with BAC and C. Sarat Sethi said he likes BAC and C and JPM and MS and SCHW.

Josh Brown said the payment stock space is "so much hotter" than the banks. But Sarat Sethi said V and MA are trading at "peak P.E. right now."

Weiss cautioned that iron ore stocks can go south in a hurry.

Josh Brown said AMBA is still an ugly chart, he doesn't want anything to do with it.

Erin Browne said transports are "well positioned."

Jim Lebenthal said VIAB is "very cheap," and the reason to own it is that it might get taken out.

Sarat Sethi said it's time to take profits in HPQ.

Jim Lebenthal predicted WGO would knock one out of the park in its earnings report.

[Thursday, Oct. 12, 2017]

‘Scott, Scott: Let’s be serious here’ — when smart people really aren’t able to showcase that smartness

Sara Eisen during Thursday's Halftime Report sat down with Larry Summers.

Interviewing Summers is not that big of a deal — he gives a lot of interviews.

But this is an extremely intelligent, plugged-in fellow (even though he probably knows little about "Road House.")

And his interviews are actually something of a small tragedy.

He obviously can't speak 100% freely (very few humans can on cable television) because of his political and professional associations.

Let's put it this way: We'd give a left arm for a completely candid conversation with this fellow. Questions would include: "Was Hillary Clinton electable." "What does Trump do well." "Does active management really outperform indexes over time." "Then again, aren't indexes just active management?" "Is it smart to use your best pitchers only once every 5 days." "Do hormones affect intelligence?" "Why aren't diseases being fought like World War II?" "What is the difference between a country … nation … state … commonwealth … territory … What is the difference — really — between Guam and Alaska …"

You get the idea.

Surely he has a thought on those subjects.

This fellow once headed perhaps the most preeminent institution of learning in the whole world.

Thus, he should be a champion of furthering people's … (here's another good definition question for him) … brainpower/intelligence/knowledge of things that are relevant.

Imagine if Sara Eisen had asked Summers any of those above questions.

Yep.

Instead, all he can do in limited time is carp about tax cuts.

OK. Whatever.

Eisen told Summers he's been "trash-talking" the Trump administration. Summers said there's been an "unprecedented level of, uh, factual error and, uh, statements that aren't supported by any economic analysis from the administration on a range of questions."

Summers scoffed at repatriation, stating it happened in 2003-05, and a "huge amount of money came home, and it all went into share repurchases and dividends."

Judge then got a chance, asking Summers if Summers thinks Jamie Dimon is "lying" about the idea that tax cuts would boost jobs and wages.

Summers said, "Jamie's, uh, my friend. And, I do not mean at all to be attacking him personally." Then he offered an example/calculation and said Judge "could get your researchers to do it for your viewers."

The example is, if the corporate tax rate were cut from 35% to 20%, and JPM's profits are about $25 billion a year, the cut would save $3.75 billion: "How many people will Jamie Dimon increase his payroll by. Will it be any substantial fraction of $3.75 billion?"

Judge protested that Dimon "is speaking for the greater corporate community."

Larry said, "Scott, Scott: Let's be serious here. You're the one who introduced Jamie Dimon and Jamie Dimon hiring as evidence in this calculation."

Sara said Larry Lindsey has offered a $30,000 bet that the economy's better under Trump than Obama, inequality declines and incomes rise. Summers grimaced and waved off Eisen; "It's not specified in a clear way."

Been a long time since Herb has been on complaining about BABA transparency and the exec who lives near him

Judge opened Thursday's Halftime with a funereal tone about the "Retail Wreck."

Judge claimed "it's a fool's game" to pick a winner among retail stocks.

Pete Najarian suggested HD, and also touted BBY and WMT, although not with the same type of vigor he saves for Micron and the big banks and MSFT and Katy Huberty's AAPL analysis.

Joe Terranova said "the scary part" is that retail had a bounce in late August, "and everyone believed the bounce."

Joe said PVH is fine, great, but "it's just a matter of time" before a couple retailers "end up on the pink sheets."

Jim Lebenthal stressed, for the umpteenth time, "The debt is where we should be looking," while Pete Najarian did neck-stretching exercises.

Jim pointed to ominous debt-market signals about SHLD, only about the 175th time such a point has been made on this program and others. (Probably costs a million bucks to short it.)

Josh Brown balked at Jim's assessment and asserted, "The corporate bond market is asleep," mentioning Toys R Us.

Jim told Brown, "You also know that the XRT rallies in November. You know that."

Jim explained that retail's a small part of his portfolio and he's doing great despite JCP. Judge stated, "We're happy for you … we truly are." But Judge wondered, "Why the hell then are you still holding this stock."

Jim said, "Because frankly I think it's undervalued" (Zzzzzzzzzzz.)

Brown said malls "are literally (sic) propping up stores themselves," stating 500 Aeropostale stores are "being operated by the mall owners."

Joe tried to tell Judge that JILL's shellacking was more company-specific than a bellwether.

Joe said of LB, "I've been talking about it; I haven't owned it … I like the company."

We are definitely not experts on this subject … but women are buying ‘gym’ apparel for work now?

After airing his own views on the subject, Judge on Thursday's Halftime asked Dana Telsey about having "hold" ratings on DDS, JCP, M and JWN.

"Why?" Judge asked Telsey.

Telsey said she agreed with the show's "dialogue" that contraction is needed. But, "The balance sheets of some of these companies happen to be very good," Telsey said.

In the day's most eye-opening comment, Telsey told Josh Brown that women used to buy apparel for 4 reasons: "Work, weekend, gym and party." But today, Telsey said, there are only 2 reasons, given the more casual society: "Work, weekend, gym as one collective, and then party."

Josh Brown asked Telsey, what if suppliers stop shipping product to JCP. Telsey said, "Haven't heard anything like that."

Brown: Good luck getting

TWTR over 20

Pete Najarian on Thursday's Halftime Report suggested low volatility was a bit of a headwind for the big banks.

There was other talk about the big banks, but 1) it's a boring space, 2) it's nevertheless discussed on the show constantly, so 3) we don't need to bring it up here. (By contrast, TWTR and (former) YHOO have apparently become so boring that not even the Halftime crew talks about them anymore.) By the way, Karen Finerman on the 5 p.m. Fast Money said the only problem with the banks was that the stocks had run up a lot before earnings.

Joe Terranova said the place where he got his "wonderful haircut" accepts SQ. Pete said TWTR was up Thursday because of "rumors, rumors, rumors," which basically happens in the stock about every 2 weeks. Josh Brown said TWTR should experience resistance at 20.

Pete said October 55 calls in AMAT were getting bought.

Brown: Equifax facing ‘potentially existential’ concerns

Josh Brown on Thursday's Halftime Report said EFX had a "very, very strong bounce" off of 90, but now it's rolling over again, and, "I don't think it holds 90 this time," though there are "no shorts in this stock."

Brown said he "kinda" thinks this is a "potentially existential" problem for the company. Judge shrugged and moved on to Futures Now.

We're not sure about holding 90, but we don't see how Equifax goes away so easily.

Jeff Kilburg said 50 should be support in crude. Jim Iuorio said the "pretty decent uptrend" remains intact.

Jim Lebenthal said he's added recently to GOOGL and QCOM.

Joe Terranova offered a curious and time-consuming (in the final seconds) take on "quant models" before just saying to buy MAR.

Pete Najarian's final trade was LULU. Jim Lebenthal said AAPL. Josh Brown predicted a "major breakout" in GOOGL. Joe Terranova said RHT.

[Wednesday, Oct. 12, 2017]

Judge notes he’ll ‘never forget’ the day COST stuck it to AXP

The opening of Wednesday's Halftime was basically a lengthy pep rally for V.

Joe Terranova said V is gaining momentum with the turnaround specific to Europe and later said he expects conservative guidance.

Kari Firestone still likes V but thinks MA is "more expensive."

Pete Najarian said he agrees MA is more expensive and said V's growth projections are "absolutely astounding."

Jon Najarian said PYPL is "just hitting high after high after high" and touted it a 2nd time in the first 10 minutes.

Judge seemed surprised nobody was touting MA. Pete said if he were to do something besides V, he'd pick AXP.

That prompted Judge to bring in Don Fandetti on the phone; Fandetti called AXP "the one to own" because it's "regained some momentum."

But Fandetti also said he likes V or MA because of Europe and being cheaper.

Fandetti conceded the possibility of disintermediation risk or regulatory surprise. (Years ago there was something about Sen. Durbin that temporarily sank these stocks.)

Judge aired a clip of Cramer calling V and MA "2 of the greatest stocks of our time."

It took 8 minutes for Judge to bring up AXP's performance since "the Costco day," adding "I'll never forget that." (As if there were any risk.) Pete said AXP was in "purgatory" for a year afterward before its stunning climb.

Joe said there are 3 others in the space, COF, DFS and SYF, and COF might be most likely to ride a bit like AXP, but he doesn't think any is as good as V or MA.

Joe implies people might believe dubious things just because someone like Larry Fink is saying them

Wednesday's Halftime gave viewers a dose of Larry Fink talking about all the cash on the sidelines. (As opposed to Howard Marks talking about how it's time to be more cautious because he heard someone on the Halftime Report talking about "sell point" and didn't like it.)

Joe Terranova grimaced, stating, "Conceptually, there's a tremendous amount of cash on the sidelines. And then, I've heard from so many people over the last 5 years, well there's nowhere else to put your money except- except in the equity market because the return environment is so low, it's the only place to be. So is there really that much cash on the sidelines? I think that kinda conflicts with each other."

That's an excellent point.

Judge noted that Larry Fink is saying it, which makes it seem like a "real issue."

Joe said, "It sounds good because Larry's saying it. Uh, if I said it, you'd laugh at me."

Kari Firestone said Q4 should have 12% earnings growth for the S&P.

Jon Najarian said of big banks, "Many of these are still a deal."

Kari Firestone said there has "literally been a massive move" into financials already.

Judge pushed Joe over whether the Fed matters because it's "normalizing" now.

Pete Najarian hung a 100 on JPM by Friday. Pete said C will get there in "7 or 8 months."

Joe said he doesn't think the lifting of financial regulation is priced in. Kari Firestone said "some of it's priced in."

This time, Judge took a break at the 18-minute mark, a step up from a day ago. #revenue

Ackman hasn’t texted lately to share what he thinks of the CMG queso sauce

In what can only be described as a light moment on Wednesday's Halftime (while Harvey Weinstein runs amok in private meetings but Judge won't even bring it up), Judge visibly snickered at Coach's name change to "Tapestry."

Judge admitted he laughed at "Alphabet" and mentioned Tronc and Altaba as other questionable monikers. "Interesting, to say the least," Judge said.

Later he mentioned Tegna, Altria and Mondelez.

Kari Firestone said the name Tapestry "doesn't tell you anything."

Toni Sacconaghi is the No. 1 so-and-so of the top-ranked whatchamacallit in the latest Barron’s whatever list (etc.)

Jon Najarian on Wednesday's Halftime said he's exited almost all of his big airline pops of this week.

Doc said ARNC October 28 calls were getting scooped up. In rare evidence of bearishness, Doc said November 20 puts in IPG were getting bought up.

Pete Najarian said someone was buying September 2018 42 calls in INTC. He said he's in the name.

Pete said JNJ has 3 pieces all working; he thinks it goes a lot higher.

Joe Terranova predicted a "very strong upcoming quarter" for FDX.

Kari Firestone noted KR has been going the opposite direction of the S&P 500 and if you want to make money in it, you'll have to be "very very patient."

Anthony Grisanti said 92.70 is support for the dollar; if it holds, it can go higher; if not, it's looking at 92. Jim Iuorio said he'd bolt below 92.45, but he thinks 94 is coming.

Joe hung a 500 on BLK. Kari's final trade was PSX. Doc said NXPI. Pete said BABA and MSFT.

Judge tripped up over whether there was an AAPL analyst call Wednesday

Judge on Wednesday's Halftime noted Credit Suisse put a 1,350 on AMZN, 235 on FB and 1350 on GOOGL.

Pete Najarian trumpeted FB for having a P.E. under 30. (Honestly, why Facebook's P.E. is so important to this program, we have no clue.)

Judge said FB is "under fire" politically. But Pete said all it took was a "shallow dip" on the congressional stuff.

Kari Firestone called the 1,350 AMZN target a "very risky call," noting it has recently underperformed tech.

Joe Terranova said the most interesting name of the 3 to him is GOOGL. He said it seems to have the most momentum near term.

In other names, Jon Najarian said NFLX has been good at picking "big winners" in programming, and he likes the Morgan Stanley 225 call. Judge said sentiment on the name "could not be more positive." Pete said for the 2nd time in a few days that Netflix can get away with raising prices now.

Judge said there was "no call today for Apple," but Pete said Katy Huberty raised the target from 194 to 199 and bumped up North America unit projections.

Judge says potential of GE dividend cut is a ‘scare’ to Cramer, possibly others

Jeffrey Immelt was always treated like royalty on CNBC (that's ownership privilege regardless of a lousy CEO record), but now, it seems, the chickens are kinda coming home to roost.

Judge on Wednesday's Halftime brought in Stephen Tusa by phone to discuss the "higher risk" of a GE dividend cut.

Tusa said paying out all the free cash flow to shareholders doesn't allow much room for turnaround spending.

Judge said GE told CNBC that the dividend remains a "top priority." Judge asked Tusa if that language happens to "scare" him like it does Cramer.

Tusa said, "I'm not really scared of that language," explaining that the signal is that if there's a "material" portfolio move, there's likely to be a dividend adjustment.

Judge conceded, "Maybe scared is a poor choice of words on, on my, my behalf."

Tusa, who knocked GE bulls throughout the chat, insisted observations and expectations about what management can do are "totally off the map" because the earnings are so low.

Judge noted Tusa sees the CFO change as nothing but negative. Tusa said Jeff Bornstein's exit is "absolutely a surprise" after he was trumped up recently as part of the turnaround.

Judge asked Tusa when the shares would be a buy. Tusa said there's a "way to go."

As for the dividend cut, Kari Firestone said she can't believe John Flannery "is going to do this as one of his first moves" or that the board would support it.

Firestone insisted GE isn't "forced" to cut the dividend; "they can certainly borrow the money."

Joe Terranova shrugged that HON is the alternative to GE. Doc said GE is "a show-me situation."

More from Wednesday's Halftime later.

[Tuesday, October 10, 2017]

Procter & Gamble CEO blames media for apparently making company, Peltz seem like enemies, then says Sara is misquoting him

Part of Tuesday's Halftime was devoted to Sara Eisen in Cincinnati, who said Nelson Peltz is claiming the PG vote is "too close to call."

Eisen recapped interviews with PG CEO David Taylor and Peltz. Taylor told Eisen, "I think the media got it more messy than it did between the two of us (sic grammar)."

Sara told Taylor, "You did call him dangerous."

"Not him. I said some ideas I think would be very harmful to the company … I'm not calling Nelson Peltz 'dangerous,'" Taylor said.

For his part, Peltz crowed about being a "pioneer" (Zzzzzzzzz) in taking on such a big company.

That picture of Sara is from a different program during the day, but you know it belongs up there.

Unreal: Judge goes 33 minutes before 1st commercial despite no breaking news

Judge on Tuesday's Halftime turned to Josh Brown at the top of the show to discuss Brown's tremendous instant call on WMT from a day ago.

Steph Link said of the stock, "I think it just keeps going."

Brown noted some were skeptical of the Jet acquisition and asked, "How much market cap has Wal-Mart added since Jet.com."

Pointing to $3 billion acquisitions, Jon Najarian said, "I think Jet is making a much bigger impact for Wal-Mart than Beats is."

Joe Terranova made a too-long point about WMT highlighting the staples space and said something about diversifying and momentum. Judge suggested WMT was enjoying a bit of a "relief rally" because retailers aren't reaffirming anything.

Eamon Javers says there’s a ‘moron flap’ in the White House; panelists snicker

Judge quickly interrupted Tuesday's Halftime with video of Donald Trump that froze after a couple words.

Panelists were heard cracking up and whispering when Eamon Javers mentioned that there's a "moron flap" in the White House.

Javers said it's unknown whether the NFL forcing employees to stand for the national anthem would stand up to "constitutional scrutiny."

CAT at all-time high. Seriously.

Joe Terranova on Tuesday's Halftime called Goldman Sachs' price upgrade for CAT a "great call."

Jon Najarian said 4 times (that's correct) that CAT hit an "all-time high." Joe said "part of the story" is CAT's oil and gas business, because it's not "near apocalyptic."

Doc said March 60 calls in DISH were popular.

Joe said of PANW, "I don't wanna go there." He prefers SAP.

Stephanie Link agrees with the LLY downgrade.

Doc said he likes RF, which he owns, and STI also: "I wouldn't sell either of these banks."

Josh Brown said he'd avoid JBL.

Judge doesn’t mention that this is an ‘Albemarle market’

Judge on Tuesday's Halftime gave Dubravko Lakos a rousing intro even though Lakos has been on the show a bunch of times before.

Lakos admitted his S&P target right now is still 2,550 (snicker). But he has 2,700 "incorporating a tax scenario."

Lakos said, contrary to David Kostin, he thinks "a lot less" than 65% of tax reform is in the market.

Lakos suggested a possible big rotation from growth to value (snicker) (meeting the show's quota of that prediction at least once a week).

Judge asked Lakos what happens if the Fed tightens "too quickly" before tax reform happens. Lakos said the question is whether, if we get tax reform, would it "invite" more aggressive central bank policy.

Whatever happened to the subscribe-to-an-iPad business model plan?

After Dubravko Lakos, Judge on Tuesday's Halftime brought in Toni Sacconaghi and introduced Toni with more resume filler that viewers have heard dozens of times already while precious seconds ticked by (and obviously not filled by commercials #lostrevenue).

Sacconaghi said he's still "very constructive" on AAPL though the stock's had a pause. He told Doc the X is a "big step forward … more screen and less real estate."

Toni verified he thinks HPE has 20% upside, mentioning "4 activists" in the name. He said he could "certainly" see the stock at 18.

Joe Terranova said of HPE, "I think it's going higher because no one owns it," a curious prediction. Josh Brown scoffed that the stock is "dead" with "multiple gaps down."

Brown was unimpressed by Sacconaghi's stature, which Judge likes to trumpet every 10 seconds. "Whatever he thinks, no offense, it's in the stock," Brown said.

Steph Link called HPE "very tempting" but mentioned CSCO, ORCL and even MSFT in the "value tech" space.

Toni called TSLA a "really polarized stock." He predicted that if the company can't show a path to profitability with the Model 3, you'll start to see investor "anxiety."

Ticker symbols that should exist (cont’d): BRA

Judge on Tuesday's Halftime brought in Matt Boss to discuss WMT. Boss said WMT is "reiterating top- and bottom-line guidance" as well as "outlining a credible strategy" (snicker) to fight off AMZN.

Boss likes TJX, BURL and ROST.

Boss said he wouldn't buy FL or NKE or UA and that they "remain pressured in the near term." He said his favorite in the space is LULU before stressing the difference between "retailer" and "brand."

He also said he "wouldn't be stepping in" to any department stores, including KSS.

Josh Brown downplayed the notion of something being a great brand, stating, "Great brands disappear all the time."

Joe Terranova asked Boss about LB. Boss actually said he remains neutral in part because of "the move towards bralettes."

Judge said "Goldman" was hitting a 2-week high when he meant "gold."

Scott Nations said gold should be up a lot higher than $8 on a day like this.

Doc's final trade was OXY. Josh Brown said INTC. Stephanie Link said EBAY. Joe said HON.

[Monday, Oct. 9, 2017]

Nobody identifies a GM product that people are clamoring to buy

Josh Brown on Monday's Halftime Report bluntly dubbed GE "uninvestable."